The Impact of China's Final Demand on GDP Formation and Growth

in the Context of Big Data: An Empirical Study based on

Input-output Models

Ping Miao

Shanghai university, Shanghai, China

Keywords: Big Data, GDP Growth, Input Output Research, Final Demand.

Abstract: In recent years, with the continuous improvement of China's comprehensive national strength, China's total

GDP is also growing continuously. It can be found that the final demand has made outstanding contributions

to the formation and growth of GDP. In addition, the arrival of the era of big data has become a new

phenomenon of world economic development, which also marks that the world has entered a new stage of

economic development, and big data has brought the revolution of intelligence and informatization, but the

big data is inseparable from the development of engineering technology. To better serve the society with big

data, we must vigorously develop the information technology. The phenomenon of industrial integration has

been formed in the context of big data. The intelligence and informatization brought by industrial integration

and information technology are essential elements for China to realize economic growth transformation in the

era of big data. Only by making full use of the advantages of the era of big data can we give correct guidance

to economic growth. Therefore, this paper uses big data technology to obtain corresponding data form the

input-output tables in 2012, 2015 and 2017, and through the establishment of mathematical models and the

use of information technical software to calculate the contribution of consumption, investment and export to

GDP formation and growth. Through big data calculation, we find that the final demand has made a great

contribution to the formation and growth of GDP. In terms of promoting GDP growth, investment and

consumption play a greater role. Although the role of export is small, its role is increasing. In terms of GDP

formation, we found that the contribution rate of consumption and investment to GDP formation continued to

rise, while the contribution rate of export to GDP formation decreased.

1 INTRODUCTION

In recent years, China's economy has developed

rapidly and its GDP has been growing. From 2012 to

2017, China's total GDP increased from 53732.9

billion yuan to 8313812 billion yuan, with an increase

rate of 53.36% and an average annual growth rate of

8.93%. It can be seen that China's economic growth

rate is very rapid. Meanwhile, China's consumption

expenditure increased from 2717185766 million yuan

in 2012 to 4441770001 million yuan in 2017, with an

average annual growth rate of 10.33%. In 2012,

China's consumption expenditure accounted for

50.57% of the total GDP of that year, and in 2017,

China's consumption expenditure accounted for

53.43% of the total GDP of that year. Similarly,

China's investment expenditure increased from

24838954 million yuan to 3644602655 million yuan,

with an average annual growth rate of 7.97%. The

export increased from 1366658526 million yuan to

1638468236 million yuan, with an average annual

growth rate of 3.69%. It can be found that the driving

effect of the troika of consumption, investment and

export on China's GDP growth is very obvious.

In the past, many scholars have made research on

the driving effect of final demand on economic

growth. They mainly focus on the driving effect of

one of the three carriages of consumption, investment

and export on economic growth, and draw

corresponding conclusions. Under the background of

Moore's law and exponential growth of data, data and

information technology become more and more

important in social production. The advent of the big

data era has brought about the overall rise of the data

analysis industry. The development of digital

information technology has brought innovation to

data analysis methods. Traditional consumption,

Miao, P.

The Impact of China’s Final Demand on GDP Formation and Growth in the Context of Big Data: An Empirical Study based on Input-output Models.

DOI: 10.5220/0011170100003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 185-189

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

185

investment and export will be based on accurate data

analysis. This paper fully considers the impact of

consumption, investment and export on economic

growth, uses the input-output tables in 2012, 2015

and 2017, and uses the corresponding input-output

data to calculate the contribution rate of consumption,

investment and export to GDP formation and growth.

2 LITERATURE REVIEW

In recent years, many domestic and foreign

economists have studied the relationship between

final demand and economic growth. Most of them use

input-output table, which can be used as a

manifestation of big data. Firstly, some domestic

economists have made outstanding contributions to

the study of the relationship between final demand

and economic growth. Zhang shaoxue and Jiang

Xuemei (Zhang, Jiang, 2020) found that the

contribution of China's final demand pull effect to the

added value of global economies is increasing. Ji

Ming and Liu Zhibiao (Ji, Liu, 2014)

believes that the

rationalization and upgrading of demand structure

can affect economic growth. (Wu, 2002, Li, Yin,

2005, Wang, Gong, 2007, Guo, 2007, Tian, 2008,

Jing, Wang, 2011, Zhou, 2019) mainly investigate the

optimal consumption rate and reasonable range in

China's economic growth. Ji Ming (Ji, 2010) believes

that the total demand and demand structure will

change in equilibrium with the path of balanced

economic growth. Han Zhong et al (Han, et al, 2018)

used the input-output table to study the impact of

exports on China's economic growth and the

exchange rate created by exports in different sectors.

Lin Yifu established a macroeconomic model with

four equations to calculate the contribution of exports

to GDP growth. Wang Zhili et al (Wang, et al, 2015)

investigated the relationship between China's export

and GDP growth from 1978 to 1998 by using

cointegration and Granger causality test, and

considered that the contribution of export growth to

economic growth was not significant. Liu Xuewu

(Liu, 2000)

studied the relationship between China's

investment, consumption, import and export and

economic growth from 1989 to 1999 by using the

extended C-D production function and cointegration

theory. He believed that export promoted China's

GDP growth in both short and long term.

Secondly, some foreign economists have made

outstanding contributions to the study of the

relationship between final demand and economic

growth. (Chenery, Syrquin, 1975, garegnani,

Trezzini, 2010, garavaglia, 2012)

believe that the

imbalance of demand structure has an adverse impact

on the long-term sustained and balanced economic

growth. Buera & kaboski (Buera, kaboski 2008)

believed that in the research on the relationship

between structural change and economic growth in

different stages of economic development, one

direction in the future should be to combine demand

factors and supply factors to understand the process

of structural change and economic growth. Ghirmay

(Ghirmay, 2001) used the time series data of 15 low-

income developing countries and VECM model to

study the relationship between export, investment and

economic growth. Jordan Shan (Jordan, 1998)

studied the relationship between export and China's

economic growth by using the method of multiple

causality test. Colm (Colm, 1962) believes that

changes in demand will have a significant impact on

supply factors, and paying too much attention to

supply may lead to wrong conclusions.

To sum up, there are various studies on China's

final demand by economists at home and abroad.

Most economists study the impact of one aspect of

final demand on economic growth. Few scholars

study the impact of consumption, investment and

export excluding import factors on economic growth.

Firstly, this paper studies the impact of consumption,

investment and export on the formation and growth

of GDP. Then it is found that the contribution rate of

export to GDP is gradually decreasing. This paper

compares the contribution rate of consumption,

investment and export of each department excluding

the import factor with that of each department not

excluding the import factor to explore the reasons for

the decrease of the contribution rate of export to GDP.

3 METHODS AND DATA

3.1 Derivation of the Model of the

Contribution of Final Demand to

GDP Excluding Import Factors

In order to eliminate the influence of import factors

on the added value of final demand, this paper divides

the input-output table under the open economy into

table 1. Using mathematical model and SPSS

software to calculate based on the data from the input-

output table.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

186

Table 1: Input production table format after splitting.

Intermediat

e use

Final

demand

Import

Total

outpu

t

1 2…n Consumption

Capital

formation

Export Total

Domestic

intermediate

investmen

t

1 2…n

𝑥

𝑐

𝑖𝑛

𝑒𝑥

𝑦

𝑥

Import intermediate

inpu

t

1 2…n

𝑥

𝑐

𝑖𝑛

𝑒𝑥

𝑦

𝑖𝑚

Added value

𝑣

Total input

𝑥

The split table satisfies the following relationship:

𝑐

=𝑐

+𝑐

𝑖𝑛

=𝑖𝑛

+𝑖𝑛

𝑒𝑥

=𝑒𝑥

+

𝑒𝑥

𝑦

=𝑦

+𝑦

and:

∑

𝑥

+

𝑦

=𝑖𝑚

(1)

In this type table, we first ask for 𝑥

can further

calculate the added value brought by the final demand

of the domestic part. First, we need to define the

localization coefficient θ, Then the localization

coefficient is diagonalized to obtain 𝑥

.

Order:

𝜃

=

1−(𝑖𝑚

/(𝑥

−𝑒𝑥

)) ⋯ 0

⋮⋱⋮

0⋯1−(𝑖𝑚

/(𝑥

−𝑒𝑥

))

(2)

Based on the localization coefficient and X given

above 𝑥

, we can find 𝑥

is:

𝑥

=𝑥

∗𝜃

(3)

Furthermore, we can also calculate the direct

consumption coefficient 𝑎

of the domestic part.

According to the row balance relation, we can

find 𝑦

=𝑖𝑚

−

∑

𝑥

, about how to find 𝑐

,𝑖𝑛

and 𝑒𝑥

.

Firstly, we assume that imported products are

homogeneous with domestic products. When using

imported products, all departments treat them equally

with domestic products, that is, imported products are

split according to the same proportion. Using the

method used by Shen Lisheng (Shen 2003), we can

find out:

𝑐

=

𝑐

𝑦

∗𝑦

,𝑖𝑛

=

𝑖𝑛

𝑦

∗𝑦

,𝑒𝑥

=

𝑒𝑥

𝑦

∗𝑦

(4)

According to the calculation method above, we

can conclude that the Leontief inverse of the domestic

part is:

(𝐼− 𝐴

)

(5)

According to the method of calculating added

value above, we can calculate the contribution of final

demand to GDP after excluding import factors:

𝛼

=

𝑠𝑢𝑚

(

𝛽

)

𝐺𝐷𝑃

,

(

β=C,IN,EX,t

= 2012,2015,2017

)

(6)

Contribution of a sector to GDP:

𝛼

=

𝛽

𝐺𝐷𝑃

(7)

According to the split input-output table, we can

more intuitively see the impact of the import part on

the final demand. By removing the import factor, we

can more truly reflect the reasons for the decline of

the contribution of exports to GDP. It can truly reflect

the current development of our country.

3.2 Data Description

This paper uses the input-output tables of 2012, 2015

and 2017 as the research data. Since the input-output

table of 2017 is newly released by the Bureau of

statistics, we adjusted more than 100 departments to

42 departments according to the input-output table

format of 12 and 15 years. In order to facilitate the

research of the problem, we split the data of the three

tables into domestic part and imported part in

advance, and verified the correctness of the split

accordingly. The input-output tables in 2012 and

2015 are interfered by other factors. In order to

improve the accuracy of the data, we also included

them in the calculation of the model, taking full

account of the original information of the input-

output table. Next, we bring all the data into the

model to get the corresponding results.

4 RESULTS

4.1 Contribution of Final Demand to

GDP Formation and Growth

By bringing the data into the model, we calculated the

contribution rate of final demand to GDP formation

in 2012, 2015 and 2017, as shown in table 2.

The Impact of China’s Final Demand on GDP Formation and Growth in the Context of Big Data: An Empirical Study based on Input-output

Models

187

Table 2: Contribution rate of final demand to GDP

formation.

Yea

r

Consum

p

tion Investment Export

2012 50.62% 46.27% 25.46%

2015 53.37% 44.58% 21.82%

2017 53.96% 44.27% 19.90%

From table 2, we can see that consumption

contributes the most to the formation of GDP,

followed by investment and finally exports. In table

2, we can see that the contribution of consumption to

GDP increases year by year, while the contribution of

investment and export decreases year by year, and the

decline of export is the largest. We will explain the

specific reasons for this phenomenon later.

Next, we calculate the contribution of final

demand to GDP growth. As shown in table 3.

Table 3: Contribution of final demand to GDP growth.

Yea

r

Export Investment Consumption

2015 8.21% 38.26% 63.65%

2017 10.77% 42.80% 56.76%

It can be concluded from table 3 that the

contribution rate of consumption, investment and

export to GDP growth is very significant. Although

the contribution rate of consumption has decreased, it

is still the backbone to promote GDP growth. Among

them, the pulling effect of investment on GDP growth

is up to about 4.5%, which is related to the gradual

increase of investment income in China in recent

years.

4.2 Contribution of Final Demand

Excluding Import Factors to GDP

Formation

According to the above, the contribution of exports

and investment to GDP formation has decreased year

by year, we give a preliminary explanation. In order

to further explore the causes, we exclude the

influence of import factors. First, to avoid the decline

of investment contribution rate caused by the decline

of import reinvestment; Second, in order to avoid the

decline of the contribution rate of entrepot trade

resulting in the decline of the contribution rate of

export.

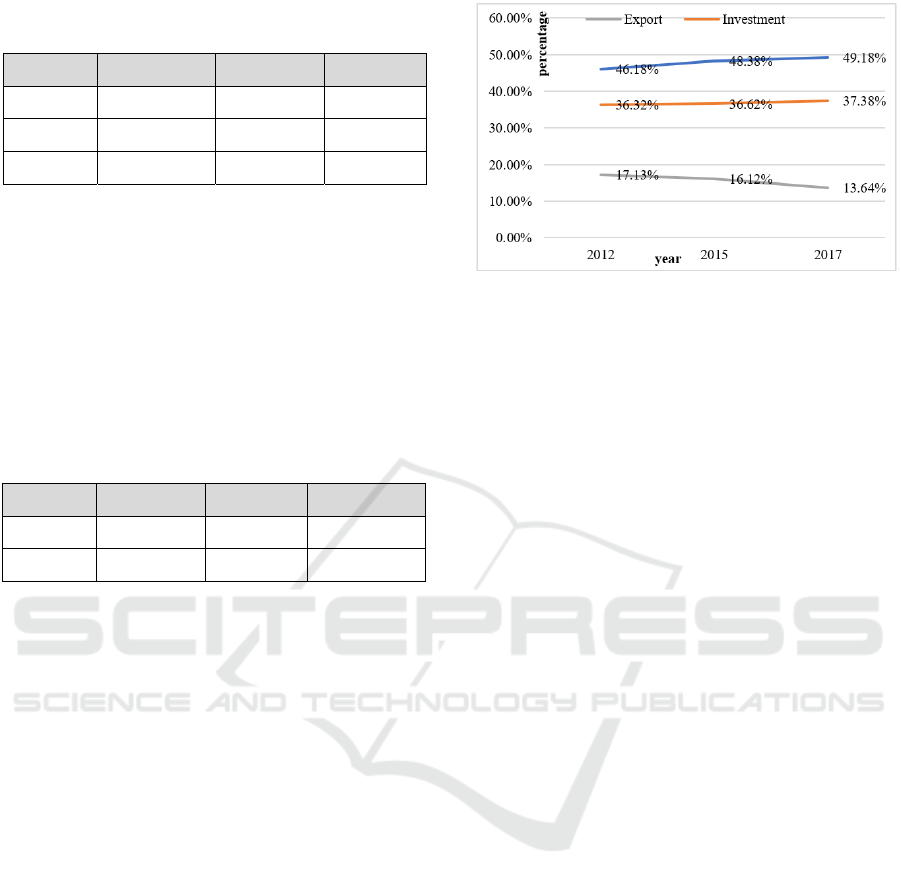

Firstly, this paper calculates the contribution rate

of final demand excluding import factors to GDP

formation in 2012, 2015 and 2017, as shown in Figure

1.

Figure 1: The contribution rate of final demand to GDP

after excluding import factors.

It can be seen from figure 1 that after excluding

the import factor, the contribution rate of

consumption to GDP is still increasing and the

contribution rate of export to GDP is still decreasing.

Different from the above, the contribution rate of

investment becomes increasing. This is consistent

with our preliminary explanation. Due to the

reduction of import reinvestment and the sudden

increase of investment in some sectors, the overall

investment contribution rate is decreasing, while

China's internal investment contribution rate is still

rising, which also shows that China's investment in

some foreign advanced equipment and devices is

getting lower and lower.

5 CONCLUSIONS

According to the big data analysis ability, this paper

analyzes the contribution rate of final demand to GDP

formation and growth by using the input-output tables

in 2012, 2015 and 2017. We draw the following

conclusions: in terms of consumption demand,

consumption has the largest contribution to GDP

formation. In terms of investment demand, the

contribution rate of investment to GDP formation is

also very obvious, and we also find that the

contribution rate of investment to GDP continues to

decline with economic growth. In terms of exports,

the contribution rate of exports to GDP formation is

relatively small compared with the first two.

Moreover, we also find that the contribution rate of

exports also continues to decrease with economic

growth. In terms of the pull of final demand on GDP

growth, the pull effect of final demand on economic

growth is very large, in which the pull effect of

consumption and investment is the most obvious,

followed by that of export.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

188

In order to explain why the contribution rate of

investment and export to GDP decreases with

economic growth. In this paper, we exclude the

influence of import factors in order to prevent the re

investment of import and the influence of entrepot

trade. After excluding the import factor, we find that

the contribution rate of investment continues to rise,

while the contribution rate of export continues to

decline. For the decline of investment contribution

rate, this paper believes that it may be caused by the

continuous decrease of added value brought by

import reinvestment and the significant decrease of

investment contribution rate of individual

departments. For the decline of export contribution

rate, by comparing the different contribution rates of

consumption, investment and export in some

different sectors, this paper concludes that the decline

of export contribution rate may be caused by the

transfer of export to domestic demand and the sudden

increase of investment in individual sectors, resulting

in the decline of growth value brought by export. In

addition, the decline of export contribution rate may

also be caused by the decline of growth value brought

by unit products, which was proposed by Shen

Lisheng (Shen 2003).

To sum up, through the application of big data

information technology, we get the conclusion that

the impact of final demand on economic growth is

very important. We should rationally distribute

consumption and investment and reasonably adjust

the export structure, so as to promote the rapid

development of China's economy. In addition, this

paper also has some shortcomings. First, this paper

does not calculate the input-output tables in 2013,

2014 and 2016, and then does not reflect the change

of the contribution rate of final demand to GDP in

detail every year. Second, this paper only analyzes

the reasons for the decline of the contribution rate of

export and investment with the help of the

contribution rate of final demand to GDP, and does

not take into account the factors such as the decline

of growth value per unit product proposed by Shen

Lisheng (Shen 2003). In addition, we must vigorously

develop education, improve the quality of the whole

people, and let the whole people better master modern

information and networking means and the ability to

obtain data and knowledge, so as to ensure that the

economic growth in the big data era is supported by

high-quality human resources and information

technology, and promote the formation of a new

growth model in the big data era.

REFERENCES

Buera, F. & J. Kaboski, 2008, “Can Traditional Theories of

Structural Change Fit the Date”, WorkingPaper,

Presented at the 2008 Congress of the EEA, Milan,

Italy.

Garavaglia, P.Malerba, F.Orsenigo, L.Pezzoni, M, 2012,

“Technological Regimes and Demand Structure inthe

Evolution of the Pharmaceutical Industry”, Journal of

Evolutionary Economics, 22(4), pp.677-709.

Han Zhong, Chen Yaohui, Shi Yun. Calculation and

decomposition of consumption carbon emissions from

the perspective of international final demand. Research

on quantitative economy and technical economy, 2018

(7): 114-129.

Ji Ming, Liu Zhibiao. The impact of the evolution of

China's demand structure on economic growth and

economic fluctuations. Economic science, 2014 (1):

10-22.

Ji Ming. Demand change and economic growth: theoretical

explanation and China's empirical. Economic science,

2010 (6): 18-29.

Liu Xuewu. Investment, consumption, international trade

and China's economic growth: An Empirical Analysis

from 1989 to 1999. World economy, 2000.

Shen Lisheng, Wu Zhenyu. Contribution of export to

China's GDP growth -- An Empirical Analysis Based

on input-output table. Economic research, 2003.

Teame Ghirmay, Richard Grabowski, and Subhash C.

Sharma, 2001, “Export, Investment, Efficiency and

Economic Growth in LDC: anEmpirical Investigation”,

Applied Economics, 33, pp.689-700.

Wang Dihai, Gong Liutang. Consumption and savings in

growing economy. Financial research, 2007.

Wang Zhili, Zhuang ya'er, Yao Liang. Study on the

employment pulling effect of China's regional final

demand and export activities. Population journal,

2015:103-110.

Wu Zhongqun. Determination of consumption and

investment in China's economic growth. Chinese Social

Sciences, 2002.

Zhang shaoxue, Jiang Xuemei. Heterogeneity analysis of

the pulling effect of China's final demand on the added

value of different economies. Journal of Xi'an

University of Finance and economics, 2020 (3): 62-70.

Zhou Wen. Reasons and Countermeasures for the decline

of employment efficiency driven by final demand.

Journal of Yunnan University of Finance and

economics, 2019 (9): 41-54.

The Impact of China’s Final Demand on GDP Formation and Growth in the Context of Big Data: An Empirical Study based on Input-output

Models

189