Environmental Regulations, Directed Technical Change and Vertical

Division of Value Chain

Beining Liu

School of International Trade and Economics, University of International Business and Economics, Huixin East Street,

Beijing, China

Keywords: Environmental Regulations, Technological Innovation, Vertical Division, Global Value Chain.

Abstract: This paper briefly reviews the economic literature on environmental regulation, technological innovation and

vertical division of labor of value chain in the past decade. We first use a stylized growth model to analyze

the channels and results of environmental regulations and the technological innovation they brought by. Then,

we consider the impact of technological innovation brought by two forms of environmental regulation on the

position of economic agents in the value chain. The results show that energy efficiency innovation brought

by intensive environmental regulation has a more significant impact on economic performance, while product

innovation brought by extended environmental regulation has a stronger promotion effect on the position of

economic agents in the value chain. Available empirical evidence supports our results. Finally, we conclude

with the goals that policies should nail in specific situations and the likely impact of different policies.

1 INTRODUCTION

How to deal with the increasing environmental

concentration caused by the consumption of fossil

fuels and take appropriate measures to ensure the

efficiency of economic growth is one of the most

serious challenges facing by the mankind today. And

public regulations provide the necessary action target

and organization frame to face and solve this

challenge. Although a large number of studies focus

on evaluating the implementation effect of public

regulations, exploring the feasibility of developing

alternative energy sources and the realization path of

improving economic efficiency, all of the main policy

analysis literature almost ignores the impact of

environmental policies on economic efficiency.

Existing evidence shows that strict environmental

regulations tend to produce positive externalities,

leading to higher economic efficiency, and economic

subjects tend to be in a higher vertical division of

labour in the Global Value Chain (GVC). On the

other hand, the concentration of production factors in

energy conservation and emission reduction may also

change the impact path of technological innovation

on economic performance, and form a resistance to

the climb of the value chain of economic entities.

What kind of environmental regulation can bring

efficient technological innovation to economic

subjects? Does such technological innovation have a

similar effect on the embedment position of economic

agents in the vertical division of labour in the GVC?

This paper briefly reviews the economic research on

these two topics, with a focus on the contributions of

the last decade.

2 LITERATURE REVIEW

2.1 Environmental Regulations and

Technological Innovation

Economic papers on environmental regulations and

technological innovation can be traced back to the

late 1980s and early 1990s, and the main issue is

whether the former promotes the latter. Different

schools hold different views on this. For example, the

Neoclassical School believes that environmental

regulation will increase the additional burden of

enterprises not to use for production, which will at

least lead to the regression of enterprises' production

efficiency in the short term (Barbera, et al, 1990,

Jorgenson, et al, 1990). In this regard, Poter and Van

der Linde (Poter, Van, 1995) put forward a different

point of view through case study. Appropriate

422

Liu, B.

Environmental Regulations, Directed Technical Change and Vertical Division of Value Chain.

DOI: 10.5220/0011183200003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 422-431

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

environmental regulation can improve productivity

through efficiency improvement, redistribution and

innovation incentive, which is also known as the

"Porter Hypothesis".

The issue of environmental regulations and

technological innovation attracted wider attention for

the first time at around 2008, mainly including

environmental quality, economic models and

technological innovation in the context of climate

change (Maria et al, 2006, Bosetti, et al, 2008,

Carraro, et al, 2009). These early studies generally

argue that increased investment in technology R&D

should be advocated in the context of climate change,

and highlight the importance and feasibility of a low-

carbon economy and cleaner production. This is

because, as a result of climate policy implementation,

especially when there is a weak substitutable

relationship between energy and non-energy sectors,

technological innovation will always be oriented

towards energy knowledge, thus diluting the potential

crowding out effect between the two sectors. The

advance of this view lies in the ability to distinguish

the energy and non-energy sectors, and then

investigate the heterogeneity of the effects of

technological innovation on the energy and non-

energy sectors.

A second wave of research was revived in less

than five years. This wave involves two distinct

research paradigms. On the one hand, under the

leadership of Acemoglu, endogenous technological

changes in the growth model with environmental

constraints have been preliminally investigated

(Acemoglu, et al, 2012, Acemoglu, et al, 2014). This

is the first theoretical study to emphasize the

importance of technological change direction under

environmental regulations: the best policy direction is

to immediately transform endogenous technological

progress into cleaner production knowledge and

technology. Compared with the existing literature,

this kind of research expands the understanding of

technological innovation: for different sectors,

technological innovation should be introduced

differently to emphasize that the environmental

regulations implemented by the economy have

different policy objectives and therefore different

policy effects. On the other hand, compared with

technological innovation, a series of models

developed around 2012 paid more attention to the

impact of industrial structure on regional

environmental quality (Whitmarsh, et al, 2011,

Turnheim, et al, 2012). These studies suggest that the

industrial structure or scale of a region (such as

mainland China) will affect its total carbon emissions

or carbon emission intensity; this effect may be

achieved through indirect transmission mechanisms.

Existing evidence shows that technological progress

brought by environmental policies does not itself

improve environmental quality, but achieves energy

conservation and emission reduction through

upgrading or optimization of industrial structure.

These studies have established a goal for the

implementation of public policies, that is, policies

that focus on the regional industrial structure may

bring about higher economic performance.

At the same time, some literature focused on the

empirical evidence of the effect of environmental

regulation on promoting technological level, and the

results were often positive. Its core conclusion is that

environmental regulation may lead to an increase in

the proportion of innovation (R&D) expenditure

(Testa, et al, 2011). In general, moderate

environmental regulations can promote the progress

of production technology. As a matter of fact, earlier

studies on verification of Porter's hypothesis in China

reached a similar point of view (Li, et al, 2010), but

only reasonable environmental regulation can

promote technological innovation of enterprises, and

different environmental policies should be adopted

for heterogeneous departments or enterprises. The

contribution of this kind of research lies in affirms the

difference between environmental regulations and

emphasizes the applicability of environmental

policies to economic subjects. In addition, the input

of policies may not produce equal or higher returns,

and economic entities need to bear the risk premium

of the transformation of innovation achievements.

Finally, there has been a third wave of interest

since 2017. Based on the fact of global environmental

crisis and energy shortage, the aim is to explore the

feasibility of energy transition and the long-term

technical and economic characteristics of energy

transition (Kittner, et al, 2017, Gielen, et al, 2019); It

can be found that the research on environmental

regulations and technological innovation has been

gradually inclined to the performance evaluation in

the field of energy. Literature shows that energy

efficiency has the most obvious impact on

environmental quality. Resource innovation and

knowledge innovation are also important aspects of

environmental innovation. At the same time, as new

environmental and economic data have been

generated by natural experiments on the

implementation of environmental policies in various

countries, more and more empirical evidence has

been generated from the hypotheses and models

emphasized in the early literature, further

contributing to the emergence of more positive views

on environmental policies (Shahbaz, et al, 2018).

Environmental Regulations, Directed Technical Change and Vertical Division of Value Chain

423

Therefore, the main contribution of the recent

literature is to consider the possibility of energy

transition and energy efficiency as an approach,

based on natural experimental data in various

countries, and to demonstrate the economic and

policy feasibility of this approach.

2.2 Literature Review of Global Value

Chain

Since the study of Gereffi and Korzeniewicz (1994)

in the 1990s, Global Value Chain, as an organized

global division of labor, has attracted the attention of

a wide range of disciplines. In such a division of labor

system, developed economies, with their high

production technology and diversified products,

occupy a relatively high position in the GVC.

Developing economies participate in the division of

labor in the GVC, and attract the processing and

transfer of intermediate products from developed

economies by virtue of cheap low-skilled labor

factors and environmental capital on the premise of

relatively lack of production technology and physical

capital. The relatively low-end position in the GVC

creates opportunities for domestic economic growth.

From the perspective of resource endowment,

developed economies have innate advantages in

technological innovation. With relatively rich

resources and experience, they can form scale effect

of technological innovation and maintain their

position and benefits in the division of labor in the

global value chain (Brandt, Thun 2010). This

innovation is mainly manifested in two aspects:

Technological innovation of final products and

intermediate products (Gereffi, 2014). In particular,

emerging economic powers have huge final product

and intermediate product markets, especially the

differentiated demand of the final product market,

which provides a huge resulting demand for the

technological innovation of intermediate product

production. After the innovation is completed and

applied, it can compete in intermediate goods markets

in developed economies. One of the manifestations of

this phenomenon is that exports participating in the

GVC will use more domestic intermediate products,

which is reflected in the improvement of the

embedding position of economies in the GVC

(Zheng, Zheng 2020). Furthermore, strong

innovation capability of intermediate products may

even produce knowledge and technology spill over to

developed economies, providing a reliable path for

the climb of global value chain (Lu, Ng, 2012, Utar,

TorresRuiz, 2013).

It can be seen that technological innovation in

specific production links can change the division of

labour status of economies in the global value chain,

that is, realize the climb of the GVC. According to the

existing literature, technological innovation caused

by environmental regulation mainly involves energy

utilization and clean production, which covers all

links in the GVC from primary products, intermediate

products to final products. Then, is the technological

innovation caused by efficient environmental

regulation homogeneous with the technological

innovation that can promote the climb of value chain?

Therefore, a satisfactory framework for studying

the embedment of environmental regulation,

technological innovation and the position of the GVC

should recognize the existence of environmental

regulation with different objectives and technological

innovation with different impact paths. It also

includes the endogenous influence of technological

innovation brought by environmental regulation on

economic performance and the endogenous reaction

of the embedment position of economic subject in the

vertical division of labor of value chain on

technological innovation. Specifically, what kind of

environmental regulation can bring efficient

technological innovation to economic subjects? What

impact will such technological innovation have on the

embedment position of economic agents in the GVC?

We hope that a step can be taken towards this

framework.

The rest of this paper will be arranged in the

following patterns: in the third section, we set up an

environmental regulation, technological innovation

and economic performance benchmark

growth model,

the introduction of two dimensions of energy

efficiency innovation and product innovation, to

simulate the environmental regulation through

technology innovation to affect the path of economic

performance, and the efficient simulation results are

analysed. The fourth section introduces the influence

of two dimensions of technological innovation on the

embedment position of economic subjects in the

vertical division of GVC. The fifth section discusses

the choice and direction of policy from the

perspective of policy makers. Finally, the article will

end in section 6.

3 A BENCHMARK GROWTH

MODEL CONSIDERING

ENVIRONMENTAL FACTORS

In this part, we propose a stylized model of

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

424

endogenous growth; it will be used as a benchmark in

the following analysis. On this basis, we consider the

impact of the implementation of environmental

regulations on economic performance, and the impact

of the impact of the results of the model.

Our model depicts a universally representative

economic agent whose economic performance is

driven by and only by four factors: technological

level, human capital, physical capital, and natural

capital. We first describe the characteristics of the

production sector and derive the analytic formula of

endogenous economic performance as a function of

environmental factors. Then we describe the

characteristics of environmental regulation and turn

environmental regulation into a function of economic

performance. It is advisable to keep all the given

values.

3.1 Four-factor Economic Growth

Model

According to the adjusted Cobb-Douglas function, in

each period, human capital (ℎ

), physical capital (𝑘

)

and natural capital (𝑒

) are combined to produce

economic performance ( 𝑦

) at a specific

technological level (𝐴

). Among them, we define

natural capital as the synthesis of net environmental

factors that can be used by economic entities and

affect economic performance, including

environmental quality and natural resources, without

considering the heterogeneity between the two.

Therefore, the performance of the economic agent

(𝑦

) is a function of the human capital (ℎ

), physical

capital (𝑘

) and natural capital (𝑒

) it can obtain:

𝑦

=

𝐴

𝑘

ℎ

𝑒

(1)

Further, each element can be combined with

different technical conditions, that is, the knowledge

required to transform production technology into

different elements, then economic performance can

be expressed as a function of the product of each

element and its knowledge:

𝑦

=

𝐴

𝑘

·

𝐴

ℎ

·

𝐴

𝑒

(2)

In the above formula, A

t

is a scale parameter that

changes with time and depends on the product of

productivity of each single factor. It is assumed that

the individual factors and their productivity are

heterogeneous and completely irreplaceable to each

other. 𝛼, 𝛽 ∈ [0,1] represents the share of physical

and human capital in the income of economic entities

respectively and satisfy 𝛼+𝛽∈[0,1].

We assume that physical capital is completely

depreciated in a certain period, and human capital

will lose its ability to contribute to economic

performance in a certain period. From the perspective

of potential investors, each economic entity has the

risk premium of physical and human capital

respectively, so the ratio of marginal return to risk

premium constitutes the risk-free interest rate. The

risk-free rate of physical capital follows the following

formula:

R

·Φ

=αA

k

-

h

e

--

(3)

Here 𝑅

is the risk-free interest rate of physical

capital at time 𝑡, and 𝛷

is equal to the risk premium

of physical capital depreciation.

The utilization cost rate of natural capital per unit

is given by the following formula:

𝑐

=

𝐴

𝑘

ℎ

𝑒

(4)

Rearrange equation (3) and substitute it into

equation (1), so that economic performance can be

expressed as a function of natural capital and human

capital:

𝑦

=𝛼

𝐴

𝑅

𝛷

ℎ

𝑒

(5)

Similar to equation (3), considering the risk

premium caused by the elimination of human capital,

take R

as the risk-free interest rate of human

capital at time t and φ

the risk premium of human

capital depreciation, the following formula is given:

R

·φ

=

-

α

-

A

-

R

-

Φ

-

e

--

-

h

-

-

(6)

Rearrange equation (6) and substitute it into

equation (5) so that economic performance can be

expressed as a function of natural capital:

y

=(α

A

)

--

·

(

-

)

-

·

·

e

(7)

Clearly, economic performance depends linearly

on the amount of natural capital per unit, increasing

as production technology improves and decreasing as

the risk premium increases.

Through equations (4) and (7), the utilization cost

rate per unit of natural capital can also be expressed

as an equation determined only by production

technology and risk premium:

𝑐

=(𝛼

𝐴

)

·

𝜑

𝛽

(

1−𝛼

)

𝑅

𝑅

·𝛷

(8)

The utilization cost rate of natural capital does not

directly depend on the factor endowment of economic

subjects. However, technological level can be

regarded as positively correlated with natural capital.

This is not inconsistent with the resource curse

theory, because as explained above, the natural

Environmental Regulations, Directed Technical Change and Vertical Division of Value Chain

425

capital we consider is not exactly equivalent to the

stock of natural resources, but the sum of

environmental quality and natural resources that can

be used by economic agents. This equation

emphasizes the role of technological level on

economic performance, which is consistent with

Schumpeter's growth theory. Among them, the

technological level is equal to the product of

productivity of each single factor, which depends on

the technological innovation ability of each factor. It

should be noted that technological development may

accelerate the depreciation of physical capital, but its

impact on the renewal cycle of human capital is not

directed which specifically depends on the culture

and strategy of economic entities, will affect the risk

premium and lead to changes in the use cost. This

gives a cost-setting equation for natural capital:

𝑦

=𝐶

(

𝑒

,𝑋

)

(9)

Here 𝑋

is a set of characteristics that affect the

production techniques and risks of economic agents.

Based on the above analysis, we assume that there is

𝐶

(

0, 𝑋

)

≥0,𝐶

>0 ; with the second order

condition 𝐶

<0; This means that our model is

compatible with yield effects trait.

3.2 Internalization of Environmental

Regulation: Product Innovation

and Energy Efficiency Innovation

We now internalize the impact of environmental

regulation. In our growth model, total factor

productivity 𝐴

is determined by the product of

individual factor productivity. The implementation of

environmental regulation shows that limited capital is

invested into natural capital and inevitably brings

technological innovation. The spillover effect of

technological innovation is reflected in its impact on

natural capital stock and factor productivity, without

changing the stock of physical or human capital and

factor productivity. Policy makers aim at maximizing

economic utility and have no preference for any kind

of capital.

There is a positive correlation between production

technology and natural capital stock. Therefore, we

assume that the single factor productivity 𝐴

of

natural capital is an increasing function of capital

stock 𝑒

, and the relationship between them is in

accordance with the following equation:

𝐴

=𝜆

𝐴

(𝑒

)

(10)

λ>1 is a parameter that can capture the progress

trend of economic subjects' r&d ability for new

products, and A(e

) represents the arrangement

and utilization efficiency of economic subjects'

natural capital. Together they constitute natural capital

single factor production technology. Thus, equation

(7) can be rearranged as:

y

=α

--

(A

·A

)

--

·

(

-

)

-

·

·[

λ

·A

(

e

)

]

--

·e

(11)

In this case, 𝜆

·𝐴

(

𝑒

)

as a single factor

productivity, combined with natural capital 𝑒

, has a

nonlinear function relation with economic

performance 𝑦

.

We mentioned in this paper, on the corresponding

natural capital factor productivity function, the

environmental regulations, on the basis of the

direction it brings, are divided into only two types: (i)

extensive model of environmental regulation, can

bring about product innovation, namely the economic

entities can develop a product never produced before

(increasing the value of λ); and (ii) intensive model of

environmental regulation can bring energy efficiency

innovation, that is, economic entities still continue to

produce existing products, but can improve the

arrangement and utilization efficiency of resources

including energy, so that 𝐴(𝑒

) can be improved.

It should be noted that energy efficiency

innovation can improve the utilization efficiency of

resources, which means that pollutant emissions will

be correspondingly reduced and the relative stock of

natural capital will be improved. It is reasonably

assumed that the marginal improvement effect of

energy efficiency innovation on natural capital stock

conforms to the following formula:

𝑒

=𝐸

[

𝑒

,

𝐴

(

𝑒

)

]

(12)

Where, 𝑒

represents the increment of natural

capital brought by energy efficiency innovation; 𝑒

and 𝐴(𝑒

) represent the original capital stock and

technology level respectively, and the first-order

conditions 𝐸

(

𝑒

,0

)

>0,𝐸

(

)

>0 are satisfied.

This suggests that the increase of natural capital

brought by energy efficiency innovation mainly

depends on the original natural capital stock, and the

original technology level also has a positive effect on

the increase.

In the implementation of policies, limited policy

funds will be directed to implement intensive or

extensive environmental regulations. We assume that

the same amount of funds can bring the same amount

of policy effect, and then a certain amount of capital

input will bring an increase of magnitude δ to the

binary margin of technological innovation

respectively. We consider the changes in economic

performance brought by technological innovation: for

product innovation, the following equation can be

obtained:

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

426

𝑦

_

=

[

𝛼

𝐴

𝐴

𝐴

(

𝑒

)

]

·

𝜑

𝛽

(

1−𝛼

)

𝑅

𝑅

·𝛷

𝑒

(𝛿 + 𝜆

)

(13)

For energy efficiency innovation, the following

equation exists:

y

_

=(α

A

A

λ

)

--

·

(

-

)

-

·

[δ + A

(

e

+e

)

]

--

(

e

+

e

)

(14)

Compare the impact of the binary margin of

technological innovation on economic performance

under the same investment scale, and rearrange the

equation (11) and (12) to obtain the ratio of energy

efficiency innovation to product innovation:

𝑦

_

𝑦

_

=

[𝐴

(

𝑒

+𝑒

)

+𝛿]

(

𝑒

+𝑒

)

𝜆

[𝐴

(

𝑒

)

]

𝑒

(𝛿 + 𝜆

)

>1

(15)

This conclusion suggests that when policymakers

plan to spend the same amount of capital, energy

efficiency innovation brought about by intensive

environmental regulations can have a stronger

positive stimulus effect on the performance of

economic agents. Therefore, the policy orientation we

advocate is to transform endogenous technological

progress into knowledge that can improve resource

utilization efficiency. This policy conclusion is

compatible with the results of Acemoglu et al.

(Acemoglu, et al, 2012).

In our model, the creation of economic benefits

does not depend on the stock of physical and human

capital, but the stock of natural capital and the

technical level of economic subjects can determine the

impact scale of environmental policies on economic

performance. At the same time, the implementation of

policies can improve the utilization efficiency of

natural capital by economic subjects, which

constitutes the benefit equation of natural capital

under the condition of whether to implement

environmental policies or not. In the absence of

environmental regulations, there are:

𝑦

=𝑅

(𝑒

,𝑈

)

(16)

In the implementation of environmental

regulations, the revenue equation is:

𝑦

=𝑅

(𝑒

,𝑈

)

(17)

In this occasion, 𝑈

is a set of characteristics that

affect resource utilization and R&D innovation

efficiency of economic subjects. According to our

model and inference, when natural capital is zero,

there is no economic output. After the implementation

of environmental policies, natural capital can produce

economic performance with higher efficiency. As a

result, we get 𝑅

(

0, 𝑈

)

=𝑅

(

0, 𝑈

)

=0,𝑅

>

𝑅

>0. At the same time, based on the natural

capital stock of energy efficiency innovation spillover

effects, assuming that the second order condition

𝑅

>0,𝑅

>0, which suggests that the stock

of natural capital has a scale effect on the economy.

3.3 The Cost-revenue Analysis of

Natural Capital

We now focus on the cost-revenue threshold in the use

of natural capital. As the stock of natural capital in a

region increases, the cost necessary to use natural

capital changes monotonously with the benefits it

brings, and the two can reach parity at some point

(denoted by subscript 𝑞). Combining formula (7) and

formula (14), it can be considered that the model has

a unique non-zero critical value, under which 𝑦

=

𝑅𝑒

=𝐶𝑒

. Figure 1 provides a reasonable

scenario that constitutes a unique threshold, in which

we assume that natural capital always has an

increasing unit return and a decreasing unit cost for

economic performance. The relationship between

natural capital and cost is identified by the cost setting

equation, and the relationship between natural capital

and income is expressed by the income setting

equation.

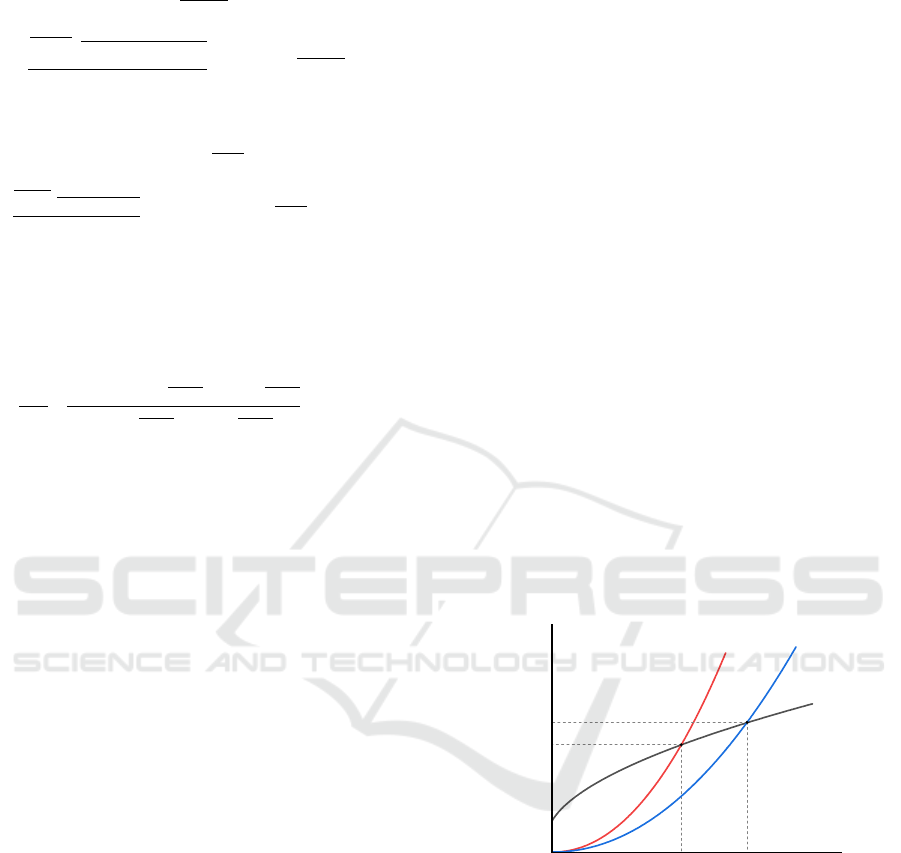

Figure 1: Cost-benefit Analysis of Natural Capital.

In the example in Fig. 1, there is a unique non-zero

threshold for the costs and benefits of natural capital

use, regardless of whether environmental regulations

are enforced or not. Assuming that both A and B are

dynamically stable, the equilibrium point A is the

critical point at which economic subjects have

incentive to use environmental capital to create output

before implementing environmental regulation.

Equilibrium point B is the critical point after the

implementation of environmental regulations.

y

t

e

t

A

B

O

e

q_A

e

q_B

y

q_A

y

q_B

C(e

t

)

R

i

(e

t

)

R

n

(e

t

)

Environmental Regulations, Directed Technical Change and Vertical Division of Value Chain

427

When 𝑒

∈ [0, 𝑒

), the economic subject will not

engage in production because the cost of using natural

capital is higher than the income it brings; when 𝑒

∈

[𝑒

,𝑒

), the economic subject will use natural

capital to produce and obtain benefits. Intensive,

therefore, the implementation of the environmental

regulation reduces the economic subject the threshold

of the natural capital needed for production, can make

more economic main body involved in the social

production; for enterprises to participate in

international trade, this change will affect them in the

international division of labor in the product structure,

cause they are vertical division of labor status changes

in the global value chain.

4 GLOBAL VALUE CHAIN:

DIRECTED TECHNICAL

CHANGE AND CLIMBING

CHANNEL

4.1 The Potential Result of Directed

Technical Change

As explained in our empirical analysis, the influence

path of the embedment of vertical division of labor

position in response to technological progress needs

to be distinguished. This is mainly based on the

nature of energy efficiency innovation, product

innovation and value chain respectively: product

innovation brought by extensive environmental

regulations is essentially the research and

development of new products, which can create more

possibilities for economic entities to embed in global

value chain. Product R&D is a knowledge-intensive

process. On the one hand, it may require the

participation of industries at the high end of the value

chain. On the other hand, there is a demand for its

achievements to serve the high-end industries of the

value chain by producing products with higher

technology content to replace the original and low-

technology products. The result of this process is that

the status of economic subjects in GVC has been

improved, that is, the value chain has climbed.

Consider the innovation in energy efficiency

brought about by environmental regulation. On the

one hand, the innovation process also needs the

participation of high-end industries in the value

chain; On the other hand, the reduction of energy

consumption per unit caused by intensive

environmental regulations indirectly brings higher

natural capital stock to economic subjects, which

means that the impact of innovation depends on the

degree of dependence of GVC on natural capital.

Under such an influence mechanism, the impact of

technological innovation brought by two

environmental regulations on the position of

economic subjects in the global value chain is

influenced by multiple factors. We wish to clarify this

influence mechanism through theoretical analysis.

4.2 Influence Path

We construct a production model of economic agents

in the global value chain division. Assume that the

economic agent co-produces product y with other

countries and the economic agent is not at the top end

of the GVC. For any production link 𝑖 ∈ [0, 1], the

closer 𝑖 is to 1, the closer the production link is to the

top of the global value chain. The economic subject

undertakes the production process of

[

𝑚,𝑘

]

; 𝑚,𝑘∈

[0, 1) in the global value chain.

According to the conclusion drawn in the fourth

part of the paper, it is reasonable to assume that all

economies and production links need only natural

capital (𝐸

) and technological level (𝐴

); 𝑝 and 𝑞

represent the unit use price of natural capital and

technology level respectively. Producing one unit of y

requires 𝑒𝑖

⁄

units of natural capital and ai units of

technology. When energy efficiency innovation

occurs, the stock of natural capital increases and the

amount of natural capital required to produce a unit of

product decreases. The unit price of natural capital is

usually determined by its mining rate and social

discount rate, which will not change in the short term.

Therefore, the result of energy efficiency innovation

will be shown as the reduction of parameter 𝑒. At the

same time, when product innovation occurs, the unit

use price of technology level will decrease in the short

term, which is manifested as the decrease of 𝑞 value.

In a perfectly competitive market, economic

performance is approximately equal to its production

cost. Therefore, when economic entities produce 1

unit of performance 𝑦, it can be expressed in the

following formula:

y

=

(

+aqi

)di

(18)

Where, monomial 𝑒𝑝 𝑖

⁄

constitutes the total cost

of using natural capital 𝐸

, and aqi constitutes the

total cost of using technical level 𝐴

. We respectively

pay attention to the impact of economic performance,

natural capital and production technology on the

position of economic subjects in the value chain, and

obtain:

𝜕𝑘

𝜕

𝐴

>

𝜕𝑘

𝜕𝐸

(19)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

428

This conclusion indicates that product innovation

plays a higher role than energy efficiency innovation

in promoting economic entities' position in the vertical

division of value chain. In other words, product

innovation will be more efficient for the promotion of

economic subject's position in the value chain.

The influence path of product innovation can also

be explained by additional influence mechanisms. The

connotation of product innovation as defined by us is

that economic subjects produce new products that

have never been involved before under the stimulus of

environmental policies. After the research and

development results are applied, the original products

will be completely eliminated, and eventually most of

them will even be completely withdrawn from the

market. In addition to our suggestion that innovation

requires the participation of the higher end of the value

chain, the results of innovation, namely the new

products developed, also tend to have higher

technological added value. The implementation of

environmental policies is usually inclusive, which

means that the technological innovation proposed by

the policies is the choice of the vast majority of

subjects. We assume that economic subjects do not

need to bear the risk premium caused by innovation

failure, and then the effect of policy implementation

will be reflected in the improvement of the division of

labor status of broad economic subjects or regions in

the value chain.

According to our conclusion, if we simply

consider from the perspective of efficiency, there is no

environmental policy that can make economic

subjects maximize their economic performance and

maximize their position in the value chain. The

maximization of one side's efficiency inevitably

means the loss of the other side's efficiency. This

means that policy makers need to make trade-offs

between the two policies according to the reality of

policy recipients.

4.3 Evidence

In terms of the research on product innovation and

energy efficiency innovation, there are two papers

that provided some of the more influential research

(Pye, McKane, 2000, Gerstlberger, Knudsen,

Stampe, 2013). Both papers limited the economic

agent to the dimension of the firm, and examine the

relationship between product innovation and energy

efficiency, or synergies. Pye and McKane (2000)

pointed out that energy efficiency may be a by-

product of product innovation, and the product

innovation can also arise as a by-product of energy

efficiency improvement, and concluded that

management must understand the costs and benefits

associated with energy efficiency investments,

regardless of the direction of this influence

mechanism. Different from Pye and McKane,

Gerstlberger et al. (Gerstlberger, et al, 2013) drew

different conclusions after using data from a larger

sample: Product innovation and energy efficiency in

business operations are often separated, so business

managers also need to make trade-offs in business

strategies, depending on whether the performance of

the business is more urgently needed, or whether it is

to meet the needs of environmental friendliness.

These analyses tell us that policy and strategy makers

are often faced with the contradiction of promoting

product innovation or energy efficiency innovation,

and it is still worth exploring whether there are

spillover effects between the two. However,

in reality,

there may exist public environmental policies that

promote both product innovation and energy

efficiency innovation. The implication for us is that a

combination of environmental policies is

recommended when policy funding constraints are

not tight.

5 POLICY IMPLICATIONS

In our analysis, policy makers often face the dilemma

of promoting product innovation or energy efficiency

innovation, that is, whether to implement intensive or

expansive environmental regulations. So, in the face

of this dilemma, how should policymakers consider

the direction of policy? Should their policy objectives

be adjusted or maintained?

First, we need to consider why environmental

policy needs to be anchored to targets for economic

performance or product structure. According to

environmental economics, the primary goal of

environmental policy is not to achieve environmental

friendliness, but to integrate the limited

environmental resources, produce economic

performance, and realize the maximization and

sustainability of output efficiency. This means that

the environmental policies implemented will rarely

maintain the stock of natural capital at the expense of

long-term economic growth. Therefore, both of the

economic performance and product structure are

factors that must be considered in the implementation

of environmental policies.

Another reason for this dilemma is why an

economic entity should care about its position in the

vertical division of labour in the value chain. Higher

vertical division of labour status usually means that

the products produced by economic subjects contain

Environmental Regulations, Directed Technical Change and Vertical Division of Value Chain

429

higher added value; In international trade, each unit

of product sold, high value-added products can bring

higher profits than low value-added products, in other

words, will affect the efficiency of economic subjects

in international trade profit. If foreign trade is an

important source for economic entities to obtain

economic performance, it is necessary to pay

attention to product structure and its position in

vertical division of labour in the implementation of

policies.

As we conclude in Section 5, when policy funds

are abundant, the policy mix is usually the

recommended course of action. However, if there are

relatively strict capital constraints, such as in less

developed economies or regions with high

implementation costs, there is usually a choice of

policy implementation. In this case, we suggest that

the policy orientation of prioritizing economic

performance should be considered. Economic

subjects choose to improve the status of international

division of labour in the hope of obtaining more

efficient economic output. Strictly speaking, it still

belongs to the path of pinning economic

performance. If the policy has a high implementation

cost, it is more efficient to implement intensive

environmental regulations to drive energy efficiency

innovation, thus obtaining a higher relative stock of

natural capital and directly contributing to economic

output.

In addition, both product innovation and energy

efficiency innovation have positive effects on the

performance of economic entities and their position

in the vertical division of labour. This can also be

proved by the theoretical model we have constructed.

As for the promoting effect of product innovation on

economic performance, formula (11)-(9) is

considered to obtain:

y

_

-y

=

·

(

-

)

-

[

(

)]

-

·[(δ+

λ

)

--

-λ

--

]>0

(20)

The role of energy efficiency innovation on the

position of economic subjects in the vertical division

of labor in the value chain is as follows:

y

=

(

+aqi

)di ,

<0

(21)

What we mainly evaluate in this paper is the

effectiveness of the two innovation paths in

promoting economic performance or division of labor

status respectively. Product innovation can also

improve the output performance of economic entities,

and energy efficiency innovation can also have a

positive impact on the position of economic entities

in the vertical division of labor in the value chain. In

this dimension, similar experience in policy practice

can also be reasonably explained.

6 CONCLUSIONS

This paper briefly reviews the economic literature on

environmental regulation, technological innovation

and vertical division of labor of value chain in the past

decade, with a focus on the role of technological

innovation and directional technological change

brought by environmental regulations on vertical

division of value chain. Developing countries and

development economists pay close attention to the

transition from a single product exporter, a low value-

added product exporter to a high value-added product

producer. Through technological innovation, we can

see that countries at the lower end of the value chain

are able to transform their product mix, thus reducing

economic inequality among the international

community.

According to Porter's Hypothesis, environmental

regulation can improve economic performance by

promoting technological innovation, but the path

behind this influence mode and the effect of the same

influence path on the position of economic subjects

in the value chain need to be further investigated. To

test these two questions, we design two stylized

growth models that are flexible enough to include the

effects of environmental policies in different

directions on economic performance and the location

of vertical division of labor. We define intensive and

extensive environmental regulations, which can bring

energy efficiency innovation and product innovation

to economic entities respectively. Our results show

that intensive environmental regulations can bring

more incremental performance to economic actors

through energy efficiency innovation, while

extensive environmental regulations can promote

economic actors to climb up the value chain through

product innovation. The existing literature provides

empirical evidence for our conclusions, which

indicates that our conclusions are basically

compatible with the practical environmental policies.

What are we going next? As we suggest in this

article, the policy mix is usually the recommended

approach. However, when the implementation cost of

combination policies is too high, we still suggest that

intensive environmental regulations should be

implemented to drive energy efficiency innovation,

and the direct spillover effects of environmental

regulations on economic performance should be

prioritized to meet the needs of regional economic

development in the short term.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

430

Finally, it is worth noting that although we

demonstrate the effects of product innovation and

energy efficiency innovation on economic

performance and vertical division of labor

respectively, the fit between model and reality still

needs further research. In particular, more empirical

evidence is needed to verify our conclusion in the

study of economic performance based on the

differentiation of technological innovation, which

may constitute the further improvement of the

analytical framework of the new Schumpeter growth

theory.

REFERENCES

Acemoglu, D. Aghion, P. and Hemous, D. The environment

and direct technical change in a North-South model.

Oxford Review of Economic Policy, 2014, 30(3), 513-

530.

Acemoglu, D. Aghion, P. Bursztyn, L and Hemous, D. The

Environment and Technical Change. American

Economic Review, 2012. 102, 131-166.

Alvarez-Herranz, A. Balsalobre-Lorente, D. Shahbaz, M.

Energy innovation and renewable energy consumption

in the correction of air pollution levels. Energy Policy,

2017, 105, 386-397.

Barbera, A. J., and V. D. McConnell. The Impact of

Environmental Regulations on Industry Productivity:

Direct and Indirect Effects. Journal of Environmental

Economy Management, 1990, 18 (1): 50-65.

Bosetti, V. Carraro, C. Massetti, E. and Tavoni, M.

International energy R&D spillovers and the economics

of greenhouse gas atmospheric stabilization. Energy

Economicss, 2008, 30 (6), pp.2912-2929.

Brandt, L. and Thun, E. The Fight for the Middle:

Upgrading, Competition, and Industrial Development

in China. World Development, 2010, 38(11), 1555-

1574.

Carraro, C. Massetti, E. and Nicita, L. How Does Climate

Policy Affect Technical Change? An Analysis of the

Direction and Pace of Technical Progress in a Climate-

Economy Model. Energy Journal, 2009,30, 7-37.

Di Maria, C. and Valente S. The direction of technical

change in capital-resource economies” ETH Zürich,

working paper, 2006.

Gereffi, G. Global value chains in a post-Washington

Consensus world. Review of International Political

Economy, 2014, 21(1), 9-37.

Gereffi, G., Korzeniewicz, M., and Korzeniewicz, R. P.

1994. Introduction: Global commodity chains. In G.

Gereffi & M. Korzeniewicz (Eds.), Commodity chains

and global capitalism (pp. 1–14). Westport, CT:

Praeger.

Gielen, D Boshell, F Saygin, D Bazilian, MD Wagner, N

and Gorini, R The role of renewable energy in the

global energy transformation. Energy Strategy

Reviews, 2019, 24, 38-50.

Gray, W. B. The Cost of Regulation: OSHA, EPA and the

Productivity Slowdown. American Economic Review,

1987, 77 (5): 998-1006.

Jorgenson, D. W., and P. J. Wilcoxen. Environmental

Regulation and Economic Growth. Rand Journal of

Economics, 1990, 21 (2): 314-340.

Kittner, N. Lill, F. and Kammen, DM. Energy storage

deployment and innovation for the clean energy

transition. Nature Energy, 2017, 2(9).

Li. S, Li. X and Yang. X, Environmental efficiency and

environmental regulation in China. Financial and

Treasure Research, 2010, (2): 59-68.

Lu, Y and Ng, T. Do Imports Spur Incremental Innovation

in the South?. China Economic Review. 2012, 23(4),

819-832.

Porter, M. E., and C. Van der Linde. Toward a New

Conception of the Environment-competitiveness

Relationship. Journal of Economic Perspectives, 1995,

9 (1): 97-118.

Pye, M., McKane, A., 2000. Making a stronger case for

industrial energy efficiency by quantifying non-energy

benefits. Resources, Conservation and Recycling 28,

171-183.

Shahbaz, M. Is Globalization Detrimental to CO2

Emissions in Japan? New Threshold Analysis.

Environmental Modeling & Assessment, 2018, 23,

557-568.

Testa, F. Iraldo, F. and Frey, M. The effect of

environmental regulation on firms' competitive

performance: The case of the building & construction

sector in some EU regions. Journal of Environmental

Management, 2011, 92(9), 2136-2144.

Turnheim, B. and Geels, FW. Regime destabilisation as the

flipside of energy transitions: Lessons from the history

of the British coal industry (1913-1997). Energy Policy,

2012, 50, 35-49.

Utar, H and Ruiz, LBT. International competition and

industrial evolution: Evidence from the impact of

Chinese competition on Mexican maquiladoras.

Journal of Development Economics. 2013, 105, 267-

287.

Whitmarsh, L. Scepticism and uncertainty about climate

change: Dimensions, determinants and change over

time. Global Environmental Change-Human and Policy

Dimensions, 2011, 21(2), 690-700.

Wolfgang G., Mette P. K., and Ian S., Sustainable

Development Strategies for Product Innovation and

Energy Efficiency. Business Strategy and the

Environment, 2013, 23(2), 131-144.

Zheng. J and Zheng. Y, Innovation of intermediate products

in large emerging economies drives up global value

chains: An explanation based on China’s experience.

China Industrial Economics, 2020, No.386(05):61-79.

Environmental Regulations, Directed Technical Change and Vertical Division of Value Chain

431