The Evaluation of Zakat Development in Indonesia

A Case Study in Banten

Mohamad Soleh Nurzaman

1

, Wulandari Citra Aryani

2

, and Nurul Huda

2

1

Center of Islamic Economics and Business, University of Indonesia, Depok, Indonesia.

2

Middle-East and Islam Postgraduate Program, University of Indonesia, Depok, Indonesia

ms.nurzaman@ui.ac.id

Keywords: Zakat development, Banten, BAZNAS, National Zakat Index (NZI).

Abstract: It is very rare to find a comprehensive evaluation of zakat development. Therefore, this research aims to

comprehensively evaluate the performance of zakat in Indonesia by using standard measurement instruments

of zakat, National Zakat Index (NZI). NZI comprehensively evaluates the performance of zakat in both Macro

which describes the support from government and society to contribute in building zakat and Micro which

observes the zakat institution in the process of collecting, managing, distributing, reporting, as well as the

impact of zakat towards the recipient (mustahik). This research which focuses on the evaluation of zakat was

conducted in Banten Province, with primary data obtained from questionnaires of 96 respondents who are the

zakat recipients (mustahik), 8 of the respondents are staffs, department heads, and the stakeholders of

BAZNAS in Banten Province. Then, the secondary data was obtained from BAZNAS in Banten from 2015

to 2016. The calculation method in this research utilizes Multhi Stage Weighted Index with the result from

0.00 to 1,00. The results of National Zakat Index (NZI) value is 0.69 which means the performance of

BAZNAS Banten Province good.

1 INTRODUCTION

Banten Province in Indonesia is currently considered

as one of the very potential regions to contribute to

Zakat Development in Indonesia. Banten is one of the

provinces which has an area of 9,160 km2, with 4

districts and 4 cities. In addition, Muslim becomes the

majority of the population in Banten province, which

is 9,730,513 people or about 92.55% of the total

population of 11,955,243 in 2015 (BPS, 2015). In

2015, BAZNAS Banten Province has been awarded

as the best regions in managing Zakat in Indonesia

(Pusat BAZNAS, 2015).

Table 2: The Collection of Zakat Funds in Banten Province.

No

Years

Zakat (IDR)

1

2012

1.596.529.282

2

2013

1.683.519.828

3

2014

2.293.478.782

4

2015

2.513.666.232

5

2016

3.216.533.369

Source: BAZNAS Banten, 2016

The collection of zakat funds in Banten Province

has increased fairly well each year. It can be seen in

Table 2, that in 2014 zakat collection increased by

26,59% from in 2013. Then, a relatively high increase

in zakat collection occurred in 2016 amounted to IDR

3.216.533.369. However, according to BAZNAS

Banten Province, the zakat obtained in 2016 is

considered not comparable with the number of

Muslim in Banten Province, which means that the

acquired zakat funds can still increase.

Zakat is one form of effort which is used to

empower the society who are less or not able in terms

of material aspect, so as to improve the welfare and

release the underprivileged from poverty in various

provinces.

Nurzaman, M., Aryani, W. and Huda, N.

The Evaluation of Zakat Development in Indonesia - A Case Study in Banten.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 43-48

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

43

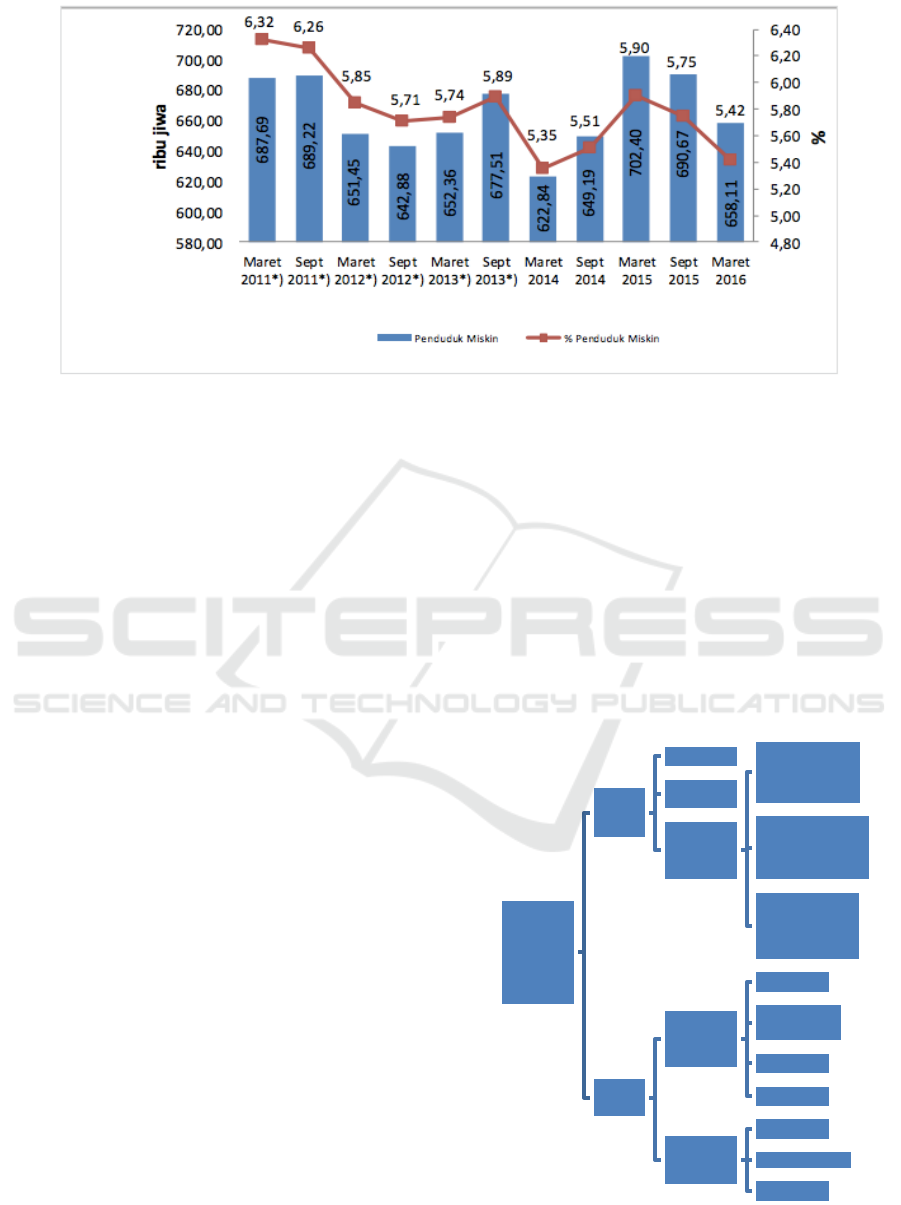

Figure 1: Number and Percentage of Poor People in Banten Province 2011-2016.

Source: BPS, 2017

From figure 1, it is can seen that the number of

poor people in Banten has descreased from 690.670

people or by 5,75% in 2015 to 658.11 thousand

people or 5,42% im March 2016. The decline

occourred due to several factors, one possible cause

is because of the empowement of zakat.

The problems based on zakat concern in Banten

Province becomes the background of this research.

Therefore, these area needs to be evaluated by using

a measuring instrument in order to provide a

comprehensive and accurate depiction of zakat

development. One of the measuring instruments

which can accurately measure zakat development is

the National Zakat Index (NZI).

NZI is a measuring instrument which refines some

of the previous zakat index measurement instruments.

This measurement instrument is not only used to

observe the development of zakat in form the impact

but also to measure how further the success of zakat

in improving the material and spiritual welfares of the

recipient of zakat, to measure the development of

zakat institution, and to measure the contribution

from the government and the society.

According to the background, it can be identified

the problem as follows: How is the performance of

zakat which is measured using the National Zakat

Index in 2016 in Banten Province?

2 RESEARCH METHODOLOGY

2.1 Research Model

The model in this research is adopted from the model

which has been made by the Team of Strategy Study

Center (Puskas) of Badan Amil Zakat Nasional

(BAZNAS) 2016 on National Zakat Index (NZI).

The depiction model in this research is seen as

follows:

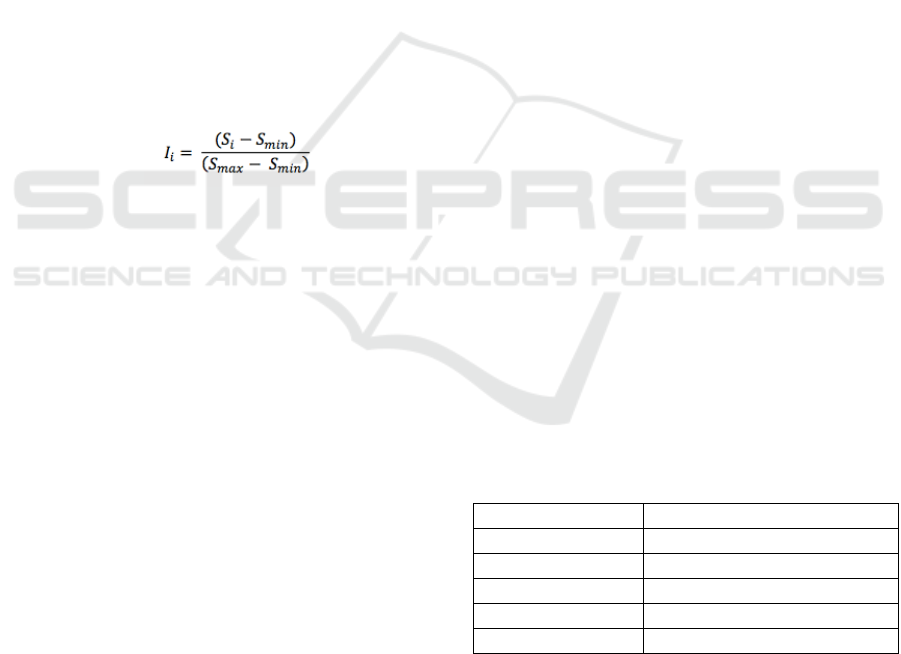

Figure 2: Research Model.

National

Zakat Index

(IZN)

Banten

Province

Macro

Regulation

Government

Budget

Zakat

Institution

database

Total of official

Institution zakat,

muzakki, mustahik

Ratio individual

Muzakki with

households

Ratio corporate

muzakki with

business entities

Micro

Institution

Collection

Management

Distribution

Reporting

Impact of

Zakat

CIBEST

Modified HDI

Self-Reliance

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

44

2.2 Types and Sources of Data

This is a quantitative research with data obtained

from primary data and secondary data. The primary

data is obtained from respondents who are the

recipient of zakat (mustahik) productive program by

collecting data in the form of questionnaires. The

secondary data is the data collected through literature

study and from Badan Amil Zakat Nasional,

BAZNAS, Banten Province, and the Central Bureau

of Statistics (BPS)

2.3 Data Calculation Method

The calculation model in this research uses the Multhi

Stage Weighted index. This method involves several

stages of weighting process which has several

systematic and gradual stages. The estimation of the

calculation index by BAZNAS PUSKAS (2016) is as

follows:

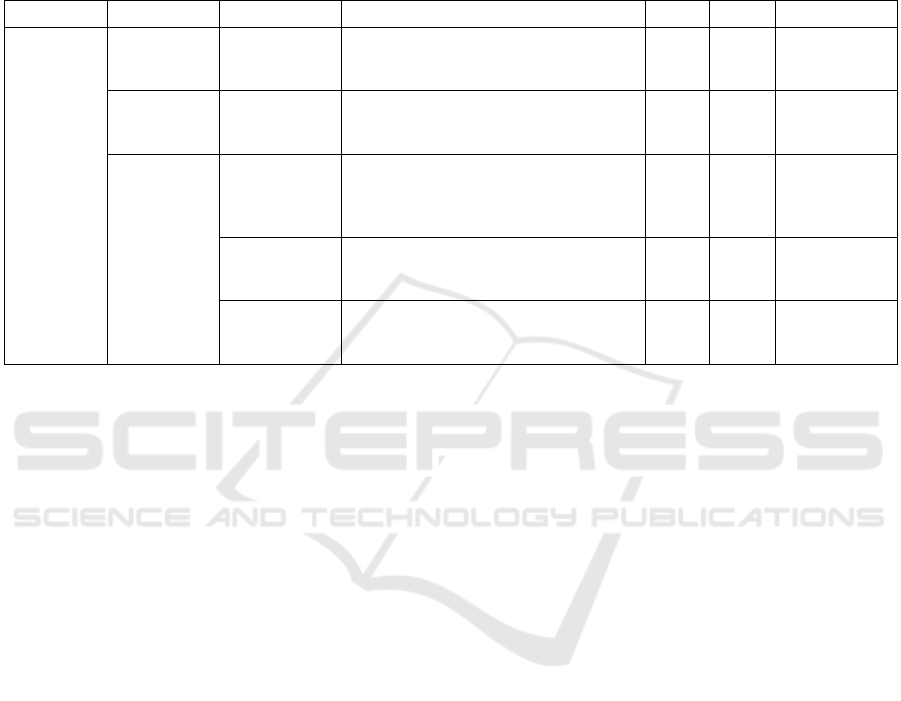

1. Calculate the index of each variable. The initial

stage to calculate NZI is to find the index value

of each variablesusing the formula calculation

formula as follows

Note:

I

i

= Index of i variable

S

i

= Actual score of the measurement of

variable

S

max

= Maximum score

S

min

= Minimum score

2. The next step is to multiply all the variables

which is incorporated into one indicator with

purpose is to generate an index on the indicator,

which are:

a. Agency data base

X

13

= 0.33X

131

+ 0.33X

132

+ 0.33X

133

(3,1)

Notes:

X

13

= Indicator Index of Zakat Institution

Database

X

131

= Variable Index of the Number of Zakat

Institution

X

132

= Variable Index of Individual Muzakki

toward the Number of Households

X

133

= Variable Index of theAgency Muzakki

toward the Number of Business Entity

b. Institutional

X

21

=0.30X

211

+0.20X

2112

+0.30X

213

+0.20X

214

(3,2)

Notes :

X

21

= Institutional Indicator Index

X

211

= Variable of Collection Index

c. The Impact of Zakat

X

22

= 0.40X

221

+ 0.40X

222

+ 0.20X

223

(3,3)

Notes:

X

22

= Zakat Impact Indicator Index

X

221

= CIBEST Variable Welfare Index

(material and spiritual)

X

222

= Education and Welfare Variables Index

(Modified IPM)

X

223

= Self-Reliant Variable Index

3. In this third stage, to obtain the index from

macro and micro dimension is as follows:

Macro Dimension

X

1

= 0.30X

11

+ 0.40X

12

+ 0.30X

13

(3,4)

Notes:

X

1

= Macro Dimension Index

X

11

= Regulation Indicator Index

X

12

= APBN Support Indicator Index

X

13

= Database Indicator of Zakat

Institution Index

Micro Dimension

X

2

= 0.40X

21

+ 0.60X

22

(3,5)

Notes:

X

2

= Macro Dimension Index

X

21

= Institutional Indicator Index

X

22

= Zakat Impact Indicator Index

4. The last stage is to multiply the obtained index

from each dimension with each value to

maintain NZI, which is:

NZI = 0.40X

1

+ 0.60X

2

(3,6)

Note:

NZI = National Zakat Index

X

1

= Macro dimension

X

2

= Micro dimension

The index value which is resulted in score range

0,00-1,00. If the index value is low, it means that the

condition of zakat performance in a particular region

is going worse. If the values is close to 1,00, it means

that the zakat performance is going better.

Table 3: Classification of Zakat Performance.

Source: PUSKAS BAZNAS 2016.

Score Range

Performance Condition

0.00-0.20

Not Good

0.21-0.40

Less Good

0.41-0.60

Fairly Good

0.61-0.80

Good

0.81-100

Very Good

The Evaluation of Zakat Development in Indonesia - A Case Study in Banten

45

3 RESULT AND DISCUSSION

3.1 Macro Dimension

There are three components indicators of the macro

dimension in calculating the National Zakat Index

(NZI) which are regulatory indicator, APBD support,

and zakat institution database. All the results are

provided in Table.4 , while the explanation of Macro

dimension is as follows.

Table 4: Macro Dimension Scoring.

Source: Primary and Secndary Data 2017.

The implementation of zakat in Banten province

can be observed through the Regional Regulation

(Perda) which regulates zakat. The table above shows

that the index value obtained from the regulation

indicator is 4 or 0.75 or fairly good. There are two

BAZNAS institutions which do not have the

regulation, which are BAZNAS located in Tangerang

City and South Tangerang City this is due to Amil

regional Zakat Agency (BAZDA), the previously

existing institutional zakat institution, was changed

into BAZNAS alongside with the governance

structure.

The next variabel is government budget which

observes how much funding from APBD (state

budget) which is allocated to zakat. In 2016, APBD

allocation for BAZNAS operations in each

district/city of Banten Province has been

implemented. Thus, it is given score 5 which means

that APBD support is available.

Meanwhile, the variable in the indicators of zakat

institutions illustrate the number of agency muzakki

and individual muzakki which has been paying zakat

to BAZNAS institutions compared to the number of

business entities and the number of households in

Banten Province.

On the variable number of official zakat

institutions, mustahik and muzakki get score 4 or

fairly good. This is because the average of BAZNAS

institution located in Banten Province have database

regarding number of official zakat instituition as well

as number of both individual or institutional muzakki

and mustahik.

The variable ratio of individual muzakki obtains

score 2 or less good; it is because public awareness in

paying zakat is still lacking. Therefore, if the number

of Muslim population in Banten Province is

compared with the amount of zakat funds obtained

today, it is still not balanced.

Furthermore, the variable ratio of the agency

muzakki towards the total number of business entities

in Banten Province is 1,78 percent and obtains score

2 or less good, which means that not many companies

pay zakat to BAZNAS institution in their respective

region. The index value of institution database

indicator is then like the following:

The calculation result of Macro index indicator

value is then obtained based on the formula:

X

1

= 0.30X

11

+0.40X

12

+0.30X

13

= 0.30(0.75)+0.40(1)+0.30(0.41)

= 0.748

The value of the macro index is 0.748, which

means that the performance of BAZNAS in Banten

Province according to macro dimension is included

into the good category, and the local government also

provides support for the sustainability of the

management of zakat development in each region.

Dimension

Indicator

Variable

Actual Condition

Score

Index

Performance

Macro

Regulation

(X

11

)

Regulation

The availability of state regulation

about zakat at province level at least

75% at district level in those province.

4

0.75

Fairly Good

Government

Budget

(X

12

)

Government

Budget

There is APBD support

5

1

Very Good

Zakat

Institution

database

(X

13

)

Number of

official zakat

institution

(X

131

)

The average of BAZNAS institution in

Banten Province has database

regarding the number of official zakat

institution

4

0.75

Fairly Good

Individual

muzakki ratio

(X

132

)

The ratio of individual muzakki toward

the number of regional household is

only 1,37 percent.

2

0.25

Less Good

Enterprise

muzaki ratio

(X

133

)

The ratio of agency muzakki toward

regional business is only 1,78 percent

2

0.25

Less Good

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

46

3.2 Micro Dimension

There are two components indicators of micro

dimension in calculating the National Zakat Index

(NZI), which are the institutional and the impact of

zakat indicators. In the institutional Indicator, it is

explained the collection, management, distribution,

and reporting variables of BAZNAS. Meanwhile, the

zakat impact indicator measures the impact of zakat

by using three variable models, which are the impact

of zakat measured based on material and spiritual

welfare or CIBEST Model (Beik and Arsiyanti,

2016), education and health or Modified HDI

(Nurzaman,2010) and Self-Reliance.

Table 6. Micro Dimension Scoring.

Source: Primary and Secondary Data 2017.

The variable of zakat fund collection in Banten

Province from 2015-2016 experienced growth by

65,75 percent and obtained score 5 or very good. The

increase in the collection of Zakat fund this year can

be seen in Table 1.3. The management variables

obtained score 4 with index value 0.75, which means

that the zakat management is considered as good.

This is because the average of BAZNAS in Banten

District/ City only has zakat management SOP,

strategic planning, and annual work program.

Then, the distribution variable also obtained index

values 0.75 or score 4, which means that in terms of

distribution BAZNAS is considered as good. This is

because BAZNAS is able to channel zakat fund to

mustahik with Allocation to Collection Ratio (ACR)

88.30 percent. In reporting variable, it is scored 3 or

good enough. This is because the average of

BAZNAS institution has the audited financial

statements, but it is not a WTP (unqualified opinion)

and has a periodic publication report.

The value results of the index based on the

calculation formula is seen as the following:

X

21

= 0.30 X

211

+0.20 X

212

+0.30X

213

+0.20X

214

= 0.30 (1) + 0.20 (0.75) + 0.30 (0.75)+0.20 (0.5)

= 0.775

Meanwhile regarding the incicators of zakat

impact, there are 3 components. First is CIBEST

Welfare Index. The CIBEST Index value is 0.75 with

score 4, which means that the material and spiritual

welfare of the mustahik after receiving productive

Dimension

Indicator

Variable

Actual Condition

Score

Index

Perfor

mance

Micro

Institution

(X

21

)

Collection

(X

211

)

The collection of zakat fund of BAZNAS in

Banten Province from 2015-2016 is up to

65,75 percent.

5

1.00

Very

Good

Manageme

nt (X

212

)

Average of BAZNAS in Banten province has a

Standard Operating Procedure (SOP), a

strategic plan, and an annual work program.

4

0.75

Good

Distribution

(X

213

)

BAZNAS in Banten Province is able to

distribute zakat funds to mustahiki with

Allocation to Collection Ratio (ACR) 88,30

percent. The distribution of social programs 3-

5 month, economic program 6-8 month,

da’wah program I allocated by 9,59 percent.

4

0.75

Good

Reporting

(X

214

)

The average BAZNAS in Banten Province has

an audited financial report, but it is not a WTP,

and it has periodic report publication.

3

0.5

Fairly

Good

Zakat

Impact

(X

22

)

Prosperity

Index

(CIBEST)

(X

221

)

The increasing of spiritual values is result after

the provision of productive zakat in a particular

government religion create a conducive

environment for worship, that is by building a

place of worship.

4

0.75

Good

Education

and Health

(Modified)

(X

222

)

The human development after receiving zakat

in forms of health and education in Banten

Province is quite good.

3

0.50

Fairly

Good

Self-

Reliance

(X

223

)

The increasing Self-Reliance is because of

before receiving productive zakat, the reciptent

mustahik have already had job as trader,

laborers, and craftsmen.

3

0.50

Fairly

Good

The Evaluation of Zakat Development in Indonesia - A Case Study in Banten

47

zakat is considered into the good category. Second is

modified Human Development Index (HDI). There

are two sub- indexes: education index and health

index. The calculation result of modified HDI is 0.43,

it has score 3, or it can be said that the it has Index

0.50. This means that the education and health index

is fairly good.

The third indicator is the index of self-reliance

which is to describe the condition of self-reliance of

the recipient households of productive zakat. It can be

seen from the ownership of jobs and also the

ownership of savings. The value of the self-reliance

index is 0.50, which means that self-reliance from the

household mustahik is considered into fairly

independent classification which is seen from the

increase in ownership of savings

The result of the value of the zakat impact index

according to the calculation formula as the following:

X

22

= 0.40 X

221

+0.40X

222

+0.20X

223

= 0.40 (0.75) + 0.40(0.50)+0.20(0.50)

= 0.6

Thus, it can be said that the productive zakat given

by BAZNAS in Banten Province has good enough

impact for the zakat recipient household (mustahik),

in terms of material or spiritual, education and health,

and self-reliance.

Here is the calculation result of micro index

dimension which is seen from the index of each

variable and indicator:

X

2

= 0.40X

21

+0.60X

22

= 0.40 (0.77)+0.60(0.6)

= 0.66

The value of micro dimension index gets score

0.66, which means the performance of BAZNAS

located in District/ City of Banten Province is good.

This result is expected to be further maintained or

improved, so that zakat can slowly be able to reduce

poverty.

3.8 National Zakat Index (NZI)

National Zakat Index is a calculation resulted by

combining macro and micro index indicator results.

Below is the result of the National Zakat Index (NZI):

NZI = 0.40X

1

+0.60X

2

= 0.40(0.748)+0.60(0.66)

= 0.69

The calculation result of National Zakat Index

(NZI) is 0.69, which means that the performance of

BAZNAS in Banten Province is considered into good

classification. However, in the case of the zakat fund

collection, it is expected to be further improved in

order to achieve the target of zakat fund collection to

be balanced with the number of Muslims in Banten

Province.

4 CONCLUSION

The result of National Zakat Index (NZI) value in

evaluating zakat performance in Banten Province is

0.69 which means that the overall zakat performance

is good. However, the performance of BAZNAS in

Banten Province can be maintained or even improved

to be better. Besides that, the measuring intrument

called NZI can be used every year to calculate zakat

perfomance. Therefore, the development of zakat in

regions from year to year can be examined. Thusm in

the end, the calculation result of NZI can be used as

an evaluation for BAZNAS instituiton to prepare a

strategy to make zakat management run more

effective.

REFERENCES

BAZNAS, 2015. Laporan Keuangan Bulanan BAZNAS.

Retreived from http://pusat.baznas.go.id/laporan-

bulanan/?did=64

Pusat Baznas, 2015. Retrieved from

http://pusat.baznas.go.id/posko-aceh/kementerian-

agama-berikan-anugerah-zakat-award-kepada-baznas-

berprestasi/

BAZNAS Banten, 2016. Buletin BAZNAS Banten Edisi

XXI-XXII. BAZNAS Provinsi Banten.

BPS, 2015. Retreived from

https://www.bps.go.id/website/fileMenu/Penduduk-

Indonesia-Menurut-Desa-2010.pdf

BPS, 2017, Jumlah Penduduk Miskin Menurut Provinsi,

2007-2017. Retrieved from

https://www.bps.go.id/linkTableDinamis/view/id/111

9

Beik, Irfan Syauqi and Arsyianti, Laily Dwi. (2016)

‘Measuring Zakat Impact on Poverty and Welfare

Using CIBEST Model’, Journal of Islamic Monetary

Economics and Finance, 1(2), pp. 141–160.

Nurzaman, Mohamad Soleh. 2010. ‘Zakat and Human

Development : An Empirical Analysis on Poverty

Alleviation in Jakarta , Indonesia 1’, 8th International

Conference on Islamic Economics and Fnance, pp. 1–

26.

Puskas BAZNAS, 2016. National Zakat Index. [Online]

Available at: http://www.puskasbaznas.com/national-

zakat-index/nzi/download/72-nzi-2.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

48