Linkage Model in Micro Sharia Financing for The Empowerment of

MSME

Muhammad Nafik Hadi Ryandono, Tika Widiastuti

and Imron Mawardi

Sharia Economics Department, Universitas Airlangga, Jl. Airlangga No.4, Surabaya, Indonesia

{muhammadnafik, tika.widiastuti, ronmawardi}@feb.unair.ac.id

Keywords: MSME, Financing, Linkage, Micro Sharia.

Abstract: Financing rolled by the Islamic Bank is still dominated by consumptive sector. The financing has a goal to

develop the Micro, Small, and Medium Enterprise (MSME) and also non-MSME sector. This research has a

goal to develop micro sharia financing in the society, and also uplift the economic condition of the low-

middle class people in the society. The research method of this research uses the qualitative descriptive

method because this research will explain and illustrate the micro sharia financing process with linkage

model like channeling, executing, and joint financing in detail and in the orderly fashion. The result of this

research shows that the increase of function and role of General Islamic Bank, Islamic Enterprise Unit,

Islamic Rural Bank, and Islamic Micro Finance Institution, in the form of a Cooperative or Baitul Mal

Wattamwil (BMT), can be done by using linkage program. This research result in linkage model of micro

sharia financing that can help the development of MSME which has advantages such as no recurring cost,

no linkage cost, no burden toward the national and local government’s budget, and can function as a

monitoring and evaluation tool.

1 INTRODUCTION

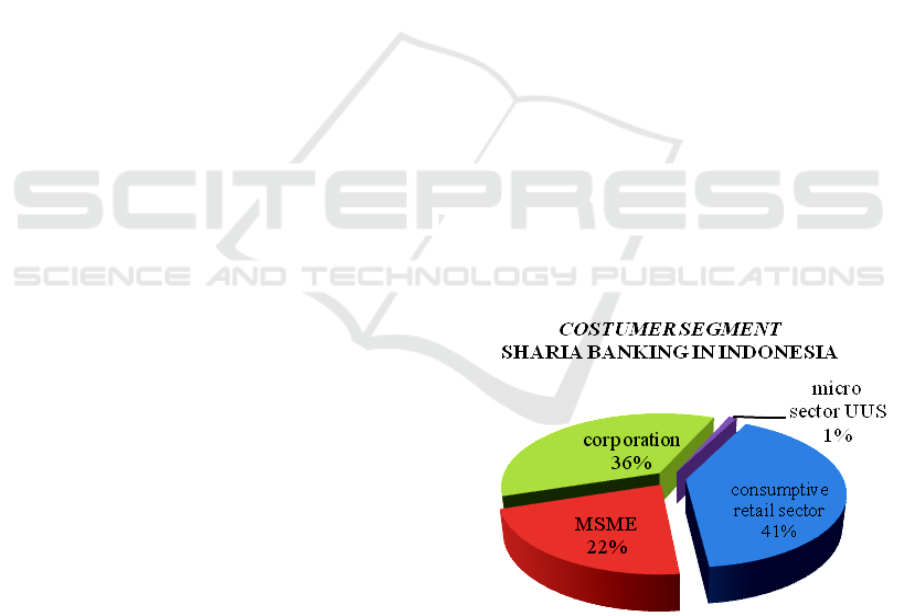

Financing activities done by the sharia banks are

still dominated by the consumptive sector that is

followed by the productive sectors. Those sectors

include consumptive retail, corporation, middle-

small enterprise, and also micro enterprise run by

Sharia Enterprise Unit or Unit Usaha Syariah

(UUS). The segmentation of recipients of sharia

banks’ financing are as follow on the figure 1.

Based on figure 1, it can be observed that the

biggest financing segment is consumptive financing

that contributes to 41% of the total financing done

by the sharia banks. Meanwhile, the smallest

financing segment is 1% given to the Sharia

Enterprise Unit. This proves that Islamic Banks

financing activities are in a very committed and

pleasing state.

The Islamic Banking and Islamic Micro Finance

Institutions (IMFI) have achieved a very satisfying

development state. This is proven by the growing

numbers of Islamic economics activists including

practitioners, academicians, and fuqaha that have

increased attention and desire to learn deeper about

Islamic-based economy. It can not be denied that the

strength of the Sharia Banks and IMFIs during the

financial crisis of 1998 and 2008, acts as one of the

reasons why their services are increasingly sought

after by the people.

Figure 1: Segmentation of Recipients of Islamic Banks’

Financing (Bank Indonesia, 2012).

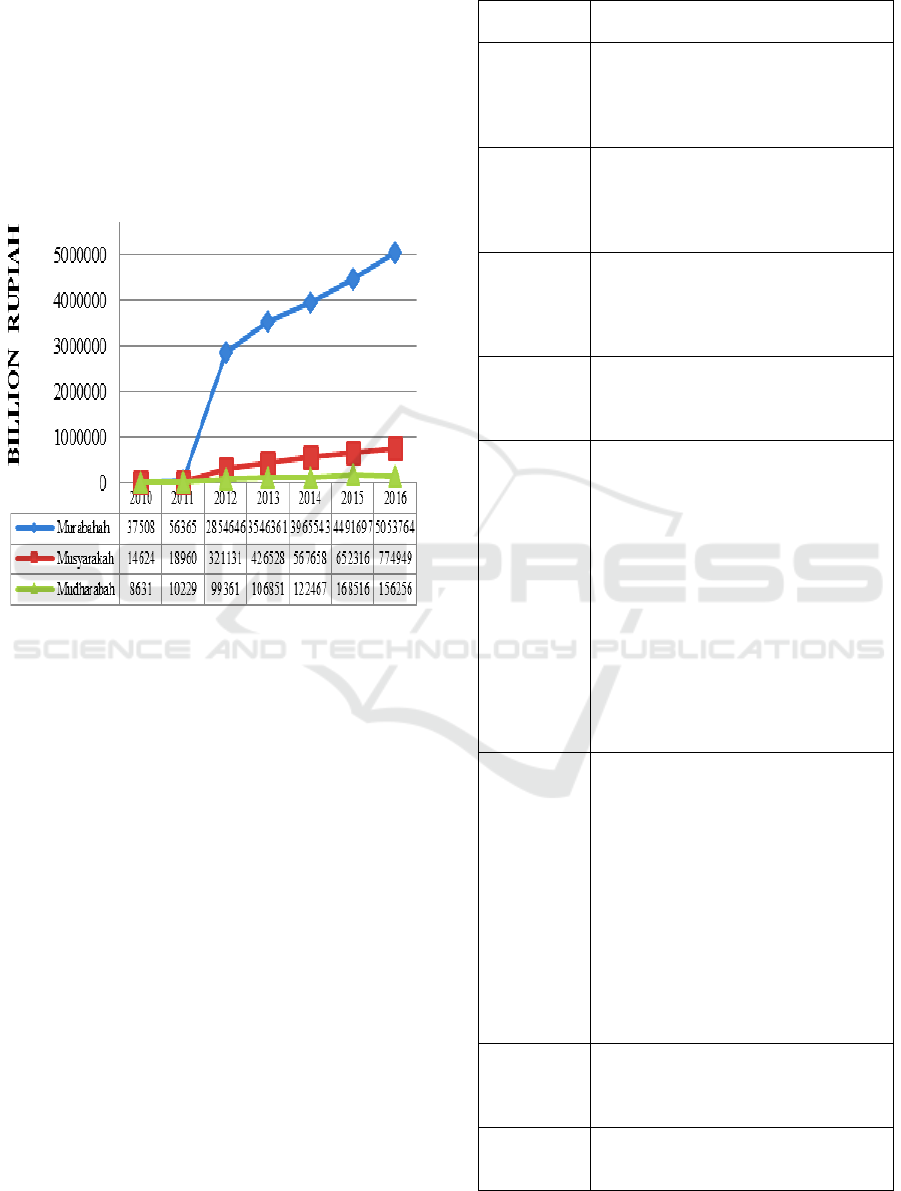

Figure 2 gives the data regarding the

composition of financing given by the Islamic

Finance Institutions. Murabahah, musyarakah, and

mudharabah showed positive trends. Consumption

behaviors of the society is a consumptive one,

proven by the financing level from the Sharia Banks

718

Ryandono, M., Widiastuti, T. and Mawardi, I.

Linkage Model in Micro Sharia Financing for The Empowerment of MSME.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 718-723

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

in the murabahah skim, that dominate the highest

financing amount with 505 trillion rupiah in the end

of 2016. Financing in the productive sector, that can

empower the real sector (micro, small, and medium

enterprises), like mudharabah and musyarakah are

having lower amount compared to the murabahah

instead (Bintoro and Soekarto, 2013; Hunt‐Ahmed,

2013; Oktafia, 2015; Rendra, 2015). Mudharabah

financing with the smallest amount is in 2010

amounting to 8.6 trillion rupiah, while the smallest

amount of musyarakah in 2010 have financing

amount of 14.6 trillion rupiah.

Figure 2: Composition of Financing from Islamic Finance

Industry (Otoritas Jasa Keuangan, 2016).

External factors that can have effects on the

success of micro banking business, especially Baitul

Mal Wattamwil (BMT), including rational partners

and customers that will ask for benefits and

advantages in using the service of Islamic Financial

Institution compared to the conventional banks,

overlapping regulations, one of the example is

regarding the supervision of Islamic Micro Financial

Institution (IMFI) and Islamic Cooperative that

needs further examination and rework, BMT has not

been able to fulfill the demand of fund from the

society, causing the economic growth of the lower-

class people to be hampered (Salam, Rahmania and

Fauziyyah, 2014).

The linkage program scheme that is done by the

banks and their partnering companies are divided

into 3 types: channeling, executing, and joint

financing (Arifin, 2013; Abdullah and Ismail, 2017).

The difference of linkage program in Islamic Bank

is the usage of a certain agreement (akad) in each of

the schemes. Here is some of the formulated linkage

program from various aspects of assessment:

Table 1: Assesment Aspects of Linkage Method (Bank

Indonesia, 2012).

Assessment

Aspect

Explanation

Market

Segment

A low-class society that is unbankable

and unable to use the conventional

bank or General Islamic Bank, can be

made into the customer of linkage

banking, including MSMEs.

Advantages

The advantage of linkage banking

offered to the customers is the simple

payment scheme, no collaterals, and

also low-interest rate that can be

afforded by the poor and unbankable.

Channel

Channel used by the linkage banking

to reach their customer segment is

Business to Consumer (B2C) because

banking industry will need to come

directly to their customers.

Personal

Approach

Personal accompanying of the

customers, especially the MSMEs are

forms of the channel used by linkage

banking to reach their customers.

Source of

Revenue

The primary source of revenue for

linkage banking comes from the

margin of interest rate, gotten by

subtracting the lending interest rate to

saving interest rate(in conventional

banks). An unbankable and poor

segment of society will usually do not

care about the interest rate as long as

the payment system is easy and simple

for them. There is also a difference in

the Islamic Financial system, that is

the source of revenue is gotten from

the profit margin (in aqad murabahah)

and nisbah of profit-sharing from aqad

musyarakah and mudharabah.

Resources

The primary power or resource for

linkage banking is the network and

support from the main bank that

supports the operation of linkage

banking. Information and technology

are also important to the customers

can access the service of linkage

banking anytime and in any place.

Technology in linkage banking is not

as sophisticated as the technology

used by conventional banks, as

generally mobile banking in linkage

banking will only involve simple

transactions.

Activity

Activities done by linkage banking is

giving banking service for the poor

and unbankable, and also give credit

financing for the microenterprise

Partners

The primary partner of linkage

banking is the main bank with the

material and non-material support that

Linkage Model in Micro Sharia Financing for The Empowerment of MSME

719

they give. Also various communities

in the society that care about the

economic development in their

environment, and central and local

government.

Cost

Component

Cost components of linkage banking

consist of human resources that need

to have the ability to be on the field to

identify locations and numbers of poor

and unbankable people that need the

service of the bank, cost of opening

services, and other costs. The

advantage of linkage banking is the

reduction of high-costing information

regarding the customers, and also the

problems of law regarding credit

problems that increase the transaction

cost in the local credit market. The

positive sides of linkage banking are

the inclusion of many people toward

the service of banks, including

segments of the society that were

previously unable to be serviced by

big commercial banks.

The assessment aspects of linkage banking as

explained in table 1 mostly discussed the activity of

linkage that often happened in the big banks or

conventional banking industry, but for the

assessment of Islamic Financial Institution, it is

adapted to their operational principles that stem in

the sharia values and norms.

There are several definitions of the

empowerment concept (Sulistiyani, 2004), one of

them is that explain that MSME consisted of 3

things, that is the creation of self-independence,

business development, and growth of business

potential. Basically, empowerment is the creation of

condition or climate that give the MSME a chance to

grow and develop. This logic is based on the

assumption that there is no business type that can be

done without any resources. MSME will face several

challenges in this time and the coming time,

primarily in these aspects (Tambunan, 2002), 1)

Rapid technological advancement, There are many

changes happening in the world of business caused

by the advancement of technology and those can be

viewed from two perspectives, the supply side and

the demand side. Supply-side, means that

technological advancement effect both the ways and

methods of production, compositions, materials, and

form and quality of a product. Meanwhile, the

demand site causes the demand behavior to be

changed, where at the beginning of the changes will

be coming from the industry. If viewed from the

perspectives of the demand of the society, after they

are introduced to new technologies, then the

consumer’s demand will also change. So regarding

this point, MSME is very much dependent on their

flexibility level to adapts on many fronts in the face

of technological advancements; 2) Open

Competition, Business players, especially the

MSME have to be able to take their opportunity to

the open market to create more productively. Higher

intensity, and also “tech-aware” have to be realized

by the business players because technology will

continue to advance faster every time and of course,

it will be followed by the change of taste from the

people. The increase in society’s revenue will affect

the rise of needs in the society, so every MSME and

even big enterprise are challenged to adapt to these

changes (Hamada, 2010).

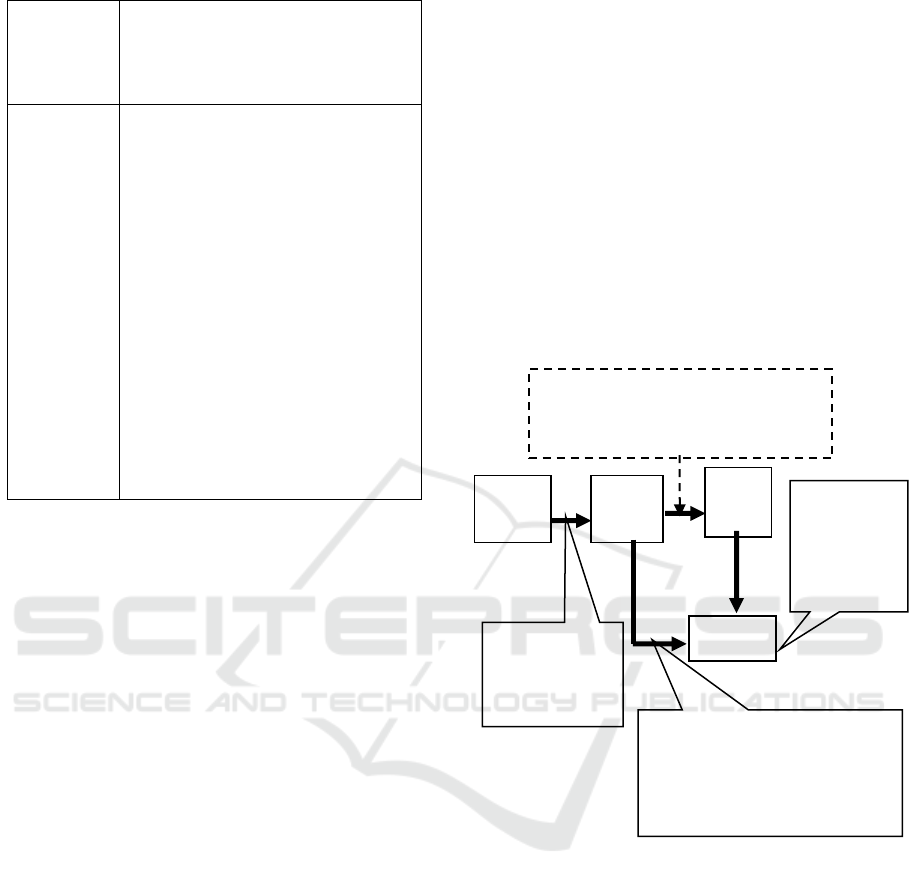

Figure 3: Conceptual Framework.

The solution of this research is explained in a

way using the conceptual framework in figure 3. In

figure 3, the grouping of problems is divided into 4

stages. First, starting from the workflow between the

third-party fund giver to the Islamic Bank that

discusses the question of ‘who will guarantee the

financing of the MSMEs’. Second, the Islamic Bank

will have to decide what scheme will be most

appropriate if they want to involve BMT or Islamic

Rural Bank in the channeling of the fund to the

MSME. Third, BMT or Islamic Rural Bank will

have to identify the profile of the MSMEs from the

aspect of habits in doing business, whether or not the

BMT create a community raise the effectiveness of

the financing, or even it is sufficient to trust it to an

2

2)

3

3)

4

4)

1)

Is it

necessary to

build

community

or do it

individually?

Who is the

guarantor of

financing for the

empowerment of

MSME?

i. Are you sure there is no moral

hazard from customers?

ii. Is physical appearance still a

consideration?

iii. Does it still need to ask for a

guarantee ?, and so on

More appropriate to use which scheme?

i. Channeling,

ii. Executing, or

iii. Joint financing.

Sharia

Bank

BMT or

BPRS

MSME

third-

party

funds

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

720

individual. Fourth, Islamic Bank can channel the

financing directly only with the joint financing

scheme. So there is more detailed task for the

Islamic Bank, that is to consider whether micro-level

consumers with no high purchasing power, informal

appearances, high potential to do moral hazard, and

still ask for fixed assets as primary collateral are

worth it.

Based on the background study regarding the

theoretical study and empirical study of IMFI’s and

Islamic Banking’s operational activities, then the

problem formulation of this research will be “How

the linkage model of financing in Micro-sharia

Baitul Mall Wattamwil (BMT) will empower the

Micro, Small, and Middle Enterprises in East Java?”

2 METHODOLOGY

The research approach used is qualitative descriptive

research, because, this research will explain and

figure the linkage model of micro sharia financing,

like channeling, executing, and joint financing, in a

detailed and orderly fashion. The chosen object of

this research is Baitul Mal Wattamwil (BMT)

located in East Java. BMT was chosen because the

micro sharia financing in Indonesia, especially in

East Java, are often practiced by IMFIs, including

BMT. The sample choosing of this research uses

purposive sampling technique. Type and source of

data that will support this research are from primary

and secondary data. The primary data is data gained

directly from the informant, by using interview,

documentation, and observation.

The emphasized in this research is the primary

data, therefore the researcher decided that BMT

employees that understand the workflow of

financing requisition and channeling to the partners

and customers of the BMT are the most appropriate

to be used as the informants. Besides the BMT

employees, there are several customers of that BMT

that were also used for the informant of this

research.

The data validation in the qualitative approach

happens in the process of data collection, and to

determine the validation of the data there needs to be

a rechecking method. The application of the

rechecking method is based on certain criteria and in

the process of validating the data, then the researcher

uses the triangulation method. The validation

method (Sugiyono, 2010) is divided into 3 methods,

first, source triangulation is a way to check the

validity of the data by checking data from different

sources. Second, method triangulation is a way of

checking the credibility by checking the same source

of data with different methods. Third, time

triangulation is a way to test the originality and

credibility of the data by considering the time when

the research was done.

3 RESULTS AND DISCUSSION

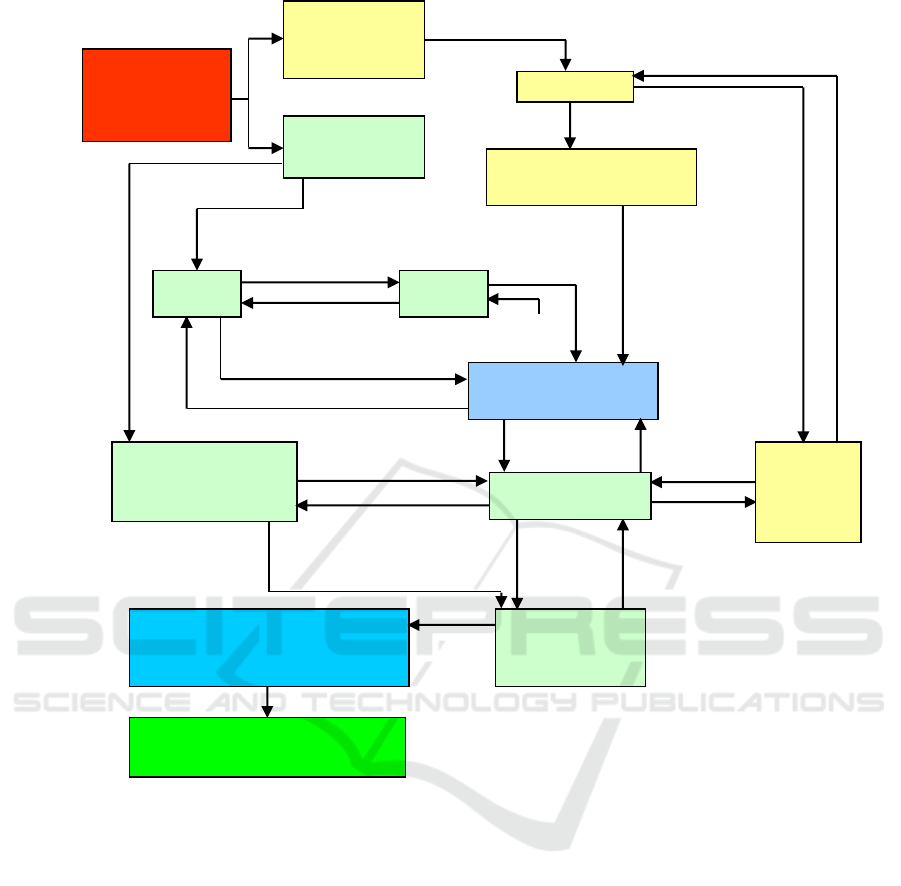

The increase of the function and role of Islamic

Bank can be done by doing linkage program

between GIB, IEU, RIB, and IMFI. The relationship

model between the parties in a linkage program can

be seen in figure 4. This program will be effective if

Bank Indonesia and Indonesian government as the

regulators for the Islamic Finance Institution can be

directly involved. This linkage also involves

consultants as the companion that can be from

university or Bank’s Partner Finance Consultant.

The accompanying institution function to increase

the capacity building for the LKMS, also function to

minimalize the risk that may arise from the receiving

partner of the linkage fund. The risk of channeling

of the fund can be minimalized by involving the

credit guaranteeing companies from the local area.

Another method that can be used to minimize the

risk is by using Tanggung Renteng system, it can be

between the KSPPS, USPPS, or another member of

financing recipients.

According to the explanation above, it can be

seen that the existence of interest will make the goal

of capital empowerment of MSME, which in the

beginning is used to stimulate the economy, will not

be effective. The profit-sharing system has various

advantages compared to fixed interest system. Those

advantages are : 1) No Recurring Cost , In a Profit

Loss Sharing (PLS) system, there is no recurring

cost that exists when we use interest rate system.

Because the payment to the creditor is based on the

revenue gained by the debtor. The profit-sharing

payment is done based on the nisbah of mutual

agreement when the akad or contract is agreed upon.

The payment of profit-sharing is not considered a

cost and have variable characteristic depending on

the rate of revenue gained by the partners or the

customers of linkage program.

Linkage Model in Micro Sharia Financing for The Empowerment of MSME

721

Figure 4: Linkage Model of GIB, IEU, RIB, and IMFI Model Linkage BUS, UUS, BPRS, and LKMS.

If the revenue increased, then the profit-sharing

will be increased too. Otherwise, if the revenue

comes down, then the profit-sharing will decrease

too. If the partner does not receive their revenue or

they are experiencing loss, then they will have no

obligation to pay the profit-sharing. This way, there

will be no need to sell assets or decrease the capital

of their venture just to pay the profit-sharing, so the

business process will be uninterrupted. In the other

hand, if economic instability should happen, the

partner will have an easier time to adapt because

they will are not burdened by the recurring costs of

interest rate.; 2) No linkage cost, Profit and Loss

Sharing does not most the creation of efficient

linkage and networking process, it even stimulate it.

This condition can happen because of the PLS

system. A financial institution who receive or do the

partnership with other financial institutions will not

”sell” their funds more expensively than their source

of funds. The PLS system does not increase the cost

or inefficiency even though the financing chain gets

longer, so it will make them more accessible to the

ordinary citizen and MSME which are the target

demographic of this program; 3) Does not burden

nation’s and local’s budgetary, Payment of profit-

sharing is an income-based system, not fund based

system. Therefore, this system would not need the

subsidy from the government because the

government would not need to subsidize there

curring interest payment borne by their recipient of

linkage program’s financing. The government can

do their mission to empower the society through the

MSME by strengthening their capital without the

need to give subsidy for the payment of profit-

sharing paid by the MSME. Because there is no cost

and subsidy, then the empowerment of MSE will be

guarantee

Return on

Services

Principal & Profit

Sharing

Capacity building

Financing

Return on Services

MSME/ Community

/ customers

Empowerment of MSME and

impowerment of community performance

Propensity of society and MSME

increase

Principal & Profit

Sharing

Financing

Empowerment

Financing

Principal & Profit

Sharing

Principal & Profit Sharing

Financing

Partners

Profit sharing

Financing

Capacity building

Cooperative or Secondary

LKMS

LKMS/BMT

College/ consultant/

KKMB

Jamkrida / Other

guarantor

institutions

BUS/UUS

BPRS

Dividend

Capital

Linkage program

LKMS, BPRS and

BUS/UUS

Indonesian Bank

APBN/D

Agency / Government Agency

Central and

Regional

Government

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

722

a burden to the government's budgetary; 4) Function

as Monitoring and Evaluation tool, The profit-

sharing system will automatically function as a

system of evaluating and monitoring the financing

given to the partners. Payment of profit-sharing by

the recipients of financing have to give the report of

their business operation, including a financial report.

The calculation of sharing-profit system will be done

by using the financial report that was submitted by

the partners, so they can determine the amount that

the financial institution and MSME will receive.

4 CONCLUSIONS

The linkage model financing done by the BMT by

involving external party has been known to the

general population. The partnership scheme of the

Islamic Bank with the external party, whether

Islamic Rural Bank or Baitul Maal Wattamwil

(BMT), are channeling, executing, and joint

financing. This program will be effective if Bank

Indonesia and the government as the regulator of

Islamic Finance Institution. The existence of linkage

program is seen as the solution for the MSME who

needs capital and Islamic Bank who has excess

liquidity. These linkage systems (mudharabah and

musyarakah) have many benefits compared to the

conventional system (interest), including no

recurring cost, no linkage cost, does not burden the

government'sbudgetary, functioning as monitoring

and evaluating tool, every involved party have direct

responsibility for the business, constant mentoring,

accompanying, and development of the business,

every fund will not be reduced but will increase

instead so instead of burdening the government’s

budgetary it might help increase the government’s

revenue instead.

REFERENCES

Abdullah, R., Ismail, A. G., 2017. Taking stock of the

waqf-based Islamic microfinance model. International

Journal of Social Economics. Emerald Publishing

Limited, 44(8), pp. 1018–1031.

Arifin, J., 2013. Hubungan Hukum Kemitraan Dalam

Linkage Program Perbankan Syari’ah. Economica:

Jurnal Ekonomi Islam. 4(2), pp. 43–54.

Bank Indonesia, 2012. Kajian Model Bisnis Perbankan

Syariah, Direktorat Perbankan Syariah, BI. Jakarta.

Bintoro, M. H., Soekarto, S. T., 2013. Strategi

pengembangan koperasi jasa keuangan syariah dalam

pembiayaan usaha mikro di Kecamatan Tanjungsari,

Sumedang. MANAJEMEN IKM: Jurnal Manajemen

Pengembangan Industri Kecil Menengah. 8(1), pp.

27–35.

Hamada, M., 2010 Commercialization of microfinance in

Indonesia: the shortage of funds and the linkage

program. The Developing Economies. Wiley Online

Library, 48(1), pp. 156–176.

Hunt‐Ahmed, K., 2013. How Does an Islamic

Microfinance Model Play the Key Role in Poverty

Alleviation?: The European Perspective.

Contemporary Islamic Finance: Innovations,

Applications, and Best Practices. John Wiley & Sons,

Inc., pp. 245–253.

Oktafia, F., 2015. Analisis pembiayaan linkage koperasi

dengan prinsip mudharabah: Studi pada Bank BRI

Syariah Cabang Malang, Universitas Islam Negeri

Maulana Malik Ibrahim.

Otoritas Jasa Keuangan, 2016. Statistik Perbankan

Syariah, Jakarta.

Rendra, B., 2015. Dampak Pembiayaan Sektor Pertanian

Oleh LembagaPembiayaan Syariah Terhadap Tingkat

Kesejahteraan Para Petani (Studi Kasus Kecamata

Torjun, Kabupaten Sampang). JAB. 12(1).

Salam, A. N., Rahmania, H. P., Fauziyyah, N. E., 2014.

Model Optimalisasi Lembaga Keuangan Mikro

Syari’ah (Lkms) Dalam Rangka Pengembangan Dan

Pemberdayaan Wilayah Pedesaan. Kumpulan Hasil

Riset Terbaik, Forum Riset Keuangan Syariah, Institut

Pertanian Bogor.

Sugiyono, P. D., 2010. Metode penelitian pendidikan,

Pendekatan Kuantitatif, Alfabeta. Bandung.

Sulistiyani, A. T., 2004. Kemitraan dan model-model

pemberdayaan, Graha Ilmu. Yogyakarta.

Tambunan, T., 2002. Usaha Kecil dan Menengah di

Indonesia: Beberapa Isu Penting, Salemba Empat.

Jakarta.

Linkage Model in Micro Sharia Financing for The Empowerment of MSME

723