Auctions and Estimates: Evidence from Indian Art Market

Shailendra Gurjar and Usha Ananthakumar

Shailesh J. Mehta School of Management, Indian Institute of Technology Bombay, India

Keywords: Presale Estimates, Art Auction, Indian Art Market, Incidental Truncation.

Abstract: We examine whether presale estimates of paintings by Indian artists are unbiased predictors of the hammer

price. Our analysis includes both sold and unsold artworks. Unbiasedness of estimates is tested by performing

a two-stage Heckit model on 5,077 artworks auctioned between 2000 and 2018. The results of our study show

that presale estimates are upward biased for expensive artworks and downward biased for others. In addition,

we also find that in the market for Indian paintings, characteristics of auction, artist, and artwork determine

the biasedness of estimates.

1 INTRODUCTION

On May 5, 2004, Picasso’s “Boy with a Pipe” created

the history by fetching US$ 104 million at Sotheby’s

auction in New Yok. Charles Moffet, then co-director

of Impressionist and modern art at Sotheby's,

described the painting as a masterpiece (“Picasso

painting sells for $104m,” 2004). On the other hand,

famed art critic Robert Hughes called “huge sums

paid to immature Rose Period Picasso a cultural

obscenity”(Kennedy, 2004). Such divergent views

about artworks and artists are not a recent phenomenon.

Back in 1863, the Paris Salon jury rejected The

Luncheon on the Grass, which is now one of the well-

known works of Edouard Manet (Spolsky, 1996). The

differences in opinions are caused due to subjectivities

involved in valuing a product for which the criteria of

valuation are not well defined (Beckert & Rossel,

2013; Velthuis, 2003). The complexities in valuation

accentuate since the quality of artworks is defined not

only by monetary value but also by cultural, aesthetic,

and social values (Klamer, 2004; Throsby & Zednik,

2014). The problems involved in determining the

quality of artworks have inspired a large body of

research from multiple disciplines, such as art history,

sociology, and economics. The economics of the art

market has witnessed a growing interest in the last two

decades. The interest is fuelled primarily due to the

availability of auction data and, to some extent, due to

the rapid growth in the art market and the appeal of art

as an alternative investment.

The extant research on the economics of art has

generally focused on three issues- determinants of

price (Galenson & Weinberg, 2000; Garay, 2020;

Renneboog & Spaenjers, 2013); returns on

investment in art (Baumol, 1986; Buelens &

Ginsburgh, 1993; Mei & Moses, 2002); and the

relationship between the auction price and presale

estimates (Ashenfelter & Graddy, 2003; Beggs &

Graddy, 1997; Ekelund, Jackson, & Tollison, 2013;

Mei & Moses, 2005). The focal point of this paper is

the last of the three issues, specifically whether

presale estimates are unbiased predictors of auction

price. While the literature on the first two issues has

found some uniform patterns, the debate on presale

estimates is far from settled. Milgrom & Weber

(1982) and Ashenfelter (1989) suggest that it is best

for auction houses to be honest and provide truthful

information to customers; therefore, presale estimates

are unbiased and reflect the true price of an artwork.

However, the later studies by Beggs and Graddy

(1997), Ekelund, Ressler, and Watson (1998),

Bauwens and Ginsburgh (2000), Mei and Moses

(2002), and Ashenfelter and Graddy (2003) provide

evidence for systematic under or overvaluation of

artworks by auction houses.

Rejecting the claims of biased estimates,

McAndrew, Smith, & Thompson (2012) argue that

since the previous studies do not take into account the

artworks that were unsold at auctions, the sample

used is not a random sample. Using both sold and

unsold artworks, they conclude that the estimation

bias observed in the previous studies can be attributed

to the sample selection bias. To verify the claims of

McAndrew, Smith, & Thompson (2012), Ekelund,

Jackson, & Tollison (2013) perform a two-stage

Heckit regression (Heckman, 1979) on artworks by

504

Gurjar, S. and Ananthakumar, U.

Auctions and Estimates: Evidence from Indian Art Market.

DOI: 10.5220/0011317200003269

In Proceedings of the 11th International Conference on Data Science, Technology and Applications (DATA 2022), pages 504-511

ISBN: 978-989-758-583-8; ISSN: 2184-285X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

American artists. They find that the presale estimates

are downward biased even after adjusting for the

sample selection, i.e., presale estimates

systematically underestimate the realized price.

In this study, we first test the biasedness of presale

estimates in the Indian art market by employing the

model specification suggested by Ekelund, Jackson, &

Tollison (2013). Next, we extend the model by

incorporating information about artists, artworks, and

auctions. Our research contributes to the literature in

the following ways- first, revisiting Ekelund, Jackson,

& Tollison (2013), we examine the findings of the

study, and second, by investigating the behaviour of

presale estimates in the Indian market, we provide a

much-needed perspective from a developing art market.

The rest of the paper is organized as follows. In

section 2, we provide a summary of prices in the

auction market. The data and methodology employed

by us are discussed in Section 3. In Section 4, we

present the results of this study. Finally, we discuss

our findings and conclude in Section 5.

2 AUCTION BACKGROUND

There are multiple prices in the auction market for

artworks – reserve price, hammer price, and purchase

price. The reserve price is the lowest price the owner

of artwork is willing to sell it for. The hammer price

is the final price fetched by the artwork at auction, and

the purchase price is the price a buyer finally pays to

the auction house. The purchase price includes the

hammer price plus taxes and commission paid by the

buyer. Before an auction, auction houses publish a

catalogue containing information about the artwork

and artist as well as presale low and high estimates.

These estimates provide a band around which the

auction house experts believe an artwork will be sold

for. However, these estimates are neither ceiling nor

floor price. It is possible that the realized price

(hammer price) is higher or lower than presale

estimates.

3 DATA AND METHODOLOGY

3.1 The Data

Our estimates are based on 5,077 paintings by 307

Indian artists for the period January 2000 and June

2018. The data is collected from Blouin Artinfo

(Blouin Artinfo), an online database of auction

records for fine art, design, decorative objects, etc.

The dataset contains the following information:

• Artist related characteristics: artist name.

• Artwork related characteristics: medium of

painting; dimensions of artworks; painting title.

• Auction related characteristics: name of the

auction house; year of auction; whether an

artwork was sold or not; the hammer price if sold;

presale estimates (low and high) of artworks.

In addition to the information provided in the dataset,

we have added the gender of artists, size of artwork

(height*width), living status at the time of the auction

(dead or alive), the reputation of an artist (computed as

per methodology suggested by Kraeussl & van

Elsland, 2008). In order to estimate the influence of

movement affiliation on price and estimates, we have

created a categorical variable "movement affiliation",

which is equal to 1 (yes) if an artist has been a part of

a well-known artistic movement; otherwise, 0 (no).

The prominent art movements in India and artist

association are selected from art history literature

(Brown, 2009; Kapur, 2000; Mitter, 2001). All prices

in the dataset- the hammer price, low estimate, high

estimate- are in USD and adjusted using US CPI 2018.

Out of 5,077 paintings, 3,139 were sold at auctions,

while 1,938 were "bought in", i.e., they were not sold.

3.2 Methodology

Let P

i

denote the hammer price of i

th

painting and

(P

Li

, P

Ui

) be its low and high presale estimates.

The presale estimates are unbiased if the

expected value of P

i

is equal to the mean of

estimates (P

AV

)

𝐸

𝑃

=𝑃

(1)

where,

𝑃

=

𝑃

+ 𝑃

2

(2)

However, the hammer price can be available for

the artworks that are sold; for those that are not sold,

we cannot witness the hammer price. By excluding

the artworks that were not sold from the analysis, we

may commit sample selection bias due to incidental

truncation (Wooldridge, 2013). Therefore, to account

for artworks that came to auctions but were not sold,

we use a two-stage Heckit model (Heckman, 1979).

In the first stage (selection equation), we fit a

probit model on the entire data, with sales status

(sold/unsold) as a dependent variable and average

estimates (P

AV

), painting title, gender of artists,

natural log of reputation score, natural log of artwork

area, medium of artwork, auction house name,

Auctions and Estimates: Evidence from Indian Art Market

505

movement affiliation, living status, and year of the

auction as independent variables. The categorical

variables in the model have the following categories

as reference: unsold for sales status, female for

gender, yes for painting title, oil on canvas for

medium, no for movement affiliation, Saffronart for

auction house name, and 2000 for the year of auction.

We use the Inverse Mills Ratio (IMR)- computed

from the first stage, in the second stage of the Heckit

model (output equation). The second stage is a

hedonistic OLS regression with natural log of

hammer price as a dependent variable and IMR as one

of the independent variables. However, in the second

stage, we use only those observations for which the

sales status is sold, i.e., only those artworks that were

sold at auction. For Heckit model to perform, the

independent variables used in the second stage must

be a subset of those in the first stage (except for IMR).

In the second stage, we specify two models. In the

first model, we use the average of estimates (P

AV

) and

IMR as independent variables. This model

corresponds to the model specified by Ekelund,

Jackson, & Tollison (2013). We think the hammer

price depends not only on the average price but also

on other characteristics variables. Therefore, in the

second model, we use all the characteristics variables

from stage 1, and IMR and P

AV

. The specifications

of the two models are as follows:

Model 1:

𝑙𝑛

𝑃

= 𝛽

+𝛽

𝑙𝑛

𝑃

,

+ 𝛽

(

𝐼𝑀𝑅

)

+𝜀

(3)

where, 𝛽

,𝛽

,𝑎𝑛𝑑 𝛽

are intercept, coefficient of the

natural log of P

AV

, coefficient of IMR respectively,

and 𝜀

is the error term. Eq. 3 can also be written as

𝑃

= exp (𝛽

)∗(𝑃

,

)

∗ exp ( 𝛽

∗

(

𝐼𝑀𝑅

)

+ 𝜀

)

(4)

Eq. 4 implies that P

AV

is an unbiased estimator of the

hammer price when β

0

= 0 and β

1

= 1. Furthermore,

when both β

0

and β

1

are greater than 1, P

AV

underestimate the hammer price. The joint test of

unbiasedness (β

0

= 0 and β

1

= 1) is measured by the F-

statistic. Ekelund, Jackson, & Tollison (2013) calls

the effect of β

0

a “multiplicative bias”, while β

1

is

designated as “proportional bias”.

Model 2:

𝑙𝑛

𝑃

= 𝛽

+𝛽

𝑙𝑛𝑃

,

+ 𝛽

(

𝐼𝑀𝑅

)

+

𝛽

,

𝑋

,

+ 𝛾

(5)

where, 𝛽

,𝛽

,𝑎𝑛𝑑 𝛽

are similar to model 1. X

i,j

is the

j

th

characteristic of painting i and 𝛽

,

is the

coefficient of X

i,j

;

𝛾

is the error term.

4 EMPIRICAL RESULTS

In this section, we present the findings of our study.

First, we present the result of the selection equation

(Table 1), and subsequently, we present findings of

model 1 and model 2 (Table 2 & 3). Since time effect

is found to be insignificant in Table 2, we have not

included in the table to keep tables concise. The

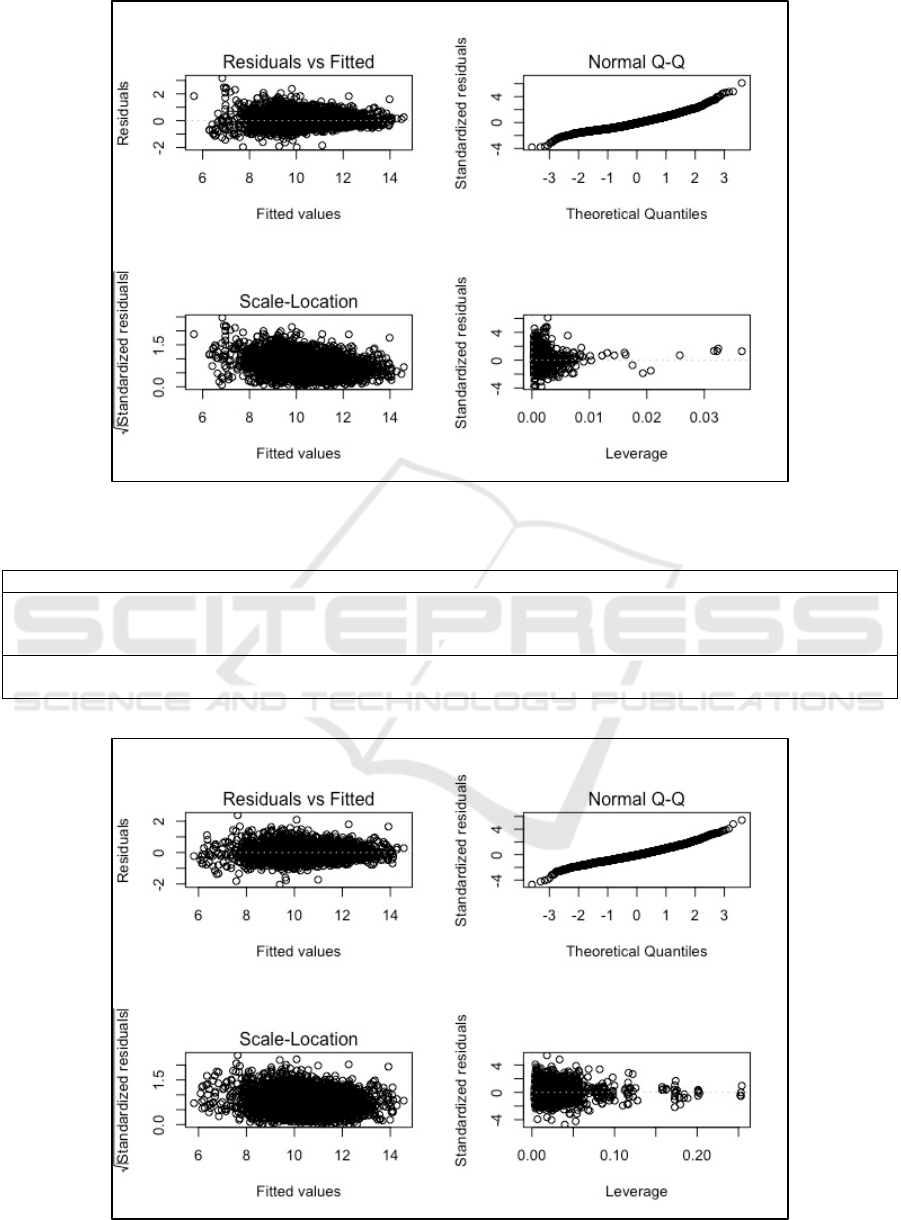

diagnostic plots for model 1 and 2 are shown in Figure

1 and 2. From plots it follows that models satisfy

assumptions of ordinary least square regression.

Table 1 indicates that the chances of artworks

getting sold at an auction increase by nearly 36%

when artists are affiliated with recognized art

movements. The chances of sell also increase with an

increase in the artist’s reputation as well as with an

increase in the area of artworks. On the other hand, an

increase in the average value of presale estimates and

artworks with certain mediums (Acrylic on Canvas

and Watercolour) decreases the probability of

artworks being sold. Other characteristics such as

auction house name, painting title, gender and living

status of artist do not have any impact on sales status.

Table 2 shows the result of model 1, i.e., replication

of the model by Ekelund, Jackson, & Tollison (2013).

Consistent with the authors, we also find that the joint

test of unbiasedness (β

0

= 0 and β

1

= 1) can be rejected

(F-statistic = 1.013e+04). The coefficient of intercept

is 0.87, which implies that auction houses

systematically underestimate by a multiplicative effect

of 138% (𝑒

.

−1). In agreement with Ekelund et al.

(2013), we also observe that the multiplicative bias is

greater than 1. However, our results indicate that the

proportional bias is less than 1 (0.95), while Ekelund et

al. (2013) found it to be greater than unity. It should be

noted that the inverse mill’s ratio (IMR) is statistically

significant at 0.001 level (Table 2). A significant IMR

suggests that errors in the selection and outcome

models are correlated. In other words, fitting a

regression model with only sold works will cause

sample selection bias. The results of model 2 are shown

in Table 3. This model includes variables from model

1, along with additional control variables. Similar to

model 1, we can reject rejected (F-statistic = 513 on 57

and 3081 DF) the joint test of unbiasedness (β

0

= 0 and

β

1

= 1). An important difference between model 1 and

model 2 is that the Inverse Mills Ratio (IMR) is

insignificant in model 2. This finding suggests that

when full information is used, the errors are not

correlated, and therefore, model 2 can very well be

estimated by OLS without correcting for sample

selection bias. The multiplicative and proportional

biases show similar behaviour as in model 1. In

addition, we observe that the characteristics of artists,

DATA 2022 - 11th International Conference on Data Science, Technology and Applications

506

artworks, auctions, and time effect also influence the

predictive power of estimates. For artist related

characteristics, the hammer price is generally greater

than the average estimates when the reputation score is

high. In other words, the artworks by highly reputed

artists on an average command a higher price than the

mean of estimates. We also witness gender differences.

Compared to female artists, the works of male artists

are underestimated. It suggests that buyers generally

pay higher than average estimates when the artist is a

male. Further, Artworks of artists who have not been

part of an art movement are overestimated. For artwork

related characteristics, our results show that the prices

are underestimated for paintings with a large area, and

for paintings that have titles. The medium of artwork

also determines the biasedness. In general, compared

to oil on canvas, acrylic leads to overestimation, but

tempera on card underestimates. While analyzing

auction related variables, we find that in comparison to

Saffronart, all other auction houses except Pundole’s

overestimate. Underestimation or overestimation is

also a function of time. Paintings sold during 2004-

2008 and 2010-2012 are underestimated compared to

paintings sold in the year 2000.

Table 1: Stage 1 of the Heckit model: Sample Selection Equation.

Variable estimates std erro

r

p

-value

(Intercept) 9.193 991.468 0.993

Painting Title: Yes 0.026 0.102 0.798

Gender: Male 0.077 0.153 0.615

Living Status: Alive -0.063 0.090 0.480

Movement Affiliation: No -0.438 0.102 0***

log(Artwork Area) 0.154 0.050 0.002**

log(Reputation) 0.416 0.073 0***

log(Average Estimate) -0.378 0.051 0***

Auction House

Artcurial -5.529 1721.708 0.997

Bonhams -4.952 1721.708 0.998

Christie's -4.912 1721.708 0.998

Osian's -3.713 200.468 0.985

Othe

r

-3.448 1721.708 0.998

Pundole's 4.211 0.218 0***

Sotheby's -4.047 1721.708 0.998

Artwork Mediu

m

Acrylic on Boar

d

-0.222 0.587 0.705

Acrylic on Canvas -0.374 0.120 0.001**

Acrylic on Pape

r

-0.438 0.323 0.174

Acrylic on Tarpaulin -4.866 1138.869 0.997

Mixe

d

Media o

n

Boar

d

-0.414 0.677 0.541

Mixe

d

Media o

n

Canvas -0.269 0.255 0.291

Oil an

d

Acrylic on Canvas -0.137 0.451 0.761

Oil o

n

Boar

d

0.267 0.186 0.151

Oil o

n

Line

n

-0.006 0.913 0.995

Oil o

n

Masonite 0.256 0.468 0.585

Oil o

n

Masonite Boar

d

-0.277 0.930 0.766

Oil o

n

Panel -0.197 0.443 0.657

Oil o

n

Pape

r

-0.575 0.546 0.292

Tempera o

n

Boar

d

-4.917 166.213 0.976

Tempera o

n

Canvas 0.812 0.467 0.082

Tempera o

n

Car

d

0.230 0.332 0.490

Tempera o

n

Pape

r

0.084 0.391 0.829

Watercolo

r

-1.291 0.600 0.031*

Othe

r

-Acrylic -0.971 0.215 0***

Othe

r

-Gouache -0.508 0.552 0.357

Othe

r

-Mixe

d

0.260 0.350 0.457

Othe

r

-Oil -0.216 0.187 0.246

Othe

r

-Tempera 0.529 0.336 0.116

All othe

r

-0.581 0.219 0.007**

Null deviance 6751.4

Residual deviance 1294.9

AIC 1420.9

Note:

∗

p < 0.05;

∗∗

p < 0.01;

∗∗∗

p

<

0.001

Auctions and Estimates: Evidence from Indian Art Market

507

Figure 1: Regression diagnostic plots for model 1.

Table 2: Stage 2 of the Heckit model for model 1 (Eq. 3).

Variable estimates std erro

r

p

-value

(

Interce

p

t

)

0.870 0.068 2E-14***

log(Average Estimate) 0.947 0.006 2E-14***

Inverse Mills Ratio

(

IMR

)

-0.349 0.030 2E-14***

Ad

j

usted R-s

q

uare

d

0.865

F-statistic 1.013e+04

Note:

∗

p < 0.05;

∗∗

p < 0.01;

∗∗∗

p

<

0.001

Figure 2: Regression diagnostic plots for model 2.

DATA 2022 - 11th International Conference on Data Science, Technology and Applications

508

Table 3: Stage 2 of the Heckit model for model 2 (Eq. 5).

Variable estimates std erro

r

p-value

(Intercept) 1.161 0.103 0***

log(Average Estimate) 0.740 0.011 0***

IMR -0.071 0.062 0.249

Painting Title: Yes 0.055 0.019 0.003**

Gender Male 0.092 0.030 0.002**

Living Status: Alive -0.028 0.019 0.147

Movement Affiliation: No -0.325 0.022 0***

log(Artwork Area) 0.114 0.010 0***

log(Reputation) 0.296 0.015 0***

Auction House

Artcurial -0.214 0.066 0.001**

Bonhams -0.187 0.038 0***

Christie's -0.115 0.027 0***

Osian's -0.394 0.033 0***

Pundole's 0.629 0.094 0***

Sotheby's -0.186 0.025 0***

Othe

r

-0.067 0.043 0.115

Artwork Medium

Acrylic on Board -0.293 0.094 0.001**

Acrylic on Canvas -0.110 0.025 0***

Acrylic on Pape

r

-0.314 0.061 0***

Acrylic on Tarpaulin -0.013 0.199 0.946

Mixed Media on Board -0.179 0.129 0.166

Mixed Media on Canvas 0.020 0.072 0.784

Oil and Acrylic on Canvas -0.098 0.088 0.266

Oil on Board 0.125 0.032 0.***

Oil on Linen -0.196 0.222 0.376

Oil on Masonite 0.078 0.077 0.313

Oil on Masonite Board 0.107 0.183 0.560

Oil on Panel -0.104 0.120 0.389

Oil on Pape

r

-0.175 0.083 0.035*

All othe

r

-0.125 0.052 0.015*

Othe

r

-Acrylic -0.200 0.052 0**

Othe

r

-Gouache -0.170 0.135 0.211

Othe

r

-Mixed -0.067 0.102 0.509

Othe

r

-Oil -0.023 0.040 0.558

Othe

r

-Tempera -0.095 0.081 0.242

Watercolo

r

0.022 0.148 0.881

Tempera on Board -0.133 0.182 0.466

Tempera on Canvas 0.084 0.070 0.233

Tempera on Card 0.224 0.064 0***

Tempera on Pape

r

0.124 0.069 0.074

Year of Auction

2001 0.144 0.094 0.126

2002 0.080 0.079 0.314

2003 0.044 0.068 0.514

2004 0.444 0.058 0***

2005 0.826 0.057 0***

2006 0.949 0.059 0***

2007 0.810 0.062 0***

2008 0.391 0.164 0.017*

2009 0.346 0.229 0.130

2010 0.449 0.130 0***

2011 0.763 0.184 0***

2012 0.671 0.127 0***

2013 0.067 0.115 0.560

2014 0.130 0.109 0.233

2015 0.146 0.107 0.172

2016 -0.035 0.114 0.761

2017 0.069 0.116 0.554

2018 0.178 0.140 0.204

Adjusted R-squared 0.903

F-statistic 513

Note:

∗

p < 0.05;

∗∗

p < 0.01;

∗∗∗

p

<

0.001

Auctions and Estimates: Evidence from Indian Art Market

509

5 CONCLUSIONS

This study investigates whether presale estimates are

a good predictor of hammer price in the Indian art

market. We use the methodology employed by

Ekelund, Jackson, & Tollison (2013). In their study,

Ekelund, Jackson, & Tollison (2013) argue that

presale estimates consistently underestimate the

hammer price due to both multiplicative and

proportional bias. However, at least in the Indian

market, while multiplicative bias underestimates, the

proportional bias seem to overestimate very

expensive paintings. The joint effect of both the bias

shows that the underestimation happens till the

hammer price is below or equal to US$ 14,357,640;

beyond US$ 14,357,640, the price is overestimated.

This finding is consistent with results of Mei & Moses

(2005), who showed that auction houses

overestimates expensive artworks.

We also find that the characteristics of artwork,

artist, and auction determine the biasedness of

estimates. In agreement with Ashenfelter & Graddy

(2003), our findings also suggest that paintings with

a large area are underestimated. One of the significant

findings of our research is that auction houses do not

follow the same strategy for estimation. Two auction

houses in our study – Saffronart and Pundole's seem

to be more inclined to overestimate, but the rest often

underestimate. In their study, Bauwens & Ginsburgh

(2000) have also noted that the Christie's and

Sotheby's follow different approaches to

under/overestimate.

A systematic underestimation for artists with

higher reputation indicates that buyers are willing to

pay higher than estimates for famous and well-

established artists; however, it is surprising to note

that buyers are more willing to pay higher than

estimates for male artists but not for female artists.

We are curious to know whether the gender-based

differentiation is peculiar to India or prevalent

universally. We have not answered many other

questions in this research, e.g., the biasedness of

estimates in physical vs. online auctions. We hope

future researchers will address these questions.

REFERENCES

Ashenfelter, O. (1989). How auctions work for wine and

art. Journal of Economic Perspectives, 3, 23–36.

Ashenfelter, O., & Graddy, K. (2003). Auctions and the

Price of Art. Journal of Economic Literature,

XLI(September), 763–786.

Baumol, W. (1986). Unnatural Value: Or Art Investment as

Floating Crap Game. American Economic Review,

76(2), 10–14.

Bauwens, L., & Ginsburgh, V. A. (2000). Art experts and

auctions: Are pre-sale estimates unbiased and fully

informative? Louvain Economic Review, 66(2), 131–

144.

Beckert, J., & Rossel, J. (2013). The Price of Art. European

Societies, 15(2), 178–195.

Beggs, A., & Graddy, K. (1997). Declining Values and the

Afternoon Effect : Evidence from Art Auctions. The

RAND Journal of Economics, 28(3), 544–565.

Retrieved from https://www.jstor.org/stable/2556028

Blouin Artinfo. (n.d.).

Brown, R. M. (2009). Art for a Modern India, 1947-1980.

Durham: Duke University Press.

Buelens, N., & Ginsburgh, V. (1993). Revisiting Baumol’s

“art as floating crap game.” European Economic

Review, 37(7), 1351–1371. https://doi.org/10.1016/

0014-2921(93)90060-N

Ekelund, R. B., Jackson, J. D., & Tollison, R. D. (2013).

Are Art Auction Estimates Biased? Southern Economic

Journal, 80(2), 454–465. https://doi.org/10.4284/0038-

4038-2012.087

Ekelund, R. B., Ressler, R. W., & Watson, J. K. (1998).

Estimates, bias and “no sales” in Latin-American art

auctions 1977–1996. Journal of Cultural Economics,

22, 33–42.

Galenson, D. W., & Weinberg, B. A. (2000). Age and

Quality of Work: The Case of Modern American

Painters. Journal of Political Economy, 108(4), 761–

777.

Garay, U. (2020). Determinants of art prices and

performance by movements : Long-run evidence from

an emerging market. Journal of Business Research.

https://doi.org/10.1016/j.jbusres.2019.03.057

Heckman, J. J. (1979). Sample Selection Bias as a

Specification Error. Econometrica, 47, 153–161.

Kapur, G. (2000). When Was Modernism: Essays on

Contemporary Cultural Practice in India. New Delhi:

Tulika.

Kennedy, M. (2004). Art market “a cultural obscenity.”

Retrieved April 21, 2022, from https://www.the

guardian.com/uk/2004/jun/03/arts.artsnews

Klamer, A. (2004). Cultural Goods Are Good for More than

Their Economic Value. In V. Rao & M. Walton (Eds.),

Culture and Public Action (pp. 138–162). Stanford:

Stanford University Press.

Kraeussl, R., & van Elsland, N. (2008). Constructing the

True Art Market Index - A Novel 2-Step Hedonic

Approach and its Application to the German Art Market

(CFS Working Paper Series.). Retrieved from

http://ssrn.com/abstract=1104667

McAndrew, C., Smith, J. L., & Thompson, R. (2012). The

Impact of Reserve Prices on the Perceived Bias of

Expert Appraisals of Fine Art. Journal of Applied

Econometrics, 27, 235–252. https://doi.org/10.1002/jae

Mei, J., & Moses, M. (2002). Art as an investment and the

underperformance of masterpieces. American

DATA 2022 - 11th International Conference on Data Science, Technology and Applications

510

Economic Review, 92(5), 1656–1668. https://doi.org/

10.1257/000282802762024719

Mei, J., & Moses, M. (2005). Vested Interest and Biased

Price Estimates: Evidence from an Auction Market. The

Journal of Finance, 60(5), 2409–2435.

Milgrom, P., & Weber, R. (1982). A theory of auctions and

competitive bidding. Econometrica, 50, 1089–1122.

Mitter, P. (2001). Indian Art. Oxford: Oxford University

Press.

Picasso painting sells for $104m. (2004). Retrieved April

21, 2022, from http://news.bbc.co.uk/2/hi/entertain

ment/3682127.stm

Renneboog, L., & Spaenjers, C. (2013). Buying Beauty :

On Prices and Returns in the Art Market. Management

Science, 59(1), 36–53.

Spolsky, E. (1996). Elaborated Knowledge: Reading

Kinesis in Pictures. Poetics Today, 17(2), 157–180.

Throsby, D., & Zednik, A. (2014). The Economic and

Cultural Value of Paintings: Some Empirical Evidence.

In V. A. Ginsburgh & D. Throsby (Eds.), Handbook of

the Economics and Culture (pp. 81–99). Elsevier.

Velthuis, O. (2003). Symbolic Meanings of Prices:

Constructing the Value of Contemporary Art in

Amsterdam and New York Galleries. Theory and

Society, 32(2), 181–215.

Wooldridge, J. M. (2013). Introductory Econometrics: A

Modern Approach (5th ed.). Mason, OH: South-

Western, Cengage Learning.

Auctions and Estimates: Evidence from Indian Art Market

511