Empirical Analysis of the Effectiveness of Hainan's Offshore

Duty-free New Policy

Boen Zhu

1

and Ruiying Li

2

1

Beijing Information Science and Technology University, Beijing, China

2

School of Economics and Management, Beijing, China

Keywords: Offshore Duty-Free Policy, Hainan, Empirical Analysis.

Abstract: Since the further relaxation of the offshore duty-free policy in 2020, the consumption of Hainan’s offshore

duty-free shopping has grown rapidly. This paper sorts out the six adjustments of the offshore duty-free policy

in Hainan. Based on the relative data of Hainan’s offshore duty-free shopping from February 2017 to

September 2020, this paper empirically examines the effect of Hainan’s offshore duty-free new policy. Results

show that the offshore duty-free new policy has greatly enhanced all the indicators of offshore duty-free

shopping in Hainan. Nevertheless, this policy still needs further improvement at this stage, relative

suggestions has been proposed in the end.

1 INTRODUCTION

On July 1, 2020, the Ministry of Finance issued an

announcement on Hainan's offshore duty-free

shopping policy. This is the sixth and the largest

adjustment to the content of the offshore duty-free

policy over the 10 years since the policy was

implemented in Hainan for the first time in 2011.

Such an intensive adjustment of this policy in 10

years reflects China’s positive strategy in promoting

tourism shopping policy, and it also conveys the

urgent need of upgrading the tax refund and duty-free

policy of tourism shopping. With this background,

this paper conducts an empirical analysis of the effect

of Hainan’s offshore duty-free new policy.

2 ANALYSES OF THE

EVOLUTION OF HAINAN’S

OFFSHORE DUTY-FREE

POLICY

The offshore duty-free policy refers to a tax

preferential policy, which allows the passengers

leaving the island (excluding departure) to buy duty-

free goods with limited value, quantity, and

categories of goods. (Chen, 2021) Usually, the

passengers have to pay in specific online or offline

offshore duty-free stores, and pick up goods at

designated areas at airports, railway stations and port

terminals when leaving the island. The offshore duty-

free policy of Hainan was implemented in 2011.

Since then, Hainan became the fourth region with the

offshore duty-free policy in the world. The purpose

of this preferential policy is to promote the

construction of the international tourism island of

Hainan Province. (Jing, 2017) So far, the content of

Hainan's offshore duty-free policy has been

continuously improved. Six adjustments were

implemented to expand the policy content, as shown

in Table 1.

The Hainan's offshore duty-free new policy

mentioned in this paper refers to the policy

implemented on July 1, 2020. From the

implementation of this new policy to

September 2021,

the number of offshore duty-free shopping

passengers in Hainan reached 8.124 million, the

pieces of offshore duty-free goods sold in Hainan

exceeded 72 million, and the amount of offshore

duty-free shopping in Hainan reached 55.53 billion

yuan. (Dai, 2020, Liu, 2017) This is due not only to

the substantially liberalization of the annual quota of

the offshore duty-free shopping, but also to the

significant improvement of the supporting service of

the offshore duty-free shopping. In 2020, all offshore

duty-free stores in Hainan launched online

supplementary shopping activities. The passengers

can still consume their remaining annual quota of

Zhu, B. and Li, R.

Empirical Analysis of the Effectiveness of Hainan’s Offshore Duty-free New Policy.

DOI: 10.5220/0011176700003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 325-329

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

325

offshore duty-free shopping through online

supplementary shopping within 180 days after

leaving the island. (Liu, 2021, Zhang, 2017)

Compared with the previous policy adjustments, this

new policy is obviously stronger than ever. For now,

this new policy has greatly improved consumers'

shopping experience and provided a new

consumption growth point for the economic

development of Hainan Province.

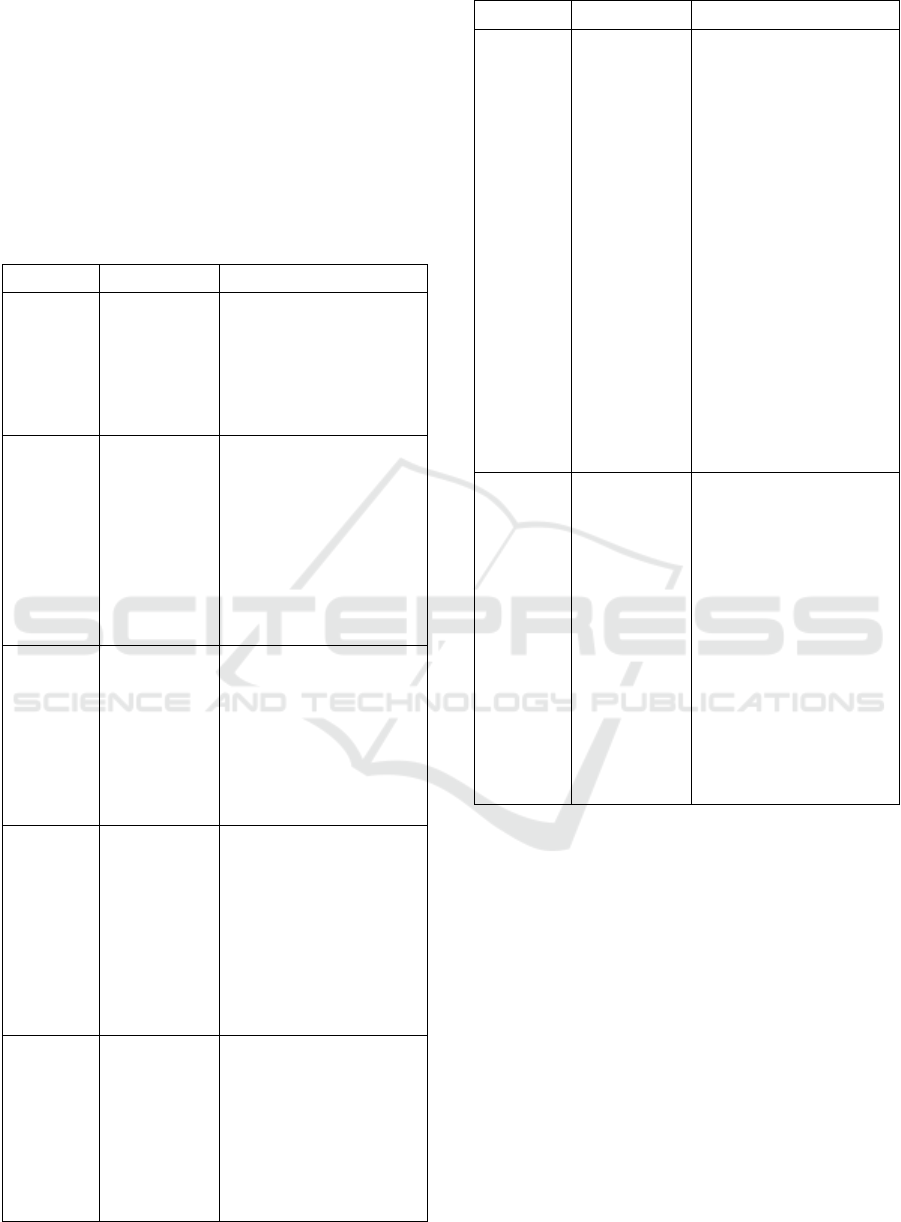

Table 1: Adjustment of Hainan’s offshore duty-free policy.

Date of Issue Policy Title Main Content of the Policy

March 24,

2011

Announcement on

Further

Adjustment of

Offshore Duty-

free Policy in

Hainan

(1) The annual quota of duty-

free shopping is RMB 5,000.

(2) The purchase opportunity is

two per year for non-island

residents and one per year for

island residents.

October 1,

2012

Interim Measures

for the

Management of

Offshore Duty-

free Shopping

Stores in Hainan

(1) The age limit for passengers

leaving the island is adjusted

from 18 to 16 years old.

(2) The categories of offshore

duty-free goods are increased

from 18 to 21.

(3) The annual quota of duty-

free shopping is increased from

RMB 5,000 to RMB 8,000.

March 20,

2015

Announcement of

the Ministry of

Finance on

Further

Adjustment of

Offshore Duty-

free Policy in

Hainan

(1) Adding 17 categories of

offshore duty-free goods, such

as infant formula.

(2) The restriction on the

quantity of single purchase of

10 categories of goods

including cosmetics and

perfumes is relaxed.

February 1,

2016

Announcement on

Further

Adjustment of

Offshore Duty-

free Policy in

Hainan

(1) The annual quota of duty-

free shopping is raised to RMB

16,000.

(2) The limit of purchase

opportunity per year for non-

island residents is lifted.

(3) Online offshore duty-free

shopping platform is

established.

January 15,

2017

Announcement on

the Incorporate

the Railway

Passengers into

the Scope of

Application of

Offshore Duty-

free Shopping

Policy in Hainan

Incorporate the railway

passengers into the scope of

application of offshore duty-

free shopping policy in Hainan.

Date of Issue Policy Title Main Content of the Policy

December 1,

2018

Announcement on

Further

Adjustment of

Offshore Duty-

free Policy in

Hainan

(1) The annual quota of duty-

free shopping is raised to RMB

30,000.

(2) The limits of purchase

opportunity per year for both

non-island residents and island

residents are lifted.

(3) The duty-free preferential

amount of a single product

within the duty-free category is

increased to RMB 8,000, and

each offshore passenger is

limited to two purchases

opportunity per year for buying

one single product with a unit

price of RMB 8,000 or more

each time.

(4) Incorporate the

rehabilitation medical

equipment into the scope of

duty-free goods categories.

July 1, 2020

Announcement on

the Offshore

Duty-free Policy

in Hainan

(1) The annual quota of duty-

free shopping is raised to RMB

100,000.

(2) The limits of purchase

opportunity per year are totally

lifted.

(3) Incorporate seven categories

of goods including electronic

consumer products into the

scope of duty-free goods

categories.

(4) The quantity of single

purchases is limited only for

cosmetics, cell phones and

alcoholic beverages.

Data sources: www.hainan.gov.cn

3 AN EMPIRICAL ANALYSIS OF

THE EFFECTIVENESS OF

OFFSHORE DUTY-FREE NEW

POLICY

3.1 Models and Data

To study the effectiveness of the adjustment of

Hainan's duty-free new policy, this paper selects

monthly data from February 2017 to September 2020

for empirical analysis. Five indicators of Hainan’s

offshore duty-free shopping are used in this paper as

the dependent variable in each regression to judge

whether the policy adjustment is effective or not.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

326

(Zuo 2021) This paper establishes a multiple

regression model as follows.

Y

t

=

α+βPolic

y

t

+

γ

1

X

t

+

γ

2

Trend+

γ

3

Month+ε

t

(1)

In this model, Y is the indicator of Hainan’s

offshore duty-free shopping. Policy is a dummy

variable reflecting the adjustment of Hainan’s

offshore duty-free new policy. (Wang 2020, Yan

2013) X, T and Month are all control variables. X

denotes a policy dummy variable released in

December 2018. Trend indicates a time trend

variable. Month is a monthly dummy variable. α is an

intercept term, β, γ

1

, γ

2

and γ

3

are the regression

coefficients of each variable.

For the dependent variables, this paper attempts to

comprehensively evaluate the effect of Hainan’s

offshore duty-free new policy. Based on the

availability of data, the indicators of dependent

variables here include the number of offshore duty-

free shoppers (Person), the sales amount of offshore

duty-free goods (Sales) and the pieces of offshore

duty-free goods (Piece), which are widely

representative of the number of people, value and

quantity of goods in sales statistics.

In addition, this

paper also calculates the per capita sales (PerS) and

per capita number of shopping pieces (PerP), which

are also included in the dependent variables. The

above variables are taken as natural logarithms. For

the explanatory variable, set the value of 0 in the pre-

policy interval and 1 in the post-policy interval. For

the control variables, the policy dummy variable X is

selected as the control variable to control the impact

on the indicators of offshore duty-free shopping

caused by the offshore duty-free policy announced in

December 2018. Other control variables include the

time trend variable (Trend) and the monthly dummy

variable (Month). In this paper, the time trend

variable is added to control for the impact of trend

changes in variables such as income and price on the

sales of offshore duty-free goods. The monthly

dummy variable is included in the model to eliminate

the seasonal effect of the data, and the dummy

variable is taken as 1 for the month of each year and

0 for the rest of the months.

3.2 Empirical Results

3.2.1 DescrIptive Statistics

The dependent variables in this paper are selected to

represent the indicators of Hainan’s offshore duty-

free shopping. Those indicators, such as

sales amount,

pieces of goods and number of shoppers, are obtained

from the website of Haikou Customs of the People's

Republic of China from February 2017 to September

2021. A brief statistical description of the dependent

variables is shown in Table 2.

Table 2: Descriptive statistics.

Variable Mean Std. Dev. Min Max

Sales amount 166984.13 136942.74 43101 524706

Pieces of goods 2248007.8 1872246.8 637726 7200000

Number of

shoppers

326622.88 164127.24 84791 756000

3.2.2 Empirical Results

The baseline regression of the model was performed

using STATA software with results shown in Table

3.

Table 3: Empirical results.

Explanatory

Variables

Dependent Variables

Sales Piece Person PerP PerS

(1) (2) (3) (4) (5)

Policy 1.29*** .958*** .75*** .26*** .43***

(.2) (.219) (.245) (.064) (.073)

X Control Control Control Control Control

Trend Control Control Control Control Control

Month Control Control Control Control Control

Constant 11.1*** 14.4*** 11.8*** 2.01*** 8.35***

(.286) (.314) (.352) (.092) (.105)

Observations 56 56 56 56 56

R-squared .783 .703 .411 .857 .823

Standard errors are in parentheses

*** p<.01, ** p<.05, * p<.1

The regression results show that the effects of

Hainan’s offshore duty-free new policy on the

indicators of offshore duty-free shopping are all

positive at the 1% significance level. The regression

results are still ideal on the basis of controlling the

impact of the previous policy, trend changes and the

seasonal effect. In a word, the implementation of

Hainan's offshore duty-free new policy does achieve

positive results in practice.

4 CONCLUSIONS AND

RECOMMENDATIONS

4.1 Conclusions

This paper empirically examines the effect of

Hainan’s offshore duty-free new policy. The results

Empirical Analysis of the Effectiveness of Hainan’s Offshore Duty-free New Policy

327

can be summarized as follows. First, as the largest

adjustment of the offshore duty-free policy in Hainan,

the new policy has achieved positive effects. Second,

the specific effect is shows that the new policy

obviously raises all the indicators of offshore duty-

free goods which including the number of offshore

duty-free shoppers, the sales amount of offshore

duty-free goods, the pieces of offshore duty-free

goods, the per capita sales and per capita number of

shopping pieces.

In the long term, the effect of this policy will be

not limited in sales or pieces of offshore duty-free

goods. The implementation of Hainan's duty-free

policy will bring a huge number of passengers to

Hainan, which will lead to the optimization of

tourism consumption structure and the upgrading of

Hainan's tourism industry. At last, this will form

valuable experience for future policy making in this

field.

4.2 Recommendations

Although Hainan’s offshore duty-free policy has

been greatly improved in 2020, it still needs to be

further improved in many aspects at this stage,

especially in terms of shopping facilitation,

regulations and information construction.

4.2.1 Further Improvement of Shopping

Facilitation

The further improvement of shopping facilitation can

be conducive to the effectiveness of Hainan’s

offshore duty-free policy. It requires the joint efforts

of the government and enterprises.

The government should continuously improve the

offshore duty-free policy. First, the government

should expand the variety of offshore duty-free

products, such as daily necessities, electronic

products, and local specialties. Second, it’s necessary

to stick to the market-oriented reform of Hainan's

offshore duty-free industry and continue to increase

market competition. Multiple measures should be

implemented to improve the vitality of the duty-free

market in order to speed up the formation of an

internal circulation system. Third, the government

should coordinate the construction of commodity

pick-up points to effectively improve the

convenience of offshore duty-free shopping for

tourists. For example, set up only one commodity

pick-up point at every airport, terminal and train

station so that the consumer can pick up the goods

purchased at all duty-free stores in Hainan after

queuing only once. Fourth, form of mail delivery

should be used more so as to reduce the

inconvenience caused by consumers queuing and the

pressure of pick-up point construction.

It’s necessary for the duty-free enterprises to

upgrade the offshore duty-free shopping industrial

chain. They should form a whole industrial supply

system, which includes comprehensive services,

logistics and distribution, intelligent supply chain and

multi-channel shopping. Firstly, the categories of

goods on the online platform should be the same as

offshore duty-free offline stores as much as possible,

so that the passengers those are willing to go online

supplementary shopping can also get the full

experience of offshore duty-free shopping in Hainan.

Secondly, based on the introduction of advanced

blockchain technology and intelligent equipment,

duty-free enterprises can form a comprehensive

system of services. Only by improving their own

software and hardware facilities and forming an

efficient and complete industrial system can they

fundamentally improve the service standard of

Hainan's offshore duty-free shopping industry.

4.2.2 More Comprehensive Regulations

With the rising sales of offshore duty-free goods, the

need for comprehensive rules and regulations has

become more and more prominent.

First, it is urgent for Hainan province to introduce

supporting laws and regulations as soon as possible,

such as anti-smuggling regulations, measures for the

administration of luggage, postal articles,

transportation and goods origin. Before the operation

of Hainan free trade port, the catalogue of

import duty,

prohibited and restricted import and export goods and

articles also need to be clarified in time. The

government need to study and judge the potential

risks of current policies so as to establish risk

prevention and control system in advance.

Second, the effective anti-smuggling measures

for the offshore duty-free commodities are vital for

the long-term implementation of the policy. The

government should improve the credit supervision

system and implement joint credit punishment

between local government. Various types of punitive

measures are necessary for smugglers. For example,

the smugglers with minor circumstances may not

enjoy the qualification of the offshore duty-free

shopping policy for a period of time, the smugglers

with serious circumstances will be included in the

national credit "blacklist". People who included in the

national credit "blacklist" are not even eligible to take

the high-speed railway.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

328

Third, while ensuring the effectiveness of

supervision, the convenience of exchanges of

personnel and goods between Hainan and the

mainland should be fully considered. The short-term

development of Hainan free trade port is inseparable

from the support of the mainland. Therefore, customs

clearance technical standards and business processes

need to be continuously optimized to ensure that

those regulations will not hurt the wish of mainland

tourists to come to Hainan.

4.2.3 Promote the Information Construction

of Port

Hainan needs to make full use of information

technology to realize modernize supervision based on

strengthening the informatization construction of

port.

First, a collaborative co-management system

which can connect the central government, the

Hainan government and all the regulatory authorities

is necessary to be established. This system should be

able to achieve information sharing and data docking,

which make those administrative departments to

realize collaborative supervision of Hainan’s offshore

duty-free shopping activities.

Second, the construction of customs intelligent

supervision in Hainan is needed. Regulatory hardware

and software need to be upgraded faster by

continuously introduce and apply advanced

technology equipment with 5G, augmented reality

(AR), artificial intelligence (AI) and other cutting-

edge technology. The construction of the traceability

management system for duty-free goods should also

be accelerated to adapt to the development of

Hainan’s offshore duty-free shopping. It would be

more reliable by innovating the means of supervision

of the whole process to realize intelligent supervision

with real-time data tracking and processing so as to

improve the efficiency of customs supervision

fundamentally.

Third, it’s urgent to strengthen the construction of

informatization supervision talent team. On the basis

of accelerating the optimization and integration of

port supervision institutions, Hainan should introduce

professional talents skilled in using latest

technologies such as big data, artificial intelligence,

cloud computing, internet of things and mobile

internet. Meanwhile, colleges in Hainan should

prepare students for the demand of the supervision

talent team mentioned above.

REFERENCES

Chen, Y., Zhang Y.W., 2021. Research on the development

of duty-free shopping in Hainan under the background

of free trade port construction[J]. Business Economics,

(01):34-36.

Dai, H., 2020. Views on Hainan's "Island Duty Free" new

deal, (08):17-19.

Jing Z.H., Xia B., Liu M.Y., 2017. The experience of

Hainan's duty-free policy[J]. China Business Journal,

(02):112-113.

Liu J.C., Lin T., Zhang Y.W., 2017. Systematic

optimization of offshore duty-free policy in Hainan

international tourism island, (08):35-37.

Liu R., 2021. Review and improvement of smuggling

supervision mode of off-island duty-free - based on the

provisions of Article 15 of Hainan Free Trade Port

Law[J]. Journal of Hainan University (Humanities and

Social Sciences Edition),39(04):75-84.

Wang W., Wang X.N., 2020. Research on the impact effect

of outlying island duty-free policy on tourism

consumption--a synthetic control analysis based on

Hainan Province[J]. China Business Journal, (23):43-

45+65.

Yan Q., Wu C.G., Ye H.B., 2013. Assessing the impacts of

the goods tax rebate policy on tourism demand for

Hainan Island, China [J]. Journal of Tourism,

28(10):47-51.

Zhang Y.W., Liu J.C., 2017. An empiric study of the

effectiveness of the adjustment of offshore duty-free

policy in Hainan[J]. Journal of Hainan University

(Humanities and Social Sciences Edition), (02):101-

107.

Zuo B., Xie M., 2021. A Study on the effects of offshore

duty-free policy on Hainan tourism demand and

consumption: based on a Joint Purchasing

Model,35(02):1-16.

Empirical Analysis of the Effectiveness of Hainan’s Offshore Duty-free New Policy

329