Acquisition of Open Intellectual Capital: A Case Study of Innovative,

Software-developing SMEs

Tomasz Sierotowicz

a

Department of Economics and Innovation, Institute of Economics, Finance and Management, Faculty of Management and

Social Communication, Jagiellonian University, Prof. Lojasiewicza 4, 30-348, Krakow, Poland

Keywords: Open Intellectual Capital, Acquisition of Open Intellectual Capital, Intellectual Capital, Empirical Analysis.

Abstract: The existing studies into intellectual capital (IC) focus on its utilisation and effect on selected business

performance indicators, mostly achieved by large enterprises. IC is subject to single-stream analyses and

understood as an internal enterprise resource. Since IC is used in the business operations of enterprises, it

must also be acquired. The aim of this study is to present the results of research conducted in a field of IC

acquisition that has not yet been explored. The described research focused on innovative small and medium

enterprises (SMEs) that develop software in Poland (2007–2019). Empirical data were obtained in time series

form through the use of dedicated statistical tools including the dynamic rate of change. The main conclusion

states that IC acquisition in the SMEs covered by the research should be described as a process taking place

simultaneously, systematically and continually in two streams: an internal and an external stream of

acquisition. Thus, considering the IC acquisition, the concept of Open IC (OIC), which consists of two streams

of acquisition: internal and external, was introduced. Future research in this field allow focus on comparative

analyses of different branches, which can extend our knowledge of the importance of OIC in businesses.

1 INTRODUCTION

The evaluation of research and development (R&D)

In a knowledge-intensive economy, the division into

property and plant equipment on the one hand and

intangible assets on the other hand is commonly used.

Intangible assets are indicated with increasing

frequency as the factor that is more important for

sustained growth, success and increased enterprise

market value (Barney and Hesterly, 2019). Intangible

resources, particularly intellectual capital (IC), are

perceived and treated by large enterprises as strategic

for sustained growth and success (Edvinsson, 1997;

Edvinsson and Malone, 1997; Stewart, 1998; Sveiby,

2001; Steenhuis et al. 2012; Rothaermel, 2016; Santis

et al. 2019; Schiavone et al. 2022). Therefore, the use

of various IC components and their constituent parts

is dictated principally by the needs of enterprises’

operating activities. The analyses and evaluations

found in the existing literature on the subject address

mainly large enterprises and questions relating to the

transfer of knowledge both inside and outside these

enterprises (Van Wijk et al. 2008; Chen et al. 2009;

Matricano et al. 2020; Ahmed et al. 2022). They focus

a

https://orcid.org/0000-0002-1462-8267

on such topics as IC value measurement (Pulic, 2004;

Wiederhold, 2014), value added creation in an

enterprise (Pike and Roos, 2000; Abeysekera, 2021),

the share of IC in the market value of an enterprise

(Dimitrios et al. 2011; Yovita et al. 2018;

Mačerinskienė and Survilaitė, 2019), and other

selected outputs and indicators achieved by that group

of enterprises (Pulic, 2000; Nazari, 2015; Roos and

Pike, 2018; Santis et al. 2019). These studies lead to

the conclusion that specific IC components are used

in line with the types and in-depth knowledge of the

individual conditions of enterprises’ business

operations. Hence, the vast corpus of literature on the

subject is focused on research into IC use in the

business operations of large enterprises. The results

of these research projects are widely used in

developing IC models and in planning strategies that

are implemented by the management of large

enterprises. Particular attention is paid to the models

that aim to describe the effect of IC use on selected

indices and performance indicators of enterprises

(Bontis, 2001; Bonfour, 2003; Hejase at al., 2016;

Lee at al., 2019). However, management practice

indicates that IC, considered a key resource for

52

Sierotowicz, T.

Acquisition of Open Intellectual Capital: A Case Study of Innovative, Software-developing SMEs.

DOI: 10.5220/0011033600003179

In Proceedings of the 24th International Conference on Enterpr ise Information Systems (ICEIS 2022) - Volume 2, pages 52-61

ISBN: 978-989-758-569-2; ISSN: 2184-4992

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

enterprise growth, is subject to limitations, like other

types of resources. First, IC in an enterprise is not a

self-renewable resource. It must be actively acquired

and developed. Consequently, the utilisation and the

acquisition of IC must be considered equally

important and key processes in the operating

activities not only of large enterprises but also of

SMEs. To be used, IC must firstly be acquired to the

extent that is necessary to ensure the continuity of an

enterprise’s operating activities. Since IC must be

acquired before it is used in an enterprise’s

operations, it can be assumed that IC acquisition also

represents a systematic and continual process related

to the enterprise’s operating activities. Moreover,

management practice indicates that IC is acquired by

enterprises both internally and externally. Also, it can

be expected that the IC utilisation level and the level

of acquisition of that capital will be higher in

innovative SMEs that operate in the knowledge-

intensive sector. This inherent characteristic

distinguishes business operations of enterprises in the

knowledge-intensive sector from those in other

sectors and types of business. The above reasons

underlie the choice of innovative SMEs that develop

software in Poland. However, studies presented in the

subject literature did not focus on IC acquisition and

these types of SMEs. Up-to-date research took into

account the utilisation of IC as a single stream of

internal resource. Since IC acquisition and use are

equally important, the absence of research into the

field of IC acquisition represents a major gap in our

knowledge. Another gap in the literature on the

subject is the absence of research projects covering

relatively long periods. Most analyses are limited to

one year, which provides only a snapshot of the

results. The research project described in this paper

aimed to fill above-mentioned gaps.

The aim of this study is to present and discuss the

results of research on the acquisition of OIC, which

occurs as a continuous process in two mutually

symmetric, internal and external streams, as observed

over the long term in innovative, software-

development Polish SMEs.

2 CHARACTERISTICS OF

SOFTWARE-DEVELOPMENT

POLISH SMES

The existing models and concepts of IC lead, among

other ideas, to the conclusion that IC utilisation is

related to the operating activities of an enterprise.

Since the operating activities of an enterprise are

carried out continually and systematically, IC

utilisation and thus IC acquisition also represent a

continual and systematic process that is related to the

operating activities of the enterprise. The knowledge-

intensive sector includes innovative, software-

development SMEs. Business operations of these

enterprises consist of developing and improving

software, based on two business models. The first is

implemented when an enterprise carries out IT

projects individually commissioned by enterprises

that conduct business in other economic sectors. The

second is used when an enterprise that develops

software introduces into the market its IT products

that are systematically extended, improved and

distributed. The range of products developed by

enterprises that are engaged in developing and

improving their own computer programs is frequently

designed for enterprises that conduct business in other

economic sectors. In both cases described, SMEs

keep and continually expand their catalogues of

regular business customers, including foreign ones,

whose opinions and suggestions are used in

subsequent projects and program versions. The

relations with regular customers form one of the

streams of acquiring IC. Generally, it can be

concluded that the business operations of innovative,

software-development SMEs consist of the

developments and improvements of their own

computer programs as part of their IT projects, and of

carrying out IT projects individually commissioned

by enterprises that conduct business operations in

other economic sectors, not only in domestic but also

in foreign markets. Thus, the operating activities of

the enterprises covered by the research project

described in this study consist of carrying out IT

projects. These operating activities are undertaken in

the enterprises continually and systematically and

include the development and improvement of

software, wherein the writing of source code is

accompanied by a number of repeated tests of the

program under development, performed using

dedicated electronic (computer) equipment. When

managing the development and improvement

processes, usually dedicated techniques based on the

Agile Manifesto are employed (Schwaber, 2005;

Brencher, 2015). Two distinctive characteristics are

evident in the IT project implementation process:

iteration and the teamwork of programmers (software

developers). This teamwork of program developers is

repeated many times as part of the software

development and improvement processes (sprints)

(Highsmith, 2009; Brencher, 2015). Each sprint aims

to implement specific parts of the functionalities to be

offered by the developed or improved software.

Acquisition of Open Intellectual Capital: A Case Study of Innovative, Software-developing SMEs

53

Sprints are systematically repeated during each IT

project. This means that each sprint aims to achieve

specific and varied values that are added to the

developed or improved software. Sprint repetitions

are accompanied by other regularly recurring events

included in the software development and

improvement process, such as (Schwaber and

Sutherland, 2012; McConnell, 2019): Product

backlog; Sprint planning; Sprint backlog; Sprint

interaction; Daily scrum; Sprint review; Sprint

retrospective and Software tests.

Sprints and other events are repeated a number of

times in each individual IT project, and each time they

refer to different content related to software

development and improvement. Hence, the above

events form an iterative mechanism of cooperation in

a programmer team that creates added value. The

iterative work of the programmer team is based on the

systematic and continual use of IC that is transformed,

by way of the written source code, into added value,

represented by functionalities offered by the developed

software. Since the value that is added in innovative

SMEs that develop software is created systematically

and continually as part of the IT projects that constitute

their principal operating activity, these enterprises are

characterised by the highest level of iterative and

systematic use of IC. These operating characteristics of

the innovative SMEs that develop software provided

the reasons this group of enterprises was chosen as the

subject of this research.

3 MATERIALS AND METHOD

This study into open IC (OIC) acquisition by

innovative, software-development Polish SMEs

aimed to answer the following research questions:

1. Is OIC acquired in two entire streams (internal and

external) simultaneously over the entire research

period?

2. Does OIC acquisition in both streams form a

systematic and continual process?

3. Which OIC acquisition stream is more important

for the surveyed enterprises, considering the level

of acquisition of that capital?

4. Which OIC acquisition stream is more important

for the surveyed enterprises, considering the

dynamic rate of change in the OIC acquisition

level?

5. Which acquired OIC component is more

important for the surveyed enterprises,

considering the dynamic rate of change in the

levels of component acquisition?

An analysis, including description of the OIC

concept, were conducted in the three stages described

below to answer the above-mentioned research

questions.

3.1 Description of OIC Concepts: The

First Stage of Empirical Analysis

Since there is no universal concept of IC in the

literature, an IC concept including as many

components as possible had to be developed for the

purposes of this study. Various IC concepts proposed

in the literature on the subject contain various sets of

components. The IC concept proposed here is as broad

as possible and includes numerous components,

facilitating a more detailed analysis and evaluation of

the OIC acquisition process. It was also useful because

only the selected components and their constituent

parts, which create the structure of IC, are utilised in

enterprises’ operations. Moreover, enterprises differ in

their utilisation of IC. It depends on such factors as the

conditions of the social and economic environment, the

economic sector, the industry and individual enterprise

conditions, e.g. its size and the employees’ educational

background and occupational experience.

The above concept was formulated in line with the

rule of uniqueness of IC components. Considering the

most comprehensive IC concepts in terms of their

components and constituent parts, concepts that are

also popular in the literature, and following the above

rule, an IC concept consisting of the following

components was developed and used in this research

project:

• Human Capital;

• Organisational Capital;

• Relational Capital;

• Project Capital;

• Innovation Capital;

• Information Capital;

• Technological Capital.

A survey was conducted with the division of

simultaneous IC acquisition into two streams: internal

and external. The internal stream describes IC

generation internally within the surveyed enterprises,

based on their own resources. The external stream

describes the IC acquisition process from the external

environment of the surveyed enterprises. For

methodological reasons, comparative analyses

required the same IC component structure in both

(symmetric) streams. Hence, the formulated concept

is termed Open IC (OIC).

The second stage of this research project was

aimed at analysing and evaluating the dynamics of

ICEIS 2022 - 24th International Conference on Enterprise Information Systems

54

OIC acquisition in two symmetric and internal and

external streams in the SMEs covered by the research.

The third stage of this research project was aimed at

analysing and evaluating the dynamics of OIC

acquisition at the component level independently for

the internal and external streams in the SMEs covered

by the research.

Seeking answers to the research questions,

comparative analyses of the streams were made, at the

level of the streams, and at the level of the individual

OIC components that constitute the internal and

external streams of IC acquisition.

3.2 Empirical Data, Research Period

and SMEs Covered by the

Research Project

The catalogue of variables describing individual OIC

components, symmetric in the internal and external

streams, was compiled based on a form used in a

regular survey for innovative entities, i.e. SMEs that

develop software in Poland and belong to the

knowledge-intensive sector. The original empirical

data set, in the form of a time series, was obtained

from a regular survey conducted by Statistics Poland.

The time series contained 13 annual observations,

covering the adopted research period of 2007–2019

and describing each component constituting OIC

separately in the internal and external streams (Table

1).

Table 1: Time series of the variables obtained during the

research project for all of the OIC components used in the

performed analysis.

OIC

component

of strea

m

Description of variables characterising the

acquiring of OIC

Streams of components forming the internal stream of

acquired OI

C

V

1

Stream of Human Ca

p

ital com

p

onent

V

2

Stream of Or

g

anisational Ca

p

ital com

p

onent

V

3

Stream of Relational Ca

p

ital com

p

onent

V

4

Stream of Technological Capital component

V

5

Stream of Information Capital component

V

6

Stream of Pro

j

ect Ca

p

ital com

p

onent

V

7

Stream of Innovation Ca

p

ital com

p

onent

Streams of components forming the external stream of

acquired OI

C

V

8

Stream of Human Ca

p

ital com

p

onent

V

9

Stream of Or

g

anisational Ca

p

ital com

p

onent

V

10

Stream of Relational Ca

p

ital com

p

onent

V

11

Stream of Technological Capital component

V

12

Stream of Information Capital component

V

13

Stream of Project Capital component

V

14

Stream of Innovation Ca

p

ital com

p

onent

The different variables characterise topics that are

directly related to the acquisition of OIC and that are

indispensable to the iterative process of software

development and improvement.

The survey included a group of innovative SMEs

that develop software in Poland over the entire

research period. The enterprises were characterised

by a headcount varying from 10 to 249 employees,

and their businesses were included in NACE classes

62.01 and 62.02 (European Communities, 2008). The

population of the surveyed group is given in Table 2.

Table 2: Number of SMEs covered by the research project.

Yea

r

Number of SMEs

2007 192

2008 246

2009 261

2010 293

2011 247

2012 282

2013 305

2014 349

2015 363

2016 345

2017 357

2018 372

2019 391

The comparative analysis and evaluation of OIC

acquisition conducted as part of this research project

required purposefully selected computational tools

and the division into internal and external streams of

capital acquisition, both at the component level and at

the level of the stream.

3.3 Statistical Tools Used in the Second

Stage of Empirical Analysis

The calculations in the second stage of analysis and

evaluation, which considers the level of OIC

acquisition in the internal and external streams over

the entire research period, are based on variables

forming time series of annual numbers of the acquired

constituent parts that form each of the structural

components of OIC. The level of OIC acquisition in

the internal stream was calculated using the variables

marked in Table 1 as V

1

– V

7

. Similarly, the level of

OIC acquisition in the external stream was calculated

using the variables marked in Table 1 as V

8

– V

14

.

Consequently, both streams consist of similar groups

of seven components and their constituent parts,

which form the OIC structure in each year of the

research period. Thus, unit streams of individual OIC

component acquisition levels could be used to build

Acquisition of Open Intellectual Capital: A Case Study of Innovative, Software-developing SMEs

55

an index of the overall level of OIC acquisition,

calculated according to Equation 1.

()

7

it

i=1 int

at

14

ext

jt

j=8

V

V

Cs = = , t = 2007,...,2019

V

V

∀

(1)

where:

t – the subsequent year in the time series;

i – the index of each variable from V

1

to V

7

(Table 1),

describing the subsequent component of OIC in the

internal stream;

V

it

– the level of the acquired subsequent component

i, of OIC in the internal stream in subsequent year t;

V

int

– the level of the OIC acquired in internal stream,

calculated in subsequent year t;

j – the variable from V

8

to V

14

(Table 1), describing

the subsequent component of OIC in the external

stream;

V

jt

– the level of the acquired subsequent component

j, of OIC in the external stream in subsequent year t;

V

ext

– the level of the OIC acquired in external stream,

calculated in subsequent year t;

Cs

at

– indices of the overall OIC acquisition by the

SMEs covered by the research project, calculated in

subsequent year t.

The calculated value of indices of the overall OIC

acquisition Cs

at

provides information as to whether

OIC is acquired in both streams simultaneously,

continually and systematically, and indicates which

stream of OIC acquisition reached a higher level in

the surveyed SMEs in each year of the research

period. The calculated indices provide answers to the

first, second and third research questions.

The obtained values of variables V

int

, V

ext

and Cs

at

,

which take the form of time series, were used to

analyse the dynamic rate of change in OIC acquisition

in the surveyed SMEs over the entire research period

(Sharpe et al. 2014; Hatcher, 2013). Equation 2 was

used to calculate the dynamic rate of change in the

described time series.

()

N

z(t)

N1

Z

t=2

z(t 1)

n

T = 1 ×100%, z = 1,...,3

n

−

−

−∀

∏

(2)

where:

t – the subsequent year in the time series;

N – the number of annual observations in a time series

of the subsequent variable calculated in that stage of

research in the adopted research period;

z – an index ranging from one to three and denoting a

subsequent variable;

n

z

– another of the three calculated variables denoting,

respectively, n

1

– V

int

, n

2

– V

ext

, n

3

– Cs

at

;

z

(t)

z

(t 1)

n

n

−

– next chain index value of another variable n

z

;

Z

T

– the value of the dynamic rate of change in each

variable:

1Vint

TT−

,

2Vext

TT−

,

3Csat

TT−

.

An interpretation of the dynamic rate of change

Z

T

provides an answer to the fourth research question.

As the dynamic rate of change exceeds one, the level

of OIC acquisition in particular stream rises, which

means that OIC acquired in this stream becomes

increasingly important for the processes of software

development and improvement that take place in the

surveyed SMEs, because OIC is acquired in line with

the demand created by these processes. This tool is

also useful in determining the dynamic rate of change

in the acquisition level separately for the internal and

external streams of OIC over the entire research

period.

3.4 Statistical Tools Used in the Third

Stage of Empirical Analysis

The third stage of analysis and evaluation is aimed at

analysing dynamic rates of change in the level of OIC

acquisition, considering the components constituting

the internal and external streams. Stage 3 consists of

the two sections described below that address

different aspects of the analysis and evaluation of the

diversified acquisition of OIC components. Section 1

of Stage 3 of the research project was aimed at

analysing and evaluating the share of the levels of

individual OIC component acquisition in the internal

and external streams over the entire research period.

Equation 3 was used to calculate the share of levels

of the individual OIC component acquisition in the

internal stream over the entire research period.

()

2019

it

t=2007

i

2019

it jt

t=2007

in

Ic = ×100%, t = 2007,...,2019; i = 1,...,7; j = 8,...,14

in +ex

∀

(3)

where:

t – the subsequent year in the time series;

i – the index of each variable from V

1

to V

7

(Table 1),

describing the subsequent component of OIC in the

internal stream;

j – the index of each variable from V

8

to V

14

(Table

1), describing the subsequent components of OIC in

the external stream;

ICEIS 2022 - 24th International Conference on Enterprise Information Systems

56

in

it

– the acquisition level of subsequent component i,

included in the internal stream of OCI acquisition by

the surveyed SMEs in subsequent year t of the

research period;

ex

jt

– the acquisition level of subsequent component

j, included in the external stream of OCI acquisition

by the surveyed SMEs in subsequent year t of the

research period;

Ic

i

– the share of the acquisition level of subsequent

component i, included in the internal stream of OIC

acquired by the surveyed SMEs over the entire

research period.

Equation 4 was used to calculate the share of the

levels of individual OIC component acquisition in the

external stream over the entire research period.

()

2019

jt

t=2007

j

2019

it jt

t=2007

ex

Ex = ×100, t = 2007,...,2019; i = 1,...,7; j = 8,...,14

in + ex

∀

(4)

where:

t – the subsequent year in the time series;

i – the index of each variable from V

1

to V

7

(Table 1),

describing the subsequent component of OIC in the

internal stream;

j – the index of each variable from V

8

to V

14

(Table

1), describing the subsequent components of OIC in

the external stream;

in

it

– the acquisition level of subsequent component i,

included in the internal stream of OCI acquisition by

the surveyed SMEs in subsequent year t of the

research period;

ex

jt

– the acquisition level of subsequent component

j, included in the external stream of OCI acquisition

by the surveyed SMEs in subsequent year t of the

research period;

Ex

j

– the share of the acquisition level of subsequent

component j, included in the external stream of OIC

acquired by the surveyed SMEs over the entire

research period.

Section 2 of Stage 3 is aimed at analysing the

dynamic rate of change in each component of the

acquired OIC (Sharpe et al. 2014; Hatcher, 2013).

Equation 5 was used for the calculations.

1, 2

N

ks(t)

N1

ks

t=2

ks(t 1)

v

T = 1 ×100%, k = 1,...,7; s

v

−

−

−∀=

∏

(5)

where:

t – the subsequent year in the time series;

N – the number of annual observations in the time

series of the subsequent components included in the

OIC acquired by the surveyed SMEs over the adopted

research period;

k – an index ranging from one to seven, denoting

subsequent components included in the OIC acquired

by the surveyed SMEs over the adopted research

period;

s – index one or two, indicating respectively the

internal or external stream of OIC acquisition by

SMEs covered by the research;

ks(t)

ks(t 1)

v

v

−

– another value of a chain index in the time

series of the acquisition level of subsequent

component k, included in the OIC acquired by the

surveyed SMEs in subsequent year t of the research

period;

ks

T

– the dynamic rate of change in the acquisition

level of component k, included in the OIC acquired

by the surveyed SMEs over the entire research period,

separately in the internal and external stream s.

An interpretation of the dynamic rate of change

ks

T

at the level of OIC components provides an

answer to the fifth research question. As the dynamic

rate of change exceeds one, the level of acquisition of

an OIC component rises, which means that OIC of

this component becomes increasingly important for

the processes of software development and

improvement that take place in the surveyed SMEs,

because OIC is acquired in line with the demand

created by these processes.

4 RESEARCH RESULTS

The results shown in Table 3 were obtained from

Equation 1. In particular, annual indices of the overall

OIC acquisition level Cs

at

were calculated.

Table 3: Calculated results of the annual indices of overall

OCI acquisition level by the surveyed SMEs.

Year/ Designation

[unit]

V

int

[number]

V

ext

[number]

Cs

at

2007 451 304 1.485

2008 626 435 1.439

2009 700 512 1.368

2010 749 526 1.424

2011 610 415 1.470

2012 671 442 1.517

2013 708 467 1.515

2014 808 567 1.424

2015 847 598 1.417

2016 812 577 1.408

2017 847 631 1.341

2018 993 761 1.305

2019 1067 849 1.258

Acquisition of Open Intellectual Capital: A Case Study of Innovative, Software-developing SMEs

57

The obtained calculation results indicate that the

values of indices C

sat

are greater than one in each year

of the research period, and thus the surveyed SMEs

acquire OIC simultaneously, continually and

systematically in the two internal and external

streams because both variables V

int

and V

ext

assume

positive values (Table 1). The value of the indices of

the overall OIC acquisition level exceeding one

indicates that:

• an analysis and evaluation of OIC acquisition

should be done by dividing it into two streams

of OIC acquisition: an internal stream and an

external stream;

• considering the level of OIC acquisition, the

internal stream is more important for the

processes of software development and

improvement taking place in the surveyed SMEs

because its OIC acquisition level is greater than

the acquisition level of OIC in the external

stream (variable V

int

is greater than V

ext

).

Table 4 contains the results obtained using Equation

2 to determine the dynamic rate of change in OIC

acquisition in the internal stream, external stream and

in the indices of overall OIC acquisition.

Table 4: Calculated dynamic rates of change in OIC

acquisition over the entire research period.

Designation

Vint

T

Vext

T

Csat

T

Calculated value 7.44% 8.93% -1.37%

The obtained calculation results indicate that the level

of OIC acquisition in the internal and external streams

rose year over year by 7.44% and 8.93%,

respectively, on average over the entire research

period. Thus, the levels of OIC acquisition rose in

both of the analysed and evaluated streams, with the

level of OIC acquisition rising faster in the external

stream. The indices of the overall OIC level decreased

year over year by 1.37% on average over the entire

research period. Thus, the level of OIC acquisition

expressed as the ratio of the internal stream to the

external stream decreased in the entire research

period. The calculated dynamic rate of change in the

indices of the overall level of OIC acquisition T

Csat

(showed in table 3), in conjunction with its calculated

value, shown in Table 3, indicates that although the

level of OIC in the internal stream is greater than in

the external stream, the difference decreases over the

entire research period. It may be concluded that the

importance of the OIC acquired in the external stream

rose over the entire research period.

Table 5 contains the calculation results of the

share of the individual OIC component acquisition

levels in the internal stream and external stream

separately, and it also contains the values of the share

of component-level OIC acquisition over the entire

research period. Calculations were done using

Equations 3 and 4.

Table 5: Calculated values of component share in OIC

acquisition, in the internal and external streams, over the

entire research period.

OIC component/

Share in strea

m

Share in whole

internal strea

m

Share in whole

external strea

m

Innovation Ca

p

ital 83.5% 16.5%

Pro

j

ect Ca

p

ital 82.4% 17.6%

Information Capital 74.0% 26.0%

Human Capital 44.6% 55.4%

Organisational

Ca

p

ital

33.8% 66.2%

Relational Capital 26.6% 73.4%

Technological

Ca

p

ital

0.0% 100.0%

The results obtained indicate that the surveyed SMEs

acquire project capital principally through the internal

stream. The project capital consists of knowledge

about IT projects management techniques. The basic

knowledge about these techniques is acquired in

external stream. After that, they are adapted to the

individual conditions in each enterprise so that the

processes of software development and improvement

are managed with the aim of creating the maximum

added value represented by an innovative product. As

described in chapter 2, added value is generated in the

processes of software development and improvement

that take place inside the surveyed enterprises by the

direct involvement of programmers in iterative

teamwork. Due to the direct, iterative involvement of

programmers in the process of creating added value,

the share of human capital in OIC acquisition was

similar in both streams: 44.6% in the internal stream

and 55.4% in the external stream. The human capital

component includes such constituents as knowledge,

competences, learning abilities and cooperation. The

obtained calculation results indicate that human

capital, like other components (except for

technological capital), are acquired simultaneously in

both streams: internal and external. This again

confirms the need to conduct analyses and

evaluations of OIC acquisition in these two (internal

and external) streams.

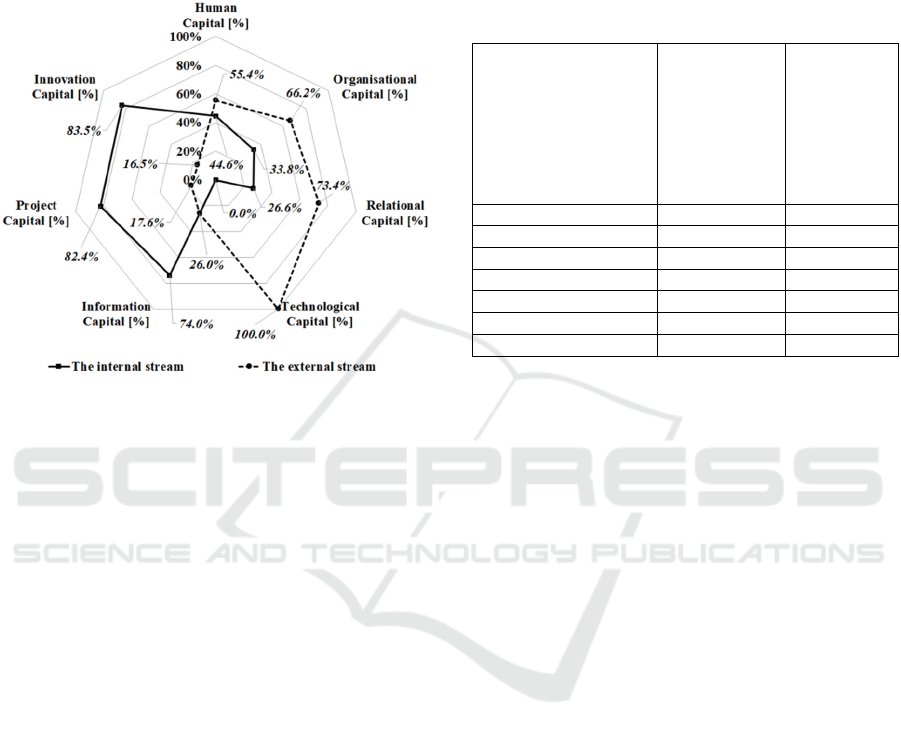

The calculation results given above demonstrate

that OIC acquisition on the component level clearly

varies in both streams. This conclusion is confirmed

by the graphic representation of the internal and

ICEIS 2022 - 24th International Conference on Enterprise Information Systems

58

external streams of OIC acquisition at the component

level, seen in Figure 1, where the intersection of

acquisition is insignificant, and larger areas are

clearly different. Thus, the components acquired in

the internal and external OIC streams are

complementary.

Figure 1: Diversified acquisition of OIC components over

the entire research period.

Attention should be drawn to the technological capital

component (indicated above) that is entirely acquired

in the external stream. This component includes

computer technologies and equipment. This result

leads to the conclusion that in the surveyed SMEs, the

computer programming environment, consisting of

suitable software, IT technologies and computer

equipment, does not result from the software

development and improvement processes, but is

acquired from external sources. The constituent parts

of the technological component are used in the

software development and improvement process

rather than produced in that process. This result

confirms the fact that the surveyed SMEs develop and

improve software as ordered by individual external

entities or as their own product designed for market

distribution. Relational capital provides another

example of diversified OIC acquisition. This

component consists of a list of regular customers, the

partners, image, trust, reputation and external

relations. The results confirms that these constituent

parts are strictly related to the external socio-

economic environment of the surveyed SMEs.

Individual orders for computer programs are

conditional on great trust and the reputation and

capability of establishing and maintaining stable

relations with customers.

Table 6 shows calculation results of the dynamic

rate of change in the level of acquiring individual OIC

components separately in the internal and external

streams over the entire research period. The

calculations were done using Equation 5.

Table 6: Calculated dynamic rates of change in the level of

OIC component acquisition over the entire research period.

OIC components

Dynamic rate of

change in the

acquisition level

in the whole

internal stream

Dynamic rate of

change in the

acquisition level

in the whole

external stream

Human Ca

p

ital 10.78% 15.47%

Relational Capital 8.83% 4.38%

Innovation Capital 7.34% 7.93%

Information Ca

p

ital 7.22% 12.82%

Pro

j

ect Ca

p

ital 6.93% 10.36%

Or

g

anisational Ca

p

ital 3.16% 6.37%

Technological Capital 0.00% 6.22%

The obtained calculation results lead to the

conclusion that human capital grew in importance

more than other components in the software

development and improvement processes in the

surveyed SMEs. This importance results particularly

from the added value that was created in the processes

completed by iteration and teamwork with the daily

participation of the program developers who

exemplify human capital. In other words, added value

is created in the surveyed SMEs due to the

implementation by programmers of new solutions in

the source code of developed or improved software.

On average, year over year, in the internal stream of

OIC acquisition, the smallest increase was observed

(excluding technological capital) in organisational

capital (3.16%), while in the external stream, the

smallest increase was observed in technological

capital (6.22%). Thus, technological capital,

including computer equipment, is acquired from

external sources only if the IT project environment

used to develop source code requires updating. For

similar reasons, organisational capital, including

computer networks and management methods, is

provided by the internal environment to the smallest

extent, as it is a capital resource acquired principally

from external sources. That capital resource is

acquired principally when computer equipment

requires maintenance, the configuration of computer

networks must be modified or knowledge of new IT

project management techniques must be obtained.

Acquisition of Open Intellectual Capital: A Case Study of Innovative, Software-developing SMEs

59

5 DISCUSSION AND

CONCLUSIONS

A review of the literature indicated that the studies

therein have focused on IC use in businesses.

Research was also conducted into the effects of IC use

on selected business indices and enterprise

performance indicators. Research additionally

focused on large enterprises, considering one-stream

models of IC, understood as an internal enterprise

resource. Acquisition of OIC was not covered by past

research. Thus, IC acquisition seems to be a new field

of research that has not been explored to date.

Business operations of today’s enterprises suggest

that IC is acquired not only internally, but also from

the external business environment. That hypothesis

triggered research into a new field of IC acquisition

that has not previously been explored. This study

discusses research results obtained in that field. This

research covered the group of innovative, software-

development SMEs in Poland. The research results

discussed above clearly demonstrate that the

surveyed enterprises acquire IC continually and

systematically from their external environment and

simultaneously from internal sources: this answers

the first and second research questions.

Consequently, considering IC acquisition, this type of

capital should be understood as OIC and analysed and

evaluated in two simultaneous acquisition streams:

internal and external, relative to the surveyed

enterprises. Additionally, the calculated values of

indices of overall OIC acquisition indicate that the

internal stream is more important for the processes of

software development and acquisition taking place in

the surveyed SMEs: this is the answer to the third

research question.

Considering the dynamic rate of change in the

OIC acquisition level, the results obtained indicate

that in the processes of software development and

improvement in the surveyed SMEs over the entire

research period, the importance of OIC acquisition in

the internal stream decreased, while the importance of

OIC acquisition in the external stream increased: this

is the answer to the fourth research question.

A significant differentiation in OIC acquisition is

observed at the component level both in the internal

and the external streams. The results indicate (Figure

1) that OIC acquisition in the internal and external

streams is diversified and complementary,

considering the components of that capital in the

surveyed SMEs. This shift between OIC areas

acquired in both streams, with a small intersection,

demonstrates the high efficiency of capital

acquisition in the surveyed SMEs. No OIC is acquired

that is not needed to conduct business and to develop

the enterprise. The intersection of both streams of

OIC acquisition indicates that certain aspects of

business operations and of innovative product

development have common content that requires OIC

acquisition in both streams. In answer to the fifth

research question: human capital was the most

important component for the surveyed enterprises

over the research period because this component had

the greatest dynamic rate of increase in acquisition.

6 FUTURE RESEARCH

This research conducted in a new field of study

undoubtedly extends the knowledge of OIC

acquisition by enterprises. The research project and

its results provide the opportunity and indicate the

need to continue research into more detailed topics in

the field of OIC acquisition in enterprises from other

industries. The continued development of research

will allow comparative analyses of enterprise groups

from various industries in terms of OIC acquisition.

This can contribute to the development of knowledge

of diversified OIC acquisition by enterprises that are

characterised by various sizes and that conduct

business in various industries. Continued research

will also improve the methods of analysis and

evaluation of OIC acquisition, with the aim of

building an OIC acquisition model.

REFERENCES

Abeysekera, I., 2021. Intellectual Capital and Knowledge

Management Research towards Value Creation. From

the Past to the Future. Journal of Risk Financial

Management. 14(6), DOI: https://doi.org/10.3390/jrfm

14060238.

Ahmed, A., Bhatti, S. H., Gölgeci, I., Arslan, A., 2022.

Digital platform capability and organizational agility of

emerging market manufacturing SMEs: The mediating

role of intellectual capital and the moderating role of

environmental dynamism. Technological Forecasting

and Social Change. 177, 121513.

Allweyer, T., 2008. Business Process Modeling Notation-

Einführung in den Standard für die Geschäftsprozess-

modellierung. Books on Demand GmbH. Norderstedt.

Barney, J.B., Hesterly W.S., 2019. Strategic Management

and Competitive Advantage. Pearson. Harlow. UK.

Bollen, P., 2016. Business Process Model Semantics in

BPMN. Springer-Verlag. Berlin.

Bonfour, A., 2003. The IC-dVAL Approach. Journal of

Intellectual Capital. 4(3), 396-413.

Bontis, N., 2001. Assessing Knowledge Assets: A Review

of the Models Used to Measure Intellectual Capital.

ICEIS 2022 - 24th International Conference on Enterprise Information Systems

60

International Journal of Management Reviews. 3(1),

41-58.

Brechner, E., 2015. Agile Project Management with

Kanban. Microsoft Press. Redmond.

Chen, C.J., Shih, H.A., Yang, S.Y., 2009. The Role of

Intellectual Capital in Knowledge Transfer. IEEE

Transactions on Engineering Management. 56(3), 402-

411.

Dimitrios, M., Dimitrios, Ch., Charalampos, T., Theriou,

G., 2011. The impact of intellectual capital on firms'

market value and financial performance. Journal of

Intellectual Capital. 12, 132-151, DOI:

10.1108/14691931111097944.

Edvinsson, L., 1997. Developing Intellectual Capital at

Skandia. Long Range Planning. 30(3), 366-373.

Edvinsson, L., Malone, M.S., 1997. Intellectual Capital:

Realizing Your Company’s True Value by Finding Its

Hidden Brainpower. Harper Business. New York.

European Communities, 2008. Statistical Classification of

Economic Activities in the European Community.

Office for Official Publications of the European

Communities. Luxembourg.

Hatcher, L., 2013. Advanced Statistics in Research.

Shadow Finch Media. Saginaw.

Hejase, H.J., Hejase, A., Assi, H.T., Chalak, H.C., 2016.

Intellectual Capital: An Exploratory Study from

Lebanon. Open Journal of Business and Management.

4, 571-605.

Highsmith, J.H., 2009. Agile Project Management:

Creating Innovative Products (Agile Software

Development). Addison-Wesley. Boston.

Lee, C., Wong, K., 2019. Advances in Intellectual Capital

Performance Measurement: A State-of-the-art Review.

The Bottom Line. 32(2), 118-134, DOI:

https://doi.org/10.1108/BL-12-2018-0051.

Mačerinskienė, I., Survilaitė, S., 2019. Company’s

Intellectual Capital Impact on Market Value of Baltic

Cuntries Listed Enterprises. Oeconomia Copernicana.

10(2), 309-339, DOI: https://doi.org/10.24136/oc.20

19.016.

Matricano, D., Candelo, E., Sorrentino, M., Cappiello, G.,

2020. Investigating the Link Between Intellectual

Capital and Open Innovation Processes: a Longitudinal

Case Study. Journal of Intellectual Capital. 3

rd

December, DOI:10.1108/jic-02-2020-0020.

McConnell, S., 2019. More Effective Agile: A Roadmap for

Software Leaders. Construx Press. Bellevue.

Nazari, J., 2015. Intellectual Capital Measurement and

Reporting Models. [In:] Knowledge Management for

Competitive Advantage During Economic Crisis,

Ordoñez de Pablos, P., Turró, L.J., Tennyson, R.D.,

Zhao, J. (eds.). IGI Global. Hershey, 117-139, DOI:

10.4018/978-1-4666-6457-9.ch008.

Pike, S., Roos, G., 2000. Intellectual Capital Measurement

and Holistic Value Approach. Works Institute Journal.

42 (October/November), 1-15.

Pulic, A., 2000. VAIC™ An Accounting Tool for IC

Management. International Journal of Technology

Management. 20(5), DOI: 10.1504/IJTM.2000.002891.

Pulic, A., 2004, Intellectual Capital-Does it Create or

Destroy Value. Measuring Business Excellence. 8(1),

62-68, DOI: https://doi.org/10.1108/1368304041052

4757.

Roos, G., Pike, S., 2018. The Strategic Management of

Intellectual Capital: Essentials for Leaders and

Managers. Routledge. New York.

Rothaermel, F.T., 2016. Strategic Management: Concepts

and Cases. McGraw-Hill. New York.

Santis, S., Binachi, M., Incollingo, A., Bisogno, M., 2019.

Disclosure of Intellectual Capital Components in

Integrated Reporting: An Empirical Analysis.

Sustainability. 11(62), 1-15, DOI: 10.3390/su1101

0062.

Santis, S., Binachi, M., Incollingo, A., Bisogno, M., 2019.

Disclosure of Intellectual Capital Components in

Integrated Reporting: An Empirical Analysis.

Sustainability. 11(62), 1-15, DOI: 10.3390/su11010

062.

Schiavone, F., Leone, D., Caporuscio, A., Kumar, A., 2022.

Revealing the role of intellectual capital in digitalized

health networks. A meso‑level analysis for building and

monitoring a KPI dashboard. Technological

Forecasting and Social Change. 175, 121325.

Schwaber, K., 2004. Agile Project Management with

Scrum. Microsoft Press. Redmond.

Schwaber, K., Sutherland, J., 2012. Software in 30 Days:

How Agile Managers Beat the Odds, Delight Their

Customers, and Leave Competitors in the Dust. John

Wiley & Sons. Hoboken.

Sharpe, N., Veaux, R., Velleman, P., 2014. Business

statistics. Pearson Publisher. Boston.

Steenhuis, H.J., 2012. Joost de Bruijn, E., Technology and

Economic Development: A Literature Review.

International Journal of Innovation and Technology

Management. 9(5), 1-11, DOI: 10.1142/S02198770125

00332.

Stewart, T.A., 1998. Intellectual Capital: The New Wealth

of Organizations. Nicholas Brealey Publishing.

London.

Sveiby, K., 2001. Methods of Measuring Intangible Assets.

Sveiby Knowledge Associates Publisher, available at:

https://www.sveiby.com/files/pdf/1537275071_metho

ds-intangibleassets.pdf (accessed: Dec, 08, 2021).

Van Wijk, R., Jansen, J.P., Lyles, MA., 2008. Inter and Intra

Organizational Knowledge Transfer: A Meta-Analytic

Review and Assessment of its Antecedents and

Consequences. Journal of Management Studies. 45(4),

May, 830-853.

Wiederhold, G., 2014. The Value of Intellectual Capital.

Springer. New York, DOI: https://doi.org/10.1007/978-

1-4614-6611-6_3.

Yovita, M., Kardina, G., Amrania, P., 2018. The Influence

of Intellectual Capital to Market Value with Return on

Assets as Intervening Variable. Journal of Accounting

Auditing and Business. 1(2), 9-16, DOI:

http://dx.doi.org/10.24198/jaab.v1i2.18267.

Acquisition of Open Intellectual Capital: A Case Study of Innovative, Software-developing SMEs

61