Impact of BOPS and ES on Demand and Profitability: Theoretical

Models and Simulation Analysis

Jinrong Liu and Haitao Sun

School of Economics and Trade, Shanghai Urban Construction Vocational College, Shanghai, China

Keywords: BOPS, ES, Omnichannel, Demand Allocation, Profitability.

Abstract: With the development of information technology and mobile e-commerce, more and more retailers are

beginning to provide consumers with convenient buy online and pickup in store (BOPS) shopping mode.

Online channel often results in high return rates due to lack of product experience, while retailers can increase

consumer perceive value by providing experience services (ES) to increase their purchases. However, the

provision of BOPS and ES will incur certain operating costs. This paper establishes four profit models under

different BOPS opening strategies and ES service offering strategies. Then, the study analyzes and compares

the impacts of BOPS and ES on retailers' demand allocation and profitability. Finally, the simulation test is

carried out by using MATLAB software. The results show that when ES is not provided before or after

opening the BOPS channel, or ES is only provided after opening the BOPS channel, if the inconvenience of

BOPS channel or online return rate is low, the opening of BOPS can reduce the online demand and increase

the total demand and profit; when ES is provided before opening the BOPS channel and ES is not provided

after opening the BOPS channel, the store demand, total demand and total profit will be reduced; when ES is

not provided before opening the BOPS channel and ES is provided after opening the BOPS channel, the total

demand and total profit increase more.

1 INTRODUCTION

With the rapid development of mobile Internet and

O2O e-commerce, online and offline integration is

increasing, and there is an emerging focus on

“omnichannel retailing” that aims to provide

customers with a seamless shopping experience

through all available shopping channels (Bell 2014,

Gallino 2014, Moreno 2014, Brynjolfsson 2013, Hu

2013, Rahman 2013, Rigby 2011). Among all

omnichannel fulfillment initiatives, the BOPS mode

that allows customers to buy online and pick up in

store is regarded as the most important in

omnichannel retailing. For example, Walmart, Best

Buy, Uniqlo, and KFC have all implemented BOPS.

Under the online channel, the customer places an

order online first, and the retailer delivers the goods

to the consumer's home; under the offline store

channel, the customer experience the product directly

in the store, then places the order and picks it up to

home. Different from the first two shopping modes,

in the BOPS mode, consumers first place an order

online and then pick up the goods at the selected

physical store. Therefore, the BOPS omni-channel

mode will bring new traffic and generate new orders

when consumers pick up goods in offline store. Due

to the lack of product experience services, the return

rate of online channel is often high, which brings

great losses to retailers. Especially products that need

to be tried on and highly personalized products, such

as fashion clothing, shoes and hats, cosmetics, etc. To

this end, many retailers are starting to offer the

ultimate experience service to customers in stores to

improve consumers' perceived value of products and

further enhance their purchase willingness and

purchase conversion rates (Liu 2021, Long 2021, Hu

2021, Xu 2021). For example, Uniqlo allows users to

enhance the brand’s awareness and influence while

enhancing the user experience with merchandise

display, personnel training, digital experience tools,

and the final scan code payment. Zara stores enhance

customers’ shopping experience with automated

click-to-carry, self-checkout, and RFID interactive

fitting mirrors. In the “Shoes HOME+” of Red

Dragonfly, the intelligent retail terminal realizes

three-dimensional foot measurement, big data

analysis, product intelligent interaction, and product

Liu, J. and Sun, H.

Impact of BOPS and ES on Demand and Profitability: Theoretical Models and Simulation Analysis.

DOI: 10.5220/0011359800003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 947-955

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

947

experience and personalized customization to

enhance consumers' multilevel product experience.

However, the opening of the BOPS channel

requires the cooperation and coordination of online

and offline channels, including the connection of

online and offline electronic systems, the increase of

store service personnel and commodity inventory

service capabilities, the distribution of benefits

between different departments, etc. The provision of

ES services also requires a certain amount of

investment in people, money, equipment and

facilities. Both of them will bring certain operating

costs to retailers, and will inevitably have a certain

impact on existing channels, demand and profits.

Therefore, in this paper, we study the impact of BOPS

and ES on the demand allocation and profitability of

brand retailers in the following four situations: 1) ES

is not provided before opening the BOPS channel; 2)

ES is not provided after opening the BOPS channel;

3) ES is provided before opening the BOPS channel;

4) ES is not provided after opening the BOPS

channel, and then make the best choice.

2 DECISION MODEL

2.1 Problem Description

A retailer sells products to customers with three

alternative shopping channels: online channel

(abbreviated as O channel), store channel

(abbreviated as S channel) and BOPS channel.

We have already described similar problems in

our previous paper (Liu 2021, Long 2021, Hu 2021,

Xu 2021), so we won’t repeat them here.

The notations used in our models and their

definitions are shown in Table 1 below.

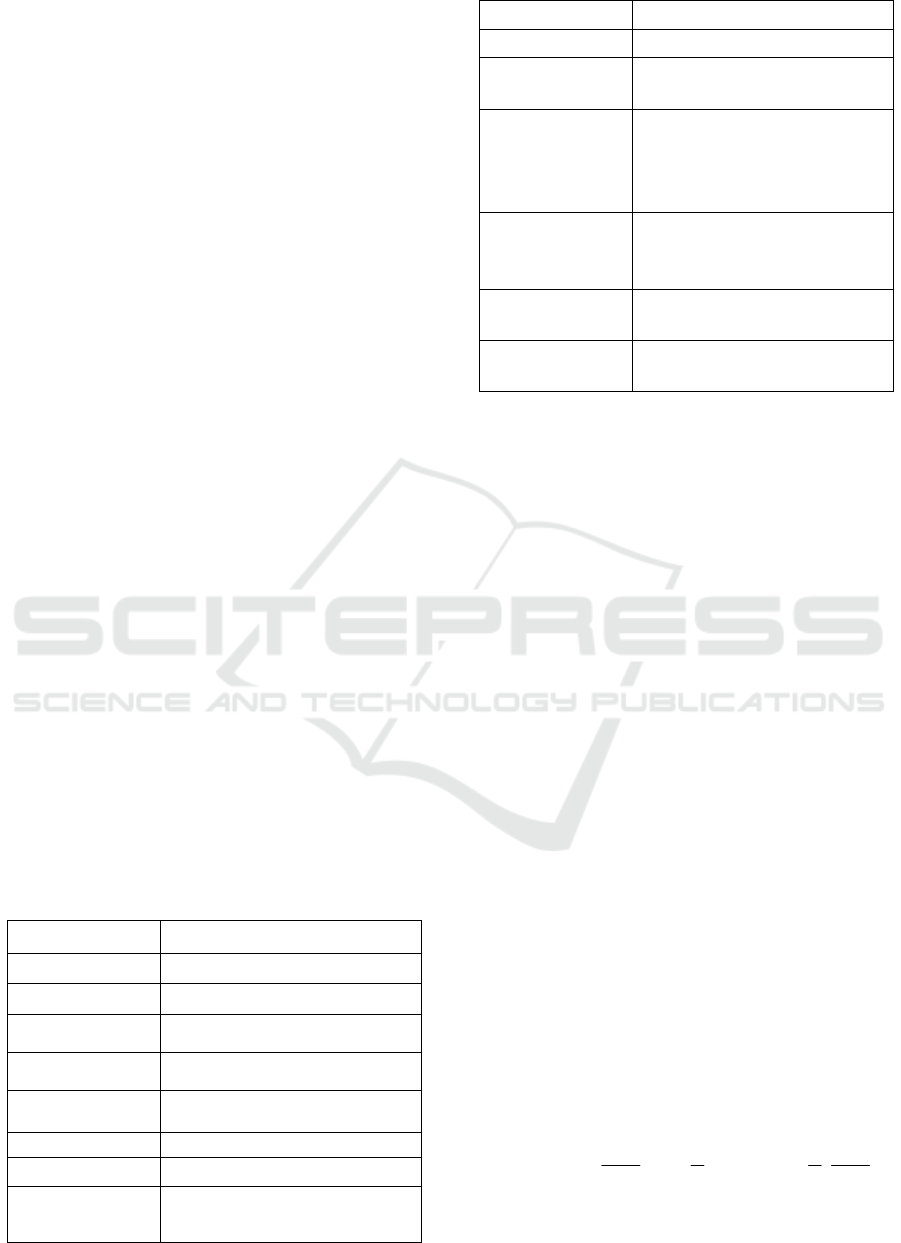

Table 1: Notations and Definitions.

Figure 1. Notation Figure 2. Definition

p

Unit product price

c

Unit product cost

o

Consumer's shopping cost under O

channel

h

Shopping inconvenient costs under S

channel

l

The inconvenience of BOPS channel

relative to S channel (

01l<<

)

θ

Online return rate (

01

θ

<<

)

s

Customer perceive value of ES

w

A cross-selling net profit from each

unit of store demand or BOPS

demand

e

Cost factor of ES (

01e<<

)

v

Product perceived value

i

U

Consumer utility under

i

channel (

, , i O S and BOPS=

)

ij

U

Consumer utility under

i

channel

in case

j

(

, , i O S and BOPS=

,

1, 2, 3 , 4j =

)

ij

Q

The demand under

i

channel in

case

j

(

, , i O S and BOPS=

,

1, 2, 3, 4j =

)

j

Q

The total demand in case

j

(

1, 2, 3 , 4j =

)

j

Π

The total profit in case

j

(

1, 2, 3 , 4j =

)

According to the problem description and the

notations and their definitions in Table 1, we can

obtain the consumer utility functions under the three

channels of O, S, and BOPS as the following (Liu

2021, Long 2021, Hu 2021, Xu 2021, Chiang 2002,

Chhajed 2003, Hess 2003, Cao 2016, So 2016, Yin

2016):

(1 )( ) (1 )

O

Uvpo

θθ

=− − −+

, (1)

S

Uvphs=− −+

, (2)

(1 )( )

BOPS

Uvpslh

θ

=− −+ −

. (3)

For ease of analysis, we assume that both

v and

h

are uniformly distributed on [0, 1].

2.2 Model Building

2.1.1 Case 1: ES Is Not Provided before

Opening the BOPS Channel

In case 1, the retailer only has two channels of O and

S to sell products, and he does not do any extra ES

efforts in stores, i.e.,

0s =

. Thus, consumer utility

functions are as following:

1

(1 )( ) (1 )

OO

UU vp o

θθ

==− −−+

, (4)

1S

Uvph=− −

. (5)

According to the distribution assumption of

v

and

h

, we can obtain the demand functions under

the two channels of O and S as following (Liu 2021,

Long 2021, Hu 2021, Xu 2021, Chiang 2002,

Chhajed 2003, Hess 2003, Cao 2016, So 2016, Yin

2016):

1

11

= (1 )[1 (1 ) (1 ) ]

12 21

O

Qpo p o

θθ θθ

θθ

++

−− − − −−

−−

,

(6)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

948

2

1

(1 ) 1 1

(2 2 ) (1 )

2(1 ) 1 2 1

S

o

Qpopo

θθθθ

θθ θ

++ +

=−−+−−

−− −

.

(7)

Then, the total demand is as follows:

2

111

111

= 1 ( )

121

OS

QQ Q p o o

θθ

θθ

++

+=−− +

−−

.

(8)

In this case, because the retailer does not offer any

extra ES efforts, he does not pay the ES cost.

However, customers who come to the store will bring

traffic and generate new orders due to cross-selling.

The retailer obtains a net profit

w from each unit of

S demand (Gao 2017, Su 2017), thus, the total profit

is obtained as follows:

11 1

2

2

() ( )

111

( )[1 ( ) ]

121

(1 ) 1 1

[ (2 2 ) (1 ) ]

2(1 ) 1 2 1

OS

pcQ pcwQ

pc p o o

o

wpopo

θθ

θθ

θθθθ

θθ θ

Π= − + − +

++

=− −− +

−−

++ +

+−−+−−

−− −

.

(9)

2.1.2 Case 2: ES Is Not Provided after

Opening the BOPS Channel

In case 2, the retailer has three channels of O, S, and

BOPS to sell products, but he does not offer any extra

ES efforts in stores, i.e.,

0s =

. Thus, consumer

utility functions are obtained as following:

2

(1 )( ) (1 )

OO

UU vp o

θθ

==− −−+

,

(10)

2S

Uvph=− −

, (11)

2

(1 )( )

BOPS

Uvplh

θ

=− − −

. (12)

Similar to Case 1, the demand functions under the

three channels of O, S, and BOPS, and the total

demand function can be obtained as following:

2

2

11 (1)(1)

=(1 )(1 ) [1 ]

12

O

l

Qpo o p o

ll

θθθ θ

θθ

++ −+

−− − − −−

−

,(13)

2

2

(1 ) (1 )(1 )

=[22 ]

2

(1 )(1 )

[1 ]

2

S

ol

Qpo

ll

l

po

l

θθ

θ

θθ

θ

+−+

−−

−+

+−−

,

(14)

22

2

(1 ) 1 1

()

21

BOPS

ol

Q

ll

θ

θθ

+−

=−

−

, (15)

22

222 2

1(1)

1

12(1)

O S BOPS

o

QQ Q Q p o

l

θθ

θθ

++

=++ =−− +

−−

.

(16)

In this case, because the retailer does not offer any

extra ES, he does not pay the ES cost. However,

whether customers who go to the store to try on and

place an order through S channel, or customers who

pick-up the goods through BOPS channel, they will

bring traffic to the store and generate new orders and

a net profit

w . Thus, we obtain the retailer’s profit

function as follows:

22 2 2

22

2

() ( ) ( )

1(1) (1)

( )[1 ] [

12(1) 2

111

(2 2 ) (1 ) ]

12

O S BOPS

pcQ pcwQ pcwQ

oo

pc p o w

ll

l

po p o

l

θθ θ

θθ

θθ θ

θθ

Π= − + − + + − +

++ +

=− −− + +

−−

+−+

−− + −−

−

.

(17)

2.1.3 Case 3: ES Is Provided before Opening

the BOPS Channel

In case 3, the retailer only has two channels of O and

S to sell products, but he does some extra ES effort in

stores, i.e.,

0s ≠

. Thus, consumer utility functions

are as following:

3

(1 )( ) (1 )

OO

UU vp o

θθ

==− −−+

(18)

3S

Uvphs=− −+

. (19)

Similar to Case 1, the demand functions under the

two channels of O and S, and the total demand

function can be obtained as following:

3

11

= (1 )[1 (1 ) (1 ) ]

1221

O

Qpos p o

θθ θθ

θθ

++

−− −− − −−

−−

,

(20)

2

3

1111

(1 )[ (1 ) (1 ) ] ( )

12 2121

S

Qposp o os

θθ θθ θ

θθθ

+++

=−− + − +− + +

−−−

, (21)

2

333

111

= 1 ( )

121

OS

QQ Q p o os

θθ

θθ

++

+=−− + +

−−

,

(22)

33 3

2

2

() ( )

111

=( ) [1 ( ) ] ( )

121

1111

{(1 )[ (1 ) (1 ) ] ( ) }

12 2121

OS

pcQ pceswQ

pc p o os wes

pos p o os

θθ

θθ

θθ θθ θ

θθθ

Π= − + − − +

++

−−− + ++−

−−

+++

−− + − +− + +

−−−

.

(23)

In this case, the retailer provides ES to customers

of S channel, and customers who go to the store to try

on and place an order through S channel will bring

traffic to the store and generate new orders and a net

profit

w . Thus, we obtain the total profit function as

Eq. (23).

Impact of BOPS and ES on Demand and Profitability: Theoretical Models and Simulation Analysis

949

2.1.4 Case 4: ES Is Provided after Opening

the BOPS Channel

In case 4, the retailer sells products through three

channels of O, S, and BOPS, and he does some extra

ES effort in stores. Consumer utility functions are

obtained as following:

4

(1 )( ) (1 )

OO

UU vp o

θθ

==− −−+

,

(24)

4S

Uvphs=− −+

, (25)

4

(1 )( )

BOPS BOPS

UU vpslh

θ

==−−+−

.

(26)

Similar to Case 2 and Case 3, the demand and

profit functions can be obtained as following:

4

1(1)(1)

=(1 )[1 ]

1

1(1)(1)

[ (1 ) (1 ) ]

2

1(1)(1)

[1 ]

O

os

Qpo

l

os

pos

l

lo s

ps

l

θθθ

θ

θθ

θθ

θθ

θ

+++−

−− −

−

++−

−−+++−

−+ +−

−+−

,(27)

4

(1 ) (1 ) (1 )[(1 ) (1 ) ]

={1 }

2

1(1)(1)

[ (1 ) (1 ) ]

2

1(1)(1)

[1 ]

S

os los

Qps

ll

os

pos

l

lo s

ps

l

θθ θθ

θ

θθ

θθ

θθ

θ

++− − ++−

−−+

++−

+−+++−

−+ +−

−+−

,

(28)

4

(1 ) (1 )

2

(1 )[(1 ) (1 ) ] (1 )

{ }

1

BOPS

os

Q

l

lo s o

s

l

θθ

θθ θ

θθ

++−

=

−++− +

−−

−

,(29)

444 4

=

1(1)(1)1

1 ( )

121

OSBOPS

QQ Q Q

os

po os

l

θθθθ

θθ

++

+++−+

=− − + +

−−

.

(30)

44 4 4

=( ) ( ) ( )

1(1)(1)1

= ( )[1 ( )]

121

(1 ) (1 ) 1

( ){ (2 2 )

21

1(1)(1)

[ (1 ) (1 ) ]

2

1

[1

O S BOPS

pcQ pceswQ pceswQ

os

pc p o os

l

os

wes ps o

l

os

pos

l

l

ps

θθθθ

θθ

θθ θ

θ

θθ

θθ

θ

Π − +−−+ +−−+

+++−+

−−− + +

−−

++− +

+− − +−

−

++−

+−+++−

−

−+−

(1 ) (1 )

]}

os

l

θθ

++−

.

(31)

3 IMPACT OF BOPS AND ES ON

DEMAND ALLOCATION AND

PROFITABILITY

In this section, we analyze the impact of BOPS and

ES on demand allocation and profitability in four

scenarios.

3.1 No ES is Provided before and after

Opening the BOPS Channel

In this scenario, by comparing the corresponding

demand and profit functions (6) ~ (9) and (13) ~ (17),

the following proposition 1 can be easily obtained.

Proposition 1. If ES is not provided, BOPS

channel has the following effects on the retailer.

(i) The total demand increases by

22

2

(1 ) (1 )

2(1 )

ol

l

θθ

θ

+−−

−

, its demand from the online

channel decreases by

22 2

22

(1 ) (1 )

2(1 )

ol

l

θθ

θθ

+−−

−

, and its

demand from the store channel decreases by

22

(1 ) (1 )

2(1 )

ol

l

θθ

θθ

+−−

−

.

(ii) The total profit increases by

22

2

(1)(1)[(1)( )]

2(1 )

ollwpcwl

l

θθθ θ

θθ

+−−−−+−+

−

.

Furthermore, if

2

3

()[4(3)(1)]

(1 )(1 )[ (1 3 ) (1 ) ]

lpcl

w

ll

θθθ

θθθ

−−−−

>

−− −−−

and

(1 )(3 ) / 4l

θθ

<− − , the increases in total demand

and total profit are negatively correlated with

l

and

positively correlated with

o . The increases in total

profit and total demand are positively correlated with

θ

, and vice versa. These values are both independent

of

s

.

Proposition 1(i) shows the impact of BOPS on the

demand allocations when ES is not offered before and

after opening the BOPS channel. Actually, some

customers will switch from O channel to BOPS

channel to avoid the costs of shipping and waiting

time, and some customers will switch from S channel

to BOPS channel to reduce the inconvenient costs of

finding goods among shelves and waiting for

checkout, thereby reducing the demand from both O

channel and S channel. In addition, this new BOPS

channel can generate new demand that was not

previously available. As a result, the retailer’s total

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

950

demand increases. Proposition 1(ii) shows the

conditions under which the retailer benefits from

opening BOPS channel due to cross-selling.

3.2 No ES is Provided before Opening

the BOPS Channel and ES is

Provided after Opening the BOPS

Channel

In this scenario, by comparing the demand and profit

functions (6) ~ (9) and (27) ~ (31), the following

proposition 2 can be easily obtained.

Proposition 2. If no ES is provided before opening

the BOPS channel and ES is provided after opening

the BOPS channel, BOPS has the following effects

on the retailer.

(i) The total demand increases by

23 2 22

2

(1 ) 2 (1 ) (1 ) (1 ) (1 )

2(1 )

sos o l

l

θθθθθ

θ

−+ − ++ + −−

−

,

its demand from the online channel decreases by

22 2 2 2 2

22

(1 ) [ (1 ) (1 ) 2 (1 )

2(1 )

]lo s s A

l

θθ θ θ

θθ

−− + + −

−

+−

, and its demand from the store channel decreases by

2(1 )

B

l

θθ

−

, when

3222

22

(1 )[ (1 ) 2 (1 )] (1 )

(1 )[ 2 (1 ) ] [ (1 ) 2 (1 )]

oo s s

l

spsoos

θθ θ θ

θθ θ θ

−+ −+−

<

−−++ −

+

++

.

Furthermore, the increase in total demand is

negatively correlated with

l

and positively

correlated with

o and

s

. If

222

2

1)[4 (1)( )(

4(1 )

]oos

o

l

θθ

θ

−−

<

−−

+

, the increase in total

demand is negatively correlated with

θ

, and vice

versa, where

22

(1 )(1 ) (1 ) (1 )Ao l o l p

θθθθ

=+ −− ++ −

,

22

2

(1 )[ (1 ) 2 (1 )]

(1 )[ (1 ) 2 (1 ) ]

Bo l o s

s

ssllp

θθ θ

θθ θ

=−− + + −

+− − −− −

.

(ii) The total profit increases by

2

22

2(1)

lEC

l

lD

θθ

+

−

−

if and only if

(

)

()

2

4/2lD D CE E<− −

, where

22

()(1)( )Cwes osos

θθθ

=− − ++−

,

2

[( )(2 ) ( ) ]( ) (1 )wes pc oso sD

θθθθθ

−−−− +=+−−

22

22

(1 ) [ 2 (1 ) ( )

2 (1 ) (1 ) [( ) (1 )]]

Eoweosop

ws w p o w

s

pc

θθ θθθ

θθθθ

−+−+++−

++ − − − − −

=

+

.

Proposition 2(i) shows the impact of BOPS on the

demand allocations when ES is not offered before

opening the BOPS channel and ES is offered after

opening the BOPS channel. Similar to Proposition 1,

the total demand increases. Proposition 2(ii) shows

the condition for the increase in total profit after

opening the BOPS channel.

3.3 ES is Provided before Opening the

BOPS Channel and no ES is

Provided after Opening the BOPS

Channel

In this scenario, by comparing the demand and profit

functions (13) ~ (17) and (20) ~ (23), the following

proposition 3 can be easily obtained.

Proposition 3. If ES is provided before opening

the BOPS channel and no ES is provided after

opening the BOPS channel, BOPS has the following

effects on the retailer.

(i) If

2

2

2

(1 )

[(1 ) (1

)

]

(1

)

l

os

o

θ

θθ

θ

−

>

++ −

+

, then the total

demand is reduced by

2222 2

2

(1 ) (1 ) (1 ) 2 (1 )

2(1 )

ls o l los

l

θθθ θ

θ

−− + −−+ −

−

. If

22 2 2 2 2

2

2

222

2(1) (1)(1)(1 )(

]

1)

2]

[[

(1 1

]8

)/[ () 2 (1 )

osl slp l

sl l

θθ θ θ θθ

θθ θ θ

−−+−+−

−−

−

−+

>

−

, the online channel demand is reduced by

22 2 22 2 2

22

(1 ) (1 ) 2 (1 ) 2 (1 )(1 )

2(1)

olosl slp

l

θθθθθ θ

θθ

+−−+ −− −−

−

, and the store channel demand is reduced by

22

(2 2 )(1 ) (1 ) (1 )

2(1 )

ls p s o l

l

θθθθ

θθ

−+ −+ + −−

−

.

Furthermore, the reduction in total demand is

positively correlated with

l

and

s

. Only when

l

is greater than a certain threshold, the reduction in

total demand is positively correlated with

o

and

θ

.

(ii) The retailer’s profit is reduced by

222 2

22

(1 )

2(1 )

ow Fl Gl

l

θθ

θθ

−−+

−

, if

22 22

4(1)

2

FF Gow

l

G

θθ

−− −

>

, where

22

(1 )(1 ) [ (2 ) ( ) ]Fo w pc

θθ θ θ

=−+ −−−

,

22

2

(1 ) [( )(1 ) ( ) ]

2 (1 )[( ) (1 )(1 )]

Go wes pc

os p c e p H

θθθ θ

θθ θ

=+ − −−−

−−−−−−−

,

222

(1 ) [( ) 2(1 )( ) (1 ) ]Hs pcws pwes es e p

θθ θ

= − −+ +− −− − −

.

Impact of BOPS and ES on Demand and Profitability: Theoretical Models and Simulation Analysis

951

Proposition 3(i) shows that total demand is

usually reduced, except for a few cases where the

inconvenience of the BOPS channel is extremely low.

Moreover, store channel demand is reduced, and the

online channel demand is reduced under some

conditions. Furthermore, the higher the

l

or

s

, the

more the total demand is reduced. When

l

is

greater than a certain threshold, the higher the

o

or

θ

, the more the total demand is reduced. Proposition

3(ii) shows that the total profit is reduced when the

inconvenience of the BOPS channel exceeds a certain

threshold.

3.4 ES is Provided before and after

Opening the BOPS Channel

In this scenario, by comparing the demand and profit

functions (27) ~ (31) and (20) ~ (23), the following

proposition 4 can be easily obtained.

Proposition 4. If ES is provided before and after

opening the BOPS channel, BOPS has the following

effects on the retailer.

(i) The total demand increases by

2

2

(1 )( )

2(1 )

losos

l

θθθ

θ

−− + + −

−

, its demand from the

online channel decreases by

22

22

()(1)

2(1)

oso s l

l

θθ θ

θθ

++ − −−

−

, and its demand from

the store channel decreases by

2

(1 )( )

2(1 )

losos

l

θθθ

θθ

−− + + −

−

. Furthermore, the

increase in total demand is negatively correlated with

l

and positively correlated with

o

and

s

. If

22

)

4

(3 4 (1 )

l

o

o

s

θθ θ

−+ −

<

−

, the increase in total

demand is negatively correlated with

θ

, and vice

versa.

(ii) If and only if

()(1)

()(1)()

wes

l

wes pc

θ

θθ

−−

<

−−−−

,

the total profit increases by

2

22

(1 )( ) [( )(1 )(1 ) ( )]

2(1 )

lososwesl lpc

l

θθθ θθ

θθ

−− + + − − − − + −

−

, where

( )(1 ) (1 )[( ) ( )(1 )]Jwes l pc wes

θθ θ θ

=− −++ − −− −

.

Proposition 4(i) shows the impact of BOPS on the

demand allocations when ES is offered before and

after opening the BOPS channel. Similar to

Proposition 1, the total demand increases. Proposition

4(ii) shows that the total profit increases after opening

the BOPS channel when the inconvenience of the

BOPS channel within a certain threshold.

Therefore, if ES is provided, the retailer’s

profitability under the three channels of O, S, and

BOPS channel is better than that under the two

channels of O and S when the BOPS channel is

convenient or the online return rate is not very high.

4 COMPARISON AND

SIMULATION ANALYSIS

In this section, we set 0.6p = and

0.3c =

with

different values of

l

, o and

θ

, the value range of

l

is set to [0.3, 0.9], the value range of

θ

is set to

[0.1, 05]. In addition,

0.04o =

indicates that the

shopping costs of the online channel is low, and

0.12o =

, indicates that the shopping costs of the

online channel is high. The comparison and

simulation analysis of the impact of opening the

BOPS channel on demand and profit in the four

scenarios are shown in Fig. 1 to Fig. 4 by using

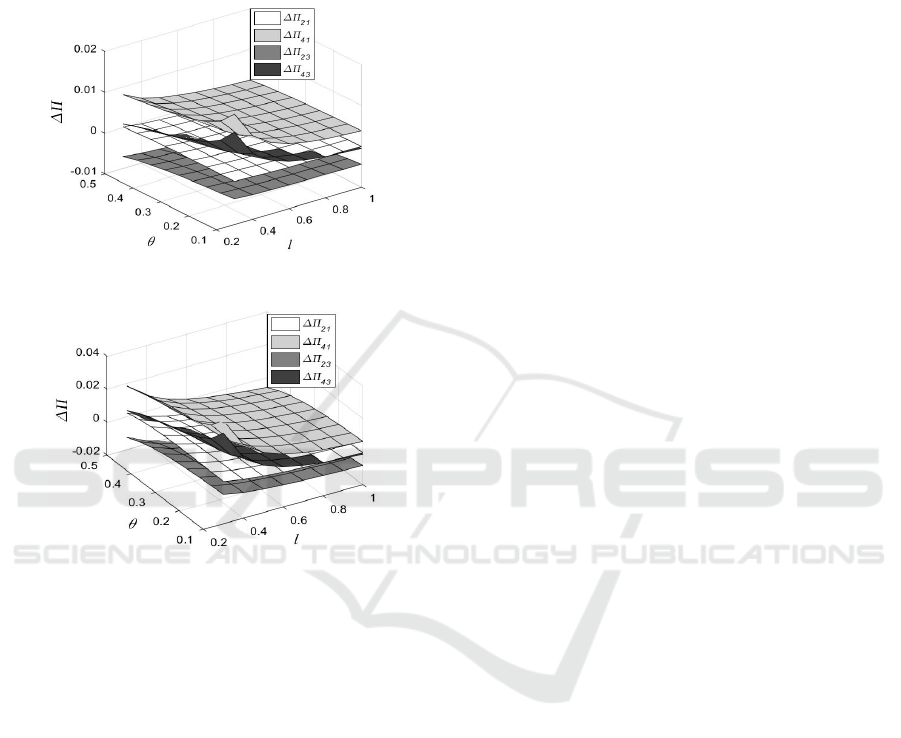

MATLAB software.

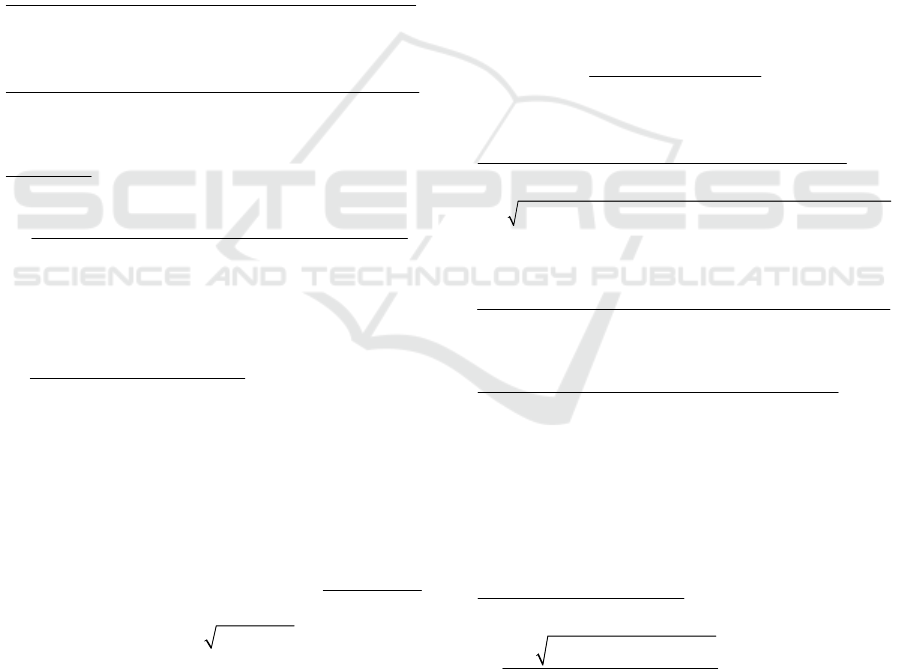

From Fig. 1, we can get the following conclusion

1.

Conclusion 1. When ES is not provided before or

after opening the BOPS channel, or ES is only

provided after opening the BOPS channel, the online

demand will be reduced because

21

0

O

QΔ<

,

41

0

O

QΔ<

,

43

0

O

QΔ<

. Moreover, regardless of

whether ES is provided after opening the BOPS

channel, when ES is not provided before opening the

BOPS channel, the online demand will be reduced

more because

41 43OO

QQΔ<Δ

,

21 23OO

QQΔ<Δ

.

In addition, the opening of the BOPS channel

does not necessarily reduce the online channel

demand due to the lack of ES. As noted in Fig. 1 (a)

and (b), the higher the shopping costs of the online

channel, the more the online channel demand is

reduced.

(a)

0.04o =

(low)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

952

(b)

0.12o =

(high)

Figure 1: Ccomparison of changes in the online channel

demand Δ𝑄

.

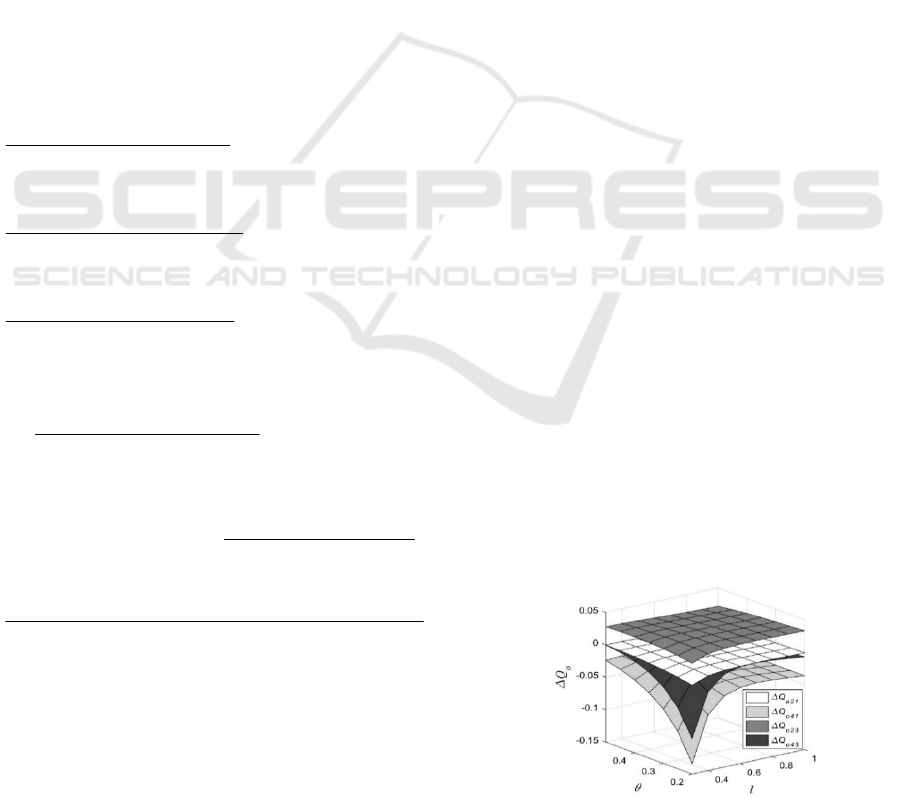

From Fig. 2, the following conclusion 2 can be

obtained.

Conclusion 2. The store demand is definitely

reduced in the scenario where ES is provided before

opening the BOPS channel and no ES is provided

after opening the BOPS channel because

23

0

S

QΔ<

.

(a)

0.04o =

(low)

(b)

0.12o =

(high)

Figure 2: Comparison of changes in the store channel

demand Δ𝑄

.

(a)

0.04o =

(low)

(b)

0.12o =

(high)

Figure 3: Comparison of changes in the total demand Δ𝑄.

Fig. 2 demonstrates that when the inconvenience

of the BOPS channel and the online return rate is not

very high, if ES is provided before opening the BOPS

channel, and regardless of whether ES is provided

after opening the BOPS channel, the store channel

demand will be reduced because

23 43 21 41

0

SSSS

QQQQΔ<Δ<Δ<Δ<

. In addition,

the higher the shopping costs of the online channel,

the more the store channel demand is reduced.

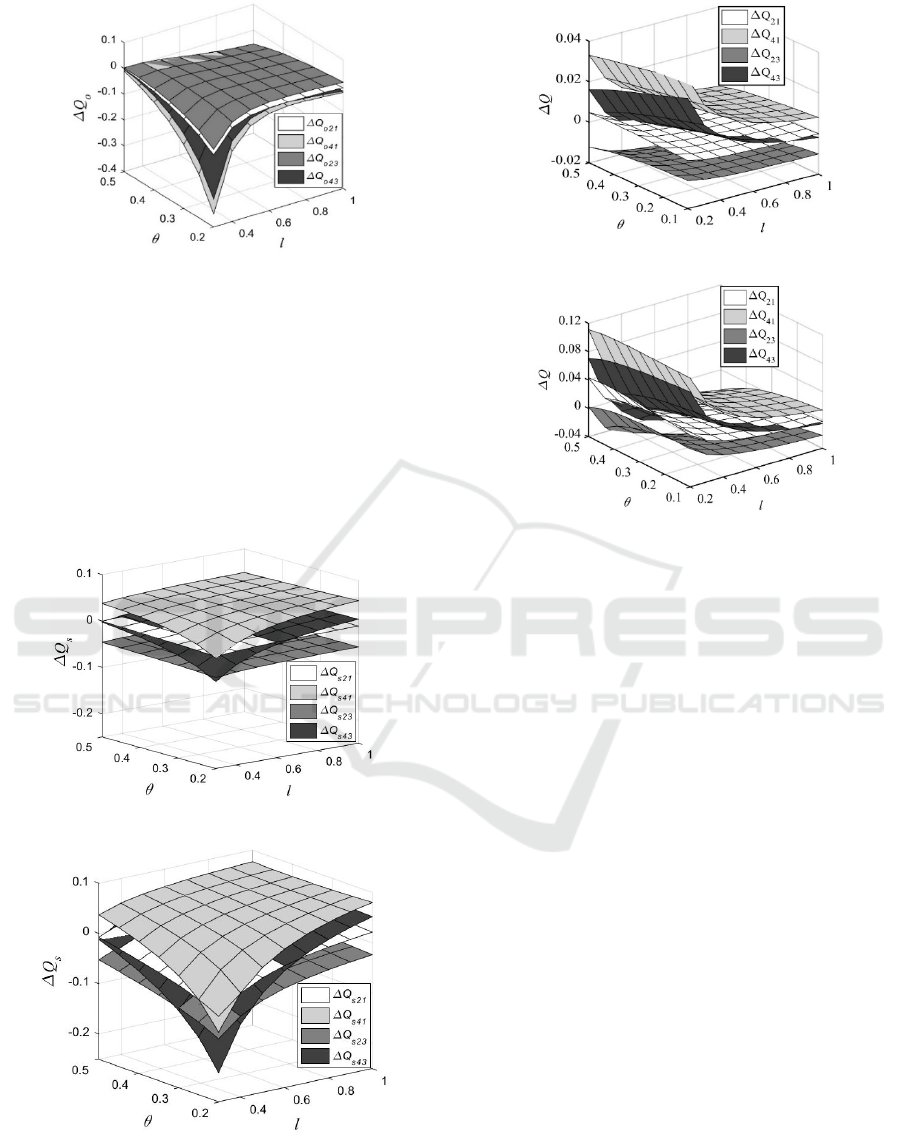

As noted in Fig. 3 and Fig. 4, we can get the

following conclusion 3.

Conclusion 3. After opening the BOPS channel,

when the inconvenience of the BOPS channel and the

online return rate is not high, the increases in the total

demand and total profit in the second scenario are the

largest followed by the fourth scenario because

23 21 43 41

0QQQQΔ < <Δ <Δ <Δ

,

23 21 43 41

0ΔΠ < < ΔΠ < ΔΠ < ΔΠ

.

In addition, regardless of whether ES is provided

before opening the BOPS channel, providing ES after

opening the BOPS channel can increase total demand

and total profit more. It reflects the significant role of

ES. Furthermore, comparing (a) and (b) in Fig. 3 and

Fig. 4, we observe that when the BOPS channel is

more convenient and the online return rate is lower or

the shopping costs of online channel is higher, the

opening of the BOPS channel is more profitable.

Impact of BOPS and ES on Demand and Profitability: Theoretical Models and Simulation Analysis

953

The third scenario is the most special of the four

scenarios. This scenario demonstrates that in the

current new retail era, ES has become increasingly

important and is an inevitable trend to provide

customers with the ultimate experience service to

enhance their competitive advantage.

(a)

0.04o =

(low)

(b)

0.12o =

(high)

Figure 4: Comparison of changes in the total profit ΔΠ.

5 CONCLUSIONS

In this paper, we present four models to study the

impact of BOPS and ES on demand allocation and

profitability. We find that whether a retailer provides

ES and whether a retailer opens the BOPS channel

depends on the number of stores and product

characteristics of the retailer. The number of physical

stores determines the convenience of the BOPS

channel, the product characteristics determine the

customer's demand for the experience service and the

return rate. Therefore, for daily necessary products,

due to the low online return rate and the high shipping

cost, regardless of whether ES is provided, it is

advisable to open the BOPS channel to increase store

traffic and generate new demand; For fast fashion

clothing, shoes and hats and consumer electronics,

due to the high demand for ES, it is advisable to

provide ES to increase customer purchases regardless

of whether the BOPS channel is open. In the above

two cases, it is more profitable to open the BOPS

channel when the number of stores is large. However,

if the number of stores is small (that is, the delivery

is not convenient), the product lacks features or the

update is slow, then the opening of the BOPS channel

or providing ES will reduce the total demand and total

profit.

This study offers several essential insights for

retailers in omnichannel retailing and helps them

develop successful omnichannel strategies. The

store's ultimate experience service not only increases

the purchase of the store channel and BOPS channel

but also directly and indirectly reduces the total return

rate. Therefore, regardless of whether BOPS is

opened, we recommend retailers to provide ES in the

new retail era centered on consumer experience.

BOPS is a popular fulfillment option among

customers. However, not all products are suitable for

store pick-up, such as large furniture, large appliances

and fresh goods. Therefore, selecting an item suitable

for in store and making corresponding inventory

decisions may be another interesting research

question in the future.

ACKNOWLEDGEMENTS

This research is partially supported by the Philosophy

and Social Science Program of Shanghai (Grant No.

2020BGL014) and Fundamental Research Funds for

the Central Universities, China (Grant No. CUSF-

DHD-2018048).

REFERENCES

D.R. Bell, S. Gallino, and A. Moreno, How to win in an

omnichannel world. 56th ed., vol. 1, MIT Sloan

Manage. Rev. 2014, pp. 45-53.

D. Rigby, The future of shopping. 89th ed., vol. 12, Harvard

Busi. Rev. 2011, pp. 65-76.

E. Brynjolfsson, Y.J. Hu, M.S. Rahman, Competing in the

age of omnichannel retailing. 54th ed., vol. 4, MIT

Sloan Manage. Rev. 2013, pp. 23-29.

F. Gao and X. Su, Omnichannel retail operations with buy-

online-and-pickup-in-store, 63th ed., vol. 8, Manage.

Sci. 2017, pp. 2478–2492.

J. Liu, G. Long, Y. Hu, and H. Xu, Impact of BOPS on

Demand Allocation and Profitability in Omnichannel

E-commerce Retailing with Consideration of

Experience Service, DOI:10.1109/ ECIT52743. 2021.

00016, pp. 40–45.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

954

J. Cao, K. C. So, and S. Yin, Impact of an“online-to-

store”channel on demand allocation, pricing and

profitability, 248th ed., vol. 1, Euro. J. Opera. Res.

2016, pp. 234–245.

W. Y. K. Chiang, D. Chhajed, and J. D. Hess, Direct

marketing, indirect profits: A strategic analysis of dual-

channel supply-chain design. 49th ed., vol. 1, Manage.

Sci. 2003, pp. 1–20.

Impact of BOPS and ES on Demand and Profitability: Theoretical Models and Simulation Analysis

955