Intelligent Human-input-based Blockchain Oracle (IHiBO)

Liuwen Yu

1,2,∗ a

, Mirko Zichichi

2,3,∗ b

, R

´

eka Markovich

1 c

and Amro Najjar

1 d

1

University of Luxembourg, Luxembourg

2

University of Bologna, Italy

3

Universidad Polit

´

ecnica de Madrid, Spain

Keywords:

Argumentation, Negotiation, Distributed Ledger Technologies, Blockchain, Smart Contracts, Trust Services.

Abstract:

The advent of Distributed Ledger Technologies (DLTs) has paved the way for a new paradigm of traceability

in all information systems areas. In the context of decision-making processes, however, DLTs are generally

used only to trace the end results. In this work we argue that a reasoning system can be put in place for

making these decisions, in order to enhance auditability, transparency, and finally to provide explainability.

We propose the Intelligent Human-input-based Blockchain Oracle (IHiBO), a cross-chain oracle that enables

the execution and traceability of formal argumentation and negotiation processes, involving the intervention of

human experts. We take as reference the decision-making processes of fund managements, as trust is of crucial

importance in such “trust services”. The architecture and implementation of IHiBO are based on leveraging

two-layer DLTs, smart contracts, argumentation and negotiation in a multi-agent setup. Finally, we provide

some experimental results that support our discussion, namely that in the use-case we have considered our

methodology can increase trust from principals to trusted services.

1 INTRODUCTION

In situations where trust plays a significant role, the

decision-making process might be considered as the

pinnacle of the engagement between parties. In the

case of funds management, for instance, investors

choose managers based not only on forecasts of future

performance but also on factors such as trust and reli-

ability (Kostovetsky, 2016). Indeed, in these so called

“trust services” the fund managers are in the position

of a fiduciary acting on behalf of the principal, sub-

ject to the overall duty to act in the best interest of

the client, i.e. the principal. Fund managers primar-

ily research and determine the best stocks, bonds, or

other securities to fit the strategy of the fund, then buy

and sell them. The decisions taken by managers af-

fect the principals directly, thus the legislator can and

does declare the principal’s right to check the fidu-

ciary’s relevant activities in order to give some weight

to this duty by its intended controlability. However,

this might not be so straightforward, as these activi-

a

https://orcid.org/0000-0002-7200-6001

b

https://orcid.org/0000-0002-4159-4269

c

https://orcid.org/0000-0002-2488-2293

d

https://orcid.org/0000-0001-7784-6176

∗

These authors contributed equally.

ties, e.g. securities transactions, are increasingly exe-

cuted as a collaborative process that involves not only

a single fund manager but also other managers, ana-

lysts, and external entities that maintain business re-

lationships. The beliefs and assumptions of this di-

verse group of participants can be influenced by a va-

riety of different background knowledge and in turn

shape the decision that leads to the execution of a

fund activity. The fund management decision process

is characterized by uncertain and changing informa-

tion, dynamic opportunities, multiple goals and strate-

gic considerations, interdependence among projects,

and multiple decision-makers and locations (Cooper

et al., 1997). This necessitates a collaborative pro-

cess that is considered reliable and trustworthy by

all participants, protects sensitive information at all

times, enables traceability and auditability to main-

tain accountability, and supports distributed and iter-

ative extending beyond the traditional boundaries of

fund management.

With the advent of the use of Distributed Ledger

Technologies (DLTs) in finance, some key concerns

such as security, transparency and accountability have

been addressed. DLTs and smart contracts seems

to be able to break the stigma, only apparently im-

mutable, of centrality and of central counterparties

Yu, L., Zichichi, M., Markovich, R. and Najjar, A.

Intelligent Human-input-based Blockchain Oracle (IHiBO).

DOI: 10.5220/0010945300003116

In Proceedings of the 14th International Conference on Agents and Artificial Intelligence (ICAART 2022) - Volume 1, pages 515-526

ISBN: 978-989-758-547-0; ISSN: 2184-433X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

515

(CCPs) (Priem, 2020; Feenan et al., 2020). For in-

stance, in some applications smart contracts can take

on a role similar to that previously played CCPs, e.g.

acting as a margin calculating agent and taking on the

task of transferring collateral. Although in a differ-

ent way, the smart contract can be used to resolve

disputes in the event of non-compliance with pay-

ment (Morini, 2017). Decentralized Finance (DeFi),

for instance, is a novel P2P financial infrastructure,

based on smart contracts, that provides non-custodial,

permissionless, openly verifiable and composable op-

erations (Werner et al., 2021). The involvement of

DLTs for the fund management, however, does not

address the possible trust issues between the principal

and the fiduciary: the principal still doesn’t have ac-

cess why the given transaction happened and whether

it happened, indeed, in his best interest. DLTs are ac-

tually used only to trace the output of such a decision-

making process. However, a reasoning system put in

place for making these decisions could be featured to

enhance auditability, transparency, traceability and to

provide explainability.

To address these challenges we propose a novel

system that leverages DLTs, smart contracts, formal

argumentation and negotiation in a multi-agent setup.

We argue that formal argumentation can help explain

why a claim or a decision is made, in terms of jus-

tification, dialogue, and dispute trees (

ˇ

Cyras et al.,

2016; Yu et al., 2022). Then, for enabling a conflict-

resolution negotiation can be used to determine the

quantities, investment timing or other activities. In

(Yu et al., 2022), we first proposed the theory of our

system, mainly discussing how the aggregation of ar-

gumentation and DLTs increases trust. Our contribu-

tion in this paper, on the other hand, consists of the

implementation of our new system and the evaluation

of the feasibility of our proposal. We demonstrate the

practicability of the proposed system by implement-

ing a proof-of-concept for the conflict resolution us-

ing a private Ethereum Blockchain. To the best of our

knowledge, our contribution is the first one to include

formal argumentation implemented using smart con-

tracts together with the use of a multi-agent system.

This leads to the impossibility of comparison with re-

lated works in terms of performance evaluation.

The remainder of the paper is organized as fol-

lows. Section 2 presents the background of formal ar-

gumentation, negotiation, blockchain and smart con-

tracts which are significant ingredients of our system.

Section 3 illustrates how to reach an investment de-

cision with an example. Section 4 introduced IHiBO

framework as well as its architecture. Section 5 shows

the experiments and the results and Section 6 con-

cludes.

2 BACKGROUND AND RELATED

WORKS

In this section we introduce the background of formal

argumentation, negotiation, DLTs.

2.1 Formal argumentation

Formal argumentation has achieved significant influ-

ence in artificial intelligence (AI), which has the capa-

bilities of representing and reasoning with incomplete

and inconsistent information. It can provide various

ways for explaining why a decision is made, in terms

of dialogue or proofs (

ˇ

Cyras et al., 2016). Dung il-

lustrates an argumentation system consisting of a set

of arguments and the relation (attacks) between them

(Dung, 1995b). Argumentation semantics are defined

later by Baroni and Giacomin for gathering accept-

able arguments lying on different criteria (Baroni and

Giacomin, 2007), in a way that somehow emulates

the way humans tackle such a complex task. When

regarding to providing explanation, one of the advan-

tages of argumentation is that the decisions can be

mapped to a graphical representation, with predefined

attack properties that subsequently will lead to the

winning decision and will show the steps that were

followed in order to reach it. In the following, we

provide the definitions needed for our agent argumen-

tation framework for modeling the decision-making

in fund management.

We first generalize argumentation frameworks

studied by Dung (1995), which are directed graphs,

where the nodes are arguments, and the arrows corre-

spond to the attack relation.

Definition 2.1 (Argumentation Framework (Dung,

1995a)). An argumentation framework (AF) is a pair

hA , →i where A is a set called arguments, and →⊆

A × A is a binary relation over A called attack. For

a set S ⊆ A and an argument a ∈ A , we say that S

attacks a if there exists b ∈ S such that b attacks a,

a attacks S if there exists b ∈ S such that a attacks b,

a

−

= {b ∈ A |b attacks a}, S

−

out

= {a ∈ A \S| a attacks

S}.

Dung’s admissibility-based semantics is based on

the concept of defense. A set of arguments defends

another argument if they attack all its attackers.

Definition 2.2 (Admissible (Dung, 1995a)). Let

hA , →i be an AF. E ⊆ A is conflict-free iff there

are no arguments a and b in E such that a attacks

b. E ⊆ A defends c iff for all arguments b attacking

c, there is an argument a in E such that a attacks b.

E ⊆ A is admissible iff it is conflict-free and defends

all its elements.

SDMIS 2022 - Special Session on Super Distributed and Multi-agent Intelligent Systems

516

Baroni and Giacomin then define semantics as a

function from argumentation frameworks to sets of

subsets of arguments.

Definition 2.3 (Dung Semantics (Baroni and Gia-

comin, 2007)). A Dung semantics is a function σ that

associates with an argumentation framework AF =

hA , →i, a set of subsets of A , the elements of σ(AF)

are called extensions.

Dung distinguishes several definitions of exten-

sion.

Definition 2.4 (Extensions (Dung, 1995a)). Let

hA , →i be an AF. E ⊆ A is a complete extension iff it

is admissible and it contains all arguments it defends,

i.e., E = {a|E defends a}. E ⊆ A is a grounded ex-

tension iff it is the smallest (for set inclusion) com-

plete extension. E ⊆ A is a preferred extension iff

it is a largest (for set inclusion) complete extension.

E ⊆ A is a stable extension iff it is conflict-free and

it attacks each argument which does not belong to E.

An agent argumentation framework extends an ar-

gumentation framework with a set of agents and a re-

lation associating arguments with agents. Note that an

argument can belong to one agent or multiple agents.

Definition 2.5 (Agent Argumentation Framework (Yu

and van der Torre, 2020)). An agent argumentation

framework (AAF) is a 4-tuple hA , →, S , @i where

A is a set of arguments, →⊆ A × A is a binary re-

lation over A called attack, S is a set of agents or

sources, @⊆ A × S is a binary relation associating

arguments with agents. A

α

= {a ∈ A |a @ α} for all

arguments that belong to agent α, S

a

= {α|a @ α}

for all agents that have argument a.

2.1.1 Social Agent Semantics

For the decision making of fund management, we in-

troduce so-called social semantics, which is based on

a reduction to preference-based argumentation by for

each argument counting the number of agents that

have the argument (Yu et al., 2020). It thus interprets

agent argumentation as a kind of voting, as studied in

social choice theory or judgment aggregation, this is

also the most closed to fund management.

We next give the definition of a preference-based

argumentation framework.

Definition 2.6 (Preference-based Argumentation

Framework (Kaci and van der Torre, 2008)). A

preference-based argumentation framework (PAF) is

a 3-tuple hA , →, i where A is a set of arguments,

→⊆ A × A is a binary attack relation, is a par-

tial order (irreflexive and transitive) over A , called

preference relation.

There are different reductions of preference have

been introduced (Amgoud and Vesic, 2014; van der

Torre and Vesic, 2017). We refer to those papers for

an explanation and motivation, and we choose one of

the reductions in our use case below which satisfies

the essential conflict-free principle analyzed in (Yu

et al., 2020).

Definition 2.7 (Reductions of PAF to AF (PR)).

Given an PAF = hA , →, i: PR(PAF)=hA , →

0

i,

where →

0

= {a →

0

b|a → b, b a, or b → a, not a →

b, a b, or a → b, not b → a}.

In social agent semantics, an argument is preferred

to another argument if it belongs to more agents. The

reduction from AAF to PAF is used as an intermediary

step for social agent semantics.

Definition 2.8 (Social Reductions of AAF to

PAF (SAP)). Given an AAF = hA , →, S , @i,

SAP(AAF)=hA , →, i with = {a b||S

a

| >

|S

b

|}.

Definition 2.9 (Social Reductions of AAF to

AF (SR)). Given an AAF = hA , →, S , @i,

SR(AAF)=PR(SAP(AAF)), PR is the reduc-

tion of PAF to AF, where the semantics

δ (AAF) = σ (SR(AAF))= σ(PR(SAP(AAF))).

2.2 Autonomous Agents and

Negotiation

An agent is a software program that acts on behalf

of another actor (often a human user) to perform

a task or achieve a given goal (Wooldridge, 2009).

Agents are designed to be bound to individual per-

spectives and this makes them good candidates to rep-

resent the subjectivity and nuances of different expert

opinions. Multi-agent systems (Weiss, 2013) provide

a distributed platform capable of implementing in-

telligence in decentralized ecosystems where agents

are capable, using well-established conflict-resolution

mechanisms (e.g. negotiation), of helping the differ-

ent stakeholders finding agreements that satisfy their

often conflicting interests.

Negotiation, in particular, is the process by which

a joint decision is made by two or more parties,

that firstly verbalize contradictory demands and then

move towards agreement by a process of concession

making or search for new alternatives (Pruitt, 2013).

The problem being negotiated, or the topic under dis-

cussion (e.g. car purchase) can be usually divided

into issues (also called attributes). Negotiators may

not only disagree on the value assigned to each issue,

the priority given to each issue can differ from one

negotiator to another and hence this can be a source

of both divergence and convergence (Pruitt, 2013).

Intelligent Human-input-based Blockchain Oracle (IHiBO)

517

Automated negotiation is one taking place among au-

tonomous agents through a protocol. The latter is the

set of rules that governs the interactions during a ne-

gotiation session (also called a thread). Whereas the

negotiation protocol defines what is the set of pos-

sible actions that can be taken during a negotiation

session, an agent has a decision model (Faratin et al.,

1998) that allows the agent to (i) evaluate the value

of an offer received from the opponent (e.g., using

a utility function), (ii) decide whether it is accept-

able , and (iii) determine what to do next (known as

the negotiation strategy). Automated negotiation has

been applied to solve conflicts and reach agreements

in several domains including cloud and service pro-

visioning (Najjar et al., 2013), smart grid and power

distribution (Tom et al., 2020), and trading and stock

market (Wellman et al., 2007). Compared with human

negotiation, autonomous agent negotiation is efficient

in contexts where the number of issues under nego-

tiation is intractable for human users, or in one-to-

many (Mansour and Kowalczyk, 2011) or many-to-

many negotiation (An et al., 2009) settings in which

the numbers of negotiators makes it difficult for hu-

mans to keep track of the evolution of the negotiation

process. Therefore, autonomous agents can offload

these tasks from the human expert shoulders, assist

them in formulating their preferences, and help reach

optimal solution that can be otherwise inaccessible to

human negotiators with the agent assistance.

2.3 Blockchain and Smart Contracts

With the launch of Bitcoin in 2008 (Nakamoto, 2008),

the technology underpinning it is becoming increas-

ingly popular, i.e. the blockchain, which is a part

of realm of DLTs. DLTs consists of a network

of nodes that maintain a distributed ledger by fol-

lowing the same protocol, and, in the case of the

blockchain, the ledger is organized into chronologi-

cally ordered blocks where each block is sequentially

linked to the previous one (Nakamoto, 2008). Thus,

the blockchain is cryptographically guaranteed to be

tamper-proof and unforgeable, enabling the creation

of “trusted” mechanism exploitable by several users

in a distributed environment and without the need

for third party intermediaries. Smart contracts are

instructions stored in blockchain and automatically

triggered once the predefined condition is met (Bu-

terin et al., 2013). Utilizing smart contracts allows

us to employ blockchain far beyond monetary trans-

actions (Kurt Peker et al., 2020; Zheng et al., 2020;

Zichichi et al., 2020b). However, smart contracts can-

not fetch data from off-chain themselves of whose the

possibility usage is obviously limited, since the many

smart contract applications would require real time in-

formation from the network external world. In this

context, oracles emerge as a bridge that connects the

blockchain network and the “outside” world, provid-

ing the ability to retrieve, verify and digest the data

into smart contracts. Oracles can be implemented as

software, hardware or human (Beniiche, 2020). In

all cases their off-chain execution is either central-

ized, i.e. coming from a single source, or decentral-

ized, consensus-based multitude of sources. The lat-

ter case can be also implemented as a cross-chain or-

acle, where a system in a blockchain, i.e. the main-

chain, can validate and read events and/or state from

another blockchain, i.e. a sidechain (Buterin, 2016).

2.4 Related Works

In the remainder of this paper we will discuss the

implementation of a system for the decision-making

based on formal argumentation, autonomous negoti-

ation, blockchain, smart contracts, and oracles, thus

leading to an overview of the related works from mul-

tiple perspectives. Indeed, to the best of our knowl-

edge, there is no mature work on the adoption of ar-

gumentation in the financial world, nor the combina-

tion of argumentation and autonomous negotiation in

blockchains using smart contracts. The only work we

can find regarding the use of argumentation as a con-

vincing tool in order to gain the stakeholders’ support

and trust is the one proposed by Palmieri (Palmieri,

2009). Focusing on formal argumentation only, sev-

eral influential works discuss its role in providing

trustworthy systems (Matt et al., 2010; Parsons et al.,

2010; Tang et al., 2010). Parsons et al suggest argu-

mentation might play a role which tracks the origin

of information used in reasoning, thus it can provide

provenance in trust (Parsons et al., 2010). Later the

same authors develop a general system of argumenta-

tion that can represent trust information, and be used

in combination with a trust network, using the trust-

worthiness of the information sources as a measure

of the probability that information is true (Tang et al.,

2010).

The adoption of blockchain and DLT has been un-

der consideration and debating for several years both

from economic and legal aspects (Priem, 2020) and

many proposals on building a DLT-based securities

has been conducted. However, most of them discuss

the transaction process including how to use these

technologies for clearing and settlement which are

process after securities trading (Oprea et al., 2020;

Wall and Malm, 2016). In our work, on the other

hand, we pay attention to the pre-trading phase, par-

ticularly in fund management context, where the in-

SDMIS 2022 - Special Session on Super Distributed and Multi-agent Intelligent Systems

518

vest decisions made by the trust services are ex-

tremely crucial to investors. Nonetheless, we also

refer to the oracle process seen in the previous sub-

section and many related works are built on this.

Human oracles, i.e. the ones requiring an input

which involves human intervention, are rarely ap-

plied (Damjan, 2018). The rare existing ones are de-

ployed in applications with binary inputs, i.e., they

only take input by one of two possibilities, typically

“yes” or “no” (Nelaturu et al., 2020), such as AS-

TRAEA (Adler et al., 2018) that leverages human ac-

tions through a voting game. Augur (Beniiche, 2020;

Peterson and Krug, 2015) is a decentralized oracle

that needs specific human users obligated by Reputa-

tion Tokens to report outcomes at specific times, users

who report incorrect results would be subject to a dis-

pute process, and then through a consensus algorithm

to calculate the results. A part from those, many ser-

vices and projects have been already established for

the implementation of oracles. Provable (Provable

Things Limited, 2019), before known as Oraclize, is

an oracle service that provides a data transport-layer

for smart contracts to fetch external data from Web

APIs. The peculiarity of such platform is that it is

blockchain agnostic and that can serve requests com-

ing from multiple DLT instances. Chainlink (Ellis

et al., 2017) offers a general-purpose framework to

build a decentralized oracle network on the Ethereum

blockchain. Its main purpose is to provide reliable

data tamper-proof input and output for smart contracts

by accessing data resources. Gnosis (GnosisDAO,

2017) approach is different, but ultimately resorts ora-

cles as well. Gnosis mainly derives information from

centralized oracle services, but enables the users to

challenge those results.

3 CONFLICT RESOLUTION USE

CASE

In this section we use a simplified example to illus-

trate how we use agent abstract argumentation and

autonomous negotiation for dealing with conflicting

information raised by agents.

The process of decision-making in fund manage-

ments fits well with argumentation theory in artificial

intelligence. The decision can be seen as being based

on arguments and counter-arguments. Argumenta-

tion, as the result, can be useful for deriving decisions

and explaining a choice already made. Managers pro-

vide their arguments from their own research to iden-

tify promising stocks with different level of accuracy

and thereby make different portfolio choices which

are likely to be incomplete and inconsistent. The fic-

titious simple example (the real life cases would be

much more complex) is as follows. Manager α and

β hold the arguments a: To buy the stocks, since the

company just donated to charities that is beneficial to

good commercial reputation, and argument c: To buy

the stocks, since the company has started to use a new

promising technology which will develop the sale per-

formance. However, another manager γ at the same

time is against buying the stocks, he holds the argu-

ments b and d, b is To sell the stocks, since there is

evidence that the leader is under accusations of char-

ity fraud, and d is To sell the stocks, since the company

now has poor sale performance.

Based on the above, we can build an agent ar-

gumentation framework on the left side of Figure 1,

AAF = hA , →, S , @i where A = {a, b, c, d}, →=

{(a,b),(b,a), (a,d),(d,a),(b,c),(c,b),(c,d),(d,c)}, S =

{α, β , γ}, @= {(a,α),(a,β ),(c,α),(c,β ),(b,γ),(d,γ)}.

Since |S

a

| > |S

b

|, |S

a

| > |S

d

|, |S

c

| > |S

b

|, |S

c

| >

|S

d

|, a b, a d, c b and c d, we get the corre-

sponding PAF showing in the middle of Figure 1, and

giving the four reductions from PAF to AF, we have

the AF on the right side of Figure 1. Then we can cal-

culate the only acceptable set {a, c} which is the only

grounded, complete, preferred and stable extension.

The set tells the final decision is to buy the stocks.

Figure 1: Social Reduction.

One thing needs to be noticed: argumentation

does not always provide a unique outcome. People

need to select the desired semantics based on various

reasoning flavour (Baroni et al., 2011). On the other

hand, depending on the decision making process, dif-

ferent protocols can be specified in advance for such

cases: e.g. to roll back or to assign weights to the

arguments and the relation among them. After reduc-

ing to AF and calculating the acceptable set, indeed,

when the outcome results in the decision to buy the

stocks, the next problem could become the numbers

of stocks to buy and the buy timing. Here the com-

putational automated negotiation comes into play. To

illustrate how it works, we give an example of the ne-

gotiation sequence based on the quantities of stocks

to buy. The negotiation process is based on the al-

ternating offer protocol (Rubinstein, 1982). Agents

can bid new offers to the opponent (O f f er() func-

tion). When receiving an offer, an agent can accept

Intelligent Human-input-based Blockchain Oracle (IHiBO)

519

it using accept() function or reject it and propose a

counter-offer (with the CounterO f f er() function). In

the example, we have a manager A, i.e., agent A, and

manager B, i.e., agent B. Agent A proposes to buy

1000 stocks at the price of 151$, while agent B coun-

teroffers to buy 1200 stocks at the price of 145$, then

agent A proposes to buy 1150 stocks at the price of

148$. The final offer given by A is accepted by both

parties which means they come to an agreement.

4 INTELLIGENT

HUMAN-INPUT-BASED

BLOCKCHAIN ORACLE

(IHIBO) FRAMEWORK

In this section we present the details of the Intelli-

gent Human-input-based Blockchain Oracle Frame-

work. IHiBO is a cross-chain oracle that enables the

execution and traceability of argumentation and nego-

tiation processes, involving the intervention of human

experts.

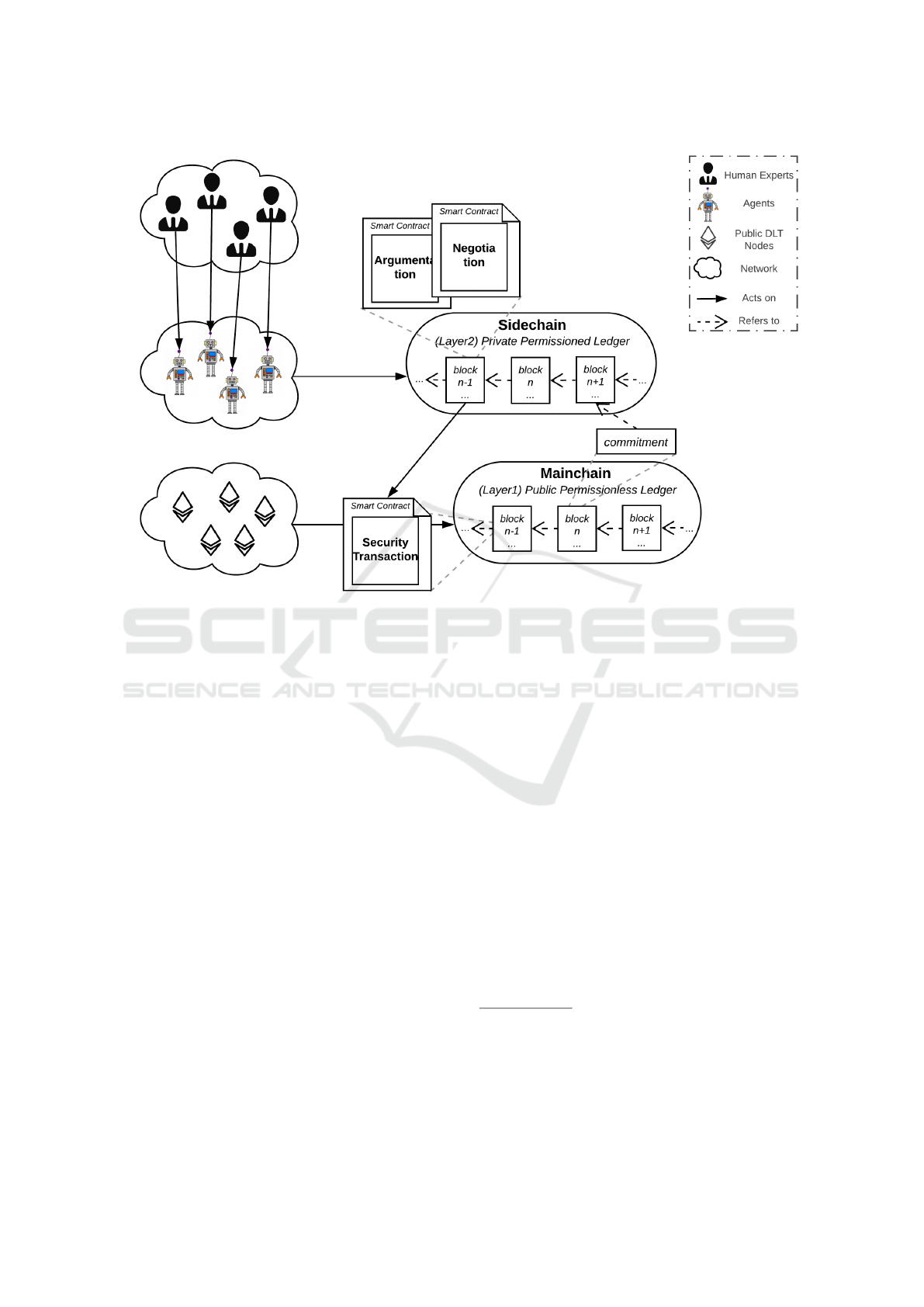

4.1 Architecture

The framework is centered around a layer two solu-

tion that moves the oracle’s off-chain

1

processes to

a sidechain. In particular, this sidechain consists of

a chain where smart contracts are executed and data

stored, and of a mainchain where commitments are

periodically stored for the framework security and

where the result of the conflict resolution is executed.

Before going into the architecture details we describe

the roles of the actors involved in the architecture,

with reference to Figure 2:

• Human Expert, the one who takes most of the

decisions and that gives inputs to the agent;

• Agent, the one that can assist human experts in

formulating their preferences and to reach optimal

solutions; these are also the ones that directly in-

teract with the sidechain.

• Public DLT Node, the one that takes part to the

mainchain consensus mechanism and that is ex-

ternal to the sidechain; this actor receives trans-

actions to be stored in the mainchain, i.e. a DLT

full-node (Nakamoto, 2008; Buterin et al., 2013).

1

The reference to “chain” will always be to the main

chain thorough the text, opposed to the “sidechain” that will

be always called as such.

For the architecture of the cross-chain oracle, we

refer to a layer two solution because

2

: (i) the first

layer includes a public permissionless DLT, i.e. main-

chain, while (ii) the second layer consists of a pri-

vate permissioned DLT, i.e. sidechain. The ad-

vantage of using a public permissionless DLT solu-

tion is that it usually offers a high level of security

and decentralization (De Angelis, 2018), needed to

completely trace and verify processes with trust, e.g.

Ethereum (Buterin et al., 2013). The usual drawbacks

are that storing large quantities of data on such a chain

is expensive (Kurt Peker et al., 2020) and that scala-

bility is often compromised for some features, such

as smart contracts execution (Sedlmeir et al., 2021;

Zichichi et al., 2020b) . Therefore, in the framework,

a public permissionless DLT maintained by public

DLT nodes is used as the mainchain solely to store

“commitments” (explained later in this section) and

to execute the business logic arising as a result of a

conflict resolution, e.g., sell stock. On the other hand,

the conflict resolution process is executed mainly on

the second layer, thanks to the use of the sidechain.

In the second layer a network of agents and/or

other nodes maintain the sidechain. We refer to a pri-

vate permissioned DLT for the framework sidechain,

where only some actors have the permission to read

and write to the ledger, e.g. agents. Private permis-

sioned DLTs solve the public permissionless issues

of: (i) the publicity of information that would clash

with trade secrets and privacy, as only allowed ac-

tors can read from the ledger; (ii) expensiveness and

scalability, as permissioned DLTs protocols can be

designed ad-hoc to specifically address these issues.

However, the level of security of private permissioned

solution decreases in respect to public permissionless

ones, due to the fact that they generally are less de-

centralized and that usually use more efficient but less

secure consensus mechanisms (Sedlmeir et al., 2021;

De Angelis, 2018).

The mainchain and sidechain are tied together in

the framework by the use of periodical commitments.

A commitment consists of storing in the mainchain

the result of an hash function applied to the state of

the sidechain at a certain point in time. This would al-

low to store data that cannot be tampered in the main-

chain and to allow its verification. At the same time,

thanks to the hash function, the privacy of information

stored in the sidechain is maintained, while assuring

that any data corruption will be detected (Gudgeon

et al., 2020), i.e. the hash result will change. Indeed,

through the use of commitments, once the nodes op-

erating the sidechain reveal part of (or all of) the in-

2

We investigated this aspect in a previous work (Yu

et al., 2022), both from a practical and legal point of view

SDMIS 2022 - Special Session on Super Distributed and Multi-agent Intelligent Systems

520

Figure 2: IHiBO Framework Architectures.

formation stored in the sidechain to possible auditors,

the latter can apply the hash function to the data re-

ceived and check that the obtained result is equal to

the hash stored in the mainchain (Singh et al., 2020).

4.2 Implementation

For the IHiBO Framework implementation we refer to

Ethereum and to its smart contract specification (Bu-

terin et al., 2013).

4.2.1 Mainchain

In particular for the mainchain, we leverage the

Ethereum public blockchain and the functions ex-

posed by its network nodes for creating and/or in-

teracting with smart contracts. In the Ethereum

blockchain some applications built through the use

of smart contracts, i.e. decentralized applications

(dApps), are already been developed for the exe-

cution of securities transactions (Pop et al., 2018).

The Ethereum protocol allows smart contracts inter-

communication, thus the framework we present is

meant to include a dedicated smart contract that

“bridges” the output of the execution in the sidechain,

e.g. a conflict resolution, to a smart contract de-

ployed to the mainchain

3

. We refer to this smart

contract as the “SecurityTransaction”, and its imple-

mentation mostly depends on the on-chain business

process it interacts with. For instance, Decentral-

ized Finance (DeFi)

4

protocols such as Decentralized

Exchanges (DEX) are already been provided in the

Etehreum blockchain for enabling anyone to engage

in non-custodial exchange of on-chain digital assets,

e.g. tokens (Werner et al., 2021). Smart contracts that

implements such DEXes can be directly invoked for

swapping tokens and cryptocurrencies depending on

their value (International Token Standardization As-

sociation, 2021). An instance of a SecurityTransac-

tion would be a smart contract that includes a method

that directly invokes a DEX smart contract for exe-

cuting a token swap. This can be seen as the direct

selling/buying of traditional stocks that have been “to-

kenized” (International Token Standardization Asso-

ciation, 2021; Bhandarkar et al., 2019).

3

Due to lack of space, we do not go into the details of

this bridge implementation, but an instance would be the

atomic execution of transactions across chains (Robinson

and Ramesh, 2021).

4

DeFi is a term that refers to smart contract based finan-

cial infrastructures that are non-custodial, permissionless,

openly verifiable and composable (Werner et al., 2021).

Intelligent Human-input-based Blockchain Oracle (IHiBO)

521

Figure 3: Argumentation smart contract class diagram.

4.2.2 Sidechain

For what concerns the sidechain, any implementa-

tion of a permissioned smart contract enabled DLT

is suitable for the framework we proposed. In

our implementation, we make use of an Ethereum

blockchain distributed among nodes in a private per-

missioned network. In this case, the consensus al-

gorithm adopted by the network does not necessar-

ily have to be the Proof-of-Work (Nakamoto, 2008;

Buterin et al., 2013), but, in order to provide a faster

service, used the Proof-of-Authority (PoA) consensus

algorithm (Toyoda et al., 2020). PoA, indeed, does

not depend on solving mathematical problems, and

to issue a new block this one must be signed by the

majority of the authorities, i.e. the nodes that are ex-

plicitly authorized to create new blocks and secure the

blockchain.

The main purpose of this sidechain is to support

smart contracts whose execution log can be later au-

dited. Thus, we implemented two smart contract

specifications for executing conflict resolution pro-

cesses, however many others can be implemented

following the Ethereum smart contracts specifica-

tion (Buterin et al., 2013).

Argumentation Smart Contract. We imple-

mented a smart contract for providing a PAF (Section

2.1.1) to the agents that operates in the sidechain.

• A data structure within the smart contract allows

to create and manage a directed graph, where

nodes are arguments and edges are attack rela-

tions. Each agent can add an argument (insertAr-

gument()) and its attacks (insertAttacks()) to the

graph or set as ”preferred” an already existing ar-

gument (supportArgument()).

• Arguments are handled through their id and the

metadata associated to it, i.e. the actual argument

text, can be stored directly on the ledger or outside

and referenced through a hash pointer.

• After a predefined time period needed for com-

pleting the PAF, reductions of PAF to AF can be

invoked and executed directly by the smart con-

tract (pafReductionToAfPr()). The result of invok-

ing this method is a new directed graph represent-

ing the AF.

• Finally, an extension can be found for the previ-

ously obtained AF, by invoking another method

(enumeratingPreferredExtensions()). The imple-

mentation of this method is based on the algo-

rithm found in (Nofal et al., 2014) for listing all

preferred extensions of an AF (Algorithm 1). This

possibly provides a set of arguments that lead to a

final decision.

Negotiation Smart Contract. We implemented a

smart contract that concludes the conflict resolution

(Section 2.1.1) with a negotiation on the arguments

provided by the argumentation process.

• A data structure within the smart contract holds

the data needed during a negotiation thread. A list

of such structures enables agents to interact for

automated negotiations on several issues. Each

agent can start a new negotiation with another

agent for a specific set of issues (newNegotia-

tion()).

• Each agent has its own decision model executed

off-chain, that allows this to evaluate the value of

an offer received from another agent, e.g. a time

dependent tactic (Faratin et al., 1998).

• Based on the evaluation, the agent can invoke the

smart contract to make a new offer (newOffer())

providing a new set of values related to the issues,

accepting (accept()) the other agent’s offer, or re-

fusing it (by not providing input to the smart con-

tract).

• The invocation of the smart contract method for

accepting the offer can directly enact the process

of interaction with the SecurityTransaction smart

contract on the mainchain (Robinson and Ramesh,

2021).

5 EXPERIMENTS AND RESULTS

We developed a cross-chain oracle prototype to test

the feasibility of the use of smart contracts for con-

flict resolution and in here we present the results

of some experiments based on two assumptions.

Firstly, we are not interested in testing out the perfor-

mances in terms of transaction per seconds and scal-

ability for public permissionless DLTs, since these

SDMIS 2022 - Special Session on Super Distributed and Multi-agent Intelligent Systems

522

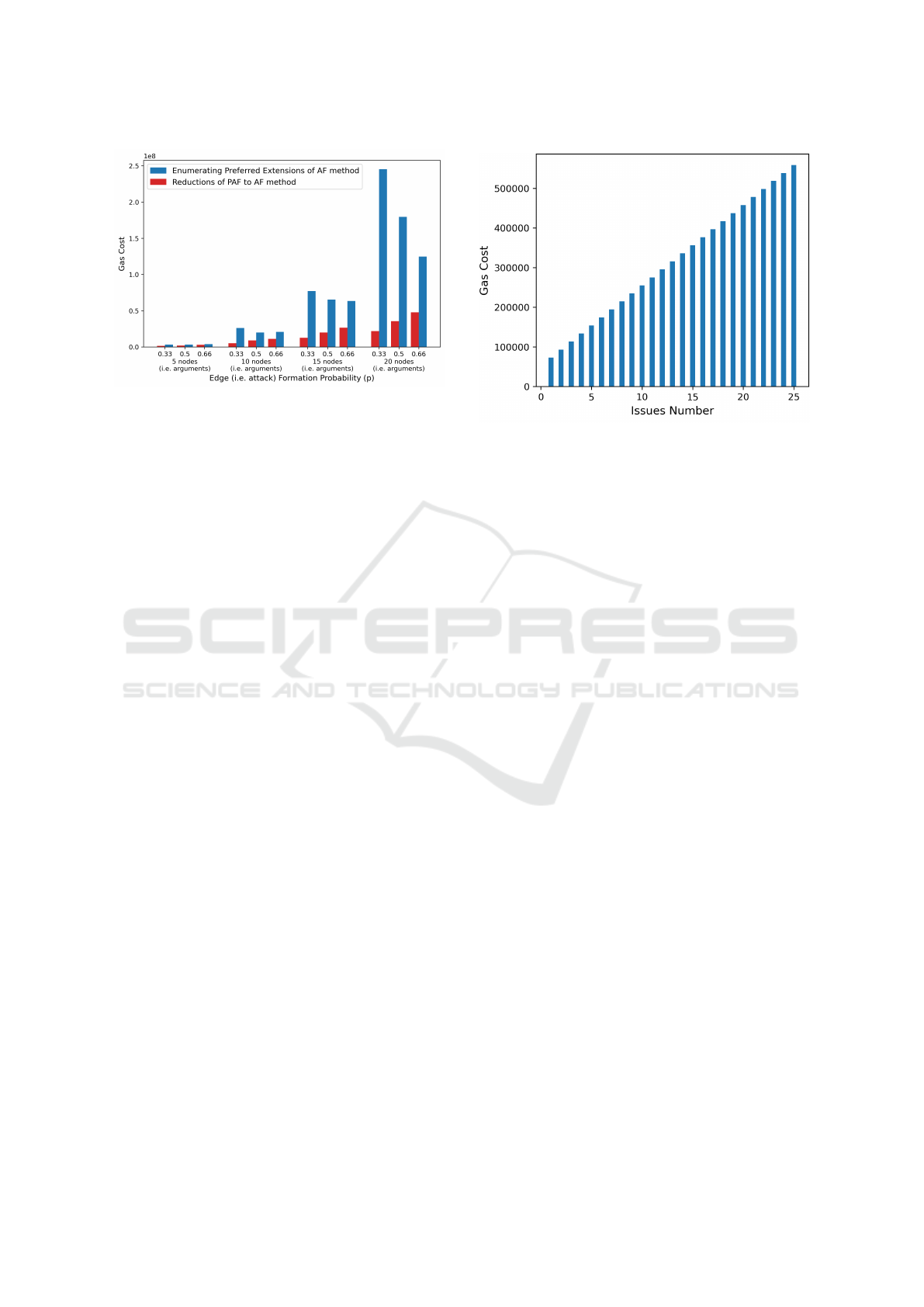

Figure 4: pafReductionToAfPr() and enumeratingPreferre-

dExtensions() methods gas cost

have already been studied in literature for similar

use cases (Sedlmeir et al., 2021; De Angelis, 2018;

Kurt Peker et al., 2020; Zichichi et al., 2020a). In-

deed, these results have already impacted the IHiBO

framework design by limiting the issuing of trans-

action to the mainchain only for periodic commit-

ments (Yu et al., 2022). Secondly, for what regards

the sidechain, performances depends on the specific

implementation used by the actors in a specific use

case. In our implementation we used an Ethereum pri-

vate network using PoA and it has been shown that,

with optimal configuration, it can reach up to 1000

transactions per second (Toyoda et al., 2020).

Therefore, our focus is on the execution of the

smart contracts that we described in the implemen-

tation section (4.2), with regards to the argumentation

and negotiation processes. We measure our experi-

ments in terms of gas cost, following the Ethereum

protocol (Buterin et al., 2013). Gas is a unit that mea-

sures the amount of computational effort that takes

to execute operations in Ethereum smart contracts.

Thus, the higher the gas cost for a method, the more

intense the computation of a blockchain node to exe-

cute the method’s instructions.

The complete experiments dataset and the refer-

ence software can be found in (Zichichi, 2021), fol-

lowing the FAIR data principles for access and reuse

of models (Wilkinson et al., 2016).

5.1 Results

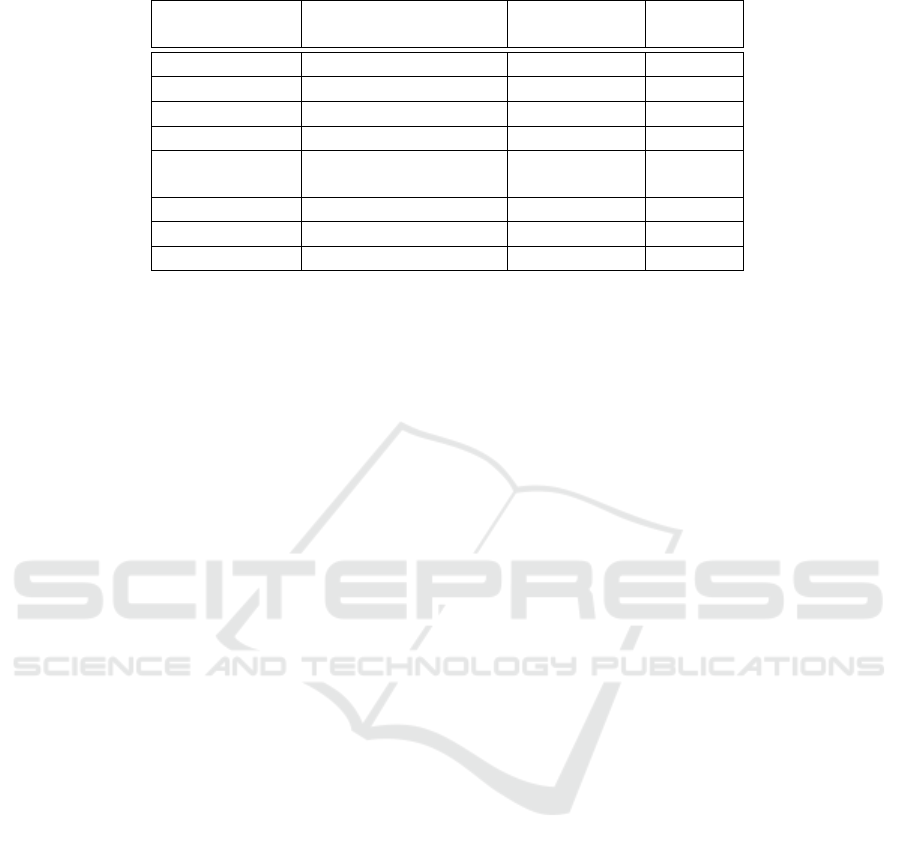

Table 1 shows the gas costs for the execution of the

Argumentation and Negotiation smart contracts meth-

ods, taking as input the data of the example in Sec-

tion 3. These results give an indicative idea relative

to the the different methods executions, since their la-

tency (i.e., the time between submitting a transaction

that invoke such methods and the actual insertion to

Figure 5: Negotiation newOffer() method gas cost.

the blockchain) depends heavily on the blockchain’s

consensus mechanism. For instance, considering a as

the arguments number and n as the agents number,

the supportArgument() method is much less expen-

sive than the enumeratingPreferredExtensions(), but

it is executed up to ≤ a × (n − 1) times while the lat-

ter only 1 time.

In Figure 4 it is shown the increase of the gas

cost while varying the AF. For each arguments num-

ber a taken into consideration, i.e. 5, 10, 15, 20, some

graphs representing a different AF have been cre-

ated randomly. In these graphs, the edge connecting

any two nodes, i.e. an attack in the AF, was firstly

formed with a probability of 0.33, then 0.5 and finally

0.66. For each probability value, 20 random graph

were created and the average of gas cost for invoking

the methods pafReductionToAfPr() and enumerating-

PreferredExtensions() was computed. For the latter

method, results show that the gas cost depends heav-

ily on the arguments number a, as with the increase of

a the gas cost increments exponentially. At the same

time, however, incrementing the edge formation prob-

ability p leads to a decrease of the gas cost. Results

for the pafReductionToAfPr() method show a much

less dramatic increment of gas cost with the increase

of a, but here the increase of edges number leads to an

increase of gas cost instead of a decrease. The mini-

mum value for the enumeratingPreferredExtensions()

method gas cost is ∼ 1.2 million gas units, while the

maximum is ∼ 528 million gas units. For what con-

cerns the other method, ∼ 0.6 million gas units is the

minimum and ∼ 51 million the maximum.

Finally, we provide the results of the measurement

of the gas cost for the newOffer() method of the Nego-

tiation smart contract. In this case, we implemented

two agents negotiating using a time dependent tactic,

as in (Faratin et al., 1998), with two different set of

Intelligent Human-input-based Blockchain Oracle (IHiBO)

523

Table 1: Gas Cost.

Smart

Contract

Method Occur rency

Gas

Cost

Argumentation insertArgument() a 157470

Argumentation supportArgument()

≤ a ×

n − 1

80491

Argumentation insertAttack()

≤ a ×

a − 1

215011

Argumentation pafReductionToAfPr() 1 1877277

Argumentation

enumeratingPreferred

Extensions()

1 1412065

Negotiation newNegotiation() 1 104961

Negotiation newOffer() t 52438

Negotiation accept() 1 64211

starting conditions and maximum values. The num-

ber of new offers t proposed by each agent cannot

be known a priori because it depends on the specific

strategy of the agent. For this reason we measured the

impact of the issues number j on the gas cost. Figure

5, indeed, shows that the latter increases linearly with

the former, due to the increasingly storage demand.

5.2 Discussion

Generally speaking, we experienced a strong depen-

dence on the arguments number for the increase of

the gas cost. This was expected, as more arguments

means a more complex argumentation framework to

deal with. The use of a private Ethereum PoA net-

work allows to limit the latency based on the results

obtained in (Toyoda et al., 2020). Assuming one in-

vocation per transaction, methods such as insertAr-

gument() or insertAttack() easily fall into the 1000

transactions per second range. However, pafReduc-

tionToAfPr() and enumeratingPreferredExtensions()

methods require more computation and might limit

the transactions per second number. Regarding the

Negotiation contract, the newOffer() method might

highly influence performances when the number of is-

sues is > 25.

The use of sidechain allows agents to operate

without too many performance limitations, while

maintaining a level of traceability that allows full au-

diting by an inspector. These results would not have

been possible in a permissionless DLT. In fact, for ex-

ample, in Etehreum the limit of gas cost per block is

currently (at the time of writing this paper) 15 mil-

lion gas units. This means that, not only some trans-

actions could not be executed (e.g. enumeratingPre-

ferredExtensions() with an AF with > 20 arguments),

but also that the latency between operations would be

very high because currently, in the Ethereum network,

a block is created every 10/15 seconds on average.

6 CONCLUSIONS

In this paper, we have proposed an integrated frame-

work which incorporates formal argumentation and

negotiation within a blockchain environment. These

techniques have distinctive features that complement

each other. They together make the decision-making

processes of fund management transparent and trace-

able. As a result, our methodology enhances trust

from principals to trust services, which is grounded

when knowing how the fund management make deci-

sions sufficiently well so that the behavior of man-

agers can be understood and predicted more accu-

rately. Our motivation came from trust services, so

we explained our idea in a fund management sce-

nario, but our proposal is not bound to this domain.

Also, the research on oracles is still in its infant stage,

there are multiple pressing questions and challenges

for the future. To the best of our knowledge, this is the

first study where such a framework that incorporates

argumentation and negotiation, i.e. IHiBO, is im-

plemented using a cross-chain oracle and smart con-

tracts. The results of our experiments shows that the

use of a two layer blockchain architecture, allows to

securely operate without too many performance limi-

tations, while maintaining a high level of traceability

that allows to audit trust services operations.

One follow up possible work is to provide a high

level of adaptability in the decisions of the fund man-

agement, e.g. to define different investment scenar-

ios according to the investors’ preferences, attitude

and the financial environment. Another possible work

could be to investigate on the integration of consensus

mechanisms for a layer two solution to the dispute

resolution phase, in order to narrow the gap between

blockchain and argumentation as well as negotiation,

since there is no specialized blockchain yet that has a

protocol that integrates reasoning.

Lastly, we also plan to rely on the recent advances

SDMIS 2022 - Special Session on Super Distributed and Multi-agent Intelligent Systems

524

of the domain of Explainable AI to explore how we

can make the decision making process presented in

this paper explainable for different types of users (ex-

perts, non-experts, etc.) and for different purposes

(e.g. transparency, debugging, etc.).

ACKNOWLEDGEMENTS

This work has received funding from the EU H2020

research and innovation programme under the Marie

Skłodowska-Curie Actions Innovative Training Net-

works European Joint Doctorate grant agreement No

814177 Law, Science and Technology Joint Doctorate

- Rights of Internet of Everything.

REFERENCES

Adler, J., Berryhill, R., Veneris, A., Poulos, Z., Veira, N.,

and Kastania, A. (2018). Astraea: A decentralized

blockchain oracle. In 2018 IEEE iThings and IEEE

GreenCom and IEEE CPSCom and IEEE SmartData,

pages 1145–1152. IEEE.

Amgoud, L. and Vesic, S. (2014). Rich preference-based

argumentation frameworks. International Journal of

Approximate Reasoning, 55(2):585–606.

An, B., Gatti, N., and Lesser, V. (2009). Extend-

ing alternating-offers bargaining in one-to-many and

many-to-many settings. In 2009 IEEE/WIC/ACM In-

ternational Joint Conference on Web Intelligence and

Intelligent Agent Technology, volume 2, pages 423–

426. IEEE.

Baroni, P., Caminada, M., and Giacomin, M. (2011). An

introduction to argumentation semantics. The knowl-

edge engineering review, 26(4):365–410.

Baroni, P. and Giacomin, M. (2007). On principle-based

evaluation of extension-based argumentation seman-

tics. Artificial Intelligence, 171(10-15):675–700.

Beniiche, A. (2020). A study of blockchain oracles. arXiv

preprint arXiv:2004.07140.

Bhandarkar, V. V., Bhandarkar, A. A., and Shiva, A. (2019).

Digital stocks using blockchain technology the possi-

ble future of stocks? International Journal of Man-

agement (IJM), 10(3).

Buterin, V. (2016). Chain interoperability. R3 Research.

Buterin, V. et al. (2013). Ethereum white paper.

Cooper, R. G., Edgett, S. J., and Kleinschmidt, E. J. (1997).

Portfolio management in new product development:

Lessons from the leaders—i. Research-Technology

Management, 40(5):16–28.

ˇ

Cyras, K., Satoh, K., and Toni, F. (2016). Explanation for

case-based reasoning via abstract argumentation. In

Computational Models of Argument, pages 243–254.

IOS Press.

Damjan, M. (2018). The interface between blockchain and

the real world. Ragion pratica, pages 379–406.

De Angelis, S. (2018). Assessing security and perfor-

mances of consensus algorithms for permissioned

blockchains. arXiv preprint arXiv:1805.03490.

Dung, P. M. (1995a). On the acceptability of arguments

and its fundamental role in non-monotonic reasoning,

logic programming and n-person games. Artificial In-

telligence, 77:321–357.

Dung, P. M. (1995b). On the acceptability of arguments

and its fundamental role in nonmonotonic reasoning,

logic programming and n-person games. Artificial in-

telligence, 77(2):321–357.

Ellis, S., Juels, A., and Nazarov, S. (2017). Chainlink a

decentralized oracle network.

Faratin, P., Sierra, C., and Jennings, N. R. (1998). Ne-

gotiation decision functions for autonomous agents.

Robotics and Autonomous Systems, 24(3-4):159–182.

Feenan, S., Heller, D., Lipton, A., Morini, M., Ram, R.,

Sams, R., Swanson, T., Yong, S., and Zalles, D. B.

(2020). Decentralized financial market infrastruc-

tures. The Journal of FinTech, Forthcoming.

GnosisDAO (2017). Gnosis whitepaper.

Gudgeon, L., Moreno-Sanchez, P., Roos, S., McCorry, P.,

and Gervais, A. (2020). Sok: Layer-two blockchain

protocols. In International Conference on Finan-

cial Cryptography and Data Security, pages 201–226.

Springer.

International Token Standardization Association (2021).

List of synthetix derivative tokens.

Kaci, S. and van der Torre, L. (2008). Preference-based

argumentation: Arguments supporting multiple val-

ues. International Journal of Approximate Reasoning,

48(3):730–751.

Kostovetsky, L. (2016). Whom do you trust?: Investor-

advisor relationships and mutual fund flows. The Re-

view of Financial Studies, 29(4):898–936.

Kurt Peker, Y., Rodriguez, X., Ericsson, J., Lee, S. J., and

Perez, A. J. (2020). A cost analysis of internet of

things sensor data storage on blockchain via smart

contracts. Electronics, 9(2):244.

Mansour, K. and Kowalczyk, R. (2011). A meta-strategy

for coordinating of one-to-many negotiation over mul-

tiple issues. In Foundations of Intelligent Systems,

pages 343–353. Springer.

Matt, P.-A., Morge, M., and Toni, F. (2010). Combining

statistics and arguments to compute trust. In Pro-

ceedings of the 9th International Conference on Au-

tonomous Agents and Multiagent Systems: volume 1-

Volume 1, pages 209–216. Citeseer.

Morini, M. (2017). Managing derivatives on a blockchain.

a financial market professional implementation. A Fi-

nancial Market Professional Implementation (May 5,

2017).

Najjar, A., Serpaggi, X., Gravier, C., and Boissier, O.

(2013). Multi-agent negotiation for user-centric elas-

ticity management in the cloud. In 2013 IEEE/ACM

6th International Conference on Utility and Cloud

Computing, pages 357–362. IEEE.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic

cash system.

Intelligent Human-input-based Blockchain Oracle (IHiBO)

525

Nelaturu, K., Adler, J., Merlini, M., Berryhill, R., Veira,

N., Poulos, Z., and Veneris, A. (2020). On public

crowdsource-based mechanisms for a decentralized

blockchain oracle. IEEE Transactions on Engineer-

ing Management, 67(4):1444–1458.

Nofal, S., Atkinson, K., and Dunne, P. E. (2014). Algo-

rithms for argumentation semantics: labeling attacks

as a generalization of labeling arguments. Journal of

Artificial Intelligence Research, 49:635–668.

Oprea, S.-V., B

ˆ

ara, A., and Andreescu, A. I. (2020).

Two novel blockchain-based market settlement mech-

anisms embedded into smart contracts for securely

trading renewable energy. IEEE Access, 8:212548–

212556.

Palmieri, R. (2009). Regaining trust through argumentation

in the context of the current financial-economic crisis.

Studies in Communication Sciences, 9(2):59–78.

Parsons, S., McBurney, P., and Sklar, E. (2010). Reason-

ing about trust using argumentation: A position paper.

In International Workshop on Argumentation in Multi-

Agent Systems, pages 159–170. Springer.

Peterson, J. and Krug, J. (2015). Augur: a decentralized,

open-source platform for prediction markets. arXiv

preprint arXiv: 1501.01042.

Pop, C., Pop, C., Marcel, A., Vesa, A., Petrican, T., Cioara,

T., Anghel, I., and Salomie, I. (2018). Decentraliz-

ing the stock exchange using blockchain an ethereum-

based implementation of the bucharest stock ex-

change. In 2018 IEEE 14th International Conference

on Intelligent Computer Communication and Process-

ing (ICCP), pages 459–466. IEEE.

Priem, R. (2020). Distributed ledger technology for securi-

ties clearing and settlement: benefits, risks, and regu-

latory implications. Financial Innovation, 6(1):1–25.

Provable Things Limited (2019). Provable.

Pruitt, D. G. (2013). Negotiation behavior. Academic Press.

Robinson, P. and Ramesh, R. (2021). General purpose

atomic crosschain transactions. In 2021 IEEE Interna-

tional Conference on Blockchain and Cryptocurrency

(ICBC), pages 1–3. IEEE.

Rubinstein, A. (1982). Perfect equilibrium in a bargaining

model. Econometrica: Journal of the Econometric

Society, pages 97–109.

Sedlmeir, J., Ross, P., Luckow, A., Lockl, J., Miehle, D.,

and Fridgen, G. (2021). The dlps: a new framework

for benchmarking blockchains.

Singh, A., Click, K., Parizi, R. M., Zhang, Q., Dehghan-

tanha, A., and Choo, K.-K. R. (2020). Sidechain tech-

nologies in blockchain networks: An examination and

state-of-the-art review. Journal of Network and Com-

puter Applications, 149:102471.

Tang, Y., Cai, K., Sklar, E., McBurney, P., and Parsons,

S. (2010). A system of argumentation for reasoning

about trust. In Proceedings of the 8th European Work-

shop on Multi-Agent Systems, Paris, France.

Tom, R. J., Sankaranarayanan, S., and Rodrigues, J. J.

(2020). Agent negotiation in an iot-fog based power

distribution system for demand reduction. Sustainable

Energy Technologies and Assessments, 38:100653.

Toyoda, K., Machi, K., Ohtake, Y., and Zhang, A. N.

(2020). Function-level bottleneck analysis of private

proof-of-authority ethereum blockchain. IEEE Ac-

cess, 8:141611–141621.

van der Torre, L. and Vesic, S. (2017). The principle-based

approach to abstract argumentation semantics. FLAP,

4(8).

Wall, E. and Malm, G. (2016). Using blockchain technol-

ogy and smart contracts to create a distributed securi-

ties depository.

Weiss, G. (2013). Multiagent Systems. MIT Press.

Wellman, M. P., Greenwald, A., and Stone, P. (2007). Au-

tonomous bidding agents: Strategies and lessons from

the trading agent competition. Mit Press.

Werner, S. M., Perez, D., Gudgeon, L., Klages-Mundt,

A., Harz, D., and Knottenbelt, W. J. (2021).

Sok: Decentralized finance (defi). arXiv preprint

arXiv:2101.08778.

Wilkinson, M. D., Dumontier, M., Aalbersberg, I. J., Apple-

ton, G., Axton, M., Baak, A., Blomberg, N., Boiten,

J.-W., da Silva Santos, L. B., Bourne, P. E., et al.

(2016). The fair guiding principles for scientific data

management and stewardship. Scientific data, 3(1).

Wooldridge, M. (2009). An introduction to multiagent sys-

tems. John wiley & sons.

Yu, L., Markovich, R., and Van Der Torre, L. (2020). In-

terpretations of support among arguments. In Legal

Knowledge and Information Systems, pages 194–203.

IOS Press.

Yu, L. and van der Torre, L. (2020). A principle-based ap-

proach to bipolar argumentation. In NMR 2020 Work-

shop Notes, page 227.

Yu, L., Zichichi, M., Markovich, R., and Najjar, A. (2022).

Enhancing trust in trust services: Towards an intelli-

gent human-input-based blockchain oracle (ihibo). In

Hawaii International Conference on System Sciences

2022 (HICSS-55). To appear.

Zheng, Z., Xie, S., Dai, H.-N., Chen, W., Chen, X., Weng,

J., and Imran, M. (2020). An overview on smart con-

tracts: Challenges, advances and platforms. Future

Generation Computer Systems, 105:475–491.

Zichichi, M. (2021). miker83z/IHiBO: Intelli-

gent Human-input-based Blockchain Oracle.

https://github.com/miker83z/IHiBO.

Zichichi, M., Ferretti, S., and D’Angelo, G. (2020a). Are

Distributed Ledger Technologies Ready for Intelligent

Transportation Systems? In Proc. of the 3rd Workshop

on Cryptocurrencies and Blockchains for Distributed

Systems (CryBlock 2020), co-located with the 26th

Annual International Conference on Mobile Comput-

ing and Networking (MobiCom 2020), ACM, pages 1–

6. ACM.

Zichichi, M., Ferretti, S., and D’Angelo, G. (2020b). A

framework based on distributed ledger technologies

for data management and services in intelligent trans-

portation systems. IEEE Access, 8:100384–100402.

SDMIS 2022 - Special Session on Super Distributed and Multi-agent Intelligent Systems

526