A NEW GROUP KEY MANAGEMENT STRUCTURE FOR

FRAUDULENT INTERNET BANKING PAYMENTS DETECTION

Osama Dandash, YilingWang

Faculty of IT, Monash University, Australia

Phu Dung Le, Bala Srinivasan

Faculty of IT, Monash University, Australia

Keywords: Internet Banking Payments, Fraud Detection, Dynamic Individual Key and Group Key.

Abstract: Fraudulent payments detection in the banking system is an extremely important form of risk management as

the industry loses close to one billion dollars annually. New techniques in detecting fraud are evolving and

can be applied to many business fields. However; there is still no efficient detection mechanism able to

identify fraudulent activity by employees. This paper presents a new Group Key Management (GKM)

structure to facilitate internal fraudulent banking payments detection by dynamically combining an

Individual Key (IK) and a Group Key (GK). The main objective of the proposed mechanism is to identify

internal fraudulent users and trace their records amongst other group members.

1 INTRODUCTION

Internal fraud is the result of employees gaining

access to customer information, creating false

accounts and performing illegal transactions. Banks

consider internal fraud as more damaging than

external fraud (Zhuang and Fong, 2004).

Studies show that the internal fraud is defined as

“acts by employees intended to defraud their

financial institution by the misappropriation of funds

and the authorisation of loans to unauthorized

parties” (Patiwat P, 1996)( Zhuang Y, 2004). To

identify fraudulent behaviour, advanced detection

techniques are required and a high level

authentication mechanism needs to be in place. This

needs to not only identify fraudulent use but to also

trace the activity. Better fraud detection has become

an essential requirement for banks in order to

maintain a viability payment system.

At present, fraud detection is conducted using

data mining, statistics, and artificial intelligence

(Ghosh, S, 1994)( Joris C, 2002)( Ren, D, 2004).

Such methods still lack sufficiently secure payment

mechanisms to identify internal fraud and trace

fraudulent transactions.

Inadequate security operations, such as staff

identification, staff access control and staff record

tracing has resulted in insecure transaction (Jon M,

2003)(Medvinsky, G, 1993). To combat this security

breach, this paper proposes a new Group Key

Management GKM structure facilitates fraudulent

payments detection by dynamically combining both

an Individual Key IK and a Group Key GK. The

objective of this proposal is to detect and trace

fraudulent use by internal workers.

The proposed detection mechanism will record

the details of each user separately even if two users

from the same group access identical information.

The role of GKM is to restrict user access to

different objects in the system. GKM performs

communication securely and efficiently and consists

of a set of protocols that perform sensitive

information transactions.

This paper is presented in the following sections:

Section 2 relates to banking payments fraud

detection methods. Section 3 presents the proposed

GKM structure. Section 4 details the proposed

structure’s advantages. Section concludes our work.

57

Dandash O., Wang Y., Dung Le P. and Srinivasan B. (2007).

A NEW GROUP KEY MANAGEMENT STRUCTURE FOR FRAUDULENT INTERNET BANKING PAYMENTS DETECTION.

In Proceedings of the Ninth International Conference on Enterprise Information Systems - SAIC, pages 57-62

DOI: 10.5220/0002356800570062

Copyright

c

SciTePress

2 RELATED WORK

The following subsections provide an overview of

banking payments fraud detection methods to date.

2.1 Outlier Detection

An outlier relies on observation techniques to trigger

suspicion that it has been generated by a different

mechanism. It detects fraud in two ways: supervised

and unsupervised.

Supervised detection relies on stored fraudulent

transactions. This requires previous fraudulent use

before any future fraud can be detected.

Unsupervised detections does not rely on previous

fraud cases but focuses on unusual transaction

behaviour (Angiulli, F, 2006)( Ren, D, 2004).

2.2 CardWatch

This relies on the current patterns of use to detect

possible anomalies. A Falcon skilled at many

different types of propagation algorithms uses feed-

forward Artificial Neural Networks is used to detect

fraud (Ghosh, S, 1994).

Such training algorithms include machine

learning, adaptive Pattern Recognition, neural

networks, and statistical modelling. These are used

to improve the way the developed Falcon can predict

specific fraudulent transactions.

Neural MLP-based classifier is another detection

method uses neural networks. It does not rely on

previous fraud cases or historic data; instead it uses

the information of the operation itself and of its

instant previous history (Xiu Li, 2004).

Such technologies have the following

disadvantages:

• They only rely on fraud attempts that have

previously occurred to detect another fraud

• They are unable to identify who has

performed the fraudulent transaction

• They rely on users sharing the same fixed

secret information for a long period of time

and applying weak cryptographic keys that

could be attacked after a limited number of

attempts

• They have weak fraud detection ability as

they don’t apply strong access rules.

• They are lack of a mechanism to specifically

deal with security and trust issue, associated

with internal user behaviour.

3 PROPOSED GROUP KEY

MECHANISM

Identifying internal fraudulent use and tracing the

activity is the most efficient way to deal with

security issues. This also allows evidence to be

harnessed to track down and prosecute the

perpetrators of fraud. Many group key management

approaches have been proposed and implemented in

the wireless and multicast environment. GK is yet to

be applied to Internet payments fraud. The most GK

efficient approach is the Logical Key Hierarchy

(LKH) (Harney H, 1997).

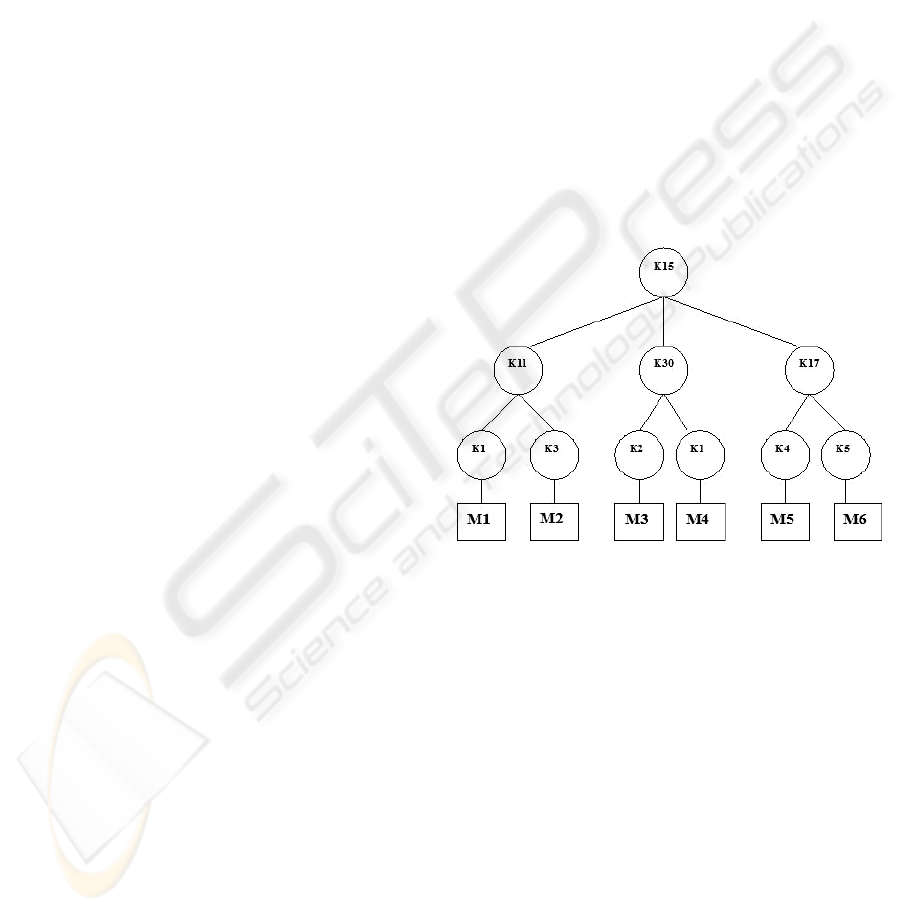

In LKH, a key tree is formed by GK and other

auxiliary keys, which are used to distribute the GK

to the users. Figure 1 depicts a typical LKH key tree

where users are associated with the leaf nodes. Each

user must store a set of keys along the path from leaf

node up to the root.

Figure 1: LKH Key Tree.

3.1 Notations

• A/R: Accept/Reject

• M: User

• Req/Res: Request and Response

• JReq: Join Request

• AccReq: Access Request

• AuthReq/AuthRes: Authentication Request

and Authentication response

• Act: Activities

• AC: Account

• GC: Group Controller

• IK: Individual Key

• GK: Group Key

• S: System

• SP: Secret Phrase

• BC: Banking Card

ICEIS 2007 - International Conference on Enterprise Information Systems

58

• h(v): hashed value

• H: History

• T: Transaction

• LT: Log on Time

3.2 Proposed System Structure (User

Authentication and Access

Controls)

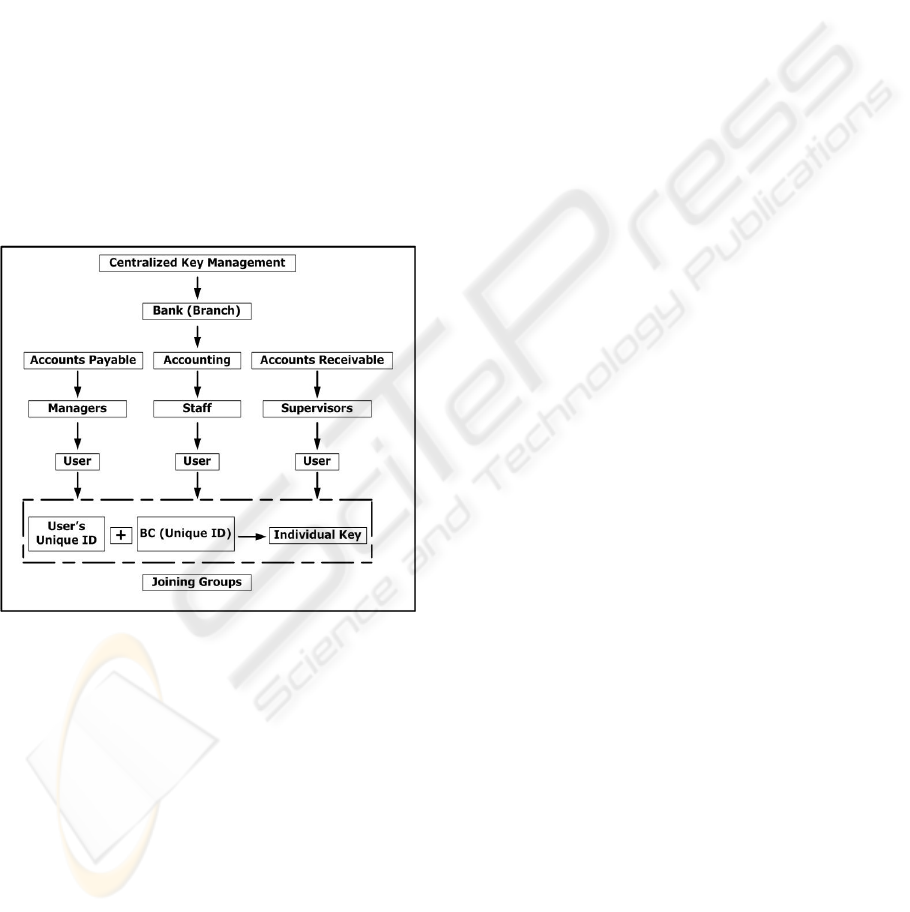

The banking system is divided into several

administrative areas. Each administrative area

consists of several branches and each branch applies

a GKM structure which will provide data security

and strong access control. The top level in the

banking structure is called a Centralised Key

Management (CKM). CKM is responsible for

coordinating the groups’ information in each branch,

generating group keys and distributing them to the

branches group members as shown in Figure 2.

Figure 2: Proposed Group Key Management Structure.

Strong authentication, authorization and access

control policies are enforced in each department to

assign various roles to the groups and their members

such as executives, directors and managers.

Therefore, each group has different access privileges

in which a strict access control can be achieved to

allow only authorized members to access

confidential information.

When changes in membership status take place

(join leave), the re-keying procedure is invoked to

update the keys along the path thereby ensuring

security. In the banking system, the internal users

are quite stable and can be grouped by the branch.

Therefore they are physically and logically

neighbours in LKH tree. This significantly reduces

the communication cost during the re-keying

procedure.

Based on this structure, each group member is

assigned, or holds, an IK and a GK. To trace each

payment transaction, the concept of dynamically

combining IK and GK to generate a tracing hashed

value h(v) is introduced into the structure.

3.2.1 User Registration

When users wish to join a group, they must register

with the Group Controller GC by providing their

personal information and biometric identification.

Registered users will be issued a Secret Phrase (SP)

and a Bank Card (BC) with a unique ID. This will be

combined with users’ unique ID to form an

Individual Key (IK). If registered, the BC will hold

users’ IK for later authentication and authorisation

purposes.

The joining procedure begins with a registration

request sent by the user M to GC.

M → GC: {JReq} (1)

Upon receiving, GC asks for personal information

and user’s unique ID:

GC → M: {M

ID

, M

PI

, Req} (2)

Where

M

ID

= {Finger Print, Retinal Scan, DNA, Face or

Voice recognition, etc}

The user has to respond with the requirements to be

legible for registration:

M → GC: h{M

ID

, M

PI

, Res} (3)

Based on the provided details, GC generates a GK

for the new member:

GC → {GK

M

} (4)

GK will be stored on GC side for later authorization

while IK will be shared between GC and M.

3.2.2 System Accessibility (Dynamic Token

Generation)

Registered users will need to have identified

themselves to their BC at the start of each

transaction by providing their registered unique ID.

M → BC: h{AuthReq, M

ID

} (5)

BC → M: {AuthRes, A/R} (6)

A NEW GROUP KEY MANAGEMENT STRUCTURE FOR FRAUDULENT INTERNET BANKING PAYMENTS

DETECTION

59

If the provided M

ID

is legitimate then authentication

to the BC will be granted. The IK will generate a

dynamic Token, which will be sent to GC to match

with the other token that is generated on GC side:

BC → GC: {AccReq, Token} (7)

GC → BC: {AccRes, A/R} (8)

If Tokens match, then GC will send a GK for that

registered M to grant access to S:

GC → BC: {GK} (9)

The sent GK will be combined with the generated

Token on BC to generate a h(v):

BC → S: h(v) (10)

h(v) = {GK, Token} (11)

The generated h(v) will be recreated each time an

individual accesses S, which makes it secure and

hardly guessable

.

3.2.3 Record Tracing

An internal M could emulate the holder of a genuine

client’s account and accesses S to perform

anonymous fraudulent transactions. To be able to

detect such behaviour, it is proposed that h(v) be

generated based on the users’ unique ID and his/her

GK. This means no authentication will be granted

for any user to the BC if he/she cannot provide a

genuine unique ID. No GK will be sent unless the

generated Tokens are matched.

Moreover, the proposed mechanism in

generating h(v) is more secure than the normal

authentication log on process as it attaches to a log

on sessions and allows the internal users to be traced

and all their details recorded into the system each

time they access it.

The recorded details will be the History (H) of

those users, which can be reviewed and checked in

the case of any suspicious activities or illegal

transactions:

Let h(v i ) = {GK i , Token i } (12)

Where i is the index of the h(v),

h(v) traces and records users’ details. The recorded

details or H will consist of the users’ identity, their

activities and the Transactions T they have

performed:

H: = {M

ID

, AC, T} (13)

Where,

M = {BC

ID

, GK, login-name, LT, password}

AC = {M

ID

, account holder name, transaction ID,

account balance, Date}

T = {Time-stamp, IP address, source transaction,

destination transaction}

The dynamic combination mechanism ensures that

every access to the system can be traced and will

discourage fraud attempts. In case of any fraud

reported, the system can easily identify the

fraudulent users and the details of their fraudulent

transactions.

From a technical point of view, once a

transaction is detected as a fraud, then all the

parameters can be used to detect and trace any other

fraudulent transactions.

4 THE ADVANTAGES OF THE

PROPOSED STRUCTURE

The GKM can assure access detection, record

tracing, identify data integrity and ensure high-level

authentication. In this section the advantages of the

proposal are detailed.

¾ The proposal provides a strong authentication

mechanism with dynamic IK generation.

Although the current existing authentication

systems use a combination of the user’s

personal details in addition to other technology

such as smart cards in identifying users, the

unique ID remains static (the same key is used

every time). This weakness gives intruders

enough time to reveal the secret and break into

the system. In the GKM system the focus is on

making the generation of the critical keys

dynamic. This makes the key unbreakable.

Intruders may decrypt the key in a very short

time with the explosive increase of computation

power but it is useless due to the constant

change of key generation.

¾ The proposal uses GK to enforce access control

restriction. It is applied to restrict the users to

critical data, which provides extra secure

protection to the access control. Due to the

stable organization structure of the banking

system, an optimized LKH algorithm is applied

to manage the distribution of GK. This

significantly reduces the communication cost

during the

re-keying. In traditional LKH, the

ICEIS 2007 - International Conference on Enterprise Information Systems

60

communication cost of new users and redundant

keys (joining and leaving) are

1log +n

α

and n

α

log , n is the number of

users and

α

is the degree of the key tree. The

cost in the proposal is as follows:

1log +

⎟

⎠

⎞

⎜

⎝

⎛

i

n

α

(14)

and

⎟

⎠

⎞

⎜

⎝

⎛

i

n

α

log (15)

Where, i is the number of branches.

¾ The proposal provides strong data integrity

which shows that the messages were generated

from the claimed users and are not modified in

transmission by group members or external

adversaries. This specification supports this

requirement based on the strict authentication

and through the use of a one-way hash function.

Each generated hashed message has a unique

value so that any change to the message will

produce a different value and will cause the

verification process to fail.

¾ The proposal provides user identification and

record tracing.

o The generated hashed value in conjunction

with the combination of unique ID and GK

can assure the identity of the originator of

the message. Also, the use of a one-way

hash function provides a high degree of

certainty that the message was generated by

M. A similar mechanism is used in the

response messages that sent back to M from

the GC, thus providing a high degree of

certainty that the response is indeed from

the GC. It is therefore a strong proof that

messages were transmitted by M and GC

o Each transmission performed by users will

be recorded in the system by the generated

h(v). The recorded parameters will provide

a complete tracking mechanism to identify

users and their activities. Therefore, users

cannot deny the actions they performed in

the system.

5 CONCLUSION

This paper proposes a new structure which can

detect fraud by dynamically combining IK and GK.

The new structure has the ability to identify users,

manage them into groups, trace their activities and

verify their authorization level. It also applies

restricted access control and employs security

policies which assign and manage different rules and

privileges for users that may belong to same group.

REFERENCES

Angiulli, F.; Basta, S.; Pizzuti, C.; Feb. 2006: "Distance-

based detection and prediction of outliers " Knowledge

and Data Engineering, IEEE Transactions on Digital

Object Identifier 10.1109/TKDE.2006.29 Volume 18,

Issue 2, Feb. 2006 Page(s):145 – 160

Donal O'Mahony, Michael Peirce, and Hitesh Tewari.

Electronic Payment Systems for E-Commerce. Artech

House, 2001. Second edition.

Ghosh, S.; Reilly, D.L, "Credit card fraud detection with a

neural-network", 1994, IEEE System Sciences,.

Vol.III: Information Systems: Decision Support and

Knowledge-Based Systems, Proceedings of the

Twenty-Seventh Hawaii International Conference on ,

Volume: 3, pp.621-630, 4-7 Jan. 1994

Harney H., Andrea Colegrove and Patrick McDaniel.

"Principles of Policy in Secure Groups" . Proceedings

of Network and Distributed Systems Security 2001.

Internet Society, February 2001. San Diego, CA

Harney H. and Muckenhirn C., 1997 “Group Key

Management Protocol (GKMP) Architecture” RFC

2094,

Jan C, Jean-Marc Piveteau, and Markus Stadler. An

Efficient Fair Payment System. In Proceedings of the

3rd ACM Conference on Computer and

Communications Security, pages 88{94, March 1996.

Jon M. Peha, Ildar M. Khamitov, "PayCash: 2003, a

secure efficient Internet payment system", Proceedings

of the 5

th

international conference on Electronic

commerce, Pittsburgh, Pennsylvania, pp.125-130,

Joris C, Valentin Dem, Danny De Cock, Bart Preneel, and

Joos Vandewalle. 2002, On the Security of Today's

Online Electronic Banking Systems. Computers &

Security, 21(3):253{265,

Medvinsky, G. & Neuman, B. C. (1993). Netcash: A

design for practical electronic currency on the internet.

Proceedings Of First ACM Conference On Computer

and Communication Security, ACM.

Patiwat P, "Money in electronic commerce: digital cash,

electronic fund transfer, and Ecash", 1996

Communications of the ACM, Volume 39, Issue 6,

pp.45-50,

Ren, D.; Rahal, I.; Perrizo, W.; 2004 "A vertical outlier

detection algorithm with clusters as by-product" Tools

with Artificial Intelligence, 2004. ICTAI 2004. 16th

IEEE International Conference on Digital Object

Identifier 10.1109/ICTAI.2004.22, 15-17 Nov. 2004

Page(s):22 - 29

Rodeh O.,et al.,"Optimized Group Rekey for Group

Communication Systems" Network and Distributed

System Security 2000, San Diego, CA , February 2000

A NEW GROUP KEY MANAGEMENT STRUCTURE FOR FRAUDULENT INTERNET BANKING PAYMENTS

DETECTION

61

Sherman A.T., McGrew D.A., “Key Establishment in

large dynamic Group Using One-Way function Trees”

IEEE on software engineering vol. 29, no. 5, 2003, pp.

444-458

Thomas Hardjono, Mark Baugher, Hugh Harney, "Group

Key Management for IP Multicast: Model &

Architecture," wetice, p. 223, Tenth IEEE

International Workshops on Enabling Technologies:

Infrastructure for Collaborative Enterprises, 2001.

Wong C., Gouda M., Lam S., 2000 “Secure Group

Communications Using Key Graphs” IEEE

networking vol. 8, no. 1, pp. 16-30

Xiu Li; Bing Li; Lin Lei; Jianyong Tuo; Shouju Ren;

Wenhuang Liu; 2004 Artificial immune system for

fraud detection Systems, Man and Cybernetics, 2004

IEEE, Volume 2, Page(s):1407 - 1411 vol.2,Digital

Object Identifier 10.1109/ICSMC.2004.1399827

Zhuang Y, Simon Fong, 2004 On Designing a Flexible E-

Payment System with Fraud Detection Capability,

2004 IEEE

ICEIS 2007 - International Conference on Enterprise Information Systems

62