Comparison of Risk and Return on Trading and Profit Sharing Based

Financing Contract in Indonesian Islamic Bank

Fatin Fadhilah Hasib, Puji Sucia Sukmaningrum, Nisful Laila and Achsania Hendratmi

Faculty of Economics and Business, Universitas Airlangga, Jl. Airlangga 4, 60286, Surabaya, Indonesia

{fatin.fadhilah, puji.sucia, achsania.hendratmi, nisful.laila}@feb.unair.ac.id

Keyword: Financing, Islamic Bank, Return, Risk.

Abstract: This study aims to analyze the difference between return and risk between profit sharing-based and trading-

based financing in Islamic bank. This study uses quantitative approach using Mann Whitney Test data

sampled from 6 Indonesian Islamic banks, collected from their quarterly financial reports from 2011 to 2015.

The result shows the significant difference in return, while the risk of profit sharing based and trading based

are almost the same. From the analysis, it can be concluded that profit sharing-based financing is less desirable

not because of its risk. Trading-based financing is more desirable then the profit sharing because of its

return. This study is discussing about the comparison between risk and return of trading and profit sharing

contract in Islamic bank. Until now still there is no study about this topic, because many of the topics of the

bank are contracts, while to compare the risk and return alone there are still not much.

1 INTRODUCTION

During the last 30 years, Islamic banking has been

growing very fast, because supported by many

emerging international conventional banks that open

sharia business units such as bank CIMB, Astra, etc.

(Mahdi and Abbes, 2017). Although relatively newer

and smaller than the conventional banking industry,

Islamic banking can still show significant growth in

innovation and scale. (Wulandari et al., 2015).

One of the functions undertaken by Islamic

banking is the function of financing, all types of

financing offered by Islamic banks in Indonesia

should be adjusted to the principles of Islamic sharia

if the bank wants to perform its financing functions.

Various types of financing that are available and well

developed in the Islamic banking industry in

Indonesia are financing with the principle of profit

sharing (mudharabah and musyarakah). Financing by

the law of sale and purchase (murabahah and

istishna), financing by the law of lease (ijarah) and

financing by debt principle (qardh).

As a profit based oriented business entity, Islamic

banks are required to consider the rate of return of all

financing provided. That is done to detect which

financing that gives advantages and which are not,

due to by such financing, the Islamic bank can gain

profit. In addition to the rate of return, Islamic banks

also need to consider the risks of financing given due

to the rate of return is always directly proportional to

the risk that is owned and every contract offered by

Islamic banks have different risks and returns. So, this

study aims to compare the risks and returns that are

held by a deal based on profit sharing to based on the

sale and purchase agreement. Since seen from the

financial report of all Islamic banks, the most

financed contract is based on the profit sharing and

based on sale and purchase, the rest is not much

found.

2 LITERATURE REVIEW

The most widely used Islamic bank contracts are

based on sale and purchase and profit sharing. For

contracts based on sale and purchase such as

murabahah and salam while for the contract based on

profit sharing is mudharabah and musyarakah. Until

now, many studies compare the risk and return to a

thing, but the object of study on risk and return is

mostly still about capital market investments,

company, and Islamic banks. While study compares

the risk and return of Islamic bank contract based on

profit sharing to contract based on the sale and

purchase simultaneously are rarely. Credits risk in

Islamic banks is in the form of settlement/payment

Hasib, F., Sukmaningrum, P., Hendratmi, A. and Laila, N.

Comparison of Risk and Return on Trading and Profit Sharing Based Financing Contract in Indonesian Islamic Bank.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 131-134

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

131

risk arising when one party to a business transaction

pays money or deliver assets before receiving its

assets or cash thereby exposing it to potential loss

(Khan and Ahmed, 2001).

Here are some studies that have the same topic.

Nurafini, (2014) studied the comparison of risk,

return, and coefficient of variation of musyarakah,

mudharabah, and murabahah in which the results

indicate that there is a significant difference to the rate

of return between all contracts. As for the level of risk

and coefficient of variation there is no significant

difference between the three. Mahdi and Abbes,

(2017) studied the relationship between capital, risk,

and liquidity between conventional banks and Islamic

banks in MENA countries. The results of this study

show that there is a definite relationship between risk

and capital in Islamic banking. Moreover, most of the

risks faced by banks related to the practice of

financing, adherence to the principle of sharia in

mudharabah and musyarakah. Also, if there is a

change of liquidity, it will have a direct effect on the

risk owned by the bank. Rifki Ismail (2010)

conducted a study with VAR approach to analyze the

changes occurred to the rate of return of financing and

expect losses from such financing in the period 2000

- 2008. The result of that study is a different resistance

rate of return on three groups financing those are

profit sharing, sale and purchase, and services in the

period 2000 - 2008. Khan and Ahmed (2001) explain

in his study that the risk rating of the contracts in

Islamic banks. In that study, contracts murabahah as

the financing with the lowest risk rating. While the

profit-sharing contract tends to has high-risk rating.

Based on the introduction and literature review that

existed above then the hypothesis in this study are:

H1: there is a significant difference between the

return of profit sharing financing and sell and

purchase financing in Islamic banking in

Indonesia.

H2: There is a significant difference between the risk

of profit sharing financing and sell and purchase

financing in Islamic banking in Indonesia.

3 METHODOLOGY

The study approach used in this study is a quantitative

approach. The variables used in this study are the

Rate of return and Risk. Types and sources of data

used in this study are secondary data in the form of

the quarterly financial report of Islamic Commercial

Banks from the years 2011-2015 and from some other

sources such as the financial report of the authority of

the Financial Services and Bank Indonesia. The

population in this study is Sharia Banking in

Indonesia. The sampling method used in this study is

purposive sampling. The requirement criteria for the

sample in this study are 1. Islamic Commercial Bank

which has published quarterly financial report during

the observation period that is 2011-2015. 2. Islamic

Commercial Bank which has the completeness of data

based on the variables studied. Based on the sample

selection criteria above the Islamic banks that meet

the criteria to be sampled are six Islamic commercial

banks, which are PT. Bank Muamalat Syariah, PT

Bank Mega Syariah, PT Bank Syariah Mandiri, PT.

Bank BRI Syariah, PT. Bank Central Asia Syariah

and PT. Bank BNI Syariah.

The analytical technique in this study use is paired

sample t-test since the purpose of this study is to

compare two means from two paired samples with an

assumption that the existing data is normally

distributed by normality test using one sample, in

Kolmogorov-Smirnov test with the level of 5%. If the

p-value is more than 5%, then the data is normally

distributed and vice versa. The test equipment used is

a nonparametric test by using Mann-Whitney test.

The next is t-test of two paired samples for data that

is normally distributed and Mann-Whitney test for

data that is not normally distributed.

In this study, the analysis technique used is the t-

test analysis technique of Paired Samples t-Test. This

Paired Samples t-Test is used to compare the

difference of two mean between the two paired

sample assuming the data are normally distributed

(Uyanto, 2009).

To test whether or not the data is normally

distributed or not, then normality test was conducted

by using the One-Sample Kolmogorov-Smirnov Test

with the significance level of 5%, then the data

distribution is not normal. If the data is not normally

distributed then the test equipment used is a different

test by using a non-parametric Wilcoxon Signed-

Rank Test.

After being conducted the normality test, then the

next process is carried out using the difference test by

using two-paired sample t-test for normal distribution

of data and Wilcoxon Signed-Rank Test for data that

is not normally distributed. The steps for difference

test using the two-paired sample t-test are as follows:

4 RESULTS AND DISCUSSION

The discussion in this study is about the comparison

of return and risk for profit sharing and sell and

purchase financing in Islamic banking in Indonesia.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

132

This study used 6 sample of sharia banks which are

Bank Muamalat Indonesia, Bank Syariah Mandiri,

Bank Rakyat Indonesia Syariah, Bank Mega Syariah,

Bank Nasional Indonesia Syariah, and Bank Central

Asia Syariah. The data used in this study obtained

using documentation method that is in the form of

quarterly financial report of Islamic banks in the

period 2011- 2015. After that, the data was processed

using Mann Whitney Test then analyzed and

interpreted. So that finally the conclusion of

conducted study could be made.

4.1 Comparison of return rate of profit

sharing financing with sale and

purchase financing of Islamic

banking in Indonesia

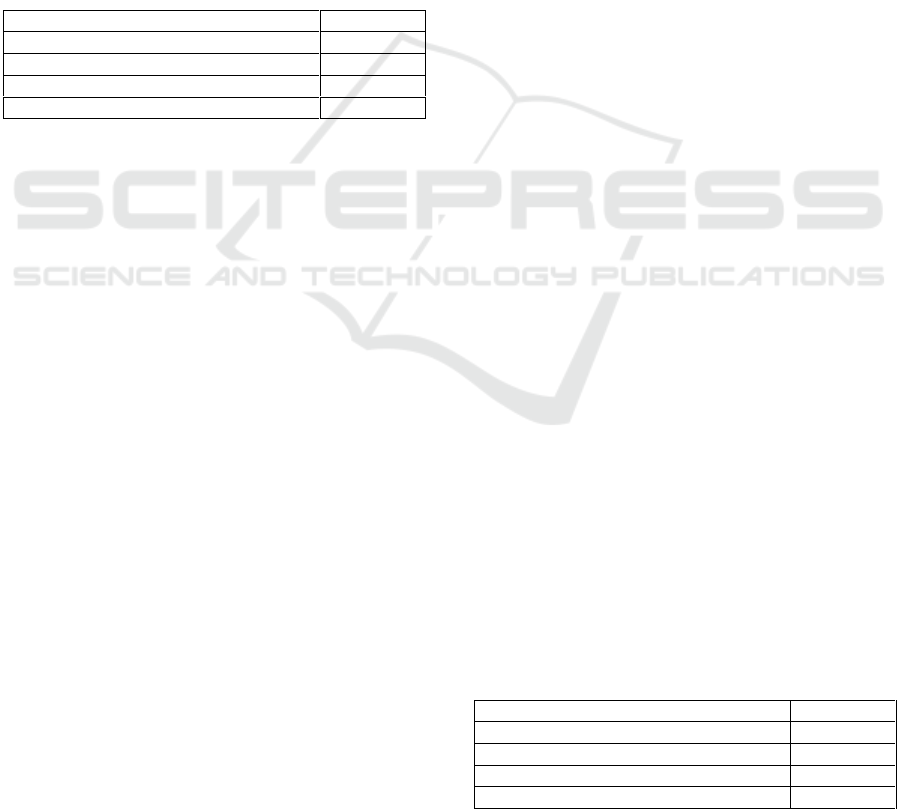

Table 2: Result of hypothesis return test.

Results

Mann-Whitney U

256.000

Wilcoxon W

721.000

Z

-2.876

Asymp. Sig. (2-tailed)

.004

Table 2 shows us that the value of P-value of the

variable rate of return is 0.004, which is smaller than

the value of a (0.05) so it can be concluded that Ho is

rejected and Ha accepted. In other words that the rate

of return on profit sharing with sale and purchase

financing, there was a significant difference. This

significant difference occurred because of the

different characteristics of Islamic banking financing

and the level of income that will be received by the

bank. That is supported by the explanation of Rosly

and Zaini (2008) explaining that the Islamic banking

industry has several models of sharia financing that

aims to meet the needs of customers in financial

facilities.

Antonio (2011) explained that the financing

system for sale and purchase financing is much more

straightforward and more comfortable in handling

administration at Islamic bank compared to profit

sharing financing system. Muhammad (2014) added

the pre-determined price of the contract of sale and

purchase financing should not change during the time

of the agreement. The customer will bear all current

administrative costs and recognized as income by the

bank. No proposition in sharia is related to the

determination of the maximum limit of business

profit taking of sale and purchase financing so that the

bank can determine the maximum profit in the

financing. The profit sharing financing has a more

complicated system than the sale and purchase

financing.

According to Muhammad (2014) profit sharing

system used in Islamic banking in Indonesia is a

profit-sharing system based on revenue sharing

system. The revenue sharing system is a profit sharing

calculation system based on the total revenue

received before deducting the expenses incurred to

obtain the income. That is done so that the level of

profit sharing received by the fund owner more

significant than the prevailing market interest rates.

Nurafini (2014) warned Islamic bank to pay more

attention to the management and handling of profit

sharing financing due to the profit or rate of profit

sharing is determined by the result of the condition of

the business financed by the Islamic bank. Karim

(2010) added in this profit sharing financing, in the

event the profit from the business financed by large

banks, then both parties including banks will get a

significant portion. Otherwise, in the event the profit

of the business is small, then the portion earned by

both parties will also be small. Muhammad (2014)

added that in case of the business in this mudharabah

contract brings losses, then the distribution of the loss

is not based on the ratio, but based on the portion of

the capital of each party. Due to there is a difference

in the ability to bear losses between the two sides.

Currently, all Sharia banks in Indonesia rely on

sale and purchase financing as the primary financing.

That is very adverse since this sale and purchase

financing includes consumptive financing unlike

profit sharing financing, which is productive

financing. Islamic banks should be more active in

finding for profit sharing financing which can support

the income of Islamic bank. In table 1. Explains the

significance Level of return on profit sharing

financing is larger than the sale and purchase

financing and it is followed by the significance level

of the risk obtained that the risk of profit sharing

financing is more significant than the risk of sale and

purchase financing. Tandelilin (2010) added the

larger return of an asset also the larger the risk

obtained.

4.2 Comparison of Risk of Profit

Sharing Financing with Sale and

Purchase Financing of Islamic

banking in Indonesia.

Table 3: Results of risk hypothesis test.

Results

Mann-Whitney U

403.500

Wilcoxon W

868,500

Z

-.697

Asymp. Sig. (2-tailed)

.486

Comparison of Risk and Return on Trading and Profit Sharing Based Financing Contract in Indonesian Islamic Bank

133

Table 3 shown us the P-value of the variable rate

of return is 0.486 which is larger than (0.05), so it can

be concluded that Ho is accepted and Ha is rejected.

In other words that the risk of profit sharing financing

with sale and purchase financing have no significant

difference. The absence of any difference between the

risk of profit sharing financing with sales and

purchase financing significantly can be due to the risk

management owned by the bank. Muhammad (2011)

explained that in an investment or business must be

followed by risk so that the main problem is how

investment or business can minimize risk. Therefore,

we need a proper risk management in investment or

business. According to Sundarajan and Errico, (2002)

most significant difficulty faced by Islamic banking

is handling and overcoming the risks that exist

because of the level of complexity that continues to

grow due to some specific risks and losses gain which

exists on the financing concept in Islam.

5 CONCLUSION

The conclusion from this study are: there is a

significant difference between the rate of return from

the profit sharing financing with the sale and purchase

financing. Moreover, there is no significant

difference between the risks of profit sharing

financing and sale and purchase financing. The

implication of this study is becoming the reference for

practitioners of Islamic banks to decide the contract

optimization and for academicians to develop this

study furthermore.

ACKNOWLEGMENTS

Thanks to our research assistant, Dewi Nuraini

Rahmiasasi. Thank you helping finish this research.

REFERENCE

Antonio, Muhammad syafi`I. 2001. Bank Syariah dari

Teori Ke Praktik. Jakarta: Gema Insani.

Ismail, Rifki. 2010. Volatility of the return and expected

losses of Islamic bank financing. International Journal

of Islamic and Middle Eastern Finance and

Management. Vol 3, No 3. PDF.

Karim, Adiwarman. 2010. Bank Islam Analisis, Fiqih and

Keuangan. PT. Raja Grafindo Perkasa, Jakarta, Issue 4.

Khan, tariqullah and habib ahmed. 1998. Edisi 1.

Manajemen resiko lembaga keuangan syariah.

Terjemahan oleh Ikhwan Adibing Basri., 2008. Bumi

Aksara.Jakarta.

Khan,T and Ahmed, H, 2001. Risk Management – An

Analysis of Issue in Islamic Financial Industry. Islamic

Development Bank – Islamic Research and Training

Institute, Occasional Paper (no 5). Jeddah.

Mahdi, Ines Ben Salah., Abbes, Mouna Boujelbene., 2017.

Relationship between Capita, Risk and Liquidity: A

Comparative Study between Islamic and Conventional

Banks in MENA Region. Research in International

Business and Finance.

Muhammad, 2014. Manajemen Keuangan Syariah. UPP

STIM YKPN. Yogyakarta, Edisi 1.

Muhammad, 2005. Manajemen Dana Bank

Syariah. Ekonisia. Yogyakarta.

Nurafini, Fira., 2014. Perbandingan Tingkat

Pengembalian, Resiko, Dan Koefisien Variasi antara

pembiayaan Mudharabah–Musyarakah dan

Pembiayaan Murabahah pada Perbankan Syariah di

Indonesia. Skripsi. Surabaya. Fakultas Ekonomi dan

Bisnis.

Rosly, Saiful Azhar, Zaini, Mohammad Ashadi

Mohd. 2008. Risk-Return Analysis of Islamic Bank's

Investment Deposits and Shareholders`

Fund. www.emeraldinsight.com.

Tandelilin, Prof. Dr. Eduardus., 2010. Portofolio dan

Investasi Teori dan Aplikasi. Kanisius. Yogyakarta.

Edisi 1.

Uyanto, Stanislaus S., 2009. Pedoman Analisis Data

dengan SPSS, graham ilmu. Yogyakarta, Edisi 1.

Wulandari, Permata., Putri, Niken Iswani Surya., Kassim,

Salina., Sulung, Liyu Adhikasari., 2015. Contract

Agreement Model for Murabahah Financing In

Indonesia Islamic Banking. www.emeraldinsight.com

Bank Syariah Mandiri. Quarterly Financial Report of bank

mandiri syariah year 2011-2015.

Bank Rakyat Indonesia Syariah.Quarterly Financial Report

of bank BRI syariah in 2011-2015.

Bank Muamalat Indonesia. Quarterly Financial Report of

Bank Muamalat in 2011-2015.

Bank Negara Indonesia Syariah. Quarterly Financial

Report of Bank BNI syariahin 2011-2015.

Bank Central Asia. Quarterly Financial Report of BCA

syariah in 2011-2015.

Bank Mega Syariah. Quarterly Financial Report of BCA

syariah in 2011-2015.

www.bi.go.id.

www.ojk.go.id.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

134