Factors That Leads to Financial Management and Their Implications

to Local Government Performance: What Should Be Done?

Sumbawati Sumbawati

,

Lalu Hamdani Husnan

and Busaini Busaini

Mataram University (Universitas Mataram), Mataram, West Nusa Tenggara, Indonesia

Keywords: Control, Accessibility, Transparency, Accountability, Performance.

Abstract: The aims of this paper is to examine the factors that leads to transparency and accountability financial

management and their implication to local government performance. Type of this paper was causative

research. The population in this study are internal and external stakeholders, with purposive sampling

technique, and involving 50 respondents. The result of this test using Smart PLS 3.0 shows that Government

internal control system and financial report accessibility has positive effect to transparency. Government

internal control sys-tem has positive effect to accountability, while accessibility has no effect. Local financial

management accountability has implication to local government performance, while transparency has no

implication. The results of this study can contribute to knowledge and development of accountancy literature

especially public sector accountancy associated with local financial management and their implication to local

government performance.

1 INTRODUCTION

The performance of government agencies is closely

linked to accountability and transparency. The

implementation of various existing laws and

regulations related to the application of the concept of

accountability and transparency in financial

management is expected to realize the management

of good local government and stand on its people.

Implementation of accountability and transparency in

local financial management is expected to improve

the performance of local governments. Local

governments need to implement an internal control

sys-tem in local financial management, and facilitate

accessibility for stakeholders in obtaining

information on local financial report to create

transparency and accountability in local financial

management. This can add to the trust and support

from various parties including the local government

apparatus working more vigorously and discipline.

Based on the Evaluation Result Report (ERR) of

the Ministry of Administrative Reform and

Bureaucracy Reform (PAN-RB) on the account-

ability performance of the Civil State Apparatus

(ASN) in 2016, the Government of Central Lombok

regency obtains the CC title. “The CC / Less score

indicates that there are many things that do not in sync

between the program / activity and the results

achieved. That is, there are still many implemented

activities that are useless. This is a challenge for local

governments to keep improving their performance,”

Abnur (2017).

The CC predicate is not in line with the opinion of

the audit of LKPD by the Supreme Audit Agency

(BPK), that the government of Central Lombok

regency obtains unqualified opinion in 5 (five)

consecutive years from 2012 until 2016. The

Government of Central Lombok Regency must

continue to improve internal control system,

compliance with statutory regulations, and

accessibility of financial statements to maintain WTP

opinion.

The current phenomenon of financial

accountability is the Audit Result Report (LHP) of

BPK for fiscal year 2016, there are 4 (four)

weaknesses of the internal control system and there

are 6 (six) findings of non-compliance with laws and

regu-lations. This has a financial impact resulting in

a loss to the financial statements of the local

government of Central Lombok Regency.

One of the efforts of the local government of

Central Lombok Regency in realizing transparency

and accountability of regional financial management

is through website http://lomboktengahkab.go.id/. On

the website there are some important data’s related to

718

Sumbawati, S., Husnan, L. and Busaini, B.

Factors That Leads to Financial Management and Their Implications to Local Government Performance: What Should Be Done?.

In Proceedings of the 2nd International Conference on Economic Education and Entrepreneurship (ICEEE 2017), pages 718-723

ISBN: 978-989-758-308-7

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

the management of regional finances such as APBD

report of Fiscal Year 2016, LPSE link (e-

procurement) which still cannot be accessed until

now. (Accessed Friday 30 June 2017).

Several studies have been conducted to ex-amine

the effect of SPIP and the accessibility of financial

statements on transparency and accountability of

local financial management. Researchers testing

SPIP's influence on transparency of local financial

management are Rakhman (2013) proving positive

results, while Azizah (2014) concludes that SPIP has

no effect on transparency. Hehanusa (2015) proved

empirically that the accessibility of financial

statements has a positive and significant impact on

the transparency of financial statements. Re-searchers

who examine the influence of SPIP on the

accountability of local financial management that are

Kartika (2013), Aramide et al (2015), Lelly and Ke-

wo (2017) show different results. The influence of

financial statement accessibility to the accountability

of local financial management is done by Sande

(2013) that the accessibility of local financial report

has a positive and significant influence on the

accountability of local financial management.

Research on the effect of transparency and

accountability of local financial management on local

government performance by Auditiya (2013) proves

that transparency and accountability of local financial

management have a positive and significant impact

on local government performance. In the other hand,

Astuti (2013) concluded that the transparency and

accountability of local financial management do not

bring effect on the performance of local governments.

The difference of this study with previous

researchers is that there is no researcher who explores

the factors that influence transparency and

accountability of regional financial management that

is the internal control system of government and

accessibility of financial report and its implication to

local government performance.

The motivation to do this research is because there

is still a research gap from previous research and the

phenomenon of BPK auditor's findings on the

weakness of internal control system, non-compliance

with legislation from internal stakeholder

perspectives and external stakeholders on the

application of government internal control system

and financial statement accessibility.

Based on the explanation above, the problem in

this research are formed as follows: the factors that

leads to transparency and accountability financial

management and their implication to local

government performance?

The objectives of this research are: The aims of

this paper is to examine the factors that leads to

transparency and accountability financial

management and their implication to local

government performance.

2 LITERATURE REVIEW

2.1 Literature Review

According to Jensen and Meckling (1976) describes

the agency relationship (Agency Theory) is a contract

made by the shareholders (principals) and managers

(agents) in which the shareholders (principal)

authorizes the manager (agent) decision making to the

agent. Furthermore, Zimmerman (1977), agency

problems, occurred also in government organization,

not just occur in the private sector. Society regarded

as principles that mandate / authority to the

government as an agent, in performing the duties of

government to improve people's welfare.

Spence (1973) as the inventor of the signalling

theory (Signalling Theory) states that by providing a

signal, the sender (owner of the information) seeks to

provide relevant information utilized by the recipient.

The receiving party will then adjust his behavior

according to his understanding of the signal.

According to Mahsun (2006: 77): "Performance

is a description of the level of achievement of the

implementation of an activity / program / policy in

realizing the goals, objectives, mission and vision

organization contained in strategic planning of an

organization.

According to Chabib (2010: 10), the financial

management needed to control the local financial

policy include: 1. Accountability 2. Value for money

3. Honesty in managing public finances 4.

Transparency 5. Control.

Transparency is to provide open and honest

financial information to the public based on the

consideration that the public has the right to know

openly and thoroughly the government's

accountability in the management of the resources

entrusted to it and its compliance with legislation,

Nordiawan (2006: 131).

Accountability of local financial management is

the responsibility of financial integrity, disclosure and

compliance with laws and regulations. The targets are

financial statements that include the receipt, storage

and financial expenditures of local government

agencies (LAN and BPKP, 2003).

PP 60 of 2008 establishing the existence of the

internal control system control that should be

Factors That Leads to Financial Management and Their Implications to Local Government Performance: What Should Be Done?

719

implemented at the level of central and local

government. COSO (2013); Arenas et al (2014: 315);

Kamath (2002:205); Whittington (2001:242)

mentioned components of internal control consist of

five components, namely: 1. Environmental control;

2. Risk Assessment; 3). Activity Control; 4)

Information and Communication; 5) Supervision.

This opinion is also supported by Government

Regulation No 60 of 2008; Dinapoli (2007:9);

Harison (2013:235).

In Law Number 33 Year 2004 regarding Financial

Balance between Central Government and Local

Government article 103, it is stated that the in-

formation mentioned in Regional Financial

Information System (SIKD) is open data which can

be known, accessed and obtained by the citizen.

In an open democracy, this access provided by the

media, such as newspapers, magazines, radio,

television stations, and websites (internet); and

forums that provide direct attention or incentives that

encourage government accountability to the citizen.

(Shende and Bennet, 2004).

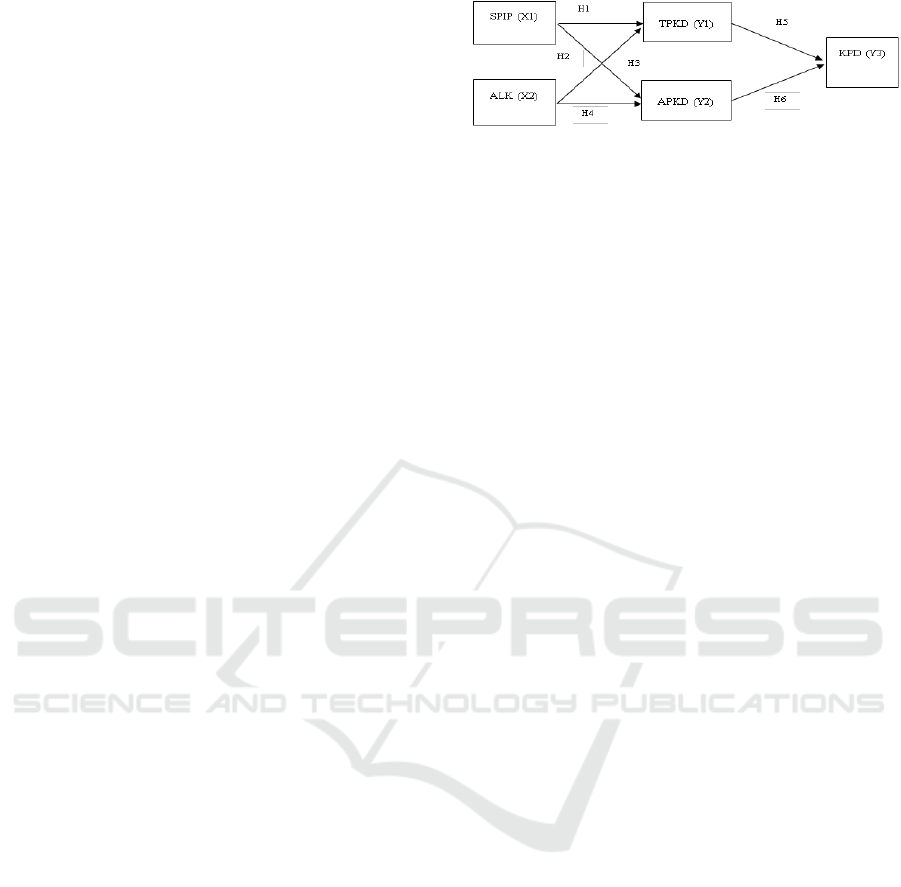

2.2 Conceptual Frame

Signal theory is used to explain the effect of SPIP on

transparency and accountability of local financial

management. Application of SPI is a form of

government (agent) to the people (principal).

Implementation of a good internal system, can be

used as a means to provide a good signal to the

citizen. The control system is designed to gain

sufficient confidence in achieving the objectives of

financial statement reliability and compliance with

laws and regulations. Moreover, this theory explains

the effect of transparency and accountability of

financial management to government performance.

To reduce asymmetry information, the government

creates integrity and reliable and financial statements.

The financial statements are then audited by the

Inspectorate and BPK to be submitted to the DPRD

as a form of accountability to the people.

Agency theory also states that agents are

opportunistic and tend to dislike the risk of

stakeholder trust toward government. The

responsibility that local governments show as the

executive is how they are able to provide access for

users of financial statements. Using financial reports

reported by the agency as their responsibility, the

principal may assess, measure, oversee transparent

and accountable local financial management.

The conceptual framework of this research can be

drown as follows:

Figure 1: Research method.

Note:

SPIP : Government Internal Control System

ALK : Accessibility Financial Report

TPKD : Local Financial Management

Transparency

APKD : Local Financial Management

Accountability

KPD : Local Government Performance

2.3 Hypothesis Development

In the signal theory, the government (agent) will try

to give a good signal to the citizen (principal) with the

implementation of control systems to achieve goals.

The research conducted by Azizah et al (2014) and

Rakhman (2013) conclude different results. Rakhman

(2013) proves the influence of the government's

internal control system on the transparency of local

government financial statements is significant and

positive. Based on the description, it can be put

hypothesis as follows: H1: The government's internal

control system has a positive effect on the

transparency of local financial management.

In the agency theory, agents are usually

opportunistic and tend to dislike risk (risk averse).

The responsibility of the government represents as an

agent is how they are able to provide access for users

of financial statements. According to Mardiasmo

(2009: 171): "the citizen as a trusting party toward the

government has the right to know and the right to be

informed financial report." Hehanussa (2015)

empirically prove that the accessibility of financial

statements has a positive and significant impact on

the transparency of local financial management.

Based on the explanation, the hypothesis would be:

H2: The accessibility of financial statements has a

positive and significant impact on the transparency of

local financial management.

The signal theory can help the government

(agent), the citizen (principal), and outsiders reduce

the asymmetry information by producing a financial

report with integrity to believe the reliability of

information submitted by the agent, need to get

opinions from others who freely give opinion about

the financial statements. Research on the influence of

internal control system on financial accountability

was conducted by Kartika (2013) that SPI does not

has direct effect on the accountability of local

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

720

financial management, in contrast to conclusion of

Aramide et al (2015), Lelly and Kewo (2017). The

results showed that the internal control system has a

significant positive effect on financial accountability.

Based on the description, it can be made a hypothesis:

H3: Internal Control System has a positive and

significant effect on the accountability of local

financial management.

In agency theory, there is an assumption that

agents act opportunistically against principals. Sande

(2013) concluded that the accessibility of financial

statements has a positive and significant impact on

the accountability of local financial management.

Based on the description, it can be made a hypothesis:

H4: Accessibility of local financial reports has a

positive and significant impact on the accountability

of local financial management.

The signal theory explains that the government as

a party given the mandate of the citizen de-sires to

show the signal to society by means of transparency

of local financial management through the website

that can be accessed by users of local financial

statement information. Auditiya (2013) concluded

that the transparency of financial management has a

positive and significant impact on performance. This

is a different result with researchers Astuti’s (2013).

Based on the description, then made a hypothesis: H5:

The transparency of local financial management has

a positive and significant impact on the performance

of local government.

The Signal Theory can help local governments as

agents in reducing the asymmetry information of

local financial by producing good and integrity

financial information. This signal indicates that the

local government has carried out its duties and

responsibilities as the citizen's caretaker (Puspita and

Martini, 2010). Auditiya’s research (2013) states that

the accountability of local financial management has

a positive and significant influence on the

performance of the local government work unit.

Unlike Astuti’s (2013). Based on the description, it

can be made a hypothesis: H6: The accountability of

local financial management has a positive and

significant impact on the performance of local

government.

3 METHODS

The type of research used is associative re-search.

The population in this test is 200 people, consisting

of all SKPD in Central Lombok District Government,

which is referred to as internal stakeholders. Those

included 31 SKPD, Auditor Inspectorate and external

stakeholders consisting of members of DPRD,

NGO/foundation, and entrepreneur. The study was

conducted in March 2017 to April 2017. Sampling

technique is taken based on purposive sampling

technique. Sample in this re-search are Sub-Head of

Finance Unit of SKPD 9 people, Finance Staff of

SKPD 9 people, Auditor Inspectorate 8 people, 8

members of DPRD, 8 NGOs, and Entrepreneur 8

persons, therefore the sample number is 50 people.

Methods of data collection is done by filling the

questionnaire. The variable, measured by Likert

scale. Data analysis used in this research is Smart PLS

program version 3.0.

4 RESULTS AND DISCUSSION

4.1 Outer Models Evaluation

The outer model evaluation is done to assess the

validity and reliability of the model. The result of the

evaluation of the first phase outer model is 18

statements declared that it does not to meet the

convergent validity because it has the loading factor

value <0.6 and 46 statements stated to meet the

convergent validity because it has a loading factor

value> 0.6. Statements that do not meet convergent

validity are 12 of the SPIP Variables, 6 of the

Variables APKD. The invalid statement is excluded

from the model, PLS Algorithm analysis is performed

again for phase II of testing. The result of outer

evaluation of phase II model shows that all statements

have loading factor value above 0.6, therefore, that

stated convergent validity.

Moreover, to fulfil the required loading factor

value, the AVE value of the construct also meets the

requirements of convergent validity is AVE value>

0.5. PLS algorithm report also shows that all variable

constructs have good reliability because they have

composite reliability value> 0.7.

4.2 Inner Model Evaluation

Based on the R-square value generated from the inner

model evaluation, it was concluded that the variable

of transparency of local financial management

(TPKD) can be explained by SPIP variable and 60.7%

financial statement accessibility, while 39.3% is

explained by other un-researched variables.

Local Government Financial Management

Accountability (APKD) can be explained by

Government Internal Control System (SPIP) and

Accessibility of Financial Statement (ALK) as much

Factors That Leads to Financial Management and Their Implications to Local Government Performance: What Should Be Done?

721

as 62,3%, while 37,7% is explained by other

unexamined variables. Local Government

Performance Variables (KPD) can be explained by

variable TPKD and APKD equal to 27,0%, while

equal to 73,0% explained by other unexamined

variables.

Besides R-Square, inner model evaluation

through the bootstrapping menu also generates T-

statistics values that will be used to test the

hypothesis. The criteria are T-statistic> 1.64 (5%

alpha value, one tail).

4.3 Discussion

4.3.1 Interpretation of Results

4.3.1.1 Effect of Government Internal Control

System on Transparency of Regional

Financial Management

The results of the first hypothesis testing, through

PLS shows that the value of T-statistics> t-table is

7,170> 1.64. This shows that the internal control

system has a positive and significant impact on the

transparency of local financial management. The

Government of Central Lombok Regency has

implemented SPIP integrally and thoroughly so that

local financial management can be implemented

transparently.

4.3.1.2 Effect of Accessibility of Financial

Statements on Transparency of Regional

Financial Management

Results of testing the second hypothesis, through PLS

shows that the value of T-statistics> t-table is 4.371>

1.64. This shows that the accessibility of financial

statements has a positive and significant impact on

the transparency of local financial management. By

providing easy access for users of financial

statements, it will enable the operation of a good

control function on the accountability of the use of

local assets as well as control over the financial

policies taken by the government, whether controlled

by external user or internal financial statements.

4.3.1.3 Influence of Government Internal

Control System on the Accountability of

Regional Financial Management

The result of the third hypothesis testing, through PLS

shows that the value of T-statistics> t-table is 12,870>

1.64. This shows that the government's internal

control system has a positive and significant effect on

the accountability of local financial management. The

Government of Central Lombok Regency has

implemented SPIP integrally and thoroughly so that

the financial management of the region can be

accounted for.

4.3.1.4 Effect of Financial Statement

Accessibility to Local Financial

Management Accountability

The results of the fourth hypothesis testing, through

the PLS shows that the value of T-statistics <t-table is

0.915 <1.64. This shows that ease of ac-cessing

financial statements does not affect the accountability

of local financial management. The results of this

study due to the publication of financial statements

through the Internet media is less effective. This is

caused by the society’s apathetic condition toward

information technology. While the publication of the

principle of easy and cheap through the newspaper

media is not published by the government.

4.3.1.5 Influence of Transparency of Regional

Financial Management to Local

Government Performance

The results of the fifth hypothesis testing, through the

PLS shows that the value of T-statistics <t-table is

0.262 <1.64. This shows that the transparency of local

financial management does not has implications for

local government performance. The result of this

research is caused by untransparency of local

financial management which is published through

newspaper media. Newspaper media is the most

inexpensive and easy media. Public ignorance of

financial statements causes a lack of community

control over local government performance.

4.3.1.6 Effect of Regional Financial

Management Accountability on Local

Government Performance

The results of testing the sixth hypothesis, through

PLS shows that the value of T-statistics> t-table is

3.153> 1.64. This indicates that the account-ability of

local financial management has implications for the

performance of local governments. This can be

proved from the opinion of the WTP from the BPK

that the Central Lombok Regency Government

achieved 5 times in a row.

5 CONCLUSIONS

The conclusions that can be drawn from this study is

the government's internal control system and the

accessibility of financial statements have a positive

and significant impact on financial management,

which in turn has implications for the performance of

local governments. The results of this study can

contribute to knowledge and development of

ICEEE 2017 - 2nd International Conference on Economic Education and Entrepreneurship

722

accountancy literature especially public sector

accountancy associated with local financial

management and their implication to local

government performance. And the results of this

study can be used as a consideration for decision

makers in the local government.

The proposed suggestions are: Indonesian

Government has to be aware of applied the role and

regulation toward evaluation of local government

performance. This is cause by different part of local

government will have different approaches. As result

of this research found that was not all of 58

determinant factors could be used as an evaluation for

performance of local government. Result of this

research will be precisely acceptable if these

determinants factor been found has to test further by

using bigger respondent and loading factor score >

0.7 as suggested by Chin (1998).

REFERENCES

Abnur, A., 2017. Banyak Daerah Bernilai Rendah, Menpan

RB Ancam Potong DAK. Available from:

http://cdp.khoirilanwar.com.

Aramide, Sanusi Fasilat, Mustapha Muhammed Bashir.

2015. The Effectiveness of Internal Control System and

Financial Accountability at Local Government Level in

Nigeria. Impact: International Journal of Research in

Business Management (IMPACT: IJRBM) ISSN (E):

2321-886X; ISSN (P): 2347-4572. Vol. 3, Issue 8, Aug

2015, 1-6.

Arenas, A. A., Elder, R. J., Beasly, M. S., 2014. Auditing

and Assurance Service: An Integrated Approach, 12 th

Edition, Pearson, Prentice Hall Inc.

Astuti, R. M., 2013. Pengaruh Akuntabilitas, Transparansi

Dan Fungsi Pemeriksaan Intern Terhadap Kinerja

Pemerintah Daerah (Studi Kasus Pada Dinas

Pendapatan Pengelolaan Keuangan Dan Aset Daerah

(DPPKAD) Kabupaten Grobogan. Tesis. Fakultas

Ekonomi dan Bisnis. Universitas Muhamadiyah

Surakarta.

Auditiya, L., Husaini, Lismawati. 2013. Analisis Pengaruh

Akuntabilitas dan Transparansi Pengelolaan Keuangan

Daerah terhadap Kinerja Pemerintah Daerah. Jurnal

Fairness. Vol.3 No. I, 21-41.

Azizah, Nur, Junaidi, Achdiar Redy Setiawan. 2014.

Pengaruh Penyajian dan Aksesibilitas Laporan

Keuangan Serta Sistem Pengendalian Intenal

Pemerintah Terhadap Transparansi Dan Akuntabilitas

Pengelolaan Keuangan Daerah. Tesis. Universitas

Trunojoyo Madura.

Chabib, S., Heru Rochmansjah. 2010. Pengelolaan

Keuangan dan Aset Daerah. Fokusmedia. Bandung.

Chin, W.W., 1998. The Partial Least Square Approach for

Structural Equation Modelling. In G.A. Marcoulides

(Ed), Modern, Modern Methods for Business Research

(pp.295-358). Mahwah, NJ: Lawrence Erlbaum.

Dinapoli. 2007. Standard for Internal Control in New York

State Government.

Harrison. 2013. Financial Accounting. 9 th Edition.

Pearson.

Hehanussa, S. J., 2015. Pengaruh Penyajian Laporan

Keuangan Daerah dan Aksesibilitas Laporan

Keuangan Daerah Terhadap Transparansi dan

Akuntabilitas Pengelolaan Keuangan Daerah Kota

Ambon. Jurnal Bisnis, Akuntansi dan Manajemen.

ISSN 2302-9791. Vol.2 No. 1 May 2015

Jensen, M., Meckling W.H., 976. Theory of the Firm:

Managerial Behavior, Agency Cost, and Ownership

Structre, Journal of Financial Economics, 3,305-360.

Kartika, I., 2013. Pengaruh Sistem Pengendalian Intern

Pemerintah (SPIP) terhadap Kualitas Laporan

Keuangan dan Impilkasinya terhadap Akuntabilitas

Keuangan (Penelitian pada Realisasi Anggaran di

Pemerintah Daerah Kabupaten Wilayah Provinsi Jawa

Barat). Skripsi. Fakultas Ekonomi dan Bisnis

Universitas Pendidikan Indonesia.

Kamath, L. F., 2002, Auditing Concepts and applications,

A Risk-Analysis Approach, 5th Edition, West

Publishing Company.

Lelly, Cecilia, Kewo, 2017. The Influence of Internal

Control Implementation and Managerial Performance

on Financial Accountability Local Government in

Indonesia. International Journal of Economics and

Financial Issues, 2017, 7(1), 293-297.

Mahsun, M., 2006. Pengukuran Kinerja Sektor Publik.

BPFE. Yogyakarta.

Mardiasmo. 2009. Akuntansi Sektor Publik. Andi.

Yogyakarta.

Nordiawan, D., 2006. Akuntansi Sektor Publik. Salemba

Empat. Jakarta.

Puspita, R., Martini, D., 2010. Analisis Pengaruh Kinerja

Dan Karakteristik Pemda Terhadap Tingkat

Pengungkapan Dan Kualitas Informasi Dalam Website

Pemda. Universitas Indonesia.

Rakhman, M. A. 2013. Pengaruh Pengendalian Intern

terhadap Transparansi Pengelolaan Keuangan Daerah

Kabupaten Bandung Barat. Tesis. Universitas

Pendidikan Indonesia.

Sande, P., 2013. Pengaruh Penyajian Laporan Keuangan

Daerah dan Aksesibilitas Laporan Keuangan terhadap

Akuntabilitas Pengelolaan Keuangan Daerah. Tesis.

Universitas Negeri Padang.

Shende, S., Tony Bennet. 2004. Concept Paper 2:

Tranpararency and Accountability in Public Financial

Administration. UN DESA.

Spence, M., 1973. Job Market Signalling. The Quarterly

Journal of Economics. Vol. 87, No.3. http//jstor.org

Whittington O. R., Pany Kurt, 2001, Principles of Auditing

and Other Assurance Services, Thirteenth Edition,

McGraw-Hill Companies Inc.

Zimmerman, L. J., 1977. The municipal accounting maze:

An analysis of political incentives. Journal of

Accounting Research Vol 15, 107-144.

Factors That Leads to Financial Management and Their Implications to Local Government Performance: What Should Be Done?

723