Determination Sovereign Sukuk in Indonesia in 2011–2016

Winda Widianingsih, Suryana Suryana, and Neni Sri Wulandari

Universitas Pendidikan Indonesia, Bandung, Indonesia

winda.widianingsih95@student.upi.edu

Keywords: Sovereign Sukuk, Economic Growth, JUB, SBIS, Multiple Linear Regression.

Abstract: This study aims to determine the value of sovereign sukuk that are affected by macroeconomic variables in

this case economic growth, Money Supply (JUB), and Bank Indonesia Sharia Certificates (SBIS). This study

uses secondary data with time series data type and used monthly for the period 2011-2016. The research

method used is descriptive and verifikatif method with multiple linear regression analysis. Variable

Dependent in this research is sukuk country. Furthermore, the independent variables in the research are

economic growth, JUB, and SBIS. Based on the results of the research note that economic growth has no

significant effect on the value of sovereign sukuk with a positive related. While JUB has significantly effect

on the value of sovereign sukuk with a positive related. As well as SBIS has significantly effect on the value

of sovereign sukuk with a negative related.

1 INTRODUCTION

The concept of Islamic Finance is growing rapidly,

universally accepted and adopted not only by Islamic

countries in the Middle East region but also by

various countries in Asia, Europe and America. It is

characterized by the establishment of various forms

of Islamic financial institutions and the issuance of

various syariah-based financial instruments (Azwar,

2015).

One of sharia financial instruments that have been

widely published both by the state and corporations

are sukuk. According to the Accounting and Auditing

Organization for the Islamic Finance Institution

(AAOIFI), the Sukuk is a certificate indicating proof

of ownership divided into a tangible asset, the value

of benefits, services or asset ownership of a particular

project or investment activity.

Sukuk is a sharia bond and is based on the concept

of securitization, sukuk is an alternative to Islam for

asset monetization, project financing, financing

through assets supported by securitization and public

financing (Shaikh, 2010).

The development of sukuk in Indonesia begins

with the fatwa of the National Sharia Council,

Indonesian Council of Ulama (DSN-MUI) Number

32 / DSN-MUI / IX / 2002 concerning Syariah Bonds,

in 2008 the development of sukuk increased when the

Indonesian government through the minister of

finance took part by issuing State Sukuk in the form

of Government Sharia Securities (SBSN).

The main objective of the government to issue

sukuk is to finance the state budget, including to

finance the construction of the project. As mentioned

in Article 4 of the SBSN Law, the purpose of SBSN

is to finance the State Budget (APBN), including to

finance the construction of the project (Kholis, 2010).

The development of Sovereign Sukuk in

Indonesia is shown in the following figure:

Figure 1: Outstanding Sovereign Sukuk in Indonesia.

Sumber: DJPU, Kemenkeu (2015).

520.66

883.78

1372.49

1801.24

2812.36

4092.28

0

1000

2000

3000

4000

5000

2011 2012 2013 2014 2015 2016

Outstanding Sovereign

Sukuk

Widianingsih, W., Suryana, S. and Wulandari, N.

Determination Sovereign Sukuk in Indonesia in 2011–2016.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 73-77

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

73

Through Figure 1 can be seen that the

development of sukuk in Indonesia experienced a

positive trend from 2011 to 2016. This achievement

is quite encouraging.

However, if we compare it with other countries

that have also been issuing sukuk, it is still small,

especially when compared with Malaysia. The

following is data of countries that have become sukuk

publishers and sukuk types issued according to

1Q2015:

Figure 2: Sukuk by Country of Issuer and Type of Sukuk.

Sumber: ISRA, IFIS, Zawya, Bloomberg (2015)

Based on data above Indonesia is still far below

Malaysia in terms of issuing sukuk. The time factor

of the issuance of sukuk in Indonesia is still new is

also a reason that causes the issuance of sukuk in

Indonesia is small.

According to Irfan Sauqi Beik in his research

stated that the issuance of sukuk in Indonesia can not

be separated from the macroeconomic conditions that

exist in this country. Irfan Sauqi Beik further stated

that in the long run, the issuance of sukuk in Indonesia

is influenced by macroeconomic indicators, namely

economic growth and money supply with positive

relationship, and open unemployment and inflation

with negative relationship. In addition, long-term

sukuk issuance is also affected by the bonus of Bank

Indonesia Sharia Certificate (SBIS).

2 LITERATURE REVIEW

Issuance of sukuk serves as a financing instrument

and also investment that can be offered into various

shapes or structures according to sharia

(Burhanuddin, 2009).

The Interest-Listed Issuers Team at Capital

Market-BAPEPAM LK (2009) mentioned that the

most influential factor in issuing sukuk is external

factor, the most influential external factor is the

excess liquidity in the market. This market liquidity

distorts the current economic condition.

Macroeconomic factors have been empirically

proven to have an effect on capital market conditions

in some countries. These factors are economic

growth, inflation, exchange rate (Tandelilin, 2010).

According to the theory of macroeconomic

transmission, the issuance of sukuk as an investment

instrument can be used by the government to reduce

macroeconomic problems, such as inflation and

unemployment. Sukuk can also contribute in boosting

economic growth. Based on the theory of monetary

transmission, the issuance of sukuk can also be used

in controlling the money supply through a contractive

policy. Issuance of sukuk in Indonesia is also

inseparable from the macroeconomic conditions in

this country (Beik and Rini, 2012).

3 METHODOLOGY

The method used in this research is descriptive and

verifikatif method with multiple linear regression

analysis. Objects in this study are Sovereign Sukuk,

Economic Growth (GDP), Total Money Supply

(JUB) and Bank Indonesia Sharia Certificates (SBIS)

period 2011-2016. Data were collected through

literature studies and documentation.

4 RESULTS

The general description of the dependent variable is

the sovereign sukuk as follows:

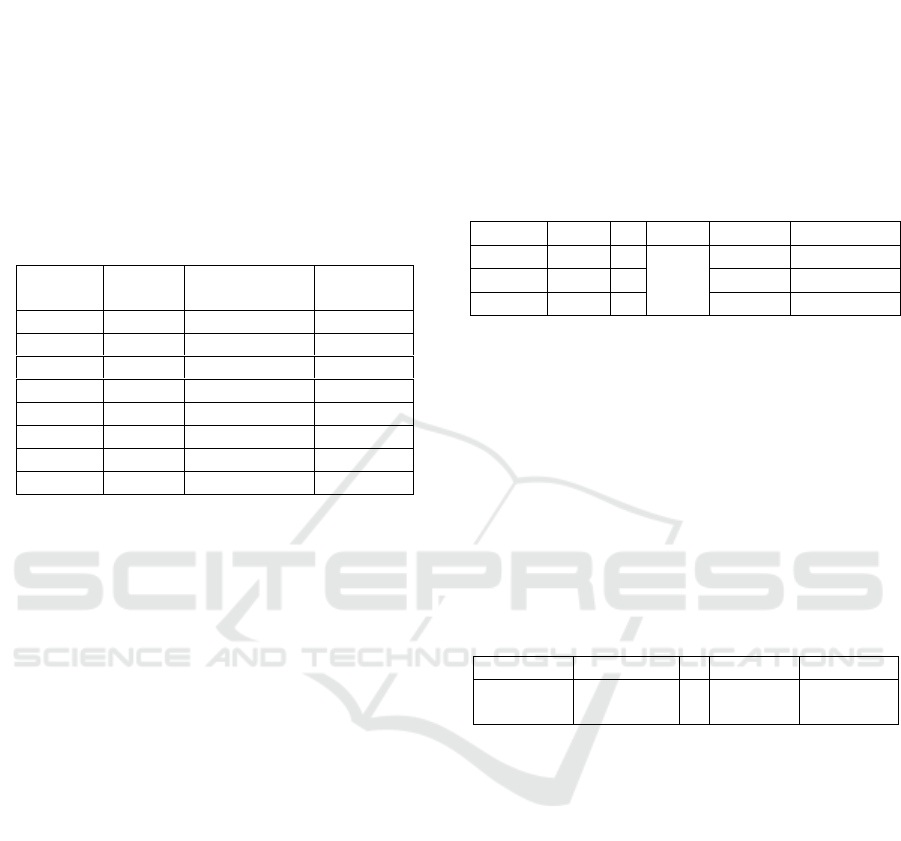

Table 1: General Description of sovereign sukuk.

Year

Outstanding Sukuk

2011

520,66

2012

883,78

2013

1.372,49

2014

1.801,24

2015

2.812,36

2016

4.092,28

Amount

11482.81

Average

1913.80

Based on data from Table 1 it can be seen that the

development of sovereign sukuk in Indonesia is very

encouraging, until 2016 the value of the sukuk

country traded is 4,092,28 trillions rupiah, 45,51%

increase from previous year, and increase 685% from

year 2011. The types of sukuk countries traded

42.30%

18.20%

14.20%

14.10%

5.30%

5%

Sovereign Sukuk

Malaysia

UAE

Bahrain

Indonesia

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

74

include Sukuk Retail (SR), Islamic Fixed Rate (IFR),

Project Based Sukuk (PBS), Indonesian State Sukuk

(SNI) and Sharia State Treasury (SPNS).

Factors affecting the issuance of state sukuk by

the Indonesian government are the factors of fiscal

stimulus financing required by the government to

finance infrastructure development and to finance the

state budget deficit (Irfan, 2012).

The general description of the independent

variables namely economic growth, JUB and SBIS as

follows:

Table 2: General description of GDP, JUB, SBIS.

Year

GDP

JUB (Billion)

SBIS

(Billion)

2011

6.17

2.571.164,25

5431

2012

6.03

3.043.937,08

4632.6

2013

5.56

3.465.391,64

5263

2014

5.01

3.867.679,49

10925

2015

4.88

4.357.423,74

6522.5

2016

5.02

4.698.075,00

4781

Amount

32.67

22,003,671.20

37555.1

Averages

5.45

3,667,278.53

6259.18

Based on Table 2, GDP growth in Indonesia from

2011 to 2016 has fluctuated, but tends to decline. This

is due to several factors such as the decreasing of

people's purchasing power and the lack of

government spending and excessive export and

import activities, the economic slowdown of export

destination countries such as China and Europe has

had a major impact on the decline of Indonesian

exports. (Sari, 2015)

JUB from 2011 to 2016 continues to increase.

According to Bank Indonesia (BI), the increase in M2

was caused by the acceleration of banking credit that

grew. The development of JUB is inseparable from

the role played by the central bank. Other factors that

greatly affect the behavior of money supply are

primary money and multiplication of money.

SBIS from 2011 to 2016 has fluctuated. The

highest nominal value of SBIS is in 2014 and the

lowest is in 2016. SBIS issuance depends heavily on

the role of Bank Indonesia in conducting Open

Market Operations (OPT), where when BI considers

that liquidity calculation as well as from interest rate

indicator in interbank money market (PUAB) excess

liquidity, BI will use its OPT policy in which SBIS is

one of the instruments used to reduce the excess

liquidity.

The result of the data obtained related to three

variables in this research then processed and analyzed

using multiple regression model to obtain the

following equation:

Y = β

o

+ β

1

X

1

+ β

2

X

2

+ β

3

X

3

+ e

Sukuk= -15,63 + 0,008PDB + 3,28JUB – 0,02SBIS

+ e

4.1 Partial test of hypothesis (t Test).

Hypothesis testing partially using t test with error rate

(α = 5%) obtained result as follows:

Table 3: The Result of t-Test.

Variable

t-Stat

t-Table

Prob.

Conclusion

GDP

1.72

>

1,67

0.0899

Insignificant

JUB

36.56

>

0.0000

Significant

SBIS

-2.14

>

0.0356

Significant

Based on the data from the Table 3, it is known

that GDP has a positive effect but not significant on

the sovereign sukuk, JUB has a significant positive

effect on the sovereign sukuk, and SBIS has a

significant negative effect on the sovereign sukuk.

4.2 Simultaneously test of hypothesis (F

Test)

F test is performed to test the overall hypothesis with

the error rate (α = 5%) obtained the following results:

Table 4: The Result of F-Test.

Variable

F Stat

F table

conclusion

GDP, JUB,

SBIS

453.0795

>

2.74

Significant

Based on Table 4, it is known that F-statistic

(453.08) is greater than F table (2.74), and Probability

(0,0000) is smaller than significance level (0.10).

Then it can be concluded that all independent

variables (GDP, JUB and SBIS) together influence

the dependent variable that is sovereign sukuk.

4.3 Determination Coefficient Analysis

(R2)

Estimation result obtained value of R

2

equal to 0,95,

that is mean contribution of independent variable that

is economic growth, Total Money Supply and SBIS

to dependent variable that is sovereign Sukuk equal

to 95% and rest of 5% influenced by other factor

outside estimation model.

Determination Sovereign Sukuk in Indonesia in 2011–2016

75

4.4 Effect of GDP on Sukuk

According to the theory of macroeconomic

transmission of sukuk issuance can contribute to the

increase of economic growth, and high economic

growth will increase the issuance of sukuk because

high economic growth reflects the good economic

condition. According to Irfan Sauqi Beik Sukuk

issuance in Indonesia is inseparable from the existing

macroeconomic conditions in the country, one of

which is economic growth. (Beik, 2012)

Based on the results of previous research studies

related to the effect of GDP on the value of sukuk

such as Irfan Sauqi Beik and Mustika Rini (2012) and

Selvianty (2015) stating that GDP positively affects

the value of the Sovereign Sukuk.

The other results are also obtained from research

conducted by Melati (2013) stating that GDP has a

negative effect on sovereign sukuk.

Thus it can be concluded that GDP has no

significant effect on the value of sukuk country in

Indonesia, so the results of this study is less

appropriate and supports some previous research

results. This may be due to several possible

differences between the years of research used, and

economic growth is a reflection of the Indonesian

economy in a macro and very broad range, while

sukuk is only one part of the Islamic investment

instrument that is a small part of the overall

investment in Indonesia. Therefore, it is unlikely that

economic growth will have a significant impact on

sukuk, but it is undeniable that GDP does have an

influence on sukuk country with a positive

relationship although its influence is not too big or not

significant

4.5 Effect of money supply (JUB) on

Sukuk

Based on the portfolio theory of money demand, the

amount of money in circulation is related to

investment. This theory says that money is part of the

asset portfolio, money provides a different

combination of risks and returns compared to other

assets (Mirazdianti, 2014).

BAPEPAM LK (2009) states that the most

influential factor in the issuance of sukuk is an

external factor, the most influential external factor is

the excess liquidity in the market. The condition of

this excess liquidity market in terms of the amount of

money circulating in the market has increased, so to

avoid inflation caused by excess amount of money

circulating the government in this case Bank

Indonesia will conduct a contractive policy through

open market operations by issuing investment

instruments one of which is sovereign sukuk. This is

in line with the theory of monetary transmission, in

which the issuance of sukuk can be used in

controlling the money supply through a contractive

policy.

On the other hand, the results of this research

support some of the previous research results related

to the influence of JUB on the sukuk value, among

others are research from Selvianty (2015) and

Nugroho (2008) stating that JUB has a positive and

significant influence on the growth of sukuk.

The same result is also given by research

conducted by Irfan Sauqi Beik and Mustika Rini

(2012) that JUB have positive effect on sukuk. When

there is an increase in the money supply in the

community, the government will issue sukuk as one

of the instruments that can be used in open market

operations.

4.6 Effect of SBIS on Sukuk

The purpose of the issuance of Bank Indonesia

regulation concerning SBIS is intended as one of

Open Market Operation instruments in the framework

of monetary control based on sharia principles. The

calculation of bonuses granted to SBIS refers to the

discount rate on the results of the same period SBI

auction issued simultaneously with the issuance of

SBIS.

The interest rate also determines the price of a

bond. One of the determinants of whether the bond

price is attractive or not is the interest rate given to

bond investors. If interest rates in the market decline,

investors tend to buy bonds with higher coupons than

deposits so bond prices tend to rise (Raharjo, 2004).

According to Khan in Nurul Huda (2008) states

that investment demand is determined by the level of

profit expected by investors, this has a very big

influence on the decision of investors in determining

what type of investment will be chosen. That is, if the

profit provided by an investment instrument other

than a sukuk is higher than that of a sukuk,

theoretically, the investor will prefer to invest in the

higher yielding instrument.

With the selection of this type of investment will

affect the issuance of sukuk. So when the value of

SBIS increases will affect the decline in value of

sukuk, because SBIS is also one of the investment

instruments into consideration investors in investing.

In other words, this SBIS has a negative relationship

with the value of sukuk.

On the other hand, the results of this research

support the results of previous research studies related

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

76

to the influence of SBIS on sukuk such as the research

conducted by Irfan Sauqi Beik and Mustika Rini

(2012) stating that in the long run the issuance of

sukuk is influenced by the SBIS rate. When SBIS

rewards rate is given high then investors will choose

to buy SBIS compared with sukuk, therefore SBIS

variable has a negative influence on sukuk country.

Thus it can be concluded that SBIS influences the

value of sukuk country in Indonesia with a negative

relationship. The implications of the findings of this

study are as a reference in the implementation of

sukuk issuance of the state to be effective and

efficient with regard to the rate of return applied by

other investment instruments.

5 CONCLUSION

The results showed that economic growth (GDP) has

an insignificant influence on the value of sovereign

sukuk with a positive relationship. Total Money

Supply (JUB) has a significant effect on the value of

sovereign sukuk with a positive relationship. Bank

Indonesia Sharia Certificates (SBIS) have a

significant effect on the value of sovereign sukuk

with negative relationship. Together GDP, JUB and

SBIS significantly influence the value of sukuk

country in Indonesia.

REFERENCES

Azwar. 2015. Pengaruh Penerbitan Sukuk Negara Sebagau

Pembiayaan Defisit Fiskal dan Kondisi Ekonomi

Makro Terhadap Perkembangan Perbankan Syariah di

Indonesia. Jurnal Inormasi Keuangan dan Akuntansi.

Beik, Irfan Syauqi dan Mustika Rini. 2012. Dampak Sukuk

Terhadap Indikator Makro Ekonomi. Iqtishodia.

Bi.go.id. 2017.

Burhanuddin. 2009. Pasar Modal Syariah. Yogyakarta: UII

pers Yogyakarta.

DJPU Kemenkeu. 2015. Jakarta.

ISRA, IFIS, Zawya, 2015. Bloomberg.

Huda, Nurul, etc. 2008. Ekonomi Makro Islam. Jakarta:

Prenada Media Group.

Hukum Online 2008. BI Terbitkan Ketentuan SBI Syariah.

[Online] Tersedia:

http://www.hukumonline.com/berita/baca/hol18901/bi

-terbitkan-ketentuan-sbi-syariah Diakses pada 17 Juli

2017.

Issuer Interest Study Team in Capital Market BAPEPAM

2009. Studi Faktor-Faktor Yang Mempengaruhi Minat

Emiten dalam Menerbitkan Sukuk di Pasar Modal.

Jakarta: Departemen Keuangan RI BAPEPAM dan LK.

Kholis, N. 2010. Sukuk: Instrumen Investasi yang Halal

dan Menjanjikan. La Riba Jurnal Ekonomi Islam, 145 -

159.

Melati, A. 2013. Faktor-faktor yang mempengaruhi tingkat

sewa sukuk Ijarah. Accounting Analysis Journal 2 (3).

Mirazdianti, F. 2014. Analisis Faktor-Faktor

Makroekonomi yang Mempengaruhi Pertumbuhan

Reksa Dana Syariah dan Perkembangannya di

Indonesia.

Nugroho, H. 2008. Analisis Pengaruh Inflasi, Suku Bunga,

Kurs dan Jumlah Uang Beredar Terhadap Indeks Lq45

(Studi Kasus Pada Bei Periode 2002-2007). Tesis.

Raharjo, S. 2004. Panduan Investasi Obligasi. PT

Gramedia Pustaka Utama.

Shaikh, Salman dan Shan Saeed. 2010. Sukuk Bond: The

Global Islamic Financial Instrument. MPRA Paper.

Selvianty, I. 2015. analisa indikator makro ekonomi

terhadap pertumbuhan sukuk di Indonesia: sebuah

analisa dengna metode Error Correction Model (ECM).

Skripsi.

Tandelilin, E. 2010. Portofolio dan Investasi. Yogyakarta:

Kanisius.

Sari, Elisia Valenta. 2015. Uang Beredar Bertambah Akibat

Penyaluran Kredit Meningkat. [Online] Tersedia:

https://www.cnnindonesia.com/ekonomi/20151006075

614-78-83050/uang-beredar-bertambah-akibat-

penyaluran-kredit-meningkat/ Diakses pada 17 Juli

2017.

Sari, Elisia Valenta. 2015. Peran Minim Belanja

Pemerintah Hambat Laju Ekonomi. [Online]. Tersedia:

https://www.cnnindonesia.com/ekonomi/20150205135

155-78-29881/peran-minim-belanja-pemerintah-

hambat-laju-ekonomi-2014/ Diakses pada 17 Juli 2017.

Determination Sovereign Sukuk in Indonesia in 2011–2016

77