Unit Cost Calculation as a Role of Cost Containment at Central

Surgery Installation of Hospital X

Setya Haksama

Faculty of Public Health, Universitas Airlangga, Mulyorejo, Surabaya, Indonesia

setyahaksama@fkm.unair.ac.id

Keywords: Central surgery installation, Unit cost, Activity-based costing.

Abstract: In regards to good health development services in terms of budgeting and financing, not all hospitals, such

as hospital X, have data on the production cost of services as the basis for determining the tariffs, because

this has not been calculated based on unit cost. The unit cost calculation of services in Central Surgery

Installation (CSI) Hospital X is the main purpose in this research, which used a cross-sectional with

descriptive observational approach and analysed using Activity-Based Costing (ABC) method. The results

showed that the unit cost calculation was divided based on eight qualifications of operation in minimum and

maximum unit cost intervals, as follows: (1) Minor: IDR 1.320.206 - IDR 2.805.815, (2) Moderate: IDR

2.057.070 - IDR 2.733.284, (3) Major: IDR 2.408.011 - IDR 3.995.652, (4) First Major: IDR 2,228,755 -

IDR 4,759,747, (5) Second Major: IDR 1.727.593 - IDR 5,523,273, (6) Third Major: IDR 3,049,093 - IDR

7,099,322, (7) Fourth Major: IDR 6,176,461 - IDR 7,512,786, (8) Fifth Major: IDR 1,711,223 - IDR

9,439,909. The existence of the unit cost calculations assists management to make accurate decisions on

budgeting and cost planning; hopefully, it can be developed in an integrated system for recording and

reporting.

1 INTRODUCTION

In the course of the development of health services,

the aspects of budgeting and financing of health are

essential, because it focuses the hospital’s attention

and how the budget can be used for investment,

operational purposes, improving the competence of

human resources and improving the welfare of its

employees. It should be considered in the

implementation of Security Agency of Health

(BPJS-Kesehatan) which has implemented tariffs in

accordance with the existing policy, namely

Permenkes Number 69 Year 2013 about Standard

Rates on Primary Health Care and Advanced Health

Facilities level in the Implementation of Health

Insurance Programs, where the determination of the

tariffs’ policy caused problems in its implementation

at this time

7

. In health care systems, hospitals

provide primary care, serve as referral institutes for

higher-level care, and train health care workers.

Those benefits are costly

(Baker, 1998).

General hospitals as health care organizations

should adjust the tariffs immediately into a variety

of management functions such as regulation,

planning, guidance, and supervision. In addition, it

should be realized that the hospital has many unit

production and supporting costs, whereby each unit

has to generate revenue and there is not a must have

list in terms of cost. Such diversity is sometimes

likely to cause a lack of accuracy of the actual costs

owned by the hospital. The unit cost as the basis for

calculating the budget does not necessarily reflect

the actual costs at the hospital. Therefore, a tally of

unit cost, actual cost and expense management

should be made in a normative order with respect to

the tariff policy of being rational and accountable

(Roztocki et al, 2004). A company which has

valuable information in comprehending and

identifying customers who are more profitable or not

will help advance the overall organizational

profitability

(Baker, 1998). Customer cost

information is considered very helpful in

maintaining the level of profits and retain customer

relationship.

In general, there has not been accurate data of the

hospital facilities and production costs of health and

medical services for use as a basis of determining

the tariff. This condition is not recommended

because the basis of current rates has not been

calculated as unit cost; basically, the hospital has

252

Haksama, S.

Unit Cost Calculation as a Role of Cost Containment at Central Surgery Installation of Hospital X.

In Proceedings of the 4th Annual Meeting of the Indonesian Health Economics Association (INAHEA 2017), pages 252-256

ISBN: 978-989-758-335-3

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

calculated the unit cost, but is still not rational. The

rationality level of the tariffs has many viewpoints,

such as the current rate being too expensive or too

low. Both conditions lead to different consequences.

If the current rate is too expensive, what the

consumer pays is not comparable with the output

obtained. Similarly, the lower rate could lead to the

hospital as a healthcare provider not reaching the

break-even point or even having a deficit

(Mulyadi,

2015). This situation should sensitize health care

providers to adopt a rational rate, in accordance with

the service received by consumers.

2 METHODS

This study was an observational study descriptive

and there was no treatment on the sample.

Observational study emphasizes on activities in the

field as a data source and a research approach in

data collection in the form of primary and

secondary data, such as financial reporting

documents, the traffic data, annual reports, internal

data and other data. Based on the time of the study,

the study design was cross-sectional because pf the

timing of data collection and information research

conducted at one particular time and then an

analysis of data using Activity-Based Costing.

The data analysis technique used was Activity-

Based Costing, which is a method for calculating the

cost of production used to provide cost information

for managers as a basis for making strategic

decisions and other actions that affect the capacity

and fixed costs

(Blocer et al, 2000). The stages of

accounting by Activity-Based Costing are as follows:

(1) identification of activities; (2) organize activities

into cost centers; (3) identification element of main

cost; (4) analysis of relationship between cost

activities; and (5) identify cost drivers

3 RESULT

The effective working time in one year was

calculated based on 2013, which determined the

total of the number of effective days of each month.

Effective days are work days which were already

reduced by holidays and national holidays. Number

of days effective in one year were then converted

into units of minutes. The result of the calculation of

time effective for one year, based on research,

showed working hours per day for eight hours with a

total time of 1,960 hours or 117,600 minutes.

Throughout 2013, there were 6,809 medical actions

undertaken operative in Central Surgery Installation,

which was divided into 12 rooms of CSI, so that at

each CSI room could serve 2-3 patients per day.

From the results of field observations, relevant data

area of Central Surgery Installation of 518m

2

were

obtained. Magnitude of spacious CSI rooms can be

divided into 12 rooms, each of 42 m

2

, except room

10. Direct costs related to the place of the medical

action operative are the fees charged to patients

when performing medical procedure operatives as

cost replacement incurred by the hospital for

procurement and the maintenance of buildings

(Fauziah et al, 2014). The building is assumed to

have a lifetime of 20 years, so the function of

building was considered normally in 20 years of life.

After knowing the entire procurement cost of space

in CSI, the cost center of the main Central Surgery

Installation (CSI) building will be delivered. Based

on calculating the cost center of the Central Surgery

Installation (CSI), obtained from Annual Investment

Cost, and the the calculation of depreciation costs of

buildings, we get the total cost center for Central

Surgery Installation (CSI) of IDR 389,042,092.88.

The costs of procurement for each operating room

obtained from the calculation of the cost center of

Central Surgery Installation (CSI) were divided by

the effective working hours per operating room in

minutes to obtain the cost per-minute on each

operating room, which were then multiplied by the

duration of action per operative medical treatment.

The following is the calculation of the cost for

medical treatment operative place.

Note:

Effective : 245 days

Working Hours effective : 245 days x 8 hours x 60

minutes = 117 600 min

Cost center of the building : IDR 389,042,092.88

Then the cost of space per :IDR 389,042,092.88

/117 600

: IDR 3308.18

Furthermore, the cost will be multiplied by the

length of each operative medical treatment in CSI.

Human Resources (HR) is composed of medical

personnel, both specialist doctors, general

practitioners, nurses and other medical personnel,

who perform operative medical procedures and non-

medical personnel involved indirectly in Central

Surgery Installation. Cost of Medical Consumables

per operative action of the medical pharmacy depot

parts were obtained from CSI. Consumable Cost

fees in the pharmaceutical depot in CSI were

different from the central pharmacy depot. In the

central pharmacy depot, using a software that shows

Unit Cost Calculation as a Role of Cost Containment at Central Surgery Installation of Hospital X

253

pharmaceutical expenditure costs, as in the table

below.

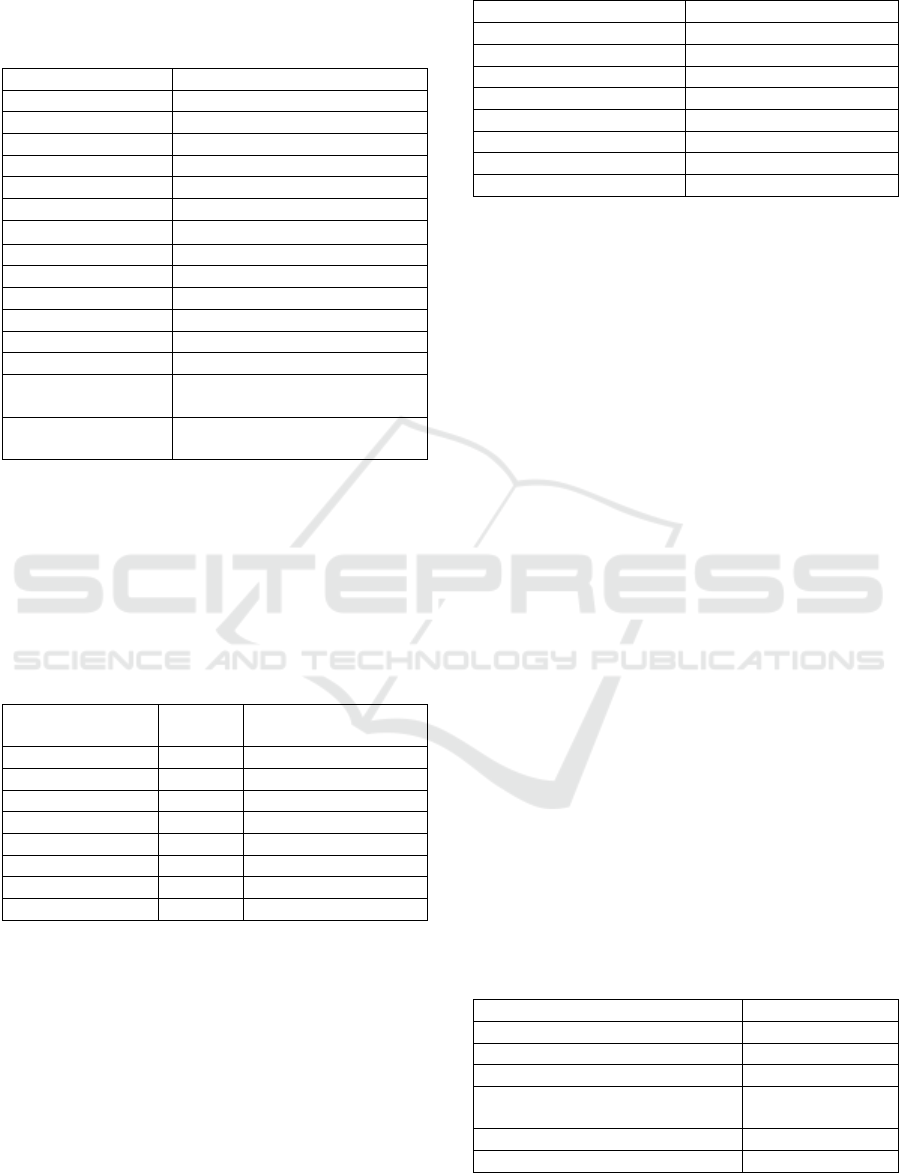

Table 1: Total Cost of Consumables

Month

Fees Consumable Cost (IDR)

January

449,181,603.00

February

449,181,603.00

March

449,181,603.00

April

449,181,603.00

May

449,181,603.00

June

449,181,603.00

July

449,181,603.00

Month

Fees Consumable Cost (IDR)

August

449,181,603.00

September

449,181,603.00

October

449,181,603.00

November

449,181,603.00

December

449,181,603.00

Total 1 year

Consumable Cost

5,390,179,236.00

Consumable Cost

Cost per action

791,625.6772

Source: Hospital pharmacy depot X

Furthermore, to obtain the value of consumable cost

per category action then a score was made according

to the category of the type of medical treatment

operative. Here the results of calculation of the

consumable cost were based on medical surgery

category.

Table 2: Cost of Consumable Per Qualifying Operation

Qualification

Operation

Score

Total Cost

Consumable Cost

Minor

1

791.626

Moderate

2

1,583,251

Major

3

2,374,877

Major 1

4

3,166,503

Major 2

5

3,958,128

Major 3

6

4,749,754

Major 4

7

5,541,380

Major 5

8

6,333,005

Waste of CSI can be divided into medical

waste and non-medical. The calculation of the unit

cost of processing medical waste obtained a sewage

treatment fee per kg of IDR 10111.09. Based on

interviews and dealing with operating personnel in

the CSI, the weight of solid waste for each action is

not always the same, but can be searched by

averaging suitably qualified operations, described as

follows.

\

Table 3: Unit Cost Medical Waste

Qualifying Operating

Weight Solid Waste (g)

Minor

400

Moderate

500

Major

600

Major 1

1700

Major 2

2700

Major 3

3700

Major 4

4700

Major 5

5800

Activities of non-medical services in the

installation of the Central Surgery entail

management and administration activities performed

at the Central Surgery. The room used to perform

non-medical services has area of 1480m

2.

with cost

per m

2

of IDR 1,401,583.73 and then multiplied by

the area. So, from the calculation of the above

Annual Investment Cost, cost directly related to for

the site of management activities is IDR 50,373 per

action. Based on the calculation of infrastructure

maintenance costs, maintenance costs can be

calculated by load per-action with the total action in

2013 as many as 6,809 by dividing the total cost of

maintenance with the actions in 2013, so that it

shows the burden of indirect costs for treatment as

IDR 50,455.66. Furthermore, other costs include the

operating costs consist of expenditure on electricity,

water and telephone/ fax. In 2013 there already

exists a recap of telephone charges, water and

electricity by the hospital. By knowing the total area

of the hospital as 82,381.01 m

2

and total action as

many as 6,809, these are used to determine the costs

of electricity, water and telephone per action and can

be explained as follows. From the calculation of

operating costs, total other costs per action is IDR

14,584.99, while the results of calculating costs for

non-medical consumables are IDR 6,809.00 for one

year, and total expenses per action is IDR 4,303.81.

Below is a table of indirect costs in the Central

Surgery installation and direct costs of each

operative medical treatment activity.

Table 4: Indirect Costs

Components Indirect Costs

Total Costs

Place

50,373

HR Non-Medical

161,797

Maintenance

50,456

Operations (electricity, water,

telephone)

14,585

Consumable Cost

4,304

Total

281,514

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

254

4 DISCUSSION

Based on this study it can be seen that the results

calculation of Unit Cost in the Central Surgery

Installation is divided based on operation

qualification. Cost drivers used are old minimum

and maximum actions that ultimately produce

intervals of unit cost minimal and unit cost

maximum. The following summary table calculates

minimal and maximal unit cost.

Table 5: Unit Cost Result

Operations

Qualification

Unit Cost

Minimum (IDR)

Cost Unit

Maximum (IDR)

Minor

1,320,206

2,805,815

Moderate

2,057,070

2,733,284

Major

2,408,011

3,995,652

Major 1

2,228,755

4,759,747

Major 2

1,727. 593

5,523,273

Major3

3,049,093

7,099,322

Major 4

6,176,461

7,512,786

Major 5

1,711,223

9,439,909

Based on the table, the calculation of unit cost

uses Activity-Based Costing, generating minimal

and maximum unit cost divided by operation

qualification. The idea concepts of Activity-Based

costing is a cost accounting system that focuses on

activities performed to produce a product / service.

Activity is any activity which is the trigger of the

cost (cost driver) and acts as a causal factor in

spending in a production process. Activity-Based

Costing is able to present more accurate product cost

and information, and is a direct measurement of the

profitability of products that more accurately reflects

strategic decisions on the selling price, market

product lines and expenditure models. It also

obtained a more accurate measurement of the costs

triggered by activity, thus helping management

improve the product value and the value of the

process, thereby helping the information on costs for

decision making (Carter et al, 2012). The weakness

of Activity-Based Costing is that some costs were

allocated at random due to limitations in finding the

cost of the activity. It also ignores the cost of

analysis and requires extensive time and cost. The

Activity-Based Costing method can help to reduce

unnecessary cost effectively and reduce costs that do

not have added value and can even remove the cost

of unnecessary activity through activity analysis.

Analysis of activity should result in: (1) what

activities are carried out; (2) how many people are

doing the activity; (3) the time and resources

required to perform the activity; and (4) the

calculation of the value of the activity

5 CONCLUSION

Based on this study, it could be concluded that the

calculation of unit cost can be used in controlling

costs in health services provided by health agencies.

The results showed that the unit cost calculation in

CSI Hospital X was divided into eight qualifications

based of operation, which resulted in minimum and

maximum unit cost intervals as follows: (1) Minor:

IDR 1,320,206 and IDR 2,805,815; (2) Moderate:

IDR 2.05707 million and IDR 2,733,284; (3) Major:

IDR 2,408,011 and IDR 3,995,652; (4) 1

st

Major:

IDR 2,228,755 and IDR 4,759,747;(5) 2

nd

Major:

IDR 1,727,593 and IDR 5,523,273; (6)

3

rd

Major:IDR 3,049,093 and IDR 7,099,322; (7)

4

th

Major: IDR 6,176,461 and IDR 7,512,786; (8) 5

th

Major: IDR 1,711,223 and IDR 9,439,909.

Calculation of unit cost is analyzed using many

approaches and methods, one of which is Activity-

Based Costing.

Therefore, the recommendations can be given as

follows. (1) There should be improvement in the

inventory records of medical devices and non-

medical, either in the form of soft files or hardfiles;

(2) improvement in the recording and reporting of

activities of medical in Central Surgery Installation

by developing an integrated system for recording

and reporting; (3) provision of services of medical

personnel according to their competencies, thus

incorporating elements of clinical pathways

becoming absolute in recording employee data; (4)

registration of consumables per action should be

through clear mechanisms ranging from pharmacy

depot or warehouse pharmacy to the pharmacy that

provides services; therefore it is necessary for the

manufacture and development of integrated

information systems; (5) the development and

strengthening of the integrated management

information system in any installation; and (6)

provide training to Human Resources to run the new

information technologies

REFERENCES

Baker, J.J. (1998). Activity Based Costing and Activity

Based Management for Healthcare. Aspen Publisher

Inc.

Blocer, Edwar J, Chen, Kung H, dan Lin, Thomas W.

(2000). Manajemen Biaya. Jilid I. Jakarta: Salemba

Empat

Carter, William K, Milton F. Usry. (2012). Cost

Accounting. 14

th

Edition. Translate by Krista. Jakarta:

Salemba Empat.

Fauziah, Ida, Dzulkirom A. R., Achmad, Husaeni. (2014).

Analisis Activity Based Costing (ABC) System

Unit Cost Calculation as a Role of Cost Containment at Central Surgery Installation of Hospital X

255

Sebagai Dasar Penetapan Harga Pokok Produksi.

Jurnal Administrasi Bisnis (JAB). 12 (02).

Mowen, MM & Hansen, D.R. (2006). Akuntansi

Manajemen. 7

th

Edition. Jakarta: P.T Salemba Empat.

Mulyadi. (2015). Activity Based Cost System, Sistem

Informasi Biaya untuk Pemberdayaan Karyawan,

Pengurangan Biaya, dan Penentuan Secara Akurat

Kos Produk dan Jasa. Yogjakarta: UPP STIM YKPN

Peraturan Menteri Kesehatan No 69 Tahun 2013 Tentang

Standar Tarif Pelayanan Kesehatan Pada Fasilitas

Kesehatan Tingkat Pertama dan Fasilitas Kesehatan

Tingkat lanjutan dalam Penyelenggaraan Program

Jaminan Kesehatan.

Roztocki, N. Porter, J. D, Thomas, RM Needy, K. L,

(2004). A Procedure for Smooth Implementation of

Activity Based Costing in Small Companies.

Engineering Management Journal. American Society

or Engineering Management. 16 (4).

Tandiontong, Mathius. (2012). Peranan Activity Based

Costing System dalam Perhitungan Harga Pokok

Terhadap Peningkatan Profitabilitas Perusahaan.

Akurat Jurnal Imiah Akuntansi. No. 05.

Trisnantoro, L. (2014). Memahami Penggunaan Ilmu

Ekonomi dalam Manajemen Rumah Sakit.

Yogjakarta: Gajah Mada University Press.

Yereli, Ayse Necef. (2016). Activity Based Costing and

Its Application in a Turkish University Hospital.

AORN Journal. 89 (3).

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

256