Bidding Strategy of Virtual Power Plant Participating in Electric

Market based on Big Data Technology

Jing Wang

1

, Jinshan Li

1

, Jinlong Gao

2

, Ning Su

1

, Dong Zhao

2

and Yanwen Wang

3

1

State Grid Integrated Energy Service Group Co., Beijing, China

2

Cathay Green Energy Co., Zhangjiakou, China

3

State Power Rixin Technology Co.,Ltd, Beijing, China

Keywords: Bidding Strategy, Power Plant, Electric Market, Big Data Technology.

Abstract: In the process of information development, digitization, networking and intelligence are three parallel main

lines. Digitalization lays the foundation, networking builds the platform and intelligence shows the ability,

which can help human beings better understand complex things and solve difficult problems. Globally, it is

becoming a trend to research and develop big data technology, use big data to promote economic

development, improve social governance and improve government service. Generally speaking, people's

decision-making process usually includes three basic steps: recognizing the current situation, predicting the

future and choosing strategies. According to the load big data analysis of the demand side users, the deep-

seated application of predicting the future and guiding practice will become the focus of development. Firstly,

we introduce the existing demand response models in detail, and then a two-stage bidding strategy is proposed

to predict the future and optimize the system operation in this paper. On the basis of massive data, this paper

describes the demand response behavior of a large number of users, and then analyzes their bidding strategies.

In the future, with the expansion of application fields, the improvement of technology and the improvement

of the open mechanism of data sharing, predictive and guiding applications with greater potential value will

be the focus of development.

1 INTRODUCTION

With the increasing diversification of load power

consumption, the distributed resources such as virtual

power plant (VPP), electric vehicles, energy storage

develop rapidly. The characteristics of power demand

side management resources are different and highly

decentralized, which puts forward higher

requirements for the comprehensive coordination and

optimization technology. Nowadays with the

development of big data acquisition, big data pre-

processing, and big data analysis technologies, it

provides more technical means for improving the

collaborative optimization level of demand side

resources and the implementation of collaborative

optimization strategy.

In addition, the diversity of users in the

characteristics of power consumption behaviour is

highlighted as a large number of new loads with

flexible regulation capacity connected to the system,

such as electric vehicles, industrial process loads, and

cloud computing loads. Highly dispersed users have

different response characteristics, so it is urgent to

adopt a more accurate response aggregation strategy

for multi-cluster users, which aims to fully integrate

all kinds of resources, give full play to the

complementarity among multi cluster users, so as to

better promote the resources allocation. Among them,

the VPP can integrate energy storage devices in

distributed energy, improve the flexibility of demand

side response, and maximize revenue. Besides,

flexible load can change the users’ energy

consumption habits through electricity price

measures as an effective means to promote the

consumption of new energy (Zhang, et al, 2008). It

can also realize the peak shaving and valley filling of

load, improve the power utilization rate and improve

the whole society profit.

Demand response behaviour analysis is a key

technical problem in the design of demand response

mechanism and the bidding strategy of demand

response system. Foreign scholars have carried out a

large number of researches on demand response

pricing mechanism and its optimization decision-

Wang, J., Li, J., Gao, J., Su, N., Zhao, D. and Wang, Y.

Bidding Strategy of Virtual Power Plant Participating in Electric Market based on Big Data Technology.

DOI: 10.5220/0011189800003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 537-542

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

537

making model based on the characteristics of demand

response behaviour, such as demand price elasticity.

The user side demand response mechanism, power

consumption characteristic behaviour analysis and

power big data application research in the United

States are in a leading position in the world. The

famous power big data application is "Los Angeles

power map", which gathers the information of each

block, users’ personal information, power

consumption information, geographic information,

meteorological information and local economic

information to obtain the law of user's power

consumption behaviour, and the analysis aims to

assist energy decision-making and investment. In

2012, the U.S. government announced the launch of

the "big data research and development plan". In

2013, the Electric Power Research Institute (EPRI)

launched two big data research projects: transmission

and distribution network modernization

demonstration projects (Catterson, 2016, Mcarthur,

2016). In the E-Energy plan of the German Federal

Economic Department, two demonstration projects

have applied power big data analysis to provide

preliminary solutions for energy Internet technology

(Wang, 2011, Wang, 2011).

For the participation of VPP in market bidding,

plenty of studies have established demand response

scheduling models based on price incentive

information (Nguyen, 2018, Le, 2018, Wang, 2018).

On the basis of considering the uncertainty of new

energy output and market electricity price, literature

(Chen, et al, 2018) establishes three-stage market

transactions including day-ahead, day-in and real-

time demand response. Literature (Xu, et al, 2019)

and (Niu, 2014, Li, 2014, Wang, 2014) only consider

the transactions in the power market when

participating in electric market. Literature (Song, et

al, 2017) and (Anvarimoghaddam, et al, 2017)

established the bidding strategy of multiple VPP

based on game theory. In the market bidding strategy,

the VPP can not only act as the seller of energy, but

also act as the buyer of energy, which fully explores

the flexibility of its market traders and is conducive

to the stable economic operation of the energy

market. The coordinated operation of demand

response in VPP can bid in different types of markets

to maximize benefits. The participation of VPP in

energy market bidding can give full play to the

commercial value of VPP and greatly enhance the

value of renewable energy resources.

To sum up, the existing research on VPP bidding

strategy mainly focuses on considering the

uncertainty of power demand response and renewable

energy output. In terms of market bidding strategy,

the impact of comprehensive demand response on

market bidding is relatively small. Therefore, it is of

great theoretical value and practical significance to

carry out the analysis of multi-user energy and power

consumption behaviour and bidding strategy

modelling and analysis considering the demand

response ability of users and demand response

resources including VPP. Based on the above

research background, it can be seen that there is an

urgent need to carry out research on multi-user power

consumption behaviour analysis and modelling

technology, extract user power consumption

behaviour characteristics based on big data

technology, and formulate demand response bidding

strategy model considering VPP.

Based on the above-mentioned literatures and

current situation analyses, the bidding strategy of

VPP has become an important problem we need to

consider in electric power market. However, the

theoretical model mentioned above has not been

established. Therefore, it is of great significance to

consider the impact of VPP and other demand side

power response in the determined power grid, and

then put forward the corresponding bidding

strategies. The specific research contents of this paper

are as follows:

1) Combined with the comprehensive demand

response and VPP technology, this paper puts

forward a two-stage bidding strategy to optimize the

system operation. The proposed model can reduce the

limitations of scattered individual load user demand

response potential based on big data technology.

2) The proposed model can condense the load

demand response resources of multiple users in

power system, and provide important technical

support for creating a flexible multi cluster user

demand response system.

3) This paper considers the demand response

resources including VPP to participate in the power

market bidding model, which can give full play to the

energy utilization potential and complementary

advantages of multiple end users, and then improve

the coupling degree between various user loads.

The rest part of this paper is structed as follows:

Section II describes the VPP modeling. We then

discuss the energy market structure in Section III. The

numerical results were shown in Section IV. Section

V draws the conclusion of paper.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

538

2 VIRTUAL POWER PLANT

MODELLING

2.1 Demand Response Pattern

Classification

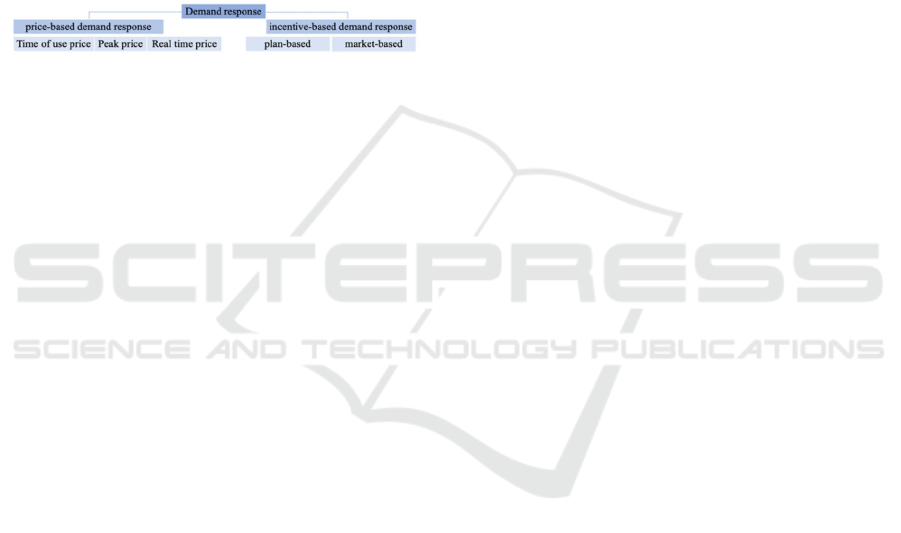

According to the Research Report of the U.S.

Department of energy, the demand response in the

power market can be divided into the following two

types: price-based demand response and incentive-

based demand response. According to the existing

demand response projects and research results, the

demand response types are summarized, as shown in

Figure 1.

Figure 1: Different demand response types.

The first type is the price-based demand response,

which mostly refers to guiding users to actively

change their power consumption habits by using the

price signal reflecting the situation of the electric

power market, adjusting their power consumption

amount, power consumption period and power

consumption mode, and adjusting the power demand

in the high price period to the low-price period in order

to reduce the power consumption cost or exchange for

economic compensation. Although Germany, the

Netherlands and other regions have introduced a

negative electricity price mechanism on the power

sales side, generally, there is no reward and

punishment mechanism for this type of demand

response, and it is entirely up to users to decide

whether to participate and the degree of participation.

Even if they do not participate or the load reduction

capacity is small, they will not be fined. At present,

generally recognized electricity price mechanisms

mainly include time of use electricity price, peak

electricity price and real-time electricity price. The

details are as follows:

2.1.1 Time of Use (TOU) Pricing

Mechanism

TOU pricing mechanism is the pricing mechanism

that sets different electricity prices in different time

periods, dates and seasons to accurately reflect the

power supply cost. Specifically, TOU includes

peak/valley electricity price, high/low electricity price

and seasonal electricity price according to the time

period division. Generally speaking, TOU price aims

to guide demand side users to reasonably arrange the

working hours of electric equipment through the

electricity price difference in different periods, so as

to minimize the power consumption in peak load

period and increase the power consumption in valley

period, so as to achieve the purpose of balancing the

seasonal load. TOU price first appeared in the U. S. in

the 1960s, while China began to implement the peak

valley TOU price mechanism since the 1980s. At

present, twenty-nine provinces in China have

implemented the TOU mechanism for large industrial

and commercial users.

2.1.2 Peak Price Mechanism

Peak price mechanism is a dynamic pricing

mechanism derived from TOU price mechanism. The

key factor of the mechanism is to superimpose the

peak rate which can be flexibly arranged on the TOU

price and can reflect the change law of power supply

cost. Generally speaking, it mainly includes two types:

typical daily peak price and typical time peak price. In

the United States, the promotion of peak price is far

less than TOU price and real-time price. In China,

only a few provinces and cities have the pilot work of

peak electricity price for large industrial users, such as

Beijing and Jiangsu Province.

2.1.3 Real Time Price Mechanism

Real time price mechanism is a dynamic pricing

mechanism based on relatively mature power market

conditions, considering operation investment, and

taking the long-term marginal cost of power combined

with the short-term marginal cost as the pricing basis.

Specifically, the mechanism includes day-ahead and

day-in real-time electricity price mechanism. The

renewal cycle of real-time electricity price in the U.

S., Australia and other places can reach 15 min, and

some companies can even provide users with

electricity price every 5 min.

To sum up, TOU and real-time price are

formulated in advance, and real-time price is a linkage

pricing mechanism. In addition, compared with TOU

price, real-time price can not only reflect the change

of long-term seasonal power supply cost of power

grid, but also reflect the problem of short-term

capacity shortage of power grid caused by large load

fluctuation, and give the incentive signal of load

reduction to users in time.

The second is incentive-based demand response.

This demand response is that the regulation

department or system operator adopts the price

discount or direct incentive policy to guide the power

demand side users to adjust the working state of power

equipment in time to reduce the peak load when

Bidding Strategy of Virtual Power Plant Participating in Electric Market based on Big Data Technology

539

maintaining the normal operation of the power

system. Once the user responds to such projects, it

means the initiative of load control is handed over to

the regulation department or system operator. This

kind of demand response mainly includes two types:

plan-based and market-based incentive price

mechanism. Due to space constraints, detailed

description and introduction will not be carried out

here.

Generally, VPP includes wind power plant, energy

storage equipment, electrical and thermal load. With

the goal of maximizing their own interests, VPP and

traditional units submit the transaction volume to the

trading center. The market trading center integrates

the information of all parties, determines the energy

price of the next day with the goal of minimizing the

energy operation and dispatching cost in the day ahead

and in the day, and publishes the price information.

All participants adjust their bidding volume according

to the published information and report it to the market

trading center again. After that, both parties adjust the

bidding volume and price based on the energy balance

until the transaction is completed.

2.2 Multi User Price Demand Response

Potential

In this section, under the background of price-based

and incentive-based demand response participating in

power grid interaction, the user's response is included

in power generation dispatching, and the optimal

dispatching model of day-ahead price demand

response and incentive demand response

participating in power system optimal dispatching is

explored and established. When carrying out the

optimal dispatching of unit combination considering

demand response, it is necessary to consider a variety

of demand response implementation objectives and

multiple stakeholders. Therefore, a power system

optimal dispatching model based on user power

consumption characteristics and social characteristics

is established, and its cost-benefit is analyzed.

2.2.1 Objective Function

In the model built in this paper, the total system cost

can be divided into generation side cost and demand

side cost. Among them, the generation side cost

includes unit operation cost and unit startup and

shutdown cost, while the demand side cost includes

incentive demand response cost and price demand

response cost, with the minimum total cost as the

objective function:

G

2

G

N

T

it i G,it i G,it i it i,t-1

t=1 i=1

N

T

P,t p,kt

t=1 i=1

minF=min [u (a P +b P +ci)+SC u (1-u )]

+ C P (1)

Where T is the time period, N

G

, N

P

are the number

of generators and different users, u

it

is binary

variable, P

G,it

, P

P,kt

are the output of generators and

different users. a

i

, b

i

, c

i

, SC

i

are the cost coefficients.

2.2.2 Constraints

The system power balance constraint is as follows:

G

N

i,t G,it W,t L,t

i=1

uP +P =P

(2)

Where P

L,t

, P

W,t

are the load and wind power

output in time period t. Alternate constraint is as

follows:

G

N

i,t Gmax,i W,t L,t L,t W,t

i=1

uP +P P R R≥+ +

(3)

Where P

Gmax,i

, P

ILmax,j

are the maximum output of

generator and maximum interruption of interruptible

load j. The thermal power unit, wind power unit and

interruptible load constraints are shown as follow.

i,t Gmin,i G,it i,t Gmax,i

uP P uP≤≤

(4)

W,t Wmax,t

0P P≤≤

(5)

Where P

Wmax,i,

is the maximum output of wind

power unit. The power consumption after

implementation of price-based demand response is as

follows:

P,k1 0P,k1 0P,k1 P,1 P,1

11 1n

P,kt 0P,kt 0P,kt n1 nn P,t P,t

PP P C/C

ε

= +

PP P ε εC/C

ε

(6)

Where P

0P,kt

is the electricity consumption in time

period t before participating in price demand

response.

3 ENERGY MARKET

STRUCTURE

There are conventional units in the whole area in

addition to VPP. In order to achieve the bidding goal,

it is necessary to minimize the cost of the whole

region. Therefore, in the regional market structure,

the goal of VPP is optimized as the lower function

and the minimum regional cost is optimized as the

upper function. The two-stage bidding strategy flow

chart of the system is shown in the Figure 2.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

540

Figure 2: The two-stage bidding strategy flow chart.

In the lower-stage optimization, the VPP and

conventional units are first optimized and dispatched

according to the previous bidding price, and the

preliminary results are obtained by maximizing the

benefits of the VPP. Then the participants adjust the

investment amount according to the price information

and submit the results to the upper-stage dispatching.

The upper-stage dispatching optimizes the market

clearing price with the minimum total operation cost

of the system and publishes it, Finally, the

participants in the whole region are balanced.

4 CASE STUDY

The system includes one VPP, four thermal power

units, six CHP units and one load aggregator. The

coal price set as 600 $/t based on historical data. The

installed capacity of wind turbine and energy storage

equipment are 400MW and 30MWh, and the

maximum charge and discharge power is 3MW

according to historical numerical experience. The

heat load accounts for 5% of the total heat load. The

daily predicted load aggregator and heat load inside

the VPP are 900MW and 40MW, respectively. Here

we assume three different scenarios and the

corresponding test result is shown in the following

figure.

There is only one wind farm in the VPP, and the

wind power output is first absorbed by the internal

load. When there is still wind power that cannot be

absorbed, it is sold to the market operator to meet the

load demand of the external market. Because the VPP

price sold to the operator is lower than that of the

conventional thermal power plant, it can promote the

consumption of wind power. As can be seen from

Figure 3, The wind power consumed in scenario 2 is

larger than that in scenario 1. The energy price in

scenario 1 is the unified selling price. The wind power

price is higher than that in scenario 2, and there are

no bidding measures, resulting in lower wind power

consumption. Due to the comprehensive demand

response and energy storage, the load curve is cut

peak and filled valley. The conversion of heat load to

electric load also promotes the further consumption

of wind power.

Figure 3: Wind power consumption under various

scenarios.

5 CONCLUSION

Combined with the comprehensive demand response

and VPP technology, this paper puts forward a two-

stage bidding strategy to optimize the system

operation. The upper and lower stages reach a balance

through the adjustment of price and bidding amount.

All participants can participate in the bidding, so as

to promote the stable development of the energy

market. In the model and case study section, we

introduce different scenarios of demand side users

participating in power grid demand response which

are carried out based on historical data. Finally, this

paper comprehensively evaluates the demand

response to participate in the transaction bidding in

the power market.

REFERENCES

Anvarimoghaddam A., Rahimikian A., Mirian M. S., et al

(2017). A multi-agent based energy management

solution for integrated buildings and microgrid system.

Applied Energy, 203, 41-56.

Catterson V. M., Mcarthur S. D. J (2016). Data Analytics

for Transmission and Distribution. Smart Grid

Handbook.

Chen J., Liu Y., He Y., et al (2018). A comprehensive

valuation of virtual power plant in multiple electricity

markets. In: 2018 2nd IEEE Conference on Energy

Bidding Strategy of Virtual Power Plant Participating in Electric Market based on Big Data Technology

541

Internet and Energy System Integration. Beijing. pp. 1-

6.

Nguyen H. T., Le L. B., Wang Z (2018). A bidding strategy

for virtual power plants with the intraday demand

response exchange market using the stochastic

programming. IEEE Transactions on Industry

Applications, 54, 3044-3055.

Niu W., Li Y., Wang B (2014). Demand response virtual

power plant modelling considering uncertainty.

Chinese Journal of Electrical Engineering, 34, 3630-

3637.

Song W., Wang J., Zhao H., et al (2017). Study on multi-

stage bidding strategy of virtual power plant

considering de mand response trading market. Power

System Protection and Control, 45, 35-45.

Wang X. W., Wang Y. Z (2011). Introduction of German

smart grid "E-Energy" project promotion. Power

Demand Side Management.

Xu F., He Y., Li J., et al (2019). Summary of research on

commercial mechanism of virtual power plant

considering demand response. Power Demand Side

Management, 21, 2-6.

Zhang Q., Wang X., Wang J., et al (2008). A review of

demand response research in the electricity market.

Automation of Electric Power Systems, 32, 97-106.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

542