Using Big Data Analytics to Combat Retail Fraud

Danni Zhang

1

, Steffen Bayer

1

, Gary Willis

2

, Gina Frei

1

, Enrico Gerding

2

and PK Senyo

1

1

Southampton Business School, University of Southampton, Southampton, U.K.

2

Electronics & Computer Science, University of Southampton, Southampton, U.K.

Keywords: Fraudulent Returns, Simulation, Returns Policy, Fraud Interventions, Retail Strategic Management.

Abstract: Fraudulent returns are seen as a misfortune for most retailers because it reduces sales and induce greater costs

and challenges in returns management. While extant research suggests one of the causes is retailers’ liberal

return policies and that retailers should restrict their policies, there is no study systematically exploring the

impacts of various return policies and fraud interventions on reducing different types of fraudulent behaviour

and the costs and benefits of associated interventions. In this paper, we first undertook semi-structured

interviews with retailers in the UK and North America to gain insights into their fraud intervention strategies,

as well as conducted literature review on fraudulent returns to identify the influential factors that lead

customers to return products fraudulently. On this basis, we developed a simulation model to help retailers

forecast fraudulent returns and explore how different combinations of interventions might affect the cases of

fraudulent returns and associated financial impacts on profitability. The background literature on fraudulent

returns, the findings of interviews, and the demonstration and implications of the model on reducing

fraudulent returns and related financial impacts are discussed. Our model allows retailers to make cost-

effective evaluations and adopt their fraud prevention strategies effectively based on their business models.

1 INTRODUCTION

Retailers collect a vast amount of data on the channels

shoppers use to buy their goods. This results in a

‘lake’ of big data leading to some powerful analysis

on shopper behaviour. Retail businesses aim to give

their customers a good experience when shopping.

Part of this experience is to make it easy to return

goods, referred to as frictionless returns and then

increase sales. However, there are dishonest

customers who will exploit lenient return policies to

obtain money or use of goods illegally through

fraudulent returns, at little or no cost to themselves

(Harris, 2010; Speights & Hilinski, 2005; King,

Dennis, & McHendry, 2007). Unfortunately,

fraudulent returns could erase a retailer’s 10%-20%

profit margin (King, 2004). A survey conducted by

the National Retail Federation in 2008 suggested that

around 5.4% of merchandise loss is due to return

abuse.

Many retailers have seen an extreme growth in

their online business since the beginning of the

pandemic. However, Covid-19 may aggravate the

problem of high genuine and fraudulent returns,

which have been increasing over the last few years

(Jack, Frei, & Krzyzaniak, 2019; Smriti, 2018).

Specifically, many non-essential retailers have to

change the way they manage their returns and

refunds, which leads to less scrutiny and increases

fraudulent returns over time. For example, most

retailers extending their returns periods resulted in

more dishonest customers returning a product long

after extracting most of the product's market value.

Retailers also try to reduce the time customers spend

in-store by introducing drop-boxes and accepting

returns at sister-brand stores, resulting in less

inspection. Additionally, returned products need to be

quarantined that retailers are unable to inspect the

returns before refunding. Moreover, a surge of

product returns arrived when non-essential retailers

reopened; however, retailers lack the staff to

thoroughly sort and check all returns. Therefore,

problem behaviours that are costly in normal periods

(e.g., fraudulent refunds, serial returners) have

become worse in this pandemic period. The

LexisNexis (2020) study confirms this and shows a

considerable increase in fraudulent returns.

The effects of these changes on fraudulent rates

are currently unknown and need investigation. To

survive this crisis, besides needing to get a handle on

returns rates, retailers must be robust when faced with

non-genuine customers who want to abuse the

system. In order to plan their returns strategies, it is

Zhang, D., Bayer, S., Willis, G., Frei, G., Gerding, E. and Senyo, P.

Using Big Data Analytics to Combat Retail Fraud.

DOI: 10.5220/0011042600003206

In Proceedings of the 4th International Conference on Finance, Economics, Management and IT Business (FEMIB 2022), pages 85-92

ISBN: 978-989-758-567-8; ISSN: 2184-5891

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

85

important to be able to predict the fraudulent rates

expected under varying conditions. Much research

associated with fraudulent returns focuses on

exploring fraudsters' motivations via surveys or

interviews methods, or identifying fraudsters’

returning patterns by analysing returns data (e.g.,

Urbanke, Kranz, & Kolbe, 2015; King & Dennis,

2006). Building a comprehensive customer profiling

model for distinguishing and identifying abusive

customers can be costly and time-consuming.

Therefore, the aim of this research is to use the big

data collected to develop a model that helps retailers

understand the effects of their return policies and

intervention in reducing fraudulent returns.

This position paper first presents the background

literature on fraudulent returns and some of the

measures that are taken to mitigate fraudulent returns.

Then we present our model used to help merchants

forecast the fraudulent returns and see how the

measures might affect the cases of fraudulent returns.

2 RELATED WORK

Modelling has been at the centre of forecasting

returns (Drechsler and Lasch 2016; Potdar and

Rogers 2012). Machine learning (Smriti 2018; Cui,

Rajagopalan, & Ward, 2020) and AI (Urbanke,

Kranz, & Kolbe, 2015) has been used to forecast

returns volumes from fashion online sales in order to

develop returns strategies, identifying consumption

patterns associated with a high return rate. Zhu et al

(2018) used historical data to address the much-

criticised ‘one size fits all’ approach to differentiate

the service approach, predict returns and derive

strategical implications for retailers. Ketzenberg et al

(2020) utilised an extensive data set with over 75

million transactions from a US retailer and identified

the characteristics of abusive returners.

However, this body of work is based on relatively

stable behaviour patterns to predict aggregate return

volumes or individual level return probabilities. In the

current, rapidly changing situation due to the

pandemic, the usefulness of such approaches is

limited: understanding patterns in past purchase data

is not enough to create robust strategies to deal with

the very significant uncertainty of the present and the

future. There are limited studies that have explored

the types of interventions that retailers can take to

reduce fraudulent return rates. The effects of

interventions remain under-researched in simulation

and modelling based analysis.

2.1 Fraud Triangle

The fraud triangle framework developed by Donald

Cressey and W. Steve Albrecht has been widely used

to explain why people violate trust and commit fraud

(Homer, 2020). The triangle suggests three elements,

namely pressure, opportunity, and rationalisation,

that are the motivations for fraudsters to commit the

crime (Cressey, 1973).

The reason for committing fraud varies, but it

often comes from financial pressure. Specific to

fraudulent returns, Wachter et al (2012) suggested

that a combination of product’s high prices and

fraudsters’ low income resulted in them utilising the

lenient returns policy to gain benefits (e.g., returning

used products). Additionally, the financial shortage

caused by the pandemic crisis may lead more

dishonest customers to consider generating financial

benefits by making a fraudulent refund, for example,

returning an empty box for a full refund.

Organisations with inadequate internal controls,

procedures and processes, or physical safeguards can

create an opportunity for fraud to be committed and

concealed (Counter Fraud Services, 2016; DeltaNet,

2021). Some employees do the return transaction for

their family members illegitimately or even do a

refund to their personal account without any

purchases. A recent review paper suggests that

opportunity is the most important factor for

explaining fraudulent behaviour in contrast to other

elements (Homer, 2020). People with antisocial

tendencies tend to believe, if someone is scammed it

is their own fault (Sarah, 2019). Piron and Young

(2000) found that recidivists blame the loss caused by

wardrobing (represents the situation that customer

legitimately buying an item for a specific occasion

with the intention of returning it after use) is retailers’

fault, and some of them manifested their surprise at

how easy it to return the used products.

2.2 Theory of Planned Behaviour

The Theory of Planned Behaviour (TPB; Ajzen,

1991) was developed from the Theory of Reasoned

Action (Ajzen & Fishbein, 1973) is also implemented

on examining the fraudulent behaviour (non-financial

generate purpose). In the TPB framework, there are

three psychological variables, namely attitudes,

subjective norms, and perceived behavioural control,

that all together lead to the formation of a

‘behavioural intention’ which in turn influence the

behaviour (Ajzen, 2002).

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

86

King et al. (2008) is the first study that applied the

TPB to analyse consumers’ dishonest returning

behaviour via a self-administered questionnaire with

535 female consumers. Their results justified that if a

person believes that dishonest returning will be an

easy or pleasant experience, they are more likely to

do it. King and Dennis (2006) is a follow-up study

that conducted in-depth interviews with dishonest

returners. Their results suggest that returners’ prior

returning experience is linked to their proclivity of

fraudulent returning in the future. According to

Johnson and Rhee (2008), if the return procedure is

complicated or there is a cost attached to returning or

getting a refund may be difficult, it reduces

opportunistic return behaviour, and the customer may

decide against return. In the retails, there are a number

of techniques fraudsters use to commit theft through

product returns (Speights and Hilinski, 2005). Some

of the most common types are:

Wardrobing or Renting: Here the shoppers buy

an item (e.g., clothing or a digital camera) with the

intention of using it for an event then returning it

after the event.

Price Arbitrage (online frauds): Here the

shoppers (1) replace the cheaper item/counterfeit

in the expensive item’s packaging and return it for

a full refund, or (2) purchase a new item, then

return an older or non-working version of the

same item, using the packaging from the newer

merchandise for a refund.

Payment Fraud: offenders purchase items with

an illegitimate credit/debit card or with one

backed by insufficient funds and then return the

merchandise before the card clears by the bank.

Insider Fraud: Offenders receive assistance from

employees to return stolen goods, or employees

return the stolen goods for their own benefits.

Returning Stolen Merchandise (in-store frauds):

Returning shoplifted items: individuals or gangs

shoplift goods in-store and then “return” the

item without a receipt for a refund or store

credit.

Receipt Switching: offender makes a genuine

purchase, leaves the store with the item and

receipt, then re-enters later (or goes to another

store but the same company), and picks up an

identical item. Then using the receipt, the

individual claim a refund on the item they have

just picked. The fraudster has in effect received

the first item for free.

Receipt Fraud: offender with a receipt obtained

from somebody else (or the sites selling fake

receipts either digital or physical) goes to shop

to return the stolen item for a refund.

The above findings and discussions indicate that

it is important to reduce the opportunity to initiate a

fraudulent or abusive return at the first purchase stage

and explore how different return policies and

interventions will affect the fraudulent rates.

3 INTERVENTION TO LIMIT

FRAUDULENT BEHAVIOUR

In this section, we discuss the interventions to reduce

fraudulent behaviour, which is based on our

interviews with retailers. The interventions aim to

remove the fraudulent opportunities at customers’

purchase and returns stages.

The interviewed retailers were drawn from the

Efficient Consumer Response (ECR) Retail Loss

Group. This is a community in which retailers discuss

issues they are facing. The interviewed organisations

were selected purposively that retail a wide range of

products, including groceries, clothing and general

merchandise products such as home entertainment

and small electrical goods. We asked the interviewees

to answer our questions regarding non-food products.

They are major players in the market, with the

number of stores ranging from 150 to 750 in the year

2021. Therefore, they all have significant impacts on

society and the economy. Having conversations with

these organisations’ loss prevention managers allows

us to develop various practical interventions in the

fraudulent prediction model (Section 4). The

interview duration was between 90 and 120 minutes.

As with security generally, retailers are willing to

discuss with researchers on fraud prevention methods

but not will have their name associated with a

particular method.

First, having a generous returns policy not only

make it easy for fraudsters to return but also to obtain

a refund illegally. A ‘no quibble’ policy gives the

feeling of trying it out first, but it can make it easy for

the fraudsters to steal items and money unless there

are some checks being done by the retailer. Common

generous policies include giving customers a refund

in cash or a gift card even if they do not have a receipt,

extending the returns period, no return costs (e.g., free

to return to stores or provide a pre-paid return label).

Much of the work has highlighted that generous

return policy is the critical driver of fraudulent returns

(e.g., Harris, 2010; Speights & Hilinski, 2005; Tyagi

& Dhingra, 2021). For example, in one organisation,

we were told:

Using Big Data Analytics to Combat Retail Fraud

87

‘We have a quibble policy up to £40 pounds. If

anyone comes to our store wanna a refund of the £40,

we don't ask them why. If something that a shoplifter

brings for a return and refund, we wouldn’t have

questioned it. However, we should’ (Loss prevention

manager A, Company A)

‘While our customers come in and will not have a

receipt and we will still refund it, we shouldn't, but

that still happens, unfortunately.’ (In-store Loss

prevention manager, Company B)

The type of intervention that retailers suggested

have been shown to make it more difficult for

fraudsters include:

• Setting a shorter return period.

• Increasing the deployment of CCTVs & guards

in-stores.

• Online, customers need to contact Customer

Services to arrange a return and fill out forms

before sending them back, as opposed to where a

return label is already included.

• Providing clear communication of return policies:

no receipt, no refund (exchange possible), if the

serial number did not match, no refund (if

appliable) and no swing tag, no return (exchange

possible).

• Returning funds to the same payment method

only.

One manager commented that:

‘We spend now roughly £40 million a year on

guarding [in-store] when it was £20 million pre-

pandemic, which obviously reduces the likelihood of

having a theft, but also significantly reduces the

likelihood of fraudulent returns. I suppose there's

theoretically more visibility over shoplifters and

fraudsters…the feedback is the visual deterrent. We

have workshops with ex-offenders, so, we have a team

that asking them[offender], how would you steal and

fraud, and what would put you off? And they

[offenders] all said that having a visible and clearly

looking guard is the biggest deterrent.’ (Loss

prevention manager B, Company A)

Second, other organisational processes aid the

fraudsters. These are poor returns management, poor

cyber security, a universal product code for the same

category’s products, weak supervision in the

workplace regarding returns and refund processes,

and lack of sufficient training to spot fraudulent

returns. Based on the discussion with retailers, a

number of interventions have been shown to improve

organismal procedures.

In-store, all returns have to be handled by the

Customer services (well-trained staff and

supervision).

Employees cannot refund their own purchased

products without the presence of a manager.

Managers should take turns to supervise refunds.

Using Address Verification Service to ensure the

cardholder has provided the correct billing

address associated with the account.

Using 3-D Secure service, Payment services

(PSD 2).

Using new technology: Radio frequency

identification (FRID).

Reporting fraudulent retunes behaviour (e.g.,

using fake products/cards) to the police for

investigation.

For example,

‘We also go down the civil recovery route in terms

of bricks and mortar fraud, even going to bailiffs. So,

we're really aggressive with that, so we give ourselves

a reputation with the bad people, not to bother with

us because we will hunt you down. We do see the

immediate effect of reducing the fraud returns.’

(Fraud prevention manager A, Company C)

‘…now, we’ve got a policy in place where all

refund of £9 and above needs to be signed for by a

senior manager. So, they need to basically see the

product, see the receipts to make sure it's been

refunded appropriately. So, we don't get colleges

refunding themselves for products fraudulently,

which we had been in the past…We have got that

policy that reduces the probability of inside fraud.’

(Loss prevention manager B, Company A)

Third, good use and analysis of the retail data

generated can reduce fraud. Data analysis can flag

serial/repeat offenders, leaving the customer service

team free to deal with cases without suspicion.

Data analytics can be used to:

Identifying serial offenders and blocking them.

Reporting on the categorisation of frauds that

result in financial and non-financial loss.

One manager highlighted that:

‘… now we're doing everything with machine

learning and getting all this fraud data into an online

screening tool. We're actually seeing that we're not

getting attacked as much now, because we're

identifying these people every week and putting new

data in. So, our database of customers that have

committed fraud with us is really big. We've got about

4,000 customers out of 20 million. And as we go, we'll

build that up. So even though they're not unique

customers, we're able to look at people that are linked

to them by a delivery address, an email etc.

Something like that, we can start really analysing

who's targeting us and manage that risk.’ (Profit

Erosion and Data Mining Manager, Company D)

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

88

4 MODELLING

The aim of our modelling was to create a tool for

retailers to evaluate the impact of different policies on

fraud. A retailer could use this model to choose cost-

effective strategies and explore complementarities

between measures targeted to reduce genuine returns

and fraudulent returns. In our approach, we

summarise different fraud types and then apply which

policies would impact fraudulent returns over time.

First, we consider six stringencies of fraud

controls that are only targeted at reducing fraud.

These targeted controls include:

1. Unique barcode for each product.

2. Radio frequency identification (RFID).

3. Limited payment methods & Stronger security of

online payment.

4. Sending warning messages.

5. Increased inspection at stores (e.g., increasing the

deployment of CCTVs & guards).

6. Stricter supervision on the returns process.

Second, we consider seven return policies that

impact return volumes as well as fraud attempts.

7. Setting a shorter the return period.

8. Requiring original receipts.

9. Requiring more return efforts for online returns

(e.g., account registration, contact customer

services for online returns).

10. Items can only be returned with tags still attached.

11. No Pre-paid return label for online returns (i.e.,

customers either pay the shipping fee or contact

the retailers first).

12. All returns have to be handled by the Customer

services.

13. Returning funds to the same payment method

only.

These policies and controls are drawn from

interviews and literature review, which have been

implemented or are considered by retailers. The

model allows employing these policies alone or in

combination with others. In this way, we can assess

any complementarity between measures.

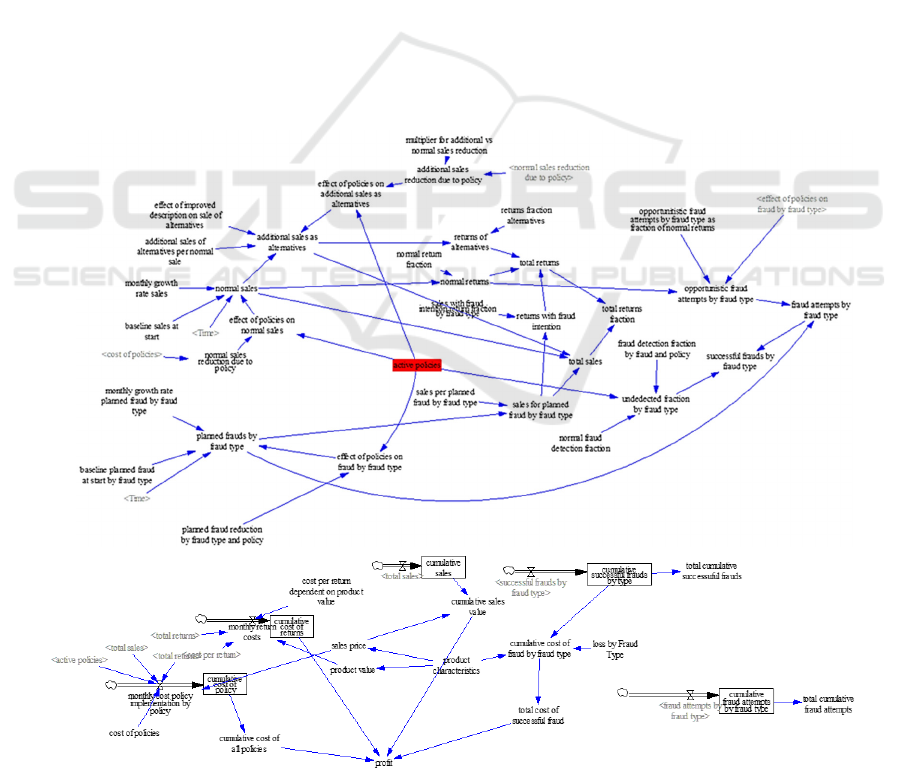

The model (see Figure 1 for the relationship on

which the calculations are based) then predicts the

number of fraud attempts and successful frauds as

well as the number of returns under different

Figure 1: The demonstration of the model for the relationship on which the calculations are based.

Using Big Data Analytics to Combat Retail Fraud

89

Table 1a: Fraud attempts over two 24 months depending on policies adopted.

Cumulative fraud

attempts by type

Ward-

robing

Price

Arbitrage

Payment

Fraud

Returning

shoplifted items

Receipt

Switching

Receipt

Fraud

Insider

fraud

Baseline 1243 1243 1243 1243 1243 1243 1243

Stricter Fraud Controls

343 244 301 283 356 844 419

Stringent Return Policies

63 80 238 281 447 854 894

All Interventions 18 16 58 64 128 580 301

Table 1b: Successful fraud over two 24 months depending on policies adopted.

Cumulative successful

frauds b

y

t

yp

e

Ward-

robin

g

Price

Arbitra

g

e

Payment

Fraud

Returning

sho

p

lifted items

Receipt

Switchin

g

Receipt

Fraud

Insider

fraud

Baseline 621 621 621 621 621 621 621

Stricter Fraud Controls 127 8 103 106 141 418 61

Stringent Return Policies 23 29 65 131 204 415 264

All Interventions 5 0 11 22 46 279 26

combinations of these 13 interventions over a two-

year time horizon distinguishing seven different types

of fraud. The fraud types are: wardrobing, price

arbitrage, returning shoplifted items, receipt

switching, receipt fraud, payment fraud, insider fraud.

In addition, the model allows users to assess the

financial impact of fraud as well as other key

performance indicators.

Table 2: Financial outcomes over two 24 months depending

on policies adopted.

Cumulative cost of all

p

olicies (£)

Baseline 0

Stricter Fraud Controls 86896

Strin

g

ent Return Policies 28171

All Interventions 110901

Cumulative cost of returns (£)

Baseline 319632

Stricter Fraud Controls 197063

Strin

g

ent Return Policies 174781

All Interventions 139616

Cumulative sales value (£)

Baseline 3863440

Stricter Fraud Controls 3278380

Strin

g

ent Return Policies 3011640

All Interventions 2843790

Total cost of successful fraud (£)

Baseline 328896

Stricter Fraud Controls 80720

Stringent Return Policies 93559

All Interventions 36720

As we have not yet have been able to apply our

model to retailers’ data, our results are illustrative and

indicative, we based this information on our

interviews with retailers. Tables 1a and 1b show the

impact of different combinations of policies on fraud

attempts and successful frauds over two years. For

illustration purposes, we assumed fraud attempts are

equally divided between fraud types, and all fraud

types have the same success rate. Table 2 shows

financial outcomes over two years depending on the

combination of policies adopted.

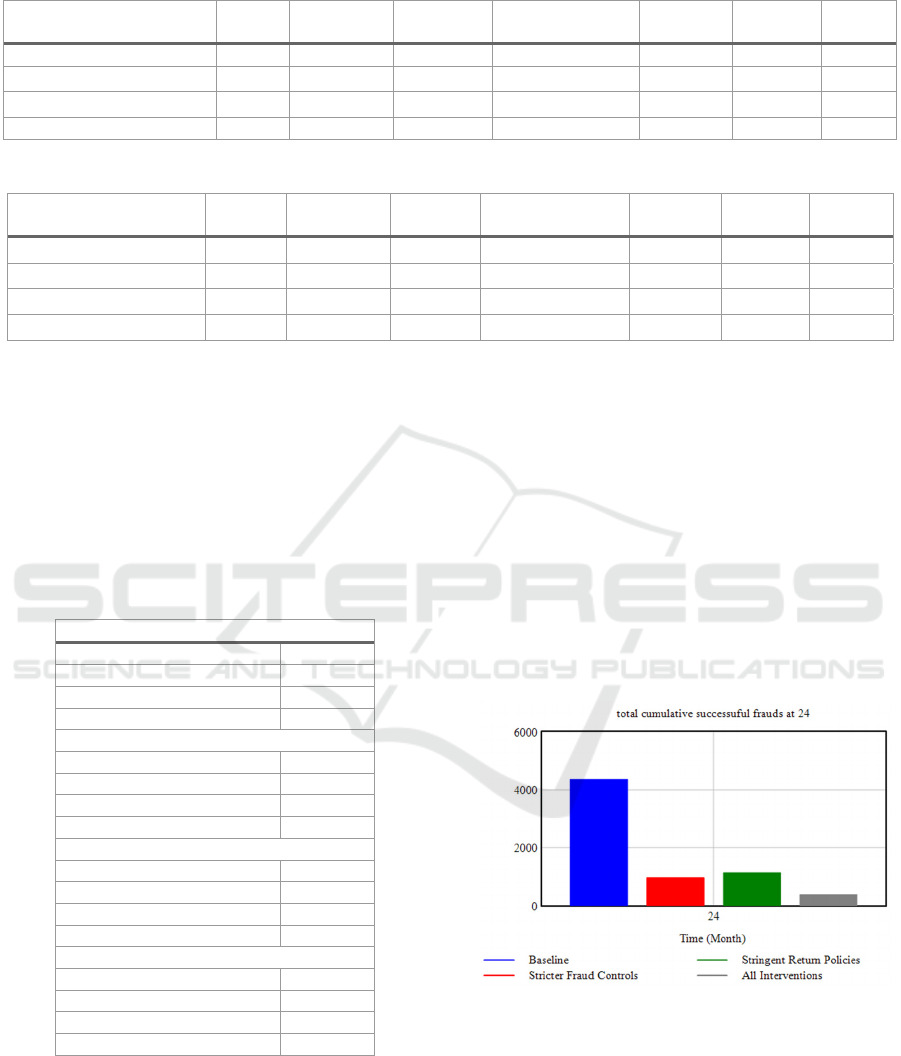

Figure 2 shows the number of successful frauds

under different scenarios, and Figure 3 demonstrates

the profit comparison under different scenarios. By

comparing scenarios, we can see how the introduction

of more stringent return policies will reduce sales,

partly by discouraging honest shoppers. Additionally,

we assume a reduction on stricter fraud detection in

fraud attempts as awareness of our policies will

spread.

Figure 2: Successful frauds under different scenarios.

The combined impact of policies can be surprising: in

our illustrative example (see Figure 2 and Figure 3),

we see that while the introduction of all policies

combined reduces fraud the most, it is not the most

profitable. Under the current assumptions of cost and

impact of the interventions, just focusing on stringent

return policies is more profitable than a combination

of all policies with a focus on fraud detection alone

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

90

being the second-best choice. These results could be

the starting point to discussion among stakeholders

across different departments in an organisation tasked

with meeting sometimes competing objectives such

as increasing sales or reducing fraud. The model and

the simulation results could guide further data

gathering and the development of strategies based on

a more holistic understanding.

Figure 3: Profit comparison under different scenarios.

5 CONCLUSION

Evidence shows that fraudulent returns cause great

losses for retailers. Retailers try to be robust by

implementing or planning various strategies to

enhance customer experience and mitigate the

probability of fraudulent returns. However, extant

returns and fraudulent research tend to focus on the

prediction of returns rates but not the rates after

changing certain policies and/or implementing new

interventions. Furthermore, managers need to know

the financial impacts of their strategies for reducing

fraudulent returns. In response, the model we

proposed in this paper demonstrates the impacts of

interventions on fraudulent rates and associated costs,

as well as other financial indicators (e.g., the potential

negative impact on sales value). The model takes

costs and profitability into account as they are key

factors for retailers when making strategic decisions.

This model has significant implications. First, it

promotes conversation between the loss-prevention

department and other stakeholders within the

company so that strategic approaches are aligned

(e.g., not incentivising fraudulent sales). Second, it

assists retailers to make effective judgements

regarding the dilemma of balancing amongst return

policies, costs and profits in retail businesses. Third,

the model offers insights for other research domains,

such as marketing management, and strategic

management, as well as practitioners. As the model

indicated, implementing stringent return policies is

likely to reduce sales values; therefore it is crucial to

balance sales and reduce fraudulent returns. Retailers

can use the model as a scenario-based analysis tool

that evaluates the impacts of different scenarios (i.e.,

different combinations of interventions). Our next

stage is to establish a greater degree of accuracy by

offering our model to retailers and applying real-

world data. We believe that this model provides a

solid foundation for further research and

development.

ACKNOWLEDGEMENTS

This research is funded by the Economics and Social

Research Council (ESRC), as part of UK Research

and Innovation’s rapid response to Covid-19.

REFERENCES

Ajzen, I. (1991). The theory of planned behavior.

Organisational behavior and human decision

processes, 50(2), 179-211.

Ajzen, I. (2002). Constructing a TPB questionnaire:

Conceptual and methodological considerations.

Available online: https://citeseerx.ist.psu.edu/viewdoc

/download?doi=10.1.1.601.956&rep=rep1&type=pdf

[Accessed on 01 Nov 2021]

Ajzen, I., & Fishbein, M. (1973). Attitudinal and normative

variables as predictors of specific behavior. Journal of

personality and Social Psychology, 27(1), pp. 41.

Alvarez & Marsal Holdings, LLC. (2021). The Shape of

Retail: The true cost of online. https://www.alva

rezandmarsal.com/sites/default/files/true_cost_of_onli

ne.pdf

Counter Fraud Services. (2016). Fraud, recognise it, Report

it. https://cfps.hscni.net/wp-content/uploads/2016/10/

Why-do-people-commit-fraud.pdf

Cressey, D. R. (1973). Other People’s Money: a study in

the social psychology of embezzlement, Montclair, NJ:

Patterson Smith.

Cressey, D. R., & Moore, C. A. (1983). Managerial values

and corporate codes of ethics. California Management

Review, 25(4), pp. 53-77.

Cui, H., Rajagopalan, S., & Ward, A. R. (2020). Predicting

product return volume using machine learning

methods. European Journal of Operational

Research, 281(3), pp. 612-627.

DeltaNet. (2021). Why Do People Commit Fraud?

https://www.delta-net.com/compliance/fraud-awarenes

s/faqs/why-do-people-commit-fraud

Drechsler S., Lasch R. (2016) Forecasting Misused E-

Commerce Consumer Returns. In: Mattfeld D.,

Spengler T., Brinkmann J., Grunewald M. (eds)

Using Big Data Analytics to Combat Retail Fraud

91

Logistics Management. Lecture Notes in Logistics.

Springer, Cham. https://doi.org/10.1007/978-3-319-

20863-3_15

Harris, L.C. (2010), Fraudulent consumer returns:

exploiting retailers' return policies, European Journal

of Marketing, 44(6), pp. 730-747.

Homer, E.M. (2020), "Testing the fraud triangle: a

systematic review", Journal of Financial Crime, 27(1),

pp. 172-187.

Jack, L., Frei, R., & Krzyzaniak, S. A. (2019). The hidden

costs of online shopping – for customers and retailers.

In The Conversation, 21 January 2019. Available

online: https://theconversation.com/the-hiddencosts-

of-online-shopping-for-customers-and-retailers-

109694 [Accessed on 01 Nov 2021]

Johnson, K. K., & Rhee, J. (2008). An Investigation of

Consumer Traits and their Relationship to Merchandise

Borrowing with Undergraduates. Journal of Family &

Consumer Sciences Education, 26(1). pp.1-13.

Ketzenberg, M. E., Abbey, J. D., Heim, G. R., & Kumar, S.

(2020). Assessing customer return behaviors through

data analytics. Journal of Operations Management,

66(6), 622-645.

King, T. (2004). An analysis of the phenomenon of

deshopping of garments in women’s wear

retailing. [Unpublished Doctoral Dissertation],

Brunnel University, Brunel.

King, T. and Dennis, C. (2006), Unethical consumers:

Deshopping behaviour using the qualitative analysis of

theory of planned behaviour and accompanied

(de)shopping, Qualitative Market Research, 9(3), pp.

282-296.

King, T., Dennis, C., & McHendry, J. (2007). The

management of deshopping and its effects on service:

A mass market case study. International Journal of

Retail & Distribution Management, 35(9), pp.720-733.

King, T., Dennis, C., & Wright, L. T. (2008). Myopia,

customer returns and the theory of planned

behaviour. Journal of Marketing Management, 24(1-

2), 185-203.

Patrick Urbanke, Johann Kranz, and Lutz Kolbe, (2015).

Predicting product returns in e-commerce: the

contribution of mahalanobis feature extraction

[completed research paper]. In Proceedings of the 36th

International Conference on Information Systems, Fort

Worth, Texas, USA.

Piron, F. and Young, M. (2000), Retail borrowing: insights

and implications on returning used merchandise,

International Journal of Retail & Distribution

Management, 28(1), pp. 27-36.

Potdar, A. and Rogers, J. (2012), Reason‐code based model

to forecast product returns, Foresight, 14 (2), pp. 105-

120.

Smriti, K. (2018). Predicting Online Returns. In A. Kumar,

& S. Saurav (Eds.), Supply Chain Management

Strategies and Risk Assessment in Retail Environments,

pp. 181-194. IGI Global. http://doi:10.4018/978-1-

5225-3056-5.ch010

Speights, D., & Hilinski, M. (2005). Return fraud and

abuse: How to protect profits. Retailing Issues

Letter, 17(1), pp. 1-6.

Tyagi, V., & Dhingra, V. (2021). Return Policy of E-

retailers: An Extensive Review. Journal of

Contemporary Issues in Business and

Government, 27(2), 1316-1336.

Wachter, K., Vitell, S. J., Shelton, R. K., & Park, K. (2012).

Exploring consumer orientation toward returns:

unethical dimensions. Business Ethics: A European

Review, 21(1), pp. 115-128.

Watts, Sarah (2019, March 21) Why Do Some People

Commit Fraud? Psychologists Say It's Complicated,

FORBES-blog. https://www.forbes.com/sites/sarahwat

ts/2019/03/21/the-psychology-behind-scamming/?sh=7

cc64c933447

Wolfe, D., & Hermanson, D. R. (2004). The fraud diamond:

Considering four elements of fraud. The CPA Journal,

74 (12), pp. 38-42.

Zhu, Y., Li, J., He, J., Quanz, B. L., & Deshpande, A. A.

(2018). A Local Algorithm for Product Return

Prediction in E-Commerce. In Proceedings of

the International Joint Conferences on Artificial

Intelligence Organization, pp. 3718-3724, Stockholm,

Sweden.

FEMIB 2022 - 4th International Conference on Finance, Economics, Management and IT Business

92