Research on the Scale and Path of Green Finance Supporting Real

Economy from the Perspective of Green Developmen

HaiQing Hu and YongXia Wu

School of Economics and Management, Xi'an University of Technology, Xi'an, Shanxi, China

Keywords: Green Finance, Real Economy, Green Credit, Green Bond, Credit Investment.

Abstract: Guiding financial resources to the field of green development, developing green finance, innovating financial

ecosystem and fully and effectively supporting the development of real economy has become an urgent need

to promote the development of green finance and stimulate the vitality of real economy at this stage.

According to the calculation standard of the total amount of green finance business evaluated by the people's

Bank of China, this paper considers the scale of green finance supporting the real economy with two

indicators: the balance of green loans and the holding of green bonds. It is found that green credit is the main

force of green finance to support the growth of real economy. A variety of new green bonds inject new funds

into green finance to support the growth of the real economy. Green credit mainly selects the path to support

the the real economy through credit investment.

1 INTRODUCTION

“Guidance of building a green financial system”puts

forward that green finance to refer to economic

activities to promote the improvement to the

environment, cope with climate change and improve

the efficiency of resource conservation, that is,

investment and financing, project management and

operation in many fields such as environmental

protection, energy conservation, cleaning, green

transportation and green construction Financial

services provided by risk prevention and control

activities.

In 2021, the central bank will take guiding

financial resources to the field of green development

as the top ten tasks. The third session of the 13th

National People's Congress pointed out that in 2020,

China will still take strengthening eco-environmental

governance and promoting the construction of

ecological civilization as one of its key tasks. In order

to ensure the realization of the phased objectives of

pollution prevention and control and improve the

effectiveness of eco-environmental governance, it is

necessary to give further play to the role of green

financial resource allocation and support the real

economy. We will guide more social capital into the

field of ecological and environmental governance, to

support the development of energy conservation and

environmental protection industries, and then to

support the fight to protect the blue sky, clear water

and pure land.

The main contribution of this paper lies in the

following three aspects. Firstly, building the basic

theoretical analysis framework of green finance

supporting the real economy and enriching the

research content of them; Secondly, guiding the

transformation and development of traditional

finance to green finance, promoting the harmonious

development of real economy and ecological

environment, and seeking new profit growth points;

Finally, it provides theoretical guidance for financial

enterprises, real economy, governments at all levels

and other departments, and provides suggestions and

strategic references for realizing green economic

development.

2 LITERATURE REVIEW AND

BRIEF REVIEW

Clean energy, green financing, and green economy

development are significant and positive indications

towards a cumulative measure of sustainable

practices. Similarly, green bonds, clean energy, and

green economy development play a constructive role

when all three pillars of sustainable development

Hu, H. and Wu, Y.

Research on the Scale and Path of Green Finance Supporting Real Economy from the Perspective of Green Developmen.

DOI: 10.5220/0011173200003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 245-251

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

245

practices are analyzed individually (Yang, et al.,

2022).

2.1 Research on the Path of Financial

Support for Real Economy

Since 2010, Professor Ma Jun has given guiding

suggestions of the policy guidance, system

construction and theoretical framework for the

development of green finance, and leading Chinese

scholars to study the path of financial support for the

real economy. The research conclusions mainly

include as improving the financial environment and

financial structure, (Li, 2011, Han, 2011) and the path

of financial support for the real economy (Ba, 2013,

Shen, 2013). Studies the influencing factors of

financial services real economic growth based on the

efficiency dimension (Zhang, 2017, Zhang, 2017).

Industry characteristics can significantly affect the

Risk Spillover level of the real industry, and the

changes of macro-financial and economic

environment will significantly affect the Risk

Spillover from the financial industry to the real

industry (Huang, 2021, Shang, 2021, Liu, 2021).

Based on the perspective of supply chain, it is found

that the mitigation of financing constraints brought by

enterprise shareholding financial institutions can

overflow with their main suppliers and customers

(Tang,

2021, Xie, 2021). Affected by technological

progress, the overall development efficiency of

financial support to the real economy shows an

upward trend, and the development efficiency of

regional financial support to the real economy shows

obvious regional differences (Chen, 2021).

2.2 Research on the Relationship

between Green Financial Efficiency

and Economic Development

The "green" fiscal policy has no significant impact on

the allocation efficiency of green finance, and the

lack of "green" regulatory policy inhibits the positive

effect of financial development on the allocation

efficiency of green finance (Wang, 2018, Wang,

2018). Green financial instruments, fiscal

expenditure, population and other factors will have an

impact on the ecological efficiency of green

investment, and then affect the improvement in the

development efficiency of green finance (Zhou,

2020, Zhang, 2020, Tang, 2020). Green finance helps

to promote high-quality economic development and

promote the transformation and upgrading of the

economic structure by promoting industrial structure

upgrading and enterprise technological innovation

(Liu, 2021, He, 2021).

These studies are instructive because of their

strong problem awareness. The deficiency is that they

do not use two indicators of green credit and green

bonds to explain and analyze in detail that the scale

and path of green finance supporting the real

economy.

3 SCALE AND PATH OF GREEN

FINANCE TO EFFECTIVELY

SUPPORT THE REAL

ECONOMY

The data in this paper comes from annual reports of

financial institutions, CSMAR database resources

(cn.gtadata. com), collated by the authors.

According to the regulations of the people's Bank

of China, since July 2021, green finance work of

banks will be evaluated in accordance with “Green

finance evaluation scheme for banking financial

institutions”. The regulation points out that the total

amount of green financial business refers to the

weighted sum of the balance of various green

financial businesses of the participating institutions

during the evaluation period. Total green finance

business= Σλi*Gi, where λi represents the weighting

coefficient, Gi represents the balance of green

financial business, and the total amount of green

financial business includes two items,i.e.green loan

balance and green bond holdings, which are both with

a weight of 1.

3.1 The Ability of Green Finance to

Support the Real Economy and

Green Transformation Has

Increased Rapidly Year after Year

In 2016, China made significant progress in the

development of green finance. The first medium-term

note of "green Debt Loan Based Portfolio" was

issued. The most important thing is the case that

China's issuance of green bonds ranked first in the

world. In 2017, Guizhou, Zhejiang, Guangdong,

Jiangxi, Xinjiang and the five provinces and their

important cities carried out the pilot construction of

green financial innovation pilot zones. In 2018, the

above five national pilot provinces of green finance

reform took the determined financial innovation as

the main line to promote the development of green

industry, explored the construction of green financial

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

246

service system, tried to develop green financial

organizations, developed and innovated green

financial businesses and products, and made efforts

to optimize the policy environment for the

development of green finance. Actively explore

valuable experience in finance to support the

construction of ecological civilization and promote

the transformation of economy to green. In 2019, the

pilot provinces initially formed a green financial

service system, and formed the characteristics of

different regions, different economic development

levels and different resource endowments, which

accumulated experience in promoting financial

support for the construction of ecological civilization

and promoting the transformation of economy to

green.

A new pattern of regional financial development

characterized by complementary functions and

superposition of advantages has been initially

formed. In terms of being compatible with the

integrated development of the Yangtze River Delta,

green credit grew rapidly, with a year-on-year

increase of 29.6%. In addition, backward western

regions such as Xinjiang, Sichuan, Ningxia and

Gansu supple the capital gap by issuing debt

financing instruments in key areas such as poverty

alleviation, entrepreneurship and green development.

3.2 Green Credit Is the Main Force of

Green Finance to Support the

Growth of Real Economy

3.2.1 the Scale of Green Credit Supporting

the Real Economy Has Increased

Rapidly Year after Year

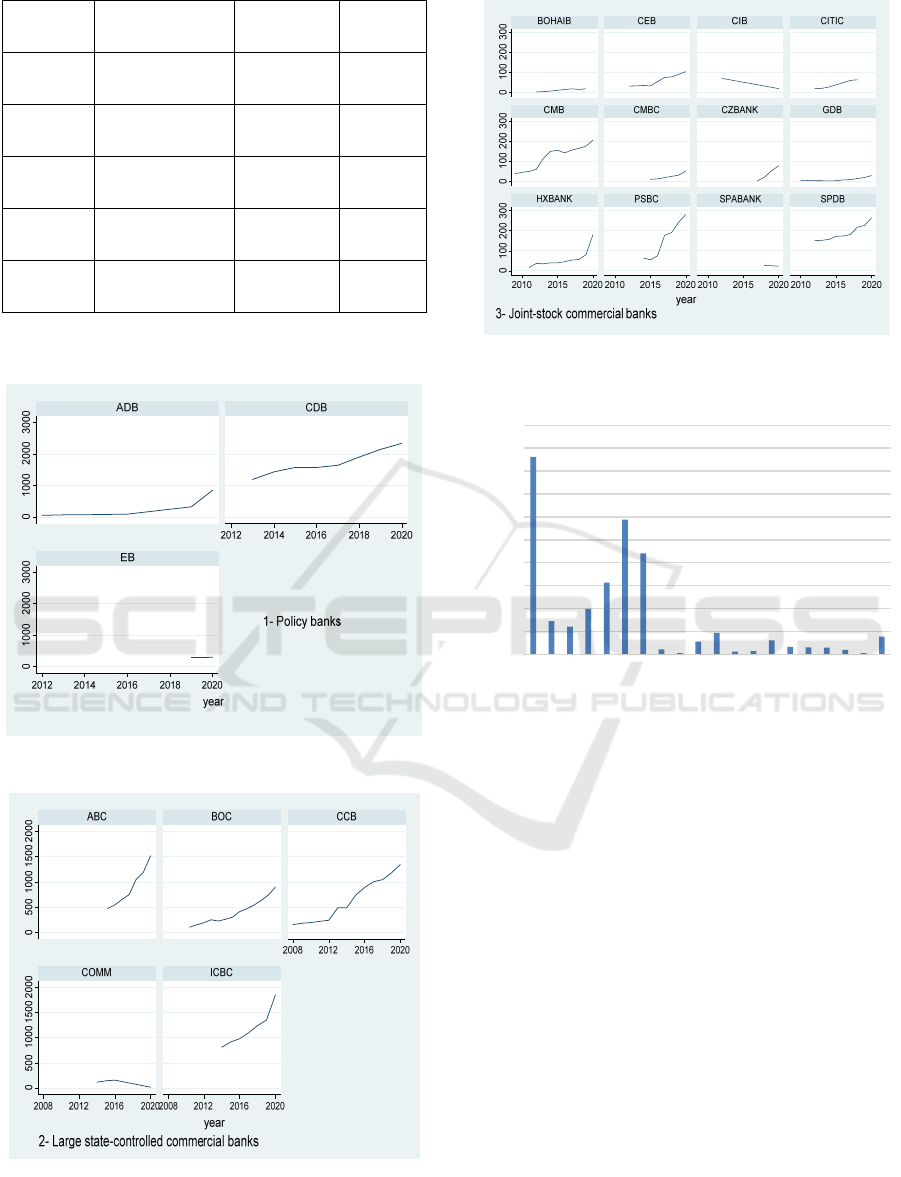

Table 1 presents main names and Short codes of

green credit banks. there were 20 major banking

institutions engaged in green credit business. Figure

1 to 3 shows that, from 2008 to 2020, promotion of

green credit business mainly depends on policy banks

and large state-controlled commercial banks.

However, in recent three years, the number of joint-

stock commercial banks carrying out green credit

business has increased year by year, and the green

credit funds issued have an obvious upward trend

year after year, playing an increasingly important

role.

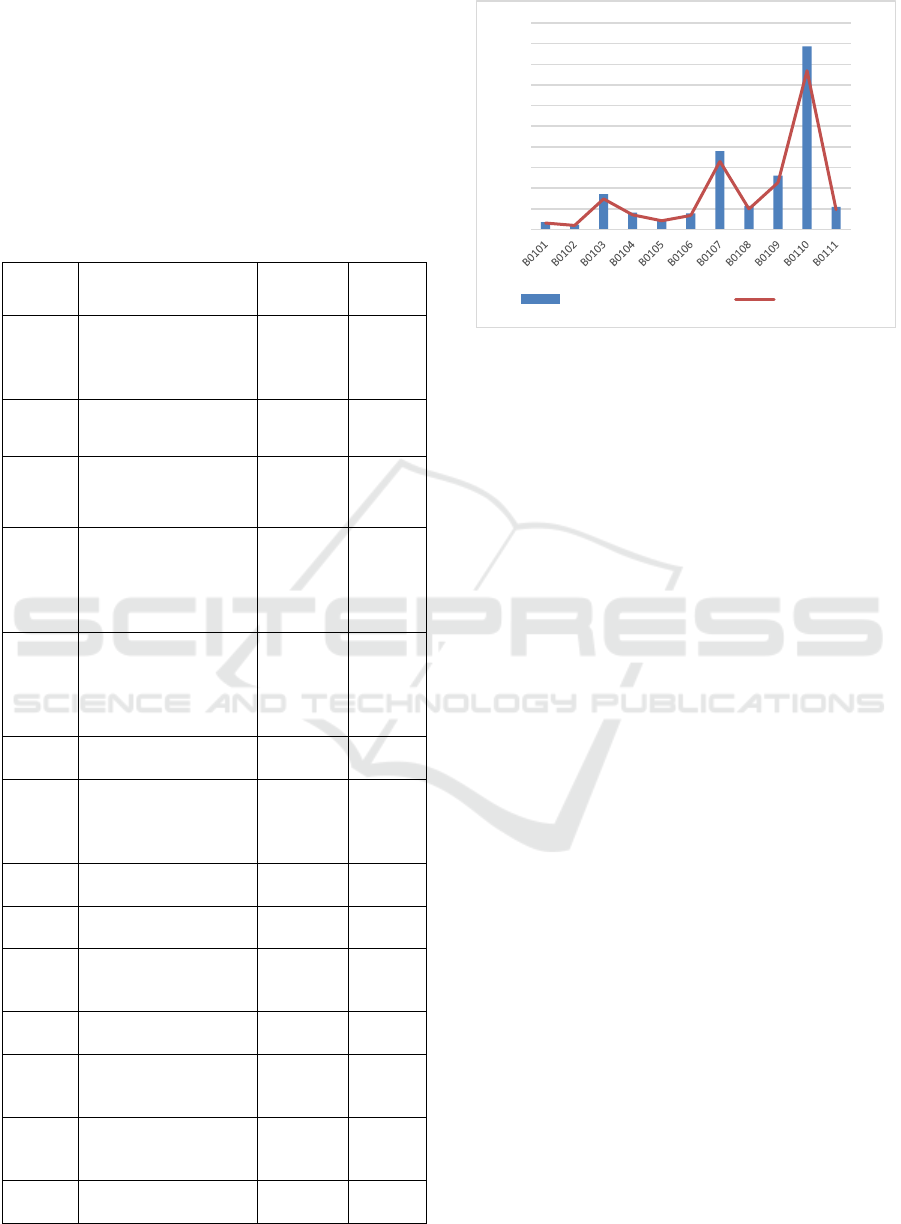

Figure 4 shows that, according to the specific

analysis of statistical data, the average credit balance

of China Development Bank is 1724.491 billion

yuan, ranking first, which is a policy bank. The

average credit balance of Industrial and Commercial

Bank of China is 1176.918 billion yuan, the average

credit balance of Agricultural Bank of China is

881.277 billion yuan, the average credit balance of

China Construction Bank is 627.023 billion yuan, and

the average credit balance of Bank of China is

397.433 billion yuan, ranking second to fifth

respectively. The four banks above are all large state-

controlled commercial banks; Among joint-stock

commercial banks, Shanghai Pudong Development

Bank and Postal Savings Bank of China rank the top

two in the average credit balance, and the number of

banks participating in green credit is increasing year

by year, and the distribution scale is increasing year

by year.

Table 1: Comparison table of main names and Short codes

of green credit banks.

Serial

number

Bank

Name

Short

code

Bank

Nature

1

China

Development

Bank

CDB 1

2

Export-import

Bank

EB 1

3

Agricultural

Development

Bank

ADB 1

4

The bank of

China

BOC 2

5

China

Construction

Bank

CCB 2

6

Industrial and

Commercial

Bank of China

ICBC 2

7

Agricultural

Bank of China

ABC 2

8

Societe

generale

CIB 3

9

Guangdong

development

b

ank

GDB 3

10

Bank of

communication

s

COMM 2

11

Shanghai

Pudong

Development

Bank

SPDB 3

12 Ping an bank

SPABAN

K

3

13

China

Minsheng Bank

CMBC 3

14

China

merchants bank

CMB 3

Research on the Scale and Path of Green Finance Supporting Real Economy from the Perspective of Green Developmen

247

15 China citic bank CITIC 3

16 Everbright bank CEB 3

17 Huaxia bank HXBANK 3

18 Zheshang bank CZBANK 3

19 Bohai sea Bank BOHAIB 3

20

Postal Savings

Bank of China

PSBC 3

Description:1- Policy banks; 2- Large state-controlled

commercial banks; 3- Joint-stock commercial banks.

Figure 1::Loan balance of green credit (1- Policy banks).

Figure 2: Loan balance of green credit(2- Large state-

controlled commercial banks).

Figure 3: Loan balance of green credit (3-Joint-stock

commercial banks).

Figure 4: Average of green credit balance (Unit:100 million

yuan).

3.2.2 the Path of Green Credit Supporting

the Real Economy Is Mainly Reflected

in the Direction of Credit Investment

Table 2 presents , from 2008 to 2020, among the two

first-class green real economy comprehensive

projects, that the green credit support rate of energy

conservation and environmental protection and

service project (B01) reached 98.48%, and the green

credit in strategic new industries project (B02)

accounted for only 1.52%. Specifically, the

cumulative balance of green credit for investment in

energy conservation and environmental protection

and service project, a comprehensive first-class

project, accounts for 51.08% at the end of the year.

It is a comprehensive investment project without

specific second-class project classification; The first

level project includes 11 second level projects. Figure

5 shows that the top four second level projects

supported by green credit are green transportation

17244,91

2905,89

2414,61

3974,33

6270,23

11769,18

8812,77

1117,86

1878,92

1549,72

0

2000

4000

6000

8000

10000

12000

14000

16000

18000

20000

CDB

EB

ADB

BOC

CCB

ICBC

ABC

CIB

GDB

COMM

SPDB

SPABANK

CMBC

CMB

CITIC

CEB

HXBANK

CZBANK

BOHAIB

PSBC

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

248

project accounting for 19.23%, renewable and clean

energy project accounting for 8.24%, building energy

saving and green building project accounting for

5.66%, and industrial energy conservation, water

conservation and environmental protection project

accounting for 3.69%. Therefore green credit

investment reflects the path choice of green finance

to support the real economy.

Table 2: Green Project loan balance (Unit: 100 million

yuan).

Item

Code

Project Category

Name

ratio

B01

Energy conservation

and environmental

protection and

service

p

ro

j

ect

47035.18 51.08%

B0101

Green agriculture

development project

708.16 0.77%

B0102

Green forestry

development

project

447.79 0.49%

B0103

Industrial energy

conservation, water

conservation and

environmental

p

rotection

p

ro

j

ect

3402.47 3.69%

B0104

Natural protection,

ecological restoration

and disaster

prevention and

control project

1622.74 1.76%

B0105

Resource recycling

p

roject

954.61 1.04%

B0106

Garbage treatment

and pollution

prevention and

control

p

ro

j

ect

1543.55 1.68%

B0107

Renewable and clean

energy project

7586.30 8.24%

B0108

Rural and urban

water

p

ro

j

ect

2270.84 2.47%

B0109

Building energy

saving and green

b

uildin

g

p

ro

j

ect

5216.21 5.66%

B0110

Green transportation

p

ro

j

ect

17709.96 19.23%

B0111

Energy saving and

environmental

p

rotection service

2188.12 2.38%

B02

Green credit in

strategic new

industries project

1400.00 1.52%

total

92085.93 100%

Figure 5: Project loan balance and proportion in B01.

3.2.3 a Variety of New Green Bonds Came

out, Injecting New Funds into Green

Finance to Support Real Economic

Growth

As shown in Table 3, from 2016 to 2021, there were

14 main types of green bonds issued. The top five in

the cumulative total issuance scale were General

financial bonds issued 339. 825 billion yuan,

accounting for 17.52%; Corporate bonds issued

328.66 billion yuan, accounting for 16.95%; Green

debt financing vehicle issued 286.721 billion yuan,

accounting for 14.78%; Ordinary financial bonds of

commercial banks issued 225 billion yuan,

accounting for 11.60%; General corporate bonds

issued 174.57 billion yuan, accounting for 9.00%.

However, from 2016 to 2018, the top five bond

types with cumulative issuance scale were Ordinary

financial bonds of commercial banks, Corporate

bonds, General financial debt, Policy financial debt

and General corporate bonds. Compared with the

latter, the former has changed significantly. It shows

that the issuance proportion of large state-controlled

commercial banks has decreased significantly, the

issuance proportion of joint-stock commercial banks

ranks first, the issuance scale of entity enterprises

other than financial institutions is of great

importance, and there is a major breakthrough in

green debt financing as an emerging bond type.

0,77%

0,49%

3,69%

1,76%

1,04%

1,68%

8,24%

2,47%

5,66%

19,23%

2,38%

0%

5%

10%

15%

20%

25%

0

2000

4000

6000

8000

10000

12000

14000

16000

18000

20000

Project loan balance proportion

Research on the Scale and Path of Green Finance Supporting Real Economy from the Perspective of Green Developmen

249

Table3: Ranking of cumulative size of green bond issuance

(100 million yuan).

Rank Bond Nature Scale Ratio

1 General financial debt 3398.25 17.52%

2 Corporate bonds 3286.6 16.95%

3

Green debt financing

vehicle

2867.21 14.78%

4

Ordinary financial

bonds of commercial

banks

2250 11.60%

5

General corporate

bonds

1745.7 9.00%

6 Policy financial debt 1466 7.56%

7

Non-public offering of

corporate bond

1230.73 6.35%

8

Asset-backedsecurities

1103 5.69%

9 Asset-backed notes 1007 5.19%

10 Medium-term notes 467.06 2.41%

11

Local government

debt

275.13 1.42%

12

Ultra-short term

financing paper

249.5 1.29%

13

Private private debt

financing instruments

25.6 0.13%

14 Short-term finan 16.5 0.09%

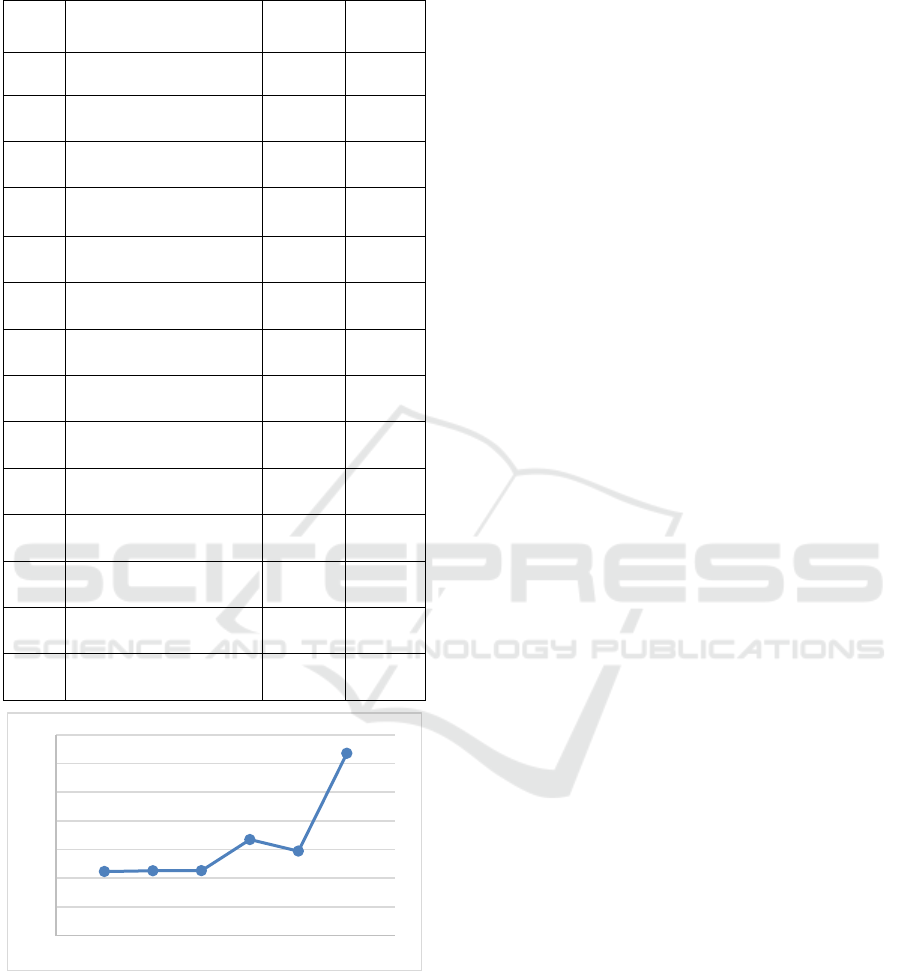

Figure 6: Trends of green bond issuance scale (100 million

yuan).

In addition, from 2016 to 2021, figure 6 shows

that the issuance scale of green bonds showed an

overall growth trend, and the number of issuance

increased from 82 to 652. Even in 2020, when the

global economy was volatile due to the epidemic, the

issuance scale of green bonds in China was only

slightly reduced. The overall issuance scale in 2021

was 635.263 billion yuan, 2.16 times than that in

2020, exceeding the sum of the issuance scale in the

previous two years.

4 FURTHER BROADEN THE

SCALE AND PATH OF GREEN

FINANCE TO SUPPORT THE

REAL ECONOMY

According to the “Statistics of China Green Finance

Development Research Report 2020”, the total

supply of green finance funds in China has increased

significantly, and the gap between supply and

demand has gradually narrowed. However, green

finance still faces some problems in supporting the

real economy, such as the small number of green

listed enterprises, the small scale of green insurance,

and the slow development of new green finance

products such as green development fund, green

guarantee fund, carbon financial products and other

derivative financial instruments. Therefore, from the

perspective of green development, determining the

“two cores” of the new model of green finance

supporting the real economy and the “two paths” of

the new path of green finance supporting the real

economy is a realistic choice to further expand the

scale of green finance supporting the real economy

and promote green finance to effectively support the

growth of the real economy.

4.1 “Two Cores”of the New Model of

Green Finance Supporting the Real

Economy

We should actively explore a new model for the

development of green finance, build an all-round

system, take the accurate grasp of “green or not” and

“sustainable green” as the two core, and based on four

green financial products such as green credit, green

bonds, green funds and green insurance, set up green

banks, take the healthy green financial market as the

medium, and form a green financial system as the

guarantee. Building a new multi integrated green

finance development model with green finance

innovation pilot zone as the new fulcrum. To achieve

financial support for the development of ecological

industries, comprehensively drive the transformation

and upgrading of advantageous industries, and realize

mutual benefit and mutual promotion between

finance, economy, society and ecology.

2233,21

2258,84

2261,32

3347,26

2941,94

6352,63

0

1000

2000

3000

4000

5000

6000

7000

2015 2016 2017 2018 2019 2020 2021 2022

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

250

4.2 “Two Paths” for Green Finance to

Support the Real Economy

The in-depth development of green finance is

inseparable from the in-depth exploration of

scientific research and theory, the support and

incentive of government policy, the innovative

development of market practice, the coordination and

cooperation of green financial policy-making

departments and the strong support of market

subjects. Therefore, to support the development of

real economy, green finance should follow two paths

that the top-level promotion of “top-down” and the

grass-roots exploration of “bottom-up”, so as to

promote the sustainable development of green

finance.

5 CONCLUSIONS

In this paper, the balance of green loans and the

holding of green bonds are used to calculate the total

amount of green finance business, and the scale and

path of green finance to support the real economy are

considered.(1) Policy banks led by China

Development Bank and four large state-controlled

commercial banks are still the main force of green

credit to support the growth of real economy, but a

large number of joint-stock commercial banks

gradually participate in green credit business, which

will be the new force of green credit business in the

future. It will play an important role in further

expanding the scale of green credit.(2)Green credit

selects the path of supporting the real economy

through credit orientation, and the credit support of

energy conservation and environmental protection

projects and services far exceeds that of green credit

projects in strategic new industries. (3) A variety of

new green bonds inject new funds for green finance

to support the growth of real economy. The issuance

scale of General financial debt,Corporate bonds and

Green debt financing vehicle ranked the top three.

However, from the perspective of green

development, it is still an arduous task to expand the

scale of the real economy supported by green finance

and explore effective operation paths. We should

continue to explore the "two cores" of a new model

of green finance supporting the real economy and the

"two paths" of a new path of green finance supporting

the real economy, so as to jointly contribute to the

standardized, healthy and sustainable development of

green finance supporting the real economy.

ACKNOWLEDGMENTS

National Natural Science Foundation of China

project "Research on niche promotion mechanism,

transition conditions and path of entrepreneurial

enterprises supported by entrepreneurship incubation

chain" (72072144).

Gansu social science planning project "Research

on ecological compensation mechanism for

promoting green development in Gansu" (20YB07

0).The innovation ability improvement project of

colleges and universities in Gansu Province

"Research on the 'twin' circular development of Gobi

ecological agriculture in Gansu Province under the

background of Rural Revitalization Strategy"

(2020B-160).

REFERENCES

Ba, S., & Shen, C. (2013). The trend of international

financial regulatory reform and the policy choice of

China's financial regulatory reform. J. Southwest

finance.08, 7-11.

Chen, F. (2021). Research on the influencing factors of

financial services on the development efficiency of real

economy. J. Discussion on modern economy.12,71-80.

Huang, C., Shang Y., & Liu, X. (2021). Industry

characteristics, real economy and Financial Risk

Spillover. J. Macroeconomic research.03,5-24+110.

Li, Y., & Han, T. (2011). Analysis on the mechanism of

financial ecological evolution on real economic

growth-from the perspective of capital allocation

efficiency. J. China industrial economy. 2,26-35.

Liu, H., & He, C. (2021). An empirical study on green

finance supporting high-quality economic development

based on intermediary effect model. J. New

finance.10,21-27.

Tang, S., & Xie, X. (2021). How enterprise holding

financial institutions serve the real economy-from the

perspective of supply chain spillover effec. J. China

industrial economy.11,116-134.

Wang, F., & Wang, K. (2018)."Green" policy and green

financial allocation efficiency - An Empirical Study

Based on Chinese Manufacturing Listed Companies. J.

Financial science.05,1-14.

Yang, Q., Du, Q., Razzaq, A., & Shang, Y. (2022). How

volatility in green financing, clean energy, and green

economic practices derive sustainable performance

through ESG indicators? A sectoral study of G7

countries. J. Resources Policy. 75,10-16.

Zhang, L., & Zhang, W. (2017). Research on the efficiency

and influencing factors of financial service real

economic growth. J. Macro quality research.5,47-60.

Zhou, H., Zhang, C., & Tang, H. (2020). Financing

constraints and the financialization of real enterprises.

J. Journal of management science.23,91-109.

Research on the Scale and Path of Green Finance Supporting Real Economy from the Perspective of Green Developmen

251