Research on the Impact of Finance on the Profitability of Commercial

Banks under the Background of Internet+

Yanxian Tan

a

,

Hui Wang and Xueqin Tan

Software Engineering Institute of Guangzhou, Guangdong, China

Keywords: Internet+, Commercial Banking, Financial Markets, Profitability, Decision Making Research.

Abstract: With the continuous progress and prosperity of mobile Internet science and technology, relying on it and the

operation of Internet finance is also natural, and with its advantages of high transparency, good cooperation,

intermediate costs and low cost, quickly occupied China's financial market. Based on the measurement and

analysis of the risk value of Internet finance and commercial banks, this paper studies the risk spillover effect

of Internet finance on commercial banks from the macro and micro levels. Based on the principle of minimum

AIC, BIC and maximum likelihood, this paper selects the best ArMA-GARCH model for the selected 2 groups

of index series and 13 groups of return series, and calculates their risk value and risk spillover value on the

basis of fitting (Wang 2021). In the aspect of risk measurement, the value of risk is quantized by calculating

the value of risk (Va R), and in the aspect of risk spillover, the risk spillover effect is comprehensively

analyzed by calculating the conditional value of risk (Co Va R), its derived index risk spillover value (△Co

Va R) and relative risk spillover degree (%Co Va R). The empirical results show that the impact of Internet

financial risks makes commercial banks suffer from positive risk spillover, but there is no consistency between

macro and micro in the direction of risk spillover (Liu ). On the macro level, the empirical results show that

Internet finance has positive risk spillover to commercial banks, but on the micro level, Yu 'ebao has positive

and negative risk spillover to 12 commercial banks, and the spillover directions of different commercial banks

are not consistent. In terms of overflow intensity, there is no uniform rule for different types of commercial

banks.

1 INTRODUCTION

Internet financial in the process of its development

has a direct impact to the traditional financial

industry, the traditional financial sector operate a

shift in the direction of formalization and digitization

two, so the Internet finance and traditional finance

also closely relates in together, when the Internet

through financial risk, the risk was amplified,

endanger the development of the traditional financial

industry, That is, there is a spillover effect. In China's

financial system, the banking industry has always

played a very important role, and the competition and

cooperation between Internet finance and banks in

business will inevitably bear the brunt of the risk

spillover effect of Internet finance. Exploring the risk

spillover effect of Internet finance on China's banking

industry, on the one hand, can provide reference

opinions for Internet finance enterprises and

commercial banks to carry out scientific and

reasonable risk control and improve the risk

assessment system; On the other hand, it can also help

investors to have a clearer understanding of

investment risks, so that investment tends to be

transparent and reasonable, and create a healthy

investment environment (Yan 2019).

On November 3, 2020, ant Financial, a giant

Internet financial company, was suspended from

listing, which once again shows that behind the rapid

development of Internet finance, there is actually a

huge financial risk. This risk not only affects ant

itself, but also spreads to other financial institutions

through the whole network of financial system.

Serious or even the outbreak of systemic financial

risks (Chen 2021). The bank is the core of the

financial system, the safety of the bank is related to

the security of the whole country's economy. At the

same time, on the one hand, the development of

Internet finance has impacted all kinds of business of

banks; On the other hand, the arrival of THE 5G era

also speeds up the pace of banking capitalization,

resulting in the formation of numerous links between

818

Tan, Y., Wang, H. and Tan, X.

Research on the Impact of Finance on the Profitability of Commercial Banks under the Background of Internet+.

DOI: 10.5220/0011350200003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 818-824

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

banks and Internet finance. Therefore, paying close

attention to the risk of Internet finance and the

spillover effect of such risk on commercial banks is

the basis of providing some reference suggestions for

reasonable control of such risk.

2 THE RELATED THEORY

2.1 Internet Finance

On October 13, 2016, The General Office of the State

Council issued the Notice on the Implementation Plan

of the Special Rectification of Internet Financial

Risks and pointed out that: Internet finance is not

simply the combination of the Internet and finance,

but a new model and business, of course, it is created

to meet the new needs of users after the realization of

security, need to trust and accept mobile radio and

other network technology (Wang 2021).

Traditional financial institutions begin to use new

technologies to upgrade their businesses and optimize

their own management. For example, artificial

intelligence technology is used to replace ordinary

labor, thus reducing business costs while improving

business efficiency and quality. Big data technology

can be used to mine and process customer

information to reduce information asymmetry and

thus reduce bank operation risks (Chen 2021).

2.2 Fin Tech

Fin tech is a financial disinter mediation activity

carried out by innovative enterprises using science

and technology to traditional financial institutions

(such as commercial banks). The Monetary Authority

of Singapore sees fin tech as an innovative

technology that can be used in the traditional

financial sector as well as relevant regulatory bodies.

In 1992, with the establishment of The China

Association for the Promotion of Science and

Finance, the word fin tech gradually entered the

Chinese people's vision. In recent years, with the

progress of information technology and its

development and innovation in the financial field (Li

2021), fin tech has become the driving force and

support for the innovation and development of

financial business from the intermediate link in the

beginning, and its role in the financial industry is

growing and its influence cannot be underestimated.

From the perspective of the application of technology

in financial business, the development of fin tech in

China can be divided into three stages: financial

electrification stage, Internet finance stage and deep

integration stage.

2.3 Profitability of Commercial Banks

Profitability of commercial banks refers to the nature

that banks can make profits by operating their own

assets. This nature is not only affected by the bank

itself, but also by the external operating conditions of

the bank. It is one of the three characteristics followed

by the operation and management of commercial

banks, and it is also the object that commercial banks

focus on. Specifically, profitability refers to the

ability of a bank to obtain income and achieve its

asset appreciation target through its own business

operation within a certain accounting period.

Therefore, this paper mainly measures this index

through return on total assets (ROA) (Liang 2021).

On the other hand is the income structure of

commercial banks, which mainly refers to the

composition of profits or operating revenues of

commercial banks (including: By comparing the

income structure and the proportion changes of each

part, we can effectively see the development of

commercial banks in different businesses, and

measure whether the current development of

commercial banks is reasonable. Therefore, This

paper mainly measures the contribution rate of bank's

balance sheet business and off-balance sheet business

to bank profits by the proportion of non-interest

income to total operating income, and analyzes the

impact of fin tech on the income structure of

commercial banks according to the changes of the

two.

3 RISK MEASUREMENT AND

MODEL CONSTRUCTION

3.1 Risk Measurement Method Va R

Va R is derived from English 'Value at Risk', which

refers to the maximum loss faced by a certain

financial asset or portfolio under normal market

fluctuations. In July 1993, G30 members proposed

that Va R was first used to measure financial risk. In

1999, Basel committee encouraged the use of Va R to

measure the credit risk of commercial banks.

Subsequently, in 2004, the measurement object of Va

R was expanded to the sum of credit, market and

operational risks. At the same time, many scholars

also strongly advocated using Va R to measure some

risks common to commercial banks. Since then, Va R

Research on the Impact of Finance on the Profitability of Commercial Banks under the Background of Internet+

819

has been widely used and plays a very important role

in risk measurement (Zeng 2021).

From a statistical point of view, Va R refers to the

maximum possible loss of a certain financial asset or

portfolio value in a specific period in the future at a

certain probability level or confidence level, which

can be expressed as:

(1)

△P represents the value loss of a certain financial

asset or portfolio within a certain holding period; P

represents probability and α represents significance

level. Generally, the significance level is set at 5%,

which reflects the risk preference or acceptance

degree of financial asset managers. Different

significance levels represent different risk degrees.

Generally speaking, the significance level is

determined according to the investor's preference,

acceptance and acceptance degree of risk.

3.2 CoVa R

The emergence of Va R has realized the

transformation of risk analysis from qualitative to

quantitative, but it can only be used to measure the

maximum loss at risk faced by a single financial

institution or market. In the same market

environment, when a certain financial institution has

a risk, other financial institutions may also be affected

by the risk spillover, but Va R cannot calculate the

size of the risk spillover or judge the direction of the

spillover.

In 2009, Adrian & Brunnermeier proposed Co Va

R, which is used to measure the economic loss that a

portfolio may face in a crisis or high risk situation

(Ren 2021). Its expression is:

α

αα

==≤ )(

m nnmn

VaRXCoVaRXP

(2)

Where,

n

VaR

α

represents the value of risk faced

by financial institution n at a given significance level

α;

n

CoVaR

α

represents the value of risk faced by

financial institution n at a given significance level,

and the value of risk is

n

VaR

α

.

mn

CoVaR

α

is the

conditional Va R of financial institution m with

respect to financial institution n, used to measure the

total Va R of financial institution m facing risks. It is

the sum of the Va R

m

VaR

α

of financial institution

m and the risk spillover value of financial institution

n to financial institution m when the market is at a

normal fluctuation level (Luo 2021).The risk

spillover value is usually expressed as

mn

CoVaR

α

Δ

, which is the difference between the conditional Va

R

mn

CoVaR

α

and Va R

m

VaR

α

of financial

institution m.

mmnmn

VaRCoVaRCoVaR

ααα

−=Δ

(3)

mn

CoVaR

α

Δ

N measures the financial

institutions for financial institutions m generated by

the size of the risk of overflow, but different size of

the risk value of financial institutions tend to have

difference, in order to better facilitate comparison and

study, to deal with the dimensional change risk tend

to overflow value, n get financial institutions for

financial institutions risk spillover, m

mn

CoVaR

α

%

.It is used to measure the proportion of risk spillover

received by a financial institution to its own risk, and

its specific mathematical expression is as follows

(Zhang 2021):

%100% ×

Δ

=

m

mn

mn

VaR

CoVaR

CoVaR

α

α

α

(4)

This paper will study the risk spillover effect of

Internet finance on commercial banks by combining

mn

CoVaR

α

,

mn

CoVaR

α

Δ

,

mn

CoVaR

α

%

and

three indicators.

3.3 Va R and Co Va R Values Are

Calculated based on ArMA-

GARCH Class Model

A mean equation plus a Va Riance equation forms a

time series. The residual of ordinary ARMA model is

the white noise sequence that cannot analyze any

information, so the Va Riance equation is ignored.

The mean value of GARCH model is usually

assumed to be a constant, and the residual has ARCH

effect, so the research focus is on the Va Riance

equation, and the mean value equation is usually

ignored. In order to model both the mean and the

difference, the two models are combined

(Teng 2021).

The ARMA(P,q)-GARCH(m,n) model is

constructed, and its expression is:

tjt

q

j

jit

p

i

it

XX

εεθφ

φ

+++

−

=

−

=

=

2

11

0

(5)

2

1

2

1

2

it

n

j

jit

m

j

it −

=

−

=

++=

εβσαωσ

(6)

It can be seen from the above expressions that the

ArMA-GARCH model is a random process in which

the mean value meets the ARMA process and the Va

Riance meets the GARCH process.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

820

In this paper, arma-garch model is used to fit the

data of Internet finance and commercial banks, and

the model with the best goodness of fit is selected to

obtain the regression results, so as to calculate the

corresponding Va R and Co Va R values. For easy

understanding, we assume that ARMA (1,1) -garch

(1,1) is used.

The model best fits the data of financial institution

M as an example to illustrate the calculation

principle, and its expression is as follows (Fan 2021):

tt

mm

t

mm

it

mmm

t

SXX

εεθφφμ

++++=

−−− 11121

(7)

2

1112

2

11

2

−−−

+++=

t

mm

t

m

t

mm

t

S

εβασαωσ

(8)

Where, is the return rate of financial institution M,

is the state Va Riable, and is the conditional Va

Riance.

m

t

X

m

S

1-t

2

t

σ

m

t

m

t

m

t

m

it

q

i

m

i

m

it

p

i

m

i

m

t

mm

t

XSX

εμεεθφφ

+=++++=

−

=

−

=

−

11

10

(9)

Then, the risk value of financial institution M

affected by the risk of financial institution n can be

calculated by the following formula:

mn

t

CoVaR

m

t

m

t

mn

t

QXCoVaR

σα

)1( −−=

(10)

4 INTERNET FINANCE AND

RISK ANALYSIS OF

COMMERCIAL BANKS

This paper measures and analyzes the value-at-risk of

Internet finance and commercial banks from macro

and micro levels. First, the selection of sample data

and Va Riable symbols are explained, followed by

descriptive statistics of sample data, and then the data

are tested. On the basis of passing the test, the best

ArMA-GARCH model is selected for each sequence

to fit according to the minimum AIC and BIC

principles and the maximum likelihood principle.

Finally, Va R is calculated and analyzed.

4.1 Sample Selection

Macroscopically, the Internet financial sector selects

THE China Securities Internet Finance Index to

represent the whole industry, while the commercial

banking sector selects the China Securities Bank

Index to represent the whole industry. The two

indexes are both compiled by China Securities

Corporation and are the most authoritative indexes in

these two industries in recent years, reflecting the

overall performance of the two major industries of

Internet finance and commercial banking. The data

comes from the official website of China Securities

Index Co LTD.

In the micro part, select a single Internet financial

product and some commercial banks, calculate their

risk value, and further study the risk spillover of

Internet financial products to commercial banks on

this basis. This paper selects the yield data of

Shanghai Composite Index as the state Va Riable.

The data of micro part and Shanghai Composite

Index come from RESSET database.

For the micro part, considering the late listing

time of some commercial banks, the first day is

selected as January 1, 2016, and the last day is

consistent with the macro part, which contains half

data of 4 years in total. Except weekends and

holidays, 1,072 observation values are included.

Since the listing dates of Bank of Shanghai and Bank

of Hangzhou were both later than January 1, 2016,

only 860 and 874 observations were included,

respectively.

4.2 Descriptive Statistics of Data

The stationarity of price series is generally poor. In

contrast, logarithmic return series has the advantages

of convenience and stability (Yu 2021). Based on

this, this paper adopts logarithmic return rate series,

whose calculation formula is as follows:

)ln()ln(

1−

−=

ttt

PPr

(11)

Among them, the rt Represents the logarithmic

rate of return at time t, PtRepresents the price level at

time t, Pt-1Represents the price level of the previous

period. There are 16 logarithmic return rate series

used in this paper, including return rate series of

Internet finance and commercial banks, return rate

series of Shanghai Composite Index, return rate series

of Yu 'ebao and return rate series of 12 commercial

banks. Since the value of the return rate itself is small,

in order to improve the differentiation, the return rate

and its descriptive statistics are uniformly reserved to

4 decimal places. The descriptive statistics are shown

in Table 1 and Table 2.

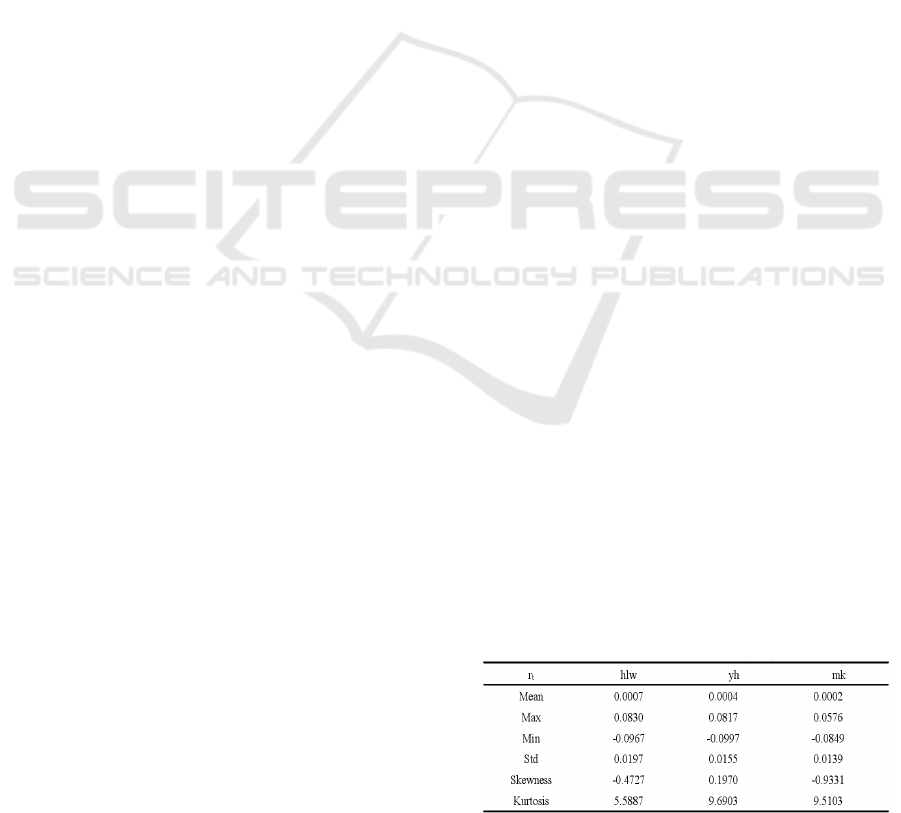

Table 1: Descriptive statistics of yield series (macro).

Research on the Impact of Finance on the Profitability of Commercial Banks under the Background of Internet+

821

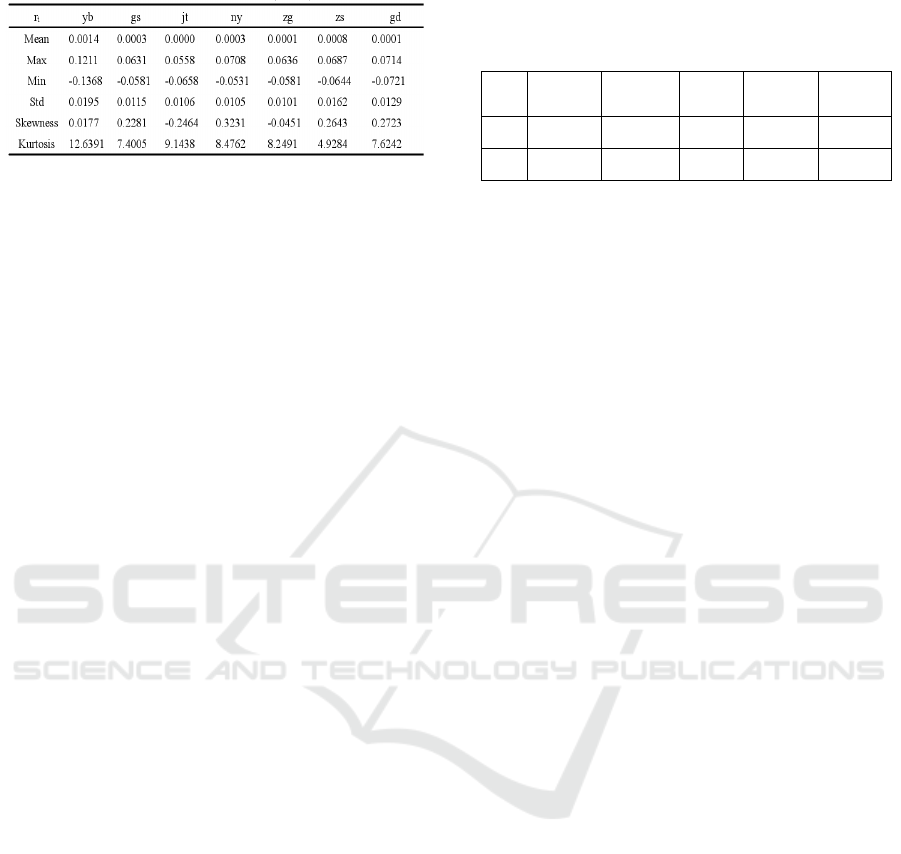

Table 2: Descriptive statistics of return rate series (micro).

Table 1 shows the data of Internet finance index,

banking index and Shanghai Composite Index. It can

be seen from the table that the average return rates of

Internet finance, banking index and Shanghai

Composite Index are all positive and decrease

successively. In contrast, the average return rate of

Internet finance index is significantly higher than the

other two indexes, reaching 0.0007, which is

consistent with the characteristics of high return of

Internet finance. The bank index followed with an

average yield of 0.0004. The Yield of the Shanghai

Composite Index is only 0.0002, which is the smallest

in comparison.

Standard deviation is used to reflect the

fluctuation of a set of data, and the greater the

standard deviation, the greater the fluctuation of the

set of data, and vice versa. It can be seen from Table

1 that the fluctuation range of the three series is not

large. The fluctuation range of the banking index is

very close to that of the SSE Composite Index, while

the standard deviation of the Internet finance index is

slightly larger than that of the first two series,

indicating that the fluctuation range of the Internet

finance index is larger than that of the banking index

and the SSE Composite Index.

4.3 Calculation and Analysis of Va R

Value

The premise of calculating Va R is to build a model

to fit the rate of return data. In order to consider both

the mean and Va Riance, this paper selects Arma-

garch class model. Different sequences of data have

different characteristics, so the selected ArMA-

GarCH model is not consistent. After the model is

established, step forward prediction is made to obtain

the step forward prediction values of mean and Va

Riance, denoted as

m

t

X

ˆ

and

m

t

σ

ˆ

respectively,

and then according to the formula:

)1(

ˆ

ˆ

ασ

−−= QXVaR

m

t

m

t

m

t

(12)

It can calculate the at risk values of Internet

finance index, China Securities Bank Index,

Tianhong Yu 'ebao and selected commercial banks at

a given significance level. The calculation results

are as follows.

Table 3: Calculation results of Va R (macro part).

Va

R

The

mean

The

maximum

The

median

The

minimum

value

The

standard

deviation

hlw 0. 0236 0. 0234 0. 0491 0. 1341 0. 0181

bk 0.0214 0. 0191 0. 0297 0. 1212 0. 0139

After calculation, the mean value of Va R of

Internet finance index is -0.0236, and that of China

Securities Bank index is Va R. The median risk value

of the Internet finance index is 0.0491, while the

median risk value of the China Securities Index is 0.

0297. Both the mean and the median risk value of the

Internet finance index are higher than that of the

banking index, so the risk of Internet finance is

relatively high. To compare the standard deviation,

the chart shows that the risk of Internet financial

index value of the standard deviation is 0. 0181, the

risk of bank index value of standard deviation is 0.

0139, much smaller than the Internet financial index,

shows that the risk of Internet financial index value

of volatility than bank index, namely that stability of

the risk, the banking sector is superior to the Internet.

5 ANALYSIS OF INTERNET

FINANCE'S RISK SPILLOVER

EFFECT ON COMMERCIAL

BANKS

5.1 Risk Spillover of Internet Finance

to the Asset Business of

Commercial Banks

The business of using assets to create income is the

asset business of commercial banks, which generally

refers to Va Rious types of loans. In Internet finance,

P2P industry, online credit consumption, Internet

crowd-funding and other industries with financing

business compete with the asset business of

commercial banks. With their unique advantages, the

asset business of commercial banks is threatened and

challenged due to many alternatives. Loans from

traditional financial institutions

The business threshold is high and the approval

procedures are complicated. Small, medium and

micro enterprises often find it difficult to borrow the

funds they need because of their congenital lack of

conditions, while the private lending market is

chaotic and risky. The emergence of P2P network

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

822

platform loans has solved these two problems well.

The PEER-to-peer (P2P) industry is gaining

popularity because of its timeliness, low barriers to

entry and simple processes. However, the financing

scale of P2P industry is limited and the risk is large,

which greatly reduces the attractiveness of customers

with superior conditions.

The emergence of crowdfunding platforms makes

it possible for many enterprises or individuals to raise

funds through the Internet. Internet crowdfunding is

popular because of its transparency and speed of

raising funds, as well as its low transaction costs. By

taking advantage of these advantages, crowdfunding

platforms have attracted a large number of customers

with capital needs, resulting in the reduction of the

loan business of traditional commercial banks and

bringing a certain impact to commercial banks. If

consumer credit platforms cooperate with banks,

consumer information can be converted into

customer credit recognized by banks. However,

Internet technology is not fully mature, and it is easy

to spread its own risks to banks, bringing default risks

and economic losses to banks.

5.2 Indirect Risk Spillover of Internet

Finance to Commercial Banks

The risk spillover of Internet finance not only directly

affects the business of commercial banks, but also

indirectly infects the risks to banks through the

financial association network, among which the most

common way is to induce and cause some systemic

risks to the commercial banks.

(1) Internet technology is not yet mature, and the

online business of commercial banks relies on mobile

Internet technology, so there are risks. The potential

risks brought by Internet technology to banks can be

analyzed from three aspects. First, there are

vulnerabilities in computers and mobile devices used

for transactions. Secondly, commercial banks' online

trading platforms or APPS have security risks.

Finally, the transaction data between customers and

banks relies on the Internet network for transmission,

and there is a risk of theft. The immaturity of Internet

technology mainly threatens the banking industry

from these three aspects. If any problem exists in any

aspect, it will cause information leakage or damage to

data integrity, and finally threaten the security of

customers' funds.

(2) Internet finance can influence the macro

economy. With the popularization and rapid

development of Internet finance in China, it has

become an important part of the whole macro

economy, so its change will have an important impact

on the whole Macro economy of China. For example,

changing the interest rate, driving the economy and

changing the supply and demand of money will lead

to the change of macro policies, which will threaten

the operation efficiency of banks and lead to the

expansion of bank credit. These are inverted shadows

It will lead to market instability, increase

economic volatility, and ultimately lead to systemic

risks.

(3) There is information contagion between

Internet finance and banking. The emergence of

Internet finance, such as platform abandonment,

centralized rectification and policy risks, has brought

crisis to the industry, which has been reported and

spread by the media and infected the

banking industry.

At the same time, the investor's psychological risk

prediction may be on their investment business

activities and financial management directly impact

behavior, spread too much negative news may even

directly affect the investor's psychological risk

prediction, make investor psychology becomes

fragile, eventually lead to investment behavior

change, reduce the profitability of commercial Banks,

eventually trigger a systemic risk.

6 CONCLUSIONS

This paper studies the risk spillover of Internet

finance to commercial banks. Before risk spillover

analysis, the risks of Internet finance and commercial

banks should be measured first. This paper measures

the risks of Internet finance and commercial banks

from macro and micro levels. From the macro point

of view, we measure and analyze the financial risks

of the two research objects by using the Internet

finance index and the bank index of China Securities

Corporation. On the micro level, the return rate series

of representative Internet financial product Antiphon

Yu 'eBay and 12 listed commercial banks of different

types are selected to calculate and analyze their

respective risk values. Secondly, the risk spillover

effect of Internet finance on commercial banks is

studied. Similarly, risk of overflow from the

macroscopic and microscopic two level, the

difference is that we study the risks are not only a

quantitative risk only when overflow of overflow

value calculation, but prior to the Internet in our

country finance for commercial bank risk caused

overflow has carried on the qualitative analysis,

qualitative analysis at the direct and indirect two

aspects to analysis the risk of overflow , let us have a

more comprehensive understanding of the risk

Research on the Impact of Finance on the Profitability of Commercial Banks under the Background of Internet+

823

spillover mechanism of China's Internet finance for

commercial banks.

This paper innovatively selects yu 'eBay, the

largest Internet monetary fund, and 12 listed

commercial banks from a micro perspective to study

the risk spillover effect of a single Internet financial

product on different banking institutions from a new

perspective. Based on the analysis of the Internet on

commercial bank financial risk spillover, although

the macro level, it is concluded that the Internet

financial overflow the risks of commercial Banks has

positive conclusion, the empirical results show that

the micro Internet financial products celestial balance

treasure of the selected 12 listed commercial Banks

to the risk of overflow direction is negative, the

overflow direction is inconsistent, However, this

paper does not further explore the specific reasons for

different risk spillover directions at the micro level.

ACKNOWLEDGMENT

Fund project 1: This paper is the mid-term research

result of the university-level teaching and research

project of Guangzhou Institute of Software "Research

on the Impact of Internet Finance development on

risk-taking of commercial Banks" (No.: KY202007).

Fund project 2: This paper is the mid-term

research result of the higher education research

project of the "14th Five-year Plan" of Guangdong

Higher Education Association, "Research on talents

Training Mode Innovation of Application-oriented

Undergraduate Colleges from the perspective of"

New Engineering "(NO.21JYB180).

Fund project 3: This paper is a phased research

result of the 2021 Scientific research and Technology

project of Guangzhou Institute of Software

(NO.ky202115), "Application and Research of Key

Technologies in Smart Campus based on 5G

Environment".

AUTHOR INTRODUCTION

Tan Yanxian (1989-), female, MASTER candidate,

lecturer, research direction: financial measurement,

big data.

REFERENCES

Chen Hui. The impact of financial disintermediation on the

profit structure of China's Commercial Banks [D].

Shandong University, 2021.

Chen Yueyi. Research on the impact mechanism of Internet

finance on commercial banks' profitability [D]. Sichuan

University, 2021.

Fan Ruixue. The impact of Internet finance on Our

commercial bank -- Based on the perspective of

profitability and security [J]. North Finance, 2021, (05):

63-67.

Li DEzhen. Research on the impact of Internet finance on

profitability of commercial banks under the

background of fintech development [D]. Sichuan

University, 2021.

Liang Xiaoming, LIAO Yangting. Profitability, return on

Total Assets and the strategic development of

commercial banks [J]. Time Finance, 2021, (17):36-39.

Liu Mengfei, WANG Qi. Does Internet finance reduce the

profitability of commercial banks? Transactions of

Beijing Institute of Technology (Social Science

Edition), 2021,23(06):96-109.

Luo Chuyue. Analysis of the impact of Internet finance on

the profitability of China's commercial banks [J].

Today's Wealth,2021, (11):43-44.

Ren Yuting. Research on the impact of Internet Finance on

the profitability of listed Commercial Banks [D].

Shanxi University of Finance and Economics, 2021.

Teng Junnan. Research on the impact of Internet Finance

on the profitability of JS Banks in China [D]. Shandong

University of Finance and Economics, 2021.

Wang Jiao. Research on the relationship between Internet

finance and profitability of Domestic listed commercial

banks [D]. Northwestern University,2021.

Wang Yu, KAN Ba. The impact of Internet Finance on the

profitability of commercial banks [J]. Financial

Science, 2021, (11): 14-24.

Yan Zhiyu. Research on strategies to improve the

profitability of commercial banks [J]. Investment and

Entrepreneurship, 2019, 32(17):74-76.

Yu Juyang, Song Liangrong. Research on the impact of

Internet Finance on the profitability of commercial

banks [J]. Reform and Opening up,2021, (09):19-24.

Zeng XIUqin. Research on profit model of commercial

banks under the Background of Internet Finance [D].

Yunnan University of Finance and Economics,2021.

Zhang Minmin. Research on the impact of financial

technology on the profit model of commercial banks

[D]. Shandong University of Finance and Economics,

2021.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

824