Look South: New Direction of South Korean Cultural Content

Export post-THAAD’s Ban

Annisa Pratamasari, Sasha Syaifani and Emanuella Toreh

Department of International Relations. Universitas Airlangga

Keywords: Political Economy of Business, Cultural Content Export, Cultural Policy, Marketing Strategy.

Abstract: State-led development and synergy with chaebols have been the most prominent features of South Korean

government since the dictatorship of Park Chung-Hee. Even after the new wave of democracy engulfed the

country, this feature remained, albeit much less restrictive. These characteristics are also reflected in Korean

cultural policy, which was also used as one of the main export engines since the 90s. Cultural content export,

despite newly-established, has been tremendously profitable for both states and corporations in South Korea.

It has consistently increased in export rate and sales in the last decade. However, in 2016, Chinese government

announced ban for cultural content export from South Korea, making both government and corporations of

South Korea were scrambling to look for a new market for its export. Hence, they started to enhance their

export to Southeast Asian countries as the new lucrative market they can aim at. This paper aims to highlight

the political-economy of Hallyu and underline the synergy between state’s cultural policy and corporations’

marketing strategy in Southeast Asian countries post-THAAD ban by China. In order to limit the research, it

focuses on the expansion of Hallyu in Thailand and Indonesia post-THAAD ban. It employs a descriptive

method to explain and validate the link between state policy and corporation’s marketing strategy. The

findings show the correlation between THAAD ban and the increase of Hallyu expansion in Southeast Asia,

as indicated by growing list of events in both Indonesia and Thailand.

1 INTRODUCTION

Hallyu (Korean Wave) refers to cultural wave which

include entertainment, music, and lifestyle from

South Korea (hereafter, Korea). The birth of Hallyu

can be credited to the cooperation between

government and business entities in South Korea.

The team-up between government and business

companies is commonly known as one of economic

development models called “political-business”

(Schmidt, 2011; Wad, 2011), “state-capitalism”

(Lim, 1988), or specifically to Korea case: “Korean

Inc” (Lee & Han, 2006). Mimicking Japan’s

economic development model with zaibatsu, South

Korea under Park Chung-Hee developed a similar

state capitalism model by reaching out to chaebols

and their giant corporations to boost Korean

economic. Albeit Lee and Han (2006) argued that this

development state model had extinct along with

Asian Crash 1998 and IMF’s structural adjustment in

South Korea, in this paper we argue that this state

capitalism model has been pretty much alive and has

extended to cultural policy as well.

At first, cultural content export was conducted as

one of the Korean government’s policies to solve

economic trouble post Asia Crisis 1997, which was

ironically worsened by the giant corporations

themselves (Wad, 2011). This export then

contributed to the country tremendously, both in

terms of post-crisis economic improvement and

national reputation. It was estimated that the

extended Hallyu-related industries (including

products’ endorsement by Hallyu stars for various

products, from skin care to food) contributed to 20-

30% of GDP (Oh, 2018).

Korean government is often credited as one of the

success factors in the global expansion of Hallyu. Lee

(2012) posited that culture is significantly related to

capital accumulation and enhancement of national

image. For those reasons, Korean government

initiated a series of cultural policies, started from

Kim Young-Sam era to Park Geun-Hye era. Over the

years, the government has established Ministry of

Culture to oversee culture development and some

government-affiliated agencies like Korea Creative

Content Agency (KOCCA), Korea Broadcasting

Institution (KBI), and Korean Film Council

230

Pratamasari, A., Syaifani, S. and Toreh, E.

Look South: New Direction of South Korean Cultural Content Export post-THAAD’s Ban.

DOI: 10.5220/0010275500002309

In Proceedings of Airlangga Conference on International Relations (ACIR 2018) - Politics, Economy, and Security in Changing Indo-Pacific Region, pages 230-238

ISBN: 978-989-758-493-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

(KOFIC). Those agencies then cooperate with

business corporations in South Korea, in which most

of them are chaebols, and further accentuate politics-

business relationship as the prominent model in

Korea economics. Each president has their own

policy, yet those were aligned and directed toward

the development of cultural industry. Therefore,

Korea’s advanced cultural industry cannot be

separated from the central role of government

support through a series of regulations,

infrastructure, and funding. Jun (2017) stated that

currently we live in the fourth stage of Hallyu (Hallyu

4.0), which is called K-Ubiquity. She marked this

stage as the signal of spreading cultural wave at the

state level and government institution, particularly in

China and Southeast Asia.

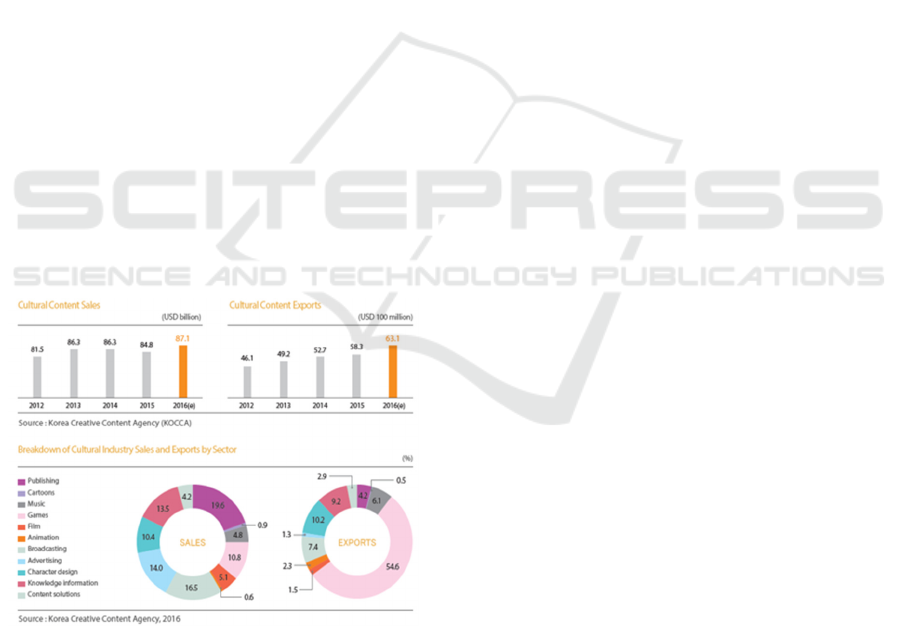

Chart 1.1 below showed that cultural content

export has been substantially climbing up from 2012

to 2016, started from USD 46.1 million to USD 63.1

million. The largest export value is recorded by game

(54.6%), while publishing recorded the largest total

sale number (19.6%). Moreover, cultural content

sales recorded USD 87.1 billion earning in 2016,

despite showing a fluctuating number of sales

between 2012 and 2016. The largest sales were

recorded by publishing (19.6%) and broadcasting

(16.5%). However, we chose to focus on Korean pop

music, based on the consideration that most people

recognized either Korean pop music or Korean drama

if they were asked about “Hallyu contents”

(Pratamasari, 2014).

Chart 1.1. Cultural Content Export of Korea in Global

Scale (KOCCA, 2016)

The cooperation between Korean government

and Korean companies which sell cultural contents

extends from erasing TV censorship, holding events

with government-affiliated organization and

ministries, and encouraging cultural content export

as one of state development strategies Korean

companies (Otmazgin and Ben-Ari, 2012).

Market liberalization which made way to

liberalized cultural content export came along with

enactment of GATT regulation for its members to

open their market in media communication and

culture. Korean government then obliged to it by

enforcing new Motion Picture Law to ease film

production and its contents (Shim, 2008). Korean

chaebols, who were part of the Korean Inc, took the

cues and established subsidiaries related to cultural

content productions, not just film. In terms of selling

pop music, as Hallyu expands, more entertainment

agencies focusing on producing singers or idols

emerge. Producing singers or idol groups are

considered as lucrative business (Kim, 2012), as the

companies could reap huge profit by selling the

singers/idols’ music and goods and getting some

product endorsement for them. Similar to drama or

film production, music and entertainment industries

also get the same treatment and ease in expanding

their business by Korean government. Evidently,

government-affiliated agencies like KOCCA

repeatedly holds various events to promote K-pop

singers overseas (Lee, 2017; Kontan.co.id, 2017).

Hence, this paper argues that the link between

government’s policy and agencies’ marketing

strategies remain strong, and even get stronger post-

THAAD blockage from China.

2 HALLYU IN CHINA AND

CRISIS CAUSED BY THAAD

One of the main partners for their cultural content

export is China. Both countries officially established

a diplomatic tie in 1992, yet their cultural trade only

started in late 1990. Politically, South Korea and

China has always been courteous and economic

cooperation in various fields has been conducted.

However, THAAD installment in 2016 was

heavily criticized by China based on two arguments,

because China argued it may reach China and China

considered the system to be ineffective to prevent any

missile attack from Pyongyang (Salah et al., 2017).

This refusal led to an unofficial sanction by Chinese

government against Korea in trade, which

encompasses import restrictions, or even blockage,

against goods and services from Korea, particularly

Korea’s cultural content export, such as music and

television programs. For instance, several programs

involving Korean pop music and actors were

cancelled or postponed indefinitely and without a

Look South: New Direction of South Korean Cultural Content Export post-THAAD’s Ban

231

justified reason. Besides, China Central Television

(CCTV), broadcasting channel of Chinese

government, officially stated that the Chinese

government bans the broadcast of South Korean

programs and other forms of cultural content exports,

including online game sales and consumer products

(cosmetics, food, and vehicles) (Jun,2017).

Not long after the ban was in effect, food exports

from South Korea to China recorded a decline by

5.6% on March 2017, while Hyundai and Kia also

declared that their sales to China declined by 52% on

March 2017 (Meick and Salidjanova, 2017). Ministry

of Culture, Sports, and Tourism conducted a survey

on economic loss post-THAAD among domestic

companies in South Korea and found that 35.3

percent of them concurred that they suffered from

loss due to THAAD (Cho, 2017).

The ban also hit the companies related to cultural

industries. Prior to THAAD, cultural content exports

value in China were amounted to ₩6.21 billion, or

equal to USD 5.52 billion, in 2016. It was an increase

of 9.7% from the previous year (Korea Herald, 2017).

Furthermore, Hallyu also bring about a tremendous

impact for Chinese people trade. In 2014, for

instance, a drama titled ‘My Love from the Star’

portrayed some scenes of food called chi-mek (fried

chicken and beer). It then became a trendsetter for

chi-mek sales in local friend chicken stores in China,

which could reap a leap in income until ¥3,000, or

equal to $431,667 (Lin, 2014). Korean cosmetic

brands were also flocking in Chinese market.

According to China Daily, Korean cosmetics reigned

in cosmetics import in China with 41% (Schmidt,

2016).

3 HALLYU IN SOUTHEAST ASIA

Hallyu was present in Southeast Asian market in the

late 1990s. Unlike East Asian market, like China,

Taiwan and Japan in which music and performance

led the entry of Hallyu, in Southeast Asia, K-drama

led the entry of Hallyu (Suh, et.al, 2013). Many

Korean content experienced global commercial

success in Southeast Asia. Hallyu first entered

Southeast Asia market in 1997 in Vietnam, year 2000

in Malaysia and Indonesia, and year 2001 in

Thailand.

This paper focuses on two Hallyu market in

Southeast Asia, Thailand and Indonesia, as two of the

main Hallyu’s targeted markets in Southeast Asia.

Moreover, both countries also have similar level of

GDP and purchasing power. Indonesia and Thailand

ranked as first and second at list of ASEAN countries

by GDP according to IMF (2018). Indonesia has

GDP Nominal per capita $4,051; while Thailand

reached $6,992. The number of GDP per capita

shows potential market for Hallyu. On the other

hand, Hallyu is unexpectedly famous in those two

countries. As a result, Jakarta and Bangkok become

the required destinations of events, like concert or

fan-meeting. Fans from Indonesia and Thailand also

willingly buy physical album and merchandises of

their idols. Indonesian youngsters, for instance,

according to Kapanlagi.com (2018) stated that a

devoted Hallyu fans approximately spend IDR

7,050,000 per year just to enjoy concerts in and

outside the country, as well us to buy official and fan-

site merchandise, idol product, internet quota, album

and fans donation. The result is based on the

interview with some fans of some idol groups under

SM Entertainment (although the results may vary

depend on the idols). Meanwhile, in Thailand, Suh,

et.al, (2013) found that in entry path of Hallyu differs

from other Southeast Asian countries and that it was

more government-led. In 2001, a Korean

organization under Korean government held a

performance of Korean singers in Thailand which led

to exports of Korean movies and drama in 2002 (Suh,

et.al., 2013). This can be seen that Hallyu market in

Thailand opened by the government itself and

amplified by the companies.

4 IN INDONESIA

Hallyu was first encountered Indonesia since the

early 2000s. Like the spread of Hallyu in most

countries, Hallyu in Indonesia was also preceded by

Korean dramas on national television. Drama

‘Mother’s Sea’ in 2002 aired on Indosiar started the

popularity of Korean dramas in Indonesia.

Furthermore, the drama “Endless Love” was also

aired and able to reach at least 2.8 million viewers. In

2005, drama “Full House” was aired and the main

casts’ popularities soared, especially Rain’s

popularity. As a result, JYP Entertainment as Rain’s

agency held the first concert of South Korean singer

(and Indonesia was the only country listed in concert

tour) in Indonesia. Years later, under the same label

with Rain, 2PM also held its inaugural concert in

Jakarta. In 2011, SM Entertainment followed JYP by

holding a Super Junior concert. In 2012, SM

Entertainment held a big concert titled “SMTown

Concert” in Indonesia. These concerts served as the

beginning of South Korean artist concert and fan

meeting in Indonesia in the following years (Lee

2016).

ACIR 2018 - Airlangga Conference on International Relations

232

However, events like concert and fan meetings in

Indonesia have not been widely held, particularly

prior to THAAD ban. We listed in Table 1.1 that

from October 2015 to November 2016 alone, only 10

concerts and fan meeting were held in Jakarta. The

celebrities were already widely popular in Indonesia.

After China blocked Korean contents post-THAAD,

the number of concert and fan meetings are doubled.

There are about 18 events held, from April 2017 to

July 2018 in Indonesia. More Korean entertainment

agencies hold their events in Indonesia. From the

government-related organization, KOCCA, it only

held two festivals in Jakarta. However, after the

blockade, it even held a festival in another city,

Surabaya.

More Korean entertainment agencies hold their

events in Indonesia. From the government-related

organization, KOCCA, it only held two festivals in

Jakarta. However, after the blockade, it even held a

festival in another city, Surabaya. If we look closer

to the table, we can conclude that before the

blockade, most events were held by major

entertainment companies that placed Top Ten

Entertainment companies in South Korea, such as

SM Entertainment, YG Entertainment, and JYP

Entertainment (Yoon, 2017). Only two of the events

are held my minor companies, namely Fantagio and

Coridel Entertainment. After the blockade, there was

an apparent increase in events held by minor

companies, including Blossom Entertainment, BG

Entertainment and YMC Entertainment seek

opportunities to expand their music market in

Indonesia. Hence, it indicates that Southeast Asia

became Hallyu companies’ market after China’s ban.

On the other hand, the government also notices

market opportunity in Indonesia. The government,

along with KOCCA, held K- Content Expo in August

2017 at Jakarta and involved more than 40 creative

content companies. In this event, SM Entertainment

played role as exhibitor, meanwhile KBS Media and

CJ E&M exhibited most popular TV Contents

(Kontan.co.id, 2017). To attract more visitors,

KOCCA with Korean Broadcasting System, national

television in South Korea held “KBS Music Bank”, a

concert which was attended by popular Korean pop

artists such as EXO, NCT 127 and B.A.P.

Table 1.1: Number of KPOP Concert and Fanmeeting in

Indonesia

No. Time/Date Events Events’ Holders

Pre-THAAD ban (before 26 FEBRUARY 2017)

1 1 Oktober

2015

Korea Festival

by KOCCA,

Jakarta

Korean Cultural

Content Agency

2 15

November

2015

2015 Infinite

2nd World

Tour: Infinite

Effect

Woolim

Entertainment

3 28

November

2015

GOT7 1st

Fanmeeting in

Indonesia

JYP

Entertainment

4 2 Januari

2016

Kyuhyun,

Ryeowook,

Yesung

(KRY) Sub-

unit Super

Junio

r

SM

Entertainment

5 29 April

2016

BTS The

Wings Tour in

Jakarta

BigHit

Entertainment

6 23 Juli 2016 KPOP World

Festival by

KCC

Indonesia

Korean Cultural

Content Agency

7 20 Agustus

2016

Seventeen Pledis

Entertainment

8 3 September

2016

IKON YG

Entertainment

9 22 Oktober

2016

Astro

Fanmeetin

g

Fantagio

Entertainment

10 19

November

2016

2016 Jessica

Fan Meeting

Coridel

Entertainment

Post-THAAD ban (after 26

Februar

y

2017)

1 29 April

2017

The Wings

Tour: 2017

BTS Live

Trilogy

Episode III in

Jakarta

BigHit

Entertainment

2 20 Mei 2017 2017 Lee

Dong Wook

Fan Meeting

Asia Tour

Jakarta

Kingkong

(Starship)

Entertainment

3 15 Juli 2017 CNBLUE

Asia Tour

Between Us in

Jakarta

FNC

Entertainment

4 29 Juli 2017 2017 VIXX

Fan Meeting

in Jakarta

Jellyfish

Entertainment

5 26 Agustus

2017

DAY 6 Live

& Meet in

Jakarta 2017

JYP

Entertainment

Look South: New Direction of South Korean Cultural Content Export post-THAAD’s Ban

233

6 2 September

2017

Music Bank in

Jakarta

(Gfriend,

NCT, Astro,

EXO, etc.)

SM

Entertainment,

Fantagio

Entertainment

7 3 September

2017

G-Dragon

2017 World

Tour – ACT

III, M.O.T.T.E

‘Moment of

Truth The

End’ in

Jakarta

YG

Entertainment

8 23

September

2017

2017

Seventeen 1st

World Tour

“Diamond

Edge in

Jakarta”

Pledis

Entertainment

9 14 Oktober

2017

Taeyang 2017

World Tour

White Night in

Jakarta

YG

Entertainment

10 13

November

2017

Park Bo Gum

Fanmeeting in

Jakarta

Blossom

Entertainment

11 25

November

2017

Saranghaeyo

Indonesia

(Taeyang,

Akdong

Musician,

Nell, etc.)

MECIMA

(Promotor)

12 4 Maret

2018

Korea

Festival,

Suraba

y

a

Korean Cultural

Content Agency

13 7 April 2018 JBJ 1st

Concert:

Joyful Days in

Jakarta

Fave

Entertainment

(CJ E&M)

14 14 April

2018

Wild Kard

Tour in Asia:

Indonesia

DSP Media

15 12 Mei 2018 14U in Jakarta BG

Entertainment

16 12 Mei 2018 NU’EST W

Concert:

Double You in

Jakarta

Pledis

Entertainment

17 30 Juni 2018 GOT 7 JYP

Entertainment

18 15 Juli 2018 Wanna One

World Tour.

One: The

World

YMC

Entertainment

Meanwhile, SM Entertainment as one of the

largest entertainment company in South Korea also

become more eager to spread its market globally. Lee

Soo-man, the founder of SM Entertainment,

presented a project called “SMTOWN: New Culture

Technology”, which consider producing global

contents using five cores of SM Culture Technology

(casting, training, producing, marketing-

management, and interactive) (Lee, 2016). The

project itself aims to East Asia, Latin America, and

Southeast Asian countries.

Lee Soo-man (2016) later stated that through

these attempts, SM will achieve the true definition of

“Hallyu Localization” which is a form to expand

market through cooperating with local companies,

government, and artists.

5 IN THAILAND

Different from Indonesia, South Korean companies

are starting to hook youth from other countries to join

their boyband and girlband groups. Three big

companies in South Korea like JYP Entertainment,

SM Entertainment, and YG Entertainment have even

begun to attract youth from outside South Korea to

be trained to become Idol since a few years ago. In

this case, Thailand is one of the countries whose

youth quite successfully recruited by the Korean

agency. For instance, Nichkhun who debuted with

2PM in 2008 under JYP Entertainment (Herman,

2008). In addition to Nichkhun, there was also a

young Thai named Ten who joined the NCT group

after passing the audition organized by SM

Entertainment. After he debuted, one of NCT's songs

entitled "Baby Do not Stop" was remade in Thailand

version and released in June 2018 (SBS, 2018). There

is also Lisa, a Thai citizen who also began her career

in South Korea by joining Blackpink (a group that

successfully seized the attention of the community

with their appearance and songs). Similar to Ten,

Lisa started her training in Korea in 2011 and

discovered by YG Entertainment through an audition

(Allkpop, 2016).

The Chinese blockade of South Korean cultural

products, especially K-Pop and K-Drama, led to an

increase in the number of concerts and fanmeeting

held by the Korean agency. One year before the

Chinese blockade of THAAD on February 26, 2017,

there were only about 14 concerts and also

fanmeeting in Bangkok involving 10 agencies and 13

South Korean artists. This number consists of the

number of events held not only for idol groups, but

also for K-Drama actors like Song Joong Ki who has

many fans in Thailand. One year before the blockade,

major agency companies such as SM Entertainment,

YG Entertainment, and JYP Entertainment had held

such events in Thailand. JYP Entertainment even

ACIR 2018 - Airlangga Conference on International Relations

234

invited many singers who work under the label to a

concert titled "2O16 JYP Nation Mix and Match" to

entertain fans. Singers who participated in this

concert are Wonder Girls, 2PM, Jo Kwon, GOT7,

DAY6, TWICE, and many other artists (Choi, 2016).

Other than that, an artist under Coridel Entertainment

also came to Bangkok is Jessica "SNSD" and held

"Jessica 1st Premium Live Showcase in Bangkok"

event in June 2016 (Bangkok Post, 2016). For K-

Drama and K-Film fans in Thailand, Blossom

Entertainment brought their actors such as Song

Joong Ki in May 2016 and Park Bo Gum in

December 2016. In fact, Song Joong Ki was also

invited as a guest star at Park Bo Gum fan meeting

(S.Ng, 2017).

The increasing of the number of concerts and

fanmeetings in Thailand can be seen after the

Chinese blockade. If a year before the blockade there

are only 14 events held in Thailand, then the number

is almost doubled as many as 27 where there are 23

artists under the auspices of 17 different agencies.

Before the blockade. many agencies have never

previously hosted concerts or fan meetings in

Thailand, but after that they started making events in

Thailand. For example, the boy band Wanna One

under Swing Entertainment came to Bangkok for

"Wanna One 1st Fan Meeting in Bangkok: WANNA

Be LovEd" (SBS, 2017). If in the period before the

blockade there was just Jessica "SNSD" from SM

entertainment that held an event in Thailand, then

after the blockade SM Entertainment also brought

Kyuhyun "Super Junior" and Taeyon "SNSD" to hold

their solo concert in Thailand. Kyuhyun's solo

concert was entitled "Kyuhyun Solo Concert -

Reminiscence of a Novelist in Bangkok” held in

March 2017. This concert was also a farewell to

Kyuhyun for his fans before he had to carry out

conscription (SBS, 2017). On the other side, Taeyon

solo concert titled "Persona" successfully made

Taeyon as the first Korean female artist that hold a

solo concert in Thailand (Churintarapan, 2017).

From this it can be seen that China's blockade of

cultural contents from South Korea has led to an

increase in the South Korea’s companies efforts to

seek markets in other countries, and one of them is in

Thailand.

Table 1.2: Number of KPOP Concert and Fanmeeting in

Indonesia

No

.

Time/Date Events Events’

Holders

Pre-THAAD ban (before 26 FEBRUARY 2017)

1. 7 Mei 2016 2016 Song Joong

Ki Asia Tour Fan

Meeting in

Bangko

k

Blossom

Entertainment

2. 11 Juni

2016

Jessica 1st

Premium Live

Showcase in

Bangko

k

Coridel

Entertainment

3. 31 Juli

2016

Park Hae Jin Fan

Meeting in

Thailand 2016

Mountain

Movement

4. 17

September

2016

Nam Joo Hyuk 1st

Fan Party in

Bangko

k

YG

Entertainment

5. 28 Oktober

2016

2016 Lee Jong Suk

Fanmeeting

Variety

YG

Entertainment

6. 29-30

Oktober

2016

2016 BIGBANG

Made [V.I.P] Tour

in Bangko

k

YG

Entertainment

7 5-6

November

2016

2016 JYP Nation

Mix & Match in

Bangko

k

JYP

Entertainment

8. 12

November

2016

Monsta X The First

Asia Fan Meeting

in Bangko

k

Starship

Entertainment

9. 13

November

2016

Gfriend Fan

Meeting In

Bangkok 2016

Source Music

10. 24

Desember

2016

2016-2017 Park

Bogum Asia Tour

Fan Meeting in

Bangko

k

Blossom

Entertainment

11. 7 Januari

2017

HYUNA Asia Tour

Fan Meeting in

Bangko

k

Cube

Entertainment

12. 21 Januari

2017

Ji Chang Wook 1st

Fan Meeting in

Bangko

k

Glorious

Entertainment

13. 12

Februari20

17

ASTRO The 1st

Season Showcase

in Bangkok 2016

Fantagio

Music

14. 18 Februari

2017

LeoLucas First Fan

Meeting in

Bangko

k

-

Post-THAAD ban (after 26 February 2017)

1. 4 Maret

2017

F.T. Island Live

[THE TRUTH] in

Bangko

k

FNC

Entertainment

2. 11 Maret

2017

Running Man

Live in Bangko

k

SBS

3. 18 Maret

2017

2017 Kim Jae

Joong Asia Tour

in Bangkok “The

REBIRTH of J”

C-Jes

Entertainment

4. 19 Maret

2017

Kyuhyun Solo

Concert –

Reminiscence of a

novelist – in

Bangko

k

SM

Entertainment

5. 1 April

2017

Pentagon in

Thailan

d

Cube

Entertainment

6. 8 April

2017

2017 Kim Woo

Bin Fan Meeting

SidusHQ

Look South: New Direction of South Korean Cultural Content Export post-THAAD’s Ban

235

Spotlight in

Thailand

7. 8 April

2017

Gfriend Fan

Meeting in

Bangkok 2017

Source Music

8. 22-23 April

2017

The Wings Tour

2017 BTS Live

Trilogy Episode

III in Bangko

k

Big Hit

Entertainment

9. 13 Mei

2017

VICTON First

Date with Alice in

Thailand

Plan A

Entertainment

10. 18 Mei

2017

Taeyon Solo

Concert

“PERSONA”

SM

Entertainment

11. 7 Juli 2017 G-Dragon 2017

Concert: ACT III,

M.O.T.T.E

YG

Entertainment

12. 8 Juli 2017 B.A.P 2017 World

Tour Party Baby:

Bangkok Boo

m

TS

Entertainment

13. 15 Juli

2017

2017 PARK HAE

JIN ASIA TOUR

in Bangko

k

Mountain

Movement

14. 5 Agustus

2017

Jisoo’s Story in

Bangko

k

Prain TPC

15. 13 Agustus

2017

Day6 Live and

Meet in Bangko

k

JYP

Entertainment

16. 16

September

2017

Wanna One 1st

Fan Meeting in

Bangkok:

WANNA Be

LovE

d

Swing

Entertainment

17. 10

September

2017

BTOB World

Tour Fan Meeting

in Bangko

k

Cube

Entertainment

18. 30

September

2017

Taeyang 2017

World Tour

YG

Entertainment

19. 11

November

2017

Nam Tae Hyun

Music Fan

Meeting in

Bangko

k

YG

Entertainment

20. 6 Januari

2018

Jessica “On Cloud

Nine Mini

Concert”

Coridel

Entertainment

21. 6 Januari

2018

Kang Min Hyuk

“2018 Romantic

Sailing: Fan

Meet”

FNC

Entertainment

22. 13 Januari

2018

ASTRO FanMeet

& Mini Live

Fantagio

Music

23. 14 Januari

2018

Jung YongHwa

Live

FNC

Entertainment

24. 28 Februari

2018

BTOB Fanmeet

2018

Cube

Entertainment

25. 3 Maret

2018

2018 ASTRO

Global Fan

Meeting

Source Music

26. 10 Maret

2018

Jeong Sewoon

The First Fan

Meeting in

Bangkok “Be

Happy”

Starship

Entertainment

27. 22-23 April

2018

BTS Live Trilogy

Episode III

Big Hit

Entertainment

6 CONCLUSIONS

This paper draws on several conclusions. First, the

political-business relationship between Korean

government and Korean corporations remain

evidently strong. Secondly, we also found that such

relationship was evident in cultural policy and

marketing strategies developed by government and

corporations respectively, particularly after

THAAD’s ban by China. Thirdly, it is also evident

that there is a significant correlation between

THAAD ban and the increase of Hallyu expansion in

Southeast Asia, as indicated by growing list of events

in both Indonesia and Thailand, including those

supported by Korean government.

Meanwhile, there are also some limitations

evident in this paper, which could become some

suggestions for future research in this study. First, it

only limits in Korean-pop music, although other

sectors of cultural content exports were also hit hard

by the blockage. Hence, future research may find

additional findings on other sectors, namely Korean

drama export and production’s funding, which was

allegedly stalled after THAAD. Second, this paper

only limits the research on two ASEAN countries.

Therefore, future research can add more findings

about the other ASEAN countries, namely Singapore

which is also one of the most popular destination of

Korean-related events in ASEAN

REFERENCES

Allkpop, (2016). YG Entertainment reveals striking photos

of another new girl group member!. Allkpop. Retrieved

from https://www.allkpop.com/article/2016/06/yg-

entertainment-reveals-striking-photos-of-another-

new-girl-group-member.

Cho, Jennifer. (2017). Turning Out the Lights?: The Impact

of THAAD on Hallyu Exports to China. KEIA.

Retrieved from http://keia.org/turning-out-lights-

impact-thaad-hallyu-exports-china

Choi, A.(2016) Park Jin Young Shares His Passion for

Singing During JYP Nation Concert. Soompi.

Retrieved from

https://www.soompi.com/2016/08/07/park-jin-young-

shares-passion-singing-jyp-nation-concert/.

Churintarapan, Fonthong. (2017). Diva Persona. Bangkok

Post. Retrieved from

https://www.bangkokpost.com/learning/learning-

entertainment/1273587/diva-persona.

ERIA Study on the Development Potential of the Content

Industry in East Asia and ASEAN Region (2014),

‘Case Studies’ in Koshpasharin, S. and K. Yasue(eds.),

Study on the Development Potential of the Content

ACIR 2018 - Airlangga Conference on International Relations

236

Industry in East Asia and the ASEAN Region, ERIA

Research Project Report 2012-13. Jakarta: ERIA.

Herman, Tamar. (2018) In A Post-THAAD World, K-Pop

Focuses On New Markets Aside From China. Forbes.

Retrieved from

https://www.forbes.com/sites/tamarherman/2018/02/2

8/in-a-post-thaad-world-k-pop-focuses-on-new-

markets-aside-from-china/#2ebacd0c6d81.

IMF, (2018). World Economic Outlook Database.

Retrieved from

http://www.imf.org/external/pubs/ft/weo/2018/01/weo

data/weorept.aspx?pr.x=72&pr.y=9&sy=2016&ey=20

23&scsm=1&ssd=1&sort=country&ds=.&br=1&c=54

8%2C518%2C516%2C522%2C924%2C566%2C576

%2C534%2C578%2C536%2C158%2C542%2C111%

2C544%2C582&s=NGDPD%2CPPPGDP%2CNGDP

DPC%2CPPPPC%2CLP&grp=0&a=

Ingyu, Oh. (2018). Interview. Conducted on March 25

th

,

2018.

Institute for Security and Development Policy. (2017).

THAAD on the Korean Peninsula. Retrieved from

http://isdp.eu/content/uploads/2016/11/THAAD-

Backgrounder-ISDP-2.pdf.

Jun, Hannah. (2017). Hallyu at a crossroads: the clash of

Korea’s soft power success and China’s hard power

threat in light of Terminal High Altitude Area Defense

(THAAD) System Deployment. Asian International

Studies Review. 18(1).

Kapanlagi.com, (2018). Album Sampai Konser, Berapa

Sih Biaya Yang Diperlukan Seorang Penggemar K-

pop?. Retrieved from

https://www.kapanlagi.com/showbiz/asian-

star/album-sampai-konser-berapa-sih-biaya-yang-

diperlukan-seorang-penggemar-k-pop-4a0fa9.html

Kim, Sang Yeob, (2012). Investigation on the Management

Status of K-Pop Revenue Model and Finding Ways for

Improvement. International Journal of Trade,

Economics and Finance. 3(5).

Kontan.co.id, (2017). Serba Korea ada di K-Content Expo

2017. Retrieved from

https://lifestyle.kontan.co.id/news/serba-korea-ada-di-

k-content-expo-2017.

Korea Cultural Content Agency, (2016). “Introduction to

KOCCA Indonesia Office”. Retrieved from

http://eng.kocca.kr/en/contents.do?menuNo=203340.

Korea Herald. (2017). Exports of Korean cultural content

up 9.7% in 2016: data. Retrieved from

http://www.koreaherald.com/view.php?ud=20170611

000044.

Koreaboo, (2017). SM Entertainment Reveals Plans To

Crated NCT Indonesia and NCT Asia. Retrieved from

https://www.koreaboo.com/news/m-entertainment-

reveals-plans-create-nct-indonesia-nct-asia/.

Kwon, Seung-Ho, and Kim, Joseph. (2014). The cultural

industry policies of the Korean government and the

Korean Wave. International Journal of Cultural

Policy, 20:4, 422-439.

Lee, Sook-Jong and Han, Taejoon. (2006). The Demise of

"Korea, Inc.": Paradigm Shift in Korea's

Developmental State. Journal of Contemporary Asia.

36(3).

Lee, Soo-man, (2016). SMTOWN: New Culture

Technology. Retrieved from

https://www.youtube.com/watch?v=Ky5NvWsXnn8.

Lee, Jung-Yup. (2012). Managing the transnational,

governing the national: cultural policy and the politics

of the “culture archetype project” in South Korea. In

Otmazgin, Nissim and Ben-Ari, Eyal (ed). Popular

Culture and the State in East and Southeast Asia. New

York: Routledge.

Lim, Timothy C. (1998) Power, capitalism, and the

authoritarian state in South Korea, Journal of

Contemporary Asia, 28(4).

Lin, L. (2014). Korean TV show sparks chicken and beer

craze in China. The Wall Street Journal.

https://blogs.wsj.com/chinarealtime/2014/02/26/korea

n-tv-show-sparks-chicken-and-beer-craze-in-china/.

Meick, Ethan dan Salidjanova, Nargiza. (2017). China’s

Response to US-South Korean Missile Defense System

Deployment and its Implications.

https://www.uscc.gov/sites/default/files/Research/Rep

ort_China%27s%20Response%20to%20THAAD%20

Deployment%20and%20its%20Implications.pdf.

Otmazgin, Nissim and Ben-Ari, Eyal. (2012). Popular

Culture and the State in East and Southeast Asia. New

York: Routledge.

Pratamasari, Annisa. (2014). The Influences of Motivation,

Opportunity, and Ability on Purchase Intention toward

Korean Idol Groups’ Collectibles. (Master’s Thesis,

Chinese Culture University).

S.Ng, (2017). Song Joong Ki Shows Up In Support For

Park Bo Gum’s Thailand Fan Meeting. Soompi.

Retrieved from

https://www.soompi.com/2017/02/12/song-joong-ki-

shows-support-park-bo-gums-thailand-fan-meeting/.

Salah, et al. (2017). Resolved: Deployment of Anti-Missile

Systems is in South Korea’s Best Interest. Victory

Briefs.

SBS, (2017). Kyuhyun’s goodbye to Thai fans begfore

military duty, Retrieved from

https://www.sbs.com.au/popasia/blog/2017/03/15/kyu

hyuns-goodbye-thai-fans-military-duty.

SBS, (2017). WANNA ONE are heading to Bangkok!,

SBS. Retrieved from

https://www.sbs.com.au/popasia/blog/2017/08/16/wan

na-one-are-heading-bangkok.

SBS, (2018). NCT are releasing a Thai version of “Baby

Don’t Stop, SBS. Retrieved from

https://www.sbs.com.au/popasia/blog/2018/05/22/nct-

are-releasing-thai-version-baby-dont-stop.

Schmidt , Johannes D. (2011). The role of the state and

foreign and domestic capital in economic development.

In Gomez, Edmund (ed). Political Business in East

Asia. New York: Routldge.

Schmidt, Anna. (2016). Hallyu and The Rise of Korean

Cosmetics in China: The overwhelming popularity and

makeup brands. City Weekend. Retrieved from

http://www.cityweekend.com.cn/shanghai/article/hall

yu-and-rise-of-korean-cosmetics-china.

Look South: New Direction of South Korean Cultural Content Export post-THAAD’s Ban

237

Shim, Doobo. (2008). The Growth of Korean Cultural

Industries and the Korean Wave. In Huat, Chua B, and

Iwabuchi, Koichi (Ed). East Asian Pop Culture:

Analysing Korean Wave. Hongkong University Press:

Hongkong.

Soompi, (2018). SM Entertainment Experiences Increase

in Sales and Operating Profit for 1st Quarter of 2018.

Retrieved from

https://www.soompi.com/2018/05/15/sm-

entertainment-experiences-increase-sales-operating-

profit-1st-quarter-2018/.

Soompi. (2014). Kim Soo-hyun and Lee Min-ho are the

Korean kings of CFs in China. Retrieved from

https://www.soompi.com/2014/03/28/kim-soo-hyun-

and-lee-min-ho-are-the-korean-kings-of-cfs-in-china/.

Suh, Chung-sok, et.al. (2013). The Korean Wave in

Southeast Asia: An Analysis of Cultural Proximity and

the Globalization of Korean Cultural Proximity.

Retrieved from

http://congress.aks.ac.kr/korean/files/2_1358476377.p

df.

Wad, Peter. (2011). The political business of development

in South Korea. Gomez, Edmund (ed). Political

Business in East Asia. New York: Routldge.

ACIR 2018 - Airlangga Conference on International Relations

238