Sukuk Return and Risk: A Comparison between Ijarah and

Mudharabah-based Contracts

Septi Adi Jaelani Bachtiar, Handi Risza, and Prima Naomi

Magister Manajemen Faculty Economics and Business, Universitas Paramadina, Indonesia

jaelanibachtiar04@gmail.com, {handi.risza, prima.naomi}@paramadina.ac.id

Keywords: Sukuk, Mudharabah, Ijarah, Risk, Return.

Abstract: Sukuk’s value and the amount of Sukuk’s emissions in Indonesia continue to increase, although the options

are still limited to Mudharabah and Ijarah contracts only. Sukuk’s issuers also prefer to issue Sukuk with an

Ijarah agreement. There are several opinions as to why Sukuk Ijarah is more popular in Indonesia, one of

which is its risk consideration of the agreement. In addition, a few previous studies have also mentioned that

Mudharabah Sukuk has a better yield than that of Ijarah Sukuk, while other research has highlighted the

relationship between the performance of Sukuk and its risk for both Ijarah and Mudharabah. This study aims

to examine the difference between Ijarah and Mudharabah Sukuk in terms of their performance and risk using

reasonable price data and a maturity period. The Sukuk’s return and risk is obtained by calculating the amount

of Holding Period Yield (HPY), Yield to Maturity (YTM), Risk Adjusted Return (RAR), and the HPY

deviation standar. We found that in terms of return and risk, the Ijarah-based Sukuk differs significantly from

the Mudharabah-based Sukuk. The Ijarah-based Sukuk shows higher return performance than Mudharabah-

based Sukuk. In terms of risk, the Ijarah-based Sukuk also shows higher risk than the Mudharabah-based

Sukuk.

1 INTRODUCTION

The Islamic capital market complies with the Shariah

Islamic law. One common Shariah investment

instrument is Sukuk. The Sukuk market has emerged

during the past decade, and Sukuk is one of the

products whose growth has been remarkable along

with Islamic Finance development (Raur, 2014).

Literally, Sukuk refers to certificates and technically

it refers to securities, notes, papers, or certificates,

with features of liquidity and tradeability (Dusuki,

2015). Sukuk is allowed under Shariah law because it

is backed up by real assets such as land, buildings, or

equipment. Therefore, when Sukuk is purchased and

sold by the investor, they engage directly in real

assets and are not simply trading paper (Wilson,

2008)

Sukuk has various structures based on its

underlying assets. There are three main clusters of

Sukuk structure, which are: (1) sale-based Sukuk,

which consists of ba’i bithamin ajil, murabahah,

salam (Bay’ al salam), and Istisna’; (2) leased-based

Sukuk (ijarah); and (3) equity-based Sukuk, which

includes Mudharabah, musharakah, and wakala.

Based on the standards of the Accounting and

Auditing Organization for Islamic Financial

Institutions (AAOIFI), all Islamic Sukuk (syariah)

instruments have been qualified as secured and save

instruments that comply with Islamic Law that are

free from usury, gharar, and maysir.

In its development, Sukuk has become one of the

most important Islamic financial instruments since

the infamous Islamic banking system spread widely

around the world. Sukuk has become an innovative

financial solution for those who need financing or

investment alternatives. Currently, Sukuk is mostly

issued by non-Muslim majority countries, such as the

United Kingdom, Saxony Anhalt (Germany), Japan,

and others. The Islamic financial market volume

reached US $2.29 trillion by the end of 2016, with

Islamic banking accounting for 80% followed by

Sukuk at 14%, and the rest is other Islamic financial

instruments (Edbiz, 2017).

In Indonesia, since the first Sukuk was issued in

2002, there have been only two types of Sukuk that

exist: Ijarah-based and Mudharabah-based Sukuk. A

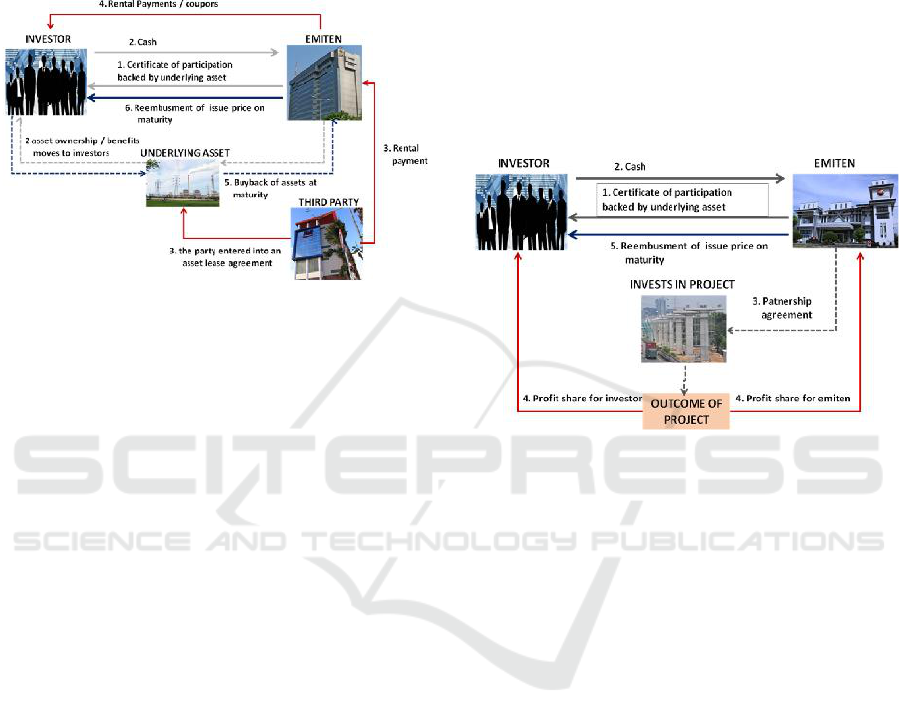

typical process of issuing Ijarah Sukuk is illustrated

in Figure 1.

First, the emiten issues a certificate of

participation and the investor is provided with cash.

Bachtiar, S., Risza, H. and Naomi, P.

Sukuk Return and Risk: A Comparison between Ijarah and Mudharabah-based Contracts.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 163-168

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

163

Under an Ijarah contract, the use of a particular

property is transferred from the owner to another

person in exchange for a rental payment. It is a leasing

agreement with the lessor (referred as the mujir), the

lesse (called the mustajir), and the rent is paid to a

lessor called ujrah.

Figure 1: Ijarah-Based Sukuk Structure.

An Ijarah contract is predetermined for a certain

period, and the rent provides regular income either

monthly, quarterly, or annually.Therefore, the Ijarah-

based Sukuk fulfills the requirement to be

characterized as a bond. It is important to denote that

Ijarah-based Sukuk represents a proportiaonate

ownership claim over a leased asset, and therefore

those who hold the Sukuk certificate will have

ownership responsibilites that only terminate either

when the securities reach maturity or if they are sold

to another party who then takes over the responsilities

(Usmani, 2002).

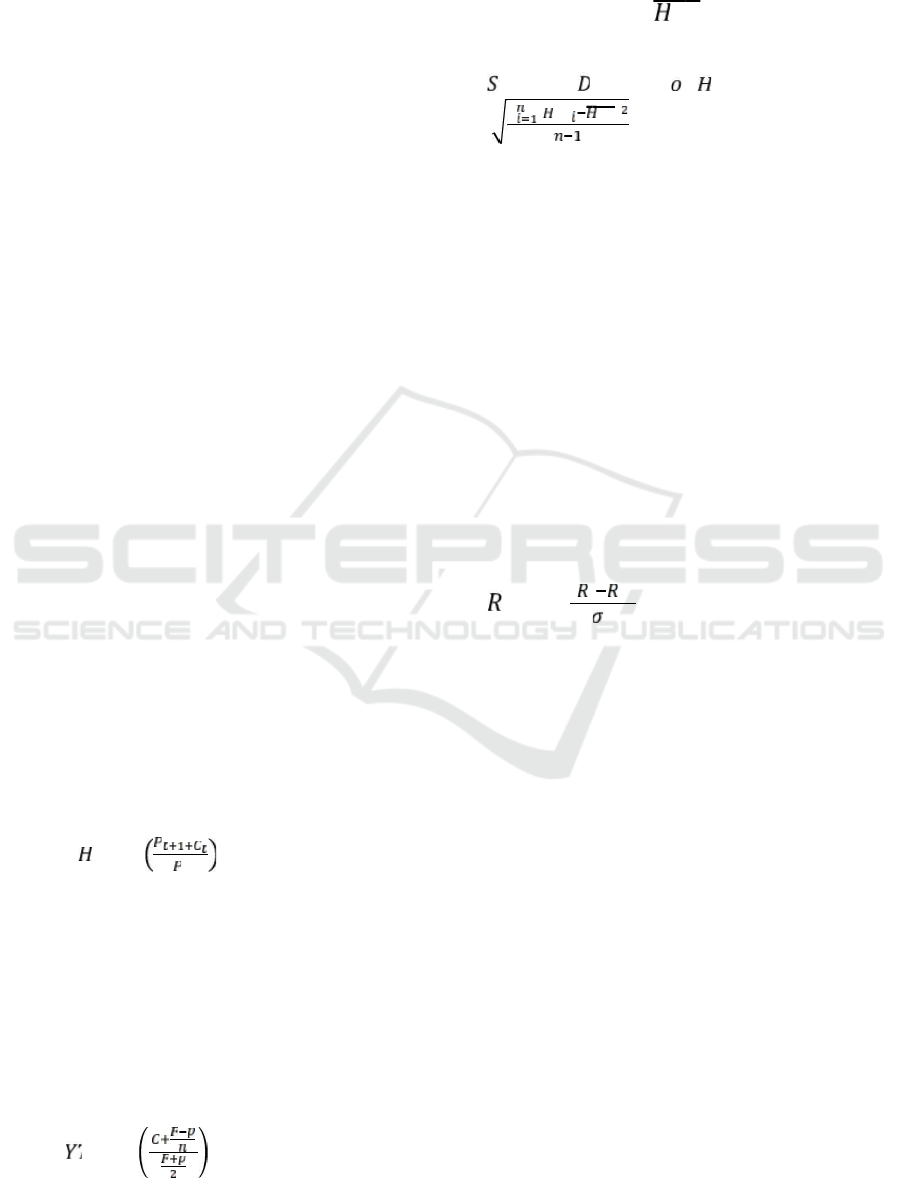

On the other hand, a Mudharabah-based Sukuk

has a slightly different structure than the Ijarah

Sukuk. The complete structure is illustrated in Figure

2. Unlike the Ijarah-based Sukuk, the Mudharabah-

based Sukuk is issued under a Mudharabah contract.

According to this contract, one party provides the

capital (rab-al-maal/shahibul maal) while the other

provides manpower and expertise (mudharib). Profits

gained from this cooperation will be divided based on

the proportion of the agreed (nisbah) ratio. However,

the losses incurred from the cooperation will be borne

entirely by the party that provides capital as long as

there is no indication of intended purpose by the party

that provided the expertise (moral hazard of the

mudharib).

In Indonesia’s Shariah capital market, the Ijarah-

based Sukuk issuing trend is currently greater than the

interest in Mudharabah-based Sukuk. To date, based

on the Financial Services Authority of Indonesia

(OJK) data, the number of outstanding corporate

Sukuk as of 21 April, 2017 is 55 series, which consist

of 37 Sukuk using Ijarah-based contracts (67.27%)

and 18 Sukuk using Mudharabah-based contracts

(32.73%). The value of Ijarah-based Sukuk has

reached Rp 5.79 trillion (47.75%), while

Mudharabah-based Sukuk is slightly greater at Rp

6.34 trillion (52.25%) (Masyrafina, 2017).

In terms of risk, both Ijarah-based and

Mudharabah-based Sukuk have important risks that

must be considered, just as with other standard

financial instruments (Amine, 2012). These risks

include country risk, sectoral risk, and assets risk.

Risks also include structure risk, market risk, credit

risk, operational risk, and taxation risk.

Figure 2: Mudharabah-Based Sukuk Structure.

However, Ijarah-based Sukuk is considered less

risky, since it has the advantage of a fixed rate of

return, which is suitable for investors who seek a

certain amount of return as well as those who want to

avoid exposure to risk. On the other hand,

Mudharabah-based Sukuk also has the advantage of

much greater opportunity to obtain a higher rate of

return, despite its volatile nature. From those

contrasting characteristics, it would be interesting to

analyse further on both types of Sukuk, as each of

them has an advantage in terms of return and risk. To

our knowledge, there are not many studies that

explore both Ijarah-based as well as Mudharabah-

based Sukuk in terms of their risk and return, in

particular for the Indonesian market. Therefore, it is

important gap in the literature that needs to be filled.

This study focuses on comparing the risk and return

between the Ijarah-based and the Mudharabah-based

Sukuk. In addition, we are also interested in

evaluating whether Sukuk, with longer time to

maturity, has a higher return and risk as highlighted

in the investment basic rule.

Understanding the return and risk of Sukuk in

Indonesia’s capital market would be necessary for

both investors and company as issuers. Firstly,

investors need to consider the risk and return of

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

164

Sukuk in order to optimize their portfolio. They will

need information on which types of Sukuk they

should choose according to their risk and return

preference as well as the length of the investment to

balance their portfolios. Secondly, the Sukuk’s issuer

should be interested in knowing what their return

would be compared to the average Sukuk market

return. Understanding the risks of each type of Sukuk

contract will be important for their future knowledge.

Thirdly, it is also important for the regulator to

understand the risk and return of each type of Sukuk

contract in order to design the future market

development for Sukuk instruments in Indonesia as

well as the capital market itself. Lastly, this research

also provides information for the National Sharia

Council (DSN) in Indonesia. As the authority that

holds an important role in issuing Islamic fatwa

(regulation), the DSN requires accurate and detailed

information so that all Shariah financial products,

particularly Sukuk that is issued in the Indonesia

capital market, can be protected and withheld from

gharar, maiysir, and riba practices.

2 METHODS

Variables used in this study consist of yield and risk

of Sukuk. We use two indicators of return: Holding

Period Yield (HPY) and Yield To Maturity (YTM),

and two indicators of risk: Risk of HPY and Risk of

YTM, which are calculated as Risk Adjusted Return

(RAR).

HPY (Holding Period Yield) is the total return

received from holding the Sukuk over a period of time

and is expressed as a percetage. HPY is calculted

using equation (1), where C is coupon, F is

redemption value, and P is fair price.

HPY = HPR -1

= − 1 (1)

YTM (Yield To Maturity) is the expected rate of

return based on the assumption that the Sukuk is held

until the maturity date and not be called. YTM

includes the coupon rate within its calculation. We

use this as a proxy, since investors are more likely to

make investment decisions based on an instrument's

YTM than its coupon rate. We use equation (2) to

calculate YTM, where C is coupon, F is redemption

value, P is fair price, and n is maturity time.

= (2)

Risk of HPY is calculated as the standard

deviation of HPY. The standard deviation of HPY is

calculated using equation (3), where xi HPY is the

holding period yield; is the average of HPY,

and n is the number of Sukuk.

=

∑

( )

(3)

RAR (Risk Adjusted Return) is a measure to find

how much return is provided by an investment given

the level of risk associated with it. It enables the

investor to make a comparison between the high-risk

and the low-risk return investment. By calculating

risk-adjusted return, investors can judge whether

he/she is extracting the highest possible gains with

minimal risk involved and thereby the return on

investment. Some of the popular risk-adjusted return

measures are the Sharpe Index, the Treynor Index,

and the Jensen's Alpha Index. In this research, we

used the Sharpe Index, and calculated it using

equation (4) where R

i

is the return of Sukuk

calculated using YTM; R

f

is the risk-free return,

which is proxied by the SBIS (Sertifikat Bank

Indonesia Shariah); and σ

p

is the standard deviation of

return.

=

( )

(4)

The data used in this study are the monthly data of

corporate Sukuk in Indonesia in 2015. Purposive

sampling is applied in order to acquire the intended

data. Criteria used for selecting the corporate Sukuk

are as follows:

1. The Sukuk is evaluated by IBPA (Price

Indonesia Securities Appraiser Corporation);

2. The Sukuk is denominated in Rupiah;

3. Sukuk does not include Sukuk’s amortization;

4. Sukuk has a minimum rating of BBB+ during

the observation period, which is based on the

relevant rating issued from standards agency

(Pefindo, Moody's, or Fitch); and

5. Sukuk has never defaulted.

Based on the sample selection criteria, the number

of Sukuk eligible for this study 46 Sukuk, which

includes 31 Ijarah-based Sukuk and 15 Mudharabah-

based Sukuk.

Sukuk Return and Risk: A Comparison between Ijarah and Mudharabah-based Contracts

165

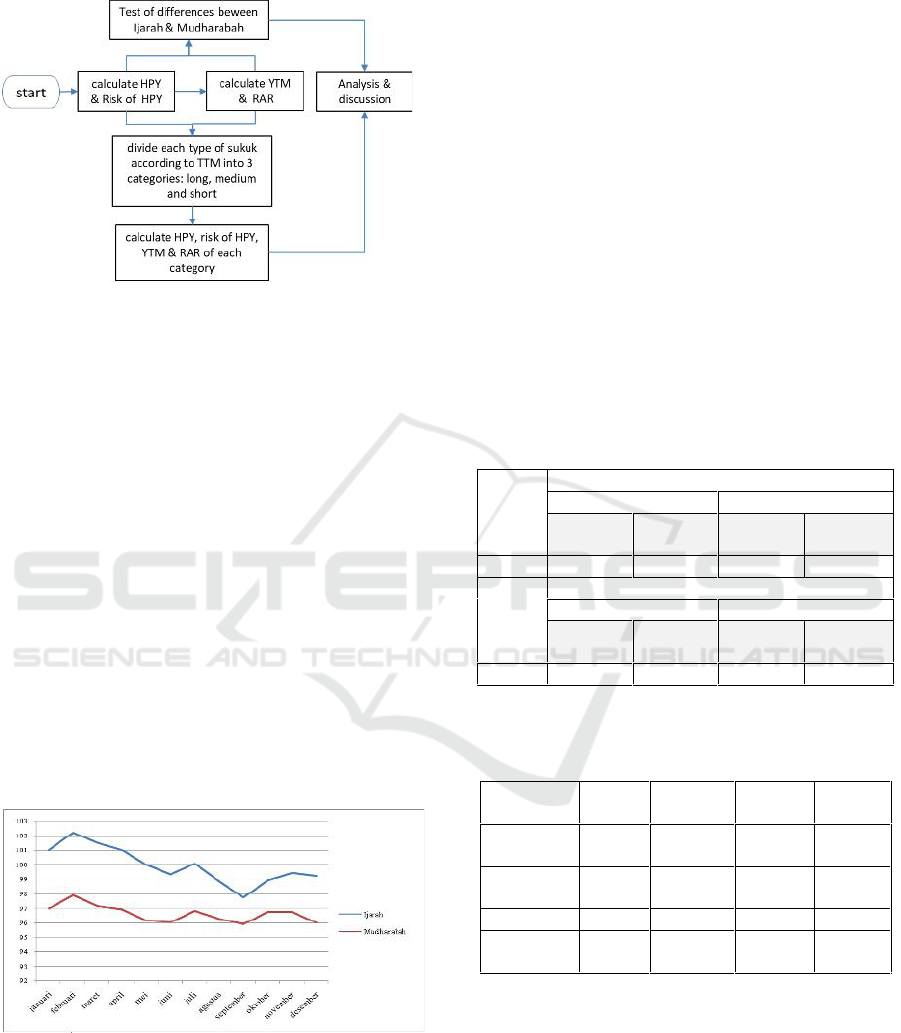

The design of the research is described in the

figure 3.

Figure 3. Research Desaign.

First, we calculate HPY and risk of HPY for each

type of sukuk. Namely ijara and mudaraba. We also

calculate YTM and RAR. Secondly, we conducted a

different test between the two types of sukuk for each

variable. Third, to analyze deeper, regarding whether

TMT impacts risk and return on each sukuk, we

divide each sukuk into three categories based on

TMT, ie long term, medium and short. Lastly, we

calculate each of these variables in each category.

3 RESULTS

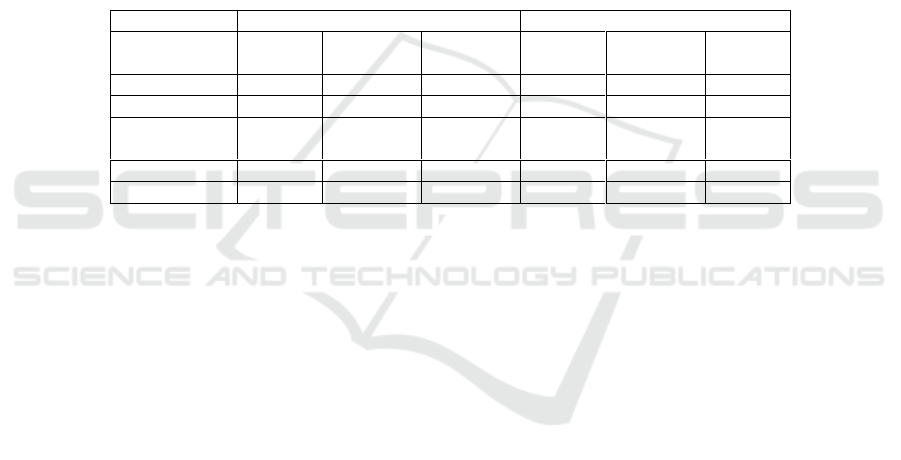

The Sukuk data employed in this study is based on its

fair market price. The monthly market price of Ijarah-

based and Mudharabah-based Sukuk in Indonesia

experienced downward and upward trend during the

year of 2015. The complete fluctuation can be seen in

Figure 4.

Source: analyzed from IBPA (2016).

Figure 4: Fair-price Trend ofIjarah and Mudharabah Sukuk

for the year 2015.

From Figure 4, it can be seen that both Ijarah-

based and Mudharabah-based Sukuk experienced

approximately similar trends. Early in the year,

during January and February, both Sukuk increased.

However, their market price slowly decreased until

the first lowest point on June and then increased

again. Both Sukuk had their lowest prices in

September 2015, while in overall the market price

Ijarah-based Sukuk was higher than the

Mudharabah-based Sukuk.

The risk and return profile of both Ijarah-based

and Mudharabah-based Sukuk are presented in Table

1. It can be seen that in terms of return, the average

monthly HPY and YTM of Ijarah-based is higher

than the Mudharabah-based Sukuk. Meanwhile, the

risk of Sukuk proxied by RISK of HPY and RAR also

indicated the same pattern, in which Ijarah-based is

higher than the Mudharabah-based Sukuk. This result

is consistent with the notion of investment in which a

high return is accompanied by high risk. Overall, the

Ijarah-based Sukuk has better performance than the

Mudharabah-based Sukuk.

Table 1: Risk and Returnof Ijarah-based and Mudharabah-

based Sukuk in 2015.

RETURN

HPY

YTM

Ijarah

Mudha

rabah

Ijarah

Mudha

rabah

Mean

10.2424

9.9814

10.1040

9.9814

RISK

RISK of HPY

RAR

Ijarah

Mudha

rabah

Ijarah

Mudhar

abah

Mean

0.3740

0.2580

0.0767

0.0646

Source: Analyzed from IBPA (2016)

Table 2: Result for Mean Difference Test of returns and

risks.

Test

HPY

RISK of

HPY

YTM

RAR

Mann-

Whitney U

4.2833

5153.5700

7.4331

5.2110

Wilcoxon W

9.1395

10009.856

0

12289464.

0000

10.0673

Z

-38.4520

-30.5350

-9.5640

-29.8940

Asymp. Sig.

(2-tailed)

0.0010

0.0000

0.0030

0.0000

Source: Data analysed using Mann-Whitney Test.

To complete the analysis, we ran the test of

normality and similarity of variance for both return

and risk of Sukuk (the full profile is available and can

be provided upon request). From both tests

conducted, the results show that both return and risk

data of Ijarah-based and Mudharabah-based Sukuk

are not normally distributed and the variance is

dissimilar. Therefore, the hypothesis testing in the

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

166

next stage of the analysis was conducted by using the

non-parametric statistics method. The Mann Whitney

for mean difference was chosen because the data are

not normally distributed. The summary of the test

results is shown in Table 2.

From Table 2, it can be seen that the Mann-

Whitney U statistics indicates significant values for

overall variables, which are 0.01, 0.00, 0.003, and

0.001 for HPY, RISK of HPY, YTM, and RAR,

respectively. Overall, those variables have p-value

less than 0.05, and thus the average return and risk

calculated are significantly different. In other words,

both return and risk of Ijarah-based and

Mudharabah-based Sukuk were proven to be

statistically different. The difference between Ijarah-

based and Mudharabah-based Sukuk is significant at

the 5% level.

In order to gain a deeper understanding of these

results, we also conducted a separate test for each type

of Sukuk. Specifically, we tested whether the

maturity of Sukuk (TMT) affects risk and return. To

run this analysis, we classified the overall Sukuk data

into three time maturity categories: Short Term (0-1

years), Medium Term (1-3 years), and Long Term

(more than 3 years). We then measured the risk and

return for each group, which are represented by four

variables, as in the full sample. The results of the test

are described in Table 3.

From Table 3 it can be seen that the return of

Ijarah-based Sukuk measured by HPY decreased

along with the increase of time to maturity; however,

the risk increased. That is not the case if we measure

by YTM, however.

Table 3: Average Return and Risk of Ijarah-based and Mudharabah-based Sukuk are based on TMT.

Return

Risk

Ijarah

TTM

Short

TTM

Medium

TTM

Long

TTM

Short

TTM

Medium

TTM

Long

HPY

10.2552

10.2353

10.1742

0.2926

0.4792

0.5189

YTM

10.0097

10.2039

10.3767

0.0723

0.0823

0.0848

Mudharabah

TTM

Short

TTM

Medium

TTM

Long

TTM

Short

TTM

Medium

TTM

Long

HPY

9.2916

-

10.3209

0.18935

-

0.58144

YTM

9.6741

-

11.8404

0.0650

-

0.0616

Source: Analyzed from IBPA (2016).

The return of Mudharabah-based Sukuk

increased along with the time of maturity, measured

both by HPY and Meanwhile, for Mudharabah it was

slightly different RTM. Nevertheless, the risk of

Mudharabah-based Sukuk resulting from both

measurements was not consistent.

The results presented in the previous section show

that Ijarah-based and Mudharabah-based Sukuk

have different return and risk. One of the important

explanations of this issue might be attributable

towards their characteristics. Mudharabah-based

Sukuk has characteristics that are similar to equity-

based investment instruments. The yield of the

Mudharabah Sukuk is derived from the revenue share

or profit received by the issuer based on the agreed-

upon nisbah level at the outset. Meanwhile, Ijarah-

based Sukuk has the characteristic that is

approximately the same as fixed income investment

instruments or debt. The yield of the Ijarah Sukuk is

derived from the margin of rent or the excess of the

principal, of which the amount is already known and

agreed upon at the earliest stage. Therefore,

theoretically, the returns and risks of the

Mudharabah-based Sukuk should be relatively

higher than the Ijarah-based Sukuk.

Despite the above explanation, results from this

study show otherwise, where the Ijarah-based Sukuk

has a higher return and risk in contrast to the

Mudharabah-based Sukuk. This finding is

interesting, since it might be due to some possible

explanations. Most of the Mudharabah-based Sukuk

in Indonesia is traded using project revenues

(contracts) on a profit-sharing basis. This contract has

a certain value until the end of the contract period.

This means that the level of certainty in the amount

of profit-sharing that will be received in the future is

higher than that of the revenue-based sharing

company in the form of operating profit or net profit.

Thus, the level of the Mudharabah-based Sukuk

investment risk is relatively low and even lower than

the Ijarah-based Sukuk due to the fact that the

majority of Mudharabah Sukuk issuers are state-

owned enterprises (SOEs, BUMN), which are

considered to have lower credit risk.

Another interesting feature from this research

finding is that in Ijarah-based Sukuk, the longer the

contract or the time to maturity (TMT), the lower the

return (HPY) will be, which in turns increases the risk

(RISK of HPY). This result is not in accordance with

the basic rules of investment, in which the longer the

Sukuk Return and Risk: A Comparison between Ijarah and Mudharabah-based Contracts

167

TMT, the greater the return and the higher the risks.

A possible explanation given was the low liquidity of

Ijarah-based Sukuk on the secondary market. The

number of outstanding Sukuk in Indonesia is still

relatively small, which tends to induce investors to

hold their assets until maturity. Therefore, the longer

the TMT, the greater the risk (additional liquidity

risk), but with a lower return (HPY).

Another important point is the finding on the

Mudharabah-based Sukuk. By using YTM to

measure return, the longer the TMT, the higher the

return, but the lower the risk. If we follow the basic

rules of investment, the longer the time to maturity,

the higher the return and the risk will be. A possible

explanation towards this anomaly is the composition

of listed Sukuk issuers used as research objects. Most

of the long-term Mudharabah-based Sukuk comes

from SOE issuers that use the value of the contract of

work as the basis for profit sharing. The SOE issuers

are considered to have smaller risk than the issuers

from the private sector. Meanwhile, the shorter term

of the Mudharabah-based Sukuk comprises a mixture

of types of issuers. In addition, the type of income that

is used as revenue-sharing basis is a mixed income or

operating profit. Thus, the level of uncertainty for this

type of Sukuk is relatively higher as opposed to the

longer term Sukuk.

4 CONCLUSION

This study provides evidence towards two different

types of Sukuk in Indonesia. We found that in terms

of return and risk, the Ijarah-based Sukuk differs

significantly from the Mudharabah-based Sukuk.

The Ijarah-based Sukuk shows higher return

performance than Mudharabah-based Sukuk. In

terms of risk, the Ijarah-based Sukuk also shows

higher risk than the Mudharabah-based Sukuk. These

findings contrast basic investment theory, in which,

based on the characteristics, the Mudharabah-based

Sukuk should have higher return and risk than Ijarah-

based, since it is an equity-based investment.

In more detailed investigations, we found several

anomalies: (1) on the Ijarah-based Sukuk, the longer

the TMT, the lower the return (HPY), but the higher

the risk of HPY; (2) on the Mudharabah-based

Sukuk, the longer the TMT, the higher the return, but

the risk decreases. These anomalies are possibly due

to the fact that most of the Mudharabah-based Sukuk

traded in Indonesia are using project revenue

(contract) as the profit-sharing basis, with a fixed

contract value until the end of the contract period. The

majority of the Mudharabah-based Sukuk issuers are

SOEs. Meanwhile, the number of existing Ijarah-

based Sukuk is still relatively small, which in turn

makes the investment hold up to maturity.

However, those results still need to be evaluated

further, for instance by lengthening the observation

period. That might have been a limitation in this

study. We also suggest that further research compare

between the Mudharaba-based Sukuk and the Ijarah-

based Sukuk that are issued by SOEs and private

companies in order to get a thorough understanding

on this issue. Investigating the variables that cause

differences in both types of Sukuk will also be

interesting to explore in future studies.

ACKNOWLEDGMENT

We would like to thank Else Fernanda, SE., M.Sc. for

his input on this research result from the practitioner's

point of view. Also to Dr. Intan Nurul Awwaliyah

who is willing to become a peer review of this article.

Suggestions from both are very meaningful in this

article.

REFERENCES

Al-Amine, M. 2012. Global Sukuk and Islamic

Securitization Market, Financial Engineering and

product Innovation, Bril. Leiden.

Dusuki, A. W., 2015. Challing of Realising Maqasid al-

Shari'ah (Objectives of Shari'ah) in the Islamic Capital

Market: Special Focus on Equity-Based Sukuk.

Newhorizon Global Perspectif on Islamic Banking.

IIBI.

Edbiz Consulting., 2017. Global Islamic Financial Report

2016. London Edbiz Consulting. Edbiz.

Masyrafina, I., Aini, N. (Penyunt.)., 2017. OJK Want

Issuance of Corporate Sukuk Is Enlarged. Quoted from

09 24, 2017,

http://www.republika.co.id/berita/ekonomi/keuangan/1

7/05/02/opbdnt382-ojk-ingin-penerbitan-sukuk-

korporasi-diperbesar.

Raur, A. L., Ibrahim, Y. b., 2014. Determinant of Risk and

Return with Special Reference to GCG Sukuk Market

Structure. International Journal of Development and

Economic Sustainability. ECRTD.

Usmani, M. T., 2002. An Introduction of Islamic Finance,

The Hague Kluwer Law International. Netherlands.

Wilson, R., 2008. Innovation in the structuring of Islamic

sukuk securities. Humamomics.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

168