Simplified Business Information

A Technical Position in Accounting and Taxation

Fátima David

1

, Rute Abreu

1

and Francisco Carreira

2

1

Polytechnic Institute of Guarda, Av. Dr. Francisco Sá Carneiro, 50, 6300-559 Guarda, Portugal

2

Polytechnic Institute of Setúbal, Campus do IPS, Estefanilha, 2914-503 Setúbal, Portugal

Keywords: Simplified Business Information, Accounting, Taxation.

Abstract: This paper is focused on Simplified Business Information (SBI) – “Informação Empresarial Simplificada”

(IES), hereinafter IES, in the accounting and taxation context. IES is a new way for firms to deliver business

information online to public services, by using a totally dematerialized procedure. The theoretical

framework of this paper is based on accounting and taxation information that evaluate the impact of the

online submission of the IES files, since firms fulfil, at once, four different obligations: 1) Deposit of annual

accounts in the Commercial Registry of the Ministry of Justice; 2) Delivery of annual fiscal declaration to

the Ministry of Finances and Public Administration; 3) Delivery of annual information to National Statistics

Institute for statistical purposes; and 4) Delivery of information to the Portuguese Central Bank. Thus, the

paper attempts to provide an understanding the adoption of the dematerialized procedure, because the

increasing of a firm’s activity and changes in its accounting and taxation environment require new attitudes

of disclosure information, as a key factor that negatively and positively influences the accounting and

taxation regime, particularly on Portugal.

1 INTRODUCTION

The Simplified Business Information (IES) system

was thus set up via Decree-Law nº 8/2007 of

January 17 (MJ, 2008). As the authors consider the

IES system as an example of good practice within

the European Statistical System, this paper attempts

to provide an understanding the adoption of the

dematerialized procedure, because the increasing of

a firm’s activity and changes in its accounting and

taxation environment require new attitudes of

disclosure information, as a key factor that

negatively and positively influences the accounting

and taxation regime, particularly on Portugal.

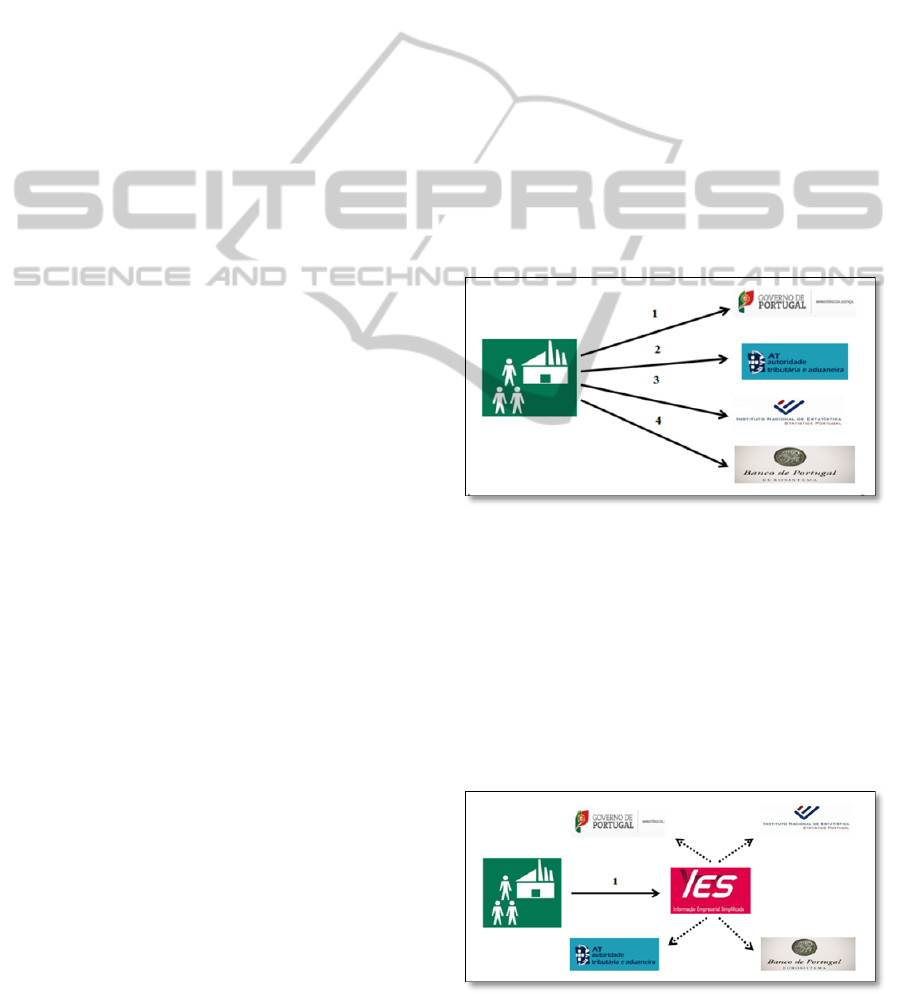

IES is a new way for firms to deliver business

information online to public services, until the end

of June or of the sixth month subsequente to the tax

year end (for firms with a tax year diferente from the

calendar year), by using a totally dematerialized

procedure, since firms fulfil, at once, four different

obligations: 1) Deposit of annual accounts in the

Commercial Registry of the Ministry of Justice; 2)

Delivery of annual fiscal declaration to the Ministry

of Finances and Public Administration; 3) Delivery

of annual information to National Statistics Institute

for statistical purposes; and 4) Delivery of

information to the Portuguese Central Bank.

The literature of the information systems

recommends that this system must exploit the new

Information and Communication Technologies for

competitive advantages of firms, develop new

architectures and creative environments of the

accounting and taxation information, exploit direct

and indirect management resources and align the

investments and costs with the business goals (Earl,

1993; Porter, 2001; Chen et al, 2010).

The structure of the paper is organized as

follows. Section 2 gives an overview of the

Portuguese regulation of the Simplified Business

Information. Section 3 argues the accounting and

taxation information disclosure through the

dematerialized procedure. Finally, the section 4

presents the conclusions and makes some

recommendations.

2 IES REGULATION

The tax system in Portugal is administered by the

Portuguese Tax Authority (Autoridade Tributária e

502

David F., Abreu R. and Carreira F..

Simplified Business Information - A Technical Position in Accounting and Taxation.

DOI: 10.5220/0004973705020507

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 502-507

ISBN: 978-989-758-029-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

Aduaneira) and usually the Portuguese tax year

follows the calendar year, closing 31 December.

A brief overview of the Portuguese tax system

shows: direct and indirect taxes with the major

emphasis on those relating to business (Corporate

Income tax (IRC); Personal Income tax (IRS); taxes

on Assets (IMI and IMT); taxes on Expenditure

(VAT, IEC, ISV); Stamp Tax; and the Tax Benefits

(AICEP, 2012).

In this context appears the Simplified Business

Information (IES) system that includes information

about the follows taxes: Corporate Income tax

(IRC); Personal Income tax (IRS); tax on consumer

spending, i.e., Value Added Tax (VAT); and Stamp

Tax.

According AICEP (2012), the Corporate Income

tax (IRC) is, among other things: charged on an

undertaking’s income and not on its assets; direct

because it is charged on the basis of a direct

statement of capacity to pay; periodic because as a

rule tax is payable annually, for successive tax

periods; proportional because the rate is constant,

irrespective of the value of the taxable income;

general because it affects all income obtained by

corporates. The Corporate Income Tax Code (CIRC)

was approved by Decree-Law nº 442-B/88 of 30

November (MF, 1988b) and entered into force on 1

January 1989.

The Personal Income tax (IRS) is based on

constitutional principle that tax must be progressive

(article 104 of the Constitution of the Republic of

Portugal), with the object of reducing social

inequality. IRS is payable on the annual total value

of all personal income, irrespective of source, form

and place of realisation. The tax base is calculated

by adding together the gross income in each one of

the 6 categories: paid employment income (A);

business and professional income (B); capital

income (E); real property income (F); asset income

and capital gains (G); and pensions (H). The Code of

Personal Income Tax (CIRS) approved by Decree-

Law nº 442-B/88 of 30 November (MF, 1988a) and

entered into force on 1 January 1989.

The Value Added Tax (VAT), approved by

Decree-Law nº 394-B/84 of 26 December (MFP,

1984) and entered into force on 1 January 1986, is a

general tax on consumption (becoming payable

every time an article of merchandise or a service is

supplied), in multi-phase form, as it is paid at all

points on the economic circuit without cumulative

effects.

The Stamp Tax is an indirect tax whose legal

basis is the Stamp Duty Code approved by Law nº

150/99 of 11 September (AR, 1999). This tax is

payable on all deeds, contracts, documents,

securities, paper and other acts in the law specified

in the General Table, including transfers of goods

and property without valuable consideration.

Following this, IES is the electronic submission

of information of accounting, fiscal and statistical

natures that firms have usually to remit to the

Ministry of Justice, the Ministry of Finances and

Public Administration, National Statistics Institute

and the Portuguese Central Bank, having the

advantage of simplifying the reporting process of

firms to different entities by concentrating all reports

in just one (KPMG, 2009). As a consequence, these

institutions are no longer allowed to directly request

the annual data included in IES.

IES is regulated by several legislation that

beginning with the approval of the Decree-Law nº

8/2007 of January 17 (MJ, 2008) allows firms to

fulfil four reporting obligations, to four distinct

public entities, through one single electronic

submission and at one moment in time.

To meet this challenge, Executive Order nº

562/2007 of 30 April (MJ, 2007), that amends

Executive Orders nº 657-A/2006 of 29 June (MJ,

2006a) and nº 1416-A/2006 of 19 December (MJ,

2006b), establishes the terms and charges for the

automated register and electronic reporting of

accounts under the simplified business information,

and regulating access to the annual account

database.

So, are subject to deliver the IES: commercial

companies; civil law companies having a

commercial form; limited companies; public entities;

companies established abroad and representation

permanently in Portugal (in these cases the accounts

relating to the present permanent representation

itself and not to the foreign company); individual

establishments with limited liability; associations;

foundations; sole traders; and cooperatives.

On one side, Executive Order nº 499/2007 of 30

April (PCM, 2007), amended Executive Order nº

245/2008 of 27 March (PCM, 2008), institutes the

rules on the reporting of simplified business

information by electronic means.

On the other hand, the forms for the annexes to

the statement on IES were approved by Executive

Order nº 208/2007 of 16 February (MFAP, 2007a),

amended Executive Orders nº 8/2008 of 3 January

(MFAP, 2008), nº 333-B/2009 of 1 April (MFAP,

2009a), nº 64-A/2011 of 3 February (MFAP, 2011a)

and nº 26/2012 of 27 January (MFAP, 2012).

The actualization of news forms for the IES

annexes is a result of legislative changes introduced

in under the tax code, such as the CIRS and CIRC.

SimplifiedBusinessInformation-ATechnicalPositioninAccountingandTaxation

503

Specifically, this last law has been subjected to

multiple amendments since it was first published

being the Decree-Law nº 159/2009 of 13 July

(MFAP, 2009c) the last one, that adapted the CIRC

to the international accounting rules adopted by the

European Union and the new national Accounting

Harmonisation System (AHS) – “Sistema de

Normalização Contabilística” (SNC) approved by

Decree-Law nº 158/2009 of July 13 (MFAP, 2009b).

More recently, the Law nº 35/2010 of 2

September (AR, 2010), institutes a special simplified

regime of accounting standards and information

applicable to micro entities. And the Decree–Law nº

36-A/2011 of 9 March (MFAP, 2011b), approves the

accounting standard regime for micro entities and

non-profit sector entities and implements certain

disclosure requirements for medium-sized

companies and also regarding the obligation to

prepare consolidated accounts.

The conceptual framework of the accounting and

taxation normative suggest that a significant

improvement exists actually, in relation to the

international comparability of practices as well as in

relation to the largest level of purification of the

concepts used in the accounting and taxation system

(David & Gallego, 2007). According to Regulation

(EC) nº 1606/2002 of 19 July 2002 (EC, 2002), the

EU member states altered its understanding of the

accounting system and consequently of the fiscal

system, with the main objective of satisfy the users’

needs, for opposition to the preparation and

presentation of the annual accounts to Fiscal

Administration.

3 INFORMATION DISCLOSURE

According to Nabais (2010), the taxpayer in addition

to accounting practice that allows you to make the

financial and economic analysis must also have tax

purposes. So, in this context, the taxpayer has to

submit the financial statement and taxation

information.

Simplified Business Information (IES) represents

a concrete measure to simplify reporting and, thus,

to reduce firms’ reporting burden in the context of

their annual accounts’ disclosing obligations. From

the viewpoint of the Portuguese Central Bank, the

success of IES is due to the excellent institutional

cooperation among the public entities involved in

this initiative (BdP, 2008).

Neves (2008) states that the success of the IES

system is centred on: political support as the key;

entities actively involved; involvement of the

enterprises; statistics Portugal commitment not

collect data more than once; and data quality was

improved.

IES makes it simpler for firms and public entities

receiving the data. In the past, firms were obliged to

remit nearly the same information about their annual

accounts to four different public entities in four

different moments in time and according to four

different formats (see Fig. 1):

the legal deposit of accounts, on paper, was to be

provided to the commercial registers of the

Ministry of Justice;

the annual declaration on accounting and

taxation data had to be sent, electronically, to the

Ministry of Finances and Public Administration;

statistical information derived from accounting

data for a subset of firms had to be reported to

National Statistics Institute of Portugal; and

statistical information derived from accounting

data for a subset of firms had to be submitted to

the Portuguese Central Bank.

Figure 1: Reporting before IES implementation.

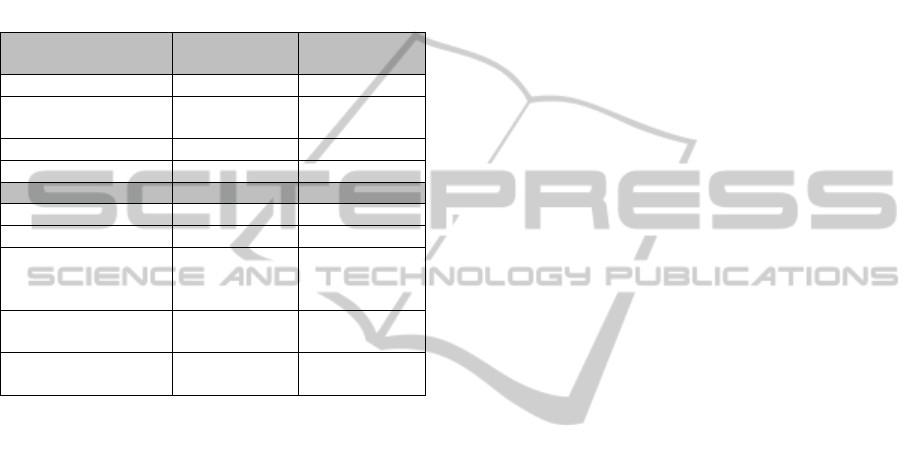

In the present, all the firms’ information has to

provide about their annual accounts is submitted just

once, in a single electronic form (see Fig. 2). At the

same time, public entities may have access to a

complete set of duly certified business information

concerning all firms (BdP, 2008). As a result, overall

social costs are reduced and a better knowledge of

the situation of firms and economic and financial

context is made available.

Figure 2: Reporting after IES implementation.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

504

The areas that most benefit with this new system

were the production of statistics and the legal

deposit of accounts. Indeed, all firms (mainly non-

financial firms) are now covered and superior data

quality is achieved, while with the deposit of

accounts, the number of firms registered increased

strongly. Table 1 based on BdP (2008) database

summarizes the main advantages of IES for the

Portuguese Central Bank and the Ministry of Justice.

Table 1: Situation before and after IES implementation.

Portuguese Central

Bank

Before After

Firms (adherence) 5% 100%

Formats Mostly

automatic

T

otally automatic

Timeliness 10/12 months 6 months

Level of detail + 600 items + 1800 items

Ministry of Justice Before After

Firms (adherence) 23% 100%

Formats Totally manual

T

otally automatic

Points of access 312

commercial

registry offices

Annual accounts

database - onlin

e

Monitoring Practically

impossible

100% possible

System One of the most

old-fashioned

One of the

most advanced

Following this, agreeing with BdP (2008), with the

IES system are expected improvements in what

concerns the production of statistics, specifically:

an accurate knowledge of the economic and

financial situation of non-financial firms, given

that a comprehensive set of information for all

existing firms will be gathered through the new

system;

the information obtained can be used to increase

the quality of existing statistics. For example, by

cross-checking IES individual data with data

resident in already existing databases;

IES can be used as a basis for defining the

reporting population in specific surveys, and

contribute to the extrapolation of certain

phenomena;

the production of “final” statistics can be

performed directly, especially because the total

population reports.

With this information, the State will create a

database that will allow later to any duly registered

user, request a certificate with the desired

information (Lemos, 2007). This measure, as well as

making the simplification of the acts of business

registration and related deeds, and the

dematerialization of documents and tax procedures,

and initiatives such as the “Empresa na Hora”, is

part of the Simplex Programme, introduced in

March 2006 by the Government through the use of

new information technologies (MFAP, 2007).

For the different services of the public

administration with responsibility on IES system the

advantages are reducing the burden associated with

purely bureaucratic tasks and release of human and

material resources for other activities, as well as the

possibility of statistical information now concerns

the universality enterprises, which will allow an

analysis closer to the national economy.

In general, with the generalization of the IES

system, the Portuguese economy is more

competitive because it becomes more transparent

and there is more information on the Portuguese

market, as well as the information to investors

becomes more present, because it is available for

consultation soon and the statistical information on

the accounts shall cover all Portuguese companies,

which allows a more accurate and complete picture

of the national economy for investors.

4 CONCLUSIONS

The authors agree with Treacy et al. (2008), who

consider the Simplified Business Information system

as a good example of innovation and coordination in

the European Statistical System, in general, and in

the Portuguese Statistical System, in particular,

reducing response burden while improving the

coverage of structural business statistics.

The Simplified Business Information are not

welcomed, enthusiastically, despite the benefits it

brings, because it concentrates information about

several areas: accounting, taxation and corporate

governance, improve the tax services and the

accountant work productivity, allow to plan the

taxation of each firm and oblige to communicate this

to the Autoridade Triburária e Aduaneira, decrease

the tax evasion and the reduction of bureaucracy.

Despite, all the advantages and disadvantages,

the technical position in accounting and taxation of

the SBI oblige the accountant to become

increasingly specialised and his strategic

involvement well beyond numbers to truly provide

consultancy services for all the options that could be

made in this information document. Indeed, with this

document is possible to produce a corporate finance

report, corporate recovery or insolvency process,

forensic and litigation activities.

The impact of technology is becoming

increasingly evident that the traditional taxation

SimplifiedBusinessInformation-ATechnicalPositioninAccountingandTaxation

505

work undertaken by accountants because the

Simplified Business Information demands

professional skills and competences on the new

Information and Communication Technologies.

The main advantages of IES adoption for firms

are presenting in a single moment accounting data

for taxes, legal and statistical purposes, giving

political support for better coordination among

institutions; no increase of burden financing and

insurance enterprises; accountants could provide all

data from their systems once the Software was

adapted.

In conclusion, although the IES does not aim the

payment of taxes, since the only tax obligation is the

delivery of the Annual Statement, it came facilitate

and reduce the costs of compliance with legal

obligations of firms as well as improves financial

analysis and system supervision by public entities.

ACKNOWLEDGEMENTS

The authors wish to thank José Ángel López Pérez

of Universidad de Seville (Spain). Also, the current

version is a publication supported by the Project

PEst-OE/EGE/UI4056/2014a UDI/IPG, finance by

the Fundação para a Ciência e Tecnologia. Ideas

expressed in the article are those of the authors and

should not be attributed to any organization.

REFERENCES

Agência para o Investimento e Comércio Externo de

Portugal (AICEP, 2012). Portuguese Tax System.

Lisboa: AICEP.

Assembleia da República (AR, 1999). Lei nº 150/99,

aprova o o Código do Imposto do Selo. Diário da

República, 213, I Série, 11/09: 6264-6275.

Assembleia da República (AR, 2010). Lei nº 35/2010,

aprovou a simplificação das normas e informações

contabilísticas das microentidades. Diário da

República, 171, I série, 02/09: 3857.

Banco de Portugal (BdP, 2008). Simplified Reporting:

inclusion of IES in the Statistics on Non-Financial

Corporations from the Central Balance-Sheet

Database. Statistical Bulletin, Supplement 1 (May): 1-

45.

Chen, D., Mocker, M., Preston, D. e Teubner, A. (2010).

Information systems strategy: reconceptualization,

measurement, and implications. MIS Quarterly, 34 (2),

233-259.

David, F., Gallego, I. (2007). Corporate Income Tax: A

European Context. Estudos e Documentos de Trabalho

da Escola Superior de Tecnologia e Gestão da

Guarda, 6 (2): 1-15.

Earl, M. (1993). Experiences in strategic information

systems planning. MIS Quarterly, 17 (1), 1-24.

European Community (EC, 2002). Regulation (EC) nº

1606/2002 of the European Parliament and of the

Council of 19 July 2002 on the application of

international accounting standards. Official Journal, L

243, 11/09: 1-4.

KPMG (2009). Tax Guide Portugal 2009. Lisboa: KPMG

& Associados.

Lemos, S. (2007). A Informação Empresarial Simplificada

(IES). NewsLetter RVR, 1 (Abril): 1-2.

Ministério da Justiça (MJ, 2006a). Portaria n.º 657-

A/2006, regula o regime da promoção electrónica de

actos de registo comercial e cria a certidão

permanente. Diário da República, 242, I Serie, 2º

Suplemento, 19/12: 8500-(38)-8500-(42).

Ministério da Justiça (MJ, 2006b). Portaria n.º 1416-

A/2006, aprova o Regulamento do Registo Comercial.

Diário da República, 124, I-B Serie, Suplemento,

29/06: 4632(2)-4632(6).

Ministério da Justiça (MJ, 2007). Portaria n.º 562/2007,

altera as Portarias n.º 657-A/2006, de 29 de Junho, e

1416-A/2006, de 19 de Dezembro, fixando os termos e

a taxa devida pelo registo automático e electrónico da

prestação de contas, no âmbito da IES e regulando o

acesso à base de dados das contas anuais. Diário da

República, 83, I Serie, 30/04: 2918-2921.

Ministério da Justiça (MJ, 2008). Decreto-Lei nº 8/2007,

cria a Informação Empresarial Simplificada (IES).

Diário da República, 12, I Serie, 17/01: 378-388.

Ministério das Finanças (MF, 1988a). Decreto-Lei n.º 442-

A/88, aprova o Código do Imposto sobre o

Rendimento das Pessoas Singulares (IRS). Diário da

República, 277, I Série, 2º Suplemento, 30/11:

4754(2)-4754(35).

Ministério das Finanças (MF, 1988b). Decreto-Lei n.º

442-B/88, aprova o Código do Imposto sobre o

Rendimento das Pessoas Colectivas (IRC). Diário da

República, 277, I Série, 2º Suplemento, 30/11:

4754(38)-4754(71).

Ministério das Finanças (MF, 2012). Portaria nº 26/2012,

aprova os novos modelos de impressos relativos a

anexos que fazem parte integrante do modelo da IES.

Diário da República, 20, I Série, 27/01: 492-493.

Ministério das Finanças e da Administração Pública

(MFAP, 2007a). Portaria n.º 208/2007, aprova o

modelo declarativo da IES e respectivos anexos.

Diário da República, 34, I Série, 16/02: 1192-1221.

Ministério das Finanças e da Administração Pública

(MFAP, 2007b). Stability and Growth Programme

2007-2011. Lisboa: MFAP.

Ministério das Finanças e da Administração Pública

(MFAP, 2008). Portaria n.º 8/2008, aprova os novos

modelos de impressos relativos a anexos que fazem

parte integrante do modelo declarativo da IES. Diário

da República, 2, I Série, 03/01: 66-82.

Ministério das Finanças e da Administração Pública

(MFAP, 2009a). Portaria n.º 333-B/2009, aprova os

novos modelos de impressos relativos a anexos que

fazem parte integrante do modelo declarativo da IES.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

506

Diário da República, 64, I Série, 01/04: 2040(2)-

2040(16).

Ministério das Finanças e da Administração Pública

(MFAP, 2009b). Decreto-Lei n.º 158/2009, aprova o

Sistema de Normalização Contabilística e revoga o

Plano Oficial de Contabilidade. Diário da República,

133, I Série, 13/07: 4375-4384.

Ministério das Finanças e da Administração Pública

(MFAP, 2009c). Decreto-Lei n.º 159/2009, no uso da

autorização legislativa concedida pelos n.º 1 e 2 do

artigo 74.º da Lei n.º 64-A/2008, de 31 de Dezembro,

altera o Código do IRC, adaptando as regras de

determinação do lucro tributável às normas

internacionais de contabilidade tal como adoptadas

pela União Europeia, bem como aos normativos

contabilísticos nacionais que visam adaptar a

contabilidade a essas normas. Diário da República,

133, I Série, 13/07: 4384-4448.

Ministério das Finanças e da Administração Pública

(MFAP, 2011a). Portaria n.º 64-A/2011, aprova os

novos modelos de impressos relativos a anexos que

fazem parte integrante do modelo da IES. Diário da

República, 24, I Série, 03/02: 674(2)-674(30).

Ministério das Finanças e da Administração Pública

(MFAP, 2011b). Decreto-Lei n.º 36-A/2011, aprova o

regime simplificado para as microentidades que a Lei

n.º 35/2010 instituiu. Diário da República, 48, I Série,

09/03: 1344(2)-1344(11).

Ministério das Finanças e do Plano (MFP, 1984). Decreto-

Lei n.º 394-B/84, aprova o Código do Imposto sobre o

Valor Acrescentado (IVA). Diário da República, 297,

I Série, 1º Suplemento, 26/12: 3924(12)-3924(44).

Nabais, C. (2010). Prática Contabilística. Lisboa: Lidel.

Neves, C. (2008). Simplified Business Information:

Improving quality by using administrative data in

Portugal. Lisboa: INE.

Porter, M.E. (2001). Strategy in the Internet. Harvard

Business Review, march, 62-78.

Presidência do Conselho de Ministros (PCM, 2007).

Portaria n.º 499/2007, estabelece as normas relativas

ao envio da IES por transmissão electrónica de dados.

Diário da República, 83, I Série, 30/04: 2798-2799.

Presidência do Conselho de Ministros (PCM, 2008).

Portaria n.º 245/2008, altera a Portaria n.º 499/2007,

de 30 de Abril, que estabelece as normas relativas ao

envio da IES por transmissão electrónica de dados.

Diário da República, 61, I Série, 27/03: 1769.

Treacy, J., Diaz Muñoz, P.. Holzer, W. (2008). Peer

review on the implementation of the European

Statistics Code of Practice. Lisboa: INE.

SimplifiedBusinessInformation-ATechnicalPositioninAccountingandTaxation

507