A Mechanism for Multi-unit Multi-item Commodity Allocation in

Economic Networks

Pankaj Mishra

1,2

, Ahmed Moustafa

1

and Fenghui Ren

2

1

Department of Computer Science, Nagoya Institute of Technology, Gokiso, Naogya, Japan

2

School of Computing and Information Technology, University of Wollongong, Wollongong, Australia

Keywords:

Economic Networks, Multi-Unit Homogeneous Resource Allocation, Diffusion Mechanism, Procurement

Auction Theory.

Abstract:

In this work, we introduce a novel resource allocation mechanism that aims to maximise the social welfare

of the market in procurement auctions. Specifically, we consider a market setting with multiple units of

homogeneous resources. In such settings, buyers submit their resource requests to a limited number of known

providers. This limited number of providers might in turn lead to a provider monopoly in the market and a

scarcity of the resources. To address this problem, we propose a novel information diffusion-based resource

allocation mechanism for resource allocation in procurement auctions. The proposed mechanism focuses on

procuring multiple units of homogeneous resources. In this regard, the proposed mechanism incentivises the

providers to truthfully diffuse the procurement information to their neighbours. This information diffusion

aids the buyers to procure the required amounts of commodities/resources at the minimum possible prices.

In addition, the proposed mechanism gives fair chances to the distant providers to fairly participate in the

procurement auction. Further, we prove that the proposed mechanism minimises the procurement costs, with

no deficits, compared to the Vickrey-Clarke-Groves mechanism. Finally, based on the experiments, we show

that the proposed mechanism has comparatively lesser procurement costs.

1 INTRODUCTION

The procurement of multiple units of different types

of resources has become a challenging problem. Nor-

mally, the procurement of resources in competitive

markets takes place through procurement auctions

(reverse auctions) (Krishna, 2009). In those procure-

ment auctions, sellers with the lowest offered price are

the winners. Further, the procurement cost is com-

puted based on an adopted pricing policy, such as

first-price auction, second-price auction, etc.

Generally, designing an optimal resource procure-

ment mechanism depends on finding an optimal win-

ner determination policy and an optimal pricing pol-

icy. An optimal winner determination policy (WDP)

is usually implemented in auction paradigms for dif-

ferent real-world market settings (Samimi et al., 2016;

Weber et al., 1998; Prasad et al., 2016; Zaman and

Grosu, 2013; Wu et al., 2018). However, the conven-

tional auction mechanisms (Myerson, 1981; Mishra

et al., 2020a; Mishra et al., 2020b), mainly focus on

maximising the revenue of the owners of the auction.

In classical auctions, the owner (buyer is the owner

in the procurement) of the auction is only aware of

a limited number of bidding participants (sellers are

the participants). This might lead to a monopoly in

the market (drop-in competition) and also a shortage

of resources. Also, the unbalanced supply or demand

in the market might affect the stability of the market

(Tobin, 1969). Therefore, there is a need for a pro-

curement mechanism that is capable of controlling the

number of participants as per the resource demands.

In this regard, an information diffusion-based mech-

anism become an appropriate choice. Specifically,

information diffusion would invite distant sellers to

take part in auctions and satisfy the market demands.

In the literature, those diffusion aided resource allo-

cation mechanisms are used in several e-commerce

platforms to advertise their products to remote buyers

(Fieldman and Chaube, 2020; Sepehrian et al., ; Mon-

eypenny and Flinn, 2009). Lately, (Zhao et al., 2018;

Li et al., 2017) introduced a set of diffusion-based

mechanisms in social networks to sell different re-

sources. In specific, (Zhao et al., 2018; Li et al., 2017)

presented diffusion-based mechanisms to reduce the

total procurement cost. In this regard, the existing

Mishra, P., Moustafa, A. and Ren, F.

A Mechanism for Multi-unit Multi-item Commodity Allocation in Economic Networks.

DOI: 10.5220/0010844400003116

In Proceedings of the 14th International Conference on Agents and Artificial Intelligence (ICAART 2022) - Volume 1, pages 265-273

ISBN: 978-989-758-547-0; ISSN: 2184-433X

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

265

work focused on selling a single unit of resources

(Li et al., 2018; Li et al., 2017) as well as multi-

item single-unit resource allocation (Kawasaki et al.,

2019; Takanashi et al., 2019). As a result, the ex-

isting diffusion-based mechanisms are being adopted

for crowd-sourcing aided bulk data collection (Shen

et al., 2019; Zhang et al., 2019).

Briefly, the existing diffusion-based auction

mechanisms have the potential to address the chal-

lenges in designing procurement auctions. However,

those existing mechanisms cannot be directly adopted

for the problem we aim to solve in this research,

i.e., designing procurement auctions for multi-unit

multi-item resource allocation. Because, the existing

diffusion-based mechanisms are mainly seller-centric

(seller is the owner), but the procurement auctions are

buyer-centric. Besides, the existing mechanisms are

designed for single-unit or unit-demand resource al-

locations, with no budget constraints. Therefore, to

the best of our knowledge, no known diffusion-based

mechanisms are designed for a multi-unit multi-item

procurement settings. Owing to this, in this research,

we focus on designing a diffusion-based collaborative

mechanism for a multi-unit multi-item procurement

mechanism. Such that, it not only keeps a check on

competition in the market but also encourages coop-

erative behaviour amongst independent sellers. Such

procurement mechanisms could be used in different

procurement problems such as the procurement of

vehicles (Remli and Rekik, 2013), crops, milk, etc,

(Vykhaneswari and Devi, ; Nuthalapati et al., 2020).

Also the proposed mechanism is incentive compat-

ible, individually rational and an optimal payment

mechanism for multi-unit multi-item resource alloca-

tion in economic networks. To summarise, the contri-

butions of this research are as follows: (1) We propose

a novel diffusion mechanism for multi-unit multi-item

resource allocation in economic networks; (2) we in-

troduce a practical information propagation mecha-

nism to disclose the private information of the partic-

ipating sellers; and (3) Then, we introduce a contest

function based iterative auction-based group determi-

nation strategy.

The rest of this paper is organised as follows: we

first discuss the model and the different key defini-

tions in modelling the proposed mechanism in Section

2. Section 3 presents the proposed (DMMP) mech-

anism. In Section 4, the properties of the proposed

DMMP mechanism is presented. Section 5 discusses

the experimental results. Finally, the paper is con-

cluded in Section 6.

2 THE MODEL

We consider an economic network with a single buyer

denoted as b having multi-unit resource request of k

types of non-substitute-able heterogeneous resources

in set K, denoted as Q

b

= {q

b,1

,q

b,2

,... ,q

b,k

}, k ∈ K,

where Q

b

is termed as the resource package or simply

the package. This procurement request is submitted

directly or through diffusion to the set N of n inde-

pendent sellers denoted as N = {s

1

,. .. ,s

n

}. In this

context, an economic network is represented as a di-

rected acyclic graph G ≡ (V,E), where V = N ∪{b} =

{s

1

,. .. ,s

n

} ∪ b representing the set of all the nodes

(including the buyer and all the sellers reachable to

buyer b), whereas E represents the set of edges be-

tween these nodes representing the neighbourhood re-

lationship. For any node i, j ∈ V (i 6= j), if there is a

directed edge from i to j, then it means j is the di-

rect successor of i, and i is the direct predecessor of

j and the edge is represented as e

i j

= 1, else e

i j

= 0,

e

i j

∈ E. Further, for all the nodes i ∈ V , its set of

immediate children is termed as neighbours and de-

noted as Ng

i

⊆ V , s.t., for j ∈ Ng

i

there exists an edge

e

i j

∈ E between node i and j. Further, a set of direct

successor for node i ∈ G is termed as neighbours de-

noted as Ng

i

, whereas direct predecessor is termed as

parent node denoted as P

i

. In this regard, if there is a

path between two nodes i, j ∈ V (i 6= j), the distance

between i, j is denoted as dist(i, j), and if no path ex-

ists, then dist(i, j) = ∞. Also, we represent set of all

the predecessors as Ng

all

i

, s.t. Ng

all

i

= { j ∈ V : 0 <

dist(i, j) < ∞}. Similarly, set of all the predecessors

P

all

i

= { j ∈ V : 0 < dist( j, i) < ∞}. Also let d

i

> 0,

represent the depth for node ∀i ∈ N, representing the

shortest path from buyer b to seller i. In our setting,

initially, buyer b has no prior information about all the

sellers in the market.

In such a market setting for multi-unit multi-item

procurement auctions, it would be ideal for the buyer

to be reachable to maximum possible sellers, so as to

procure the resources at the minimum possible price.

However, initially, buyer b can only submit its pro-

curement request to its neighbour nodes j ∈ Ng

b

.

Also, submitting its procurement request to distant

potential sellers would incur extra cost on the buyer’s

budget. Therefore, to avoid this extra cost, we pro-

pose a diffusion-based mechanism, that encourages

each seller to invite their respective neighbours to par-

ticipate in the procurement. In specific, firstly, buyer b

submit its procurement request to set of neighbours in

Ng

b

. Then, all the seller j ∈ Ng

b

would diffuse the in-

formation to their respective neighbour set Ng

j

. The

subgraph formed with root node j is termed as local

economic network of the node j ∈ V denoted as G

j

≡

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

266

Figure 1: Local economic networks.

Figure 2: Global economic networks with three local net-

works.

(V

j

,E

j

) ≡ (Ng

j

,E

j

). In this regard, independent local

economic networks are connected to form a complete

economic network denoted as G = G

1

∪· ·· ∪G

k

. This

whole economic network G resembles a rooted tree,

wherein the buyer b is the root node and a set N of

potential sellers are leaf nodes.

For instance, Figure 1 depicts an example of eco-

nomic network. In this regard, upon receiving a re-

source request from the buyer b, b’s immediate neigh-

bours along with their local economic networks are

combined to form an economic network as depicted

in Figure 2.

Further, it should be noted that the resource pack-

age request Q

b

from buyer b denotes the minimum

resource demand, such that buyer b aims to procure at

least Q

b

package of resources from a single or a group

of sellers in an economic network through a diffusion

mechanism. In this context, the objective of the buyer

is to procure at-least Q

b

at minimum possible price

from least number of sellers. Because, with the in-

crease in number of sellers, would lead to increase in

transaction overhead, also referred as chaining cost in

communication domain (Kayal and Liebeherr, 2019).

Each seller i ∈ N has two private values, i.e., per-

unit valuation of the resource (bid-density) v

i

≥ 0 and

the maximum quantity of resource the seller is avail-

able for selling denoted as A

i

= {a

i,1

,a

i,2

,. .. ,a

i,k

}.

Also, ∀ j ∈ N, let set of all the sellers except seller

j denoted as N

− j

, s.t., N

− j

≡ N \ j. For example,

in Figure 2, for the seller s

1

, Ng

s

1

≡ {s

4

,s

5

}, and

Ng

all

s

1

= {s

4

,s

5

,s

8

,s

9

,s

11

,s

13

,s

14

}.

Further, in any multi-item market setting, combi-

natorial auctions that allow bidders to bid on com-

binations (bundles or packages) of items make busi-

ness sense when there are bundles of items that have a

combined valuation to bidders higher than the sum of

their individual valuations. Such items are said to be

complementary. In addition to that, we assume that

each seller has incentive in selling their maximum

possible resources to avoid wastage of their remain-

ing resources. Therefore, it is practical to assume that

sellers give discounted price over bulk procurement.

To simplify the valuation, we consider two types of

valuation, namely, valuation for bulk purchases and

single item purchases. Therefore, ∀i ∈ N, its truth-

ful type is represented as θ

i

= (bv

i

,sv

i

,A

i

,Ng

i

), where

bv

i

, sv

i

, A

i

and Ng

i

are the per unit valuation for bulk

purchase (i.e, all the offered resources), the per unit

valuation for single item purchase, offered quantity

of resource and set of neighbours, respectively. Fur-

ther, the type profile of all the sellers is denoted as

θ

θ

θ = (θ

1

,. .. ,θ

n

). Let θ

θ

θ

−i

be the type profile for sell-

ers except i, s.t θ

θ

θ = (θ

θ

θ

−i

,θ

i

). Also, let Θ

i

be the type

space for seller i, s.t., Θ = (Θ

i

,. .. ,Θ

n

) = (Θ

−i

,Θ)

be the the type profile space for all sellers. Also,

we consider a strategic setting, wherein sellers might

not report their true type to maximise their utility,

this reported type of the seller i ∈ N is denoted as

θ

0

i

≡ (bv

0

i

,sv

0

i

,A

0

i

,Ng

0

i

), where bv

0

i

, sv

0

i

, A

0

i

and Ng

0

i

are

the reported per unit valuation for bulk purchase (i.e,

all the offered resources), the per unit valuation for

single item purchase, offered quantity of resource and

set of neighbours, respectively. Also, let

/

0 be the

default reported type, when i ∈ N had not received

the information I

P

i

≡ (Q

i

,b) from its parent seller or

seller i ∈ N do not want to participate in the procure-

ment, where Q

i

denotes the minimum resource pack-

age requested by seller i, whereas b resembles the pro-

curement information from buyer b. In this context,

we assume that, if a seller i ∈ N is not invited, then

the mechanism will not observe any action from that

seller, called feasible type profile denoted as F(θ

θ

θ

0

),

s.t. F(θ

θ

θ

0

) ⊆ θ

θ

θ

0

. Further, the diffusion mechanism for

feasible type profile is defined as follows:

Definition 1. A diffusion mechanism M in the eco-

nomic network is denoted by an allocation policy

π = (π

1

,π

2

,. .. ,π

n

) and a payment policy pay =

(pay

1

, pay

2

,. .. , pay

n

), where π

i

: θ

θ

θ → {0,1}, π : θ

θ

θ →

R and pay

i

denotes the payment received by the seller

i ∈ N from buyer b.

Given the type profile θ

θ

θ

0

= (θ

0

1

,. .. ,θ

0

(n)

) ∈

F(θ

0

), the payment policy p

p

pa

a

ay

y

y(θ

θ

θ

0

) =

(pay

1

(θ

θ

θ

0

),. .. , pay

(n)

(θ

θ

θ

0

)) represents the amount

of money each seller would be given at the end

of the resource procurement. For seller i ∈ N,

if pay

i

(θ

θ

θ

0

) ≥ 0, then it receives pay

i

(θ

θ

θ

0

) from

the buyer and if pay

i

(θ

θ

θ

0

) ≤ 0, then it will pay to

the buyer. In this regard, the allocation policy

π(θ

θ

θ

0

) = (π

1

(θ

θ

θ

0

),. .. ,π

n

(θ

θ

θ

0

)) represents the resource

allocation. We have, π

i

= 1 if seller i is among the

winning seller, else π

i

= 0.

In this context, for the diffusion mechanism M =

A Mechanism for Multi-unit Multi-item Commodity Allocation in Economic Networks

267

(π, p

p

pa

a

ay

y

y), we assume that there is no cost for a seller to

spread the procurement information to its neighbours.

Thus, for seller i ∈ N of type profile θ

0

i

, given a feasi-

ble type profile θ

θ

θ

0

∈ F(θ) of all sellers, then the utility

of seller i’s is defined as the payment received mi-

nus the expected payment based on its true valuation.

In this context, we say that a diffusion mechanism is

individually rational if the utility of every seller in-

volved is non-negative as long as it performs its ac-

tions truthfully, i.e., reports the valuation truthfully

no matter how many neighbours it invites to join the

mechanism and how many resources it is willing to

sell, as defined in Theorem 1. It should be noted that

the definition does not rely on diffusion and disclosed

quantity of resources as we do not want to force the

seller to invite others and sell all its resources to guar-

antee him a non-negative gain. Further, if all the sell-

ers are willing to report their valuations truthfully for

the reported quantities of resource, we say the mecha-

nism satisfies the property of incentive compatibility.

However, in this mechanism, sellers also need to in-

vite their neighbours. Thus, we want to incentivise

sellers not only to report their truthful bids but also to

invite all their neighbours, as defined in Theorem 2.

In the next section, we present a novel diffusion

mechanism for multi-unit homogeneous resource al-

location wherein a seller collaborates within their lo-

cal economic network. Then, finally, the resource is

served by a group of sellers having the minimum val-

uation for the minimum requested resource. Also, all

the related sellers who contributed to inviting the win-

ner are given incentives for diffusion.

3 DIFFUSION BASED

MULTI-UNIT MULTI-ITEM

PROCUREMENT

In this section, we introduce a novel procurement

mechanism for decentralised multi-unit multi-item re-

source allocation. This proposed mechanism, i.e.,

Diffusion based Multi-Unit Multi-Item Procurement

(DMMP) is based on information diffusion tech-

nique. In specific, DMMP mechanism adopts a

reverse-auction paradigm (Krishna, 2009), wherein

each buyer/seller submits a multi-unit multi-item of

resource request to their neighbours sequentially. In

this context, a seller i ∈ N and its respective neigh-

bours Ng

i

is called local economic network.

Firstly, buyer b submits its minimum package of

resource request Q

b

to all the sellers in set Ng

b

. Then,

seller ∀ j ∈ Ng

b

are encouraged through incentives to

diffuse this information within their respective local

economic network. Finally, package Q

b

is allocated

to a single or a group of sellers and its corresponding

payment is computed. Besides, all the intermediate

sellers between the buyer and the winner are given

incentives for information diffusion. In specific, in

this novel DMMP mechanism, two independent pro-

curements are carried out, namely local procurement

and global procurement. The local procurement takes

place within the local economic networks, whereas

global procurement takes place between sellers and

the buyer. In this regard, once the seller agrees to be-

come the part of the global network by reporting its

type θ

0

, then the DMMP mechanism computes diffu-

sion information for that seller. In addition, mecha-

nism computes bids for local and global procurement

sequentially on behalf of the sellers. In this context,

it should be noted that the set of neighbours remains

the same throughout in local and global procurement.

Also, we assume that, any seller can participate in the

global procurement , only if participates in local pro-

curement.

Briefly, whole mechanism can virtually

1

be di-

vided into three major stages, that is, (1) information

propagation, (2) group determination, and (3) winner

determination, discussed in the following subsections.

3.1 Information Propagation

In this subsection, we present the information dif-

fusion stage in the DMMP mechanism. In specific,

upon receiving Q

b

≡ {q

b,1

,q

b,2

,. .. ,q

b,k

} from b, all

the sellers i ∈ Ng

b

diffuse the information message

I

i

= (Req

i

,b) to their neighbours Ng

i

, wherein, Req

i

=

{req

i,1

,req

i,2

,. .. ,req

i,k

} is minimum local package

request for Ng

i

, i.e., minimum quantity required by

its neighbours to participate in the local procurement,

computed by the mechanism using Equation 1 ∀k ∈ K

and b represent the buyer b’s information.

req

i,k

=

q

i,k

, if i = b.

req

P

i

,k

− a

0

i,k

, if req

p

i

,k

> a

0

i,k

.

0, if q

p

i

≤ q

0

i

.

(1)

In this way, mechanism would model the diffusion

information I

i

for all the sellers sequentially based on

the reported type θ

0

i

∀i ∈ N. Note that, from Equation

1, diffusion information reveals only the difference

of the resources request for each of the sellers. This

difference-mechanism is designed to preserve the pri-

vacy of the sellers. Also it promotes participation of

the sellers and maintain the competition in the over-

allprocurement process. In real-world setting, assum-

1

stages are interdependent and run simultaneously

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

268

ing that seller would reveal the true resource require-

ments from its ancestors is unrealistic. This is unre-

alistic because any greedy seller would be interested

in selling its resource first and then inviting other sell-

ers. Therefore, this difference-mechanism is in ac-

cordance with the rational behaviour of the sellers.

Further, to avoid information diffusion for infinitely

larger economic networks, diffusion phase will con-

tinue until enough resources are available in the over-

all economic network. In this context we set the max-

imum available resources is reached at-least A

max

or

T

max

time is reached. The value of A

max

is computed

as A

max

= Q

b

× δ, where, δ represents the maximum

resource factor. This value is decided such that, there

should be enough resource available in the global eco-

nomic network to maintain the competition. Also,

too much availability of the resource would lead to

wastage of resources as well as bidder drop prob-

lem (Baranwal and Vidyarthi, 2015). Therefore δ

should be chosen such that it maintains the trade-off

between supply and demand in the global market. In

this regard, A

max

is computed such as, for k = 3, then

for Q

b

≡ (q

1,b

,q

2,b

,q

3,b

) ≡ (5,7,8), then for δ = 2

A

max

≡ Q

b

× δ ≡ (5,7,8) × 2 ≡ (10,14, 16). In ad-

dition to that, in order to restrict the infinitely infor-

mation diffusion, we set the maximum time T

max

, this

is there to stop the algorithm if A

max

is never reached.

This maximum time step is fixed at the beginning of

the mechanism. So once algorithm has A

max

or T

max

is

reached, the mechanism moves to the next stage, i.e,

group determination discussed in the next subsection.

Algorithm 1 gives the full pseudocode for information

propagation stage.

This algorithm takes buyer b’s information i.e., lo-

cation and request Q

b

along with the whole network

information G ≡ (V, E), δ and T

max

as input. Besides,

it has temporary (arbitrary) neighbour list which is a

queue used for traversing the neighbour list. After

that, the algorithm en-queues the neighbours of buyer

list. Then the algorithm runs until maximum T

max

or

A

max

volume of resources available, and dequeue the

top element from the arbitrary neighbours’ list and

diffuses the information to its neighbours. Finally, it

enqueues, sequentially, all its neighbours to the neigh-

bour list and arbitrary list and update the value of the

level of each seller and computes the maximum depth

d

max

. In the next subsection, we will present the sec-

ond stage of the DMMP mechanism i.e., Group For-

mation.

3.2 Group Determination

In this subsection, we present the second stage of the

novel DMMP mechanism, i.e., the group determina-

Algorithm 1: Information Propagation.

Input: G ≡ (V,E), Q

b

, δ, T

max

Result: d

max

1 A

max

← Q

b

× δ ; sn ← b ;

2 A

total

, h

max

← 0 ;

3 req

sn,k

← q

b,k

; ∀k ∈ K ;

4 Req

sn

= {req

sn,k

: ∀k ∈ K} ;

5 I

s

n ≡ (Req

sn

;

/

0) ;

6 neighbour list[b][][∅];

neighbour list arbitrary[b][] ← R

b

;

7 while t = T

max

or A

total

≥ A

max

do

8 for neighbour list arbitrary[sn] 6= ∅ do

9 node ←

DEQU EUE(neighbour list arbitrary[sn])

node ← []diffuseI

sn

≡ (Q

sn

;b) ;

10 seller list; seller list arbitrary ← node

;

11 end

12 sn ← DEQU EUE(seller list arbitrary) /*

changing the seed node */ ;

13 compute Req

sn

using Equation 1 */ ;

14 A

total

+ = Q

sn

;

15 if Ng

sn

6=

/

0 then

16 if sn /∈ neighbour list then

17 d

max

+ = 1

18 end

19 neighbour list[sn];

neighbour list arbitrary[sn] ← Ng

sn

;

20 t + + ;

21 end

22 end

tion stage. After receiving the information messages

I

i

from ancestor node P

i

, on behalf of seller i ∈ N,

the proposed mechanism starts to fill the requested

package Req

i

. In fact, the proposed mechanism does

this based on an iterative auction, sequentially for

all the local networks from bottom to top. In spe-

cific, all the seller at level j ∈ N submit their bids

bid

1

i

≡ (bv

+

i

,sv

+

i

,Q

i

) to their parent node P

j

, where

bv

+

i

, sv

+

i

and Q

i

are the updated valuations and the

combined available bids. Then, finally, after form-

ing groups all the seller’s bids can now be submit-

ted directly to buyer b. In this context, it should be

noted that, in any economic market, any greedy seller

would prefer to sell its resource first then would try

to sell others resource. Therefore, we assume that

seller would consume the resource from its neigh-

bours, only when its available resource is less than

the resource request from its respective parent. In

specific, if a

0

i,r

< req

p

i

,r

, then the mechanism would

aid the seller i to collaborate with its neighbour(s)

and submit the bid the combined resource in the local

procurement. Similarly, if a

0

i,k

< q

b,k

, then only the

mechanism would reveal the combined resource in its

submitted bid bid

2

i

. Then, at the end of local procure-

A Mechanism for Multi-unit Multi-item Commodity Allocation in Economic Networks

269

ment i.e., after receiving reported type bid

1

i

,∀ j ∈ Ng

i

,

set of local winners L

i

is elected by performing iter-

ative auction. In specific, winning seller in each it-

eration is decided based on customised contest suc-

cess function (CSF) (Skaperdas, 1996). A CSF de-

termines each sellers probability of winning the local

auction in terms of other sellers bidding package. In

specific, based on CSF, a local winner in each itera-

tion is determined from the local network with seed

node i ∈ N, lw ∈ Ng

i

is elected as lw ≡ min(cs f

j

),

∀ j ∈ Ng

i

, whereas cs f

j

is computed using Equation

2.

cs f

i

=

∑

k∈K

(q

i,k

)

σ

∗ v

0

i

∑

N

j6=i

(q

j,k

)

σ

xv

0

j

(2)

where, 0 < σ ≤ 1 represents the noise parameter

in the contest, interpreted as the marginal increase in

probability with the increase in valuation (Shen et al.,

2019). Towards this end, seller i would update its total

available resources Q

i

using Equation 3 ∀k ∈ K

q

i,k

= a

0

i,k

+

∑

l∈L

i

q

j,k

(3)

where, L

i

is set of local winner from all the lo-

cal iterative auctions. In this regard, mechanism con-

ducts a iterative auction based matching for all the

seed node belonging to same height h sequentially

with continuous iteration. In each round of auction for

seed node i ∈ N, mechanism elicits a single winner.

The iteration continues until minimum package Q

i

is

filled or maximum waiting time W

d

has been reached,

where d denotes the depth of the seed node. In addi-

tion, in each iteration XOR bids (Leyton-Brown et al.,

2000) are submitted, i.e. each local seller can win

only once. This will reduce the complexity of the iter-

ative auction by reducing the number of combinations

in each iteration.

Further, at the end of each iteration for local auc-

tion for seed node i ∈ N, mechanism computes the

per unit valuation for each of the winning sellers in

L

i

using Equation 4 at which each of the local winner

j ∈ L

i

would get its payment, if seller i is the winner

in the procurement.

v

l

=

min(v

0

j

)∀ j ∈ Ng

0

i

\ l, if Ng

i

6= {null}.

max(v

0

i

,v

0

j

), if |Ng

i

| = 1.

0, otherwise.

(4)

where, v

0

j

= bv

0

j

, if all the resources in the offered

package Q

j

is allocated, else v

0

j

= sv

0

j

. Intuitively the

above equation depicts that, if there are more than one

neighbours, i.e., |Ng

i

| > 1, then the valuation of the

local winner is computed based on the VCG mecha-

nism (Krishna, 2009). However, if there is only one

local neighbour, i.e., |Ng

k

| = 1, then the valuation is

the maximum valuation among seller i and j ∈ Ng

i

;

otherwise its set to be zero. Similarly, the valuation

for the seed seller is updated based on the valuation

of the local winner using Equation 5.

v

i

=

(

v

0

i

, if Ng

i

= {null}.

v

0

i

×(q

0

i,k

−

∑

∀l∈L

i

q

0

l,k

)+v

l∈L

×

∑

∀l∈L

i

q

0

l,k

q

i,k

, otherwise.

(5)

Then, after end of the iterative auction at depth

d, mechanism moves upward at depth d − 1. In spe-

cific, at depth d, ∀i ∈ N, where d

i

= d, seller i sub-

mit their bids to parent P

i

∈ N. In this way, lo-

cal groups are formed within the local economic net-

works in a decentralised manner. In this regard, max-

imum time-step w

d

for which iterative auction will

continue at depth d is computed as w

d

= ((d

max

−d)+

1) ∗ (T

max

/d). Finally, after completion of auctions in

local networks, a new global economic network with

updated valuation and available resources is formed,

represented as G

0

⊆ G.

In the next subsection, we will present the third

and the final stage of the DMMP mechanism i.e., win-

ner determination and payment distribution.

3.3 Winner Determination

In this section, we present the third stage i.e., win-

ner determination, wherein, payment of the winning

seller(s) are computed. In addition to that, rewards

for all the sellers who has contributed by informa-

tion diffusion are computed. Specifically, the mech-

anism determines a single winner w which can fill

all the requested resources in the package Q

b

, s.t.

w ≡ min(cs f

i

), ∀i ∈ G

0

, whereas cs f

i

is computed us-

ing Equation 2. Also, all the sellers in the path path

bw

from buyer b to the winning seller w are rewarded

for diffusing the information to winner w. This path

path

bw

is called as winning path and represented as

path

bw

≡ {b,...,w}. Let, v

∗

D

= min

i∈D

v

0

i

be the min-

imum reported valuation in the subset D ⊆ N and the

corresponding seller is represented as w

∗

D

, and then

v

0

w

= v∗

∗

N

whereas w = w

∗

N

. Similarly, v

∗

D\i

denotes

the minimum valuation and w

∗

D\i

when seller i ∈ D

does not participate. Also to simplify the notations,

let v

∗

N

∗

\i

= v

∗

−i

.

Definition 2. feasible global neighbours (N∗) is a set

of all sellers for buyer b having req

b

≤ q

0

k

, s.t k ∈ N

and N∗ ⊆ N

Definition 3. A critical seller set (C), is a set of all

the sellers in winning path path

bw

including the local

winner of the winning seller, i.e., C ≡ {c

1

,. .. ,c

h

,L

c

h

},

where i ∈ path

bw

, w = w

∗

N

. This critical seller C set

is an ordered set, s.t., d

c

1

⊃ d

c

2

⊃,. .. ,⊃ d

c

h

⊃ d

L

c

h

,

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

270

where d

c

i

denotes the depth of the node c

i

from buyer

b.

In this regard, the allocation policy for diffusing

mechanism DMMP is computed using Equation 6.

π

i

(θ) =

(

1 if i ∈ C, v

0

i

= v

∗

−(i+1)

.

0, if i /∈ C.

(6)

Intuitively, in DMMP mechanism, the first criti-

cal seller who has the least per unit valuation when

critical seller i + 1 is removed from the economic net-

work is the winner. Then the bid density bd

i

∀i ∈ C

is computed using Equation 7., bid density represents

the value at which payment for a seller will be calcu-

lated

bd

i

=

v

∗

−i

+ ε

i

if i = w.

ε

i

, if i ∈ C

−w

.

v

0

L

i

, if i = L

w

.

0, Otherwise.

(7)

where, ε

i

represents the reward factor for seller

i ∈ C for diffusing the information to its neighbours,

which is computed using Equation 8

ε

i

=

v

∗

−(α

i+1

,w

∗

α

i

)

− v

∗

−α

i

|C − 1|

(8)

where, α

i

= 1, if i ∈ C and i ∈ N

∗

, else α

i

= 1 if

i ∈ C and i /∈ N

∗

and P

i

∈ N

∗

, represent the closest

ancestor node in N

∗

if i /∈ N

∗

According to above bid density calculation policy,

winning seller’s bid density is sum of vcg payment

v

∗

−w

, i.e., winner is paid the second lowest per unit

valuation. In addition, winning seller is rewarded γ

w

for diffusing the information to its neighbour. On the

other hand, all the other critical sellers are rewarded

γ

i

for information diffusion. Intuitively, reward is the

decrease in payment for buyer b for seller i ∈ C dif-

fusion action. In particular, it is change in payment

for buyer b when seller i + 1 along with the seller w

∗

−i

(when seller i do not participate) do not participate

and when seller i ∈ C do not participate in the pro-

curement. Finally, bid density of local winner is same

as computed during its local procurement based on

VCG mechanism.

To the end, based on the valuation computed using

Equation 7 and 8, payment pay

i

is computed for all

the critical sellers in set C.

pay

i

=

(

bd

i

× (q

0

i

− q

0

L

i

), if L

i

6= null and i ∈ C.

bd

i

× q

0

i

, otherwise.

(9)

Further, the total payment given by the buyer b to

all the sellers in winning path path

bw

is computed as

pay =

∑

i∈C

pay

i

In this way, winners and their respective payment

are computed, also rewards for all the sellers in win-

ning path is computed for information diffusion. In

the next section we would discuss the properties of

the proposed DMMP mechanism.

4 PROPERTIES OF DMMP

In this section, we prove that DMMP mechanism is in-

dividual rational (IR) (Theorem 1) and incentive com-

patible (IC) (Theorem 2). The proofs for both the

Theorems are in the appendix.

Theorem 1. A diffusion mechanism M = (π, p

p

pa

a

ay

y

y) is

IR, if u

i

(θ

i

,(θ

i

,θ

θ

θ

0

−i

)) ≥ u

i

(θ

i

,(θ

0

i

,θ

θ

θ

00

−i

)), ∀i ∈ N, all

θ

0

i

∈ Θ

i

, where (θ

0

i

,θ

00

−i

) ∈ F(θ

0

i

,θ

0

−i

). In this theorem

we will prove that DMMP is individually rational.

Theorem 2. A diffusion mechanism M = (π, p

p

pa

a

ay

y

y) is

IC, if u

i

(θ

i

,(θ

i

,θ

θ

θ

0

−i

)) ≥ u

i

(θ

i

,(θ

0

i

,θ

θ

θ

00

−i

)), ∀i ∈ N, all

θ

0

i

∈ Θ

i

, where (θ

0

i

,θ

00

−i

) ∈ F(θ

0

i

,θ

0

−i

). In this theorem

we will prove that DMMP is incentive compatible.

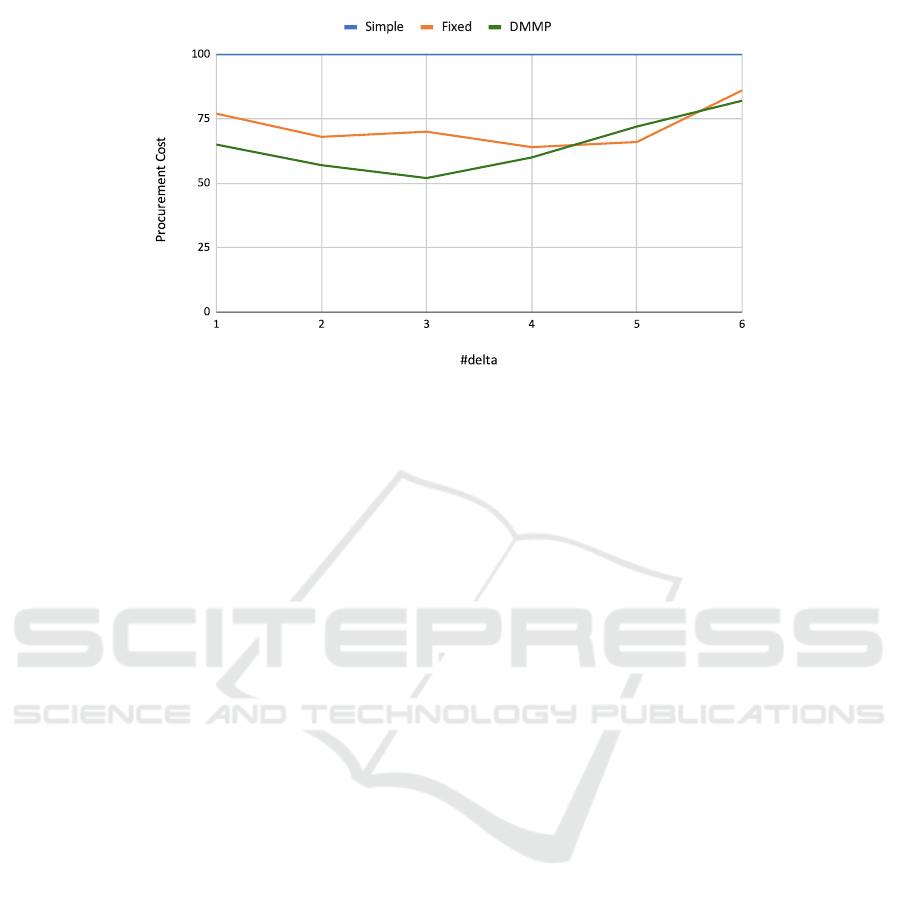

5 EXPERIMENTAL RESULTS

In this section, we present the experimental results

performed to evaluate the performance of the novel

DMMP mechanism based on two conventional mech-

anisms. In this regard, we compare the performance

of the following three mechanisms: (1) Simple Pro-

curement: This is the classical procurement, wherein

the buyer procures only from its neighbours through

iterative first price reverse auctions; (2) Fixed Re-

ward: In this mechanism, sellers are given a fixed

reward ω for the diffusion of information, whereas

payment is based on a second price auction: and (3)

DMMP: In this mechanism, the buyer is not aware of

all the sellers in the economic network until its neigh-

bour directly or indirectly diffuses the procurement

information; whereas, payment and rewards are com-

puted using DMMP.

In our experimental setting, we consider the pro-

curement of five different types of resources i.e., k = 5

and set the maximum neighbours for each node as 4,

i.e. 0 < |Ng

i

| ≤ 4, ∀i ∈ V , and for fixed reward, ω

is set to root of the per-unit valuation of the corre-

sponding node. In this regard, we randomly generate

economic networks and set available resource pack-

age for each seller. Besides, we set that |Ng

b

| = 4,

s.t., buyer has at least four sellers directly reachable

which can collectively fill the requested package Q

b

,

i.e., Q

b

⊆ {A

i

: ∀i ∈ Ng

b

}. Further, values for Q

b

A Mechanism for Multi-unit Multi-item Commodity Allocation in Economic Networks

271

Figure 3: Impact of value of δ on the total procurement cost.

and A

i

∀i ∈ N, for all the five types of resources are

sampled from a random generator which takes val-

ues [200,1000] units. Further, both the per unit val-

uations, i.e., sv

i

and bv

i

∀i ∈ N is also drawn from

a random generator which takes values [20,50] s.t.

sv

i

> bv

i

. In this setting, for the economic network,

we run all mechanism for 20 times. Then we evalu-

ate the results to show the merits of adopting DMMP

mechanism for multi-unit multi-item resource pro-

curement based on the cost of the procurement for

the buyer. Besides, in our experimental setting, we

intend to analyse the impact of change in the value

of δ on the cost of procurement. Therefore, we de-

signed six different experimental settings concerning

the value of δ, such as, δ = (1,6). Finally, all the

mechanism are implemented in Python 3 and the ex-

periments are performed on Intel Xeon 3.6GHz 6 core

processor with 32 GB RAM.

From Figure 3, it can be observed the procurement

cost is minimum for DMMP mechanism as compared

to the other two mechanisms. An interesting observa-

tion here is, initially, procurement cost decreases with

the increase in value of δ. However, later the procure-

ment cost increases with the increase in value of δ.

For instance, at δ = 3, procurement cost is the least,

but at δ = 5 procurement cost rises. This is possibly

because of the increase in the number of nodes in the

winning path, which leads to an increase in the to-

tal rewards distributed. Overall, the experimental re-

sults highlight that the novel DMMP mechanism out-

performs the other two mechanisms and demonstrate

its efficiency for procurement of multi-unit multi-item

resources through economic networks.

6 CONCLUSION

In this research, we present a novel information

diffusion-based resource allocation mechanism in

economic networks. In specific, we consider the eco-

nomic networks where independent buyers submit

their multi-unit multi-item resource requests to mul-

tiple independent sellers. In this regard, the proposed

mechanism aids the buyers to procure the required re-

sources from a group of distant sellers with the min-

imum possible prices. Besides, the proposed mecha-

nism encourages the independent sellers to share their

available resources amongst each other. Also, the pro-

posed DMMP mechanism guarantees that every seller

receives an incentive to reveal their truthful type and

invite all their neighbouring sellers to participate in

the procurement. In this context, rewards are given

to all the sellers in the winning path for diffusing in-

formation. Most importantly, those rewards do not

increase the buyer’s payment. In fact, the buyer’s pay-

ment is even improved as compared to the VCG mech-

anism. As for future work, we plan to focus on mul-

tiple buyers with multi-unit heterogeneous resource

combinatorial auctions in economic networks.

REFERENCES

Baranwal, G. and Vidyarthi, D. P. (2015). A fair multi-

attribute combinatorial double auction model for re-

source allocation in cloud computing. Journal of sys-

tems and software, 108:60–76.

Fieldman, E. H. and Chaube, R. (2020). Systems and meth-

ods for tracking referrals among a plurality of mem-

bers of a social network. US Patent 10,621,608.

Kawasaki, T., Barrot, N., Takanashi, S., Todo, T., and

ICAART 2022 - 14th International Conference on Agents and Artificial Intelligence

272

Yokoo, M. (2019). Strategy-proof and non-wasteful

multi-unit auction via social network. arXiv preprint

arXiv:1911.08809.

Kayal, P. and Liebeherr, J. (2019). Distributed service

placement in fog computing: An iterative combina-

torial auction approach. In 2019 IEEE 39th Interna-

tional Conference on Distributed Computing Systems

(ICDCS), pages 2145–2156. IEEE.

Krishna, V. (2009). Auction theory. Academic press.

Leyton-Brown, K., Shoham, Y., and Tennenholtz, M.

(2000). An algorithm for multi-unit combinatorial

auctions. In Aaai/iaai, pages 56–61.

Li, B., Hao, D., Zhao, D., and Zhou, T. (2017). Mecha-

nism design in social networks. In Thirty-First AAAI

Conference on Artificial Intelligence.

Li, B., Hao, D., Zhao, D., and Zhou, T. (2018). Cus-

tomer sharing in economic networks with costs. arXiv

preprint arXiv:1807.06822.

Mishra, P., Maustafa, A., Ito, T., and Zhang, M. (2020a).

Optimal auction based automated negotiation in real-

istic decentralised market environments. In Proceed-

ings of the AAAI Conference on Artificial Intelligence,

volume 34, pages 13726–13727.

Mishra, P., Moustafa, A., and Ito, T. (2020b). Reinforce-

ment learning based real-time pricing in open cloud

markets. In International Conference on Industrial,

Engineering and Other Applications of Applied Intel-

ligent Systems, pages 419–430. Springer.

Moneypenny, N. F. and Flinn, S. D. (2009). Influence-

based social network advertising. US Patent App.

12/172,236.

Myerson, R. B. (1981). Optimal auction design. Mathemat-

ics of operations research, 6(1):58–73.

Nuthalapati, C. S., Sutradhar, R., Reardon, T., and Qaim,

M. (2020). Supermarket procurement and farmgate

prices in india. World Development, 134:105034.

Prasad, G. V., Prasad, A. S., and Rao, S. (2016). A combi-

natorial auction mechanism for multiple resource pro-

curement in cloud computing. IEEE Transactions on

Cloud Computing, 6(4):904–914.

Remli, N. and Rekik, M. (2013). A robust winner de-

termination problem for combinatorial transportation

auctions under uncertain shipment volumes. Trans-

portation Research Part C: Emerging Technologies,

35:204–217.

Samimi, P., Teimouri, Y., and Mukhtar, M. (2016). A com-

binatorial double auction resource allocation model

in cloud computing. Information Sciences, 357:201–

216.

Sepehrian, A. H., Aghaei Shahri, M. S., and Azimzadeh,

S. M. Investigating the role of tarp factor in social

network advertising in brand awareness and purchase

intention of sport brands. Annals of Applied Sport Sci-

ence, pages 0–0.

Shen, W., Feng, Y., and Lopes, C. V. (2019). Multi-winner

contests for strategic diffusion in social networks. In

Proceedings of the AAAI Conference on Artificial In-

telligence, volume 33, pages 6154–6162.

Skaperdas, S. (1996). Contest success functions. Economic

theory, 7(2):283–290.

Takanashi, S., Kawasaki, T., Todo, T., and Yokoo, M.

(2019). Efficiency in truthful auctions via a social net-

work. arXiv preprint arXiv:1904.12422.

Tobin, J. (1969). A general equilibrium approach to mon-

etary theory. Journal of money, credit and banking,

1(1):15–29.

Vykhaneswari, K. and Devi, K. U. Marketing efficiency of

milk and milk products in prakasam district of andhra

pradesh.

Weber, C. A., Current, J. R., and Desai, A. (1998). Non-

cooperative negotiation strategies for vendor selec-

tion. European Journal of Operational Research,

108(1):208–223.

Wu, D., Chen, X., Yang, X., Wang, H., Tan, Q., Zhang, X.,

Xu, J., and Gai, K. (2018). Budget constrained bid-

ding by model-free reinforcement learning in display

advertising. In Proceedings of the 27th ACM Inter-

national Conference on Information and Knowledge

Management, pages 1443–1451. ACM.

Zaman, S. and Grosu, D. (2013). Combinatorial auction-

based allocation of virtual machine instances in

clouds. Journal of Parallel and Distributed Comput-

ing, 73(4):495–508.

Zhang, W., Zhang, Y., and Zhao, D. (2019). Collaborative

data acquisition. arXiv preprint arXiv:1905.05481.

Zhao, D., Li, B., Xu, J., Hao, D., and Jennings, N. R.

(2018). Selling multiple items via social networks.

In Proceedings of the 17th International Confer-

ence on Autonomous Agents and MultiAgent Sys-

tems, pages 68–76. International Foundation for Au-

tonomous Agents and Multiagent Systems.

A Mechanism for Multi-unit Multi-item Commodity Allocation in Economic Networks

273