InterCriteria Analysis Applied to Various EU Enterprises

Lyubka Doukovska

1

, Vassia Atanassova

2

, George Shahpazov

1

and František Čapkovič

3

1

Institute of Information and Communication Technologies, Bulgarian Academy of Sciences

Acad. G. Bonchev str., bl. 2, 1113 Sofia, Bulgaria

doukovska@iit.bas.bg, atlhemus@abv.bg

2

Institute of Biophysics and Biomedical Engineering, Bulgarian Academy of Sciences

Acad. G. Bonchev str., bl. 105, 1113 Sofia, Bulgaria

vassia.atanassova@gmail.com

3

Institute of Informatics, Slovak Academy of Sciences

Dubravska cesta 9, 845 07 Bratislava, Slovak Republic

Frantisek.Capkovic@savba.sk

Keywords: InterCriteria decision making, Intuitionistic fuzzy sets, Index matrix, European enterprises, Micro, small,

medium and large enterprises in EU27, Positive consonance.

Abstract: The present research aims to detect certain correlations between four economic indicators, against which

have been evaluated the economic entities of the European Union with 27 Member States, as split into four

categories: micro, small, medium and large enterprises. The mathematical formalism employed for

revealing these dependencies, particularly termed here ‘positive’ and ‘negative consonances’, is a novel

decision support approach, called InterCriteria Analysis, which is based on the theoretical foundations of the

intuitionistic fuzzy sets and the augmented matrix calculus of index matrices. The proposed approach can be

useful in processes of decision making and policy making, and it can be seamlessly integrated and further

extended to other related application areas and problems, where it is reasonable to seek correlations between

a variety of economic and other indicators.

1 INTRODUCTION

In present work, we make the consequent step in a

series of research, aimed at proposing the

application of the novel approach of InterCriteria

Analysis (ICA) to economic data, aimed at the

discovery of correlations between important

economic indicators, based on available economic

data. At this new step, we take as input information

about the economic enterprises in the EU27, the

European Union with 27 Member States, as grouped

in the four types of enterprises with respect to the

scale: micro, small, medium and large enterprises,

(Calogirou, et al., 2010).

The indicators against which these four types of

EU27 enterprises have been evaluated are four,

namely: ‘Number of enterprises’, ‘Number of per-

sons employed’, ‘Turnover’ and ‘Value added at

factor cost’. Potential discovery of correlations (in

this approach termed as positive consonances)

between economic indicators can bring new know-

ledge and improve decision making and policy

making processes.

The ICA approach is specifically designed for

datasets comprising evaluations, or measurements of

multiple objects against multiple criteria. In the initial

formulation of the method, the aim was to detect

correlations between the criteria, in order to eliminate

future evaluations/measurements against some of the

criteria, which exhibit high enough correlations with

others. This might be the desire, when some of the

criteria are for some reason deemed unfavourable, for

instance come at a higher cost than other criteria, are

harder, more expensive and/or more time consuming

to measure or evaluate. Elimination or reduction of

these unfavourable criteria from the future evaluations

or measurements may be desirable from business

point of view in order to reduce cost, time or

complexity of the process.

284

Doukovska L., Atanassova V., Shahpazov G. and Capkovic F.

InterCriteria Analysis Applied to Various EU Enterprises.

DOI: 10.5220/0005888302840291

In Proceedings of the Fifth International Symposium on Business Modeling and Software Design (BMSD 2015), pages 284-291

ISBN: 978-989-758-111-3

Copyright

c

2015 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

This paper is organized as follows. The basic

mathematical concepts employed in the ICA method

are presented in Section 2. In Section 3, we present

the input data and the results of their processing. We

report of the findings, produced by the algorithm and

formulate our conclusions in the last Section 4.

2 INTERCRITERIA ANALYSIS

METHOD

The building blocks of the presented InterCriteria

Analysis for decision support are the two concepts

of intuitionistic fuzziness and index matrices.

Intuitionistic fuzzy sets defined by Atanassov

(Atanassov, 1983; Atanassov, 1986; Atanassov,

1999; Atanassov, 2012) are one of the most popular

and well investigated extensions of the concept of

fuzzy sets, defined by Zadeh (Zadeh, 1965). Besides

the traditional function of membership µ

A

(x) defined

in fuzzy sets to evaluate the membership of an

element x to the set A with a real number in the

[0; 1]-interval, in intuitionistic fuzzy sets (IFSs) a

second function has been introduced, ν

A

(x) defining

respectively the non-membership of the element x to

the set A, which may coexist with the membership

function. More formally the IFS itself is formally

denoted by:

A = {〈x, µ

A

(x), ν

A

(x)〉 | x ∈ E},

and the following conditions hold:

0 ≤ µ

A

(x) ≤ 1, 0 ≤ ν

A

(x) ≤ 1,

0 ≤ µ

A

(x) + ν

A

(x) ≤ 1.

Multiple relations, operations, modal and

topological operators have been defined over IFS,

showing that IFSs are a non-trivial extension of the

concept of fuzzy sets.

The second concept, on which the proposed

method is based, is the concept of index matrix, a

matrix which features two index sets. The basics of

the theory behind the index matrices is described in

(Atanassov, 1991), and recently developed further

on in (Atanassov, 2014).

In the ICA approach, the raw data for processing

are put within an index matrix M of m rows {O

1

, …,

O

m

} and n columns {C

1

, …, C

n

}, where for every p,

q (1 ≤ p ≤ m, 1 ≤ q ≤ n), O

p

in an evaluated object,

C

q

is an evaluation criterion, and e

O

p

C

q

is the

evaluation of the p-th object against the q-th

criterion, defined as a real number or another object

that is comparable according to relation R with all

the rest elements of the index matrix M.

11 1 1 1

1

1

1

1

1, , , ,

,C , , ,

,, ,,

,, ,,

,

kln

iikilin

jjkjljn

mmjmlmn

kln

OC OC OC OC

i O OC OC OC

jOC OC OC OC

mOC OC OC OC

CC CC

M

Oe e e e

Oe e e e

Oe e e e

Oe e e e

=

KKK

KKK

M MOMOMOM

KKK

M MOMOMOM

KKK

M MOMOMOM

KKK

From the requirement for comparability above, it

follows that for each i, j, k it holds the relation

R(e

O

i

C

k

, e

O

j

C

k

). The relation R has dual relation

R

,

which is true in the cases when relation R is false,

and vice versa.

For the needs of our decision making method,

pairwise comparisons between every two different

criteria are made along all evaluated objects. During

the comparison, it is maintained one counter of the

number of times when the relation R holds, and

another counter for the dual relation.

Let

,kl

S

μ

be the number of cases in which the rel-

ations R(e

O

i

C

k

, e

O

j

C

k

) and R(e

O

i

C

l

, e

O

j

C

l

) are simul-

taneously satisfied. Let also

,kl

S

ν

be the number of

cases in which the relations R(e

O

i

C

k

, e

O

j

C

k

) and its dual

R

(e

O

i

C

l

, e

O

j

C

l

) are simultaneously satisfied. As the total

number of pairwise comparisons between the object is

m(m – 1)/2, it is seen that there hold the inequalities:

,,

(1)

0

2

kl kl

mm

SS

μν

−

≤+≤

.

For every k, l, such that 1 ≤ k ≤ l ≤ m, and for

m ≥ 2 two numbers are defined:

,,

,,

2,2

(1) (1)

kl kl

kl kl

CC CC

SS

mm mm

μν

μν

==

−

−

.

The pair, constructed from these two numbers,

plays the role of the intuitionistic fuzzy evaluation of

the relations that can be established between any two

criteria C

k

and C

l

. In this way the index matrix M

that relates evaluated objects with evaluating criteria

can be transformed to another index matrix M* that

gives the relations among the criteria:

11 11 1 1

11

1

1,C,C ,C,C

,C ,C ,C ,C

*

.

,,

,,

nn

n n nn nn

n

CC C C

nCC CC

CC

M

C

C

μν μν

μν μν

=

K

K

MMOM

K

InterCriteria Analysis Applied to Various EU Enterprises

285

From practical considerations, it has been more

flexible to work with two index matrices M

μ

and M

ν

,

rather than with the index matrix M

*

of IF pairs.

The final step of the algorithm is to determine

the degrees of correlation between the criteria,

depending on the user’s choice of µ and ν. We call

these correlations between the criteria: ‘positive

consonance’, ‘negative consonance’ or ‘dissonance’.

Let α, β ∈ [0; 1] be the threshold values, against

which we compare the values of µ

C

k

,C

l

and ν

C

k

,C

l

. We

call that criteria C

k

and C

l

are in:

• (α, β)-positive consonance, if µ

C

k

,C

l

> α and

ν

C

k

,C

l

< β;

• (α,

β)-negative consonance, if µ

C

k

,C

l

< β

and

ν

C

k

,C

l

> α;

• (α, β)-dissonance, otherwise.

The approach is completely data driven, and each

new application would require taking specific

threshold values α, β that will yield reliable results.

3 DATA PROCESSING

Here we dispose of and analyse the following input

datasets from (Calogirou, et al., 2010):

• The number of enterprises in EU27, by country,

divided to the four categories: Micro, Small,

Medium and Large (p. 16, Table 4)

• The number of persons employed in EU27, by

country, divided to the four categories: Micro,

Small, Medium and Large (p. 18, Table 6)

• The Turnover (millions of €) in the EU27, by

country, divided to the four categories: Micro,

Small, Medium and Large (p. 20, Table 8)

• Value added at factor cost (millions of €), by

country, divided to the four categories: Micro,

Small, Medium and Large (p. 22, Table 10).

These four source datasets we rearrange in a way

to discover for each of the four indicators: ‘Number

of enterprises (NE)’, ‘Number of persons employed

(PE)’, ‘Turnover (TO)’ and ‘Value added at factor

cost (VA)’ what are the correlations between them

in the different scale, given by the type of

enterprises: ‘Micro’, ‘Small’, ‘Medium’ and ‘Large’.

During this processing, we remove both the rows

and the columns titled ‘Total’ and ‘Pct’, and remain

to work only with the data countries by indicators,

that are homogeneous in nature.

In these new 4 processed datasets (Tables 1–4),

for each type of enterprise, we have one index

matrix with 27 rows being the countries in the

EU27, and 4 columns for the four indicators.

The data from Tables 1–4 concerning the micro,

small, medium and large enterprises, have been

analysed using a software application for Inter-

Criteria Analysis, developed by one of the authors,

Mavrov (Mavrov, 2014). The application follows the

algorithm for ICA and produces from the matrix of

27 rows of countries (objects per rows) and 4

indicators (criteria per columns), two new matrices,

containing respectively the membership and the non-

membership parts of the IF pairs that form the IF

positive, negative consonance and dissonance

relations between each pair of criteria, In this case,

the 4 criteria form 6 InterCriteria pairs.

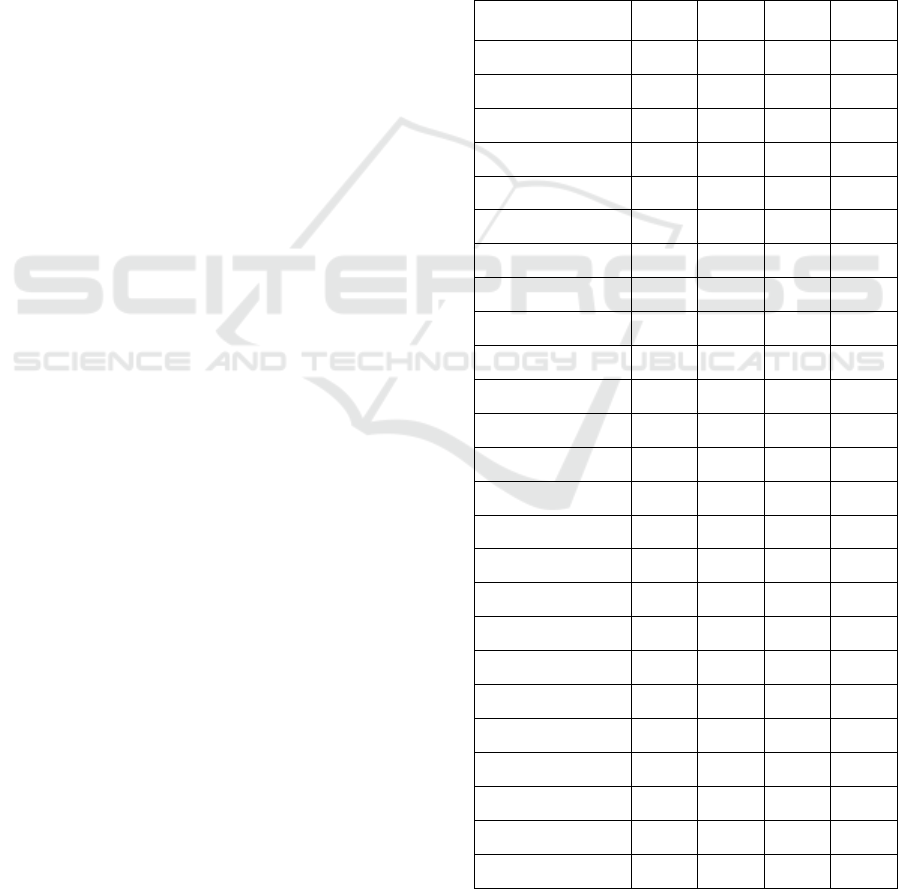

Table 1: Data for the microenterprises in the EU27

countries, as evaluated against 4 criteria (in %).

EU Member NE PE TA VO

Austria

88 25 18 19

Belgium

92 30 21 19

Bulgaria

88 22 20 14

Cyprus

92 39 30 31

Czech Rep.

95 29 18 19

Denmark

87 19 23 28

Estonia

83 20 25 21

Finland

93 24 16 19

France

92 38 19 21

Germany

83 23 12 16

Greece

96 25 35 35

Hungary

94 58 21 18

Ireland

82 35 12 12

Italy

95 20 28 33

Latvia

83 47 23 19

Lithuania

88 23 13 12

Luxembourg

87 19 18 24

Malta

96 22 22 21

Netherlands

90 34 15 20

Poland

96 29 23 18

Portugal

95 39 26 24

Romania

88 42 16 14

Slovakia

76 21 13 13

Slovenia

93 25 20 20

Spain

92 28 23 27

Fifth International Symposium on Business Modeling and Software Design

286

Sweden

94 15 18 20

United Kingdom

87 22 14 18

Table 2: Data for the small enterprises in the EU27

countries, as evaluated against 4 criteria (in %).

EU Member NE PE TA VO

Austria

11 23 23 20

Belgium

7 22 20 20

Bulgaria

9 24 21 18

Cyprus

7 25 29 26

Czech Rep.

4 19 18 16

Denmark

11 22 22 21

Estonia

14 25 29 25

Finland

6 28 14 16

France

6 26 19 19

Germany

14 19 16 18

Greece

3 21 23 20

Hungary

5 17 18 16

Ireland

15 19 20 17

Italy

5 26 23 23

Latvia

14 22 28 27

Lithuania

9 25 24 23

Luxembourg

11 24 24 20

Malta

4 28 22 20

Netherlands

8 20 21 21

Poland

3 21 13 12

Portugal

5 12 23 22

Romania

9 23 21 16

Slovakia

19 20 16 15

Slovenia

6 21 19 19

Spain

7 18 24 24

Sweden

5 18 18 18

United Kingdom

10 18 16 16

Table 3: Data for the medium enterprises in the

EU27 countries, as evaluated against 4 criteria (in %).

EU Member NE PE TA VO

Austria

2 19 22 21

Belgium

1 16 19 19

Bulgaria

2 24 22 21

Cyprus

1 20 24 21

Czech Rep.

1 20 24 20

Denmark

2 19 22 19

Estonia

3 21 28 30

Finland

1 26 18 18

France

1 15 17 16

Germany

2 18 20 19

Greece

0 16 19 17

Hungary

1 12 19 18

Ireland

3 16 25 23

Italy

1 23 20 16

Latvia

3 12 28 28

Lithuania

2 26 27 29

Luxembourg

2 23 17 19

Malta

1 26 26 23

Netherlands

1 20 26 21

Poland

1 17 23 22

Portugal

1 19 22 21

Romania

2 16 21 20

Slovakia

4 23 21 18

Slovenia

1 18 24 21

Spain

1 21 20 17

Sweden

1 23 19 18

United Kingdom

2 15 18 17

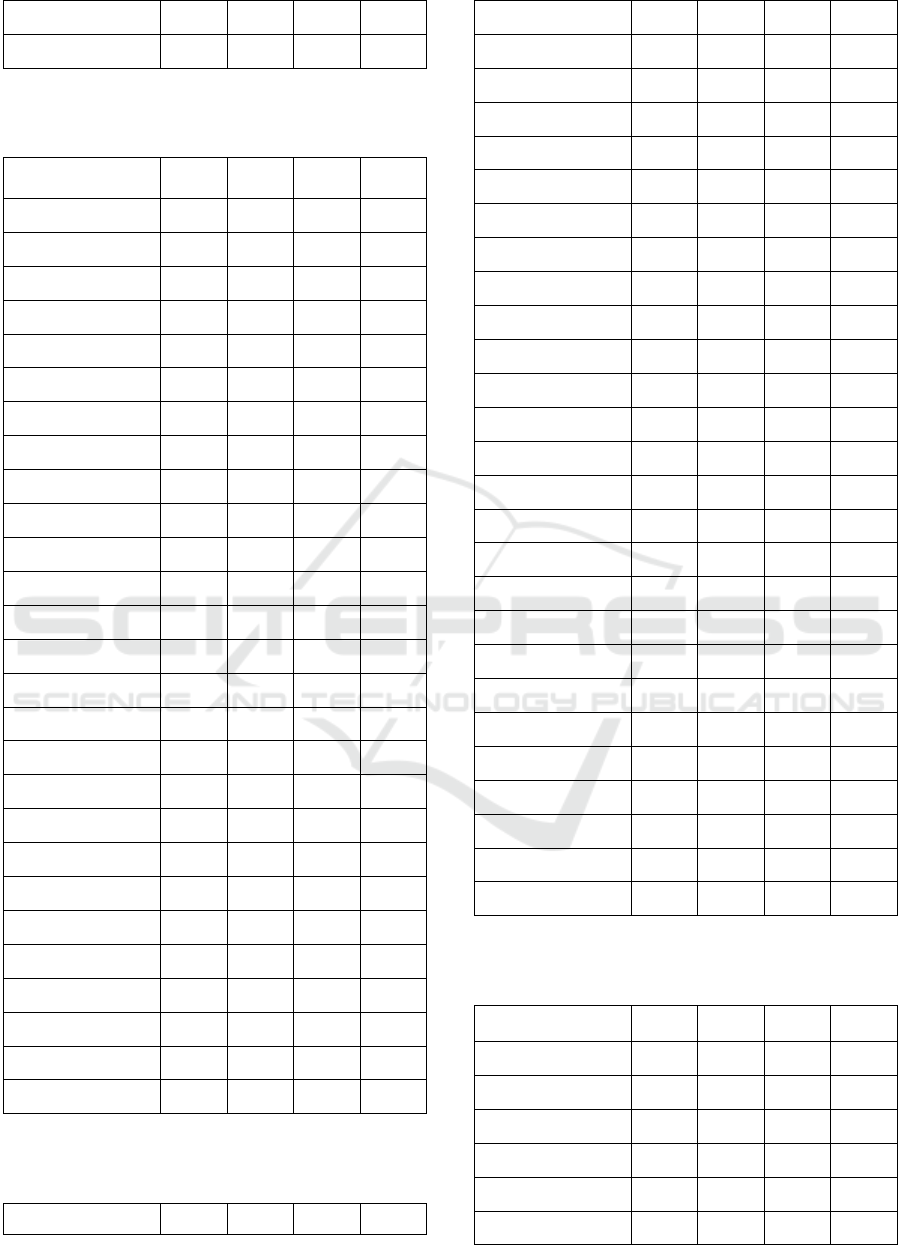

Table 4: Data for the large enterprises in the EU27 countries,

as evaluated against 4 criteria (in %).

EU Member NE PE TA VO

Austria

0.3 33 37 40

Belgium

0.2 33 39 42

Bulgaria

0.3 30 37 46

Cyprus

0.2 17 17 21

Czech Rep.

0.2 32 41 45

Denmark

0.3 40 33 32

InterCriteria Analysis Applied to Various EU Enterprises

287

Estonia

0.4 34 18 24

Finland

0.3 22 52 46

France

0.2 22 44 45

Germany

0.5 41 52 47

Greece

0.1 38 23 28

Hungary

0.2 13 41 48

Ireland

0.5 29 43 48

Italy

0.1 32 29 28

Latvia

0.3 19 20 26

Lithuania

0.3 25 35 36

Luxembourg

0.4 33 42 37

Malta

0.1 24 30 36

Netherlands

0.3 26 38 38

Poland

0.2 33 41 48

Portugal

0.1 31 30 32

Romania

0.4 18 41 50

Slovakia

1.0 36 50 54

Slovenia

0.3 36 37 40

Spain

0.1 33 33 32

Sweden

0.2 44 44 44

United Kingdom

0.4 45 51 49

Because of the diverse nature of the types of

enterprises (micro, small, medium or large enter-

prises), it is expected that these six InterCriteria

pairs will be different depending on which kind of

enterprises are taken into consideration.

Thus, for the micro enterprises, for which are the

data in Table 1, the two index matrices with Inter-

Criteria pairs are respectively given in Table 5, for

the small enterprises the two index matrices are

given in Table 2 – in Table 6, for the medium

enterprises, for which are the data in Table 3, the

two index matrices are given in Table 7, and for the

large enterprises for which are the data are in Table

4, the two index matrices are given in Table 8.

Respectively, the InterCriteria correlation pairs

for small, medium and large enterprises are given in

Tables 5–8. We can immediately note the similar

patterns in the conditional formatting of the eight

tables in Tables 5–8, which are highlighted in a way

to outline the highest possible positive consonances.

Table 5: InterCriteria pairs in micro enterprises.

μ

NE PE TO VA

ν

NE PE TO VA

NE

1.000 0.504 0.621 0.584

NE

0.000 0.396 0.256 0.285

PE

0.504 1.000 0.496 0.413

PE

0.396 0.000 0.425 0.493

TO

0.621 0.496 1.000 0.735

TO

0.256 0.425 0.000 0.160

VA

0.584 0.413 0.735 1.000

VA

0.285 0.493 0.160 0.000

Table 6: InterCriteria pairs in small enterprises.

μ

NE PE TO VA

ν

NE PE TO VA

NE

1.000 0.436 0.533 0.484

NE

0.000 0.447 0.362 0.387

PE

0.436 1.000 0.567 0.527

PE

0.447 0.000 0.319 0.342

TO

0.533 0.567 1.000 0.803

TO

0.362 0.319 0.000 0.077

VA

0.484 0.527 0.803 1.000

VA

0.387 0.342 0.077 0.000

Table 7: InterCriteria pairs in medium enterprises.

μ

NE PE TO VA

ν

NE PE TO VA

NE

1.000 0.316 0.433 0.456

NE

0.000 0.299 0.222 0.182

PE

0.316 1.000 0.516 0.467

PE

0.299 0.000 0.376 0.385

TO

0.433 0.516 1.000 0.781

TO

0.222 0.376 0.000 0.088

VA

0.456 0.467 0.781 1.000

VA

0.182 0.385 0.088 0.000

Table 8: InterCriteria pairs in large enterprises.

μ

NE PE TO VA

ν

NE PE TO VA

NE

1.000 0.453 0.578 0.567

NE

0.000 0.328 0.242 0.248

PE

0.453 1.000 0.527 0.481

PE

0.328 0.000 0.399 0.450

TO

0.578 0.527 1.000 0.829

TO

0.242 0.399 0.000 0.120

VA

0.567 0.481 0.829 1.000

VA

0.248 0.450 0.120 0.000

4 RESULTS AND DISCUSSION

Following a recent idea about analysis of the results

of application of the ICA approach, described in

(Atanassova, 2015), we can interpret the IF pairs,

representing the membership and the non-member-

ship parts of the InterCriteria correlation, as coord-

inates of points in the IF interpretation triangle,

(Atanassov, 1989).

Fifth International Symposium on Business Modeling and Software Design

288

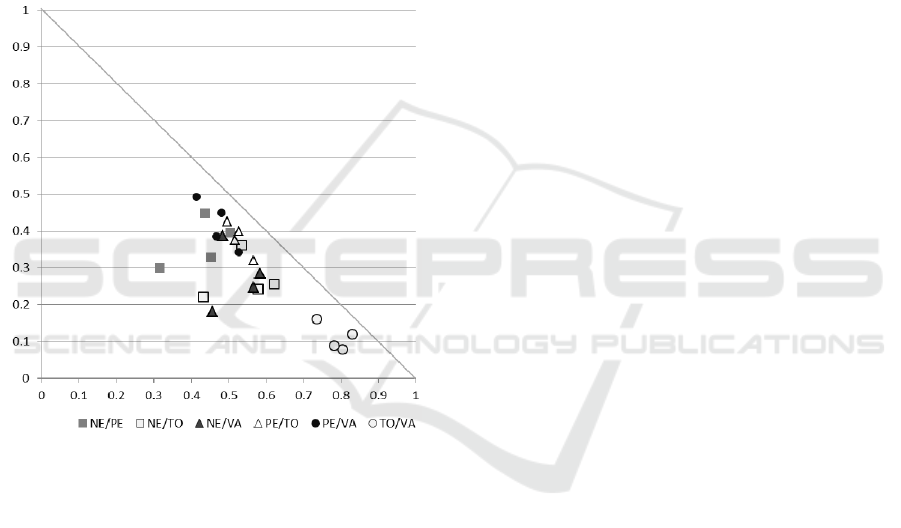

We will note for the interested reader, that

the intuitionistic fuzzy interpretation triangle, see

Figure 1, is the IFS-specific graphical interpretation

of IFSs, which is not available for graphical interpre-

tation of the ordinary fuzzy sets, defined by Zadeh.

The triangle is part of the Euclidean plane, with

vertices the points (0, 0), (1, 0) and (0, 1), staying

respectively for the complete uncertainty, complete

truth and complete falsity as the boundary values

with which elements of an IFS can be evaluated. The

hypotenuse corresponds to the graphical inter-

pretation of the [0, 1]-interval, and points belonging

to it are elements of a classical fuzzy set.

In this interpretation, we can plot the 24 resultant

points onto a single IF triangle: 6 InterCriteria

correlation points for the 4 types of enterprises.

Since we are interested in the highest InterCriteria

correlations, in these terms, it means finding the

points, which are closest to the complete truth in

point (1, 0), which is equivalent to having their

membership parts greater than a given threshold

value

α

, and, simultaneously, their non-membership

parts less than a second threshold value

β

. For each

of the points, i.e. for each of the correlations

between two different criteria C

i

and C

j

, i ≠ j, we

can calculate its distance from the (1, 0) point,

according to the simple formula:

22

,

(1 )

i j ij ij

C C CC CC

d

μν

=− +

The results are given in Table 9, and presented

sorted in ascending order according to the distance.

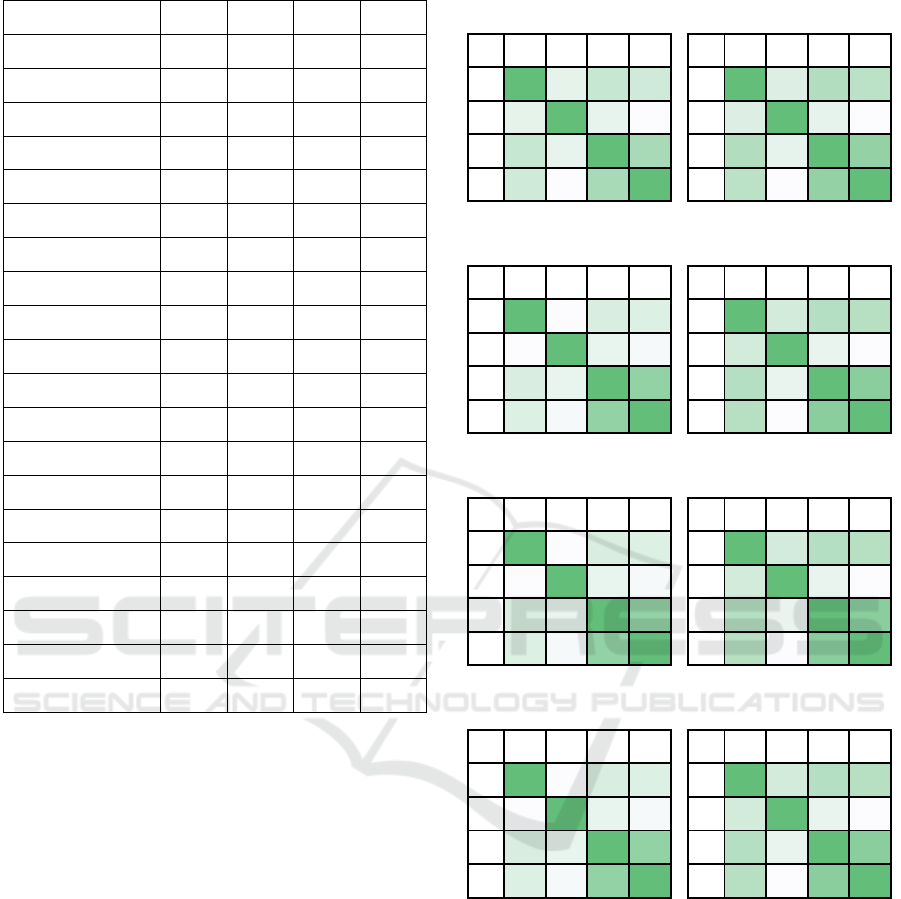

Table 9: Ranking the InterCriteria pairs

by distance to Truth (1, 0).

Enterprise

type

C

i

C

j

μ

CiCj

ν

CiCj

d

CiCj

Large TO VA 0.829 0.120 0.209

Small TO VA 0.803 0.077 0.212

Medium TO VA 0.781 0.088 0.236

Micro TO VA 0.735 0.160 0.310

Micro

N

E TO 0.621 0.256 0.457

Large

N

E TO 0.578 0.242 0.486

Large

N

E VA 0.567 0.248 0.499

Micro

N

E VA 0.584 0.285 0.504

Small PE TO 0.567 0.319 0.538

Medium

N

E VA 0.456 0.182 0.574

Small PE VA 0.527 0.342 0.584

Small

N

E TO 0.533 0.362 0.591

Medium

N

E TO 0.433 0.222 0.609

Medium PE TO 0.516 0.376 0.613

Large PE TO 0.527 0.399 0.619

Micro

N

E PE 0.504 0.396 0.635

Large

N

E PE 0.453 0.328 0.638

Small

N

E VA 0.484 0.387 0.645

Medium PE VA 0.467 0.385 0.658

Micro PE TO 0.496 0.425 0.659

Large PE VA 0.481 0.450 0.687

Small

N

E PE 0.436 0.447 0.720

Medium

N

E PE 0.316 0.299 0.746

Micro PE VA 0.413 0.493 0.767

We can, then, make two rounds of discussions.

On one hand, see Figure 1, we can seek and for-

mulate some assumptions about the InterCriteria

correlations with respect to the type of enterprise.

Figure 1: ICA results with respect

to the type of enterprise.

We can notice from here that micro and small

enterprises exhibit very similar patterns of Inter-

Criteria consonance, with all the InterCriteria pairs

exhibiting relatively low levels of uncertainty, and

only the pair TO/VA exhibiting relatively high

positive consonances. The same pair ranges highest

among the InterCriteria correlations with the other

two types of enterprises, medium and large. The

large type of enterprises also exhibits relatively low

uncertainty in the InterCriteria correlations, being

lowest with TO/VA, PE/TO and PE/VA, and highest

uncertainty featured in the rest three of the pairs.

Expectedly, the most scattered is the pattern with the

InterCriteria Analysis Applied to Various EU Enterprises

289

medium type of enterprises, where also the largest

uncertainty is observed, all in the pairs containing

the number of enterprises: NE/PE, NE/TO and

NE/VA.

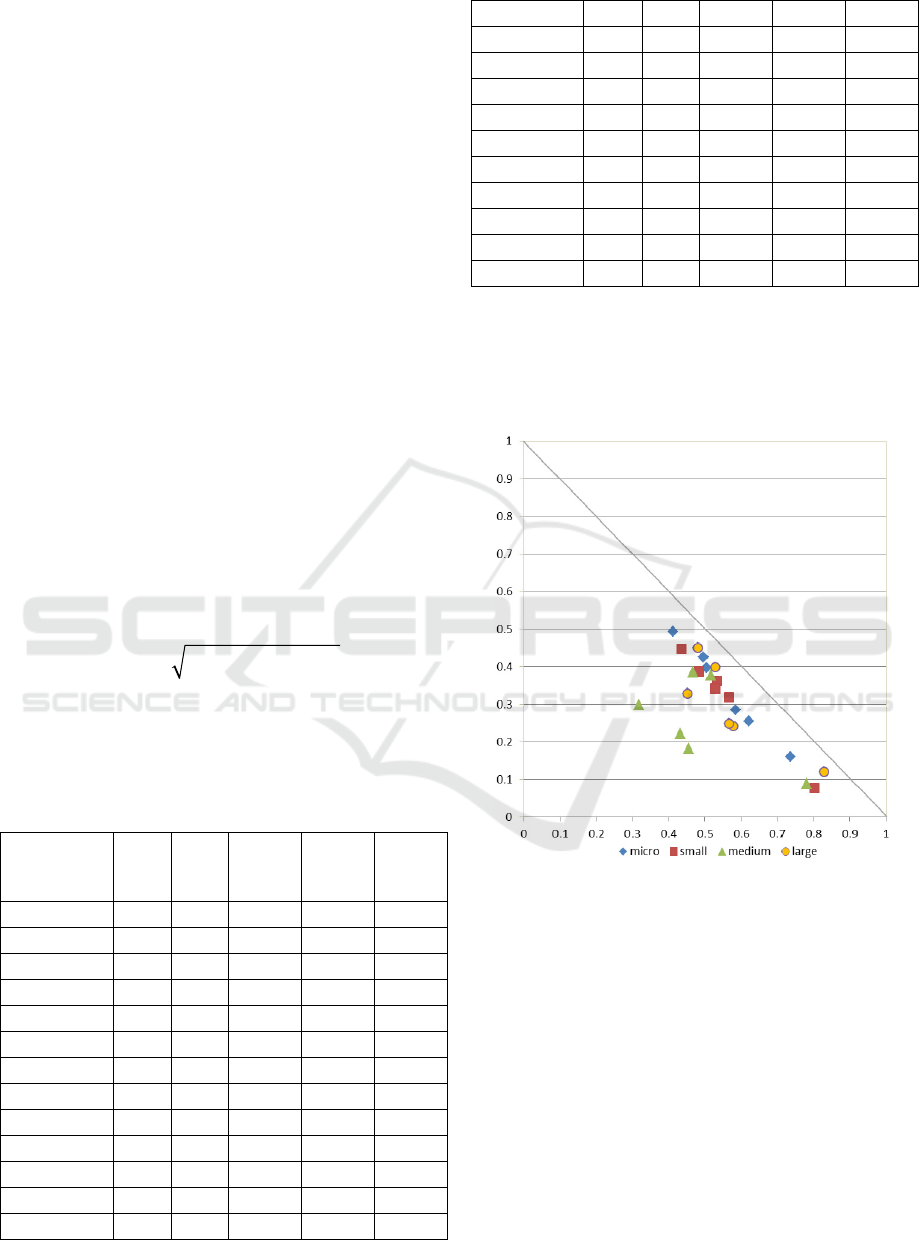

On the other hand, it is considered appropriate

to analyse these 24 points as 6 groups of 4 points,

grouped according to the criteria in the pair

(Figure 2). We can then make some assumptions

about the nature of these correlations, judging from

how concentrated or how scattered the four points in

each group are: the more concentrated the points for

a given InterCriteria pair, the more consistent beha-

viour of this pair across the different scales of

economic entities.

Figure 2: ICA results with respect

to correlations between economic indicators.

We will immediately note what was visible from

the Table 9, that that the pair of criteria TO/VA are

distinctly best correlating across the different scales

of economic entities, concentrated in the closest

proximity to the absolute truth represented by the

(1, 0) point. It is interesting however to note other,

less clearly seen relations. For instance, we can note

that quite similar patterns are formed for the two

four-point sets corresponding to the pairs of criteria

PE/VA and PE/TO: relatively parallel and closely

located to the hypothenuse. In both these pairs, the

distances from the (1, 0) point, according to the type

of enterprise, follow in decreasing order the se-

quence: ‘small’ – ‘medium’ – ‘large’ – ‘micro’, with

medium and large enterprises exhibiting very close

results. Quite similar and closely located to each

other are also the patterns for the pairs of criteria

NE/TO and NE/VA.

These three observations over these particular

economic data lead us to the speculation that from

theoretical point of view it would be interesting to

pay attention to situations when we have two criteria

C

i

, C

j

that exhibit high positive consonance with

each other, and each of them exhibit similar or

identical consonance patterns in the pairs C

i

–C

k

and

C

j

–C

k

, or vice versa, if C

i

–C

k

and C

j

–C

k

are two pairs

of criteria with high positive consonances, would

there be high positive consonance in the pair C

i

–C

j

.

This question would be worth exploring in the light

of the possibility to detect, using ICA not just pairs

of correlating criteria, but also triplets, etc.

5 CONCLUSION

The present research analysed data about the micro,

small, medium and large economic entities in the

EU27, as evaluated against four economic indicators

(criteria). The utilised method for analysis of the

datasets was the novel decision support approach,

called InterCriteria Analysis. The results are two-

fold: they outline correlations between economic in-

dicators on these four levels of economic enterprise,

new thus potentially brining new knowledge and

understanding, and also contribute to elaboration of

certain aspects of the methodology of ICA.

ACKNOWLEDGEMENTS

The research work reported in the paper is partly

supported by the project AComIn “Advanced

Computing for Innovation”, Grant №316087, funded

by the FP7 Capacity Programme (Research Potential

of Convergence Regions) and partly supported under

the Project № DFNI-I-02-5/2014 “InterCriteria

Analysis – A New Method for Decision Making”.

REFERENCES

Atanassov K. (1983). Intuitionistic fuzzy sets, VII

ITKR's Session, Sofia, June 1983 (in Bulgarian).

Atanassov K. (1986). Intuitionistic fuzzy sets. Fuzzy

Sets and Systems. vol. 20 (1), pp. 87–96.

Atanassov K. (1989). Geometrical interpretations of

the elements of the intuitionistic fuzzy objects.

Pre-print IM-MFAIS-1-89, Sofia.

Fifth International Symposium on Business Modeling and Software Design

290

Atanassov K. (1991). Generalized nets. World

Scientific, Singapore.

Atanassov K. (1999). Intuitionistic Fuzzy Sets: The-

ory and Applications. Springer Physica-Verlag,

Heidelberg.

Atanassov K. (2012). On Intuitionistic Fuzzy Sets

Theory. Springer, Berlin.

Atanassov K. (2014). Index Matrices: Towards an

Augmented Matrix Calculus. Springer, Cham.

Atanassov K., D. Mavrov, V. Atanassova (2014).

InterCriteria decision making. A new approach

for multicriteria decision making, based on index

matrices and intuitionistic fuzzy sets. In: Issues

in Intuitionistic Fuzzy Sets and Generalized

Nets, vol. 11, pp. 1–8.

Atanassova V. (2015). Interpretation in the Intui-

tionistic Fuzzy Triangle of the Results, Obtained

by the InterCriteria Analysis, IFSA-EUSFLAT

Conference, 29 June – 3 July 2015, Gijon, Spain

(to appear).

Atanassova V., L. Doukovska, K. Atanassov, D.

Mavrov (2014). InterCriteria Decision Making

Approach to EU Member States Competitiveness

Analysis. Proc. of 4th International Symposium

on Business Modeling and Software Design, 24–

26 June 2014, Luxembourg, pp. 289–294.

Atanassova V., D. Mavrov, L. Doukovska, K.

Atanassov (2014). Discussion on the threshold

values in the InterCriteria Decision Making

approach. Notes on Intuitionistic Fuzzy Sets, vol.

20 (2), pp. 94–99.

InterCriteria Research Portal,

http://www.intercriteria.net/publications.

Calogirou C., S. Y. Sørensen, P. B. Larsen, S.

Alexopoulou, et al. (2010). SMEs and the

environment in the European Union, PLANET

SA and Danish Technological Institute, Pub-

lished by European Commission, DG Enterprise

and Industry.

InterCriteria Analysis Applied to Various EU Enterprises

291