A Systematic Review of Analytical Management Techniques in

Business Process Modelling for SMEs Beyond What-if-Analysis and

Towards a Framework for Integrating Them with BPM

Dimitrios A. Karras

1

and Rallis C. Papademetriou

2

1

Automation Department, Sterea Hellas Institute of Technology, P.C. 34400 Psachna, Evoia, Greece

2

Faculty Technology, University of Portsmouth, Anglesea Road, Portsmouth, PO1 3DJ, U.K.

dakarras@teiste.gr, rallis.papademetriou@port.ac.uk

Keywords: Business Process Modelling, Modelling Requirements, Analytical Management Techniques, Game-Theory

Modelling, Markov-Chain Modelling, Probabilistic Modelling, Cognitive Maps Modelling.

Abstract: Unquestionably, Business Process Modelling (BPM) is an increasingly popular research area for both

organisations and enterprises due to its effectiveness in enabling better planning of resources, business

reengineering and optimized business performance. The understanding of Business Process modelling is an

essential approach for an Organization or Enterprise to achieve set objectives and improve its operations.

Recent development has shown the importance of representing processes to carry out continuous

improvement. The modelling and simulation of Business Processes has been able to show Business Analysts,

and Managers where bottleneck exists in the system, how to optimize the Business Process to reduce cost of

running the Organization, and the required resources needed for an Organization. Although large scale

organizations have already been involved in such BPM applications, on the other hand, Small Medium

Enterprises (SME) have not drawn much attention with this respect. It seems that SME need more practical

tools for modelling and analysis with minimum expenses if possible. One approach to make BPM more

applicable to SME but, also, to larger scale organizations would be to properly integrate it with analytical

management computational techniques, including the game-theoretic analysis, the probabilistic modelling,

the Markov-chain modelling and the Cognitive Maps methodology. In BPM research the Petri Nets

methodology has already been involved in theory, applications and BPM Software tools. However, this is not

the case in the previously mentioned as well as to other analytical management techniques. It is, therefore,

important in BPM research to take into account such techniques. This paper presents an overview of some

important analytical management computational techniques, as the above, that could be integrated in the BPM

framework. It provides an overview along with examples of the applicability of such methods in the BPM

field. The major goal of this systematic overview is to propose steps for the integration of such analytical

techniques in the BPM framework so that they could be widely applied especially for SME since currently

are well suited to smaller scale problems.

1 INTRODUCTION

Small and Medium-sized Enterprises (SMEs) account

for more than 90 per cent of the world’s enterprises

and 50-60 per cent of employment. Their contribution

to national and regional economic development and

gross domestic product growth is well-recognized

(Morsing and Perrini, 2009). In fact, SMEs are often

characterized as fostering enhanced local productive

capacities; innovation and entrepreneurship; and

increased foreign direct investment in both developed

and developing countries (Raynard and Forstater,

2002).

Hence, while SMEs account for more than 60 per

cent of employment in developing countries, and

although they are sometimes portrayed as key

vehicles in the struggle against poverty

(Luetkenhorst, 2004), there is still a critical lack of

knowledge about the extent to which these firms may

contribute to the achievement of broader objectives of

sustainable and equitable development (Fox, 2005;

Jeppesen et al., 2012).

In order to understand the possibility of such a

contribution it is important to investigate how SMEs

are involving analytical management techniques to

better explore their possibilities and systematically

99

optimize their performance in a complex financial

world and global market. The focus and interest on

complex data management, including big data

analytics, has been increased over the recent years in

the world of SME firms.

Several research reports attempt, through

questionnaires, to understand the use of analytical

management and planning tools and techniques in

SMEs operating in different countries.

As a result of these studies, the most common

used tools and techniques are strategic planning,

human resources analysis, total quality management,

customer relationship management, outsourcing,

financial analysis for firm owners, vision/mission,

PEST, financial analysis for competitors,

benchmarking, STEP analysis, Porter’s 5 forces

analysis and analysis of critical success factors.

According to Gunn and Williams (2007), the results

of their research in the UK, SWOT analysis is the

most widely applied strategic tool by all organizations

surveyed. Benchmarking was ranked second in terms

of its usage by all but manufacturing organizations.

However, it is important to perform a meta-

analysis research on all these and most recent reports

on the use of management tools and techniques in

SMEs in order to clearly answer, in detailed tables, in

what extend each technique is involved by SMEs

depending on its sector of economy, on its

country/continent as well as on other crucial meta-

analysis factors.

Moreover, it is frequently noticed that the value of

just data has significantly reduced in recent past.

There are 2 main factors and open issues to consider:

a) There is an overdose of data and it’s really hard

for a resource strapped SME to be able to digest

it;

b) There is an overdose of technology solutions and

again it’s really hard for SME’s to understand this

landscape and pick the right solution.

Actionable insights from data is what everyone,

including SMEs, want, something with which, on a

daily basis, they can uncover new opportunities to

grow their business within a complex world,

understanding completely their true performance.

The above two questions have not been answered

so far by the research reports for SMEs. These

questions are, also, highly correlated to the issue of

“on what extend the different analytical management

tools are really used by SMEs in the optimization of

their performance”.

In order, however, for an SME or a larger scale

organization to apply such analytical techniques and

for the research community to answer the above

questions, modelling of the business processes

(BPM) involved is absolutely necessary in order to

establish a common language, a well-defined

framework for the application of analytical

management techniques. Therefore, more critical

than the meta-analysis previously discussed on the

use of data by SMEs and other larger scale

organizations, is to review, discuss and provide a

framework for the proper integration of BPM

methodologies and analytical management

techniques worthwhile to be utilized in SMEs and

beyond.

The major goal of the paper is, therefore, to

discuss suitable analytical management techniques

that could be integrated in the BPM framework, and

through examples to discuss the feasibility of

establishing a well-defined framework for the

application of these techniques to SME and larger

scale enterprises.

With this respect we herein discuss and give

examples of game theoretic analysis,

probabilistic/stochastic methodology, Markov-chain

analysis as well as Cognitive maps methodology in

business modelling and analysis towards discussing

the feasibility of a well-defined framework for the

application of these techniques to SME and larger

scale enterprises through the BPM approach

2 AN OVERVIEW OF SUITABLE

ANALYTICAL MANAGEMENT

TECHNIQUES THAT COULD

BE INTEGRATED IN THE BPM

METHODOLOGY

Most attempts to describe and classify business

models in the academic and practice literatures have

been taxonomic, that is, developed by abstracting

from observations typically of a single industry. With

only a few exceptions, these attempts rarely deal fully

and properly with all its dimensions of customers,

internal organization and monetization; see, for

instance, Rappa (2004) and Wirtz et al. (2010). So far,

the literature lacks clear typological classifications

that are robust to changing context and time (Hempel,

1965). A typology has been proposed that considers

four elements Baden-Fuller C. et al. (2010-2013):

Identifying the customers (the number of separate

customer groups); customer engagement (or the

customer proposition); monetization; and value chain

and linkages (governance typically concerning the

firm internally).

In order to define a framework for the application

of analytical management techniques through BPM

Seventh International Symposium on Business Modeling and Software Design

100

methodology such a typology of business processes

models is important in order to establish the

ontologies, the conceptual links as well as the

application paradigms. The herein systematic review

attempts to describe the aforementioned techniques

within this context.

2.1 The Game Theoretic Modelling

Analysis

Every game has players (usually two), strategies

(usually two, but sometimes more) and payoffs (the

payoffs to each player are defined for each possible

pair of strategies in a two-person game). There are

also rules for each game which will define how much

information each player knows about the strategy

adopted by the other player, when this information is

known, whether only pure strategies or mixed

strategies may be adopted, etc. etc. Game theory is

used to help us think about the strategic interaction

between firms in an imperfectly competitive industry.

It is particularly helpful for looking at pricing,

advertising and investment strategies, and for looking

at the decision to enter an industry (and the strategies

that can be adopted to deter a firm from entering an

industry – entry deterrence) as well as to formulate

the outcomes of different strategies of specific

business processes. There is a lot of terminology to

when someone is first introduced to game theory.

For instance, games can be co-operative or non-

cooperative. A co-operative game is one in which the

players can form lasting agreements on how to

behave. We focus our attention, however, on non-

cooperative games in which such binding agreements

are not possible, and players are always tempted to

cheat on any temporary agreement if they can gain an

advantage by cheating. Such games are well suited in

the case for modelling different strategies for specific

business processes.

Games can be “pure strategy” games or they can

allow for “mixed” strategies. Most of the time we will

discuss only pure strategy games (for example: if a

firm has two strategies for a business process, which

are to charge $50 and to charge $100, then a pure

strategy game allows for only these two possibilities).

However, we could consider some examples of mixed

strategies (for example: if the firm has the two pricing

strategies described above, it would also have the

option of charging $50 thirty percent of the time and

charging $100 seventy percent of the time – i.e., a

probabilistic move).

Games can be single-period games or many-

period games (many-period games are also called

repeated-play games or multi-period games). A

single-period game will only be played once and no

one thinks about the future possible replaying of the

game in making their decisions about the best

strategy. However, many of life’s strategic decisions

(for business firms as well as individuals) require us

to think about the payoffs that will occur if a game is

played over and over and over again. Results in a one-

period game can be overturned once you take

repeated effects into account.

Games can be described as simultaneous games

or sequential games. In a simultaneous game, the two

players know what their possible strategies are, they

know the identity of the other player, they know what

the payoffs are for both players from any combination

of strategies, but each player does not know what

move the other player has decided to make. In other

words, each player knows the incentives, but not the

actual strategy adopted. On the other hand, in a

sequential game, one player moves first and the other

player moves second. The second player to move

already knows what strategy the other player has

adopted when the second player is making his/her

decision.

What constitutes a dominant strategy? A

dominant strategy is one that gives you the best result,

no matter what the other person chooses to do. For

example, consider the following game (note: in all the

games herein discussed the payoff for the enterprise

following the first process will always be listed first):

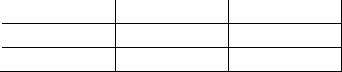

Proc.#2

Strate

gy

A Strate

gy

B

Proc.#1 Strate

gy

Y (100,50) (70,60)

Strate

gy

Z (40,30) (60,10)

For process #1, Y is a dominant strategy, because

process#1 always ends up with a higher payoff for the

enterprise by choosing this strategy. For process #2

there is no dominant strategy, because process #2

does better by choosing A if #1 chooses Z, but

process#2 does better by choosing B if #1 chooses Y.

A Nash equilibrium occurs when neither party has

any incentive to change his or her strategy, given the

strategy adopted by the other party. Clearly, the

existence of a dominant strategy will result in a Nash

equilibrium: in the game above, the enterprise

following process #1 always chooses strategy Y;

while the enterprise following process 2 then, chooses

B; Y,B is a Nash equilibrium. However, games

without any dominant strategies also often have Nash

equilibria. A game may have no Nash equilibrium, a

single Nash equilibrium, or multiple Nash equilibria.

In order for such a methodology to be applied it is

important to completely define strategies, payoffs and

A Systematic Review of Analytical Management Techniques in Business Process Modelling for SMEs Beyond

What-if-Analysis and Towards a Framework for Integrating Them with BPM

101

of course the players. In our case the players are

different competitive processes within an enterprise,

but they could be within two different firms too.

Regarding the payoffs could be even the number of

customers attracted by the different strategies.

Therefore, the applicability of this analytical

management technique should be discussed within

BPM framework in order to be established for wide

use within SME or larger enterprises.

2.2 The Markov Chain Modelling

Analysis

Many real-world systems, including enterprises

functionality and operations, contain uncertainty and

evolve over time. Stochastic processes (and Markov

chains) are probability models for such systems.

A discrete-time stochastic process is a sequence

of random variables X

0

, X

1

, X

2

, . . . typically denoted

by { X

n

}.

The state space of a stochastic process is the set of

all values that the X

n

’s can take. (we will be

concerned with stochastic processes with a finite # of

states).

Time: n = 0, 1, 2, . . .

State: v-dimensional vector, s = (s

1

, s

2

, . . . , s

v

)

In general, there are m states, s

1

, s

2

, . . . , s

m

or s

0

, s

1

, . . . , s

m-1

.

Also, X

n

takes one of m values, so X

n

↔ s.

A stochastic process { X

n

} is called a Markov chain

if

Pr{ X

n+1

= j | X

0

= k

0

, . . . , X

n-1

= k

n-1

, X

n

= i }

= Pr{ X

n+1

= j | X

n

= i } ← transition probabilities

for every i, j, k

0

, . . . , k

n-1

and for every n.

Discrete time means n ∈ N = { 0, 1, 2, . . . }.

The future behavior of the system depends only

on the current state i and not on any of the previous

states.

Pr{ X

n+1

= j | X

n

= i } = Pr{ X

1

= j | X

0

= i },

for all n (They don’t change over time).

Normally, stationary Markov chains are

considered. The one-step transition matrix for a

Markov chain with states S = { 0, 1, 2 } is:

where p

ij

= Pr{ X

1

= j | X

0

= i }

If the state space S = { 0, 1, . . . , m –1} then we

have:

∑

j

p

ij

= 1 ∀ i and p

ij

≥ 0 ∀ i, j

A relevant example for the application of Markov

chain modeling in the field of SMEs or larger scale

organizations, regarding the number of customers

switching from enterprise to enterprise is as follows

(adapted from https://www.analyticsvidhya.com/

blog/2014/07/markov-chain-simplified/):

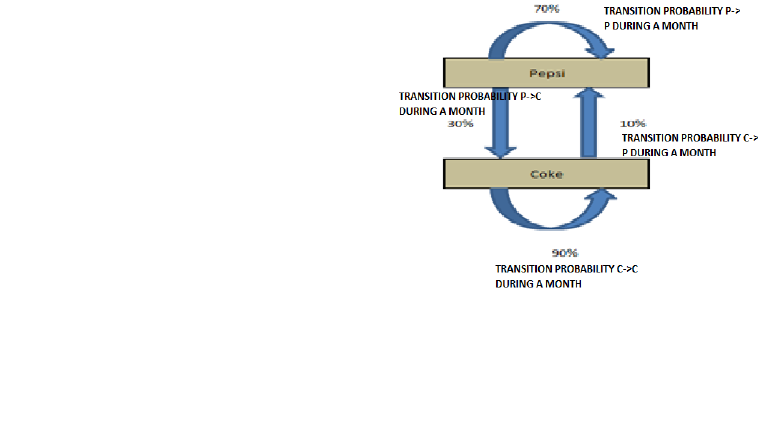

Let’s say Coke and Pepsi are the only companies

in a country. A soda company wants to tie up with one

of these competitor. They hire a market research

company to find which of the brand will have a higher

market share after 1 month. Currently, Pepsi owns

55% and Coke owns 45% of market share.

Following are the conclusions drawn out by the

market research company:

P(P->P) : Probability of a customer staying with

the brand Pepsi for one month = 0.7

P(P->C) : Probability of a customer switching

from Pepsi to Coke for one month = 0.3

P(C->C) : Probability of a customer staying with

the brand Coke for one month = 0.9

P(C->P) : Probability of a customer switching

from Coke to Pepsi for one month = 0.1

We can clearly see customer tend to stick with

Coke but Coke currently has a lower wallet share.

Hence, we cannot be sure on the recommendation

without making some transition calculations.

Transition Diagram

The four statements made by the research company

can be structured in a simple transition diagram

The diagram simply shows the transitions and the

current market share (MS). Now, if we want to

calculate the market share after a month, we need to

do following calculations:

Market share (t+1) of Pepsi = Current market Share

of Pepsi (t)* P(P->P) + Current market Share of Coke

(t) * P(C->P)

⎥

⎥

⎥

⎦

⎤

⎢

⎢

⎢

⎣

⎡

=

222120

121110

020100

ppp

ppp

ppp

P

Seventh International Symposium on Business Modeling and Software Design

102

Market share (t+1) of Coke = Current market Share

of Coke(t) * P(C->C) + Current market Share of Pepsi

(t)* P(P->C)

These calculations can be simply done by looking

at the following matrix multiplication of course under

the assumption of stationary only Markov processes.

Current State(t) X Transition Matrix(t->t+1) =

Final State (t+1). When t=0, that is, at the initial state,

we have:

0

0

55% 45%

70% 30%

10% 90%

1 1

43% 57%

As we can see clearly: Pepsi, although having a

higher market share now, will have a lower market

share after one month. This simple calculation is

called stationary Markov chain. If the transition

matrix does not change with time, we can predict the

market share at any future time point. Let’s make the

same calculation for 3 months later:

1

1

43% 57%

70% 30%

10% 90%

70% 30%

10% 90%

1

1

43% 57%

52% 48%

16% 84%

2 2

31,48% 68,52%

Steady State Calculations

Furthermore to the business case in hand, the soda

company wants to size the gap in market share of the

company Coke and Pepsi in a long run. This will help

them frame the right costing strategy. The share of

Pepsi will keep on going down till a point the number

of customer leaving Pepsi and number of customers

adapting Pepsi are equal. Therefore, we need to

satisfy the following conditions to find the steady

state proportions:

Pepsi MS (t)*(Prob(P->C) = Coke MS(t)*Prob(C->P)

=> Pepsi MS(t)*30% = Coke MS(t)*10%

Pepsi MS + Coke MS = 100%

4*Pepsi MS = 100% => Pepsi MS = 25% and Coke

MS = 75%

The formulation of an algorithm to find the steady

state is easy. After steady state, multiplication of

Initial state with transition matrix will give initial

state itself. Hence, the matrix which can satisfy

following condition will be the final proportions:

Initial state of Market Share X Transition Matrix

= Initial state of Market Share

By solving for above equation, we can find the

steady state matrix. The solution will be the same as

above [25%,75%].

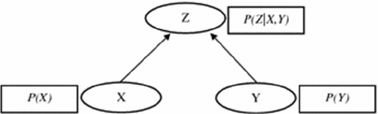

2.3 The Bayesian Network (BN)

Modelling Analysis

Bayesian Networks are also known as recursive

graphical models, belief networks, causal

probabilistic networks, causal networks and influence

diagrams among others (Daly et al. 2011). A BN can

be expressed as two components, the first qualitative

and the second quantitative (Nadkarni and Shenoy

2001, 2004). The qualitative expression is depicted as

a directed acyclic graph (DAG), which consists of a

set of variables (denoted by nodes) and relationships

between the variables (denoted by arcs) (Salini and

Kenett 2009).

The quantitative expression comprises

probabilities of the variables. The figure below shows

a Bayesian Network with three variables X, Y and Z.

Variables X and Y are parents for variable Z, which

indicates that Z is the dependent node. The

probability for Z is a conditional probability based on

the probabilities of X and Y.

The probabilities in a Bayesian Network are

simplified by the DAG structure of the BN, by

applying directional separation (d-separation) (Pearl,

1988) and a Markov property assumption (Jensen and

Nielsen, 2007; Johnson et al., 2010), so that the

probability distribution of any variable is solely

dependent on its parents. Thus, the probability

distribution in a BN with n nodes

(X

1

,…,X

n

) can be formulated as:

A Systematic Review of Analytical Management Techniques in Business Process Modelling for SMEs Beyond

What-if-Analysis and Towards a Framework for Integrating Them with BPM

103

where Pa(X

i

) is the set of the probability distributions

corresponding to the parents of node X

i

(Heckerman

et al., 1995; Johnson et al., 2010). For the above

figure the above equation can be written as

P(Z)=P(Z|X,Y)∗P(X)∗P(Y).

Bayesian Networks based modelling relevant to

BPM framework has been recently investigated,

although not in depth, and only in the field of

customer modelling for some specific applications

(Ashcroft M., 2012; Anderson et al., 2004;

Chakraborty S., et. al., 2016).

2.4 The Cognitive Maps Approach in

Modelling Analysis

Cognitive maps (Axelrod, 1976), (Eden, 1992) are a

collection of nodes linked by some arcs or edges. The

nodes represent concepts or variables relevant to a

given domain. The causal links between these

concepts are represented by the edges. The edges are

directed to show the direction of influence. Apart

from the direction, the other attribute of an edge is its

sign, which can be positive (a promoting effect) or

negative (an inhibitory effect). Cognitive maps can be

pictured as a form of signed directed graph. Figure 1

shows a cognitive map used to represent a scenario

involving some issues in public health.

BP1

BP2

BP3

BP4

BP6

BP5

BP7

+

+

+

+

+

+

+

-

-

-

Figure 1: Cognitive map concerning causal relations in

business processes within an enterprise.

The construction of a cognitive map requires the

involvement of a knowledge engineer and one or

more experts in a given problem domain. Methods for

constructing a cognitive map for a relatively recent

real-world application are discussed in (Tsadiras,

2003; Jetter, 2014).

The main objective of building a cognitive map

around a problem is to be able to predict the outcome

by letting the relevant issues interact with one

another. These predictions can be used for finding out

whether a decision made by someone is consistent

with the whole collection of stated causal assertions.

Such use of a cognitive map is based on the

assumption that, a person whose belief system is

accurately represented in a cognitive map, can be

expected to make predictions, decisions and

explanations that correspond to those generated from

the cognitive map. This leads to the significant

question: Is it possible to measure a person’s beliefs

accurately enough to build such a cognitive map? The

answer, according to Axelrod and his co-researchers,

is a positive one. Formal methods for analysing

cognitive maps have been proposed and different

methods for deriving cognitive maps have been tried

in (Axelrod, 1976).

In a cognitive map, the effect of a node A on another

node B, linked directly or indirectly to it, is given by

the number of negative edges forming the path

between the two nodes. The effect is positive if the

path has an even number of negative edges, and

negative otherwise. It is possible for more than one

such paths to exist. If the effects from these paths is a

mix of positive and negative influences, the map is

said to have an imbalance and the net effect of node

A on node B is indeterminate. This calls for the

assignment of some sort of weight to each inter-node

causal link, and a framework for evaluating combined

effects using these numerically weight-ed edges.

Fuzzy cognitive maps (FCM) (Caudill, 1990;

Brubaker, 1996a; Brubaker, 1996b) were proposed as

an extension of cognitive maps to provide such a

framework.

Fuzzy Cognitive Maps

The term Fuzzy Cognitive Map (FCM) was coined in

(Kosko, 1986) to describe a cognitive map model

with two significant characteristics:

(1) Causal relationships between nodes are fuzzified.

Instead of only using signs to indicate positive or

negative causality, a number is associated with the

relationship to express the degree of relationship

between two concepts.

(2) The system is dynamic involving feedback, where

the effect of change in a concept node affects

other nodes, which in turn can affect the node

initiating the change. The presence of feedback

adds a temporal aspect to the operation of the

FCM.

∏

=

=

n

i

iin

XPaXPXXXP

1

21

))(|(),...,,(

Seventh International Symposium on Business Modeling and Software Design

104

F-BP1

F-BP2

F-BP3

F-BP4

F-BP6

F-BP5

F-BP7

+0.1

+0.7

+0.9

+0.8

+0.9

+0.9

+0.6

-0.9

-0.3

-0.9

Figure 2: Fuzzified version of the cognitive map shown in Figure 1.

The FCM structure can be viewed as a recurrent

artificial neural network, where concepts are

represented by neurons and causal relationships by

weighted links or edges connecting the neurons.

By using Kosko’s conventions, the inter-

connection strength between two nodes C

i

and C

j

is

e

ij

, with e

ij

, taking on any value in the range -1 to 1.

Values –1 and 1 represent, respectively, full negative

and full positive causality, zero denotes no causal

effects and all other values correspond to different

fuzzy levels of causal effects. In general, an FCM is

described by a connection matrix E whose elements

are the connection strengths (or weights) e

ij

. The

element in the i

th

row and j

th

column of matrix E

represents the connection strength of the link directed

out of node C

i

and into C

j

. If the value of this link

takes on discrete values in the set {-1, 0, 1}, it is called

a simple FCM. The concept values of nodes C

1

, C

2

,

…, C

n

(where n is the number of concepts in the

problem domain) together represent the state vector

C.

An FCM state vector at any point in time gives a

snapshot of events (concepts) in the scenario being

modelled. In the example FCM shown in Figure 2,

node C

2

relates to the 2

nd

component of the state

vector and the state [0 1 0 0 0 0 0] indicates the event

"migration into city" has happened. To let the system

evolve, the state vector C is passed repeatedly

through the FCM connection matrix E. This involves

multiplying C by E, and then transforming the result

as follows:

C(k + 1) = T[C(k) . E]

where C(k) is the state vector of concepts at some

discrete time k, T is the thresholding or nonlinear

transformation function, and E is the FCM

connection matrix.

With a thresholding transformation function, the

FCM reaches either one of two states after a number

of passes. It settles down to a fixed pattern of node

values - the so-called hidden pattern or fixed-point

attractor. Alternatively, it keeps cycling between a

number of fixed states - known as the limit cycle.

With a continuous transformation function, a third

possibility known as the chaotic attractor (Elert,

1999) exists, when instead of stabilising, the FCM

continues to produce different state vector values for

each cycle.

Extensions of FCMs

A number of researchers have developed extended

versions of the FCM model described above. Tsadiras

(2003) and Jetter et al. (2014) describe the extended

FCM, in which concepts are augmented with memory

capabilities and decay mechanisms. The new

activation level of a node depends not only on the sum

of the weighted influences of other nodes but also on

the current activation of the node itself. A decay

factor in the interval [0,1] causes a fraction of the

current activation to be subtracted from itself at each

time step.

Park (1995) introduces the FTCM (Fuzzy Time

Cognitive Map), which allows a time delay before a

node x

i

has an effect on node x

j

connected to it

through a causal link. The time lags can be expressed

in fuzzy relative terms such as “immediate”,

“normal” and “long” by a domain expert. These terms

can be assigned numerical values such as 1, 2, 3. If

the time lag on a causal link e

ij

is m (1≥m) delay units,

then m – 1 dummy nodes are introduced between

node i and node j.

Decision-makers often find it difficult to cope

with significant real-world systems. These systems

are usually characterised by a number of concepts or

facts interrelated in complex ways. They are often

A Systematic Review of Analytical Management Techniques in Business Process Modelling for SMEs Beyond

What-if-Analysis and Towards a Framework for Integrating Them with BPM

105

dynamic ie, they evolve through a series of

interactions among related concepts. Feedback plays

a prominent role among them by propagating causal

influences in complicated pathways. Formulating a

quantitative mathematical model for such a system

may be difficult or impossible due to lack of

numerical data, its unstructured nature, and

dependence on imprecise verbal expressions. FCMs

provide a formal tool for representing and analysing

such systems with the goal of aiding decision making.

Given an FCM's edge matrix and an input

stimulus in the form of a state vector, each of the three

possible outcomes mentioned above can provide an

answer to a causal “what if” question. The inference

mechanism of FCMs works as follows. The node

activation values representing different concepts in a

problem domain are set based on the current state.

The FCM nodes are then allowed to interact

(implemented through the repeated matrix

multiplication mentioned above). This interaction

continues until:

(1) The FCM stabilises to a fixed state (the fixed-

point attractor), in which some of the concepts are

‘on’ and others are not.

(2) A limit cycle is reached.

(3) The FCM moves into a chaotic attractor state

instead of stabilising as in (1) and (2) above.

The usefulness of the three different types of

outcomes depends on the user’s objectives. A fixed-

point attractor can provide straightforward answers to

causal “what if” questions. The equilibrium state can

be used to predict the future state of the system being

modelled by the FCM for a particular initial state. As

an example based on figure 2, the state vector [0 1 0

0 0 0 0], provided as a stimulus to the FCM, may

cause it to equilibrate to the fixed-point attractor at [0

0 0 1 0 0 0]. Such an equilibrium state would indicate

that an increase in “migration into city” eventually

leads to the increase of “garbage per area”.

A limit cycle provides the user with a

deterministic behaviour of the real-life situation being

modelled. It allows the prediction of a cycle of events

that the system will find itself in, given an initial state

and a causal link (edge) matrix. For FCMs with

continuous transformation function and concept

values, a resulting chaotic attractor can assist in

simulation by feeding the simulation environment

with endless sets of events so that a realistic effect can

be obtained.

Development of FCMs for Decision Modelling

FCMs can be based on textual descriptions given by

an expert on a problem scenario or on interviews with

the expert. The steps followed are:

Step 1: Identification of key concepts/issues/factors

influencing the problem.

Step 2: Identification of causal relationships among

these concepts/issues/factors.

Experts give qualitative estimates of the strengths

associated with edges linking nodes. These estimates

are translated into numeric values in the range –1 to

1. For example, if an increase in the value of concept

A causes concept B to increase significantly (a strong

positive influence), a value of 0.8 may be associated

with the causal link leading from A to B. Experts

themselves may be asked to assign these numerical

values. The outcome of this exercise is a

diagrammatic representation of the FCM, which is

converted into the corresponding edge matrix.

Learning in FCMs

FCM learning involves updating the strengths of

causal links. Combining multiple FCMs is the

simplest form of learning. An alternative learning

strategy is to improve the FCM by fine-tuning its

initial causal link or edge strengths through training

similar to that in artificial neural networks. Both these

approaches are outlined below.

Multiple FCMs constructed by different experts

can be combined to form a new FCM. FCM

combination can provide the following advantages:

1. It allows the expansion of an FCM by

incorporating new knowledge embodied in other

FCMs.

2. It facilitates the construction of a relatively bias-

free FCM by merging different FCMs

representing belief systems of a number of experts

in the same problem domain.

The procedures for combining FCM are outlined in

(Kosko, 1988). Generally, combination of FCMs

involves summing the matrices that represent the

different FCMs. The matrices are augmented to

ensure conformity in addition. Each FCM drawn by

different experts may be assigned a credibility

weight. The combined FCM is given by:

k=N

∑ W

k

E

k

k=1

E =

where E is the edge matrix of the new combined

FCM, Ek is the edge matrix of FCM k, Wk is the

credibility weight assigned to FCM k, and N is the

number of FCMs to be combined. Siegel and Taber

Seventh International Symposium on Business Modeling and Software Design

106

(1987) outlines procedures for credibility weights

assignment in FCMs.

McNeill and Thro (1994) discuss the training of

FCMs for prediction. A list of state vectors is supplied

as historical data. An initial FCM is constructed with

arbitrary weight values. It is then trained to make

predictions of future average value in a stock market

using historical stock data. The FCM runs through the

historical data set one state at a time. For each input

state, the ‘error’ is determined by comparing the

FCM's output with the expected output provided in

the historical data. Weights are adjusted when error is

identified. The data set is cycled until the error has

been reduced sufficiently for no more changes in

weights to occur.

If a correlated change between two concepts is

observed, then a causal relation between the two is

likely and the strength of this relationship should

depend on the rate of the correlated change. This

proposition forms the basis of the Differential

Hebbian Learning (DHL). Kosko (1992) discusses

the use of DHL as a form of unsupervised learning for

FCMs. DHL can simplify the construction of FCMs

by allowing the expert to enter approximate values (or

even just the signs) for causal link strengths. DHL can

then be used to encode some training data to improve

the FCM’s representation of the problem domain and

consequently its performance.

Business Models as Cognitive Maps

Drawing on the insights of the cognitive mapping

approach in strategic management, we argue that the

causal structures embedded in business models can be

usefully conceptualized and represented as cognitive

maps (Furnari S., 2015). From this perspective, a

business model’s cognitive map is a graphical

representation of an entrepreneur or top manager’s

beliefs about the causal relationships inherent in that

business model (Furnari S., 2015). By emphasizing

the causal nature of business models, this definition is

consistent with previous studies viewing business

models as sets of choices and the consequences of

those choices (e.g. Casadesus-Masanell & Ricart,

2010), and with studies that explicitly highlight the

importance of cause-effect relationships in business

models’ cognitive representations (e.g. Baden-Fuller

& Haefliger, 2013; Baden-Fuller & Mangematin,

2013). Business models’ cognitive maps can be

derived from the texts that entrepreneurs and top

managers use in designing their business models, or

to pitch their projects to various audiences (including

investors, customers, policy makers); or they can be

derived from primary interviews with entrepreneurs

and top managers (Furnari S., 2015). Thus, the

content of a business model’s cognitive map can be

idiosyncratic, depending on the particular

individual’s cognitive schemas and on the language

they use. The raw concepts that entrepreneurs and top

managers use in their causal statements identify the

elements of a business model’s cognitive map that are

induced empirically (Furnari S., 2015). At the same

time, such maps may include elements deduced

theoretically from extant theories about business

models - i.e. the conceptual categories developed in

such theories (such as “value proposition”,

“monetization mechanisms”) - that can be useful to

classify the raw concepts used by entrepreneurs and

top managers, providing a basis for comparing

different individuals’ cognitive maps Thus, business

models’ cognitive maps include both inductive and

deductive elements, as do other types of cognitive

maps (e.g. Axelrod, 1976; Bryson et al., 2004)

For the sake of illustrating examples of business

models’ cognitive maps, we focus particularly on the

business model representation developed by Baden-

Fuller and Mangematin (2013), (Furnari S., 2015).

Among the several business model representations

suggested in the literature, we adopt this typological

representation because it strikes a balance between

parsimony and generality, thus meeting the criteria

typically recommended for solid theory-based

typologies (e.g. Doty & Glick, 1994; Delbridge &

Fiss, 2013). Specifically, this typology includes the

essential building blocks of the business model as

covered by other business model representations, thus

having a general scope in terms of content. At the

same time, it uses a more parsimonious set of

categories than other business model representations

in covering this general scope. For this reason, in the

cognitive maps’ illustrations provided below, we used

the four constructs characterizing this business model

representation (“customer identification”, “customer

engagement (or value proposition)”, “value chain”

and “monetization”) as organizing categories

(Furnari S., 2015). Although we use this specific

business model representation here for illustrating

business models’ cognitive maps, the cognitive

mapping approach developed in this paper can be

used, more generally, with any other business model

representation, depending on the analyst’s

preferences and research objectives (Furnari S.,

2015).

3 CONCLUSIONS

In this study we have attempted to present and analyse

some important analytical management techniques

A Systematic Review of Analytical Management Techniques in Business Process Modelling for SMEs Beyond

What-if-Analysis and Towards a Framework for Integrating Them with BPM

107

that are of value especially for SME, but through

extensions, under research, to larger scale enterprises

too. We have argued through examples relevant to

Business Process Modelling that in order for these

techniques to be widely utilized by enterprises a

common well defined framework should be

established based on BPM. BPM could provide the

representation schemes that should be integrated in

the associated formalisms. To this end, our

presentation is a first step. Each analytical

management technique herein presented should be

analysed in depth in order to be integrated with BPM

methodology in a common useful and well organized

application framework that in the sequel could be

employed in real world scenarios, managing even big

data of the associated enterprises.

REFERENCES

Ashcroft M. (2012), Bayesian networks in business

analytics, [in:] M. Ganzha, L. Maciaszek, M. Paprzycki

(Eds.), Proceedings of the Federated Conference on

Computer Science and Information Systems FedCSIS

2012, Polskie Towarzystwo Informatyczne, IEEE

Computer Society Press, Warsaw, Los Alamitos, CA

2012, pp. 955–961.

Anderson RD, Mackoy RD, Thompson VB, Harrell G.

(2004), A Bayesian network estimation of the service-

profit chain for transport service satisfaction. Decis Sci.

2004;35(4):665–89.

Axelrod R.M. (Ed.).(1976). Structure of decision: The

cognitive maps of political elites. Princeton: Princeton

University press.

Baden-Fuller C. & Morgan M. (2010). Business Models as

Models, Long Range Planning, 43(23): 156171

Baden-Fuller C. & Haefliger S. (2013). Business models

and technological innovation, Long Range Planning,

46(6): 419-426.

Baden-Fuller C., & Mangematin V. (2013). Business

models: A challenging agenda, Strategic Organization,

11(4), 418-427.

Barr P.S., Stimpert J.L. & Huff A.S. (1992). Cognitive

change, strategic action, and organizational renewal.

Strategic management journal, 13(S1): 15-36.

Bhargava, H. K., Herrick, C., Sridhar, S. (1999) “Beyond

Spreadsheets: Tools for Building Decision Support

Systems”, IEEE Expert, 32(3), 1999.

Brubaker, D. (1996a) "Fuzzy Cognitive Maps", EDN

Access, April 11 1996, [WWW document].

URL http://www.ednmag.com

Brubaker, D. (1996b) "More on Fuzzy Cognitive Maps",

EDN Access, April 25 1996b, [WWW document]. URL

http://www.ednmag.com

Bryson J.M., Ackermann F., Eden C. & Finn, C.B. (2004).

Visible thinking: Unlocking causal mapping for

practical business results, John Wiley & Sons.

Calori R., Johnson G. & Sarnin P. (1994). CEOs’ cognitive

maps and the scope of the organization, Strategic

Management Journal, 15: 437-457.

Carley K. & Palmquist M. (1992). Extracting, representing,

and analyzing mental models. Social forces, 70(3): 601-

636.

Casadesus-Masanell R. & Ricart J.E. (2010). From Strategy

to Business Models and onto Tactics. Long Range

Planning, 43(2-3): 195–215.

Caudill, M. (1990) “Using Neural Nets: Fuzzy Cognitive

Maps”, AI Expert, June 1990, pp. 49-53.

Chakraborty S., et. al. (2016), A Bayesian Network-based

customer satisfaction model: a tool for management

decisions in railway transport, Decision Analytics,

2016, 3:4,DOI: 10.1186/s40165-016-0021-2,

published:9/2016

Chesbrough H. & Rosenbloom R.S. (2002). The role of the

business model in capturing value from innovation:

Evidence from Xerox Corporation‘s technology spin-

off companies. Industrial and Corporate Change,

11(3): 529-555.

Chong, A., Khan, S., Gedeon, T. (1999a) “Differential

Hebbian Learning in Fuzzy Cognitive Maps: A

Methodological View in the Decision Support

Perspective”, Proc. Third Australia-Japan Joint

Workshop on Intelligent and Evolutionary Systems, 23-

25 Nov. 1999, Canberra (to be published).

Chong, A. (1999b) "Development of a Fuzzy Cognitive

Map Based Decision Support Systems Generator",

Honours dissertation, School of Information

Technology, Murdoch University, 1999.

Clarke, I., & Mackaness, W. (2001). Management

‘intuition’: an interpretative account of structure and

content of decision schemas using cognitive maps.

Journal of Management Studies, 38(2): 147-172.

Daly R, Shen Q, Aitken S. (2011), Learning Bayesian

networks: approaches and issues. Knowl Eng Rev.

2011;26(02):99–157.

Davis G.F. & Marquis C. (2005). Prospects for organization

theory in the early twenty-first century: Institutional

fields and mechanisms. Organization Science, 16(4):

332-343.

Delbridge R. & Fiss P.C. (2013). Editors' comments: styles

of theorizing and the social organization of knowledge.

Academy of Management Review, 38(3): 325-331.

Doganova L. & Eyquem-Renault M. (2009). What do

business models do?: Innovation devices in technology

entrepreneurship. Research Policy, 38(10): 1559–1570.

Doty D.H. & Glick W.H. (1994). Typologies as a unique

form of theory building: Toward improved

understanding and modeling. Academy of management

review, 19(2): 230-251.

Doz Y.L. & Kosonen M. (2010). Embedding Strategic

Agility: A Leadership Agenda for Accelerating

Business Model Renewal. Long Range Planning, 43(2–

3): 370–382.

Eden C., Ackermann F. & Cropper S. (1992). The analysis

of cause maps. Journal of Management Studies, 29(3):

309-324.

Seventh International Symposium on Business Modeling and Software Design

108

Eisenmann T., Parker G. & Van Alstyne M.W. (2006).

Strategies for two-sided markets. Harvard business

review, 84(10): 92.

Elert, G. (1999) The Chaos Hypertexbook, 1999,

http://hypertextbook.com/chaos/about.shtml

Elster J. (1998). A plea for mechanisms. in Hedström, P., &

Swedberg, R. (Eds.). Social mechanisms: An analytical

approach to social theory. Cambridge University Press.

Fiol C.M. & Huff A.S. (1992). Maps for managers: where

are we? Where do we go from here? Journal of

Management Studies, 29(3): 267-285.

Fox, T. (2005), Small and Medium-sized Enterprises

(SMEs) and Corporate Social Responsibility – A

Discussion Paper, International Institute for

Environment and Development, London.

Furnari, S. (2015), A Cognitive Mapping Approach to

Business Models: Representing Causal Structures and

Mechanisms, Chapter 8 in Business Models and

Modelling; Volume 33; Advances in Strategic

Management editors C. Baden-Fuller and V.

Mangematin; Emerald Press, 2015

Gavetti G.M., Henderson R. & Giorgi S. (2005) Kodak and

The Digital Revolution (A). Harvard Business School

Case #705-448.

Goldman I. (2012) ‘Poor decisions that humbled the Kodak

giant’. Financial Times. 13 April.

Grandori A. & Furnari S. (2008), A chemistry of

organization: Combinatory analysis and design,

Organization Studies, 29(2): 315-341.

Gunn R. and Williams W. (2007), Strategic tools: an

empirical investigation into strategy in practice in the

UK, Strat. Change 16: 201–216 (2007), Published

online in Wiley InterScience

(www.interscience.wiley.com) DOI: 10.1002/jsc.799

Heckerman D, Geiger D, Chickering DM. (1995), Learning

Bayesian networks: the combination of knowledge and

statistical data. Mach Learn. 1995;20:197–243

Hempel, C. G. (1965) ‘Fundamentals of Taxonomy, and

Typological Methods in the Natural and Social

Sciences’, Aspects of Scientific Explanation, ch. 6., pp.

137–72. New York: Macmillan.

Hodgkinson G.P., Bown N.J., Maule A.J., Glaister K.W. &

Pearman A.D. (1999). Breaking the frame: An analysis

of strategic cognition and decision making under

uncertainty, Strategic Management Journal, 20: 977-

985.

Hodgkinson G.P. & Healey M.P. (2008). Cognition in

organizations, Annual Review of Psychology, 59: 387-

417.

Hodgkinson G.P., Maule A.J. & Bown, N.J. (2004). Causal

cognitive mapping in the organizational strategy field:

A comparison of alternative elicitation procedures,

Organizational Research Methods, 7(1): 3-26.

Huff A.S. (1990). Mapping strategic thought. Chichester,

UK: Wiley.

Huff A.S., Narapareddy V. & Fletcher K.E. (1990). Coding

the causal association of concepts in Huff, A.S.

Mapping strategic thought, New York: John Wiley and

Sons.

Jenkins M. & Johnson G. (1997). Entrepreneurial intentions

and outcomes: A comparative causal mapping study.

Journal of Management Studies, 34: 895-920.

Jensen FV, Nielsen TD. (2007), Bayesian networks and

decision graphs. 2nd ed. Berlin: Springer; 2007

Jeppesen, S., Kothuis, B. and Tran, A.N. (2012), Corporate

Social Responsibility and Competitiveness for SMEs in

Developing Countries: South Africa and Vietnam,

Focales 16, Agence Francaise de Development, Paris.

Jetter Antonie J. and Kok K. (2014), Fuzzy Cognitive Maps

for futures studies—A methodological assessment of

concepts and methods, Futures journal, Volume 61,

September 2014, Pages 45–57, Elsevier,

https://doi.org/10.1016/j.futures.2014.05.002

Johnson S, Fielding F, Hamilton G, Mengersen K. (2010),

An integrated Bayesian network approach to lyngbya

majuscula bloom initiation. Mar Environ Res.

2010;69(1):27–37.

Kaplan S. & Sawhney M. (2000). B2B E-Commerce hubs:

towards a taxonomy of business models. Harvard

Business Review, 79(3): 97-100.

Kardaras, D., and Karakostas, B. (1999) "The use of Fuzzy

Cognitive Maps to Simulate Information Systems

Strategic Planning Process", Information and Software

Technology, Vol.41, Issue 4, 1999, pp. 197-210.

Klang D., Wallnöfer M. & Hacklin F. (2014). The Business

Model Paradox: A Systematic Review and Exploration

of Antecedents, International Journal of Management

Reviews.

Kosko, B. (1986) "Fuzzy Cognitive Maps", Int. J. Man-

Machine Studies, Vol.24, 1986, pp.65-75.

Kosko, B. (1992) “Neural Networks and Fuzzy Systems”,

Prentice Hall, Englewood Cliffs, NJ, 1992.

Lee, K.C., Kim, H. S. (1997) “A Fuzzy Cognitive Map-

based Bi-directional Inference Mechanism: An

Application to Stock Investment Analysis”, Intelligent

Systems in Accounting, Finance & Management, 6,

1997, pp. 41-57.

Lee, K.C., Lee, W.J., Kwon, O.B., Han, J.H., Yu, P.I.

(1998) “Strategic Planning Simulation Based on Fuzzy

Cognitive Map Knowledge and Differential Game",

Simulation, Nov. 1998, pp. 316-327.

Laukkanen M. (1994). Comparative cause mapping of

organizational cognitions, Organization science, 5(3):

322-343.

Luetkenhorst, W. (2004), “Corporate social responsibility

and the development agenda”,Intereconomics, Vol. 39

No. 3, pp. 157-166.

McNeill, M. F., and Thro, E. (1994) "Fuzzy Logic: A

Practical Approach", AP Professional Boston 1994.

Morsing, M. & Perrini, F., 2009. CSR in SMEs: do SMEs

matter for the CSR agenda?. Business Ethics: A

European Review, 18(1).

Nadkarni S, Shenoy PP. (2001) A Bayesian network

approach to making inferences in causal maps. Eur J

Oper Res. 2001;128(3):479–98.

Nadkarni S, Shenoy PP. (2004) A causal mapping approach

to constructing Bayesian networks. Dec Support Syst.

2004;38(2):259–81.

A Systematic Review of Analytical Management Techniques in Business Process Modelling for SMEs Beyond

What-if-Analysis and Towards a Framework for Integrating Them with BPM

109

Park, K.S. (1995) “Fuzzy Cognitive Maps Considering

Time Relationships”, International Journal of Human-

Computer Studies, Feb 1995, pp. 157-167.

Pearl J. (1988) Probabilistic reasoning in intelligent

systems. San Francisco: Morgan Kaufmann Publishers

Inc; 1988.

Power, D.J. (1997) "What is DSS?" DS*, The On-Line

Executive Journal for Data-Intensive Decision Support,

Vol.1, No.3, October 21, 1997, [WWW document].

URL: http://dss.cba.uni.edu/ papers/whatisadss

Rappa, M. A. (2004) ‘The Utility Business Model and the

Future of Computing Services’, IBM Systems Journal

43(1) 32–42.

Raynard, P. and Forstater, M. (2002), “Corporate social

responsibility: implications for small and medium

enterprises in developing countries”, UNIDO, Geneva,

available at: www.unido.org/fileadmin/import

/29959_CSR.pdf (accessed 27 September 2016).

Render, B., and Stair, M.S. (1988) "Quantitative Analysis

for Management", Allyn & Bacon, Boston 1988.

Salini S, Kenett RS. (2009), Bayesian networks of customer

satisfaction survey data. J Appl Stat.

2009;36(11):1177–89

Taber, R. (1991) “Knowledge Processing with Fuzzy

Cognitive Maps”, Expert Systems With Applications,

Vol. 2, 1991, pp. 83-87.

Tsadiras, Athanasios K. "Using fuzzy cognitive maps for e-

commerce strategic planning." Proc. 9th Panhellenic

Conf. on Informatics (EPY’2003). 2003.

Turban, E. (1993) Decision Support and Expert Systems

Management Support Systems, 3rd ed., Macmillan,

New York 1993.

VidHya Analytics (2017), Introduction to Markov chain :

simplified!,

(https://www.analyticsvidhya.com/blog/2014/07/mark

ov-chain-simplified/) accessed 1/2017

Wirtz, B. W., Schilke, O. and Ullrich, S. (2010) ‘Strategic

Development of Business Models: Implications of the

Web 2.0 for Creating Value on the Internet’, Long

Range Planning 43(2–3): 272–90.

Seventh International Symposium on Business Modeling and Software Design

110