Effect of Competence and Internal Accountant Certification on

Quality Information Financial Statements with Information

Technology as Mediation Variables

Rozmita Dewi Yuniarti Rozali

1

and Ling Ling

2

1

Universitas Pendidikan Indonesia, Jl. Dr. Setiabudhi No. 229, Bandung, Indonesia

2

Trisakti University, Jalan Kyai Tapa No.1, Jakarta, Indonesia

rozmita.dyr@upi.edu, lingwo9@gmail.com

Keywords: Competence of Accountant Internal, Certification Accountant Internal, Technology Information, and

Quality of Financial Reports Information.

Abstract: This study aims to investigate the influence of the competence and certification of internal accountants as a

presenter of financial reports on the quality of financial reporting information that is the end product of a

task professionalism of accountants through the mediation of information technology. To achieve this

objective of this study, data were collected from primary and secondary sources. The secondary sources

were from textbooks, journals and published and unpublished thesis, and the internet study. The primary

source involves a well-structured questionnaire, which is distributed to the respondents with the internal

accounting profession that is responsible for presenting the financial statements in accordance with financial

accounting standards in Indonesia, ranging from staffing levels up to the leaders involved in the preparation,

implementation and reporting of financial statement information. The procedure of sample selection was

purposive sampling and obtained a sample of 200 respondents using regression model path analysis.

Analysis of the data using the program Statistical Package for Social Science (SPSS) version 19. The data,

before being used to test the hypothesis, first tested for the validity and reliability testing, were collected

through questionnaires. The results showed that the competence and certification of internal accountants

have a positive significant effect on the quality of financial reporting information, while the internal auditor

certification positive no significant effect on the quality of financial reporting information. Mediation of

information technology as a positive influence on the relationship between competence and certification of

internal accountant on the quality of financial reporting information. Based on these research, can provide

input for the Indonesian Accountants Association (IAI), that in order to produce quality financial

information for the users of the report can be done with the active participation of professional associations,

education, business industry, and the government, as well as the internal accountants themselves to jointly

interact together in forming a professional and qualified accountant.

1 INTRODUCTION

1.1 Background

A company's financial statements can describe the

overall financial situation of the company for a

period of time or on a specific date. The information

in this report is very important, to take many

important decisions, especially for those who deal

with such companies, such as material suppliers,

customers, investors, banks, financial institutions,

insurance, government, tax authorities, employees,

partners and their competitors. For this purpose,

these financial statements should be guaranteed to be

prepared, manufactured and certified by those

skilled in the art (preparer), so that objectivity,

integrity, reliability and credibility of information

are assured for the majority of users. Chairman of

the IAI period 2002-2010, Ahmadi Hadibroto, said

that in Malaysia, the person in charge of the

compilers of the financial statements in one

company, at least in an open company, must be a

registered accountant in a professional association.

So that the competence is maintained and bound by

the rules of the profession.

The rise of fraud and manipulation of financial

statements since the beginning of the millennium

Rozali, R. and Ling, L.

Effect of Competence and Internal Accountant Certification on Quality Information Financial Statements with Information Technology as Mediation Variables.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 335-347

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

335

(2001) involving the Big Five Public Accounting

Firm (KAP) directly or indirectly leads to the

accounting profession. A row of fraud has occurred

both overseas and in Indonesia, leading to a lack of

user confidence in the quality of financial statement

information, especially for listed companies in the

capital market.

By mid-2015, we are surprised by the scandalous

deviation of financial statements by the world-class

Toshiba company. In Indonesia itself there are

various problems regarding financial reporting in

recent years, among others Indonesia Corruption

Watch (ICW) question the financial statements of

political parties. ICW questioned the accountability

of the party's financial statements, the Chairman of

the IAI for the period of 2002-2010, Ahmadi

Hadibroto in one of his seminars, the head of

accounting and who prepared the financial

statements of an entity was a dentist. Constraints

Small and Medium Enterprises (SMEs) to make

financial statements. In mid-2015, one of the IAI's

work programs is to formulate a simpler Financial

Accounting Standards (SAK) pillar of SAK ETAP

with proposed names of Micro, Small and Medium

SAK Entities (SAK EMKM). Freezing Inovisi's

shares because the financial statements are many

wrong. The Supreme Audit Board (BPK)

miscalculated the financial statements of East

Belitung. Error of the Supreme Audit Agency (BPK)

assessment of local government financial reports.

Financial Reporting Error Financial Service

Reporting (October 12, 2015). The House of

Representatives issues a mistake in the 2015 Haj

financial report. The traces of global corruption from

Panama. A total of 11.5 million financial documents

from a Fonseca Mossack law firm (founded by

Panama's Jurgen Mossack and Ramon Fonseca)

leaked and revealed how the network of corruption

and tax crimes of heads of state, secret agents,

celebrities and fugitives are hidden in tax-free

paradise, and provide guidance on how law firms

work with banks to offer financial secrecy to

politicians, swindlers, drug mafias, to billionaires,

celebrities and world-class sports stars. Reportedly,

in the document, there are 2961 names of individuals

and entrepreneurs who are famous in Indonesia. This

matter did not escape the attention of Corruption

Eradication Commission (KPK).

These incidents further add to the long list of

distrust of the accounting profession of the users of

financial statements on the quality of financial

statement information, especially for listed

companies in the capital market. Presentation of

incorrect information or omission of information,

whether balances or records, manipulations, forgery,

or changes to accounting records or supporting

documents on which the financial statements are

based, and incorrect application of accounting

principles related to balances, classifications,

presentation forms, and disclosures the information

on financial statements, intentionally or

unintentionally, affects the users' decisions of

financial statements and is closely related to the

quality of accountant competencies in charge of

preparing and responsible for the quality of the

financial statement information (preparer).

This research is a development of some previous

research in Indonesia, which has been done about

the competence of the accounting profession (human

resources), information technology and its influence

on financial statements, such as research conducted

in 2016 by Evicahyani and Setiawina, research in

2015 by Enof et al; Iskandar and Setiyawati;

Eunuch; Maryana and Aditya; Haliah et al; Hertati;

Sudiarianti et al; and research conducted in 2014 by

Syarifudin; as well as research in 2013 conducted by

Setiyawati; Karmila et al; and Yendrawati.

The main significance of this study that

distinguishes from previous research is the

independent variable used in this study is the

internal accountant (corporate accountant) by

looking at the competence and certification which is

the composition of a professional accountant, to the

resulting output of information quality financial

statements as a variable dependent, with information

technology as a mediation variable.

It is also supported by the results of the

Odianonsen dissertation (2011), in his dissertation

entitled "State Agencies, Industry Regulations and

The Quality of Accounting Practice in Nigeria".

Generate research: The impact of state agencies and

industry regulations was significant and positive for

the five agencies and regulations tested, however,

significant dysfunctional behavior was observed in

the quality of accounting practice, and gave a

recommendation: "the regulations are not enough to

ensure that the quality of accounting practice is high

in Nigeria, it is recommended that emphasis should

be focused more on the qualities possessed by those

who prepare financial statements and attest to them

".

Based on the description above and based on

previous research, the authors are interested to

conduct research with the title: "The Influence of

Competence and Certification of Internal

Accountants Against Quality Information Financial

Statements with Information Technology as Variable

Mediation".

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

336

1.2 Formulation of the Problem

Based on the description of the background, then the

formulation of the problem proposed in this study

are as follows:

Does the competence of internal accountants

positively affect the quality of financial

statement information?

Does the certification of internal accountants

have a positive effect on the quality of financial

statement information?

Does the competence of internal accountants

positively affect the information quality of

financial statements mediated by information

technology?

Does the certification of internal accountants

have a positive effect on the quality of

information on financial statements mediated

by information technology?

1.3 Benefits of Research

This research is intended to provide understanding

and can provide a clearer theoretical contribution to

the relationship between the accountant's

competence as the preparer resulting in the quality

and usefulness of financial statement information

that is strongly influenced by the role of the

regulator as regulators, professional certification,

and the need for support of the equipment which is

used in supporting the work of information

technology. Accounting professionalism consists of

accounting practices, accountant skills improvement,

regulatory awareness, and professional ethical

orientation.

1.4 Theoretical Basis

According to Gudono (2015: 146-147), agency

theory is built to solve the problems that arise when

there is an incomplete information when contracting

(bonding) between the principal (employer) and the

agent (the recipient of the order). One of the most

frequently used mechanisms to achieve this goal is

to employ an employment contract in which it

contains an appropriate compensation system for

management, based on the agency's output of

activities. Gudono (2015: 149-150). By reporting

relevant financial information (output) to the

company owner (shareholder) so as to add to the

manager's reputation. A good reputation of all

stakeholders, including the public, should result in

higher compensation as the agency monitoring costs

can be minimized if the owner is confident of the

accounting report.

Management theory is an actor with intrinsic

motivation to move forward. Shows what has been

done or the stewardship of the resources entrusted to

it (Gudono, 2015: 159), one of which is through the

financial statement information.

Stakeholder theory considers that the continuity

of the enterprise within its business environment is

dependent on a broad range of stakeholders, which is

not limited to owners and management, such as

governments, employees, creditors, and consumers.

Institutions are created not only to fulfill their own

interests but to meet the needs of the various parties

around Gudono (2015: 268).

Operate in accordance with community

expectations (theory of legitimacy) to survive and

one of the expectations of society is a company can

operate professionally (Gudono, 2015: 159).

Worried managers will be expelled from the

company's interest to signal to the market (note: the

stock market and labor market) that they are good

managers. Gudono (2015: 161). One form of social

responsibility of the organization or company to the

community (stakeholders or stakeholders) is to

inform the report of the use of company resources in

the form of financial statement information.

According to Gudono (2015: 71-74), the

structural contingency theoretical approach, to

produce the best performance of human

management within an organization depends on

several factors, one of them by paying attention to

the impact of environmental properties on

organizational structures and strategies, if

management requires results optimal. Almost all the

theorists of contingency theorists find three

important possibilities that affect the organizational

structure, namely the size of the organization, the

technology used, and the operating environment.

Accountants have a big role to increase the

transparency and quality of financial information for

the realization of a healthy and efficient national

economy. There is no process of accumulation and

distribution of economic resources that does not

require the intervention of the accounting profession.

Accountants play a role in all sectors: public,

private, and non-profit. In the public sector,

accountants can encourage state financial

management to run more orderly, clearer,

transparent, and more accountable. In the private

sector, the Accountant prepares reliable and reliable

financial statements, for which an accountant must

be competent. According to Spencer and Spencer

(1993: 9-11), there are five competent characters:

Effect of Competence and Internal Accountant Certification on Quality Information Financial Statements with Information Technology as

Mediation Variables

337

motivation (motive), self-nature (trait self), self-

concept, knowledge and skill.

A company accountant is an accountant who

works for internal companies, this means that

accountants who work in organizational units

(Rudianto 2012: 9). So, the competence of the

internal accountant includes the knowledge, skills,

attitudes and experience possessed by an accountant

working in an organizational unit or company.

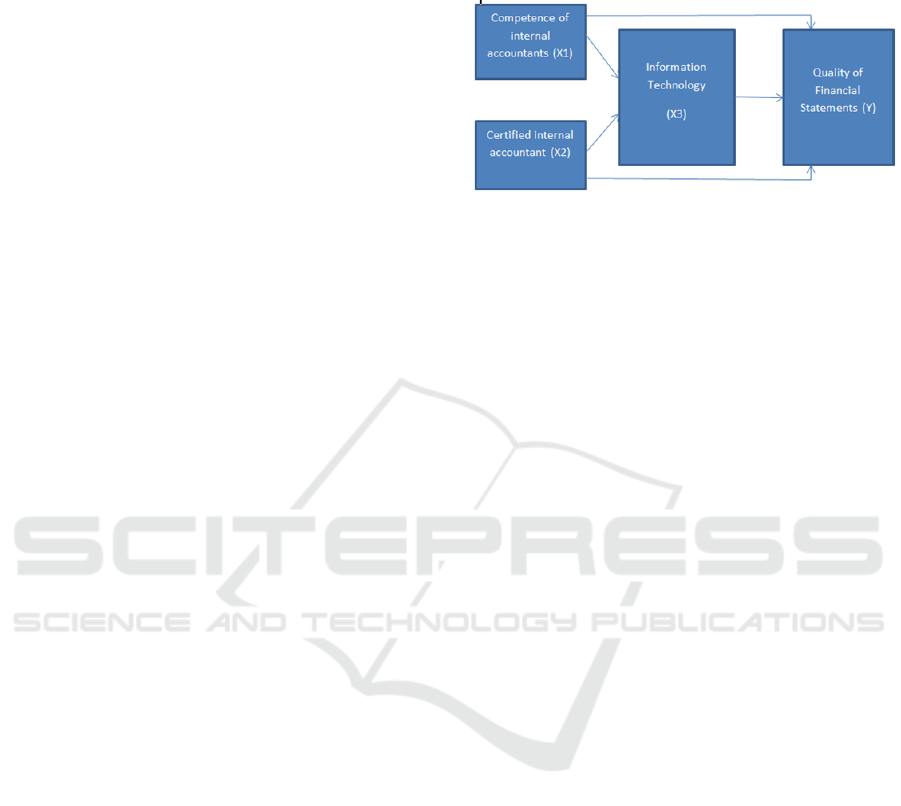

1.5 Theoretical Thinking Framework

Competence is a characteristic that underlies a

person achieving high performance in his work. A

competent person will work with his knowledge and

skills, so that it can work easily, quickly, intuitively,

and with his experience can minimize errors.

Likewise, the preparation and preparation of quality

financial report information requires human

resources that is accountant companies that have

competence and control of corporate accounting and

must also be able to follow the rapid development in

connection with the profession in line with business

demands and applicable relevant regulations.

The results of the theory review and the study of

previous studies are relevant that information

technology can be placed / treated as a mediating

variable (intermediate) in the relationship between

environmental attributes and the attributes of the

organizational structure. This is because the high

level of utilization / use of information technology in

the company and the application of information

technology is an important requirement in managing

business activities of the company. The role of

technology in the relationship between

environmental attributes with the organizational

structure attribute is information technology as a

mediator / intermediary in the relationship.

Information technology has become an important

element in achieving organizational goals to address

environmental uncertainty. The existence of

technology is needed to create the desired structural

response of management in anticipating the

existence of environmental change.

In the end there is a harmonious relationship

between the accounting profession and information

technology. It provides new opportunities for the

accounting profession of a company that is also able

to increase its role to the stakeholders in providing

quality company financial statement information.

Based on the description above, then to know

whether or not the influence between the education

of internal accountant competence and certification

of internal accountants to the quality of financial

statement information by involving information

technology as a mediation, it can be described a

research model as follows:

Figure 1: Research framework model.

1.6 Development of Hypotheses

1.6.1 Influence of Internal Accountant

Competence on Quality of Financial

Statement Information

In accordance with the professional code of

accountant profession issued by IAI and in IESBA

section 130 competence indicates the achievement

and maintenance of a level of understanding and

knowledge that allows a member to provide services

with ease and ingenuity. In the case of professional

assignment exceeding the competence of a member

or company, a member shall consult or deliver the

client to a more competent competitor. Each

member is responsible for determining each

competency or assessing having adequate education,

guidance and considerations for being responsible.

Evicahyani et al. (2016), conducting research with

the results of human resource competency, SAP

implementation, SIPKD utilization, and application

of SPIP have positive and significant impact to the

quality of LKPD Tabanan Regency. There is an

indirect effect of human resource competence, the

implementation of SAP, and the utilization of

SIPKD on the quality of the Tabanan LKPD which

is mediated by the application of SPIP.

Research conducted by Enofe et al. (2015), with

the results of research ethics of accounting has a

significant relationship with the quality of financial

reporting. Iskandar and Setiyawati (2015), with the

results of internal accountant competence research

has a significant influence on the quality of financial

reporting. Kasim (2015), with the results of

competence study of government accountants and

the implementation of internal controls related

significantly to the quality of financial reporting and

the implementation of good internal control will

result in good quality financial reporting.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

338

Haliah and Ferdiansah (2015), with the results of

competency research of human resources and

internal auditors can maximize the improvement of

report quality if supported by effective internal

control. Hertati (2015), the competence of human

resources significantly affects the value of

government financial reporting information.

Sudiarianti et al. (2015), with the result of human

resource competency research have positive effect

on SPIP and SAP implementation, and on LKPD

quality in Tabanan regency. The higher the

competency of PPK-SKPD, the application of SPIP,

SAP and LKPD quality tend to be better, and

Application of SPIP, SAP, and HR competence have

positive effect on the quality of financial report of

Tabanan regency.

Setiyawati (2013), with the findings of research,

internal accountant competence, managerial

commitment to the organization and the

implementation of internal control system

simultaneously have a positive effect on the quality

of financial reporting especially on local

government.

Nuryanto and Afiah (2013), the results of his

research simultaneously states, there is a positive

and significant influence of the competence of the

apparatus, the utilization of information technology

and internal control on the quality of financial

reporting in the work unit of the provincial

government of Jakarta.

Yendrawati (2013), the results of his research

capacity of human resources positively affect the

quality of financial statement information. Ogbonna

and Ogbonna and Ebimobowei (2012), with the

result of research ethical standards of accounting

integrity, objectivity and technical competence are

significantly related affect the quality of bank

financial statements in Nigeria.

Although many research results state that the

competence of accountant (HR) has a positive effect

on the quality of financial statement information, but

there are also studies that stated otherwise, such as

research conducted by: Maryana and Aditya (2015),

Quality accountant does not affect the quality of

financial statements. Syarifudin (2014), with the

results of his research Human Resource competence

and the role of internal auditors, no significant effect

on the quality of LKPD. Karmila et al. (2013), with

the results of his research variable human resource

capacity and internal control there is no significant

effect on the reliability of reporting SKPD financial

Riau Province.

Competence is a characteristic that underlies a

person achieving high performance in his work. A

competent person will work with his knowledge and

skills, so that it can work easily, quickly, intuitively,

and with his experience can minimize errors.

Likewise, the preparation and preparation of quality

financial report information requires human

resources that is accountant companies that have

competence and control of corporate accounting and

must also be able to follow the rapid development in

connection with the profession in line with business

demands and applicable relevant regulations.

Although the accounting system built is good but

if the human resources do not have the capacity to

implement it, it will cause obstacles in the

implementation of existing accounting functions and

finally accounting information as a product of the

accounting system can be poor quality. The resulting

information becomes information that is lacking or

has no value. Based on the description the authors

suspect there is a positive relationship between the

capacity of human resources in this case an internal

accountant, with the quality of corporate financial

statement information and the relationship is

hypothesized as follows:

H1: The influence of internal accountant

competence has a positive effect on the quality of

financial statement information.

1.6.2 Influence of Certification of Internal

Accountant on Quality of Financial

Statement Information

Certification is a form of recognition of a person's

professionalism in his profession according to his

field. Such certifications distinguish the level of

quality and skill of an accountant as compared to

other accountants. Certified internal accountants,

generally more knowledgeable than those who do

not have certification. Certified Indonesian

Accountants are composed as members of the IAI,

who adhere to the basic principles of

professionalism, such as integrity, honesty, ethics,

discipline, responsibility, dedication and

independence.

Thus, the guarantee on the reliability of reports

provided by the internal accountant can be trusted by

all parties concerned because the accountant can

provide quality financial report information. The

results of Irawati's research (2015) show that public

accountants (auditors) who have audit certification

have a positive and significant impact on their

ability as public accountant (auditor) in expressing

fraud.

Triani et al. (2015) with the conclusion of his

research, some internal accountants are unaware of

Effect of Competence and Internal Accountant Certification on Quality Information Financial Statements with Information Technology as

Mediation Variables

339

themselves as internal accountants who must meet

certain qualifications, in improving their quality.

Some of them do not understand what is meant by

the certification. Thus some of these internal

accountants will find it difficult to compete in the

free market now, because they do not have the

certification of the internal accountant. Some

accountants also meet the qualifications that must be

met by all accountants. Accountants in their

services, generally for their public accountants have

prepared themselves in the face of free market

competition, they also have certification, and in

carrying out their duties in providing their services

have also applied standards that have adopted

international professional standards.

The Government in cooperation with IAI has

formulated a mature policy package in the face of

service liberalization in ASEAN. However, the

strategy will not be implemented properly without

the support of each Indonesian accountant.

H2: The influence of internal accountant

certification has a positive effect on the quality of

financial statement information.

1.6.3 Influence of Competence of

Accountant Internal-mediated

Information Technology to Quality of

Financial Statement Information

To carry out accounting activities in the form of data

collection, data processing, data storage, and

provision of information for decision-making

effectively and efficiently, adequate tools are

needed. Incidentally for the present the best tool to

use is the computer, but in the future, if there is

another better tool, of course the tool will be used to

perform information generating activities for

decision makers (Krismiaji, 2015: 10).

Computers are tools that contain high

technology, then of course the revolution in the field

of technology, especially information technology,

which is now being and will still take place, will

affect the accounting information system used by

various organizations. So that accountants can keep

up with the development and change of information

technology, then of course have to understand new

things like networking system, electronic data

interchange, and various other computer technology

(Krismiaji, 2015: 10).

To produce accounting information can be done

manually with paper and pencil, while for complex

systems use the latest information technology or a

combination between the manual and with

information technology. Regardless of the approach

taken, the process is the same. The accounting

information system shall collect, input, process,

store and report data and information. Paper and

pencil or hardware (hardware) and computer

software are the tools used to produce information

(Romney and Steinbart, 2015: 36).

The use of information technology provides an

opportunity for increased efficiency and

effectiveness of the general ledger and reporting

cycle in terms of (1) timeliness of the general ledger,

(2) monthbook closing process, and (3) financial

reporting (Krismiaji, 2015: 443).

The results of research from several researchers,

showing the results of research that information

technology has no influence on the quality of

financial statements, as in the study: Haliah et al

(2015), moderation variable information technology

does not affect the effectiveness of internal control

relationship with report quality.

The research which gives the result of the

research with the positive effect of information

technology on the quality of financial statements, ie

research conducted by: Hertati (2015), with the

results of research utilization of information

technology significantly influence the value of

information government financial reporting and

government financial reporting information in the

accounting unit / the financial administration unit

(SKPD) within the provincial government in

Indonesia, is derived more from the contribution of

information technology utilization factors compared

to the competence of human resources. Karmila et al

(2013), results the research is only variable

utilization of information technology which have a

significant influence to the reliability of financial

reporting in Riau Province. Maryana and Aditya

(2015), the results of his research utilization of

information technology and the existence of internal

controls led to the quality of financial reports

generated by the system is also qualified. Nuryanto

and Afiah (2013), the results of his research

simultaneously states, there is a positive and

significant influence of the competence of the

apparatus, the utilization of information technology

and internal control on the quality of financial

reporting in the work unit of the provincial

government of Jakarta.

To become a professional, accountants in

addition to having accounting knowledge must also

be able to develop his career in various fields,

including information technology and the

preparation of financial statements. Technological

advances affect the development of accounting.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

340

The role of information technology on the

development of accounting in each round is

different. The more advanced the information

technology, the more its influence on the field of

accounting. The advancement of information

technology affects the development of SIA in terms

of data processing, internal control, and increasing

the amount and quality of information in financial

reporting. With the progress that has been achieved

in the field of accounting related to computer-based

SIA in generating financial statements.

The results of the theory review and the study of

previous studies are relevant that information

technology can be placed / treated as a mediating

variable (intermediate) in the relationship between

environmental attributes and the attributes of the

organizational structure. This is because the high

level of utilization / use of information technology in

the company and the application of information

technology is an important requirement in managing

business activities of the company.

Based on theory and result of majority research,

hence proposed hypothesis is as follows:

H3: Competence of Internal Accountants

mediated by Information Technology will affect the

quality of financial statement information.

1.6.4 The Influence of Certified Internal

Accounting Firms Mediated by

Information Technology on Financial

Information Quality Report

The process of book closing monthly, and (3) the

preparation of financial statements (Krismiaji, 2015:

443). Accountants are involved both in the design

and audit of accounting information systems (Hal,

2016: 20-21). In addition, one of the services that

can be provided by the accountant is the information

technology system services (PMK 25 / PMK.01 /

2014 article 9 paragraph 2), so the accountant must

also have in-depth knowledge of the topic of

information technology.

Knowledge and information technology

education one of them through certification is

Certified Information System Auditor (CISA) issued

by ISACA. The CISA Certificate becomes a very

prestigious certificate within the IT Audit

environment. Quality assurance demands on

products and services resulting from IT technology

are enormous, therefore it takes reliable

professionals who can provide confidence that an

organization's information system is adequate. For

Indonesian citizens who want to take this certificate

do not have to bother going to America where

ISACA centered, just like CIA, PPAK UI and YPIA

also facilitate the implementation of review and

examination. In addition to CISA, other certificates

issued by ISACA are Certified Information Security

Managers (CISM), Certified in the Governance of

Enterprise IT (CGEIT), and Certified in Risk and

Information Systems Control (CRISC).

The results of Irawati's research (2015) show that

public accountants (auditors) who have audit

certification have a positive and significant impact

on their ability as public accountant (auditor) in

expressing fraud.

The role of information technology on the

development of accounting in each round is

different. The more advanced the information

technology, the more its influence on the field of

accounting. The advancement of information

technology affects the development of SIA in terms

of data processing, internal control, and increasing

the amount and quality of information in financial

reporting. With the progress that has been achieved

in the field of accounting related to computer-based

SIA in generating financial statements.

The results of the theory review and the study of

previous studies are relevant that information

technology can be placed / treated as a mediating

variable (intermediate) in the relationship between

environmental attributes and the attributes of the

organizational structure. This is because the high

level of utilization / use of information technology in

the company and the application of information

technology is an important requirement in managing

business activities of the company.

In the end there is a harmonious relationship

between the accounting profession and information

technology. It provides new opportunities for the

accounting profession of a company that is also able

to increase its role to the stakeholders in providing

quality company financial statement information.

Based on the description above and the majority

research results, the hypothesis proposed is as

follows:

H4: Certification of Internal Accountants mediated

by Information Technology will affect the quality of

financial statement information.

2 RESEARCH METHODS

2.1 Data and Data Collection

Techniques

Sources of data used in this study are primary data

obtained from individual respondents ie to the

Effect of Competence and Internal Accountant Certification on Quality Information Financial Statements with Information Technology as

Mediation Variables

341

internal accountants involved in the activities of

formulating, preparing, preparing, and using

financial statements. Data collection methods used

in this study is a survey with media questionnaires

via email and researchers also provide

questionnaires in the form of direct distribution of

questionnaires. The questionnaires that the authors

used in the data collection were adopted by

questionnaires that have been made by Sudiarianti et

al. (2015); Irawati (2015), and equipped with author

development based on supporting theories.

2.2 Population and Sample

The population in this study is with questionnaires

with media questionnaires distributed to the internal

accountants. Method of sampling used in this study

is non probability sampling (seampel sampling is not

random), with sampling technique purposive

sampling that is quota sampling, because with this

method the author determines the number of samples

based on certain criteria (Agustine and Kristaung,

2013: 81-82). This technique is chosen because the

population and the samples taken have certain

criteria, namely: The company's internal accountant

(private), has been working for more than 2 years,

working in Jabodetabek area, and in charge of

preparing and preparing financial reports (preparer).

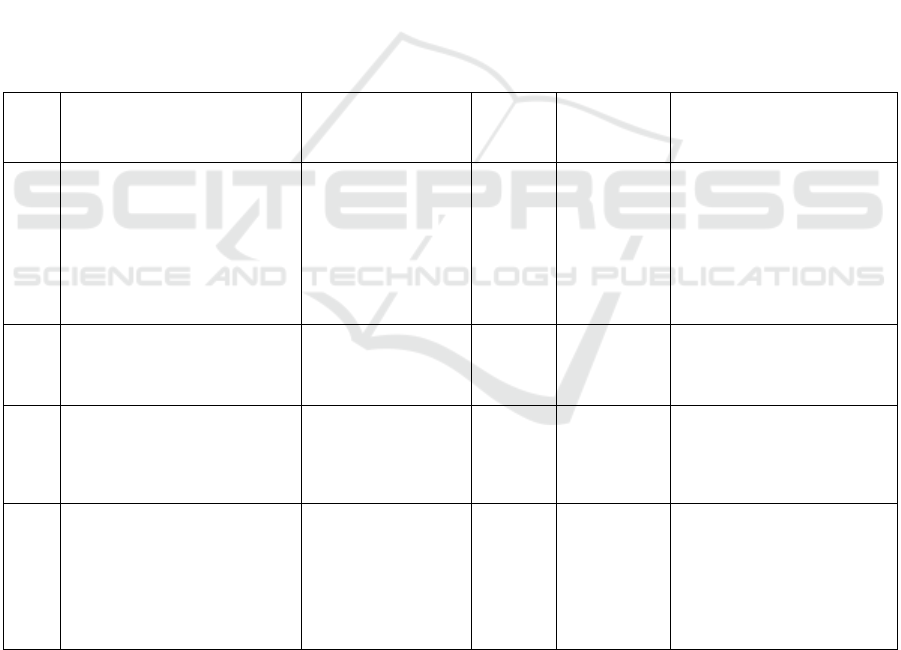

2.3 Operational Definition of Variables

The variables used in this study are independent

variables (independent) namely the competence of

internal accountant (X1) and certification of internal

accountant (X2) with mediation variable of

information technology (X3), while the dependent

variable (Y) is financial statement information

quality. The following table summarizes the

operational definition of variables and research

indicators:

Table 1: Summary of operational definitions of research variables and indicators.

No.

Variable

Measurement

Indicator

Variable

Symbol

Scale

Measurement

Reference

A.

Independent Variable

1.

Competence of internal accountants

(X1) (Spencer and Spencer, 1993)

1. Knowledge

2. Skills

3. Behavior

Kom1

Kom2

Kom3

Kom4

Kom5

Kom6

Kom7

Kom8

Interval scale

1-4

Spencer and Spencer, 1993.

International Ethics Standards

Board for Accountants (2015).

Ni Made Sudiarianti (2015).

2.

Certified internal accountant (X2)

It (2016)

PMK No.25 / PMK.01 / 2014.

1. Expertise accountant

2. Accountant

competence

Ser1

Ser2

Ser3

Interval scale

1-4

Irawati (2015).

Mardiasmo

(http://pppk.kemenkeu.go.id/News/

Details/14).

3.

Mediation Variables:

Information Technology

(X3)

1. Ease of use

2. Utilization

3. Behavioral trends to

keep using a technology

Ti1

Ti2

Ti3

Ti4

Ti5

Ti6

Interval scale

1-4

Mapping of the AICPA Core

Competency Framework

(https://www.aicpa.org/InterestArea

s/AccountingEducation/Resources/P

ages/CoreCompetency.aspx).

4.

Dependent Variables

Quality of Financial Statements (Y)

(Kieso et al, 2011)

1. Understandable

2. Relevant

3. Reliable

4. Can

compared

Kilk1

Kilk2

Kilk3

Kilk4

Kilk5

Kilk6

Kilk7

Kilk8

Kilk9

Interval scale

1-4

Financial Accounting Standards:

2015.

Sudiarianti, Ulupui, and Budiasih

(2015).

2.4 Data Analysis Method

Completion of this research using quantitative

analysis techniques. Quantitative analysis is done by

analyzing a problem that is realized with

quantitative. In this study, because the type of data

used is qualitative data, the quantitative analysis is

done by quantitating the research data into the form

of numbers by using the Likert scale of 4 points.

Testing of data analysis is only used to know the

strength of correlation between X factor (internal

accountant competence and certification of internal

accountant) to factor Y (quality of financial

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

342

statement information) with information technology

as mediation variable.

3 RESULTS AND DISCUSSION

3.1 Influence of Internal Accountant

Competence on Quality of

Financial Statement Information

Positive influence of the competence of internal

accountants on the quality of financial statement

information significant. The results of this study

prove that the higher the competence of internal

accountants will increasingly improve the quality of

financial statement information and the lower the

competence of internal accountants will further

reduce the quality of financial statement

information.

Competence is a characteristic that underlies a

person achieving high performance in his work. A

competent person will work with his knowledge and

skills, so that it can work easily, quickly, intuitively,

and with his experience can minimize errors.

Likewise, the preparation and preparation of quality

financial report information requires human

resources that is accountant companies that have

competence and control of corporate accounting and

must also be able to follow the rapid development in

connection with the profession in line with business

demands and applicable relevant regulations.

Although the accounting system built is good but

if the human resources do not have the capacity to

implement it, it will cause obstacles in the

implementation of existing accounting functions and

finally accounting information as a product of the

accounting system can be poor quality. The resulting

information becomes information that is lacking or

has no value.

Thus, the higher the competence of internal

accountants will increasingly improve the quality of

financial statement information and the lower the

competence of internal accountants will further

reduce the quality of financial statement

information.

This is in line with the research undertaken in

2016 by Evicahyani and research in 2015 by Enofe

et al, Iskandar and Setiyawati, Kasim, Haliah et al,

Hertati, Sudiarianti et al and research conducted in

2013 by Setiyawati, Nuryanto and Afiah,

Yendrawati, as well as research in 2012 by Ogbonna

and Ebimobowei.

The results of this study contradict the research

conducted by Maryana and Aditya (2015) the quality

of the accountant does not affect the quality of

financial statements with the results of quality

research accountant does not affect the quality of

financial statements and Syarifudin (2014) stating

that the quality of accountants have no effect on the

quality of financial statements , where the research

was conducted on the respondents of national

accounting students of STIE. While in this study,

respondents are those who have applied in practice,

which has worked for 2 years spread across the

Greater Jakarta area and served in generating

financial statements. The results of this study also

contradict the research conducted by Karmila et al

(2013), which states that variable human resource

capacity and internal controls there is no significant

effect on the reliability of SKPD financial reporting

in Riau Province. The differences in the results of

this study, allegedly caused by differences in

respondents who play a role in research.

Differences in results are also supported by the

results of determination coefficient test (R2) in this

study, that the behavior of independent variables are

internal accountant competence, certification of

internal accountants and information technology

able to explain the behavior of the dependent the

quality of financial statement information 25.8%

74.2% of the behavior of other independent

variables that affect the quality of financial

statement information but not included in the model.

The differences in the results of this study are

suspected to be caused by different research objects

such as in the suggestions presented by Karmila et al

in his research, which is expected to subsequently

expand research object, for example taking samples

in SKPD in some districts even Riau Province. So,

the results obtained more leverage and provide a

clearer picture.

3.2 Influence of Certification of

Internal Accountant on Quality of

Financial Statement Information

The positive effect of internal accountant

certification on the quality of financial statement

information proved to be insignificant because p-

value 0.066> α 0.05, this proves that the certification

of internal accountants is not significant effect on

the quality of financial statement information. This

result is in contrast to the specified hypothesis. This

result also contradicts the results of research

conducted by Irawati (2015), which states that

professionalism and audit certification have a

Effect of Competence and Internal Accountant Certification on Quality Information Financial Statements with Information Technology as

Mediation Variables

343

positive and significant impact on the ability of

auditors to reveal fraud, with a significance value

smaller than α 0.05.

The difference in alpha significance value is due

to the research conducted by Irawati is a study of

external auditors (public accountant) and involves

respondents in KAP who are professionals as

external auditors, where it is known that the

regulation on certification and the obligation of PPL

is very clear the rules both from government and

institutions public accounting associations as

regulators, as well as support from the industrial

world and or organizations where the public

accountant works, so that with clear rules it raises

awareness in supporting his profession as a public

accountant (external auditor).

In addition, the respondent was not objective in

filling out the questionnaire for the certification

statement of the internal accountant, as opposed to

the response result from the same respondent in the

question asked about the need or not of certification

for internal accountant in supporting his work, from

total 200 respondents who answered required

certification in support of its work is as much as 161

respondents (80.5%), with the composition answered

that is very necessary as many as 11 respondents

(5.5%), 136 respondents (68%) who stated

necessary, who answered not only as many as 14

respondents or 7%, and as many as 39 respondents

or 19.5% did not answer.

This is also supported by research conducted by

Triani et al (2015) in his research on the readiness of

the accounting profession in Indonesia in dealing

with the MEA with the conclusion that some internal

accountants do not conform to themselves as internal

accountants who must meet certain qualifications, in

improving their quality. Some of them do not

understand what is meant by the certification. They

complained about the lack of socialization about the

certification qualification for the internal accountant.

Thus, some of these internal accountants will find it

difficult to compete in the free market now, because

they do not have the certification of the internal

accountant. Some accountants also meet the

qualifications that must be met by all accountants.

Accountants in their services, generally for their

public accountants have prepared themselves in the

face of free market competition, they also have

certification, and in carrying out their duties in

providing their services have also applied standards

that have adopted international professional

standards.

The government in cooperation with IAI has

formulated a mature policy package in the face of

service liberalization in ASEAN. However, the

strategy will not be implemented properly without

the support of each Indonesian accountant. The lack

of competitiveness of Indonesian accountants, both

in terms of quantity and quality in the international

arena, demands a careful preparation in the face of

service liberalization in ASEAN. The government

also intervened. The Indonesian government

publishes a legal product that is expected to "force"

accountants in Indonesia to prepare themselves in

the face of the MEA. The legal product is PMK 25 /

PMK.01 / 2014 concerning Accountant with

Country Status.

Based on the above explanation it can be

concluded that the accountant's awareness to certify

is great but in fact contrary to the amount already

certified, it indicates the existence of a regulation

that set firmly in its implementation.

3.3 Influence of Competence of

Accountant Internal-mediated

Information Technology to Quality

of Financial Statement Information

The result of statistical test shows that the influence

of internal accountant competence on information

technology is significant and the influence of

information technology on the quality of financial

statement information is also positively significant,

so it is proven that the indirect influence of the

competence of internal accountants on the quality of

financial statement information through information

technology proved positively significant.

To become a professional, accountants in

addition to having accounting knowledge must also

be able to develop his career in various fields,

including information technology and the

preparation of financial statements. Technological

advances affect the development of accounting. The

role of information technology on the development

of accounting in each round is different. The more

advanced the information technology, the more its

influence on the field of accounting. The

advancement of information technology affects the

development of SIA in terms of data processing,

internal control, and increasing the amount and

quality of information in financial reporting. With

the progress that has been achieved in the field of

accounting related to computer-based SIA in

generating financial statements. The more advanced

information technology the more its influence on the

field of accounting. For that required a professional

company accountant and able to communicate,

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

344

understand the development of technology, so as to

compete, adapt amid rapid technological changes.

Information technology is not just limited to

computer technology (hardware and software) used

to process and store information, but also includes

communication technology to transmit information.

So, information technology is used in the

organization's information system to provide and

submit financial statement information for users in

the framework of decision making.

This supports research and research conducted in

2015 by Hertati, Karmila et al, Maryana and Aditya,

Hertati, and research conducted in 2013 by Nuryanto

and Afiah, and even research conducted by Karmila

et al. only variable utilization of information

technology which have a significant influence to the

reliability of financial reporting in Riau Province.

3.4 The Influence of Certified Internal

Accounting Firms mediated by

Information Technology on

Financial Information Quality

Report

The results of statistical tests proved that the effect

of the certification of accountants internal to

information technology significant, as well as the

influence of information technology on the quality

of information positive financial statements so that

statistically can be concluded the indirect effect of

certification of internal accountants to the quality of

financial report information mediated by information

technology positively significant.

In the end there is a harmonious relationship

between the accounting profession and information

technology. It provides new opportunities for the

accounting profession of a company that is also able

to increase its role to the stakeholders in providing

quality company financial statement information. By

improving quality, improving competence and

professionalism by joining professional associations.

For accountancy can join IAI and for information

technology can join ISACA Chapter Indonesia. As

well as following the training provided and followed

the certification of accounting and information

technology both local and which have been based

internationally.

The results of this study support the results of

research conducted in 2015 by Irawati states that

educational background, technical competence,

continuous education and training and work

experience simultaneously affect the quality of the

results of the examination.

4 CONCLUSIONS

Based on the analysis and discussion and test results,

it can be concluded, as follows:

The competence of the internal accountant has

a significant positive effect on the quality of

financial statement information, supported by

Evicahyani and Setiawina research, and

research in 2015 by Enofe et al, Iskandar and

Setiyawati, Kasim, Haliah et al, Hertati,

Sudiarianti et al and research conducted in

2013 by Setiyawati et al, Yendrawati, as well

as research in 2012 by Ogbonna and

Ebimobowei.

Certification of positive internal accountant

does not significantly affect the quality of

financial statement information.

The result of the third hypothesis testing shows

that the indirect influence of internal

accountant competence on financial

information quality mediated by information

technology proved to be significant positive,

supported by research conducted in 2015 by

Hertati, Karmila et al, Maryana and Aditya,

Hertati, and research conducted in 2013 by

Nuryanto and Afiah.

The result of the fourth hypothesis testing

shows that the indirect effect of internal

accountant certification on the quality of

financial statement information mediated by

positive information technology is significant,

supported by research conducted in 2015 by

Irawati.

5 LIMITATIONS AND

IMPLICATIONS

The results of this study have several limitations as

follows:

In this study time is limited, so that the object

being sampled (respondent) is limited, both in

terms of number and scope of the area, then the

sample distribution has not represented

significantly compared with the existing

population, so the research is not able to use or

generalize to represent profession of internal

accountants throughout Indonesia.

After the research, it is known that the

variables used as independent variables are

internal accountant competence, internal

accountant certification, and information

technology as a whole only influence 25.80%

Effect of Competence and Internal Accountant Certification on Quality Information Financial Statements with Information Technology as

Mediation Variables

345

to the dependent variable is the quality of

financial statement information. While the

behavior of independent variable of internal

accountant competence and certification of

internal accountant explain behavior of

dependent variable of information technology

equal to 29,2%. This means there are many

other factors that affect the quality of financial

reporting that is not included in this study.

Limitations of literature on the profession and

certification of internal accountants in

Indonesia, so that more use of internet media.

List of statements used in the making of this

research questionnaire developed by the

researchers themselves by adopting some of the

literature both from previous research and from

the existing literature so it needs to be refined.

Lack of seriousness and low awareness and

appreciation of some respondents to participate

in a research and the difficulties of the authors

to monitor directly the respondent's answer, so

not all statements and questions answered

completely, this makes the constraints for

writers to collect well the opinion respondents

and obstacles to analyze more deeply against

existing research variables.

The results of this study have implications, among

others:

For internal accountants are expected to

maintain and improve competence by

consciously to continue to develop competence

and actively play a role in the development of

accounting science and information

technology.

Internal accounting service users to set

standards for recruitment or selection of

competent and certified internal accountants so

as to produce quality financial information

according to established standards.

Internal accountant service users should

provide a variety of training and be given the

opportunity to attend training or continuous

improvement of professional education of

internal accountant to improve competence

especially for new accountant, and reserve fund

for this activity.

For the Accounting Profession Professional

Accounting Indonesia IAI as Associate

Profession of Accountant according to KMK.

263 / KMK.01 / 2014 on the Establishment of

Indonesian Institute of Accountants as the

Association of Accounting Professions, must

make clear rules regarding the Law regulating

the profession of the internal accountant and

the accountability of the financial statements.

And policy rules on certification and

continuing education for internal accountants.

As stated by Ahmadi Hadibroto (Head of IAI

period 2002-2010), the business world if not

required, will find someone who is important to

be trusted, not necessarily an accountant. So, it

actually takes a coercion, at least to provide

credibility of financial statements in the State

of Indonesia.

(http://www.iaiglobal.or.id/v02/berita/detail.ph

p?catid=&id=659). Therefore, the birth of the

Financial Reporting Act (PK) is highly awaited

by all internal accountants as professional

accountants of Indonesia and regulations for

accounting services activities to ensure its

activities are increasingly regulated and

protected, and the output (financial report)

generated can be accounted for by the

profession and of course the users of financial

statements become more comfortable.

REFERENCES

Augustine, Y., Robert, K., 2013. Business Research

Methodology and Accounting. Dian Rakyat, Jakarta.

Enofe, A. O., Chukzy, C. E., Ewaen, O. O., 2015. The

Effects of Accounting Ethics on the Quality of

Financial Reports of Nigeria Firms. Research Journal

of Finance and Accounting. Vol. 6, No. 12, 2015.

Evicahyani, Sagung, I., Nyoman, D. S., 2015. Analysis of

Factors Affecting the Quality of Local Government

Financial Statement of Tabanan Regency. ISSN: 2337-

3067. E-Journal of Economics and Business Udayana

University 5,3 (2016): 403-428.

Gudono, G., 2015. Organizational Theory, Yogyakarta.

BPFE.

Haliah, A. H. H., Ferdiansah, M. I., 2015. The Role of

Information Technology as Moderating Variable and

Internal Control Effectiveness as intervening variable

in the Relationship between Human Resource

Competency and Internal Auditor Service Quality on

Quality of Report. Asia-Pacific Management

Accounting Association (APMAA) 2015 Annual

Conference, At Bali, Indonesia

Hertati, L., 2015. Competence of Human Resources, The

Benefits of Information Technology on Value of

Financial Reporting in Indonesia. Research Journal of

Finance and Accounting. ISSN 2222-1697 (Paper)

ISSN 2222-2847 (Online). Vol. 6. No. 8.

Irawati, S., 2015. Influence of Independence, Experience,

Professionalism and Audit Certification to Auditor's

Ability Uncover Fraud with Auditing Fee as

Moderation Variable. Thesis Master of Accounting

Program Trisakti University. Jakarta (not published).

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

346

Iskandar, D., Setiyawati, H., 2015. The Effects of Internal

Accountants' Competence on the Quality of Financial

Reporting and the Impact on the Financial

Accountability. International Journal of Managerial

Studies and Research. Volume 3, Issue 5, May 2015,

PP 55-64.

Karmila, K., Amries, R. T., Edfran, D., 2013. Influence of

Human Resource Capacity, Utilization of Information

Technology, and Internal Control on Reliability of

Local Government Financial Reporting (Study on

Government of Riau Province). Research Institute of

Riau University. Journal SOROT Vol 9 No. 1 April pp

1 -121.

Kasim, E. Y., 2015. Effect of Government Accountants

Competency and Implementation of Internal Control

to the Quality of Government Financial Reporting.

International Journal of Business, Economics and

Law, Vol. 8, Issue 1 (Dec.) ISSN 2289-1552.

Kieso, W., Jerry, J. W. Terry, D. W., 2011. Intermediate

Accounting IFRS Edition. John Wiley & Sons, Inc.

USA.

Krismiaji, K., 2015. Accounting Information System

Fourth Edition, Publisher and Printing Unit Seklah

High Science Management YKPN. Yogyakarta.

Maryana, F., Aditya, B. I., 2015. Persepsi Mahasiswa

Akuntansi STIE Nasional Mengenai Pengaruh

Kualitas Akuntan, Pemanfaatan Teknologi Informasi

dan Sistem Pengendalian Intern. Dinamika Ekonomi

Jurnal Ekonomi dan Bisnis Vol. 8. No. 1 Maret 2015.

Nuryanto, M., Afiah, N. N., 2013. The Impact of

Apparatus Competence, Information Technology

Utilization and Internal Control on Financial

Statement Quality (Study on Local Government of

Jakarta Province – Indonesia). World Review of

Business Research. Vol. 3. No. 4. November 2013

Issue. Pp. 157-171.

Ogbonna, G. N., Ebimobowei, A., 2012. Effect of Ethical

Accounting Standards on the Quality of Financial

Reports of Banks in Nigeria. Current Research Journal

of Social Sciences 4(1): 69-78, 2012. ISSN: 2041-

3246.

Romney, M. B., Steinbart, P.J., 2015. Accounting

Information Systems, Pearson Education, Inc. New

Jersey, Thirteenth Edition.

Rudianto, R., 2012. Pengantar Akuntansi – Konsep dan

Teknik Penyusunan Laporan Keuangan. Adaptasi

IFRS. Penerbit Erlangga.

Setiyawati, H., 2013. The effect of Internal Accountants’

Competence, Managers’ Commitment to

Organizations and the Implementation of the Internal

Control System on the Quality of Financial Reporting.

International Journal of Business and Management

Invention. Volume 2 Issue 11 November. 2013:

PP.19-27.

Spencer, M. L., Spencer, M. S., 1993. Competence at

Work Models for Superior Performance, Jhon Wiley

and Sons, Inc. New York. USA.

Sudiarianti, N. M., I Gusti Ketut Agung Ulupui, I G. A.

Budiasih, 2015. Pengaruh Kompetensi Sumber Daya

Manusia Pada Penerapan Sistem Pengendalian Intern

Pemerintah dan Standar Akuntansi Pemerintah serta

Implikasinya pada Kualitas Laporan Keuangan

Pemerintah Daerah. Simposium Nasional Akuntansi

18 Universitas Sumatera Utara, Medan 16-19

September 2015.

Syarifudin, A., 2014. Pengaruh Kompetensi SDM dan

Peran Audit Intern terhadap Kualitas Laporan

Keuangan Pemerintah Daerah dengan Variabel

Intervening Sistem Pengendalian Internal Pemerintah

(studi empiris pada Pemkab Kebumen). Jurnal Fokus

Bisnis, Volume 14, No. 02.

Triani, N. N. A., Erlina, D., Merlyana, D. Y., 2015.

Kesiapan Profesi Akuntan di Indonesia Dalam

Menghadapi MEA. Seminar Nasional dan the 2nd Call

for Syariah Paper. ISSN 24600-0784.

Yendrawati, R., 2013. Pengaruh Sistem Pengendalian

Interen dan Kapasitas Sumber Daya Manusia

Terhadap Kualitas Informasi Laporan Keuangan

Dengan Faktor Eksternal Sebagai Variabel

Moderating. Jurnal Akuntansi & Auditing Indonesia

(JAAI) Volume 17 No. 2: 165-174.

Effect of Competence and Internal Accountant Certification on Quality Information Financial Statements with Information Technology as

Mediation Variables

347