Profitability Ratio to Distinguish between Islamic and Conventional

Banks in Indonesia

Tulus Suryanto

Faculty Economic and Business Islam, Universitas Islam Negri Raden Intan Lampung, Indonesia

Bandar Lampung, Indonesia

tulus@radenintan.ac.id

Keywords: Profitability Ratio, Islamic Bank, Conventional Bank.

Abstract: The aim of this paper is to find out whether Islamic and conventional banks in Indonesia can be

distinguished from each other based on profitability. In particular, we consider whether researchers or

regulators can properly categorize Islamic or conventional banks by using profitability ratios. This

research method is explanatory method. Data generated from 2008 - 2017 comes from 7 Islamic banks

and 30 conventional banks in Indonesia. The results of this study are Islamic banks and conventional

banks can be distinguished from each other based on profitability and Islamic banks more profitable than

conventional banks, because the profitability ratios (ROA) obtained greater.

1 INTRODUCTION

Since the founding of Dubai Islamic Bank in 1975 as

the world's first private interest-free bank, the growth

of sharia banking worldwide has been phenomenal

with its managed assets generally growing at an

annual rate of 12% to 15% per annum. In Iran,

Pakistan, and Sudan, the entire banking industry has

become Islamic and many major international banks

(eg, HSBC, BNP Paribus, Commerzbank, and

Citicorp) have introduced Islamic divisions that offer

different Islamic or Sharia products in the structure of

the banking conventional. According to the Institute

of Islamic Banking and Insurance (IIBI) there are 277

sharia banks and financial institutions operating in

more than 70 countries in 2005. IIBI estimates that

Islamic banks manage assets of $ 260 billion in 2004.

Most of the early growth of Islamic banking took place

in South Asia. However, only in the 1990s, Indonesia

enlivened the Islamic banking industry with the

establishment of Bank Muamalat by Majelis Ulama

Indonesia in 1991 and officially began operating in

1992.

The principles in sharia banks differ significantly

with conventional banks. Sharia banks are governed

and operate on the basis of Islamic legal principles

(sharia) that require the sharing of risks and prohibit

the payment or receipt of interest (usury). In contrast,

conventional banks are guided primarily by the

principle of maximizing profits. If the difference

between the two types of banks is not just semantic (as

some Islamic finance critics say), sharia and

conventional banks must be distinguished from each

other based on financial information obtained from the

company's balance sheet and income statement.

However, since all banks operate in the same

competitive environment and are regulated in the

same way in most countries, it is possible that both

Islamic and conventional banks show similar financial

characteristics.

A substantial body of research examined the

structure, operation, and management of Islamic

banks (Turen, 1995; Murjan and Ruza, 2002; Islam,

2003; Essayyad and Madani, 2003), while other

research explains the principles of finance Islam is

common to non-Muslim readers (Siddiqui, 1981;

Bashier, 1983; Khan, 1985). Unless Karim and Ali

(1989) and Rosly and Abu Bakr (2003), Olson and

Zoubi (2008) researchers have not examined the

financial ratios of sharia banks. Karim and Ali (1989)

argue that Islamic banks prefer to obtain funds from

depositors rather than shareholders during the period

of expansion in the economy. Rosly and Abu Bakar

(2003) showed that profitability (based on return on

assets and profit margin) was statistically higher for

Islamic banks in Malaysia during the period 1996-

1999 than the conventional banks. However, they

point out that in recent years, Islamic banks have

286

Suryanto, T.

Profitability Ratio to Distinguish between Islamic and Conventional Banks in Indonesia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 286-289

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

chosen to behave more like conventional banks than

strictly follow the principles of Sharia. In summary,

research to date has not been resolved the question of

whether Islamic and conventional banks are

operationally different and whether profitability ratios

can be used to differentiate between two types of

banks significantly.

The purpose of this paper is to find out whether

Islamic and conventional banks in Indonesia can be

distinguished from each other based on profitability.

In particular, we consider whether researchers or

regulators can properly categorize Islamic or

conventional banks by using profitability ratios.

Although many studies have documented the

usefulness of accounting information in predicting

bankruptcy and credit ratings, no research has been

conducted on the potential value of accounting

information data in distinguishing between sharia and

conventional banks.

Examination of previous studies, such as Karim

and Ali (1989) and Rosly and Abu Bakar (2003),

suggest that Islamic banks may be more profitable

than conventional banks. However, it is possible that

shareholders in Islamic banks are willing to accept

lower equity yields (Olson and Zoubi, 2008).

Assuming that the possibility that Islamic banks are

more profitable. Hence the hypothesis in this study is

Islamic banks are more profitable than conventional

banks.

2 DATA AND METHODOLOGY

2.1 Data

The data used are secondary data from 30

conventional banks and 7 Islamic banks since 2008 -

2017. The data used from the financial statements

(balance sheet and profit and loss) taken from the

stock exchange of Indonesia.

Table 1: Number of Banks in the Sample.

Total Observations

Conventional

30

Islamic

7

Total

37

2.2 Methods

The analytical method used is descriptive analysis. By

using 3 measure of bank profitability ratio, that is

Return on Assets, Return on Equity and Profit Margin.

Table 2: Definitions of 3 financial ratios.

Bank Profitability

Ratios

Measurement

ROA

net income /

average total assets

ROE

net income /

average stockholders' equity

PM

net income / operating income

3 RESULTS AND DISCUSSION

To begin an analysis of whether Islamic banks and

conventional banks can be distinguished from each

other based on their profitability characteristics, Table

3 presents descriptive statistics for both types of

banks.

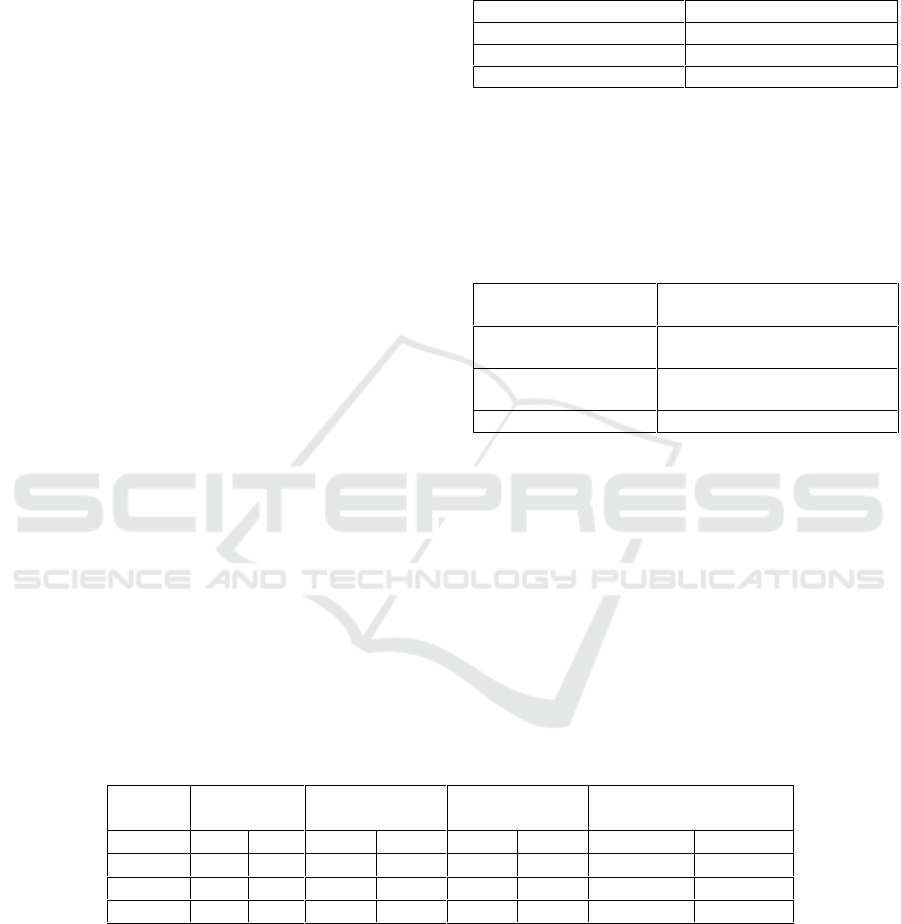

Table 3: Descriptive statistics for the 3 profitability ratios.

Variable

N

Mean

St. dev

t-test for equality of

means

CB

IB

CB

IB

CB

IB

t-value

p-value

ROA

30

7

0.004

0.008

0.077

0.009

-0.067

0.004

ROE

30

7

0.104

0.057

0.348

0.073

-0.275

0.047

PM

30

7

0.077

0.066

0.335

0.457

0.121

0.104

The t-test for equality of means is based on the mean for Islamic banks minus that of conventional banks for each ratio. The

test is calculated assuming unequal sample variances.

The last column of the table shows the t-test results

for the similarities between Islamic and conventional

bank groups for each ratio. Test statistics and degrees

of freedom are calculated assuming unequal

population variance, and are not equal, since the

variance of about one-third of the financial ratios is

more than twice as large for one bank group than any

other group. The average values for ROA and ROE

differ significantly at the 1% and 5% levels between

the two types of banks, while the mean of both ratios

Profitability Ratio to Distinguish between Islamic and Conventional Banks in Indonesia

287

(ROA and ROE) also differ significantly at the 1% and

5% levels.

The results of the above analysis is the ROA of

sharia banks higher than conventional banks. These

results answer the hypothesis above bahwasannya

Islamic banks more profitable than conventional

banks when viewed from the ROA. In line with

previous studies which reported higher ROA for

sharia banks [Rosly and Abu Bakar (2003)]. In this

study, an ROA of 0.8% for sharia banks while

conventional bank ROA was only 0.4% larger at a

significant 1% level.

However, for the results of ROE analysis can not

answer the above hypothesis, because the results of

Islamic bank ROE is not greater than conventional

banks. Average ROE per year of conventional banks

is 10.4%, while Islamic banks are only 5.7%, with

significant differences at the 5% level. The reason for

this analysis is that Islamic banks prefer toraise capital

from investment deposits rather than equity capital in

funding their investment which is a high strategic

choice according to Islamic banks (Karim and Ali

(1989) .While the Islamic financial boom in recent

years finally, it makes sense for sharia banks to rely

more on deposits than on equities (Olson and Zoubi,

2008), but in Indonesia conventional banks operate

longer and have more customers than Islamic banks

and have a market share of only 5% of conventional

banks. which resulted in the results of this study not in

accordance with previous research (Olson and Zoubi,

2008) and obtaining the results of Islamic bank ROE

is smaller than conventional banks While profit

margin has no significant significance in the results of

analysis in this study.And in line with previous

research that PM has no significance (Olson and

Zoubi, 2008).

The above results show the reliability of Islamic

banks compared to conventional banks. With a

relatively smaller amount of assets than conventional

banks, Islamic banks can still optimize their

profitability and generate higher return on assets than

conventional banks. It can be deduced that Islamic

banks are indeed more profitable than conventional

banks. This is in line with previous researchers [olson,

karim, rosli] who produced similar findings. Thus can

be said accounting information in the form of

profitability can be made differentiation between

Islamic banks and conventional banks, Islamic banks

are more profitable than conventional banks.

4 CONCLUSION

The result of the above analysis gives the conclusion

that Islamic banking especially in Indonesia is more

profitable than conventional bank. This is because

profits derived from assets are higher than

conventional banks. This illustrates that although the

assets of Islamic banks in Indonesia are small, and the

market share is low, Islamic banks can still optimize

the profits of their assets compared to conventional

banks. The results of this study can provide

information to customers to be able to prefer Islamic

banks to save funds because Islamic banks do not use

the system of interest that became a ban on Islamic

religion, as well as more profitable than conventional

banks. Although with a small capital Islamic banks

can still be optimal in generating profits. Limitations

in this study were to use only three profitability ratios

to see the difference between the two banks. For

further research is expected to increase the ratio of

profitability in order to increase the accuracy that the

two banks can be distinguished by looking at

profitability.

REFERENCES

Bashier, B. A. 1983. Portfolio management of Islamic

banks: A certainty approach. Journal of Banking and

Finance, 7(3), 339−354.

Essayyad, M., Madani, H. 2003. Investigating bank

structure of an open petroleum economy: The case of

Saudi Arabia. Managerial Finance, 29 (11) , 73 − 92.

Institute of Islamic Banking and Insurance. 2005. Website

http://www.islamicbanking.com/ibanking/statusib.php.

Islam, M. 2003. Development and performance of domestic

and foreign bank in the GCC countries. Managerial

Finance, 29 (2/3), 42 − 7 2.

Karim, R., Ali A. 1989. Determinants of the financial

strategy of Islamic banks. Journal of Business Finance

and Accounting, 16(2), 193−212.

Khan, M. S. 1985. Islamic interest free banking: A

theoretical analysis. IMF Staff Papers DM/85754.

Murjan, W., Ruza, C. 2002. The competitive nature of the

Arab Middle Eastern banking markets. International

Advances in Economic Research. 8(2), 267-275.

Olson, Denis., Zoubi, A.T 2008. Using accounting ratios to

distinguish between Islamic and conventional banks in

the GCC region. The International Journal of

Accounting, 43, 45 – 65.

Rosly, S. A., Abu Bakar, M. A. 2003. Performance of

Islamic and mainsteam banks in Malaysia.

International Journal of Social Economics, 30(12),

1249 − 1265.

Siddiqui, M. N. 1981. Muslim economic thinking: A survey

of contemporar literature. London: The Islamic

Foundation.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

288

Turen, S. 1995. Performance and risk analysis of Islamic

banks: The case of Bahrain Islamic Bank. Journal of

King Abdul Aziz University: Islamic Economics, 7(1).

Profitability Ratio to Distinguish between Islamic and Conventional Banks in Indonesia

289