Impact of Tobacco Control on Tobacco Farmers and State Revenue

in Indonesia

Nabila Wahyu Syakura

Public Health Faculty, Universitas Airlangga, Mulyorejo, Surabaya, Indonesia

nabila.wahyu.syakura-2014@fkm.unair.ac.id

Keywords: Control, Country Income, Impact of Tobacco Control, Tobacco, Tobacco Farmers.

Abstract: According to the estate office (2002:1), it states that the notion of tobacco is as follows; the "tobacco plant

known by the Latin name is nicotiana tabacum. It is one of the plantations that have important role for the

national economy that is contributing to the state revenue through cigarette and foreign tax, and as one of

the economic sources in the village in the form of smallholder plantation business". This study aims to add

new insights related to the impact of tobacco control on tobacco farmers and the state revenue in Indonesia.

The method used in the study was the qualitative methodology. The results obtained are from the

employment aspect. The excise policy affects the sustainability of formal sector employment, consisting of

401,989 people, of which three quarters or 291,824 people are involved in the production of hand-rolled

cigarettes which is a labour-intensive industry. When added to the informal sector, this policy impacts the

lives of 2.3 million tobacco farmers, 1.5 million clove farmers, 600 thousand tobacco workers, and 1 million

retailers. Based on this data, it can be concluded that the excise policy has an impact on the lives of more

than 5.8 million people in Indonesia.

1 INTRODUCTION

The tobacco plant, which has the Latin name

Nicotiana tabacum, has an important role in the

economy and state development through tobacco

taxes, and has become a common source of

employment for society. Tobaco products are the

result of processed tobacco leaves. They can be

consumed by burning, sucking, and chewing. One of

the most common products from tobacco are

cigarettes.

Plants of Nicotania tabacum produce various

nicotania by smoke which contains tar and nicotine.

According to PPRI number 109 of 2012, "tar is a

smoke condensate which is a total residue that

produced when cigarettes are burned after nicotine

and water are reduced, which is carcinogenic."

Whereas, "nicotine is a substance, or pyrrolidine

compound contained in nicotiana tabacum,

nicotiana rustica, and other species or its addictive

synthetic. It makes people who consume it become

dependent,”

(Indonesia Government, 2012).

Over time, the consumption of cigarettes among

children to adults has been increasing. Women are

also no longer rare to find smoking. The habit or

addiction to smoking cigarretes is an effect of the

environment and associations with addicted

adolescents and adults.

The increase that occurs due to cigarette

consumption can impact on productivity at an early

age, and death

(Data and Information Centre

Ministry of Health RI, 2017). There is a burden on

the economic, social, health, and environmental

costs of society. If an active smoker smokes, then a

lot of smoke is inhaled by passive smokers. It causes

various diseases, especially for children and infants.

Therefore, the control of tobacco has been done by

raising cigarette taxes.

2 METHODS

The research used a qualitative approach by

collecting secondary data, which is data that already

exists. The purpose of this study is to gain insights

into the impact of tobacco control on tobacco

farmers and the country’s income in Indonesia

156

Syakura, N.

Impact of Tobacco Control on Tobacco Farmers and State Revenue in Indonesia.

In Proceedings of the 4th Annual Meeting of the Indonesian Health Economics Association (INAHEA 2017), pages 156-160

ISBN: 978-989-758-335-3

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

3 RESULT AND DISCUSSIONS

3.1 Cigarette Consumption in Indonesia

The smoking prevalence in Indonesia is very high. It

ranges from children to adults without filtering by

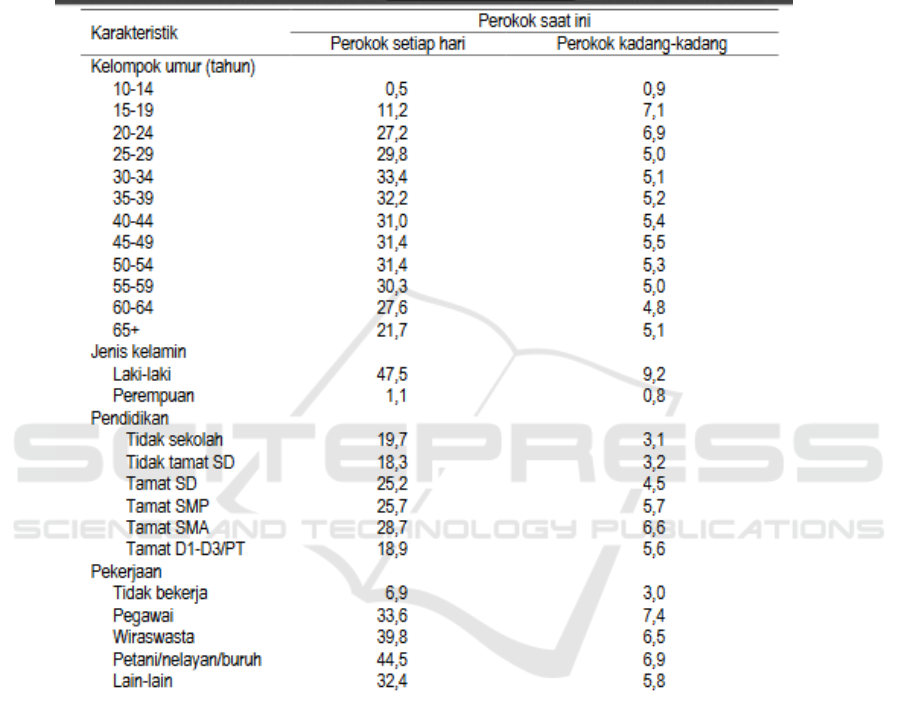

way of sex (male or female) and occupation. Figure

1 shows the proportion of the population aged ≥10

years according to smoking habit and characteristics.

Source: Riskesdas 2013

Figure 1: Proportion of Population Aged ≥10 Years According to Smoking Habit and Characteristic of Indonesia 2013.

3.2 Agency for Health Research and

Development

From the data, it can be concluded from the

population data aged ≥10 years that everyday-active-

smokers are primarily aged 30-34 years old (33.4%)

and 35-39 years old (32.2%). The proportion of male

smokers is more than female smokers (47.5%). The

highest education level of cigarette consumers is that

of a high-school graduate at 28.7%. For occupation,

44.5% are farmers, fishermen and labourers

compared to other work groups. From the age of ≥15

years, there is some data that serves as evidence of

inhaled and chewed tobacco consumption.

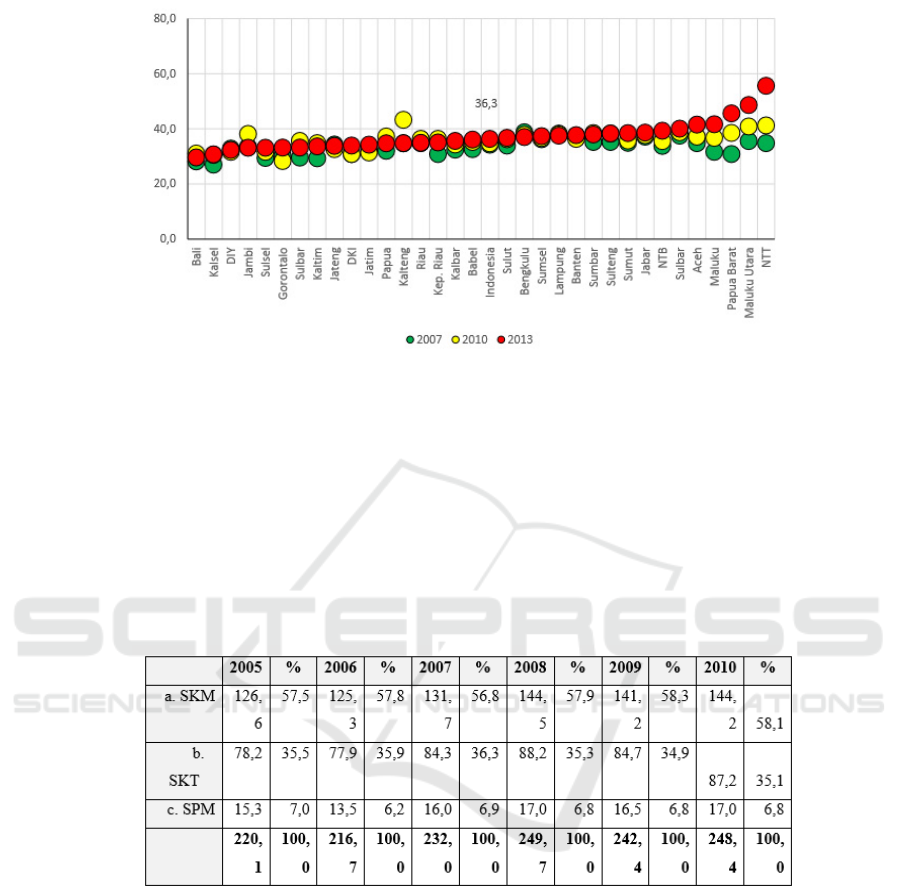

According to Riskesdas in 2007, 2010, and 2013, the

consumer tends to increase their consumption as

they age. The results of 2007 amount to 34.2%, in

2010 of 34.7%, and in 2013 to 36.3%. The highest

proportion in 2013 was in East Nusa Tenggara

(55.6%).

Impact of Tobacco Control on Tobacco Farmers and State Revenue in Indonesia

157

Source: Riskesdas 2013, Agency for Health Research and Development

Figure 2: The Combined Data of Smokers of Suction and Chewing of Tobacco in the Age Group ≥15 Years

3.3 Cigarette Production

There are three types of cigarette production in

Indonesia; SKM (Clove Cigarettes Machine), SKT

(Hand Clove Cigarettes), and SPM (Cigarette White

Machine). From 2005 to 2010, the average result of

SKM was 58%, SKT was 35%, and SPM was 7%

every year.

Source: Ministry of Finance. Financial Note and RAPBN 2011

Figure 3: Production of Cigarettes by Type of Cigarettes, 2005-2010 (Billion Stems/ Year)

The consumption of cigarettes in Indonesia

reached 36.6% of the population because the number

of people who consume cigarettes will affect

cigarette production by way of supply and demand.

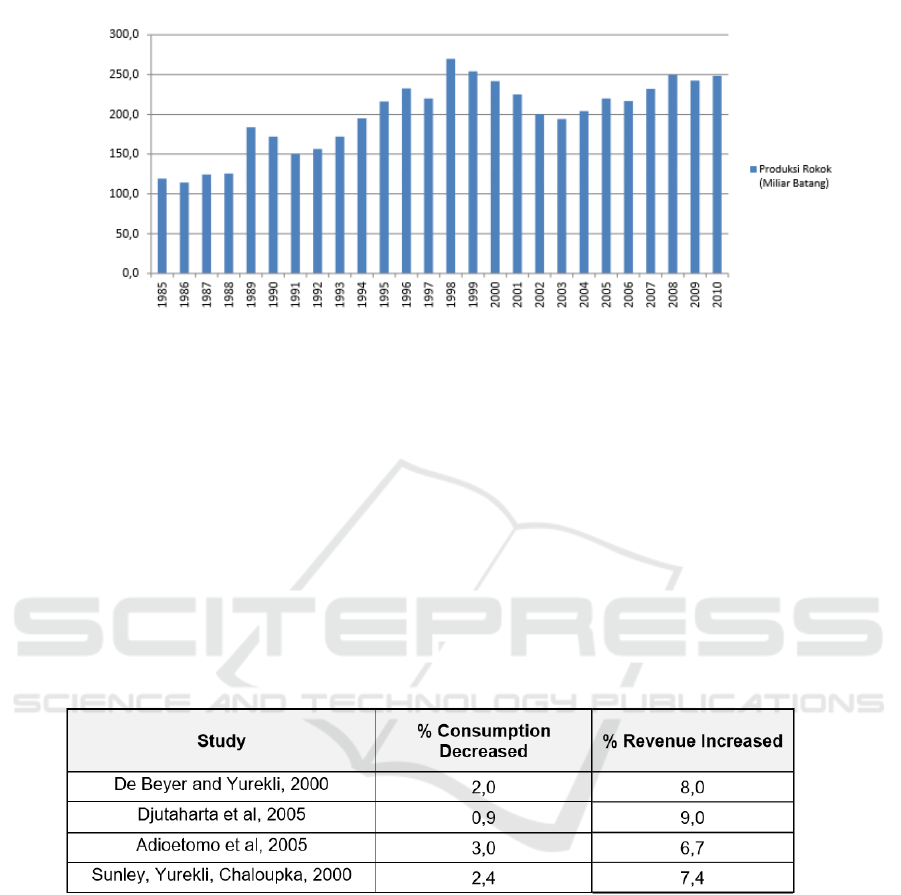

Cigarette production increased from 1985 to 2010,

which resulted in 269 billion cigarettes.

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

158

Figure 4: Trend of Cigarette Production Year 1985-2010 in Indonesia

3.4 Cigarette Control

The Law of the Republic of Indonesia number 39

2007 concerns the Amendment to Law Number 11,

1995. This relates to customs, which is the

characteristic of goods subject to customs charges.

Their consumption needs to be controlled. Its

circulation needs to be supervised; it may have a

negative impact on society or the environment, or its

use requires the imposition of state levies for the

sake of justice and equilibrium. Cigarette

consumption can be reduced if the control of

cigarettes raises the customs tax. Consuming

cigarettes continously will have an impact on others,

as well as the individual. It will lead to a lack of

productivity, as many people will be less healthy,

increasing the number of deaths. It could affect

Indonesia’s overall state income.

In Figure 5, it can be seen that cigarette

consumption decreased by 1-3% and increased the

state income earned from cigarette taxes by 7-9%.

Cigarette consumption leads to an increase in state

income. The control of cigarettes, by raising the duty

of 10%, will affect the state income.

Source: World Health Organization

Figure 5: Impact of 10% Excise Tariff Increase on Consumption and Revenue

Cigarettes are harmful to the health of the

individual. The efforts to raise the taxes by 2016

requires careful consideration, such as labour, illegal

cigarette distribution, tobacco farmers, and state

income. Therefore, according to him, all aspects

need to be considered when making a policy that

relates to the price and customs to do with cigarettes.

From the employment aspect, the customs policy

also affects the sustainability of the formal sector

employment of 401,989 people. Three quarters of

people, or 291,824, are involved in the production of

handmade cigarettes which are labour-intensive

industries. When added to the informal sector, this

policy impacts 2.3 million tobacco farmers, 1.5

million clove farmers, 600 thousand tobacco

workers, and 1 million retailers’ lives. Based on the

available data, it can be concluded that the customs

policy has a significant impact on 5.8 million

Indonesians’ lives. This data is also supported by the

LPEM UI study in 2013, which found that the

customs policy affects more than 6 million people

directly.

For 2017, the government issued a new customs

policy by way of regulation by the Minister of

Impact of Tobacco Control on Tobacco Farmers and State Revenue in Indonesia

159

Finance number 147 / PMK.010 / 2016. In this new

policy, the increased fare is 13.46% for White

Cigarette Machine Tobacco (SPM) tobacco

products, and the lowest is 0% for Cigarette Tobacco

(Tobacco) with an average increased weight of

10.54%. In addition to the increased fare, the retail

price (HJE) has also increased to an average of

12.26%. The main problem that must be considered

to do with the increases is the control of production,

labour, illegal cigarettes and tax receipts which the

policy have been discussed from various

stakeholders (Directorate General of Customs and

Excise of the Ministry of Finance. 2016).

4 CONCLUSIONS

Cigarette control is done by raising the tax, so that

people in Indonesia can limit their consumption of

cigarettes. It is better to reach 1-3% because there

are a lot of disadvantages in the economic, social,

environmental aspects otherwise. The formal sector

of employment consists of 401,989 people, which is

three quarters of society or 291,824 people, who are

involved in the production of hand-rolled cigarettes,

which is a labour-intensive industry. When added to

the informal sector, the policy impacts 2.3 million

tobacco farmers, 1.5 million clove farmers, 600

thousand tobacco workers, and 1 million retailers’

lives. Based on the data, it can be concluded that the

customs policy has a significant impact on more

than 5.8 million Indonesians’ life.

REFERENCES

Ahsan, Abdillah, Nur Hadi Wiyono, and Flora Aninditya.

(2012). Cigarette Consumption Expense, Excise Policy

and Poverty Alleviation. Available from URL:

https://www.researchgate.net/publication/301197583_

Beban_Konsumsi_Rokok_Kebijakan_Cukai_dan_Pen

gentasan_Kemiskinan [Accessed September 2017]

Directorate General of Customs and Excise of the Ministry

of Finance. (2016). Through Excise Policy 2017, the

Government Increases Care for Health, Employment,

and National Development. Available from URL:

http://webcache.googleusercontent.com/search?q=cac

he:p4xJUA4-

NRAJ:www.beacukai.go.id/berita/melalui-kebijakan-

cukai-2017-pemerintah-tingkatkan-kepedulian-akan-

kesehatan-kesempatan-kerja-dan-pembangunan-

nasional.html+&cd=1&hl=id&ct=clnk&gl=id

[Accessed September 2017]

Data and Information Center Ministry of Health RI.

Smoking Behavior of Indonesian Society. Available

from

URL:http://www.depkes.go.id/resources/download/pu

sdatin/infodatin/infodatin-hari-tanpa-tembakau-

sedunia.pdf [Accessed August 2017]Unknown.

Understanding of Tobacco Plants. Available from

URL: http://a-

research.upi.edu/operator/upload/s_geo_0607448_cha

pter2(1).pdf [Accessed August 2017]

Indonesia Government, 2012. Government Regulation of

the Republic of Indonesia Number 109 year 2012

About Security Ingredients Containing Addictive

Substance for Tobacco Products for Health

Law of the Republic of Indonesia Number 39 Year 2007

Concerning Amendment to Law Number 11 Year

1995 About Excise

Novianti, Diana, dan Rizal Effendi. Analysis of Production

Level and Excise Levy of Alcoholic Beverages at

Dragonfly Plant Palembang. Available from

URL:http://eprints.mdp.ac.id/693/1/JURNAL%20200

9210018%20DOANNA_NOVIANTI.pdf accessed

September 2016

Regulation of the Minister of Health of the Republic of

Indonesia Number 28 Year 2013 About Inclusion of

Health Warning and Health Information on Tobacco

Products Packaging

Research and Health Development RI. (2013). Basic

Health Research. Available from

URL:http://www.depkes.go.id/resources/download/ge

neral/Hasil%20Riskesdas%202013.pdf [Accessed

September 2017]

Wibisana, Widyastuti, dkk. (2008). Global Strategy for

Tobacco Control. Available from

URL:https://media.neliti.com/media/publications/6583

6-ID-strategi-global-pengendalian-tembakau.pdf

[Accessed August 2017]

INAHEA 2017 - 4th Annual Meeting of the Indonesian Health Economics Association

160