AN EMPIRICAL EVALUATION OF THE COMPETITIVENESS

OF THE FINANCIAL SERVICES INDUSTRIAL CLUSTER

Zhang Huiwen, Gu Baoyan

School of Management, University of Shanghai for Science and Technology

516 Jungong Road, 200093 Shanghai, P.R.China

Huang Hai

School of Management, Shanghai Finance University, 201209 Shanghai, P.R.China

Keywords: Financial services industrial cluster, Competitiveness, Evaluation index system, Three domestic economic

rings.

Abstract: The paper mainly intends to establish an evaluation index system of the competitiveness of the industrial

cluster of financial services and an empirical study of the competitiveness of the financial services industrial

cluster of the provinces (cities) within the three domestic economic rings. On the basis of comparing the

differences of the competitiveness of the financial services industrial cluster of the three economic rings,

strategies and suggestions about the further improvement of the competitiveness of the financial services

industrial cluster of the three domestic economic rings are formed.

1 PREFACE

The practice of reform and opening-up proves that

the prompt development of Chinese economy is up

to the driving of some core areas with economic

vitality. For example, the Pearl River Delta Region

having Shenzhen and Guangdong as its core was the

powerful engine of the Chinese economy during the

80s and the middle 90s. Till the middle and late 90s,

the Yangtze River Delta Region, having Shanghai as

its core, have begun to promote the economic

development of Chinese economy. Now the Circum-

Bohai Economic Ring has become the third growth

pole following the Pearl River Delta Region and

Yangtze River Delta Region and attracted wide

domestic and overseas attention. The co-existence of

competition and co-ordination between the three

economic rings and cities within the rings has

surfaced and the competitiveness of the provinces

and cities have become the determinants of the

social development, economic growth and

competitive situation of the regions. As an

important environmental factor of the

competitiveness of provinces, cities, regions, even

nations, financial competitiveness determines the

competency and efficiency of the allocation of

financial resources of various layers. With the

quickening of financial opening-up and degree of

market in finance, the part of the financial services

industrial cluster plays in increasing the

competitiveness of the enterprises, regions and

nations will be more outstanding.

This paper intends to make a quantitative

measurement of and comparison between the

competitiveness of the financial services industrial

cluster of the three economic rings of China and

provinces and cities within the economic rings,

understand the relative status and differences

between the competitiveness of the financial

services industrial cluster of the provinces and cities

within the rings, and the general situation of

development of the three economic rings, and

provides referential basis for the sensible allotment

of regional financial resources, orderly flow and

relevant organs’ scientific decision-making.

212

Baoyan G., Hai H. and Huiwen Z.

AN EMPIRICAL EVALUATION OF THE COMPETITIVENESS OF THE FINANCIAL SERVICES INDUSTRIAL CLUSTER.

DOI: 10.5220/0003269102120217

In Proceedings of the Twelfth International Conference on Informatics and Semiotics in Organisations (ICISO 2010), page

ISBN: 978-989-8425-26-3

Copyright

c

2010 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

2 THE BASIC FRAMEWORK OF

THE EVALUATION INDEX

SYSTEM OF THE

COMPETITIVENESS OF THE

FINANCIAL SERVICES

INDUSTRIAL CLUSTER

Chinese and foreign scholars have different analyses

on the source of the competitive advantages of the

financial services industrial cluster in that these

analyses have different emphases of factors to

consider and have respective characteristics,

advantages and weak points. Because it is hard to

give scientific and reasonable evaluation to the

financial services industrial cluster, Index System,

although widely, is not yet established.

On the basis of close relating to the reality of the

development of the industrial clusters of Chinese

financial services, this paper consults the current

evaluation index systems and evaluation models of

the industrial clusters, takes into account the

characteristics of the financial services industrial

cluster, classifies them according to natures of

various factors, and believes that the evaluation of

competitiveness of the financial services industrial

cluster can be considered from three aspects:

Scale competitiveness of the financial services

industrial cluster: is the apparent index, and is also

the most important indicator to measure the might of

the financial services industrial cluster.

Developmental competitiveness of the

financial services industrial cluster: is the

efficiency index of development of the financial

services industrial cluster and represents the depth

and width of the development of the financial

services industrial cluster.

The environmental competitiveness and the

external environmental factors of financial

services: have the most important influence on the

competitiveness of the industrial cluster.

The final thing is the selection of indexes. This

paper has introduced 20 index variants to reflect the

competitiveness of industrial clusters of financial

services. Please refer to Table 1 for specific index

system.

3 THE MEASUREMENT AND

COMPARISON BETWEEN THE

COMPETITIVENESS OF THE

FINANCIAL SERVICES

INDUSTRIAL CLUSTER OF

THREE ECONOMIC RINGS

3.1 Choosing of Samples and Index

Data

According to the aforementioned evaluation index,

this paper evaluates the competitiveness of the

financial services industrial cluster of the twenty

cities and provinces within the three domestic

economic rings. Among them, the geographical

scope of Circum-bohai Economic Ring contains five

provinces and two cities (Beijing, Tianjin, Hebei,

Liaoning, Shandong, Shanxi, and Inner Mongolia),

the Pan-Yangtze River Delta Region covers four

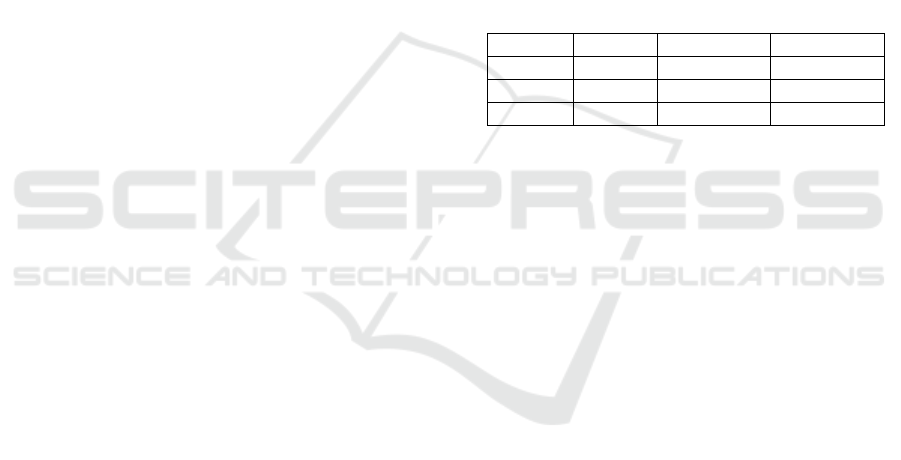

Table 1: Evaluation index system of the competitiveness

of the financial services industrial cluster.

Categories of Index Items of Index

Scale Competitiveness

(X1)

Personnel of financial

services (X11), Number of

legal persons of financial

institutions (X12), Deposits

at the end of a year (X13),

Loans at the end of a year

(X14), Percentage of

deposits (X15), Percentage

of Loans (X16), Deposit

Balance (X17), Fiscal

Budget Expenditures

(X18), Income of Insurance

Fees (X19)

Developmental

Competitiveness

(X2)

Financial Output Value

(X21), Proportion of

deposits to loans (X22),

Deposit Amount Per Capita

for financial institutions

(X23), Loan Amount per

Capita for financial

institutions (X24),

Financial co-relational

factors (X25),

Securitization Rate of

Capital (X26)

Environmental

Competitiveness

(X3)

Regional General Product

(X31), Formation of Capital

(X32), Investment Amount

of Fixed Assets (X33),

Final Consumption (X34),

Really Used Foreign

Capital (X35)

AN EMPIRICAL EVALUATION OF THE COMPETITIVENESS OF THE FINANCIAL SERVICES INDUSTRIAL

CLUSTER

213

provinces and one city (Shanghai, Jiangsu, Zhejiang,

Anhui, and Jiangxi), Pan-Pearl River Delta Region

used to cover the scope of nine provinces and two

districts including Jiangxi, and the two special

administrative regions of Hong Kong and Macau

according to original “Framework Agreement of the

Regional Co-operation of Pan-Pearl River Delta

Zone”. In view of the fact that Jiangxi province has

been included in the developmental framework of

Pan-Yangtze River Delta Region and the big

differences between the two special administrative

regions of Hong Kong and Macau, and the mainland

provinces, the Pan-Pearl River Delta Region chooses

eight provinces and autonomous regions of Fujian,

Hunan, Guangdong, Guangxi, Hainan, Sichuan,

Guizhou, and Yunnan as research objects. The data

come from the statistical almanacs of the provinces,

Chinese Financial almanacs, statistical almanacs of

Stock Exchanges, Annual reports of Securities

supervisory Committee and Banking Supervisory

Committee. Some data is from various relevant

websites of financial institutions and financial

regulatory organs. All the data was through

calculation and arrangement, and the time of data is

December 29th, 2009.

3.2 The Empirical Analysis on the

Competitiveness of Financial

Industries for Three Economic

Rings

3.2.1 The Process of Empirical Analysis

In this paper, we use principal component and factor

analysis to evaluate the competitiveness of financial

industries for different cities. According to the

requirements of factor analysis, we construct an

evaluation matrix: using the indicated variables and

data of 20 provinces (regions) to establish an

evaluation matrix with 20 rows and 20 columns, and

then analyze the correlation matrix of variables to

validate the significance of factor analysis.

Considering the different variable units and

extremely large variances for some variables, in

order to avoid undue influence on the factor

loadings, we apply non-dimensional treatment to the

raw data, that is, we standardize the raw data and get

Z scores. After the transformation, the mean value is

zero and the standard deviation is 1 (the data and

process omitted).

With SPSS software, we used a quartimax

method to rotate the data 25 times, so that the

elements in each column of the component matrix

can be polarized enough to explain the practical

meaning of the common factors. The number of

extracted factors depends on the common factors’

variance, to the original variables. With a greater

variance contribution, the common factor can

portray the study area’s characteristics with a higher

level of clarity. When the eigenvalues of several

important factors are greater than 1, and their

cumulative variance contribution rate reaches or

exceeds 85%, these factors can represent the original

variables to reflect the overall characteristics of the

study area. By solving the characteristic equation of

the correlation matrix, we obtained 20 unit

eigenvectors. The results showed that three

components could be selected as the principle

components for further analysis. After orthogonal

rotation, the eigenvalues and variance of the three

principle components are shown in Table 2.

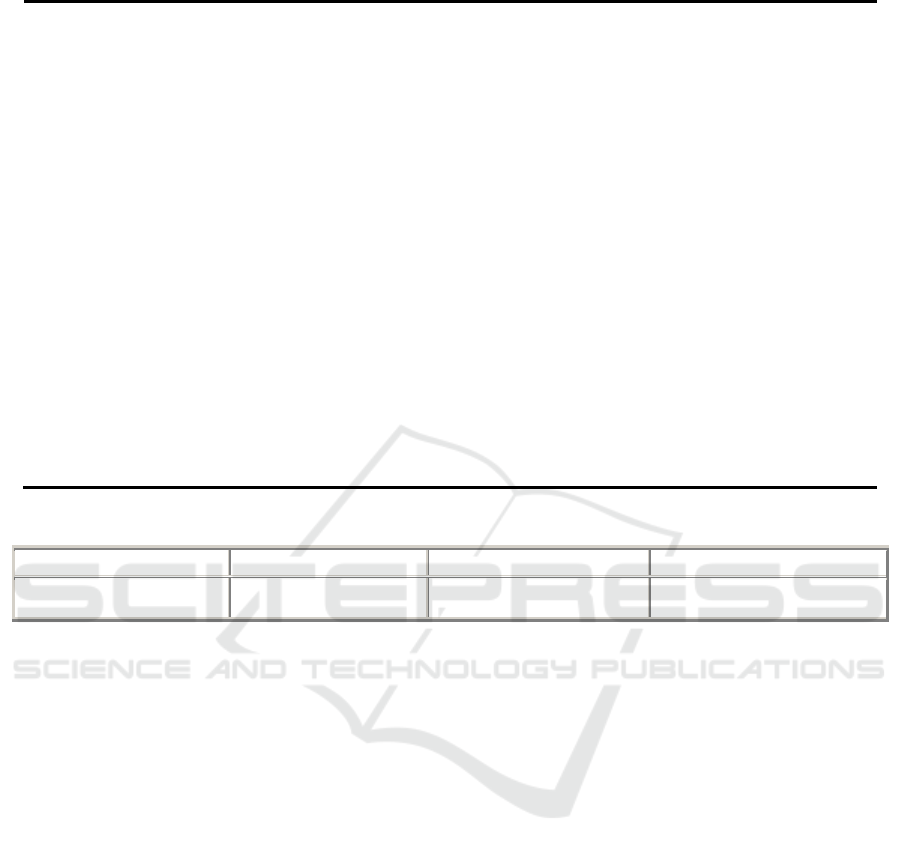

Table 2: Total variance explained after rotation.

Component Eigenvalue

% of variance Cumulative %

F1 5.859 39.057 39.057

F2 5.857 39.044 78.101

F3 2.784 17.504 95.605

3.2.2 The Explanation of Principle

Components

According to the rotated component matrix and

component score coefficient matrix, we can analyze

and explain the three principal components.

Principal component 1 has a larger loading in the

variables of year-end balance of deposits, year-end

loan balance, premium income, savings balance,

percentage of deposits, percentage of loans, budget

expenditures, regional GDP, fixed asset investment,

the number of financial institutions, and the number

of financial practitioners. The variables of the

component represent the overall size and

development level of economy and financial

industry, so component 1 can be regarded as the

scale component of the financial industry’s

development. Its contribution rate is 39.057%.

Component 2 has a larger loading in the variables of

financial industry output, per capita deposits for

financial officers, per capital loans for financial

officers, deposit-loan ratio, final consumption,

financial interrelation ratio, and capital securitization

ratio. The variables mainly reflect the depth and

breadth of financial industry’s development, so the

component can be regarded as the efficiency

component of financial industry. Its contribution rate

is 39.044%. Component 3 has a larger loading in the

variables of actual foreign investment and capital

ICISO 2010 - International Conference on Informatics and Semiotics in Organisations

214

Table 3: Competitiveness rankings of financial industry.

Region F1 F2 F3 F Ranking

Shanghai 2.56872 1.18506 1.52383 1.88867 1

Beijing 0.75469 2.26458 1.11495 1.43727 2

Shenzhen 1.05803 1.22925 1.90641 1.28328 3

Guangdong 1.17032 0.85762 0.80739 0.98245 4

Zhejiang 1.04885 1.07945 0.07185 0.88247 5

Jiangsu 1.11583 0.78663 -0.10131 0.75855 6

Tianjin 0.89594 0.27343 -0.47115 0.39142 7

Liaoning 0.37916 -0.00756 -0.25952 0.10429 8

Shandong 0.10938 -0.16659 -0.28557 -0.07563 9

Fujian -0.08294 0.10204 -0.05263 -0.17657 10

Sichuan -0.26171 -0.32813 -0.19326 -0.27630 11

Hebei -0.36543 -0.35482 -0.26224 -0.34220 12

Anhui -0.29976 -0.58798 -0.43536 -0.44229 13

Inner Mongolia -0.55198 -0.47183 -0.39877 -0.49120 14

Shanxi -0.30064 -0.75948 -0.50119 -0.52474 15

Yunnan -0.47501 -0.69985 -0.71032 -0.60991 16

Jiangxi -0.49673 -0.70131 -0.68865 -0.61542 17

Hainan -0.80162 -0.68823 -0.34326 -0.67139 18

Guangxi -0.73296 -0.78345 -0.50951 -0.71267 19

Guizhou -0.74587 -0.95174 -0.74969 -0.83064 20

Table 4: The clustering of financial competitiveness.

First grade Second grade Third grade Fourth grade

Shanghai, Beijing, Shenzhen Guangdong, Zhejiang,

Jiangsu, Tianjin, Liaoning

Shandong, Fujian, Sichuan,

Hebei, Anhui, Inner Mongolia

Shanxi, Yunnan, Jiangxi, Hainan,

Guangxi, Guizhou

formation. It mainly reflects export-oriented

economy’s influence on the competitiveness of

financial industry, so the component can be seen as

the outward component. Its contribution rate is

17.504%.

3.2.3 Component Scores and Ranking

We used regression to get the three component

scores F1, F2, F3, and then compute the weighted

comprehensive component score with the variance

contribution rate as the weight, that is, F = (F1 *

39.057 + F2 * 39.044 + F3 * 17.504)/95.605. The

comprehensive score shows the competitiveness of

respective provinces (regions) in three economic

circles of our country and we can rank them (see

Table 3).

3.2.4 Clustering of the Provinces (Regions)

Based on the preceding component analysis, we get

clustering variables through multiplying the sample

provinces’ component score by their respective

contribution rate, and then we use clustering analysis

to divide up the provinces according to their

competitiveness in financial industry. After

clustering, we divide the provinces with different

competitiveness in financial industry into four

categories (see Table 4).

3.3 Analysis of the Results

The comprehensive ranking and clustering results

reflect the developmental differences between the

financial services industrial cluster of the three

domestic economic rings. It can be clearly found out

from the table that the competitiveness of the

financial services industrial cluster of Shanghai,

Beijing, and Shenzhen is mighty and plays a leading

role respectively in the Pan-Yangtze River Delta

Region having Shanghai as its centre, Circum-bohai

Economic Ring having Beijing as its centre, and

Pan-Pearl River Delta Region having Shenzhen as

its centre. Within the three economic rings, Pan-

Yangtze River Delta Region ranks No. 1 with a

powerful comprehensive competitiveness of the

financial services industrial cluster, and circum-

Bohai Economic Ring ranks No. 2 with an obvious

AN EMPIRICAL EVALUATION OF THE COMPETITIVENESS OF THE FINANCIAL SERVICES INDUSTRIAL

CLUSTER

215

increase of competitiveness, while Pan-Pearl River

Delta Region has a relatively weaker

competitiveness of the financial services industrial

cluster. From the perspective of comprehensive

ranking, the ranking of Shanghai as No.1, Beijing as

No.2, and Shenzhen as No.3 corresponds with our

qualitative analysis of the development of economy

and finance of the three cities. From the perspective

of specific data, the comprehensive score of

Shanghai, Beijing, Shenzhen, Guangdong, Zhejiang,

Jiangsu, Tianjin, and Liaoning are above zero, which

indicates that their performance level is above the

average level within the three economic rings. All

the other provinces, whose comprehensive score are

below zero, fail to reach the average performance

level. Hence the big differences of the

competitiveness of the financial services industrial

cluster between the big three economic rings and

cities within the provinces. Seen from the leading

role of the development of the financial services

industrial cluster played by Shanghai as the core of

the regional development of the Pan-Yangtze River

Delta Region, Shanghai is unique in both the

developmental scale of the financial services

industrial cluster and depth and width of

development of the financial services industrial

cluster, in that it has a balanced development of

banking, securities and insurance, forms a relatively

complete market financial system, is the centre of

the national financial market, hosts a large number

of foreign-funded financial institutions, and has a

leading degree of financial opening-up in China.

Seen from the perspective of the developmental

effect of the financial services industrial cluster of

the central cities of the three economic rings, Beijing

and Tianjin have obvious advantages. Being the

capital, Beijing is the location of many headquarters

of domestic financial institutions and regional

headquarters of international financial institutions so

it has an exclusive advantage of financial

competitiveness of headquarters, which is also able

to connect ideally with the advantages of powerful

international trade and shipping of Tianjin. All that

cannot be emulated by cities and provinces of other

economic rings and is the reason why the

development of the industrial cluster of financial

services of Circum-Bohai Economic Ring can

surpass its previous leaders. Seen from the

perspective of the degree of opening-up of the

development of the industrial cluster of financial

services of the central cities of the three economic

rings, Shenzhen, as the earliest special economic

zone of China, plays the important part of the testing

field of reform and opening-up and enjoys a high

opening-up level of economic and a relatively high

degree of co-operation between Hong Kong,

Shenzhen and Macau because of its vicinity with the

two special administrative zones.

4 CONCLUSIONS AND

SUGGESTIONS

Empirical studies indicate that extremely close

relationship exists between the competitiveness of

the industrial clusters of regional financial services

and comprehensive regional competitiveness,

especially the economic developmental levels.

Gradient differences of modes of economic

development, developmental levels, clustering

abilities of the financial services industrial cluster,

radioactive abilities, spillover effects, financial

market system, financial organization system, and

degree of financial opening-up exist between the

three economic rings. Different judiciary

environments and social credit environments cause

big differences between rings, which generates the

gradient circumstance of the competitiveness of the

financial services industrial cluster among the three

economic rings and provinces and cities within the

rings. That has been proved by the competitiveness

rankings and clustering results of the

competitiveness of the financial services industrial

cluster within the three economic rings and the

clustering results, which basically corresponds with

the regional differences of the economic

development in reality. Thus it can be illustrated that

the competitiveness evaluation index of the financial

services industrial cluster chosen by this paper

closely relates to the fact of development of regional

finance. And on the basis of this evaluation, the

reasons of the differences of regional financial

development are found and suggestions and

strategies to improve the competitiveness of the

financial services industrial cluster are provided.

As for the Pan-Yangtze River Delta Region

having Shanghai as its centre, the source and

improvement of the competitiveness of the industrial

clusters of regional financial services depends on the

strong demand for funds and financial services in the

developmental process of regional economy, which

is the basis of improving the competitiveness of the

industrial clusters of regional financial services.

Simultaneously, the impetus of policy is also an

important factor of development of the industrial

cluster of financial services of the Pan-Yangtze

River Delta Region. Finally, on one hand,

organizational system of financial institutions of the

ICISO 2010 - International Conference on Informatics and Semiotics in Organisations

216

provinces and cities within the region shall be

continuously optimized; on the other hand, efforts

made by the financial institutions themselves of the

provinces and cities within the region shall also be

strengthened. As for the Circum-bohai economic

ring having Beijing and Tianjin as its center, the

main idea to improve the competitiveness of the

financial services industrial cluster shall be the

continuous expansion of financial opening-up and

institutional innovation, the generation of market

environment to construct the financial services

industrial cluster, the promotion of innovation of

financial instruments and financial services, further

formation of the system of financial organization

with apparent clustering effect and the financial

market system involving currency market, credit

market, security market, insurance market promoting

each other, and the exertion of core effects of the

financial services industrial cluster in the functions

of regional development. As for the Pan-Pearl River

Delta Region having Shenzhen and Guangdong as

its centre, improving the competitiveness of the

financial services industrial cluster takes optimizing

regional economic environment, creating conditions

for the co-ordination and development of economy

and finance and forming source and basis for the

competitiveness of the industrial cluster of financial

services of the provinces and cities within the region

through increasing the attraction toward financial

institutions, high quality labor resources and

infrastructure, and sensible and sound regulatory

environment.

The comparative study of the competitiveness of

the financial services industrial cluster of the three

economic rings extends a powerful foundation for

the central bank to stipulate differentiated regional

financial and currency policies: The central bank

may stipulate differentiated indexes of economic

development to reflect the degree of market, degree

of currency, and degree of integration that indicates

economic development of different regions, and

marginal profit rate of the funds and indexes of

returning loans to reflect the abilities of input and

output of funds of different regions to promote the

cross-region flow and operation of funds and

financial institutions, break the regional barriers of

financial resources, mend the segmented situation of

regional financial resources, promote the formation

of the spatial flow and mechanism of allocation of

financial resources to increase the competitive level

of the financial services industrial cluster of the

region as a whole.

REFERENCES

National Statistical Bureau of PR China, 2008. Chinese

Statistical Almanac 2008, Chinese Statistical Press,

Beijing, 2008 edition.

General Social & Economic Investigation Group, 2008.

Statistical Almanac of Chinese Cities 2008, Chinese

Statistical Press, Beijing, 2008 edition.

National Statistical Bureau of PR China, 2008. Statistical

Almanac of 2007, 2008, Provinces and Cities of

Shanghai, Beijing, Shenzhen, Zhejiang, and

Guangdong, Chinese Statistical Press, Beijing, 2007&

2008 edition.

Wu Junhai, 2007. The measurement and comparative

analysis of financial competitiveness of all cities of

Fujian Province. In Academic Journal of Putian

College 2007(3).

Zhang Zhi Yuan, 2006. Summary of Theoretical

Researches of Industrial Clusters of Financial

Enterprises. In Trends in Economics

,

2006,

(

10

):

92-96.

Pan Yingli, 2003. The micro-basis of the formation of

financial centres – the spatial clustering of financial

organization. In Academic Journal of Shanghai

University of Finance & Economics

,

2003(2).

Fan Hongwei, 2007. Study on the industrial Clusters of

Pudong New Area, East China Normal University Press.

Shanghai.

Liu Ai Xiong, 2007. Evaluation of Competitiveness of the

Industrial Clusters. In Research of Scientific and

Technological Management,2007,(2):161-162.

Hu Zhenhua, He Yanqiong, 2008. Study of the Evaluation

of competitiveness of High and New Technological

Industrial Clusters. In Academic Journal of Central

South Forestry Science and Technology University

(Social Sciences Edition),2008,(3):69-70.

Porter, M., 2002. The Competitive Advantage of Nations,

Hua Xia Press. Beijing.

Porter, M., 2002. Industrial Clusters and Economics of

New Competition, translated by Zheng Haiyan. In

Comparison of Economic and Social Institutions

2000(2): 29.

Pandilt, N. R, Gary, A. S.,Cook, G. M.,Swann, P.,

2002. A Comparison of Clustering Dynamics in the

British Broadcasting and Financial Services Industries.

In International Journal of the Economics of Business

,

2002

,

9

(

2

):

195-224.

Pandilt, N. R, Gary, A. S., Cook, G. M., 2003. The

Benefits of Industrial Clustering: Insights from the

British Financial Services Industry at Three Locations.

In Journal of Financial Services Marketing Vol.7

Issue3

,

2003.

King, R. G., Levine R., 2003. Finance and Growth :

Schumpeter Might Be Right. In Quarterly Journal of

Economics

,

1993

,

108

(

3

):

717~737.

AN EMPIRICAL EVALUATION OF THE COMPETITIVENESS OF THE FINANCIAL SERVICES INDUSTRIAL

CLUSTER

217