Research on the Impact of Central Bank Digital Currency on

Third-party Payment and Countermeasures

Junming Zhang, Xinyue Zhang and Yinghao Yang

InstitutYantai Research Institute of China Agricultural University, Yantai, Shandong, China

Keywords: Digital Currency Electronic Payment, Third-Party Payment, Electronic Commerce.

Abstract: Based on the existing public information, this paper analyzes the advantages of central bank digital currency

by comparing with the third-party payment. Although the foundation of third-party payment will not be

shaken, the legal digital currency of the central bank has brought opportunities and challenges to a certain

extent. Therefore, the third-party payment platform should do a good job in "wallet" service, optimize user

experience, scenario cooperation, make efforts to end B and explore cross-border payment.

1 INTRODUCTION

With the rocketing progress of information

technology, the digital economy characterized by

mobile technology, big data, blockchain, IOT and

other emerging technologies is booming, reshaping

the business model of all walks of life and bringing a

huge impact on the payment industry. At the same

time, with the spread of COVID-19 in the world, the

monetary policy has also been hindered. Under the

dual influence, the use of digital currency is

particularly important.

Digital currency can be called another major

revolution in the process of currency evolution. Many

countries in the world are carrying out the research

and development of central bank digital currency,

including the eurozone, Japan and Russia. And other

major economies have decided to launch CBDC and

enter the proof of concept or research and

development (R&D) stage. China's digital currency

pilot work is also advancing steadily. The people's

Bank of China took the lead in opening the analysis

topic of China's official digital currency. With the

field tests carried out in the selected pilot cities, the

veil of legal digital currency worn by the central bank

has been gradually lifted.

2 OVERVIEW OF CENTRAL

BANK LEGAL DIGITAL

CURRENCY

2.1 Concept Definition

Central bank legal tender (DCEP) is a legal tender

issued in digital form by the people's Bank of China

(the Central Bank of China). Fundamentally, the

central bank's legal digital currency has the same

payment positioning as RMB paper currency. It will

enable users to have more payment options during

transaction payment by replacing part of M0. In daily

life, it will be mainly used in retail, high-frequency

and small amount scenarios such as shopping centers.

2.2 Six Core Characteristics

By combing the existing public data, the writer

believes that the legal digital currency of the central

bank has the following six core characteristics, which

are specifically shown as follows.

2.2.1 Issued by the People's Bank of China

The currency is guaranteed and issued by the people's

Bank of China (central bank). With the credit

endorsement of the central bank, it has more authority

and high stability. It uses distributed accounting

technology to form a series of encrypted strings,

which can realize point-to-point direct payment and

has higher security. In contrast to the current third-

12

Zhang, J., Zhang, X. and Yang, Y.

Research on the Impact of Central Bank Digital Currency on Third-party Payment and Countermeasures.

DOI: 10.5220/0011155000003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 12-17

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All r ights reserved

party payment institution, it undoubtedly has a certain

bankruptcy risk. The digital currency stored by users

is difficult to be protected, so they can only

participate in bankruptcy liquidation.

2.2.2 Adopt the Double-layer Operation

Mode

The operation of the central bank's legal digital

currency adopts the "central bank to commercial

bank" dual structure model which has been well

applied for a long time. In short, the central bank, as

the back-end, needs to perform the responsibility of

issuing digital currency and supervising its dynamic

flow, while the commercial bank, as a secondary

organization, should play a front-end role to facilitate

the public to access or exchange digital currency,

Therefore, a dual investment and two-tier operation

system is formed in which the central bank and

financial institutions reach front-end and back-end

cooperation and commercial banks connect with the

public.

2.2.3 Account Loose Coupling Model

The central bank's legal digital currency adopts the

loose coupling mode of bank accounts that is not used

by most institutions, that is, it provides users with two

feasible options. One option is to bind the bank

account like the third-party payment, and the other

option is not to bind the account, but to make

independent payment directly by relying on the

central bank's legal digital currency wallet, which

eliminates the "running cost" And quickly shorten the

waiting time. But now the account tightly coupled

mode is adopted by most of the non cash payment

agencies. This means that if the third party payment

is used, the bank account must be tied up, otherwise

it will not be able to pay. This obviously exists natural

business barriers. For example, Alipay and fortune

paid (WeChat payment) can not transfer transactions

across the platform. Therefore, the central bank's

legal digital currency, which completes the payment

task without any intermediate link, can meet the

public's demand for efficiency. Especially after the

popularity of 5g network, there will be a significant

difference in the transaction speed affected by the

clearing step of intermediary or not.

2.2.4 No Interest, No Handling Charge

The legal digital currency of the central bank has no

interest, and no service charge will be charged

whether it is in the exchange process of commercial

banks or paid under commodity transactions, and the

transaction cost is zero. At the same time, because it

is separated from physical materials, it avoids the loss

and difficulties of paper money and coins in the

issuance and circulation, and greatly reduces the cost.

2.2.5 Controllable Anonymity

Anonymity: before the advent of digital RMB, third-

party payment institutions can easily capture the

user's "digital footprint", including a large number of

personal accounts and credit information, so as to

accurately depict the user's exclusive portrait and

promote their own financial products in a

personalized and targeted manner. Let's compare the

actual use of the central bank's legal digital currency.

Users do not need to bind any account. Through the

regional network technology, their personal account

content will be packaged and then encrypted, which

closes the door for third-party payment institutions to

directly obtain user information, prevents third-party

payment institutions from deliberately using or

disclosing private information, and maximizes the

protection of user privacy, Prevent users from being

cheated by telecom payment due to information being

sold.

Controllable: Although the legal digital currency

of the central bank can be anonymous, it cannot be

completely anonymous. If it is completely

anonymous and its transaction is extremely rapid, it

is very likely to facilitate criminals to commit crimes.

Therefore, it must emphasize the core characteristics

of "controllable anonymity". First, protect users'

privacy. Second, the people's Bank of China should

ensure that it has certain control. Therefore, with the

help of encryption, blockchain and other

technologies, the user data traded with digital RMB

is only disclosed to the central bank, monitor the flow

of funds in real time, master the real M0, and

effectively avoid and crack down on money

laundering Corruption and terrorist financing.

2.2.6 Support Offline Payment

Online and offline parallel payment in two ways can

be implemented on the central bank statutory digital

currency, which is significantly different from the

mobile payment led by Alipay and fortune paid

(WeChat payment). There is no need to connect to the

network. Even if there are extreme conditions such as

earthquakes, if the mobile phone is available, the user

can carry out the digital RMB transfer through mobile

phone operation. This also determines that the daily

trading limit of digital RMB is not high, which is

mainly used in small and high-frequency retail

scenarios.

Research on the Impact of Central Bank Digital Currency on Third-party Payment and Countermeasures

13

3 OVERVIEW OF THIRD PARTY

PAYMENTS

3.1 Concept Definition

Third party payment refers to the payment activity in

which the payer or payee uses electronic equipment

without interaction between users of both parties on a

specific exclusive equipment, uses the Internet to

issue payment instructions without actual meeting,

and in the intermediate link, the third-party payment

institution carries out collection and payment

coordination.

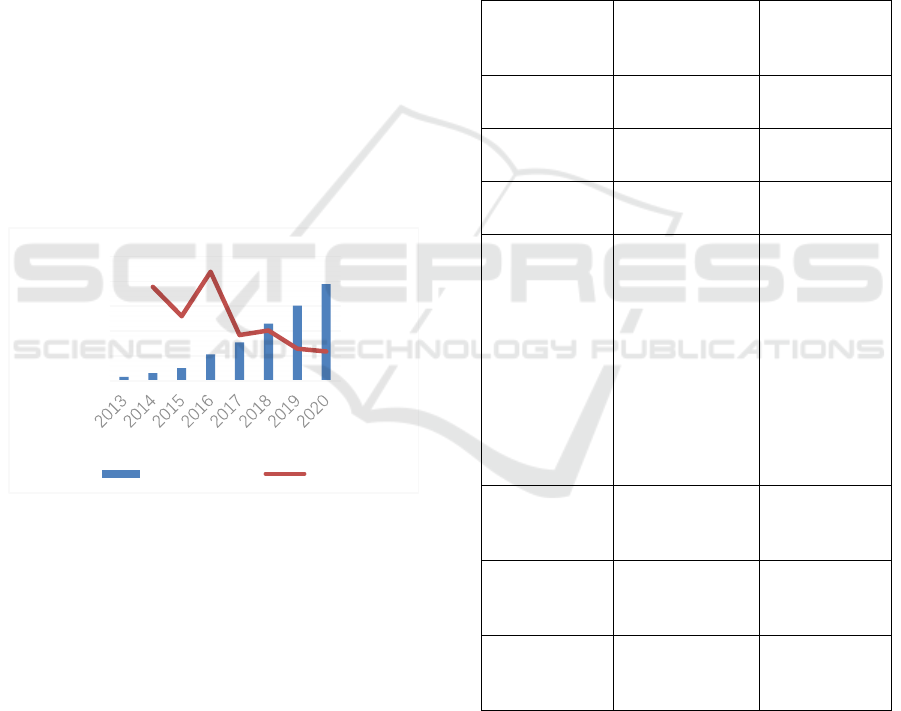

According to the data of China industry

information network, we can get the market scale and

growth rate of the third-party payment platform from

2013 to 2020, as shown in Figure 1. It can be seen

that in recent years, the transaction scale of China's

third-party payment platform has been increasing.

Based on the above data, it can be seen that the third-

party payment platform plays an important role in

China's economic development and will also become

a powerful power source to promote the steady and

rapid development of China's economy.

Figure 1: Market scale and growth rate of third-party

payment platform from 2013 to 2020.

3.2 Profit Model

At present, third-party payment institutions can

obtain income from multiple links in their long

industrial chain, including transaction commissions,

service fees for providing solutions for other

platforms and interest income from stored funds.

Third party payment institutions avoid direct

collision with the main businesses of commercial

banks - asset business and liability business, and find

another way based on user data to successfully

explore the road of payment and e-finance business.

First, they help to realize fund transfer payment, and

second, they develop payment products to gather

users.

The key features of the above Central Bank digital

currency and third-party payment platform are listed

in Table 1. It can be seen that compared with the

central bank's digital currency, although the third-

party payment platform has advantages in terms of

guarantee and cost, it has disadvantages in terms of

security, payment environment, privacy protection

and account mode. Therefore, the issuance of the

central bank's digital currency will have varying

degrees of impact on the third-party payment

platform.

Table 1: Comparison of characteristics between central

bank digital currency and third-party payment platform

Characteristic

type

Central bank

digital currency

Third party

payment

platform

Security

It has unlimited

legal compensation

There may be a

bankruptcy crisis

Payment

environment

Support dual

offline payment

Rely on good

network

Privacy

protection

Controllable

anonymity

Some degree of

anonymity

Guarantee

function

Direct settlement

to merchant

account

The payment for

goods shall be

kept by the

platform, and the

payment for

goods shall

reach the

merchant's

account after

being confirmed

by the buyer

Settlement mode

Direct settlement

of digital currency

by the central bank

User's bank

deposit

settlement

Cost advantage unknown

Scale effect,

with cost

advantage

Account model loose coupling

Tight coupling,

bank card must

be bound

0,00%

20,00%

40,00%

60,00%

80,00%

100,00%

120,00%

0

100

200

300

400

500

Transaction scale/100

million yuan

year

Market scale Growth rate

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

14

4 OPPORTUNITIES AND

CHALLENGES BROUGHT BY

THE CENTRAL BANK'S

LEGAL DIGITAL CURRENCY

TO THIRD-PARTY PAYMENT

On June 30, 2018, the provision interest, part of the

important revenue source of third-party payment was

cut off. Provision, refers to the funds actually

received in advance from the client but not yet

delivered by the third-party payment institution when

processing the transaction business. The ownership of

the reserves belongs to the user. Before the

introduction of this policy, the third-party payment

institution has maintained a direct contact network

with commercial banks. The third-party payment

institution deposits the user's reserves in the reserve

account opened in the bank and can transfer funds at

any time. Then the third-party payment institution

can obtain the interest on the reserve deposit.

Especially when the third-party payment attracts

many loyal users, it precipitates a large amount of

reserve. When they deposit in commercial banks, the

third-party payment institution will obtain higher

interest by virtue of large deposits. In fact, the third-

party payment institution, by collecting the interest

on reserves, is exercising cross-border liquidation

that does not belong to its functions, which is beyond

the business scope permitted by law. Therefore, the

central bank stipulates that non bank payment

institutions (including third-party payment

institutions) must deposit full reserves before January

14, 2019, that is, the current third-party payment

institutions have been completely "disconnected", so

their revenue growth will be mainly contributed by

the payment field and its derivative business.

Through the above analysis, although the central

bank's legal digital currency and third-party payment

exist in different levels, its excellent six core

characteristics make it inevitable to collide with third-

party payment head-on in some fields. It will not only

shake the current situation of duopoly monopoly

third-party payment market, but also mainly affect

the "disconnection and direct connection" The future

payment field and its derivative business.

4.1 Service Fee Income is Affected

At present, when the user selects the third-party

payment platform as the payment path, the third-party

payment institution needs to complete the fund

transfer step by step. The first step is to complete the

bookkeeping process, and then the second step is to

carry out the clearing process. As the intermediary of

transactions, they also provide commercial services,

so users need to pay handling fees to them.

When the payee receives the digital currency

under the transaction supported by the legal digital

currency of the central bank, it can deposit it in the

relevant settlement account for free in real time. In

other words, the legal digital currency of the central

bank instantly enters the payee's bank card deposit

account. This greatly saves the trouble of going to the

bank to deposit money after receiving cash, and also

saves the handling fee that must be paid for

withdrawing cash from a third-party payment

institution. A more convenient and cost-effective

payment method may lead to a large loss of third-

party payment users, so that third-party payment

institutions cannot profit from this business.

4.2 Third Party Payment Derivative

Business is Affected

Moreover, the derivative business income based on

user payment information is also one of the important

sources of third-party payment profits. Relying on the

accumulated user information, third-party payment

institutions constantly create new scenarios. On the

one hand, they develop microfinance and other

businesses, on the other hand, they open a third-party

credit investigation window and provide risk

identification services, such as sesame credit scoring

system.

After the landing of digital RMB, a lot of this cake

will be cut off. The central bank can analyze and

evaluate users' financial assets and debt repayment

ability, judge the loan risk status, and then control the

lending speed according to the risk status. As a result,

third-party payment institutions cannot directly

capture users' personal information from the

transaction process, and the profit scope of credit

investigation business will be greatly encroached and

reduced.

4.3 Promote the Emergence of

Emerging Businesses

Although the legal digital currency of the central

bank has brought a certain blow to the traditional

profit channels of third-party payment institutions, it

has also created a more complete and sound financial

trading system for third-party payment institutions.

Under this system, third-party payment institutions

can reduce their dependence on e-bank accounts and

gateway interfaces of major banks, so as to

Research on the Impact of Central Bank Digital Currency on Third-party Payment and Countermeasures

15

continuously stimulate innovation and find

opportunities for emerging businesses.

5 CONCLUSION AND

COUNTERMEASURES

5.1 Main Conclusions

Based on the above analysis, the strong attack of the

central bank's legal digital currency means that the

tangible RMB is gradually transitioning to the

intangible digital currency, and the cash society is

moving into the cash free society in an orderly

manner. Although the foundation of third-party

payment will not be shaken, the current monetary

system will not be greatly adjusted, and there will be

no outlier changes in transaction payment channels

and application scenarios, the launch of the central

bank's legal digital currency can be regarded as a

reminder signal, which has brought different

opportunities and challenges to a certain extent,

Therefore, the third-party payment platform should

take precautions and make full preparations in

advance to deal with the surging wave of legal digital

currency of the central bank.

5.2 Coping Strategies

The regulations on optimizing the business

environment came into force on January 1, 2020. The

regulations show that we should treat the relationship

between the government and the market in a scientific

and reasonable way. Although the third-party

payment faces many unknown situations and

uncertainties, it can still make full use of the long-

term accumulation to meet the challenges under the

changing situation. Now, the following

countermeasures are proposed for the future

development of the third-party payment institutions

for reference.

5.2.1 Doing a Good Job in the "Wallet"

Service

As "money", the central bank's legal digital currency

has not yet entered the "wallet" industry. Therefore,

the central bank's legal digital currency needs the

infrastructure support provided by the digital wallet.

"Money" and "wallet" complement each other, so the

wallet, as a basic tool, plays an indispensable role in

the monetary payment system. It is expected that in

the future, the central bank's legal digital currency

will coexist with third-party payment. Third party

payment institutions can focus on fully developing

the wallet function and adding procedures for it. On

the one hand, they can benefit from providing

operational technical support for the central bank's

legal digital currency, On the other hand, we can also

rely on original technology to help other central bank

legal digital currency operators, so as to make profits.

5.2.2 Optimizing the User Experience

Third party payment occupies a strong congenital

characteristic in terms of user experience. In the early

stage, it squeezed commercial banks with good user

experience, gained a firm foothold in the market, was

widely accepted by the public and difficult to shake,

and its advantages in the transaction payment system

developed more mature. Then third-party payment

institutions can further optimize the user experience

based on huge data and strong technical strength. In

the early promotion, a good user experience is

indispensable for the central bank's legal digital

currency. If a third-party payment institution can

provide better experience support for the application

process of the central bank's legal digital currency,

the third-party payment institution can stand out from

many third-party payment institutions and precipitate

a considerable number of loyal users for the

institution.

5.2.3 Cooperation based on Scenario

At present, the central bank's legal digital currency

still needs to be piloted for many times, which has not

officially covered all regions of the country, the

application scenario still needs to be developed, the

customer group has not been transformed on a large

scale, and the user habits have not been significantly

changed. The widespread application of Alipay and

WeChat has brought great difficulty to the promotion

of the legal digital currency of the central bank. In the

early stage, the promotion of the central bank's legal

digital currency is bound to spread out the application

scenarios as much as possible. Then, the third-party

payment institutions can seize the gap period between

the central bank's legal digital currency and it,

constantly create new scenarios, and develop strong

coverage and wide application scenario cooperation

with other central bank legal digital currency

operators.

5.2.4 Applying Force to Business

The saturated competition in the C-end market may

make many institutions and companies shift their

strategic focus from locking the competition between

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

16

the C-end to seizing the potential market of the b-end.

Third party payment institutions can focus on

promoting the closer combination of mobile payment

and the b-end business model, expand intelligence

and personalization, and then start a new round of

strategic deployment.

5.2.5 Exploring Cross-Border Payment

In recent years, with the expansion and deepening of

economic globalization and the continuous growth of

Chinese people's consumption demand in Z era, the

growth of Chinese people's demand for cross-border

payment is obvious. From the current situation, the

central bank's legal digital currency has not yet

moved into the field of overseas payment. Third party

payment institutions can explore in the field of cross-

border payment with great growth potential, explore

new opportunities from overseas shopping and

tourism, and then quickly expand overseas layout.

REFERENCES

Ren Linxiang & Shi Lina. (2021). Impact analysis and

development suggestions of legal digital currency. J.

Times finance (10), 49–51.

Wang Qiang & Xie Zhigang. (2020). How does the central

bank's digital currency DCEP affect third-party

payment. J. Contemporary financier (08), 86–87.

Wu Tingting & Wang Junpeng. (2020). China's central

bank issuing digital currency: impact, problems and

countermeasures. J. Southwest finance (07), 25–37.

Yuan Xiuting. (2021). Development and regulation of

Internet third-party payment market. J. People's forum

(07), 82–85.

Zhao Guodong. (2017). Impact, change and suggestions of

digital currency on third-party payment platform. J.

Tsinghua financial review (10), 67–68.

Zhao Yanping. (2021). Analysis on the development status

and Prospect of digital currency of the central bank. J.

Hainan finance (04), 26–31.

Research on the Impact of Central Bank Digital Currency on Third-party Payment and Countermeasures

17