Benchmarking Consumer Data and Privacy Knowledge in Connected

and Autonomous Vehicles

Flora Barber and Steven Furnell

School of Computer Science, University of Nottingham, U.K.

Keywords: Connected and Autonomous Vehicles, Data Privacy, User Acceptance, Consumer Behaviour.

Abstract: Connected and Autonomous Vehicles (CAVs) and their features are integrating into the conventional personal

vehicle market, irrevocably transforming the definition of a vehicle. However, consumers have been routinely

omitted from stakeholder research and their understanding of CAV’s data implications has been understudied.

This paper addresses this through benchmarking the consumer’s current data and privacy knowledge with a

survey, focus group, and analysis of privacy provisions available to consumers from manufacturers, where it

found the materials insufficient. Using thematic analysis, this consultation of 168 survey respondents from

14 countries established the consumer’s need to be ‘Informed’, with further sub-themes of ‘Given

Information’, ‘Information Requirements’, ‘Privacy Communications’, and ‘Privacy Control’. A follow-up

focus group of 6 participants identified a further four themes of ‘Disinterest’, ‘Distrust’, ‘Impact’, and

‘Vehicle Perception’. This paper recommends industry prioritisation of consumer education and engagement

with data privacy to maximise public trust, including the introduction of vehicle specific data protection

legislation, government level assurance of manufacturer compliance, and use of the manufacturer’s app to

control privacy. Consumers purchasing a vehicle must be made aware of its data transmission, collection, and

protection technologies.

1 INTRODUCTION

As connectivity and autonomy are newer additions to

vehicular design, concerns have been raised by

researchers that security has become an afterthought

(Karnouskos & Kerschbaum, 2017) (Strandberg,

Olovsson & Jonsson, 2018). With autonomous

vehicles collecting a gigabyte of data per second

(Boom, 2015) and monetization of this data forecast

to be worth $750 billion by 2030 (Bertoncello,

Camplone, Gao, Kaas, Mohr, Moller & Wee 2016),

45% of new buyers express concern about the

detriment to their privacy that these new technologies

have (Dean, 2017). Consumers are already

challenged to understand the data privacy options

available to them on the devices they currently use. It

is, therefore, vital to take a consumer-centric

approach and consult the stakeholders themselves in

order to ascertain their knowledge and improve the

public’s confidence in Connected and Autonomous

Vehicles (CAVs). In order for their deployment to be

a success consumers and users of the vehicles must

be allowed to make informed decisions about their

data. This paper aims to address the above gaps by

creating a consumer data and privacy knowledge

benchmark through consumer consultation.

The study evaluates the consumer’s awareness,

understanding, and recognition of data-collecting

CAV features in their own vehicles, their experience

of their vehicle manufacturer’s privacy materials, and

what they value as important to improving consumer

engagement with vehicular data privacy. The findings

suggest that current privacy provisions and materials

insufficiently engage and inform consumers about

vehicular data use and collection. The consumer’s

understanding has not kept up with the pace of

innovation that is enabling once isolated vehicles to

become more connected and autonomous. The

participants suggested a variety of approaches to

engage consumers with their vehicular privacy and to

build trust in manufacturers. The findings

compliment those from interviews with CAV experts

about cyber security and privacy in CAVs (Liu et al.

2020), and the more generalised study by Maeng et

al. (2021) into consumers’ attitudes towards CAV

information security threats.

Following an overview of related work, is an

examination of privacy-related materials from

vehicle manufacturers. The methodology for survey

426

Barber, F. and Furnell, S.

Benchmarking Consumer Data and Privacy Knowledge in Connected and Autonomous Vehicles.

DOI: 10.5220/0010862000003120

In Proceedings of the 8th International Conference on Information Systems Security and Privacy (ICISSP 2022), pages 426-434

ISBN: 978-989-758-553-1; ISSN: 2184-4356

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

and focus group activities are described in Section 4,

with results then presented in Section 5. The paper

concludes with a series of related recommendations.

2 RELATED WORK

Drivers can be fingerprinted with 100% accuracy

solely on 8 minutes of brake pedal data (Enev et al.,

2016), purely acceleration data (Virojboonkiate et al.,

2017), a combination of sensors (Pesé & Shin, 2019),

or mapping the location of journeys without GPS

either through fog nodes data near the vehicle’s

journey (Butt, Iqbal, Salah, Aloqaily, & Jararweh,

2019) or from vehicle speed, waiting at traffic lights,

and turns (Bellatti et al., 2017). This reveals that users

can be identified by data that is not classed as

personal under current GDPR regulations. In light of

the Facebook-Cambridge Analytica data scandal and

the multimillion fines against technology

corporations for breaching data protection rules

(Beato, 2013), consumers are wary of their data’s

security, from it being sold to third parties to turning

the relatively anonymous and private space of a

vehicle into a means of surveillance to profile and

predict their behaviour (Collingwood, 2017) (Glancy,

2012).

Current automotive manufacturer privacy polices

fail to define the “legitimate business purposes” used

as a reason for collecting data (Booz Allen Hamilton,

2019). Further research has found that no original

equipment manufacturer (OEM) details the data it is

collecting, who has access to or uses it, the security in

place to protect it, or that real time querying may

occur unknown to the consumer, despite researchers

discovering that this data could be accessed via the

vehicle’s VIN at a car dealer (Frassinelli et al., 2020).

The importance of CAV consumer training has

been identified, but not prioritised, by the United

Nations Economic and Social Council (ECOSOC)

World Forum for Harmonization of Vehicle

Regulations (UNECE, 2019). The Society of Motor

Manufacturers and Traders has called on the UK

Government to provide consumers with materials to

increase public confidence in industry, data privacy,

and the safety provisions of CAVs (SMMT, 2017).

Consumer trust, readiness, and acceptability is

one of 10 priority areas that has been identified by

researchers as imperative to the success of CAVs

(Nikitas, 2020). The proposed assurance framework

for assessing a CAV’s cyber security level, known as

the 5StarS initiative, is designed to support

consumers and insurers in understanding the cyber

security risk for vehicles that have been

independently tested under the framework, yet omits

consumers from its stakeholder research (5StarS,

2019). Consumers are at risk of their data being

targeted by hackers for purposes of extortion,

increasing the credibility of targeted social

engineering attacks, burglary, and exploitation as a

back door into companies for intellectual property or

data theft (Kam, 2016).

As the average vehicle life span is 13.9 years, a

figure exceeding that of many operating systems, new

vehicle specific security systems must be flexible to

change and work consistently to protect the vehicle

user’s data (SMMT, 2016). Researchers propose

vehicle specific solutions such as a Differentially

Private Data Streaming (DPDS) system to address

privacy weakness in distributed edge computing,

guaranteeing privacy levels over time as well as when

vehicles dynamically move over time (Ghane et al.,

2020), a start, predict, mitigate, and test (SPMT)

system to predict and mitigate vulnerabilities

systematically (Strandberg et al., 2018), and an

architecture (CARAMEL) that detects attacks,

provides in-vehicle anti-hacking measures, and real-

time validation of the integrity of the vehicle’s data

transmissions (Vitale et al., 2020).

Such solutions are part of a number of tools that

need to be considered. It is crucial that regulation is

brought up-to-date to reassure consumers and

demonstrate respect for user privacy, ensuring that

the consumer and users of CAVs have control over all

aspects of their data (Collingwood, 2017)

(Karnouskos & Kerschbaum, 2017).

3 DATA PRIVACY

INFORMATION AVAILABLE

TO CONSUMERS

It is vital to understand the resources currently

available to consumers in order to contextualise their

knowledge as benchmarked by this study. Six

manufacturers (namely Audi, BMW, Ford, Tesla,

Toyota and Volvo) were selected to represent a range

of vehicles in production. These represent a selection

of manufacturing groups from the top 15 ‘Most

innovative Automotive OEMs of 2021’, as ranked by

the Center of Automotive Management (CAM,

2021), and from the top 15 manufacturers by market

capitalisation (Ghosh, 2021). The owner’s manual

and privacy policies for these manufacturers were

evaluated from a consumer’s perspective for their

ease of use when locating privacy information, as

well as the details covered in the material. All

Benchmarking Consumer Data and Privacy Knowledge in Connected and Autonomous Vehicles

427

documentation was manually evaluated using

document analysis by one researcher. The vehicles

chosen for analysis were:

• Audi A6 – 2021, Executive (Audi, 2021)

• BMW i3 Electric – 2015, Small Family Car

(BMW, 2015)

• Ford Focus – 2021, Small Family Car (Ford,

2021)

• Tesla Model 3 – 2021, Large Family Car (Tesla,

2021)

• Toyota Corolla - 2020, Small Family Car (Toyota,

2020)

• Volvo XC40 – 2021, Small Off-Road (Volvo,

2021)

The findings are summarised in Table 1 and the

parameters are grouped into the three main outlets of

privacy information that vehicle manufacturers

provide: the in-vehicle infotainment system, the

vehicle handbook/owner’s manual, and the

manufacturer’s website. The results for each

parameter are based on the joint findings from the

selected owner’s manuals and privacy policies. The

infotainment system has three main parameters, for

which the results were based on the information

provided in the owner’s manuals. Access to an

electronic copy of the owner’s manual was

determined to establish the ways in which consumers

can find privacy information in-vehicle. Access to

privacy information and settings from the

infotainment system determined if the consumer

could control the data transmitted from their vehicle.

The infotainment and manufacturer’s websites were

jointly checked for software release notes

availability. These notes are an important method of

engaging consumers with their vehicle and with their

data privacy by understanding the functions and

abilities their vehicle possess and the cyber security

protections in place. The manufacturer’s websites

were judged for their signposting and ease of

navigating the privacy policy. Lack of these factors

may dissuade consumers from engaging with privacy

information and weaken their privacy knowledge.

The websites were also analysed for material that

emphasised the importance of removing personal data

from a vehicle before sale, thus protecting the

consumer’s data. The owner’s manual was checked

for the same emphasis as well as how to complete this

procedure. The selected owner’s manuals were

analysed for the inclusion of information about

vehicular privacy, Event Data Recorders, and how to

update the vehicle, including references to full copies

of the manufacturer’s privacy policy. It is important

that all data collecting and recording features in the

vehicle are clearly explained to the consumer, as well

as where they can access further privacy information.

Vehicle software update procedures are important in

maintaining the cyber security protections of the

vehicle, protecting the consumer’s privacy and data.

Table 1: Summary of the privacy information available to

the consumer from selected manufacturers.

Criteria

Manufacture

r

A B F Te To V

Infotainment system

Access to e-copy of

owner's manual in-

vehicle?

N Y N Y N Y

Access privacy info and

settin

g

s in-vehicle?

Y P Y Y N Y

Software release notes

available

P N N Y N Y

Owner's manual

Privacy information

include

d

Y P Y Y P Y

Dedicated chapter on

data protection

Y N Y N N Y

References on where to

find full privacy polic

y

Y N Y Y N Y

Event Data Recorder

information

Y Y Y P P Y

Includes how to remove

personal data stored in

vehicle

N Y Y Y N Y

Information on how to

update vehicle

Y N Y Y N Y

Clear who is

responsible for updating

the vehicle

N N N Y N N

Manufacturer's

website

Ease of privacy policy

navigation

N Y N Y Y Y

Emphasis on personal

data removal

N N Y N Y N

Software release notes

available

N Y N N N Y

Key: Y=Yes, N=No, P=Partially available depending on

regions or vehicle, and manufacturers (A=Audi, B=BMW,

F=Ford, Te=Tesla, To=Toyota, V=Volvo).

Owner’s manuals were checked for clear signposting

to privacy information through the use of dedicated

chapters detailing the vehicle’s data protections.

ICISSP 2022 - 8th International Conference on Information Systems Security and Privacy

428

Audi’s owner’s manual contained multiple prompts

to remove personal data before sale, and the privacy

information was generally well written. However, the

advice about software update responsibility was

conflicting and the privacy policy was very difficult

to find. BMW’s online offerings were much easier to

navigate with hyperlinked buttons and subdivided

sections. The owner’s manual was devoid of privacy

information despite having ‘ConnectedDrive’

features. Ford’s manual contained a ‘Data Privacy’

chapter which was thorough and detailed. Only

software updating responsibility was omitted. All of

Ford’s online provisions are available from their one-

stop resource ‘Terms & Privacy Policy Hub’ (Ford,

2021). Whilst very clear, the density of the

documentation could be better subdivided with the

use of hyperlinked sections. Only Telsa specified who

is responsible for software updates, but they lacked a

dedicated data privacy section in the manual. Tesla’s

online provisions were extremely clear and organised

to minimise information fatigue. Toyota’s website

placed significant focus on deleting personal data

before selling your vehicle, but this information, and

some of the privacy policies inferred, were not easily

found. Toyota’s owner’s manual provided the least

amount of privacy information of those compared. In

contrast, Volvo’s materials were very comprehensive

throughout, including provision of a software release

notes finder. However, Volvo did not make clear who

should be responsible for updating the vehicle.

4 ASSESSING CONSUMER

AWARENESS

Following on from ascertaining the information

available to the public, this section details the survey

and focus group consumer consultations. A thematic

analysis approach was chosen to evaluate the

resulting qualitative data, allowing for rich thematic

discussions of consumer knowledge (Braun &

Clarke, 2006). A primarily inductive analysis method

was used to allow for data-driven results without a

pre-existing coding framework, although it is

acknowledged that aspects of deductive analysis were

required to ensure the themes’ relevance. (Byrne,

2021). The analysis performed combines semantic

and latent approaches to identifying meanings in data,

recognising both the levels of explicit meaning and

underlying assumptions that the respondents hold

(Braun & Clarke, 2006). This approach is important

to ascertaining how consumers understand privacy in

the context of their vehicles and if the current

provisions identified are effective or influential.

The wider contextual influences expressed on a

latent level are important to establishing the

reasoning behind the quantitative results of the

survey. As only a single researcher coded and

analysed the resulting data there was a significant risk

of bias being introduced. This has been minimised

through using Braun and Clarke’s six ‘Phases of

Thematic Analysis’ to structure the process of coding

and analysis (2006). The manual coding method was

replaced by the use of NVivo 12 Pro as the themes

became more numerous and more difficult to track.

The software enabled a more flexible and detailed

hierarchical organisation of themes, as well as a better

adhesion to the six ‘Phases of Thematic Analysis’

(Braun & Clarke, 2006). This method also preserved

responses that were divergent from themes with a

greater number of coded references, which is

imperative to creating a comprehensive benchmark

that accurately reflects the market CAVs are entering.

All responses were anonymous, and no personal

data was collected from respondents. Participants

were recruited from social media, where the survey

link and focus group were advertised from the

researcher’s account. Convenience sampling was

primarily used alongside snowballing sampling.

Participant’s consent was obtained before both the

survey and the focus group, and a pilot survey was

conducted prior to the primary version.

4.1 Consumer Survey

The online consumer survey, titled ‘Surveying

Vehicular Data Privacy and the Consumer’, consisted

of seven sections: the participant information sheet,

demographic details, the participant’s primary

vehicle, privacy in relation to the primary vehicle,

general privacy questions, improving current privacy

provisions, and contact information for joining the

virtual focus group. These sections aimed to evaluate

consumer awareness of connected and autonomous

features in their own vehicles, their current

understanding and recognition of vehicular data

collection and privacy, their experience of current

privacy provisions and materials from manufacturers,

and what is important to improving the consumer’s

engagement with their data privacy.

Question branching was used to ensure the survey

was asking suitable questions (e.g. not asking about

experiences of manufacturer’s privacy policies if they

had answered ‘No’ or ‘I am unsure of what that is’ to

the question ‘Are you aware of what a privacy policy

Benchmarking Consumer Data and Privacy Knowledge in Connected and Autonomous Vehicles

429

is?’). Multiple choice questions with option shuffling

to minimise bias was the primary question type used.

The primary consumer survey of 28 questions was

conducted from 5

th

– 19

th

August 2021, receiving 168

responses from 14 countries.

4.2 Focus Group

A small focus group was used to expand upon and

investigate further the identified themes, generating a

more detailed insight into consumer’s knowledge,

differing from the interviews of CAV experts

conducted by Liu et al (2020). The content of the

focus group was semi-structured around key

questions, developed from the data of the initial

survey results, and a supporting presentation. The

focus group began with more open questions and

gradually increased the level of structure whilst

allowing for spontaneous pursual of any points raised

of interest. The questions concluded with a highly

structured scenario based question where two

vehicles, a vehicle with and without CAV features,

were compared under given circumstances.

The focus group was conducted in August 2021

with 6 participants and lasted 1 hour 15 minutes. The

majority of participants identified as male, with only

one participant identifying as female. All were from

different undergraduate backgrounds and

professions, including areas such as business, the

humanities and sciences, environmental science, and

the vehicle manufacturing industry. None of the

participants were experts in the area of CAVs.

5 RESULTS

This section details and discusses the results of the

consumer survey and the focus group, which

incorporate quantitative survey results to support the

primary qualitive thematic analysis.

5.1 Consumer Survey

Of the 168 respondents of the survey 69% drive a

vehicle. Despite only 8% of drivers reporting that

current privacy provisions are sufficient, only 5% of

respondents who say they drive a vehicle with privacy

settings have changed their in-vehicle settings, whilst

the remaining 95% of respondents report never

having changed or looked at such settings. 29% of

respondents did not know if their vehicle had this

optionality. As only 14% of drivers had read and 52%

partially read their vehicle handbook, many may be

unaware that such privacy controls exist. Groups with

particularly low engagement with their vehicle

handbook included drivers who neither own nor lease

the primary vehicle they drive and those who drive

monthly or less frequently than monthly. Despite the

lack of engagement with the owner’s manual, it was

the second most popular place (33%) respondents

aware of what a privacy policy is said they would

look for privacy information. Those who owned their

primary vehicle and those who drive weekly were

more likely to read a vehicle handbook.

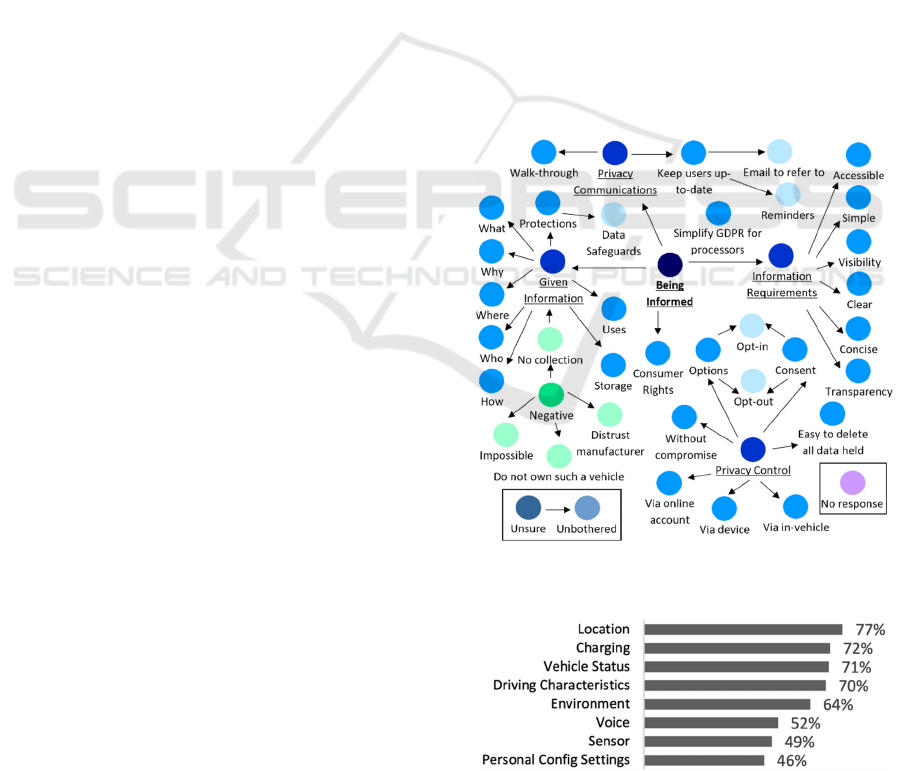

The primary overarching theme of the question

‘What would help you feel in control of your data?’,

was that respondents needed to be ‘Informed’. 85%

of responses relate to the themes of ‘Given

Information’, ‘Information Requirements’, ‘Privacy

Communications’, and ‘Privacy Control’, which are

summarised in Figure 1. 35% of all respondents

wanted the information provided to specifically

address how their data is being used, where it is

stored, who has access to it, why it is being collected,

and what is being collected from their vehicle. When

asked which data types the respondents thought

vehicle manufacturers collect from modern vehicles,

the most chosen type was location data (77%). All the

Figure 1: Thematic map of the responses to ‘What would

help you feel in control of your data?’.

Figure 2: Data that respondents believe is collected by

manufacturers from modern vehicles.

ICISSP 2022 - 8th International Conference on Information Systems Security and Privacy

430

data types listed are collected by manufacturers. The

question’s full results are presented in Figure 2.

A similar question that asked respondents who

drive about the features of their primary vehicle also

highlighted this uncertainty. All the features listed in

the question collected data from the vehicle. The

‘built-in SIM’ feature had the highest level of

uncertainty (43% responded with “I don’t know”)

concerning whether the primary vehicle had such a

feature, with an average of 17% of respondents being

unsure about any of the listed features. Drivers with a

vehicle aged 5 years old or newer had a particularly

high rate of uncertainty about the data collecting

features of their vehicle, answering with “I don't

know” if their vehicle had the listed features to 23%

of the listed features. There were no respondents who

reported having a primary vehicle with all the features

listed. These levels of uncertainty about the data

collecting features of the respondent’s primary

vehicle correlates with the 20% of respondents who

wanted to know exactly what data was being

collected in order to feel in control of their data.

Whilst 28% of the primary vehicles reported in this

survey were 11 years old or older and may currently

only include few of the listed features, the average

age of a vehicle at scrappage is only 13.9 years and

therefore these drivers may soon be replacing their

vehicle with one that may have such features (SMMT,

2016).

Privacy information provided should follow key

guidelines, ensuring that the information is more

visible and accessible to the consumer from the

manufacturer’s website, written clearly and concisely

in ‘layman’s terms’ using ‘simple language and

expression’, and is without the use of ‘jargon’.

Despite these responses requiring more concise and

clear privacy information, ‘Brevity of policies’ was

the least chosen factor regarding data use by

manufacturers in the survey with only 20% of the 168

respondents regarding it as one of the most important

factors to them. Transparency from the manufacturer

at every stage was prioritised by as one of the most

important factors by 77% of respondents and

specified by 12% as crucial to enabling them to take

control of their data. Despite privacy information

being available from the website, and this being the

preferred communication method of a third of

respondents, only 3 had actually checked this source.

Participants also expressed a need to be able to

control their data privacy from different places, such

as in the vehicle, from a mobile device, and/or from

an online account. 26% of respondents specifically

noted the need for opt-in or opt-out options to enable

them to control the data collected from their vehicles.

These results correspond with 70% of respondents

prioritising 'Clear opt-out information' as the second

most important factor of their data use by vehicle

manufacturers.

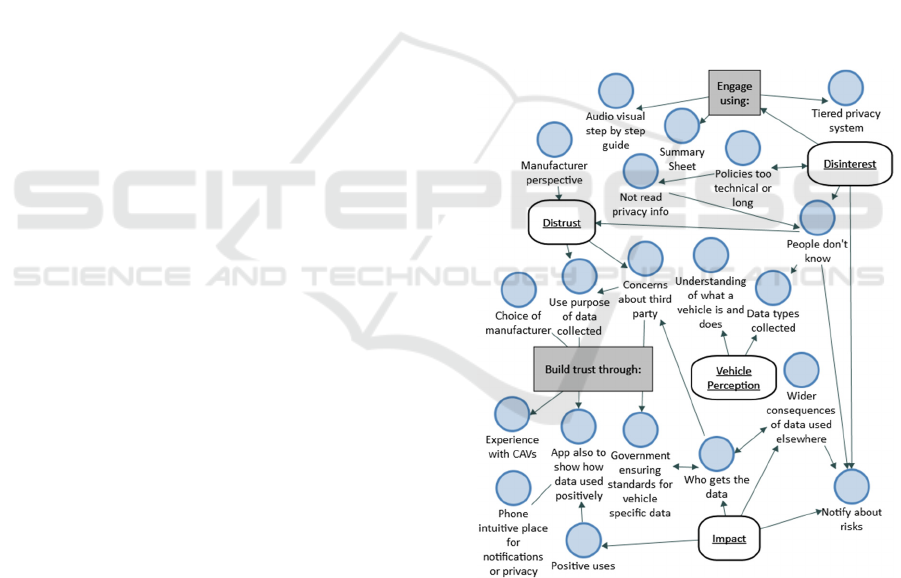

5.2 Focus Group

The four key themes, summarised in Figure 3, were

identified from the focus group as: ‘Disinterest’,

‘Distrust’, ‘Impact’, and ‘Vehicle Perception’.

Participants expressed that disinterest forms from

two distinct branches – uninterest in data privacy due

to the technical wording and length of the current

policies, and disinterest from not experiencing data

misuse or that they are not at risk of harm if their data

was misused. This correlates with the survey results,

where only 57% of respondents who drive know what

a privacy policy is, and of those only 3 respondents

had read their vehicle manufacturer’s privacy policy.

Of the 116 respondents who drive, only 2 had

changed their in-vehicle privacy settings.

Figure 3: Focus Group Thematic map.

One participant described their reluctance towards

CAVs as stemming from having ‘grown up knowing

what the risks are with cyber’. Another participant

suggested ‘some sort of tiered system’ for privacy

settings, similar to that used for cookies on website,

where each tier relates according to personal attitudes

towards risk, as an approach to increasing

engagement with data privacy. The group also

Benchmarking Consumer Data and Privacy Knowledge in Connected and Autonomous Vehicles

431

discussed using the vehicle manufacturer’s app as a

more native environment for vehicular privacy

controls, as one participant noted that drivers may not

associate a vehicle with data privacy. The disjointed

relationship between modern, connected vehicles and

those that participants have grown up with again

contributes to the belief that privacy concerns are not

relevant for vehicles and their users.

Participants discussed the need for transparency,

honesty, and frankness about the potential risks

involved as a way of motivating consumers, as well

as requiring that vehicle manufacturers to show what

is being done to protect consumers’ data. Participants

expressed that their distrust in manufacturers and

third parties could be remedied through government

assurance and through manufacturers using their apps

to demonstrate the benefits of sharing data, such as

‘early intervention’ system for mechanical issues or

the eCall system. One participant was concerned

about the interdependence of the data transmitted

used in other systems, such as the collection of voice

command data and voice ID authentication for

banking. Another was concerned about the impact of

data theft or tracking for CAV users who are in

witness protection or are being stalked. Participants

who had experienced or grown up with CAVs were

more comfortable with vehicular data collection.

The understanding of what a vehicle is carried a

significant amount of uncertainty about the data that

may be collected. What was an isolated system is now

able to connect with other vehicles, infrastructure,

and/or manufacturers as part of a wide range of

services and features. The consumer’s understanding

of this has not caught up with the fast pace of vehicle

development, with associations of CAVs being

limited to futuristic, expensive, or ‘flashy’ vehicles.

6 CONCLUSIONS AND

RECOMMENDATIONS

CAVs are representative of a scale of disruptive,

pervasive, and integrated technologies that are

present in vehicles both on the market and on the

road, as well as those in concept. Vehicle

manufacturers must ensure their privacy information

is clearly visible, accessible, written with simple

expression, provides examples, is transparent, and

easily navigated through. This information must be

accessible from multiple places, with

recommendations for use in their mobile applications.

Manufacturers should use their app to actively engage

consumers and show the consumer how their data is

being used. An opt-in, tiered system of privacy

controls based on risk levels is recommended.

Information about privacy and the data collection

activities of a vehicle must be available at the time of

the vehicle’s purchase. The manufacturer must make

the consumer aware of how to remove personal data

from their vehicle, how to change the privacy settings

in their vehicle, how to find privacy information, and

told who to contact regarding privacy questions or

concerns. Extra support is recommended for those

unfamiliar with connected vehicles. An in-vehicle

and/or in-app walkthrough of the data transmitting

features and privacy settings is recommended for all

consumers purchasing a vehicle with CAV features.

Future research may further consider the data

stored in-vehicle and on applications in the vehicle

infotainment system, as well as the privacy issues that

may be additionally added by the use of the vehicle

manufacturer’s associated mobile applications.

Future work may consider examining how other

fields are attempting to engage the public with their

cyber security and if any approaches may address the

barriers respondents raised. Future research may also

be conducted into mapping the changing data and

privacy knowledge of consumers through repeating

the survey and focus group at periodic intervals,

especially as CAVs become more commonplace.

REFERENCES

5StarS. (2019). A Roadmap to Resilience: How the

Automotive Sector can build trust in Connected

Vehicles. 5StarS White Paper. https://5starsproject.

com/wp-content/uploads/2019/06/5StarS_WhitePaper

_12_6_19.pdf (accessed 9 June 2021).

Audi. (2021). 2021 Audi A6 – Owner’s Manual [PDF file].

Retrieved from https://ownersmanuals2.com/audi/a6-

2021-owners-manual-78210/.

Audi. (2021). Data Protection Notice Audi Connect [Web

page]. https://www.audi.com/en/privacy-audi-

connect.html (accessed 22 August 2021).

Beato, G. (2013). Google's Driverless Future: Will self-

piloting vehicles rob us of the last of our privacy and

autonomy? Reason. https://reason.com/2013/05/10/

googles-driverless-future/ (accessed 9 June 2021).

Bellatti, J., Brunner, A., Lewis, J., Annadata, P.,

Eltarjaman, W., Dewri, R., & Thurimella, R. (2017).

Driving Habits Data: Location Privacy Implications

and Solutions. IEEE Security and Privacy, 15(1), 12-

20.

Bertoncello, M., Camplone, G., Gao, P., Kaas, H., Mohr,

D., Moller, T., & Wee, D. (2016). Monetizing car data.

McKinsey & Company. https://www.mckinsey.com/

industries/automotive-and-assembly/our-

insights/monetizing-car-data (accessed 9 June 2021).

ICISSP 2022 - 8th International Conference on Information Systems Security and Privacy

432

BMW. (2015). The BMW i3. Owner’s Manual [PDF file].

Germany: Bayerische Motoren Werke. Retrieved from

https://www.i3guide.com/pdf/BMWi3-owners-

manual.pdf.

BMW. (2021). BMW Privacy Policy [Web page].

https://www.bmw.co.uk/en/footer/legal/privacy-

policy.html (accessed 22 August 2021).

Boom, F. (2015). If Autonomous Cars Could Talk! 135

Privacy Laws & Business International 17, 17.

Booz Allen Hamilton. (2019). Driving Away with Your

Data: Privacy and Connected Vehicles. United States

Government Accountability Office: Report to the

Subcommittee on Research and Technology,

Committee on Science, Space, and Technology, House

of Representatives, GAO-17-656 https://www.gao.gov/

assets/gao-17-656.pdf (accessed 9 June 2021).

Braun, V., & Clarke, V. (2006). Using thematic analysis in

psychology. Qualitative Research In Psychology, 3(2),

77-101.

Butt, T. A., Iqbal, R., Salah, K., Aloqaily, M., & Jararweh,

Y. (2019). Privacy Management in Social Internet of

Vehicles: Review, Challenges and Blockchain Based

Solutions. In IEEE Access, 7, 79694-79713.

Byrne, D. (2021). A worked example of Braun and Clarke’s

approach to reflexive thematic analysis. Quality &

Quantity, 1-22.

Centre of Automotive Management. (2021).

AutomotiveINNOVATIONS: Ranking of the most

innovative automotive OEMs and premium brands

2021 [Web article]. Retrieved from https://auto-

institut.de/automotiveinnovations/automotiveinnovatio

ns-ranking-of-the-most-innovative-automotive-oems-

and-premium-brands-2021/.

Collingwood, L. (2017). Privacy implications and liability

issues of autonomous vehicles. Information &

Communications Technology Law, 26(1), 32-45.

Dean, B., C. (2017). Three Core Security & Privacy Issues

of Connected Vehicles. Center for Democracy &

Technology. https://cdt.org/insights/three-core-

security-privacy-issues-of-connected-vehicles/

(accessed 9 June 2021).

Enev, M., Takakuwa, A., Koscher, K., & Kohno, T. (2015).

Automobile Driver Fingerprinting. Proceedings On

Privacy Enhancing Technologies, 2016(1), 34-50.

Ford Motor Company. (2020). FORD FOCUS Owner's

Manual (Vehicles Built From: 15-03-2021) [PDF File].

Retrieved from https://www.fordservicecontent.com/

Ford_Content/Catalog/owner_information/CG3784en-

202012-20201221153253.pdf.

Ford. (2021). Terms & Privacy Policy Hub [Web page]

https://www.ford.co.uk/useful-information/terms-and-

privacy-policy-hub#PrivacyPolicies (accessed 22

August 2021).

Frassinelli, D., Park, S., & Nürnberger, S. (2020). I Know

Where You Parked Last Summer: Automated Reverse

Engineering and Privacy Analysis of Modern Cars.

IEEE Symposium on Security and Privacy, 1401-1415.

Ghane, S., Jolfaei, A., Kulik, L., Ramamohanarao, K., &

Puthal, D. (2020). Preserving Privacy in the Internet of

Connected

Vehicles. IEEE Transactions on Intelligent

Transportation Systems, 1-10.

Ghosh, I. (2021). The World’s Top Car Manufacturers by

Market Capitalization [Web article]. Retrieved from

https://www.visualcapitalist.com/worlds-top-car-

manufacturer-by-market-cap/.

Glancy, D. J. (2012). Privacy in Autonomous Vehicles.

Santa Clara Law Review, 52(4), 1171-1239.

Kam, R. (2016). Connected cars: security and privacy risks

on wheels. IAPP. https://iapp.org/news/a/connected-

cars-security-and-privacy-risks-on-wheels/ (accessed 9

June 2021).

Karnouskos, S., & Kerschbaum, F. (2017). Privacy and

Integrity Considerations in Hyperconnected

Autonomous Vehicles. Proceedings of the IEEE,

106(1), 160-170.

Liu, N., Nikitas, A., & Parkinson, S. (2020). Exploring

expert perceptions about the cyber security and privacy

of Connected and Autonomous Vehicles: A thematic

analysis approach, Transportation Research Part F:

Traffic Psychology and Behaviour, 75, 66-86.

Maeng, K., Kim, W., & Cho, Y. (2021). Consumers’

attitudes toward information security threats against

connected and autonomous vehicles, Telematics and

Informatics, 63.

Nikitas, A., Michalakopoulou, K., Njoya, E. T., &

Karampatzakis, D. (2020). Artificial Intelligence,

Transport and the Smart City: Definitions and

Dimensions of a New Mobility Era. Sustainability,

12(7), 2789. MDPI AG.

Pesé, M.D. & Shin, K.G. (2019). Survey of Automotive

Privacy Regulations and Privacy-Related Attacks. SAE

Technical Paper, 2019-01-0479.

SMMT. (2016). 2021 Automotive Sustainability Report:

Average Vehicle Age. Retrieved from

https://www.smmt.co.uk/industry-

topics/sustainability/average-vehicle-age/.

SMMT. (2017). Connected and Autonomous Vehicles:

SMMT Position Paper. The Society of Motor

Manufacturers and Traders Limited, February 2017.

https://www.smmt.co.uk/wp-

content/uploads/sites/2/SMMT-CAV-position-paper-

final.pdf (accessed 25 May 2021).

Strandberg, K., Olovsson, T., & Jonsson, E. (2018).

Securing the Connected Car. IEEE vehicular

technology magazine, 56-65.

Tesla. (2021). Model 3 Owner’s Manual (Software version:

2021.24 Europe) [PDF file]. Retrieved from https://

www.tesla.com/sites/default/files/model_3_owners_m

anual_europe_en.pdf.

Tesla. (2021). Customer Privacy Notice [Web page].

https://www.tesla.com/en_gb/legal/privacy (accessed

22 August 2021).

Toyota. (2020). Toyota 2020 Corolla Owner's Manual

(OM12P10E) [PDF file]. Retrieved from https://

www.toyota.com/t3Portal/document/om-

s/OM12P10E/pdf/OM12P10E.pdf.

Toyota. (2021). Privacy Policy [Web page]. https://

www.toyota.co.uk/footer/privacy-policy (accessed 22

August 2021).

Benchmarking Consumer Data and Privacy Knowledge in Connected and Autonomous Vehicles

433

UNECE. (2019). Revised Framework document on

automated/autonomous vehicles, World Forum for

Harmonization of Vehicle Regulations, United Nations

Economic and Social Council, 3 September 2019.

https://unece.org/DAM/trans/doc/2019/wp29/ECE-

TRANS-WP29-2019-34-rev.1e.pdf (accessed 25 May

2021).

Virojboonkiate, N., Vateekul, P., & Rojviboonchai, K.

(2017) Driver Identification Using Histogram and

Neural Network from Acceleration Data. 17th IEEE

International Conference on Communication

Technology, 1560-1564.

Vitale, C., Piperigkos, N., Laoudias, C., Ellinas, G.,

Casademont, J., Khodashenas, P. S., ... Hofmann K.

(2020). The CARAMEL Project: a Secure Architecture

for Connected and Autonomous Vehicles. 2020

European Conference on Networks and

Communications (EuCNC), 133-138.

Volvo. (2021). XC40 Owner’s Manual [PDF file].

Retrieved from https://az685612.vo.msecnd.net/pdfs/2

0w17/XC40_OwnersManual_MY21_en-GB_TP32876

/XC40_OwnersManual_MY21_en-GB_TP32876.pdf.

Volvo. (2021). Volvo Car Privacy Policy [Web page].

https://www.volvocars.com/uk/legal/privacy/ privacy-

car (accessed 22 August 2021).

ICISSP 2022 - 8th International Conference on Information Systems Security and Privacy

434