Comparison of Sensitivity Gap Formation between Maybank

Syariah Indonesia and Maybank Malaysia

Puji Sucia Sukmaningrum, Achsania Hendratmi, Fatin Fadhilah Hasib, and Nisful Laila

Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

{puji.sucia, achsania.hendratmi, fatin.fadhilah, nisful.laila}@feb.unair.ac.id

Keywords: Asset-Liability Management, Gap Sensitivity, Rate Sensitive Asset, Rate Sensitive Liability.

Abstract: Maybank Malaysia is the top 5 largest bank in Malaysia means that will have an effect on the economy in

Malaysia which is currently expanding in Indonesia. The aims of this research are to investigate the factors

that affect the sensitivity gap between Maybank Syariah Indonesia and Maybank Malaysia. The methodology

using t-test and Mann-Whitney. The data used is maturity profile of both Banks. The results suggest that the

formation of the gap period sensitivity of ≤ 1 month and 3-12 > months shows the real difference between

Maybank Syariah Indonesia and Maybank Malaysia while having no significant difference in the gap period

sensitivity of > 1-3 month.

1 INTRODUCTION

The regulation of Bank Indonesia as the central bank

must be obeyed by all banks in Indonesia. Therefore,

Islamic banks are no exception. According to Karim

(2014), even Islamic Bank does not set interest rate

on their operation, both in funding and financing side,

Islamic banking still cannot avoid the interest rate

risk.

Among the many tools of risk management, the

anticipation that can be done with regard to the risk

of interest rates is a management gap wich is part of

Asset-Liability Management (ALM). Framework for

ALM areas include interest rate risk, liquidity risk,

credit risk and exchange risks. ALM is an operation

to assess risks actively changing the portfolio of

assets-liabilities and strategically taking action to

manage risk in order to maximize profits. The main

objective of ALM is making Bank is fully prepared to

face the challenges that arise (Dash and Pathak, 2016)

The gap is the difference between assets that are

sensitive to interest rates (Rate Sensitive Assets/RSA)

with a liability that is sensitive to interest rates (Rate

Sensitive Liability/RSL). While the management gap

aims to narrow the gap between the Rate Sensitive

Assets (RSA) and Rate-Sensitive Liability (RSL)

(Riyadi, 2006). The position of the gap that is formed

due to the mismatch in the RSA and RSL can provide

information about the potential risk of Islamic

banking in line with interest rate changes so that the

proper gap management will affect the performance

of Sharia banking.

This study will compare the formation of the gap

that exists in banking have a dual banking system.

The Bank is used as a sample of the research is

Maybank Islamic Indonesia and Malaysia. The reason

for the sampling against Sharia in Maybank Indonesia

Malaysia is because the ownership of the bank is the

same i.e. Maybank Holding. Thus, this study will

compare the banks operating in different countries in

the period of ≤ 1 month sensitivity, month, and 1-3 >

> 3-12 month year 2012 – 2016.

2 LITERATURE REVIEW

2.1 Prior Research on Asset-Liability

Management

Sood and Asaray (2017) analyzes the relationship of

dependency between the choice of portfolio asset-

liability from Islamic Banks (IBs) in developing

countries. IBs tend to make decisions on financial

resources based on their asset portfolio options. IBs

choose more investment financing to reduce risk of

the instrument which may share the risks with the

client and sale and purchase financing based rather

than financial instruments.

Dash and Patak (2016) indicates that ALM on IBs

more efficient. Therefore, it can gain more profit. At

146

Sukmaningrum, P., Hendratmi, A., Hasib, F. and Laila, N.

Comparison of Sensitivity Gap Formation between Maybank Syariah Indonesia and Maybank Malaysia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 146-151

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

the private bank, liquid assets, investments, advances,

and fixed assets from the assets side and net worth,

deposits, and borrowings from the liabilities side has

a significant correlation. There is a positive

correlation between, assets, investments and advance

smoothly on one side and net worth, deposits and

loans. And a strong negative correlation between

fixed assets and net worth, deposits, and borrowings.

Bidabad and Allahyarifard (2008) there are

dissimilarities between the ALM on Islamic banking

and conventional banking. First, the differences in

accounting systems in Islamic banking as compared

to conventional banking. Second, the prohibition of

riba and its specifications shows that not only

effective factor in improving equity (capital deposits)

return but also share profits and losses from

investments in the real sector of the economy wihich

is the basis important in monetary transactions

2.2 Gap Management

Riyadi (2006:133) explains that the gap is the

difference between assets that are sensitive to interest

rates (Rate Sensitive Assets/RSA) and liabilities that

are sensitive to interest rates (Rate Sensitive

Liability/RSL). While the purpose of gap

management is to narrow the width disparity between

the Rate Sensitive Assets (RSA) with a Rate Sensitive

Liability (RSL). By definition, the management gap

is a gap setting caused by the degree of sensitivity of

each post as well as assets liabilities to the post

respectively.

Based on the level of sensitivity, asset/liability is

divided into two types; rate sensitive assets–liablities

and fixed rate assets-liabilities (Antonio, 2001).

Assets classified as rate sensitive assets (RSA) are all

assets, including assets with a fixed rate (fixed rate),

which have a maturity of less than one (1) year (short-

term) or assets with a floating interest rate (floating

rate) that should be updated every (1) month, three (3)

months, 6 (six) months, and a maximum of 1 (one)

year. The classified rate sensitive liabilities liabilities

(RSL) is all liability, including liability for fixed rate

(fixed rate liabilities), which has a maturity of not

more than 1 (one) year, or loans with a floating

interest rate that must be updated every (1) month,

three (3) months, or 6 (six) months, or not more than

1 (one) year.

2.3 Gap Position

According to Antonio (2001), the potential interest

rate risks arises while the gap between assets and

liabilities, where the composition of the RSA does not

match or mismatch with RSL composition. With

reference to the mismatch, it can form three types of

positions the gap IE (Riyadi, 2006):

a. Zero Gap ( RSA = RSL)

Zero gap indicates low risk in variable income

support due to the quantity of the asset sensitive to

interest rates equal to the quantity of liabilities

sensitive to interest rate.

b. Positive Gap (RSA > RSL)

On the position of the positive gap, sensitive to

interest rates on assets greater than liabilities

sensitive to interest rates (RSA > RSL). This value

indicates that the RSA portion is financed with

funds that are not sensitive.

c. Negative Gap (RSA < RSL)

On the position of the negative gap, Rate Sensitive

Assets are smaller than in Rate Sensitive

Liabilities (RSA < RSL).

3 RESEARCH METHODOLOGY

Research conducted by the writer uses a quantitative

approach, that is a gap analysis of sensitivity and

difference to see the comparison of gap formation

result in Sharia banking and conventional banking

that came from the companies' financial report. The

difference test is one of the parametric statistical

techniques used to test the comparative hypothesis

(difference test).

3.1 Variables

Variables in this study refer to the analysis model

used by researchers in answering the problem. The

analytical model that contains some Variables

Variables in this study refer to the analysis model

used by researchers in answering the problem. The

analytical model that contains some analytical

techniques gives different variables used in each

technique. The variables used in this study are as

follows:

1. Rate Sensitive Assets (RSA)

Assets classified as rated sensitive assets (RSA)

are all assets, including fixed-rate assets, which

have maturities of less than 1 (one) year (short-

term) or floating rate assets which must be

renewed every 1 (one) month, 3 (three) months,

6 (six) months, and maximum 1 (one) year.

2. Rate Sensitive Liabilities (RSL)

Liabilities classified as sensitive liabilities (RSL)

are all liabilities, including fixed rate liabilities,

which have no maturity of more than 1 (one)

year, or floating rate loans which must be

Comparison of Sensitivity Gap Formation between Maybank Syariah Indonesia and Maybank Malaysia

147

renewed every 1 (one) month, 3 (three) months,

or 6 (six) months, or not more than 1 (one) year.

3. Gap Ratio

The ratio is used to measure the gap due to

fluctuating changes in interest rates. This ratio

shows the sensitivity to the interest rate.

Gap Ratio =

3.2 Types and Data Sources

This study uses secondary data obtained from the

annual financial statements of Maybank Sharia

Indonesia and Maybank Malaysia in the period of

2012-2015. Secondary data required in this study is

Maturity Profile or Maturity Analysis which contains

information on the amount of assets and liabilities in

each sensitivity period.

3.3 Sample

Samples taken are Maybank Syariah Indonesia as part

of Maybank Holding Malaysia and Maybank

Malaysia as the parent of Maybank Syariah Indonesia

3.4 Gap Sensitivity Analysis

The steps in this analysis are as follows:

3.4.1 Develop Mismatch Rate Sensitivity

Grouping of repricing/maturity schedules is the

preparation of assets and liabilities based on the

determination of new interest rates or profit sharing

rates and margins and based on maturity, as well as

the grouping of assets and liabilities based on their

level of sensitivity. Following the approach of Ali

(2004), the grouping of the interest rate gap is done

by grouping asset-liabilities in groups, namely Rate

Sensitive Assets (RSA), Rate Sensitive Liabilities

(RSL) and Fixed Rated and Non Rate Sensitive

Liabilities (NRSA) & (NRSL). Risk Analysis;

Analysis of gaps arising from changes in interest rates

3.4.2 Difference Test

The steps are as follows:

1. Determining the operational hypothesis

a. H0: μ1 = μ2, there is no significant

difference in gap formation between

Maybank Syariah Indonesia and Maybank

Malaysia

b. HA: μ1 ≠ μ2, there is a significant difference

in gap formation between Maybank Syariah

Indonesia and Maybank Malaysia

2. Determining the level of significant (α) of α = 5%

3. Determine the test criteria

a. H0 is accepted and HA is rejected if Sig. >

0.05 indicates that there is no significant

difference in the formation of gaps between

Maybank Syariah Indonesia and Maybank

Malaysia. (t-test)

b. H0 is accepted and HA is rejected if

Asymp.sig> 0,05 indicates that there is no

significant difference in gap formation

between Maybank Syariah Indonesia and

Maybank Malaysia. (Mann Whitney test)

4 RESULTS AND DISCUSSION

4.1 Gap Sensitivity Analysis

From the gap analysis of sensitivity that has been

done then it can be concluded that the formation of

gap position by Maybank Syariah Indonesia during

2012-2016 is a negative gap in 2014 and 2015 while

in 2012, 2013, and 2016. The results of the sensitivity

gap analysis of Maybank Bank Malaysia show that

the establishment of Maybank Malaysia gap position

during 2012-2016 is the negative gap that occurred in

2012, 2014 and 2015. In 2013 and 2016 there is a

positive gap.

4.2 Analysis of Research Results and

Hypothesis Testing

4.2.1 Normality test

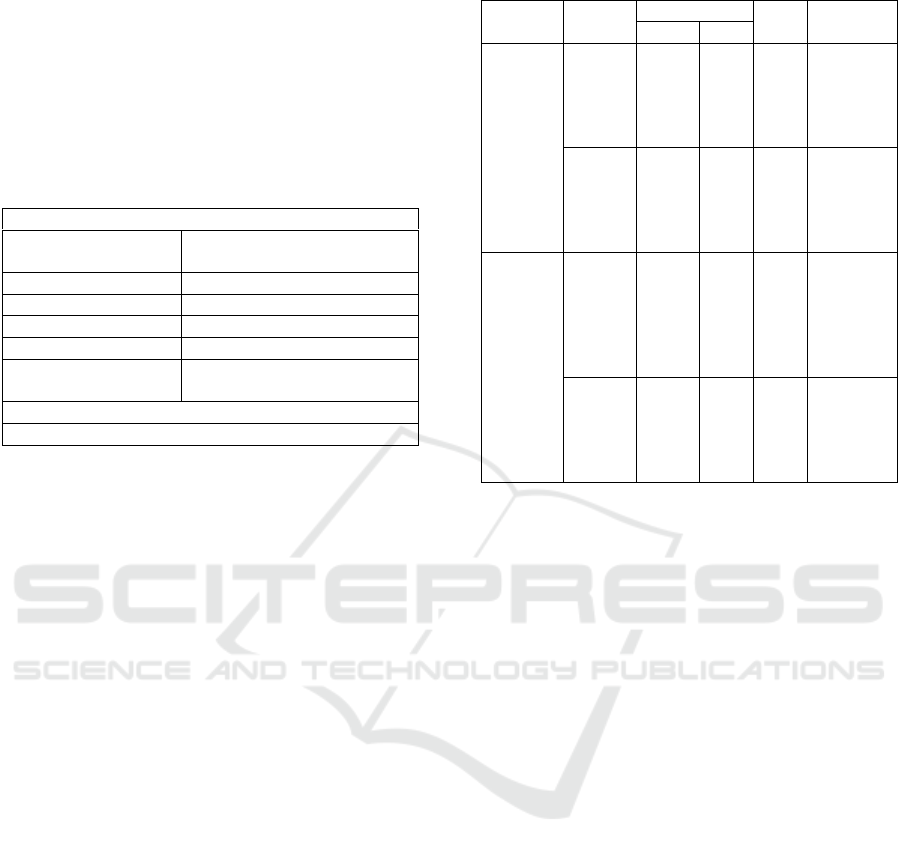

Table 1: Normality Test Results.

Kolmogorov-Smirnov

a

Statistic

df

Sig.

GAP SENSITIVITY

RATIO <1 MONTH

.219

10

.191

GAP SENSITIVITY

RATIO 1-3 MONTH

.217

10

.200

*

GAP SENSITIVITY

RATIO 3-12

MONTH

.256

10

.062

*. This is a lower bound of the true significance.

a. Lilliefors Significance Correction

Table 1. above shows the Gap Ratio of ≤ 1 month

sensitivity period and> 1-3 months period are

normally distributed because it has a 0.05

significance value so that the test uses t-test, while the

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

148

Gap Ratio of > 3-12 months sensitivity period is not

normally distributed because the value of significance

is below 0, 05 so that the test is done using Mann-

Whitney test.

4.2.2 Difference Test

1. Mann-Whitney Test

Table 2: Mann-Whitney Test Results.

Test Statistics

GAP SENSITIVITY RATIO 3-

12 MONTHS

Mann-Whitney U

.000

Wilcoxon W

15.000

Z

-2.611

Asymp. Sig. (2-tailed)

.009

Exact Sig. [2*(1-tailed

Sig.)]

.008

b

a. Grouping Variable: BANK SAMPLE

b. Not corrected for ties.

Based on the results of different test calculations

with Mann-Whitney test in Table 2. above can be

seen that the value of Asymp. Sig. (2-tailed) Gap ratio

sensitivity period> 3-12 months by 0.009. This

significance value is smaller than the limit of 0.05 so

it can be concluded that the formation of the

sensitivity gap between Maybank Syariah Malaysia

and Maybank Indonesia sensitivity period> 3-12

months there is a significant difference.

2. t-test

In Table 3. it can be seen that F arithmetic Levene test

Gap ratio period sensitivity ≤ 1 month and> 1-3

months have significance value of > 0,05 so that the

t-test different test analysis must use assumption on

the equal variances. From the output, it shows that the

Gap Ratio of ≤ 1 month sensitivity period has a

significance value of less than 0.05 so it can be

concluded that the formation of sensitivity gap

between Indonesian Syariah Bank and Maybank

Malaysia on ≤ 1 month gap period of sensitivity there

are significant differences. While > 1-3 months gap

period sensitivity has a significance value greater than

0.05 so it can be concluded that the formation of

sensitivity gap between Maybank Syariah Indonesia

and Maybank Malaysia in > 1-3 months sensitivity

period that there is no significant difference.

Table 3: T-Differences Test Result (T-Test).

4.3 Discussion

4.3.1 Sensitivity Period ≤ 1 Month

Based on the test that has been done, it can be stated

that the formation of the sensitivity gap between

Maybank Syariah Indonesia and Maybank Malaysia

in the sensitivity period ≤ 1 month seen from the Gap

Ratio differ significantly. The position of gap

generated by Maybank Syariah Indonesia and

Maybank Malaysia is in 2014 and 2015 occur

negative gap while in 2013 and 2016 in both banks

positive gap occurred and in 2012 in a positive gap

while Malaysia Maybank negative gap occurred.

The compositions of RSL and RSA of the 1-

month sensitivity period in the two banks showed

different patterns, most of which had a maturity in

different sensitivity periods where Maybank Syariah

Indonesia was always in negative position while

Maybank Malaysia fluctuated in 2012 - 2016. This is

what causes the formation of gaps in the two banks

then became significantly different.

The occurrence of this significant difference is

due to the business factors of sharia financial industry

model in Indonesia, especially sharia banking, which

is more focused on fulfilling the needs of the real

sector and maintaining "maqasid syariah". This is in

contrast to other countries whose role in the financial

sector (money market and capital market) is more

dominant although, in essence, the structure of

Var.

Leven’s Test

Sig.

Ket.

F

Sig.

Gap

Ratio

Sensitiv

ity ≤ 1

month

Equal

varian

ces

assum

ed

1.411

.269

.032

Ho

rejected

(There is

differenc

e)

Equal

varian

ce not

assum

ed

.045

Ratio

Sensitiv

ity > 1-

3

Month

Equal

varian

ces

assum

ed

3.088

.117

.185

HA

accepted

(There is

no

differenc

e)

Equal

varian

ce not

assum

ed

.195

Comparison of Sensitivity Gap Formation between Maybank Syariah Indonesia and Maybank Malaysia

149

Islamic financial development in Indonesia will be

stronger than other countries. (Alamsyah, 2012)

The lack of instruments in the Islamic financial

market has an impact on the management of Maybank

Syariah Indonesia's gap for the ≤ 1 month sensitivity

period so that the number of RSA owned is not able

to compensate RSL as in Maybank Malaysia.

4.3.2 Sensitivity Period> 1-3 months

Based on the tests that have been done, it can be stated

that the creation of a sensitivity gap between

Maybank Syariah Indonesia and Maybank Malaysia

in the > 1-3 months sensitivity period seen from the

Gap Ratio differs significantly.

The cumulative position of the gap formed in the

sensitivity period > 1-3 months in both banks is

negative, but Maybank Syariah Indonesia is able to

generate positive gap positions during 2012 and 2013

while in Maybank Malaysia almost as a whole is

negative except in 2012 a positive gap. Differences in

the resulting gap position caused the calculation of

statistical tests for gap formation showed significant

differences.

The structure of RSL Maybank Malaysia in the

sensitivity> 1-3 months period consists of deposits

from customers, deposits from other banks and loans

received. While RSL on Maybank Syariah Indonesia

only consists of Temporary Syirkah Fund (DST)

which includes Mudharabah Deposit and

Mudharabah Deposit from Other Banks.

Depositors (customers) of sharia banking in

Indonesia is divided into several market

segmentation. Karim and Affif (2005) stated that in

Indonesia there is three market segmentation, namely

sharia loyalist (consisting of adherent religion),

floating segment (combination of religion and market

power) and conventional loyalist. Research

conducted by Khairunnisa (2001) found that

depositors in Indonesia are eyeing profit

maximization. Research Mangkuto (2004) also

confirmed that the factors that become the public's

consideration of investing funds in sharia banking are

the profit-sharing return factor.

4.3.3 Sensitivity Period> 3-12 Months

Based on the test that has been done, it can be stated

that the formation of sensitivity gap between

Maybank Syariah Indonesia and Maybank Malaysia

in the sensitivity period> 3-12 months seen from Gap

Ratio that there is a significant difference.

The formation of the gaps of both banks for the

sensitivity period> 3-12 months indicates the same

positive position but if seen in nominal terms, there

are big differences on 2012-2016. This then causes

the results of statistical tests seen from the Gap Ratio-

which is the percentage of gap positions against total

assets-shows there are significant differences.

The Gap position of sensitivity> 3-12 months

period in Maybank Syariah Indonesia and Maybank

Malaysia shows that the results did not differ

significantly due to the similarity of RSA and RSL

allocations of both banks in this sensitivity period.

Based on the Maturity Profile of Maybank Indonesia

and Maybank Malaysia, the > 3-12 months sensitivity

period is generally the period of sensitivity with the

second largest number of RSAs after the sensitivity

period of ≤ 1 month and on the other has the smallest

number of RSLs compared to the other two sensitivity

periods ( ≤ 1 month and> 1-3 months).

The number of RSA sensitivity periods of > 3-12

months greater than the sensitivity period of > 1-3

months is caused by longer periods of time, but the

smaller number of RSLs compared to the previous

two sensitivity periods was a limited indicator of fund

accumulation products in the sensitivity> 3-12

months both in Maybank Indonesia and in Maybank

Malaysia. Although the basic principles are different,

fundraising products in Maybank Indonesia and

Maybank Malaysia consists of three main structures,

namely demand deposits, savings accounts, and time

deposits. Deposits have different characteristics

compared to demand deposits and savings because

there is a grace period of storage. The existence of this

grace period makes the main purpose of the use of

deposit products is an investment rather than a

precautionary motive. The grace period also causes

the RSL-forming structure in the longer sensitivity

period to be ultimately dominated by deposits.

Conventional banks tend to avoid this by

preferring to use short-term funding sources to

finance long-term credit to minimize the negative

effect of interest rate volatility on profitability.

Maybank Syariah Indonesia as a Syariah bank should

not have to worry about the cost of these funds

because deposits with mudharabah Akad using profit

sharing approach so that the cost of funds that arise is

tailored to the performance rather than the promised

interest. However, as in the previous explanation, the

character of Islamic banking depositors, as well as the

level of profit sharing, is a critical bargaining power

for Maybank Syariah Indonesia. Socialization and

performance improvement by Maybank Syariah

Indonesia is necessary so that the quality of fund

sources from third parties and the gap setting for the

longer period of sensitivity will be better than

Maybank Malaysia.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

150

5 CONCLUSION

The conclusion of the different forms of the gap on

Maybank Syariah Indonesia and Maybank Malaysia

Period 2012-2016 are:

1. Based on difference test (α = 0,05) gap

formation in the period 2012-2016 for the ≤ 1

month sensitivity period and > 3-12 month

there is a significant difference, whereas in the

sensitivity period of > 1-3 months there is no

significant difference.

2. The recommended suggestion is:

Maybank Syariah Malaysia should make

adjustments to the maturity of assets and

liabilities.

Maybank Syariah Indonesia should reduce

dependence on RSA components such as Murabahah

Financing and increase the volume of profit sharing-

based components such as Mudharabah and

Musyarakah Financing to reduce risk due to

fluctuations in the benchmark of interest rate

changes..

REFERENCES

Alamsyah, D. H., 2012. Perkembangan dan Prospek

Perbankan Syariah Indonesia: Tantangan Dalam

Menyongsong MEA 2015. Makalah disampaikan dalam

Ceramah Ilmiah Ikatan Ahli Ekonomi Islam (IAEI),

Milad ke-8 IAEI, Hal. 1-8.

Ali, M., 2004. Asset-Liability Management: Menyiasati

Risiko Pasar dan Risiko Operasional dalam

Perbankan. Jakarta: Elex Media Komputindo.

Antonio, M. S. 2001. Bank Syariah Dari Teori Ke Praktik.

Jakarta: Gema Insani Press.

Bidabad, B. and Allahyarifard, M. 2008. Assets and

liabilities management in Islamic banking, Paper

Presented at the 3rd International Conference on

Islamic Banking and Finance, Karachi. 24-25 March.

Dash, M. and Pathak, R. 2016. Canonical correlation

analysis of asset–liability management of Indian banks.

Journal of Applied Management and Investments, Vol.

5 No. 2, pp. 75-81.

Heba Abou-El-Sood, Osama El-Ansary. 2017. Asset-

liability management in Islamic banks: evidence from

emerging markets. Pacific Accounting Review, Vol. 29

Issue: 1, pp.55-78

Karim, A. A. 2014. Bank Islam: Analisis Fiqih dan

Keuangan. Edisi Kelima. Jakarta: PT RajaGrafindo

Persada.

Karim, A. A., Affif, A. Z., 2005. Islamic Banking

Consumer Behaviour in Indonesia: A Qualitative

Approach. International Journal Islamic Finance, 5(1).

pp. 1-18.

Khairunnisa, D., 2001. Preferensi Masyarakat Terhadap

Bank Syariah (Studi Kasus Bank Muamalat Indonesia

dan BNI Syariah). Yogyakarta, P3EI-FEUII.

Mangkuto, I., 2004. Pengaruh Tingkat Suku Bunga

Deposito Bank Konvensional dan Tingkat Pendapatan

Deposito Mudharabah Terhadap Pertumbuhan

Deposito di Bank Muamalat. Tesis tidak

dipublikasikan. Jakarta: Universitas Indonesia.

Riyadi, S. 2006. Banking Assets and Liability

Managements. Jakarta: Lembaga Penerbit Fakultas

Ekonomi Universitas Indonesia.

Comparison of Sensitivity Gap Formation between Maybank Syariah Indonesia and Maybank Malaysia

151