A Framework to Evaluate the Performance of Zakat Institutions

A Case Study on Zakat Institutions in Yogyakarta, Indonesia

Nur Azizah Widyaningsih

1

, Mohammad Soleh Nurzaman

2

and Nurul Huda

3

1

Middle-East and Islam Postgraduate Program, University of Indonesia, Depok, Indonesia

2

Center of Islamic Economics and Business, University of Indonesia, Depok, Indonesia

3

Faculty of Economics Yarsi University and Middle-East and Islam Postgraduate Program, University of Indonesia, Depok,

Indonesia

dedenmsn@gmail.com, ms.nurzaman@ui.ac.id

Keywords: Zakat institutions, performance indicators, zakat management, National Zakat Index, performance

measurement.

Abstract: The objective of this paper is to implement a conceptual framework of National Zakat Index for evaluating

the performance of zakat institution. National Zakat Index (NZI) acts as the standard measurement for

assessing and evaluating the performance of national zakat including the role of government and public, zakat

institutions, and the impact of zakat on the recipients(mustahik). National Zakat Index include two dimensions

(i.e., the macro and micro dimensions). Micro dimension includes two indicators: the performance of zakat

institutions and the impact of zakat on the mustahik. The indicator of the performance of zakat institutions

includes four variables: collection, management, distribution, and reporting. This study will compare the

performance of zakat institutions managed by the government and private zakat institutions. The data for this

study obtained in the province of Daerah Istimewa Yogyakarta (DIY), Indonesia. Zakat institutions in Daerah

Istimewa Yogyakarta that are being examined are BAZNAS DIY and Rumah Zakat DIY. The result of this

research show that the performance of BAZNAS DIY is better than the performance of Rumah Zakat DIY

especially in the aspect of the collection.

1 INTRODUCTION

Zakat is one of the five pillars of Islam (also known

as Rukun Islam). Zakat is an obligation for Muslims

to give a specific amount of their wealth (with certain

conditions and requirements) to beneficiaries called

mustahik (Mohd Noor, 2012). Zakat functions not

only as a vertical worship for Allah (hablumminallah)

but also as a form of horizontal worship associated

with fellow human beings (hablumminnas).

According to Kahf (1999), the main purpose of zakat

is to achieve socio-economic justice. Zakat is a real

form of social solidarity in Islam because zakat can

develop the sense of togetherness and responsibility

to help each other between the members of a society

as well as can eliminate selfish and individualistic

nature (Huda et al., 2015).

In zakat funds management, the most crucial thing

is the role of zakat institutions. This is because the

functions of zakat in various aspects can be realized

if zakat institutions can strengthen their positions in

collecting, managing, and distributing zakat in the

society (Ayuniyyah, Hafidhuddin, and Hambari

2017). Various programs of zakat institutions can

improve social welfare, education, health, and

spirituality of the poor if the performance of zakat

institutions is carried out both effectively and

efficiently.

In Indonesia, according to Act no. 23 in 2011,

there are two zakat management organizations, which

are BAZNAS (Badan Amil Zakat Nasional) or The

National Zakat Board of the Republic of Indonesia

and Amil Zakat Institution (LAZ). BAZNAS is a non-

structural government institution which is

independent and responsible to the President through

the Minister. In contrast to BAZNAS, LAZ is an

institution formed by a community which has a duty

to help the fundraising, distribution, and utilization of

zakat. BAZNAS, alongside with the Government, is

responsible for guarding the management of zakat

based on Islamic law, trust, benefit, justice, legal

certainty, integrated, and accountability.

Because of the importance of zakat institutions

positions in achieving the objectives of zakat, an

indicator which can measure and evaluate the

performance of zakat institutions in Indonesia is

needed. Actually, such measurement tool is very

important in assessing the ability of zakat institutions

26

Widyaningsih, N., Nurzaman, M. and Huda, N.

A Framework to Evaluate the Performance of Zakat Institutions - A Case Study on Zakat Institutions in Yogyakarta, Indonesia.

In Proceedings of the 1st International Conference on Islamic Economics, Business, and Philanthropy (ICIEBP 2017) - Transforming Islamic Economy and Societies, pages 26-32

ISBN: 978-989-758-315-5

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

to fulfil their objectives. In 2016, Center of Strategic

Studies BAZNAS (Puskas BAZNAS) developed the

NZI to evaluate the zakat performance at the national

level, which was especially important since Indonesia

did not previously have an effective tool performing

such measurements.

National Zakat Index is formed by two

dimensions, which are macro and micro dimensions.

Each dimension is divided into several supporting

indicators. Institutional indicators are parts of the

micro dimension of zakat which evaluate the

performance of zakat institutions based on 4 (four)

variables. The four variables which measure the

performance of zakat institutions consist of the

collection, management, distribution, and reporting

aspects.

Therefore, this research attempts to implement the

National Zakat Index in measuring the performance

of zakat institutions in Yogyakarta Province. In

addition, this research will also compare the

performance between zakat institutions which is

formed by the government (BAZNAS) with zakat

institutions formed by the private institution (House

of Zakat as known as Rumah Zakat) in Yogyakarta

Province. Daerah Istimewa Yogyakarta Province was

selected as the geographic location for this study. In

terms of religion, Daerah Istimewa Yogyakarta

contains a clear Muslim-majority (92.5 percent in

2016). Despite Islam being the religion of a majority

of its population, the realization of zakat collection in

Daerah Istimewa Yogyakarta was only about 10% of

its potential. Due to this fact, the problem on the level

of public trust to pay zakat through zakat institutions

was believed to be a major factor for wide gap

between potential and actual collection of zakat in

Daerah Istimewa Yogyakarta.

In addition, a comprehensive research to evaluate

the performance of zakat institutions in Indonesia has

not been available so far. Past empirical studies

focused mainly on the management of zakat

collection and distribution. Hence, due to the lack of

studies on the governance of zakat institutions these

concerns need to be empirically studied especially in

the context of a modern Muslim state. A

comprehensive framework to evaluate the

performance of zakat institutions can increase the

institution’s ability in realizing its mission in order to

achieve social and economic justice. Therefore, the

measurement framework of the zakat institutions

performance used in this study is expected to fill the

gaps in the current literature, which will be useful for

further empirical research in this area.

2 LITERATURE REVIEW

Some researches regarding zakat have been carried

out both theoretically and empirically. Wahab and

Rahman (2011) developed and proposed a conceptual

model to study the efficiency and governance of zakat

institutions that are responsible in collecting,

managing, and distributing zakat in Malaysia Using

DEA, the study examined the efficiency of zakat

institutions in Malaysia.

Mohd Noor et al. (2012) also proposed a

comprehensive framework in measuring performance

for zakat institution, taking into account that non-

financial measures are as important as input, process,

output measures and outcome measures. In addition,

Wahab et al., (2016) examined service quality

(SERVQUAL) of zakat institutions in Malaysia using

an enhanced model appropriate for zakat institution.

They used a new and enhanced model (combination

of SERVQUAL and CARTER) to examine the extent

of SERVQUAL of zakat institutions from the

perspective of zakat stakeholders.

Most of the research regarding zakat in Indonesia

focuses on the impact and the role of zakat toward

poverty reduction (Beik, 2009; Nurzaman, Annisa, &

Hendharto, 2017) and zakat management (Adachi,

2017). However, there is little research on the

performance of zakat institutions, some of which

focus on the strategies to strengthen the role of zakat

agency and institutions in Indonesia (Ayuniyyah,

Hafidhuddin, and Hambari 2017) and examine the

effect of types and regulations towards the efficiency

level of zakat institutions in Indonesia (Sanrego and

Rusydiana 2017).

3 RESEARCH METHODOLOGY

3.1 Data Collection

The data used in this study consists of primary data

and secondary data. The primary data is obtained

from interview and questionnaire to the staff of

BAZNAS DIY and Rumah Zakat DIY. The primary

data collection was conducted from BAZNAS DIY

and Rumah Zakat DIY financial report in 2014- 2015.

Meanwhile, the secondary data is obtained from

literature study of BAZNAS DIY and Rumah Zakat

website.

A Framework to Evaluate the Performance of Zakat Institutions - A Case Study on Zakat Institutions in Yogyakarta, Indonesia

27

3.2 Method of Data Analysis

This study uses National Zakat Index (NZI) to

evaluate the performance of zakat institutions. The

estimation technique of calculation in obtaining the

value of NZI is using a method called Multi-Stage

Weighted Index. The method combines several

processes of weighting stages which are given to each

index components so that the weighted score for each

of these components must be performed gradually

and procedural. Table 1 shows the measurement

index of zakat institutions that reflected the

performance of zakat institutions. The variable index

of collection describes year over year growth of the

collection by zakat institutions.

The variable index of management consists of the

availability of SOP Zakat management, strategic

planning, ISO/quality management, and the annual

working program. The variable index of distribution

is divided into four parts, which are ACR (Allocation

to Collection Ratio), SP (Social Program), EP

(Economic Program), and DP (Dakwah Program).

ACR is the ratio between the proportion of zakat

funds that are distributed and the collected zakat fund.

Social Program (Consumptive Program) is designed

to meet the needs of mustahik which are urgent and

short-term as well as a charitable act, including health

care and education. Economic Program (Productive

Program) focuses on empowering mustahik and aims

to equip mustahik with the ability to meet their needs

in the long term. Dakwah Program focuses on

strengthening the spiritual of mustahik, including

advocacy programs within the framework to defend

the interests of mustahik, as well as the overall

community awareness efforts that are shown by

active support on the development of national zakat.

Variable index of reporting describes the availability

of audited financial report and periodic publication.

The indicator of the performance of zakat

institutions includes four variables: collection,

management, distribution, and reporting. The formula

for calculating the indicator index of the performance

of zakat institutions is as follows:

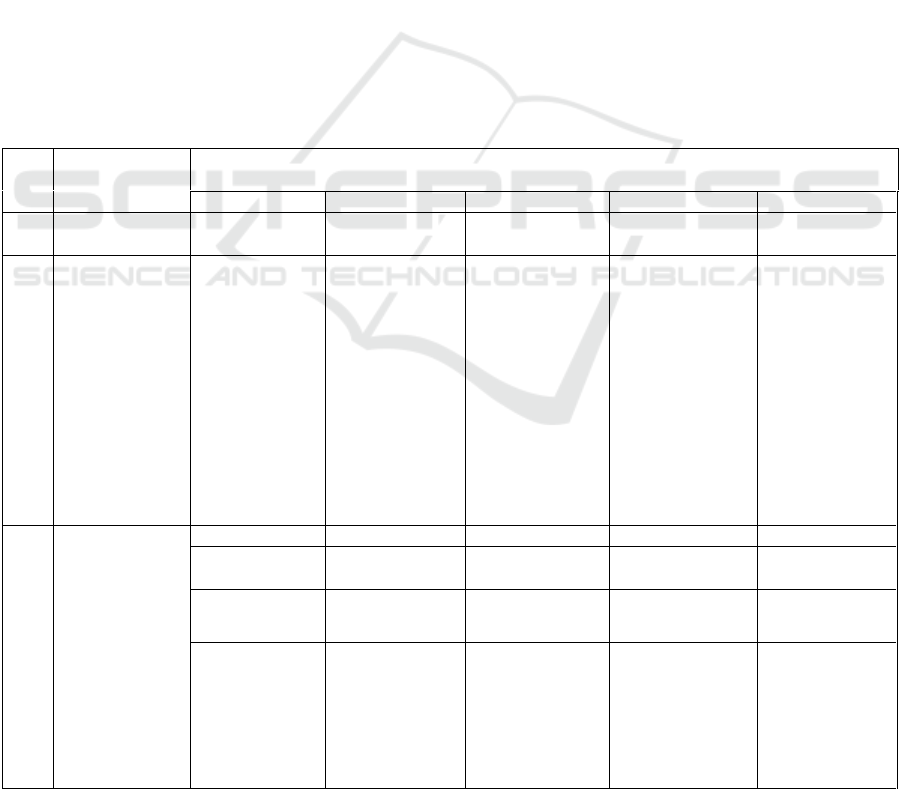

Table 1: Variables used to measure the institutional indicator index.

No

Variable

Criteria

(1= very weak, 2= weak, 3= neutral, 4= strong, 5= very strong)

1

2

3

4

5

1

Collection

Growth (YoY)

<5%

Growth (YoY)

5-9%

Growth (YoY)

10-14%

Growth (YoY)

15-19%

Growth (YoY)

>20%

2

Management

SOP Zakat

management,

strategic

planning,

ISO/quality

management,

and the annual

working

program are

unavailable

Has at least one

document from

these required

documents;

SOP zakat

management,

strategic

planning,

ISO/quality

management,

and the annual

working

program

Has at least two

documents from

these required

documents; SOP

zakat

management,

strategic

planning,

ISO/quality

management,

and the annual

working

program

Has at least three

documents from

these required

documents; SOP

zakat

management,

strategic

planning,

ISO/quality

management,

and the annual

working program

SOP Zakat

management,

strategic

planning,

ISO/quality

management,

and the annual

working

program are

available

3

Distribution

ACR <20%

ACR 20-49%

ACR 50-69%

ACR 70-89%

ACR ≥ 90%

SP > 12

months

SP 9-12

months

SP 6 - <9

months

SP 3 - <9 months

SP <3 months

EP > 15

months

EP 12 - 15

months

EP 9 - <12

months

EP 6 - < 9

months

EP < 6 months

No budget

allocation

for Dakwah

program (DP)

Budget

allocation for

DP at least 0.1 -

< 2.5 % from

total

distribution

Budget

Budget

allocation for

DP at least

2.5 - < 7.5 %

from total

distribution

budget

Budget

allocation for DP

at least

7.5 - < 10 %

from total

distribution

budget

Budget

allocation for

DP at least

>= 10 %

from total

distribution

budget

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

28

Source: Puskas BAZNAS (2016)

X

21

= 0.30X

211

+ 0.20X

212

+ 0.30X

213

+ 0.20X

214

Where,

X

21

: Indicator index of institution

X

211

: Variable index of collection

X

212

: Variable index of management

X

213

: Variable index of distribution

X

214

: Variable index of reporting

The results should be within the range of 0.00–

1.00. In this regard, the lower the index value, the

worse the zakat performance, whereas the larger the

index value, the better the zakat performance. The

following is the range of the index valuations:

0.00–0.20 = Unsatisfactory performance

0.21–0.40 = Less than satisfactory performance

0.41–0.60 = Fair performance

0.61–0.80 = Satisfactory performance

0.81–1.00 = More than satisfactory performance

4 RESULT AND FINDINGS

Zakat institutions not only has a responsibility to

manage zakat funds effectively, but also has a

primary task which all are related to the management

of zakat funds, ranging from counting the number of

properties and the amount of zakat, picking it up,

carrying out to review the poverty minimum levels,

and ensuring mustahik to receive zakat fund. The

National Zakat Index evaluates the performance of

zakat institutions based on four variables, which are

the collection, management, distribution, and

reporting.

The measurement result of BAZNAS DIY

performance from the four measurement variables

can be seen in table 2. Based on table 2, the growth of

zakat collection (YoY) in BAZNAS DIY is more than

20 percent. In 2014, the total zakat collection was

IDR 682,890,318, after which it reached IDR

919,009,901 in 2015 (an increase of 34.5%). As a

result, the index score is 1, which means that the zakat

4

Reporting

Does not have

any financial

report

Has financial

report which is

not audited by

independent

auditor

Has audited

financial report

with qualified

opinion, adverse

opinion, and

disclaimer

Has audited

financial report

with unqualified

opinion and

periodic

publication

Has audited

financial report

with

unqualified

opinion, Sharia

audit and

periodic

publication

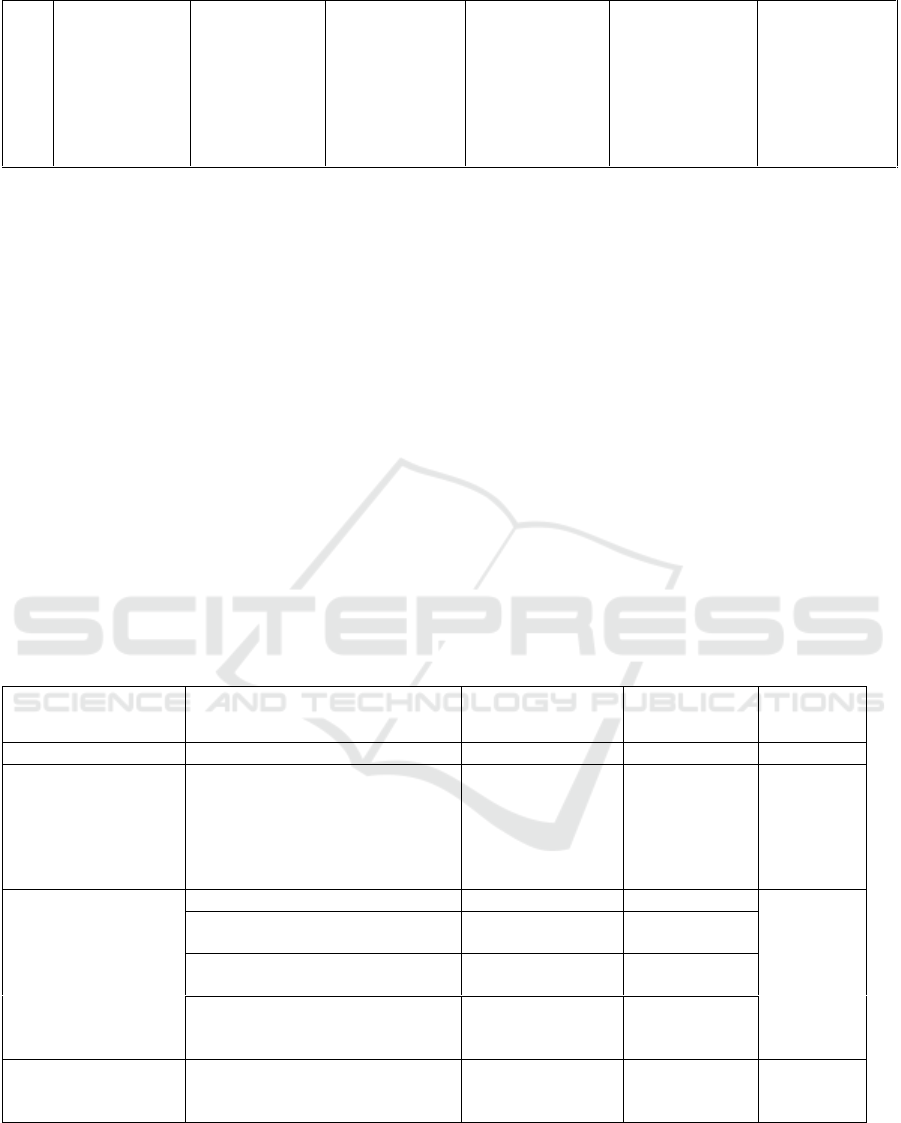

Table 2: Indicator index of institution (BAZNAS DIY).

Variable

Actual Condition

Criteria

Score

Index

Collection

Growth (2014-2015) 34.5%

Very Strong

5

1

Management

Has at least three documents from

these required documents; SOP

zakat management, strategic

planning, ISO/quality

management, and the annual

working program

Strong

4

0.75

Distribution

ACR 78.9%

Strong

4

0.93

The intensity of Social Program is

less than 3 months

Very strong

5

The intensity of Economic Program

less than 6 months

Very Strong

5

Budget allocation for Dakwah

Program is 13.38 % from total

distribution budget

Very Strong

5

Reporting

BAZNAS DIY has financial report

which is not audited by

independent auditor

Weak

2

0.25

A Framework to Evaluate the Performance of Zakat Institutions - A Case Study on Zakat Institutions in Yogyakarta, Indonesia

29

collection in BAZNAS DIY is more than satisfactory.

For the management variable, BAZNAS DIY

receives a index score of 0.75, which shows that the

zakat institution has at least three of the four

substances of SOP zakat management, strategic plan,

and annual program.

Regarding the distribution variable, BAZNAS

DIY receives a score of 0.93. BAZNAS DIY has an

allocation to collection ratio of 78.9 percent. This

index score indicates that the zakat distribution by

BAZNAS DIY is satisfactory.

The reporting variable of BAZNAS DIY receives

a score of 0.25, which means that the reporting of

zakat funding by the BAZNAS DIY is unsatisfactory.

BAZNAS DIY has the financial report but has not had

external audit yet. After obtaining the index score of

each indicator, the index score for the institution

indicator can be calculated as follows:

X

21

= 0.30X

211

+ 0.20X

212

+ 0.30X

213

+ 0.20X

214

X

21

= 0.30(1) + 0.20(0.75) + 0.30(0.93) + 0.20(0.25)

X

21

= 0.77

According to the results above, the index score for

the institutional indicator is 0.77, which means that

the performance of the BAZNAS DIY is satisfactory.

After obtaining the index value of institutional

indicators BAZNAS DIY, then next is to calculate the

index score of institutional indicators of Rumah Zakat

DIY. The index scores for the institution indicator of

Rumah Zakat DIY are presented in Table 3. The

growth of zakat fund (YoY) in Rumah Zakat DIY

decreased by 4.52 percent. In 2014, the total zakat

collection in Rumah Zakat DIY was IDR

1,543,003,000, after which it reached IDR

1,473,321,000 in 2015. Therefore, the index score is

0, which means that the zakat collection in Rumah

Zakat DIY is unsatisfactory. Although the fund

collected by Rumah Zakat DIY decreased in 2014-

2015, the amount of fund collected is greater than the

fund collected by BAZNAS DIY.

For the management variable, Rumah Zakat DIY

receives index an index score of 0.75, which shows

that the zakat performance is satisfactory.

Regarding the distribution variable, Rumah Zakat

DIY receives a score of 1, which means that the ACR

is more than 90 percent, which is 203.19 percent. This

shows that the zakat distribution by Rumah Zakat

DIY is more than satisfactory. In 2015, Rumah Zakat

DIY distributed IDR 2,993,684,000. The distributed

fund is more than twice the amount raised in 2015,

this is because Rumah Zakat is a national institution

which implements a cross-subsidy schemes towards

the branch offices or provincial offices which require

funding from other regions.

The reporting variable, Rumah Zakat DIY

receives a score of 1. As a national institution, the

central of Rumah Zakat performs the auditing of

financial reports per branch office internally. After

that, the financial reports are combined nationally,

then those are audited externally with the supervision

of the Sharia Supervisory Board of Rumah Zakat.

Table 3: Indicator index of institution (Rumah Zakat DIY).

Variable

Actual Condition

Criteria

Score

Index

Collection

Growth (2014-2015) -4.52%

Very weak

1

0

Management

Has at least three documents from

these required documents; SOP

zakat management, strategic

planning, ISO/quality

management, and the annual

working program

Strong

4

0.75

Distribution

ACR 203.19%

Very strong

5

1

The intensity of Social Program is

less than 3 months

Very strong

5

The intensity of Economic Program

less than 6 months

Very strong

5

Budget allocation for Dakwah

Program is blended with all Rumah

Zakat Program

Very Strong

5

Reporting

Has audited financial report with

unqualified opinion, Sharia audit

and periodic Publication (Rumah

Zakat national)

Very strong

5

1

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

30

Rumah Zakat regularly publishes financial reports on

the website of Rumah Zakat. After obtaining the

index score of each indicator, the index score for the

institution indicator of Rumah Zakat DIY can be

calculated as follows:

X

21

= 0.30X

211

+ 0.20X

212

+ 0.30X

213

+ 0.20X

214

X

21

= 0.30(0) + 0.20(0.75) + 0.30(1) + 0.20(1)

X

21

= 0.65

According to the results above, the index score for

the institutional indicators of Rumah Zakat DIY is

0.65, which means that the performance of the Rumah

Zakat is satisfactory. The highest index value is

achieved in the distribution and reporting variables

while the lowest index value is in the collection

variable.

Based on the calculation of institutional indicator

index of BAZNAS DIY and Rumah Zakat DIY, it can

be known that BAZNAS DIY received index score of

0.77 and Rumah Zakat received index score of 0.65.

Therefore, it can be deduced that BAZNAS DIY has

higher index value than Rumah Zakat DIY in 2014-

2015. However, in Indonesia, private zakat sector

proves to be more active and creative in mobilizing

zakat funds (Saidurrahman, 2013).

5 CONSLUSION AND

RECOMMENDATION

According to the result, indicator index of the

performance of BAZNAS DIY and Rumah Zakat

DIY was satisfactory. For collection variable,

BAZNAS DIY received higher index score than

Rumah Zakat DIY. This is because the number of

zakat collection that BAZNAS DIY collected in

2014-2015 has increased. Meanwhile, Zakat fund that

collected by Rumah Zakat DIY in 2014-2015 has

decreased. Despite the decline in the collection

aspect, the amount of fund collected by Rumah Zakat

DIY is greater than the fund collected by BAZNAS

DIY. For management variable, BAZNAS DIY and

Rumah Zakat DIY received the same index score (a

score index of 0.75), which means that both

performances in management aspect was satisfactory.

Moreover, for the distribution variable,

BAZNAS DIY and Rumah Zakat DIY received a

quite high index score. So that, their performance in

distribution aspect was more than satisfactory.

Finally, for the reporting variable, Rumah Zakat DIY

has better performance than BAZNAS DIY. The

reporting variable of BAZNAS DIY received the

lowest score index, which indicated that the reporting

variable was unsatisfactory.

BAZNAS DIY and Rumah Zakat DIY are

expected to have evaluations in improving their

performances. It is necessary for BAZNAS DIY as an

institution managed by the state to improve the

reporting aspect in order to increase public trust. In

the future, it is expected that BAZNAS DIY can have

audited financial reports with unqualified opinion and

sharia audit reports which are published periodically.

Meanwhile, Rumah Zakat DIY is expected to

improve its performance on the collection aspect, so

that there will be an increase in the collection zakat

funds. The findings in this study are expected to

contribute to the existing knowledge on the

performance of zakat institutions in Indonesia.

REFERENCES

Adachi, M. 2017. The Evolution of the Top-down Zakat

Management System and Its Importance for

Contemporary Indonesia, pp. 21–34.

Ayuniyyah, Q., Hafidhuddin, D. and Hambari. 2017. The

Strategies in Strengthening the Role of Zakat Boards

and Institutions in Indonesia, WZF Conference 2017

Proceedings, pp. 51–64.

Beik, Irfan Syauqi. 2009. Analisis Peran Zakat Dalam

Mengurangi Kemiskinan: Studi Kasus Dompet Dhuafa

Republika, Zakat & Empowering - Jurnal Pemikiran

dan Gagasan, 2, pp. 45–53.

Beik, Irfan Syauqi and Arsyianti, Laily Dwi. 2016.

Measuring Zakat Impact on Poverty and Welfare Using

CIBEST Model, Journal of Islamic Monetary

Economics and Finance, 1(2), pp. 141–160.

Mohd Noor, A. H. et al. 2012. Assessing performance of

nonprofit organization: A framework for zakat

institutions’, British Journal of Economics, Finance

and Management Sciences, 5(1), pp. 12–22.

Nurul Huda, e. a., 2015. Zakat Perspektif Mikro-Makro:

Pendekatan Riset. Jakarta: Prenadamedia Group.

Nurzaman, Mohamad Soleh. 2010. Zakat and Human

Development: An Empirical Analysis on Poverty

Alleviation in Jakarta, Indonesia 1, 8th International

Conference on Islamic Economics and Fnance, pp. 1–

26.

Nurzaman, M. S., Annisa, N. and Hendharto, R. G. 2017

‘Evaluation of the Productive Zakat Program of

BAZNAS: A Case Study from Western Indonesia’,

2(1), pp. 81–93.

Saidurrahman. 2013. Zakat Management in Indonesia'.

Journal of Indonesian Islam, 7(2), pp. 366-382.

Sanrego, Y. D. and Rusydiana, A. S. 2017. The Effect of

Types and Regulations on the Level of Zakat

Management Organization (OPZ) Efficiency in

Indonesia, WZF Conference 2017 Proceedings, pp. 65–

79.

Puskas BAZNAS, 2016. National Zakat Index. [Online]

Available at: http://www.puskasbaznas.com/national-

zakat-index/nzi/download/72-nzi-2.

A Framework to Evaluate the Performance of Zakat Institutions - A Case Study on Zakat Institutions in Yogyakarta, Indonesia

31

Wahab, N. A. and Rahim Abdul Rahman, A. 2011. A

framework to analyse the efficiency and governance of

zakat institutions’, Journal of Islamic Accounting and

Business Research, 2(1), pp. 43–62.

Wahab, N., Zainol, Z. and Bakar, M. 2016. Developing

Service Quality Index for Zakat Institutions, of

Economics and …, 6(2012), pp. 249–258.

ICIEBP 2017 - 1st International Conference on Islamic Economics, Business and Philanthropy

32