Useful Pattern Mining on Time Series

Applications in the Stock Market

Nikitas Goumatianos

1,2

, Ioannis T. Christou

1

and Peter Lindgren

2

1

Athens Information Technology, 19km Markopoulou Ave. PO Box 68, Paiania, Greece

2

Aalborg University, Fibigerstræde 16, Aalborg, DK-9220, Denmark

Keywords: Pattern Mining, Stock Market, Trading Systems, Time-series Forecasting, Distributed Computing,

Databases.

Abstract: We present the architecture of a “useful pattern” mining system that is capable of detecting thousands of

different candlestick sequence patterns at the tick or any higher granularity levels. The system architecture

is highly distributed and performs most of its highly compute-intensive aggregation calculations as complex

but efficient distributed SQL queries on the relational databases that store the time-series. We present initial

results from mining all frequent candlestick sequences with the characteristic property that when they occur

then, with an average at least 60% probability, they signal a 2% or higher increase (or, alternatively,

decrease) in a chosen property of the stock (e.g. close-value) within a given time-window (e.g. 5 days).

Initial results from a first prototype implementation of the architecture show that after training on a large set

of stocks, the system is capable of finding a significant number of candlestick sequences whose output

signals (measured against an unseen set of stocks) have predictive accuracy which varies between 60% and

95% depended on the type of pattern.

1 INTRODUCTION

Stock market prediction has long been an attractive

area of research both by academy and industry.

Regarding the predictability of future prices of

instruments (stocks, futures, forex, options, etc)

from historical data, there is an ongoing dispute

between scientists. Before the 1980s, most

researchers were sceptical about the ability to predict

future prices, especially, when using technical

analysis, and concluded that is not possible to

produce as good results as the buy-hold strategy

(Alexander, 1961); (Jensen and Bennington, 1970);

(Fama, 1970). However, later studies showed just

the opposite (Pruitt and White 1988, Bessembinder

and Chan 1995). Trading rules/systems based on

past data could create excess returns and prove that

usefulness of technical analysis (Brock et al., 1992),

Bessembinder and Chan (1995, 1998); (Lo et al.,

2000) and many others.) Moreover, there is a

behavioural bias which may be consistent with

technical analysis and price patterns (Bodie et al.,

2009, pp. 395). There are chart/price patterns in

technical analysis that are repeated many times in

the past depicting specific investors’ behaviours.

Generally, based on technical analysis, there are

two types of price patterns: Charts formations which

consist of many consequent data such as Head and

Shoulders and Candlestick patterns which consist of

2-3 candlesticks such as Engulfing, Harami, doji, etc

(Bulkowski, 2008). Candlestick is the visual

representation of an instrument (stock, future, etc)

which consists of a body (open, close) and a shadow

(high, low) over a specific time frame (a week, a

day, 1 min, etc).

1.1 Related Work

Much academic research has been done regarding

specific chart formations (head & shoulder, triple-

top, double-top, etc). Zhang et al., (2010)’s work is

about pattern matching based on Spearman’s rank

correlation and sliding window, which is more

effective, sensitive and constrainable comparing to

other pattern matching approaches such as Euclidean

distance based or the slope-based method. Similarly,

there are a lot of studies involving candlestick

patterns. An expert system for predicting stock

market timing using candlestick charts was proposed

by Lee and Jo (1999). The patterns which considered

as representation of rule could be composite and

608

Goumatianos N., T. Christou I. and Lindgren P. (2013).

Useful Pattern Mining on Time Series - Applications in the Stock Market.

In Proceedings of the 2nd International Conference on Pattern Recognition Applications and Methods, pages 608-612

DOI: 10.5220/0004334106080612

Copyright

c

SciTePress

contain a hierarchy of primitive patterns. They were

classified into five (5) groups providing an average

hit ratio of 72% for buy/shell signals. Additionally,

another study made by Gaginalp and Laurent (1998),

showed that specific candlestick patterns (“three-

white-soldiers”, “three-black-crows” etc.) have

predictive capability and indicate a profit of 1%

during a two-day holding period. In contrary, in a

paper by Marshall et al., (2006), the authors found

candlestick technical analysis has no value on U.S.

Dow Jones Industrial Average stocks during the

period from 1992–2002. The common characteristic

of all previous studies is that all are dealing with a-

priori known specific patterns. A related work of

discovering unknown (hidden) profitable candlestick

patterns was carried out by Sheng et al., (2006).

They designed a Knowledge Representation Model

which held the information of three (3) successive

candlesticks using a bit codification method, called

Relative Price Movement (RPM). The training daily

data was from January 1, 1994 to December 31,

1998, of 82 stocks, while the testing data was from

January 1, 1999 to December 31, 1999. In total, in

the test set, the mined patterns occurred less than

100 times.

1.2 Position

Our position states that by using advanced

computational methods (machine learning, data

mining, computational intelligence) for pattern

recognition, one can obtain high quality actionable

information (knowledge) that no one else has.

Particularly, although the same raw information is

available to everyone, not everyone has the ability to

analyze it successfully and so there is opportunity

for profit while the market adjusts its prices. So, our

hypothesis is that while the market is mostly

efficient for large periods of time, there exist periods

of time (starting and ending at certain events) when

the efficient market hypothesis breaks down. During

these periods, profits can be realized.

Our preliminary results found more than 15,000

different patterns which can predict the direction of

next day(s) price. These hidden patterns cannot be

visually detected by a trader not only due to the

large number (thousands) of patters but also due to

complexity of information they present. There is no

common point with the well-known candlestick

patterns (which are not more than 100).This work

starts with the research question: Are there any

candlestick patterns useful beyond the well-known

candlestick patterns? If there are, how we can

discover them? How we can construct a dynamic

rule-based system to extract such information?

2 SYSTEM ARCHITECTURE

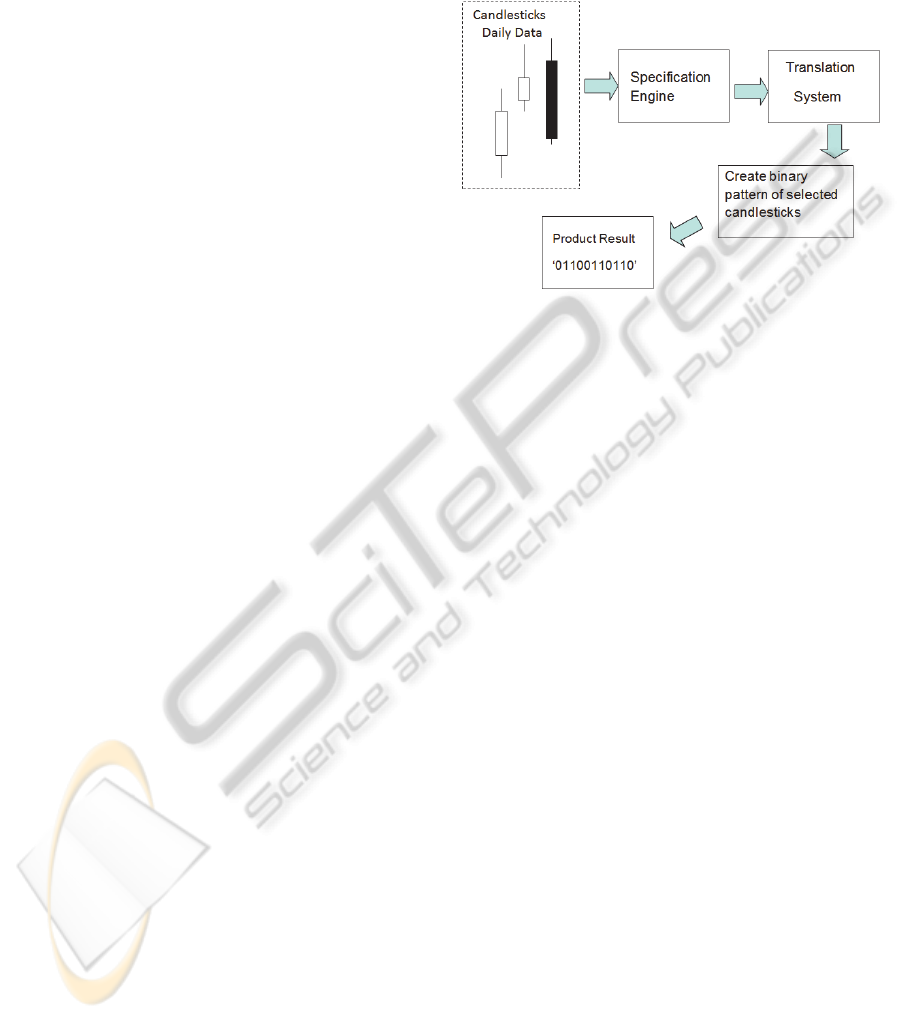

Figure 1: The Rules Codification Engine.

The system architecture consists of an engine

that produces ten (10) different methods of

generating patterns and a lot of dynamic statistical

and technical indicator filters. The specification

engine contains rule-based expressions which can

record three types of information: Bits refered to

candlestick itself, bits refered to exact position

(relationship) among two or more candlesticks and

bits presenting the strength of the price movement.

The translation system uses these rules in a specific

order to construct ten (10) types of binary products:

Pattern of 3 candlesticks (simple or detailed), Pattern

of 4 candlesticks (simple or detailed), Pattern of 5

candlesticks (simple or detailed), Pattern of 3

candlesticks with complicated codified filters,

Pattern of 4 candlesticks with complicated codified

filters, Pattern of 3 candlesticks with numerical

simple filters, Pattern of 4 candlesticks with

numerical simple filters. The created binary pattern

is stored in a relational database which corresponds

to a specific day and stock price data (open, high,

low, close of specific day). Around five million

patterns were stored in the database (4,982,994 to be

exact). For clarity, we present one bit-condification

rule for each category:

i) Condification rule for Simple pattern: if body

down of the candlestick is geater than its (high +

low)/2 return ‘1’ else return ‘0’.

ii) Condification Rule for Simple pattern

relationship: If current open price is greater than

previous close price return ‘1’ else return ‘0’.

iii) Detailed Condification Rule (strangth): If open-

lose difference is less than moving average (MA) of

UsefulPatternMiningonTimeSeries-ApplicationsintheStockMarket

609

0.6 * (open-close) of 100 previous periods return

‘00’ else if open-close difference is between 0.6 *

MA and 1.4 * MA return ‘01’ else (above 1.4 * MA)

return ‘11’.

iv) Indicator Filter Condification Rule: If Spearman

Indicator is greater than 80 return ‘0’ else return ‘1’.

iv) Indicator Signal Condification Rule: If

Directional Indicator Plus(DI+) is greater than

Directional Indicator Minus (DI-) return ‘1’ else

return ‘0’.

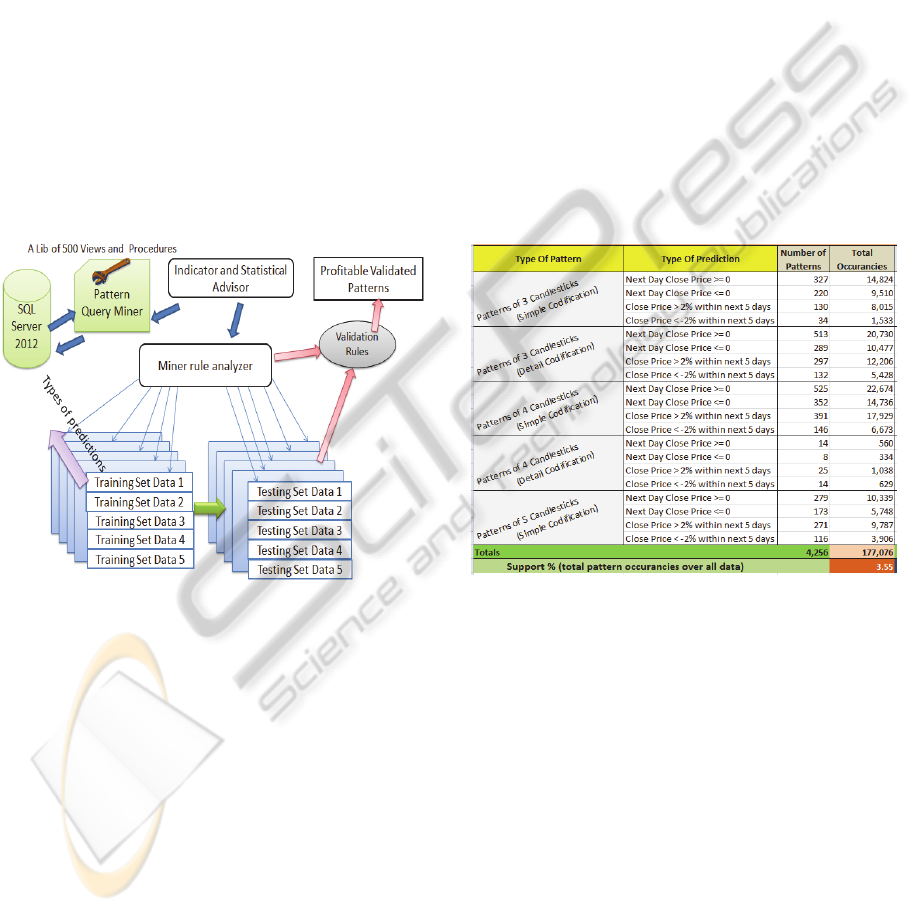

Next, the mining system rule analyzer processes the

historical candlestick patterns for each training set,

for each type of pattern and for each type of

prediction. Figure 2 displays the rule analyzer

architecture. The miner initially collects the patterns

created from each training set having at least 20 total

occurrences (depending on the complexity) and

productivity (a.k.a. confidence level) more than

65%.

Figure 2: System architecture.

The validation rule system analyzes only the

patterns found in test sets to obey minimum support

and confidence, and marks as successful only those

patterns with total occurrences more than 20 and

average productivity more than 60%. The final result

would be an intelligence database which contains all

complex patterns with their performance indicator.

This database can be a useful aid tool to make

successful trade decisions.

3 INITIAL RESULTS

The initial setup consists of 2129 stocks selected

from NYSE, NASDAQ and AMEX and daily data

from January 2001 to Aug 2012. Stocks are all from

S&P500 and NASDAQ100 (sum = 600). The rest of

stocks are the most traded having average price

greater than USD $3. Patterns are tested using 5-fold

cross validation. Preliminary results seem to be more

promising and useful that the initial expectations.

The validation rule system selected totally more than

13,600 different successful price patterns

corresponding to 708,442 occurrences of the whole

data patterns (4,982,994 rows). The total support is

about 14.2%. 4,256 different patterns were

discovered that correspond to 177,096 occurrences

with support in the database of 3.55%. The research

was then extented to include the information of the

next price open. It means that we make the trading

decision after the opening of the stock market, so

that the opening price of the stocks becomes known.

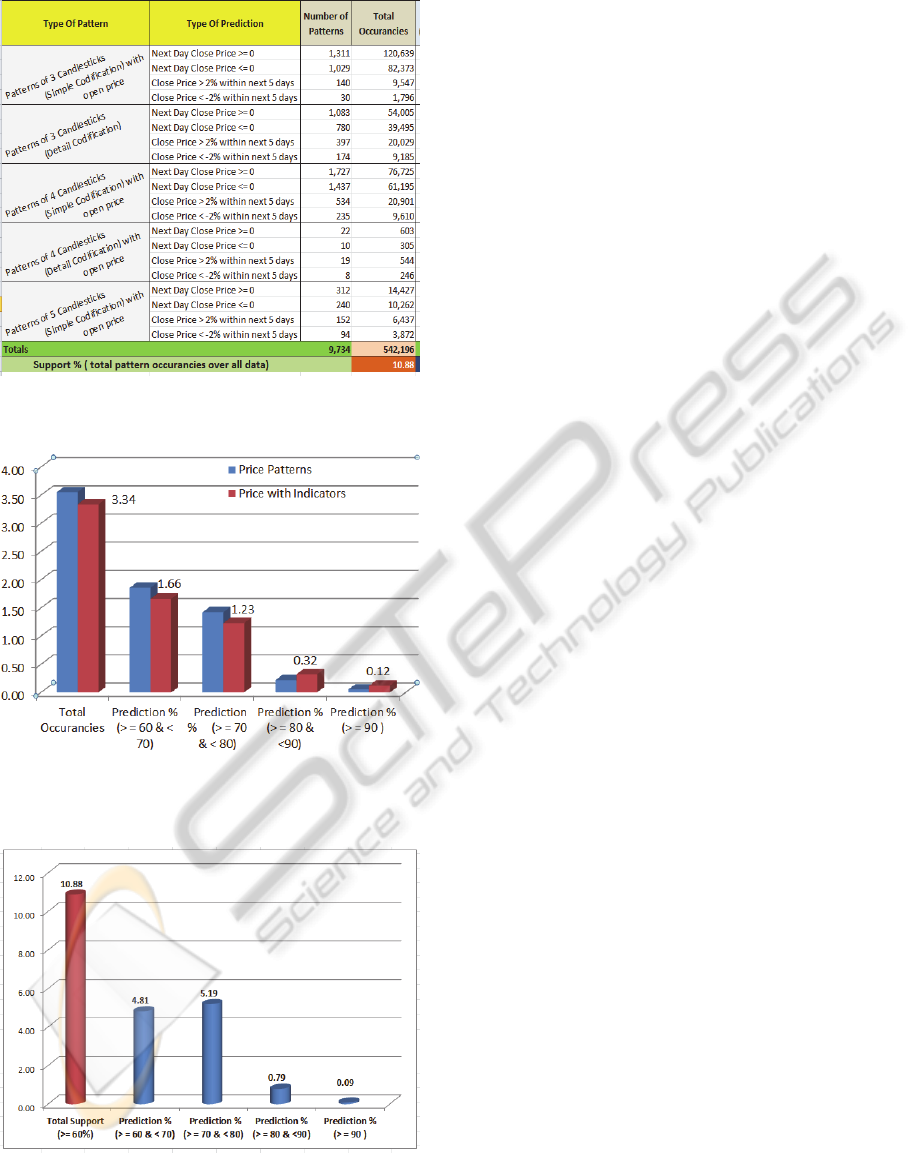

The results were very surprising. The system

discovered 9,734 different patterns corresponding to

542,196 occurrences with a support of 10.88%.

Figures 3 and 4 summarize the results.

Figure 3: Sumarization of Validated Results (no open

price involved).

We have experimented with more complex price

patterns by combining technical and statistical

indicators as filters. The results include 3,108

different complex patterns of totally 166,281

occurrences and support level of 3.34%.

Fig. 5 depicts the distribution of accuracy of

discovered patterns over support x% level, without

involving next open price. Finally, fig. 6 depicts the

distribution of accuracy of discovered patterns, this

time involving next open price. Comparing the two

charts it can easily be seen that when using the open

price we have significantly better prediction (on

average) and receive more frequently trading signals

of high accuracy.

ICPRAM2013-InternationalConferenceonPatternRecognitionApplicationsandMethods

610

Figure 4: Sumarization of Validated Results (with open

price involved).

Figure 5: Distribution of accuracy of validated price

patterns vs combined with indicators (open price of next

day not considered).

Figure 6: Distribution of accuracy of validated patterns

(considering open price of next day).

4 CONCLUSIONS, FUTURE

WORK

We have described the architecture and initial

implementation of an early prototype pattern mining

system that is capable of processing a very large part

of the existing stock-market (NYSE, NASDAQ, and

AMEX) of 2,129 stocks and daily historical data

from January 2001 to Aug 2012 and produce highly

accurate patterns without resorting to the use of any

templates to guide its search. The initial results are

very encouraging and show that such a system can

significantly enhance the performance of current

trading systems that only take into account a much

smaller portion of the markets’ historical data

available today.

Further, the system can be improved by

involving other type of markets as well as using

intraday time frame patterns (e.g. 1 min, 5 min, etc).

Additionally, there are a lot of different ways of

involving the pattern recognition in trading systems.

This pattern prediction system could be used as

stock selector system in creating a portfolio and

using long/short strategy.

REFERENCES

Alexander, S. S., 1961. Price movements in speculative

markets: trends or random walks, Ind. Mgmt. Rev.,

vol.2, pp. 7-26.

Bessembinder H. and K. Chan, 1995. The profitability of

technical trading rules in the asian stock markets, Pac-

Bas. Fin. J., 3(2-3):257-284.

Bessembinder, H., Chan, K., 1998. Market efficiency and

the returns to technical analysis, Fin. Mgmt. 27:5-17.

Brock, W., Lakonishok, J., LeBaron, B., 1992. Simple

technical trading rules and the stochastic properties of

stock returns, J. of Fin., 47:1731-1764.

Bulkowski, T. N., 2008. Encyclopedia of Candlestick

Charts .2

nd

ed. John Wiley & Sons, Hoboken, NJ.

Chien, Y.-W. C., Chen, Y.-L., 2010. Mining associative

classification rules with stock trading data – a GA-

based method. Knowl.-bas. Sys., 23:605-614.

Constantinides, G. M., Harris, M., Stulz, R., 2003.

Handbook of the Economics of Finance. 1

st

ed.

Elsevier, Amsterdam.

Fama, E. F., 1970. Efficient capital markets: A review of

theory and empirical work, J. of Fin., 25:383-417.

Gagilalp, G., Laurent, H., 1998. The predictive power of

price patterns. App. Math. Fin. 5:181-205

Jensen M. C., Bennington, G. A., 1970. Random walks

and technical theories: Some additional evidence, J. of

Fin., 25(2):469-482.

Lee, K. H., Jo, G. S., 1999. Expert system for predicting

stock market timing using a candlestick chart. Exp.

UsefulPatternMiningonTimeSeries-ApplicationsintheStockMarket

611

Sys. Appl. 16:257-364.

Marshall, B. R., Young, M. R., Rose, L. C., 2006.

Candlestick technical trading strategies: can they

create value for investors? J. Bank. Fin. 30:2303-2323.

Lo, A. W., Mamaysky, H., Wang, J., 2000. Foundations of

technical analysis: Computational Algorithms,

Statistical Inference, and Empirical Implementation, J.

of Fin., 55:1705 – 1770.

Pruitt S.W., White, R.E. 1988. The crisma trading system:

who says technical analysis can't beat the market? J. of

Portf. Mgmt. 14:55-58.

Sheng, Y. P., Hou W. C., Chen, Z. 2006. Mining for

profitable patterns in the stock market. In:

Encyclopaedia of Data Warehousing and Mining, Idea

Group Inc, 2006

Zhang et al., 2010. A real-time hybrid pattern matching

scheme for stock time series. Proc. 21

st

Australasian

Conf. on Database Technologies 104:161-170.

Zvi Bodie, Kane A., Marcus A. J., 2009. Investments. 8

th

ed. McGraw-Hill/Irwin, NY, NY.

ICPRAM2013-InternationalConferenceonPatternRecognitionApplicationsandMethods

612