The Influence of Firm Performance to Corporate Social

Responsibility Disclosure

Case Study of Sharia Banks in Indonesia

Ria Yanuari Pramono

Faculty of Economics and Business, Airlangga University Surabaya, Indonesia

riayanuaripramono@gmail.com

Keywords: Capital Adequacy Ratio, Asset Growth, FDR, CSR Disclosure, Shariah Enterprise Theory.

Abstract: The development of CSR disclosure has a positive impact on Islamic economy which is characterized by the

concept of Shariah Enterprise Theory. Profitability of the company shows the company succeeded in

obtaining profit as measured by Capital Adequacy Ratio (CAR), Asset Growth and Financing Deposit to Ratio

(FDR). This research is an explanation research in which the researcher explains the relationship between the

variables through hypothesis testing. The research variables include three independent variables is CAR,

Asset Growth, FDR and then CSR Disclosure as a dependent variable. The population of the study was all

Sharia Banks operate in Indonesia and have published annual financial reports during the period 2012-2014.

The data source is secondary data. The study used multiple regression analysis and processed using SPSS.

The result of the study concluded that there are significant influences between firm performance and Islamic

Corporate Social Responsibility Disclosure. This research gives a suggestion for further research to use other

measure variables of financial performance to get a more comprehensive model.

1 INTRODUCTION

Market participants consider that companies that have

a sustainable social concern have a good reputation

and better opportunities than other companies that do

not have it. The strengthening of the principles of

Environmental Management Accounting, Good

Corporate Governance such as fairness, transparency,

accountability, and responsibility has encouraged

broader accounting concepts using accounting tools

and practices to support internal corporate

management decision-making on environmental

issues and their impact on corporate performance

(Doorasamy 2015).

Corporate social responsibility (Corporate Social

Responsibility) is one of the several corporate

responsibilities to stakeholders. Stakeholders, in this

case, are people or groups who can influence or be

influenced by various decisions, policies, and

operations of the company, Inoue, Funk, and

McDonald (2017). The tendency of globalization and

increased demand from stakeholders for companies to

carry out the role of social responsibility and

disclosure encourages the involvement of companies

in practice EMA. Sees the practice of EMA emerged

CSR as evidence of activity from EMA. According to

Lopatta, Reemda and Chen (2017) CSR is a general

statement which indicates the company's obligation to

utilize its economic resources in operations to provide

and contribute to internal and external stakeholders.

Profitability of the company is often highlighted

because it shows the success of the company in

obtaining profit, to measure the extent to which the

company gains profit can be seen from capital

measured by Capital Adequacy Ratio (CAR) ratio.

According to Li, Chen, Chien, Lee, and Hsu (2016).

CAR ratios are able to show how far all bank assets

that contain risks (credit, investments, securities, bills

with other banks) participate in financing from the

bank's own capital funds in addition to obtaining

funds from sources outside the bank, such as funds

from the community, and loan.

Aset is an asset used for corporate operational

activities. The large operating results generated by the

company, the increase in assets followed by increased

operating results will further increase the confidence

of outsiders of the company.

While the company's liquidity reflects the

condition of the company in carrying out its

operational activities and the appropriate measure of

corporate liquidity in this research is the ratio of

Financing Deposit to Ratio (FDR) because this ratio

shows the finance of sharia banking companies,

152

Pramono, R.

The Influence of Firm Performance to Corporate Social Responsibility Disclosure - Case Study of Sharia Banks in Indonesia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 152-156

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

especially related to the liquidity aspect which shows

the customer deposit funds and used in meet the loan

request (loan request) of its customers. Companies

with high profits, growth and liquidity levels will get

a lot of attention especially from the public and

investors so that the spotlight has more value in the

eyes of the public and investors, the company tends

to disclose Social Responsibility (CSR Disclosure).

In Indonesia the development and disclosure

activities of CSR received government support, it was

proven after the House of Representatives passed the

Act on social and environmental responsibility or

CSR as a Limited Liability Company in Article 74 of

Law No.40 of 2007 on Limited Liability Company

(UUPT) on July 2007. It is mentioned that a limited

liability company that carries on business in the field

or concerned with natural resources is obliged to

carry out social and environmental responsibility

(Article 74 paragraph 1). According to Pramono

(2015), the reason companies, especially in the field

of banking, do social reporting is due to a change of

responsibility paradigm, from management to

shareholders to management to all stakeholders.

In addition, according to Isnanisa 2016, the

challenge to maintain a corporate image in the

community is the reason why a bank in Indonesia

conducts social reporting. One type of bank that plays

an important role in the disclosure of social

responsibility is sharia bank. According to Meutia

(2010), Islamic banks should have more spiritual

dimension. This spiritual dimension not only requires

non-usury business but also able to provide welfare

for the wider community, especially for the weak

economic community. According to Yusuf (2010),

the position of sharia banks as financial institutions

that already exist at the national and international

level should be a pilot financial institution in moving

the CSR program. Implementation of Islamic bank

CSR program is not only to fulfill the mandate of the

law, but furthermore that the social responsibility of

Islamic banks is built on the basis of the philosophy

and tasawwur (picture) of Islam is strong to become

one of the financial institutions that can prosper the

community. Looking at the above demands, public

companies in Indonesia that make CSR reporting

separately have increased by 60% by 2014 compared

to 2012. In addition, the rapid development of

Indonesia's sharia banking industry makes research

on social responsibility at banks sharia is required.

The statistics of the development of sharia banking up

to December 2016 shows that sharia banking services

are increasingly widespread throughout the

archipelago with 12 Sharia (BUS), 37 Sharia

Business Unit (UUS) and 154 BPRS. Total assets of

sharia banking have reached 130.5 trillion rupiahs or

grew 47.5% year on year (yoy). The high growth of

sharia banks is able to increase its share to 3.7% of

total national banking assets.

The development of EMA practice not only has a

positive impact on the development of the

conventional economy, but also the Islamic economy.

It is characterized by the emergence of CSR with the

concept of Shariah Enterprise Theory.Shariah

Enterprise Theory is an Enterprise Theory that has

been internalized with Islamic values to produce

transcendental and more humanist (Triyuwono,

2007). According to Meutia (2010), the most

appropriate theory to express corporate social

responsibility is Shariah Enterprise Theory (SET).

This is because in the Shariah Enterprise Theory God

is the source of the main mandate. While the

resources possessed by the Stakeholders are the

mandate of Allah in which it attaches a responsibility

to use in the manner and purpose set by the Giving of

the Trust.

CSR reporting is a practice established on the

basis of norms in the community. In the sharia

banking sector, the values of norms used are Islamic

religious values, or also called the values of sharia.

This research intends to explain how the reporting of

Corporate Social Responsibility (CSR) is based on

Sharia values.

Research that examines the influence of CSR has

been done. Susilowati (2013) examines the effect of

profitability, growth and firm size on the disclosure

of corporate social responsibility information from

manufacturing companies listed in Indonesia Capital

Market Directory, using partial least square against an

inner model of ERC direct influence, firm size and

growth on CSR showing influence not significant

(significant). While inner model test for direct

influence of profitability to CSR showed significant

result. Isnanisa, Kartika and Suryan (2016), analyzed

the effect of profitability and growth on disclosure of

social responsibility according to Shariah Enterprise

Theory at Syariah Commercial Bank in Indonesia.

The result of research by using multiple linear

regression shows that profitability variable measured

by ROE have positive effect to CSR Disclosure and

growth variable have negative effect to CSR

Disclosure.

Based on the results of previous research, several

independent variables affecting Corporate Social

Responsibility research Kusumawardhany (2014) and

Isnanisa, Kartika and Suryan (2016) have differences

where the results of this study are contradictory where

profitability negatively affect the disclosure of social

responsibility in the mining industry, while

profitability have a positive effect on disclosure of

social responsibility in Sharia banks industry both

previous research equally use ROE to measure

profitability so that research this time using CAR.

According to Li, et.al (2016) the CAR ratio shows

The Influence of Firm Performance to Corporate Social Responsibility Disclosure - Case Study of Sharia Banks in Indonesia

153

how much the total assets of banks that contain risks

that come funded from their own capital in addition

to obtaining funds from sources outside the bank so

that the increase in profitability positively affect the

disclosure of social responsibility (CSR Disclosure).

In addition to the research of Isnanisa, Kartika and

Suryan (2016) by taking 7 research samples indicated

that growth by using Assets Growth had negative

effect on the disclosure of social responsibility, this

study investigated whether growth positively

influences CSR Disclosure by researching the entire

population of Sharia Commercial Banks registered in

Islamic Banking Statistics. None of the previous

research has used liquidity to measure the financial

performance of sharia banks in Indonesia by using

Shariah Enterprise Theory. Seen from the results of

previous research the researchers used three basic

theories (agency theory, the theory of legitimacy and

stakeholder theory) which has been frequently used in

research with the theme of CSR.Previous research

using profitability variables with ROA and ROE

proxy as a measuring tool to see the performance

corporate finance as well as variable growth and

company size to assess the company's financial

performance. There is little research using CAR

(Capital Adequacy Ratio) proxy to measure the

profitability of a company, growth by using Assets

Growth proxy and liquidity by using FDR (Financing

to Deposit Ratio) proxy as variable to measure

company's financial performance. In addition, the

practice of CSR disclosure is more often seen from

the CSD index or GRI index, whereas still not much

explored by researchers is how the practice of CSR

disclosure is seen from the CSRI index according to

Shariah Enterprise Theory.Therefore this study was

conducted on the annual report all sharia banks

registered in Islamic Banking Statistics due to the use

of CSRI index according to Shariah Enterprise

Theory as appropriate to see how far the disclosure of

social responsibility of Sharia Commercial Banks in

Indonesia.

2 LITERATURE REVIEW

2.1 Shariah Enterprise Theory

Shariah Enterprise Theory is an Enterprise Theory

that has been internalized with Islamic values to

produce a transcendental and more humanist theory.

Enterprise Theory according to Triyuwono (2007), is

a theory that recognizes the existence of

responsibility not only to the owners of the company

but to the broader stakeholder group. Enterprise

Theory is able to accommodate the plurality of

society (stakeholders), things that can not be done by

proprietary theory and entity theory. This is because

the concept of enterprise theory shows that economic

power is no longer in one hand (shareholders), but is

in many hands, that is stakeholders.

2.2 Relationship Profitability to

Corporate Social Responsibility

Disclosure (CSR Disclosure) on

Sharia Bank

Profitability in this study is measured by Capital

Adequacy Ratio (CAR) which is a capital indicator

used as a variable affecting CSR Disclosure based on

the level of bank risk. This capital adequacy ratio is

an indicator of the ability of sharia banks to cover the

decline in their assets as a result of sharia bank losses

caused by risky assets Dendrawijaya (2003). So with

the increased capital itself, the bank's health-related

with the capital ratio (CAR) is increasing and with

large capital, the company is very flexible to perform

the disclosure corporate social responsibility in social

media.

2.3 Relationship Growth to Corporate

Social Responsibility disclosure

(CSR Disclosure) on Sharia Bank

Company growth can show improvement of

company's financial performance. Maria Ulfa (2009)

states that growth is a company's growth rate as

measured by the company's sales growth. The growth

of the company is one of the considerations of

investors in investing. Companies with high growth

opportunities are expected to provide high

profitability in the future, expected earnings more

persistent, so investors will be interested to invest in

the company. Companies with high growth will get a

lot of spotlights so that predicted companies that have

a higher growth opportunity tend to do more

disclosure of corporate social responsibility (CSR

Disclosure). Growth in this study was measured by

Asset Growth which is a growth indicator used as a

variable affecting CSR Disclosure based on the level

of productivity and sustainability of sharia banks.

2.4 Relationship Liquidity to Corporate

Social Responsibility disclosure

(CSR Disclosure) on Sharia Bank.

The Financing Deposit to Ratio (FDR) measures the

extent to which a bank can meet its short-term

liabilities, such as repaying its depositors' funds at the

time of billing and sufficient credit requests. The

amount of credit disbursed will determine the bank's

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

154

profit. If the bank is not able to disburse credit while

the funds that collected a lot will cause the bank loss.

The higher the FDR, the liquidity of the company is

increasing with the assumption that the bank is able

to channel credit effectively, so a number of bad loans

will be small so that the positive effect on the

disclosure of social responsibility (CSR Disclosure).

3 METHODS

In this research, there are four observation variables

related to three of them as the independent variable

that is profitability measured by Capital Adequacy

Ratio (CAR), growth measured by Asset Growth and

liquidity as measured by Financing Deposit to Ratio

(FDR) and a dependent variable that is CSR

Disclosure. The dependent variable in this research is

CSR Disclosure in company's annual report measured

by corporate social responsibility index (CSRI). The

CSRI measurement instrument to be used in this

study is based on Shariah Enterprise Theory, which

classifies CSR disclosures into five categories, God

(2 items), Customer (17 items), Employees (10

items), Communities (9 items), and Nature (9 items).

The population in this study is the Sharia

Commercial Bank according to the Islamic Banking

Statisticsin Indonesia (11 Islamic Banking Statistics),

which are listed on Sharia Banking Statistics and have

published the annual financial statements for the

period 2012-2014.

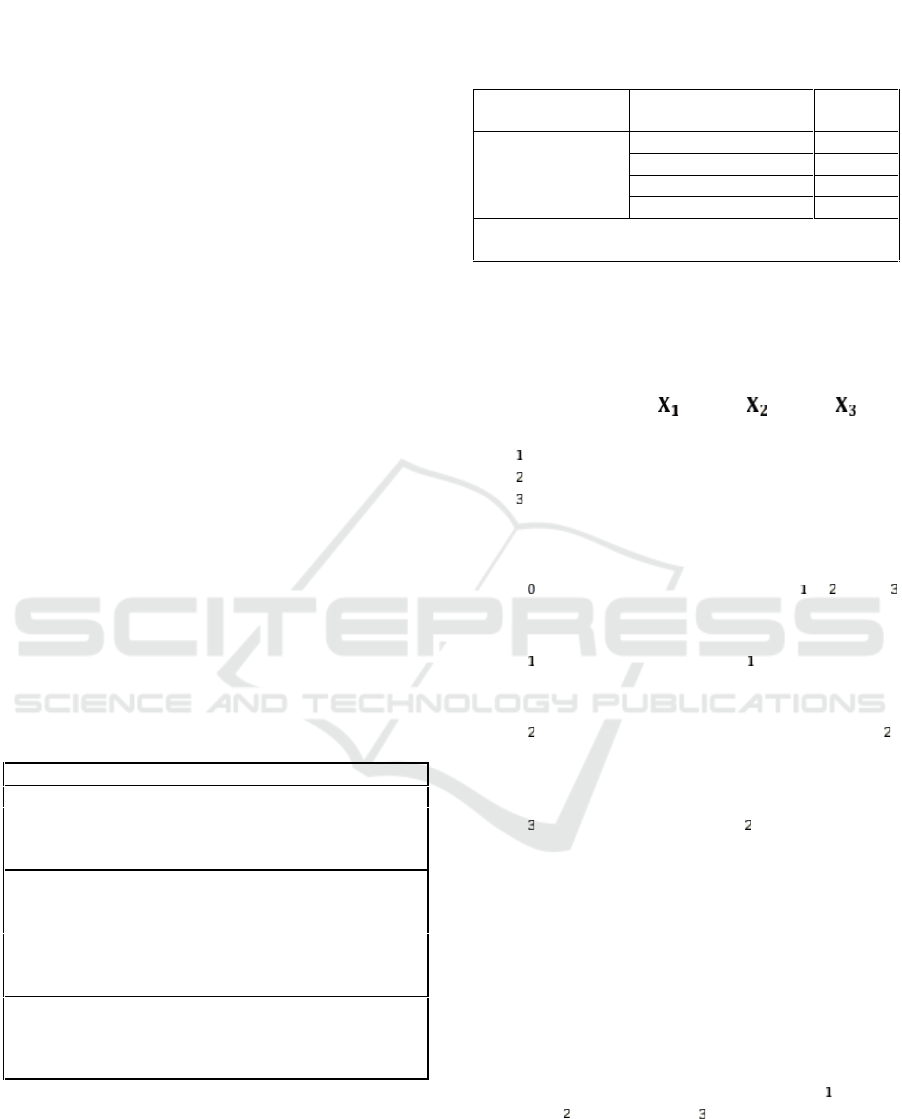

Table 1: Name of Sharia Banks in Indonesia.

Name of Sharia Banks

PT. BNI Syariah

PT. Bank Muamalat Indonesia

PT. Bank Syariah Mandiri

PT. Bank Syariah Mega Indonesia

PT. BCA Syariah

PT. BRI Syariah

PT. Bank Jabar Banten Syariah

PT. Bank Panin Syariah

PT. Bank Syariah Bukopin

PT. Bank Victoria Syariah

PT. Bank Maybank Syariah Indonesia

4 RESULTS AND DISCUSSION

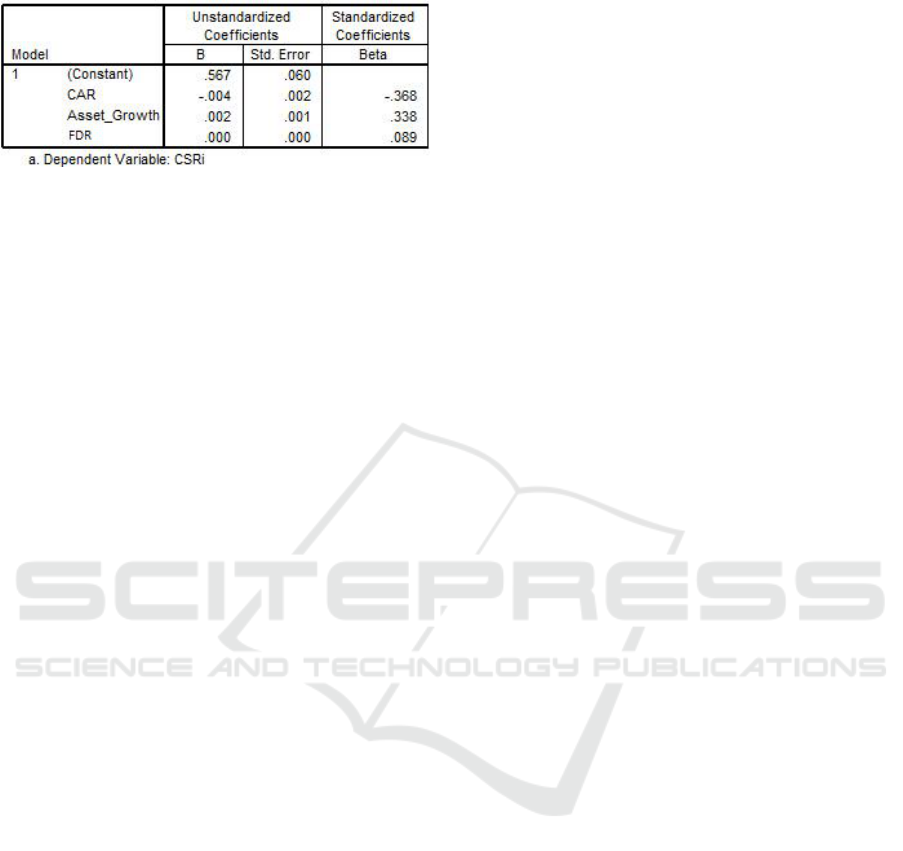

Table 2: Results of Multiple Linear Regression Analysis.

Dependent

Variable

Independent

Variable

ß

CSR Disclosure

(Y)

Konstanta

0,567

CAR (X1)

-0,004

Asset Growth (X2)

0,002

FDR (X3)

0,000

R = 0,557

Adjusted R² = 0,239

Obtained by regression model of variable relation

ratio of sharia public bank consisting of sub-variable

of CAR, Asset Growth, and LDR to CSR Disclosure

as follows:

Y = 0,567 + -0,004 + 0,002 + 0,000 (1)

Where:

X : CAR

X : Asset Growth

X : FDR

The interpretation of the regression model is as

follows:

b = 0,567 means if the variables X , X

,

dan X

are zero, then the variable Y will be worth 0.567

units.

b = -0.004 means if CAR (X ) increases by unit

and variable other constant, then variable Y will

decrease by 0,004 unit.

b = 0.002 means if Asset Growth (X )

increases by unit and other variables are

constant, then variable Y will increase of 0.002

units.

b = 0,000 means if FDR (X ) increases by unit

and variable other constant, then the variable Y

will increase by 0.000 unit.

The coefficient of determination (Adjusted R²) is

a measure of the suitability of the regression line. In

addition Adjusted R² can also be used to measure the

proportion of total diversity that can be explained by

the regression line.

KD = Adjusted R² x 100%

= 0.239 x 100%

= 23.9%

Thus, the value of Determination Coefficient of

23.9% indicates meaning that if CAR (X ), Asset

Growth (X ), and FDR (X ) gives a simultaneous

effect of 23.9% toward CSR Disclosure (Y). While

the rest equal to 76.1% influenced by other factors

that are not observed.

The Influence of Firm Performance to Corporate Social Responsibility Disclosure - Case Study of Sharia Banks in Indonesia

155

Table 3: The Test Results on Hypothesis.

This study is a population study so that partial

test t is not required to test the hypothesis, hypothesis

test on population research seen from the coefficient

value ß. The interpretation results from Table 4.2 are

as follows:

1. The negative CAR coefficient of (-0.004) shows

that CAR negatively affect CSR Disclosure.

2. The result of positive Asset Growth coefficient

of 0.002 indicates that Asset Growth has a

positive effect on CSR Disclosure.

3. The coefficient of FDR of 0,000 has the

meaning that the FDR is not effect on CSR

Disclosure.

5 CONCLUSION

By considering the analysis relating to the

formulation of the problem in this study, it can be

concluded that Capital Adequacy Ratio (CAR) has a

negative effect on corporate social responsibility

disclosure (CSR Disclosure) of sharia banks in

Indonesia. This indicates that if the CAR value

increases then the company tends to decrease the

disclosure of corporate social responsibility because,

with high profitability, the funds are allocated to the

capital adequacy of the company used to bear the risk

of financing by the company.

Asset Growth has a positive effect on corporate

social responsibility disclosure (CSR Disclosure) of

sharia banks in Indonesia. This indicates that if the

value of Asset Growth increases then the company

increases CSR Disclosure because the existence of

the company can grow and sustain by conducting

disclosure of social responsibility.

Loan to Deposit Ratio (LDR) does not affect the

disclosure of corporate social responsibility (CSR

Disclosure) of sharia banks in Indonesia. This

indicates that if a high or low LDR will not affect

corporate social responsibility disclosure, CSR

Disclosure is not affected by liquidity seen from LDR

ratio and quality in CSR disclosure is not easy to

measure.

REFERENCES

Doorasamy, Mishelle. 2015. Theoretical Developments In

Environmental Management Accounting And The Role

And Importance Of MFCA. Foundations of

Management 7.1: 37-52.

Isnanisa, Clara Hagya, Kartika Dewi Sri Susilowati, and

Suryan Widati. 2016. Factors affecting csr disclosure

according to shariah enterprise theory. Journal of

Management Accounting Students 2.3.

Inoue, Yuhei, Daniel C. Funk, and Heath McDonald. 2017.

Predicting behavioral loyalty through corporate social

responsibility: The mediating role of involvement and

commitment. Journal of Business Research 75: 46-56.

Kusumawardhany, Sayekti Indah. 2014. The Effect of

Profitability and Leverage on Disclosure of Corporate

Social Responsibility of Mining Registered at Indonesia

Stock Exchange 2010-2012. Unpublished.

Li Y, Chen YK, Chien FS, Lee WC, Hsu YC. 2016. Study

of optimal capital adequacy ratios. Journal of

Productivity Analysis. 2016 Jun 1;45(3):261-74.

Lopatta, Kerstin, Reemda Jaeschke, and Chen Chen. 2017.

Stakeholder Engagement and Corporate Social

Responsibility (CSR) Performance: International

Evidence. Corporate Social Responsibility and

Environmental Management 24.3 (2017): 199-209.

Maria Ulfa. 2009. The Influence of Corporate

Characteristics on Social Responsibility. Unpublished.

Meutia, Inten. 2010. Menata Pengungkapan CSR di Bank

Islam (Suatu Pendekatan Kritis). Jakarta: Citra Pustaka

Indonesia.

Meutia, Inten. 2010. Shari’ah Enterprise Theory sebagai

Dasar Pengungkapan Tanggungjawab Sosial Bank

Syariah. 2010. Unpublished.

Pramono, R. Y. 2015. Pengaruh Profitabilitas,

Pertumbuhan dan Likuiditas terhadap Pengungkapan

Tanggung Jawab Sosial (CSR Disclosure) Menurut

Shariah Enterprise Theory (Studi Kasus pada Bank

Syariah di Indonesia). 2015. Unpublished.

Susilowati, Kartika Dewi Sri. 2013. Kemitraan Strategis

dalam Implementasi CSR (Studi Kasus Pada Produk

‘Kecap Bango’ PT Unilever Indonesia, Tbk.

Unpublished.

Triyuwono, Iwan. Mengangkat ”sing liyan ” untuk

Formulasi Nilai Tambah Syari’ah. Simposium

Nasional Akuntansi X Unhas, 26-28 Juli 2007. 1-21.

Yusuf, yasir. 2010. Aplikasi CSR pada Bank Syariah: Suatu

Pendekatan Maslahah dan Maqasid Syariah. EKSIBISI,

Vol 4, No 2, juni 2010.98-115.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

156