Research on the Impact of Digital Economy on China's Real

Economy: An Empirical Study based on Big Data Analysis of

Household Consumption from 2010 to 2020

Yan Zhang

Xi'an Mingde Institute of Technology, Xi'an, Shanxi, China

Keywords:

Digital Economy, Real Economy, Household Consumption, Var Model.

Abstract:

Digital Economy has become an important engine of China’s economic growth. A large number of

enterprises represented by the Digital Economy, such as Alibaba, bytedance, tencent and Meituan, are rising

rapidly, the decrease of the store, the depression of the large-scale Shopping Mall and the economic

depression have become the important factors that hinder the economic development of our country. Based

on the big data, this paper studies the residents consumption from 2010 to 2020, combs the existing research

results of the academic circles, selects the research variables to construct the Var model, and studies the

relationship between the Digital Economy and the real economy in China, through the Var model, we get

the following conclusion: The moderate growth of the digital economy is beneficial to the promotion of the

consumption level of the residents and the development of the economic aggregate, however, we should pay

attention to and develop the integration of digital economy and real economy to form new industrial

upgrading and innovation.

1 INTRODUCTION

Digital Economy is to take digital as an important

factor of production, through data mining,

processing, screening, processing to produce a new

economic value. At the technical level, including big

data, cloud computing, Internet of things,

blockchain, artificial intelligence, 5g communication

and other emerging technologies, represents the

future direction of technology development. In the

development process of China’s real economy,

domestic demand is the basis of national economic

development, China’s real economy is also an

important indicator of regional economic

development. The current national epidemic, rising

prices, low consumption rate has become an

important factor hindering China’s economic

development. In the development of Digital

Economy, we should consider the sensitivity of

residents’consumption to digital economy in

different periods, so as to better realize the rapid

development of digital economy. At the same time,

China’s real economy also presents a typical dual

characteristics, urban and rural residents in the

consumption concept, consumption structure, there

are obvious differences. Although the contribution

rate of consumption to the total economy is larger

than that of investment and export, there is still a big

gap between China and developed countries.

Whether it is based on the perspective of economic

development, or the perspective of China’s real

economy, this paper is of great significance.

2 LITERATURE REVIEW

Domestic scholars began to pay attention to the

impact of Digital Economy on China’s economic

development, but mostly from the production

efficiency, resource integration, employment and so

on. Zhou Zhihan and Yang Xi (Zhou, 2021, Yang,

2021) studied the impact of Digital Economy on

industrial productivity, intra-industry resource

integration and social welfare. The results show that

after the introduction of the Digital Economy, the

critical productivity of exports increases, the

changes of the critical productivity of production

and the average productivity of industries are

determined by the critical value of the corresponding

productivity increase index, while the degree of

Zhang, Y.

Research on the Impact of Digital Economy on China’s Real Economy: An Empirical Study based on Big Data Analysis of Household Consumption from 2010 to 2020.

DOI: 10.5220/0011165500003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 145-149

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

145

intra-industry production competition is alleviated,

intensification of intra-industry Export Competition.

Wang Dong, LV Yanfang (Wang and LV , 2021)

mathematical model of the effect of digital

technology on employment in real economy, and a

nonlinear empirical framework was used to test the

effect of digital input on employment in real

economy during 2003-2019. The empirical results

show that narrow-sense digital technology index has

a negative impact on labor employment, but with the

increase of industry output, the negative inhibition

tends to weaken; The effect of generalized digital

technology on the employment of labor force shows

a complicated non-linear trend, which first

suppresses, then promotes, then suppresses, the

cross-product of digital technology and output has a

positive effect on the employment of labor force,

and digital technology has a significant positive

effect on the employment of labor force in low-tech

industries. Thus, while digital technology can induce

unemployment in the real economy through

substitution, when digital technology is deeply

integrated with the real economy, it can lead to the

expansion of industry scale and ultimately promote

employment in the real economy. Liu Shijin (Liu ,

2022) , deputy director of the Economic Committee

of the National Committee of the Chinese People’s

Political Consultative Conference , published an

article in the Beijing Daily: Promoting the effective

integration of the digital economy and the real

economy. In the article, the author talks about the

trend of digital economy, and how to integrate the

real economy with the digital economy is the focus

of attention.

3 VARIABLE SELECTION AND

MODEL INTRODUCTION

3.1 The Selection of a Variable

The digital economy, as an integral part of the

national economy as a whole, will have an important

impact on economic development, and the impact of

the digital economy on the real economy will vary at

different stages of economic development; The aim

of developing the digital economy is to ensure that

our country’s technological development can keep

pace with the global technological progress and

make breakthroughs in new fields. Different types of

digital economy are usually identified according to

the economic cycle, and technical growth rates are

used to reflect changes in the digital economy when

selecting research variables, the following factors

should be considered in the study of Digital

Economy:

(1) the stability and continuity of the

development of digital economy are closely related

to the current information technology, artificial

intelligence technology and blockchain technology.

(2) the development of the digital economy will also

promote and realize the stable and rapid

development of the economy. Whether the digital

economy can promote the development of the real

economy is the focus of our consideration. (3) apart

from the goal of driving economic growth, the

digital economy also has the goal of technological

development and global strategy. The Central Bank

should keep prices stable within the range

acceptable to the residents and avoid irrational price

increases impacting their normal lives, because of

the global impact of the epidemic, the extent of

inflation will also have an important impact on the

development of the Digital Economy, prices will

affect the development of the real economy.

To sum up, according to the existing research

results and the availability of data in the academic

circle, this paper selects the price level (WZ) , the

growth rate of information technology (MN) , and

the resident consumption (CZ) as the research

variables, to explore the relationship between digital

economy and real economy in China.

3.2 Model Introduction

When studying the impact of the digital economy on

residents’ consumption, this paper intends to use the

variable auto-regression model to study the

relationship between them. The expression of the

VAR model is:

11

+=1,2

tt ptpt

yAy Ay t T

ε

−−

=++

(1)

Expand the above formula (1) to:

1

111 1

2

221 2

1

1

,1,2,

tp

tt t

tp

tt t

p

kt p

kt kt kt

y

yy

y

yy

A

AtT

y

yy

ε

ε

ε

−

−

−

−

−

−

=+ +=

(2)

In formula (2) the AP is:

11, 1 ,

1, ,

pkp

P

kp kkp

AA

A

AA

=

(3)

In the Var model, the lag term is included on the

right side of the equation, and the random

perturbation term is independent constant variance.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

146

4 AN EMPIRICAL STUDY ON

THE IMPACT OF DIGITAL

ECONOMY ON REAL

ECONOMY

4.1 ADF Unit Root Test

Before the Empirical Analysis, ADF unit root test

was conducted to determine the validity of the data.

It can be seen from Table 1 that the ADF test value

of variable dlz is-5.93832, p value is 0.0503, the

data of variable nwdlz is stable at 10% level, the

ADF test value of variable DlnMN Is-3.79849, p

value is 0.0112, the data of variable DlnMN is stable

at 5% level The ADF test value of Dlncz

Was-5.37192, P value was 0.0561, which was

significant at 10% level.

Table 1: ADF unit root test.

Variable

ADF test

value

Prob

1%

critical

value at

significan

t level

5%

critical

value at

significan

t level

10%

critical

value

at

signifi

cant

level

Conclu

sion

DlnWZ -5.93832 0.0503

unstable

unstable stable stable

DlnMN -3.79849 0.0112

unstable stable stable stable

DlnCZ -5.37192 0.0561

unstable

unstabl

stable stable

4.2 Construction of Var Model

It is necessary to determine the optimal lag order

before constructing the Var model, and choosing the

appropriate lag time can not only guarantee the

scientificity of the model, but also make the

variables have dynamic characteristics. In this paper,

SC criterion and AIC are used to judge the best lag

order of the model. The test results are shown in

Table 2. Table 2 shows that the AIC and SC values

both reach the minimum when the variable lags the

second order, which shows that the second order is

the best lag order of the model.

Table 2: Test of the order of delay in Var model.

La

g

LogL LR FPE AIC SC

0

65.874

89

NA

9.4843

1*

-9.74932

-11.8474

2

1

89.774

91

148.938

12

5.9383

2

-18.9441

2

-19.9958

8*

2

138.93

135

47.9821

2*

2.0841

1

-19.0842

3*

-20.0945

9*

According to the test result of the lag order of

Var model, the Var model is reconstructed. The

output of the model is as shown in equation (4) .

ln 0.6465 ln ( 1) 0.7089 ln ( 2) 2.0781 ln ( 1)

+1.7842 ln ( 2) 1.8503ln ( 1)+1.6782 ln ( 2) 0.9847

CZ WZ WZ MN

MN CZ CZ

=−×−− ×−+ × −

×−+ − −+

(4)

The regression coefficients of LNWZ (- 1) ,

LNWZ (- 2) and LN (CZ) are both negative, which

shows that the price level has a significant negative

correlation with the resident consumption. The

regression coefficients of LNMN (- 1) and LNMN (-

2) with LN (CZ) are both positive, which shows that

the growth rate of information technology has a

significant positive correlation with residents ’

consumption, it also shows that the moderate

development of digital economy can promote the

consumption of residents. The regression

coefficients of LNCZ (- 1) , LNCZ (- 2) and LN

(CZ) are both positive, which shows that residents’

consumption has a certain path dependence effect

and has a certain consumption inertia in a certain

period of time, the previous consumption habits and

consumption ideas will have an important impact on

the follow-up consumption behavior, it is difficult

for residents to get rid of the solidified consumption

habits in a short time.

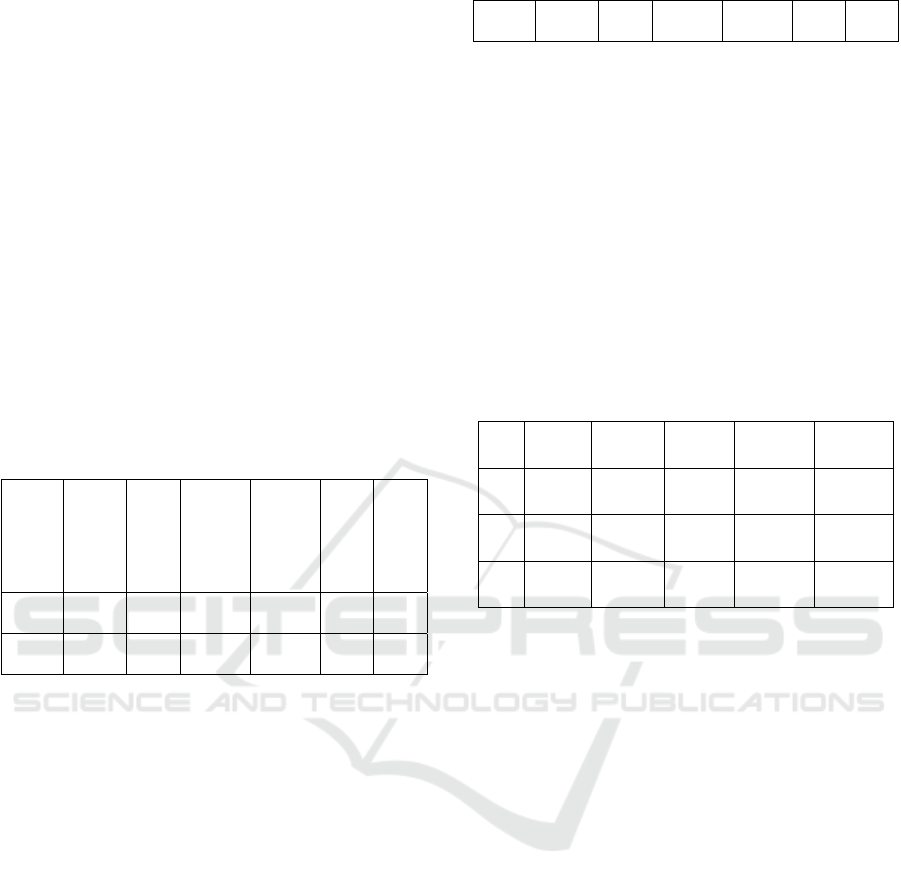

4.3 Robustness Test of Var Model

The robustness of Var model is very important to the

research conclusion. This paper uses unit root test to

test the robustness of Var model. The test result is

shown in figure 1. It can be seen from Fig. 1 that all

the unit roots of Var (- 2) model constructed in this

paper are in a single circle, and the Var model

constructed in this paper is robust by robustness test.

Research on the Impact of Digital Economy on China’s Real Economy: An Empirical Study based on Big Data Analysis of Household

Consumption from 2010 to 2020

147

Figure 1: VAR Model Robustness Test Results.

4.4 Percy Grainger’s Causality Test

Granger causality tests were performed on Lnwz,

lnMN and LNCZ. The results are shown in Table 3.

From Table 3, it can be seen that there is a mutual

Granger causality between LNMZ and Lncz, which

shows that the price level and the resident

consumption are Granger causality, and they are

related and influence each other. lnMN is the Percy

Grainger cause of LNCZ, and LNCZ is not the

Percy Grainger cause of Lnmn, which shows that the

growth rate of information technology will affect the

real economy of our country, but the real economy

of our country will not affect the growth rate of

information technology.

Table 3: Percy Grainger’s causality test.

Original

hypothesis H0

Lag

peri

od

F

test

valu

e

Confiden

ce

Probabilit

y

Conclu

sion

LnWZ is not

lnCZ’s Percy

Grainger reason

2 2.72

13

0.002 Refuse

H0

lnCZ is not

lnWZ’s Percy

Grainger reason

2 3.16

53

0.025 Refuse

H0

lnMN is not

lnCZ’s Percy

Grainger reason

2 2.20

93

0.037 Refuse

H0

lnCZ is not

lnMN’s Percy

Grainger reason

2 3.14

03

0.026 Accept

H0

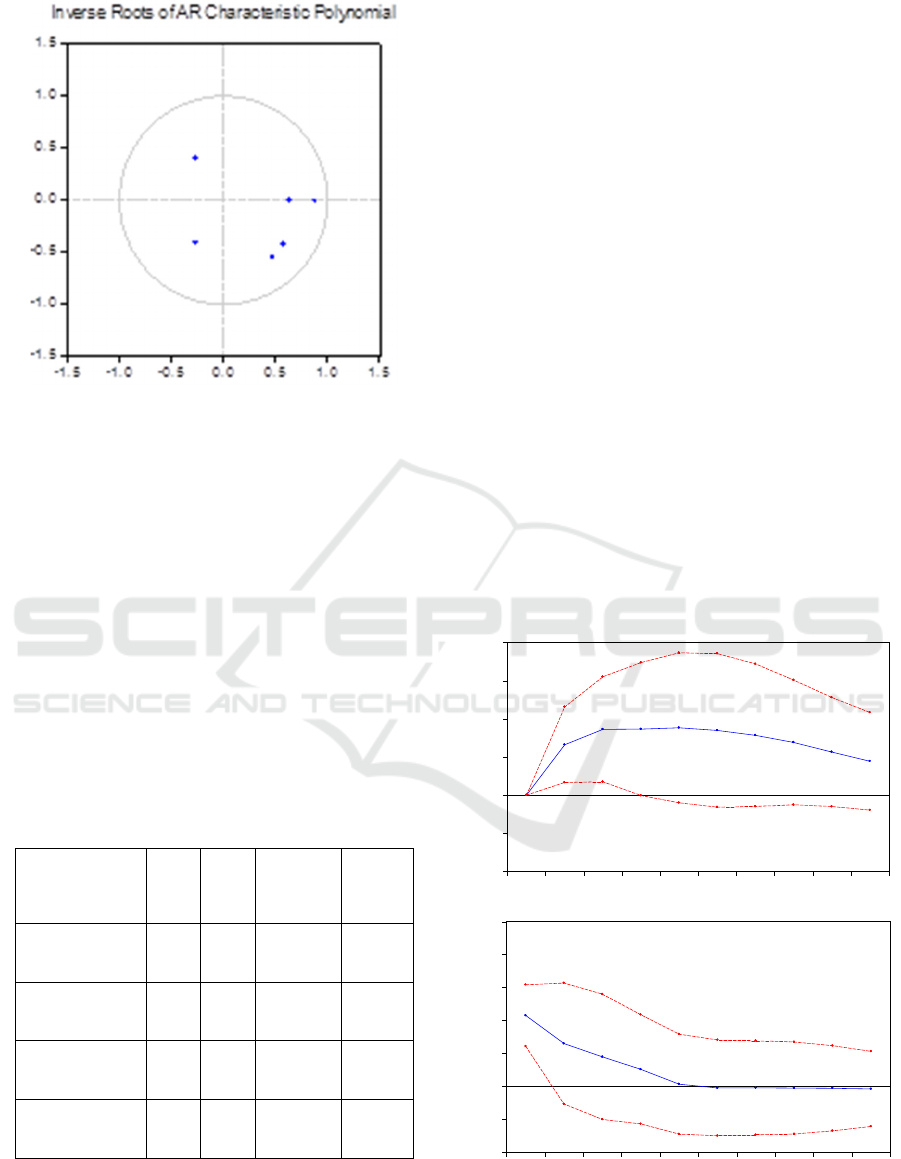

4.5 Impulse Response Test

In the Var model, the impulse response is mainly to

examine the impact of one variable’s change on

another. This paper analyzes the impact of it growth

rate and price level on China’s real economy, the

result is shown in figure 2, where the red line shows

the change trajectory of the variable after the

pressure is applied, and the Blue Line shows the

deviation region of plus or minus twice the standard

deviation. As can be seen from figure 2, the impact

of the growth rate of information technology on

China’s real economy shows an obvious upward

trend in the first and second periods, reaching the

peak in the third period, and showing a clear

downward trend after the third period, this shows

that the appropriate growth of information

technology is conducive to improving the level of

consumption of residents, but the digital economy

after a large-scale people’s lives, and form habits,

such as online shopping is not conducive to China’s

real economy. The impact of the price level on

China’s real economy shows an obvious downward

trend from the first to the sixth period, and the

change tends to be stable after the sixth period,

which shows that the rise of the price level is not

conducive to the promotion of China’s real

economy, this is also in line with the basic economic

law.

-.10

-.05

.00

.05

.10

.15

.20

1 2 3 4 5 6 7 8 9 10

Response of lnMN to lnCZ

-.08

-.04

.00

.04

.08

.12

.16

.20

1 2 3 4 5 6 7 8 9 10

Response of lnWZ to lnCZ

Figure 2: Impulse response of price level and information

technology growth rate to China’s real economy.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

148

5 CONCLUSIONS AND

RECOMMENDATIONS

Based on the time series data from 2010 to 2020,

this paper sorts out the existing research results in

the academic circle, selects research variables to

construct the Var model, and studies the relationship

between digital economy and China’s real economy,

the following conclusions are obtained by Var

Model: (1) the growth rate of digital economy and

the regression coefficient of real economy in China

are positive, showing a positive correlation between

them. The impulse response analysis found that in

the first and second periods, there was an obvious

upward trend, reaching the peak in the third period,

and after the third period, there was an obvious

downward trend. This shows that the moderate

growth of the digital economy is beneficial to the

promotion of the consumption level of the residents,

we will promote the development of our overall

economic output. The excessive growth of digital

economy is not conducive to the promotion of China

’s real economy. Attention must be paid to the

integrated development of digital economy and real

economy to form new industrial upgrading and

innovation. (2) the regression coefficient between

price level and real economy is negative, which

shows that there is a significant negative correlation

between them. The impulse response shows that

there is an obvious downward trend from the first to

the sixth period, and the change tends to be stable

after the sixth period, which indicates that the rising

of price level is not good for the promotion of

China’s real economy.

According to the above analysis, we can put

forward countermeasures and suggestions to

improve China’s real economy. First, adjust the

digital economy according to the actual economic

situation. From the results of Var model, we can see

that in different stages of economic development,

the impact of digital economy on China’s real

economy is different. Second, external factors have

been affected by the global epidemic since 2020,

and the real economy has been severely impacted,

and with the rapid development of information

technologies such as big data, artificial intelligence,

blockchain, and the meta-universe, the real economy

and the digital economy have both grown and

grown, but the digital economy is a part of the total

economy, how to integrate the real economy and the

digital economy, to upgrade industries and innovate,

is one of the trends in the future. Third, stabilizing

the price level is the first priority. Price level will

have an important impact on China ’ s real

economy, and there is a significant negative

correlation between the two. Price is a key factor

affecting the national economy and the people’s

livelihood, and also has a very important impact on

social stability and harmony. The important aim of

the implementation of the digital economy is to

stabilize the economic development and promote the

promotion of the national income level and the

consumption level. In the implementation of the

digital economy, we should proceed from the basic

goal and promote the improvement of the real

economy of our country, we will ensure steady and

orderly economic development.

REFERENCES

Lau sai-kam. Promoting the effective integration of digital

economy and real economy. Beijing Daily, 2022-1-10.

Wang Dong and Lu Yanfang. A study on the nonlinear

effect of digital technology on employment in real

economy. Modern Management Science, 2021(12):

110-120.

Zhou Zhihan, Yang Xi. Industrial effect of Digital

Economy: A theoretical analysis based on data factor.

Contemporary Finance and Economics, 2021(12):

101-114.

Research on the Impact of Digital Economy on China’s Real Economy: An Empirical Study based on Big Data Analysis of Household

Consumption from 2010 to 2020

149