Risk Management in the Credit Loan Project

Mingyi Du

1,*,†

, Yingqi Xuan

2,†

, Yunxuan Zhang

3,†

and Anqi Zhu

4, †

1

New York University, New York, U.S.A.

2

University of Bristol, Bristol, U.S.A.

3

Beijing Institute of Technology, Beijing, China

4

Capital University of Economics and Business, Beijing, China

†

These authors contributed equally

Keywords: Commercial Banks, Credit Loan, Risk Management.

Abstract: The key to the business success of commercial banks is determined by whether they are willing to take risks,

whether they can properly control and manage credit risk. For the past few years, the national and international

economic and financial situation has been complicated. With the constant adjustment of national macro-policy

and banking supervision measures, solving the problem of national commercial bank credit risk management

under the new situation has become the priority of domestic banks. The goal of credit risk management is not

only to ensure the safety of the loans but also through credit risk management to improve the quality of

examination and approval of new loans and establish a good relationship between banks and enterprises.

Based on the relevant data that has been obtained, compared to the statistical data analysis, theory and

empirical analysis study, this paper explored the development of China's commercial bank credit markets and

the general laws by drawing on foreign commercial bank loan management's advanced experience combined

with the status of China's commercial bank loan management and empirical analysis and discussion by the

method of its existing loan management issues. Finally, after analysing the current situation of loan

management of China's banks, combined with foreign commercial banks' experience, this paper put forward

some improving strategies of commercial banks' loan management. We alter, optimize, and control each stage

of the project and minimize its risk within one stage to its least possible, and we achieve to manage the risks

of the project as a whole.

1 INTRODUCTION

1.1 Background History

Project management refers to the integration of

various systems, methods and personnel to complete

the various tasks of the project within the specified

time, budget and quality objectives. That is to plan,

organize, direct, coordinate, control and evaluate the

whole process from the beginning of the investment

decision of the project to the end of the project so that

the project objectives can be completed. For the

banking industry, the process of credit risk

management can be regarded as a project completion

process. Admittedly, the credit risk management of

banks has been paid more and more attention by

enterprises in practice, not only because the current

banking industry is experiencing the impact of an era

of crisis, but it is the foundation that determines the

survival growth and profitability of banks. The

concept of banking credit risk management first

appeared in the 1990s. Before the 1990s, credit risk

management was used to explain the technology and

risks associated with insurance. This kind of risk

management refers to purchasing traditional

insurance products suitable for any event to prevent

future hazards. In the financial investment market,

derivatives have also been promoted as risk

management tools for hedging activities. Derivatives

are not only used for hedging but these tools can also

be used for speculation and arbitrage. However, the

meaning of banking risk management is slightly

different from financial risk management. Even so, in

1997, the Basel Committee on Banking Supervision

issued the 'core principles' for effective bank

supervision, which provided an important link

between capital and risk containment. In particular,

banks need to adopt risk measurement and risk

management procedures and processes to ensure the

Du, M., Xuan, Y., Zhang, Y. and Zhu, A.

Risk Management in the Credit Loan Project.

DOI: 10.5220/0011345900003437

In Proceedings of the 1st International Conference on Public Management and Big Data Analysis (PMBDA 2021), pages 379-389

ISBN: 978-989-758-589-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

379

risk-adjusted return of their enterprises (Information

on https://www.bis.org/publ/bcbsc125.pdf). The

core concept of credit risk management in the

banking industry is to ensure the safety and

profitability of the banking industry. In recent years,

due to the impact of the macroeconomic downturn,

real economy enterprises have encountered certain

difficulties in production and operation, credit

business default risks have increased significantly,

and the quality of credit assets in the banking industry

has shown a difficult situation. Therefore, credit risk

management in the banking industry has become

indispensable.

1.2 Research Status Quo

After almost forty years of research, the Chinese bank

sector has developed a relatively efficient and

complete risk management system in dealing with

credit risk. Our Chinese bank industry has grown to

demonstrate awareness and knowledge of identifying

and forestalling some credit risks to guarantee the

success of enterprises. However, in comparison to

western bank institutions, our bank industry is still

immature in managing credit risks. In general, this

immaturity is due to sufficient practical use of risk

management theory. Chinese bank industry adopts

certain management methods from prestigious

Western management models and integrates them

into our own credit risk management. Still, our risk

management system is under great improvements and

justifications since it is important to apply the

management methods that best suits our own

economic condition and policy. In addition, part of

our Chinese bank industry currently has a limited

understanding of risk management, which leads to

inattention and neglect to risks that harm the banks.

For example, our banks have a relatively

uncomprehensive pre-credit management risk

system. Our Chinese enterprises are more focused on

emergency management in the post-credit phase

rather than detecting the potential risks before giving

out loans in the pre-credit phase. As a result, the

Chinese bank sector is experiencing inadequacies in

estimating and judging the underlying credit risk and

standardizing performance appraisal systems for

credit loans. Hence, our bank industry is challenged

to improve, gain better insight and sharp intuition,

and set up comprehensive risk management

mechanisms and instruments.

1.3 Research Paper Structure

Our research will follow the structures as described

below. The first part is an introduction to our

research, summarizing the research background and

status quo. The second component focuses on our

main research content, introducing and analyzing

major instruments and tools in managing the credit

risk in three phases: pre-credit, mid-credit, and post-

credit. We will also demonstrate the process and

method of how authors extract and analyze the data

pertinent to the credit risk. What follows is the third

component displaying the results and discussions.

We will reflect on the examples we introduce in our

research and analyze the causes of failures and

successes. We will also provide conclusions and

propose solutions to practical issues in the domain of

credit risk loans in the bank industry. In the end, we

summarize and reflect on our studies, rethinking how

our research provides meaningful insights into the

development of prospective credit-risk management

in the Chinese bank sector.

2 METHOD

The credit loan project is crucial for commercial

banks. The article investigates the question of how to

successfully manage the credit loan project from its

three phases: pre-loan, mid-loan and post-loan.

There are countless examples that can prove that

risk management is essential to bank credit

operations. For example, in 2007, the Royal Bank of

Scotland chose to develop its credit business, not

using depositors’ funds, but using short-term loans

from other banks. The British Financial Services

Authority stated that the bank had not conducted a

detailed risk management investigation prior to this.

The increase in bad debts, the suspension of funds,

and the deterioration of its own financial situation

directly led to the bankruptcy of Royal Bank of

Scotland and the acquisition of 83% of its shares by

the government.

For analyzing risk management during the pre-

credit phase, we will use the literature research

method and case analysis method to study the risk

management of credit projects.

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

380

2.1 Risk Management in Pre-loan

Phase

2.1.1 Evaluation of Pre-loan Risk

Management

Credit risk refers to the possibility that the loan

cannot be recovered on time, causing the loss of

credit funds and its income. We should be clear:

Firstly, credit risk is a probabilistic event, which may

or may not occur, and the loss studied only refers to

the possibility of loss, not reality; secondly, credit

risk runs through the business. The process of bank

credit management emphasizes the possible

consequences of risks before lending and requires

banks to pay attention to risks from time to time

throughout the credit activities and control and

reduce risks by improving the bank's business

management behavior. Credit risk cannot be

eliminated. It can only be controlled, reduced and

resolved. Credit risk will inevitably exist as long as

there is a credit category in social and economic

activities (Olaf 2011). Therefore, commercial banks

must strengthen the prevention of credit risks in their

capital operations and try their best to avoid losses

caused by bad debts.

In the bank's pre-credit business, it is necessary to

fully understand the customer's credit rating and the

customer's financial status. After conducting business

with customers, they also need to track and supervise

their customers. If supervision is not in place, it is

easy to cause customers to default or overdue credits,

thereby affecting the bank's business development.

In the pre-credit investigation, some account

managers did not pay attention to the authenticity and

completeness of the relevant information; they did

not clarify the true use of the bank loan (especially

when issuing short-term credit); the review was too

optimistic and did not analyze the potential of

changes in related factors Influencing factors, in-

depth market review, insufficient understanding of

business management status and the future, and

thorough risk reassessment; inaccurate assessments

and insufficient coverage of credit risks; and

ineffective identification of group customers and

related company risks. The above factors damaged

the following loans in the initial stage.

In addition, some banks ignore problems such as

incomplete loan procedures and insufficient review

materials; some implement anti-procedures, such as

issuing loans before enterprises apply for loans,

signing loan contracts before loan approvals, issuing

letters of credit or bank acceptance drafts before

approval, etc.; merger credit extensions have not been

granted (Olaf 2011). Fully cashed, the credits to some

group members were not included in the consolidated

credit management; lending in violation of

regulations, that is, lending beyond authority,

dividing a large sum into several small pieces,

avoiding authority restrictions, rolling out bank

acceptance bills to capital enterprises, or when there

is no actual Issuance of acceptance bills, discounts,

etc. in the context of trade.

2.1.2 Existing Problems in the Pre-loan

Control of Credit Risk of Chinese

Commercial Banks

1) The establishment of functional credit departments

is unreasonable. Commercial banks currently set up

industrial and commercial credit, project credit,

housing credit, and other departments have the same

functions, segmentation, easy to indulge in

standardization circles such as sub-indices,

competition for scale, etc. Commercial banks

conduct research on credit markets, develop

customers, and formulate credit management

strategies. Insufficient research on the objective

requirements of credit operations in China is not

conducive to effective prevention and control of

credit risks. In addition, they have integrated pre-loan

inspections, loan-time inspections, and post-loan

inspections and lack a mechanism for mutual restraint

and checks and balances (Olaf 2011).

2) The risk management institution is not sound.

The credit risk management team still cannot be self-

contained from top to bottom like Western

commercial banks and lacks a strong system.

However, the credit business department and the

credit management department are not

administratively separated. The review opinions of

the credit management department often do not have

a substantive restrictive effect, and the improper

phenomenon of "outsiders managing insiders" is

prone to appear (Olaf 2011).

3) Weak implementation of the credit system.

Most commercial banks in China have not yet

established a dedicated credit decision.

The policy agency is responsible for the bank's

credit policy, management system and customer

credit rating standards. However, the business

department has no rules to follow. It can only conduct

business management according to the traditional

scale and ratio indicators, which cannot guarantee the

effective operation of the entire credit mechanism. In

addition, there is no special department to evaluate

and inspect the compliance of credit policies, work

procedures, and operating standards by business

Risk Management in the Credit Loan Project

381

departments, which has led to many business

departments appearing in ultra vires loans and illegal

loans (Olaf 2011).

2.1.3 Case Study: China Construction Bank

At present, the pre-lending risk management

department of CCB's LC branch operates in

accordance with the relevant requirements of the

Guidelines for Due Diligence of the Construction

Bank's Pre-lending of Corporate Credit Business and

other documents. In the actual operation process, the

account manager account manager of each branch

and the risk manager of the bank conduct pre-loan

investigations on credit customers. The basic process

of the pre-loan investigation includes business

acceptance, pre-investigation preparation,

implementation of the investigation, and writing of

the investigation. Six stages of manuscript,

investigation review and investigation review. Every

detail in the front and back process is interlinked. If

there is an omission in a certain link, it will leave

hidden dangers for later risk research and judgment

and control. The long management process and high

professional knowledge requirements have caused

banks to manage the pre-loan inaccurately and

superficially. In many cases, problems are discovered

and solved in the loan, which cannot be controlled in

the pre-loan link (Chen 2019, Christian 2015).

In this case, during the pre-loan review, China

Construction Bank discovered that Group B had two

companies with credit balances in the CCB LC

branch, namely Company A and a new material

production company, with credit balances of 89.7

million yuan and 129.87 million yuan, respectively.

The group's credit balance in the LC branch of China

Construction Bank totalled 21.57 million yuan. As a

result, the construction bank LC branch loan is

expected to lose 160 million yuan, with a loss rate of

73%. Among them, A company lost 62.98 million

yuan, recovered 26.72 million yuan, a loss rate of

70.21%; G new material is expected to lose 97.28

million yuan, recovered 32.59 million yuan, a loss

rate of 74.92%. The detailed analysis of the evolution

process of company A's credit business quality

migration is as follows:

(1) In August 2014, Company A issued a letter of

credit advance with ICBC. In January 2015, it owed

interest in the local Rural Commercial Bank, and in

July, it owed interest in the LC branch of China

Construction Bank. The bank's LC branch failed to

settle the payment due to the bank acceptance

business and formed advances. From November 2015

to January 2016, it handled the refinancing business

for it. After that, interest arrears occurred. The

classification was lowered on September 30. The

loan was overdue in the LC branch of China

Construction Bank in November 2016, and it was

adjusted to the suspicious category in March 2017

(Chen 2019).

(2) In October 2014, the new material production

company had advanced payments and interest owed

in other banks. From April to July 2015, the new

material production company temporarily suspended

production and owed the interest of the LC branch of

China Construction Bank. The company settled all

the debts at the end of 2015. From 2016 to 2017, the

new material production company maintained its

operations and repaid the loan interest from the LC

branch of China Construction Bank every month. In

May and December 2016, the company was involved

in the "import and export agency contract dispute"

case. The construction was completed on December

30, 2017. As a result, the LC branch of the bank

downgraded the classification to substandard. In

January 2018, it began to default on the interest of

CCB LC Bank. In February 2018, the loan was

overdue in LC Bank, and then it was adjusted to the

suspicious category in March (Chen 2019).

2.2 Risk Management in the Mid-credit

Phase

To analyze risk management during the mid-credit

phase, we employ the methods of document analysis

and case study.

2.2.1 Mid-credit Risk Management

Summary

Right after the loan is issued, the whole loan project

enters the phase of mid-credit. Good mid-credit

management practice is the second line of defence

against potential risks, and it is crucial for the safety

and securities of loans belonging to banks. We have

seen a great quantity of non-performing loans present

because of inadequate pre-credit investigation and

review, which further led to a lack of investigation

reports and credit-loan documentations regarding the

bank's loan customers. As a result, it creates

difficulties for banks to perform mid-credit reviews

and investigations. For mid-credit loan audit and

review, administrators should review the credit loan

materials carefully and independently, follow up with

borrowers to supplement the missing documentation

and materials needed according to law and protocol,

and scrutinize financial reports, investigation

documentations to expose any potential risks

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

382

associating with non-performing loans. The auditors

of banks should make sure that all documentations

are legal and valid and issue investigation and audit

reports regarding the loan customers to ensure the

validity and safety of loans (Information on

https://blog.csdn.net/hajk2017/article/details/81

325661)

.

Through the documentation analysis method, we

find out that major Chinese commercial banks

employ various mathematical models to perform

quantitative analysis, including prediction model,

decision model, and linear programming in decision-

making regarding credit loans. Banks determine

borrowers' loan qualification and loan amount mainly

based on analysis of their documentation, such as

financial reports. The credit loan project usually

starts when company borrowers submit their loan

applications to banks, and banks perform their

analysis on borrower companies and projects they use

loans for. After banks issue the written evaluation

report, the Risk Management Department will

establish panels of specialists to review the

evaluation report and feedback to the Risk

Management Committee. Finally, after all the legal

process, the loan is issued (Wang 2010, Basic system

of credit management, Baidu Wenku).

2.2.2 Case I

Since 2008, The steel market industry opened by

Commercial Banks of Fujian began to transfer from

Shanghai to Wuxi. During this transfer, the strong

investment aspiration of Steel trade business entities

coincides with the willingness of Fujian Commercial

Banks to expand credit loan business. As a result, the

Banks lent too much and bankrolled the bubble,

which reached its peak in 2011. At the same time, the

number of programs that commercial banks require

their branch to achieve is over 40, and commercial

banks also require their branch to triple the deposit.

Under these requirements, many bank branches start

to issue loans without careful investigations, and

credit-loan risks arise (Dai 2013).

In late January 2012, Bank A actively made

efforts to make sales for Company B. In April 2012,

Bank A provided Company B with 50 million

comprehensive credit lines, and Shanghai Huashi

Company undertook a joint liability guaranty. In June

2012, Bank A issued a total of 60 million bank

checks, which utilized 30 million exposures. In June

2012, Bank A granted 200 million indirect credits to

Company B, financing for downstream steel

distributors in an advance payment mode. Until

August 2012, an estimated total of 180 million were

used by Company B for the advance payment

process. The difference between the purchase price

and sale price will be refunded. Company B made

advance payments to Shanghai Huashi Company, and

Huashi Company shipped the goods to warehouses of

Shanghai Guangji Logistics Co., Ltd. All the

transactions were made on the spot. The downstream

distributors made 30% advance payments, and a

third-party Zhongchu Logistics supervised all the

steel goods. Company B had the ownership of goods,

and downstream distributors could make payments

and obtain the goods in batches. If Company B could

not make repayments, Shanghai Huashi Company

would guarantee to buy the remaining steels. At the

end of August 2020, the Head Corporation of

Company B found out that parts of steel kept in

Shanghai Guangji Logistics Co., Ltd were double

pledged by Company B's upstream firm, Shanghai

Huacheng materials co., Ltd. On 24th September

2012, the Head Corporation of Company B

announced that they will appeal to Municipal

Intermediate Court to recover against 803.63 million

RMB non-payment and steel goods owed by

Company B's supplier, included 209.24 million RMB

granted by Bank A (Cai 2011, Zou 2012, Zhou 2013).

Table 1: Transaction detail chart.

Transactions Date

Quantity RMB(

ten thousands)

Bank A provided

B credit line

2012.4 5000

Bank A issued 5

bank notes

2012.6 6000

Bank A provided

B indirect credit

line

2012.5 20000

2.2.3 Case II: Bank of China

One sub-branch of Bank of China signed an

Individual first-hand housing loan agreement with a

personal borrower and the real estate development

company. The agreement specifies that the sub-

branch of the Bank of China issues a total amount of

64 thousand RMB of loan within a time limit of 300

months. The personal borrower agreed and

authorized the Bank of China to send the loan directly

to the Real Estate Company to buy a house with a

monthly interest of 6.0042%. The borrower pledged

the house as security for the loan, and the Real Estate

Company provided the joint liability guaranty.

During the agreement periods after the loans were

issued, the borrower already had several overdue

Risk Management in the Credit Loan Project

383

payments to the Bank. The Bank of China tried to

contact the borrower several times but failed due to a

borrower's permanent address change. Therefore, the

Bank of China had no other way but to prosecute the

borrower and Real Estate Company in court. The case

was dismissed because the borrower did not show up

and the Bank of China did not submit enough

evidence on the borrower's refusal to pay the loan

(Shen 2013, Zhao 2012, Wang 2017).

2.3

Risk Management in Post-credit

Loan Phase

To analyzing risk management during the mid-credit

phase, we employ the methods of document analysis

as well as comparable case analysis.

2.3.1 Data and Summary

When obtaining data associated with post-credit loan

risk management analysis, we employ methods of

documentation analysis to understand the concepts

and characteristics of post-credit loan management

and perform comparable case analysis on post-credit

risk management, making a comparison between

foreign and Chinese commercial banks.

Post-loan risk management means the

management from the time loan is issued to the time

when loan principal and interest are repaid. Thus, it

is the last activity in the whole process of loan project

management (Yang 2014).

2.3.2 Comparable Case Studies

(1) Case I: Citibank (Zhang 2014)

We first analyze the post-credit loan management by

Citibank, N.A. Citibank was founded in 1812 as the

City Bank of New York. Citibank was merged with

Travelers Group to establish Citigroup, one of the

largest financial services giants. Citigroup has

divisions including Citibank, Salomon Smith Barney,

Banamex, Citifinancial and other 13 financial

services enterprises with assets over a trillion dollars.

Citigroup has its branches in 150 countries and

regions with employees over 27 thousand. The

financial products provided by Citigroup ranges from

enterprise and investment banking services to credit

loans, insurance, brokerage, financial consulting, etc.

As a bank that develops global business, its business

branches include credit cards, private banking

services, corporate banking services, multinationals,

and emerging markets business, helping Citibank

gain advantages unmatched by other banks.

Regarding the post-credit loan risk management

approach, Citibank believes that risk prevention is

better than risk governance; voluntary target market

setting is better than passive remedial action after

risks happen; active commercial advertisement is

better than passive risk aversion. Citibank's

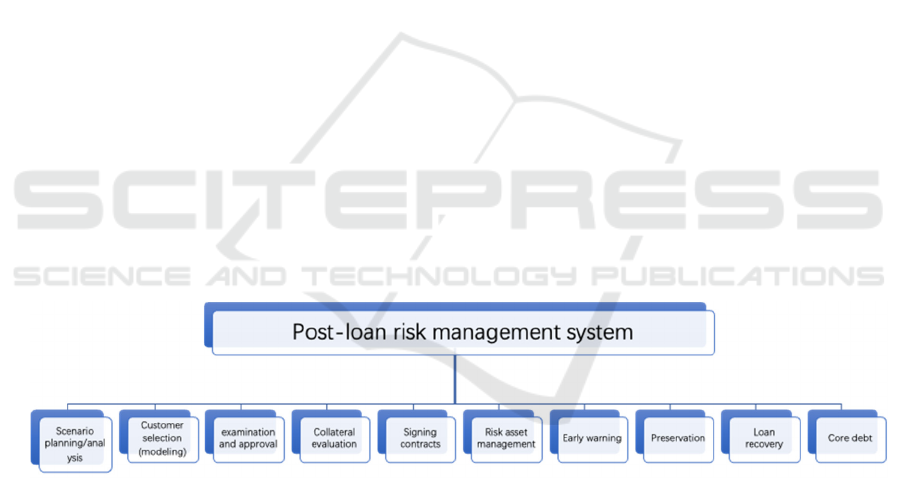

management system is detailed in figure 1 below.

Figure 1: Citibank's post-loan management mode (Zhang 2005).

Citibank proposes to be proactive when dealing

with post-credit loan risk. First, Citibank determines

market admittance by analyzing specific industry life

cycles. Citibank decides that it is accessible to enter

industries in the growth stage and in a mature state.

As for sunset industries and industries in recession,

the market admittance for financial credit funds is

very limited and restricted. Second, Citibank

performs portfolio analysis on the loan project,

including factors such as geography, transaction type,

borrower's background, collateral information to

investigate and monitor. Third, they use dynamic risk

measures to ensure that credit funds are issued

following protocols, make the risk under control, and

calculate the expected returns.

(2) Case II: Industrial and Commercial Bank of China

Limited

The Industrial and Commercial Bank of China

Limited, also known as ICBC, is the biggest state-

owned Commercial bank in China and is also one of

the Fortune 500 companies. ICBC has been ranked as

the largest bank in the world for five consecutive

years up until 2012. Since its establishment in 1984,

ICBS has always regarded "providing excellent

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

384

financial services" as its mission. ICBC has been

financing both internationally and domestically and

raising social funds broadly to provide financial

support for the development and reform of

enterprises, which further contribute to China's

economic development.

Regarding the personal housing loan, ICBC

studies and formulates administrative methods

according to Provisions of INDUSTRIAL and

Commercial Bank of China on strengthening post-

loan management to regulate the post-credit loan

management, prevent and control potential risks,

ensure the quality and efficiency of personal housing

loans, etc. ICBC enacts administrative methods in the

post-credit loan phase and divides loans into five

class loan classification based on risk level. For the

normal loan activities, the Bank will conduct post-

loan supervision by means of regular selective

examination. For the other four classes of loans, the

Bank will conduct a complete and comprehensive

inspection. At the same time, ICBC set specific

requirements on the intervals between inspections.

The inspection frequency is significantly higher for

the class of loans with a high risk level (Information

on www.pbc.gov.cn).

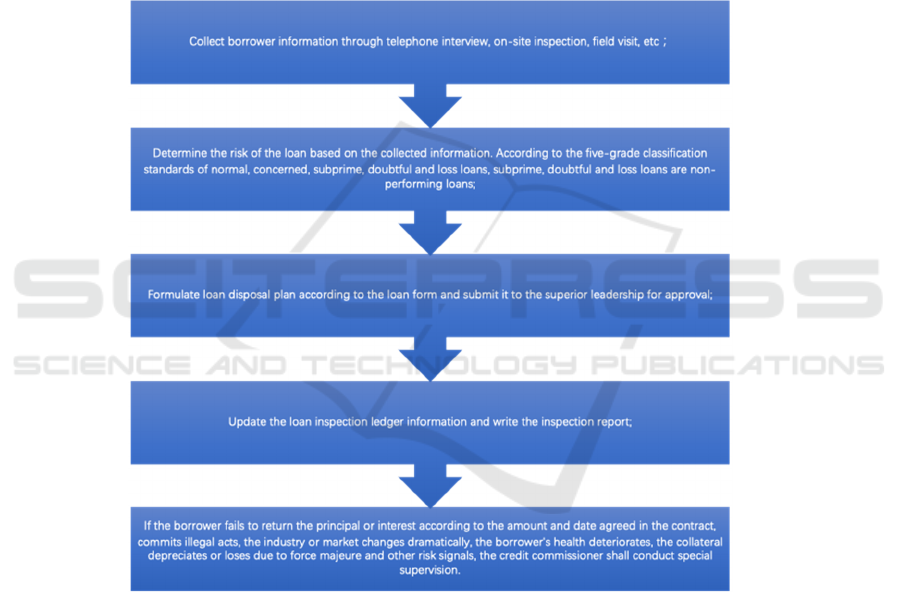

The general process for post-credit inspection is

described below in the chart:

Figure 2: General procedures for post-loan inspection.

When loans are due, the Credit Control officer

will send out a reminder notice in advance. For

defaulted loans, Banks could charge a penalty fee,

stop the outstanding loan, deal with the pledges by

regulation, and recourse to the guarantor for joint and

several liabilities. In addition, the Bank must conduct

a risk assessment on loans 90 days before due. Then,

the Banks would formulate emergency measures for

potential defaulted loans. When one month before

due, the Bank must analyze the overdue default risk

again. All the branches of the Bank must take

initiatives to prevent and defuse overdue risks

(Information on www.cbrc.gov.cn).

3 RESULTS AND DISCUSSIONS

3.1

Pre-credit Loan

Pre-loan risk management is the first hurdle in the

credit management process, and it is also a more

important process link. It is the basic basis for

Risk Management in the Credit Loan Project

385

customer screening and credit plan judgment and the

bridgehead for actively avoiding credit risks and

ensuring the quality of credit assets (Christian 2015).

3.1.1 Case Analysis of Pre-loan Risks

(1) In the process of group relationship sorting, the

group customer relationship was not identified in

accordance with the principle of substance over form,

and the identification of companies controlled by

family members within the range of three generations

directly and two generations was insufficient

(Information on

https://www.mckinsey.com/business-

functions/risk-and-resilience/our-

insights/banking-models-after-covid-19-taking-

model-risk-management-to-the-next-level)

.

(2) Failure to carefully analyse customers'

production and operation needs, resulting in

excessive credit extension. In 2010, when the new

material production company declared a general

quota of 54 million yuan and calculated based on the

production capacity of 60,000 tons of the two

production lines, it was concluded that the trade

financing business demand was 9.072 million yuan.

In 2011, the company only put into production one

production line, and the actual production capacity

was 36,000 yuan. Based on the exchange rate of 6.63,

the company's actual import volume was

270,291,900 yuan. Various financial institutions have

handled import letters of credit services for the

company in a cumulative amount of 310,114,000

yuan, exceeding the enterprise's actual production

and import demand. In April 2012, the new material

production company had a credit line of 7 million

yuan, increasing 16 million yuan compared with

2011. At the end of 2012, the balance of the forward

letter of credit opened with various banks was 272.25

million yuan. After inquiring about customs data, the

new material production company's annual import

volume in 2012 was 34.82 million dollars, converted

into 216.93 million yuan based on the exchange rate

of 6.23 in December 2012. Without considering the

term of the letter of credit, the amount of bank credit

has far exceeded the actual credit limit of the

enterprise. In April 2012, Company A had a credit

line of 50 million yuan, an increase of 30 million

yuan compared to 2011, with a credit line of 415.0

million yuan in various banks and a stock loan of

31,583,77 million yuan (including low-risk

businesses). In 2011, Company A had total assets of

59.674 million yuan and realized sales income of

85.83 million yuan. According to the company's size

and sales income, the company's business capital

needs did not match the total amount of bank credit

(Chen 2019, Information on

https://www.mckinsey.com/business-functions/

risk-and-resilience/our-insights/banking-

models-after-covid-19-taking-model-risk-

management-to-the-next-level

).

(3) Failure to consider the potential impact of

changes in the economic environment on the

borrower's ability to repay the principal and interest.

For all loans, the most important thing is information

about the borrower's current financial situation, the

expected use of the loan, and the probability of

successful operation of the financing project. In

practice, account managers often fail to make clear

economic expectations for the target borrower. For

example, as the growth rate of the market economy

slows, company A's profitability declines. The group

was affected by the slowdown in domestic economic

growth, and the overall plastic products industry was

in a downturn. As a result, the profitability of

company A and the new material production

company both experienced a serious decline. The net

profit of company A has declined year by year since

2014. And it fell to 2.4 million yuan in 2016, and the

net profit of new materials production companies

dropped from 13.325 million yuan in 2014 to 5.27

million yuan in 2016 (Chen 2019, Information on

https://www.mckinsey.com/business-

functions/risk-and-resilience/our-

insights/banking-models-after-covid-19-taking-

model-risk-management-to-the-next-level

).

3.1.2 Results and Discussions

Banks can gradually form a proactive ability to

manage credit risk and can control the risk as far as

possible in the link before lending. With the support

of this ability, establishing a scientific and reasonable

risk management system is the only way to build the

core competitiveness of modern commercial banks. It

is also a final requirement of risk management. In the

process of customer selection and judgment, all links

need to be strictly controlled. Therefore, no matter

the micro or macro factors, the customer itself or the

external environment, it is necessary to in-depth

analysis and analysis, effectively select the risk pre-

lending management target, and arrange the follow-

up risk treatment measures are crucial.

3.2 Mid-credit Loan

The mid-loan phase can be seen as the in-process

inspection stage in project management. Whether the

project will be executed successfully is being

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

386

reviewed during this stage. Therefore, it is extremely

crucial to detect any potential risks in the mid-credit

loan phase.

3.2.1 Risk Analysis

Case I:

The risk occurred because of the following:

(1)The risk detection in the pre-loan

investigation was insufficient. Moreover, because the

steel industry was extremely popular at that time, the

bank neglected necessary investigation regarding

crucial process implementation in this loan project.

(2)The investigation about Shanghai Huashi

Company is superficial.

(3)The check and examination on the credit

review process are not rigorous at all. The provision

of Bank A states that only companies with credit

ratings above AA are qualified to get credit lines for

the purpose of trade financing business. In our case,

Company B is only a newly founded company

(founded in 2011) with a credit rating of BBB. It is

an obvious break of rules when a BBB company

could obtain a total of 250 million RMB of indirect

and direct credit lines. The bank relaxed the credit

rating requirement because it believed the steel

industry had a bright prospect. It reflects the lack of

rigorous mid-credit inspection and the too simplistic

credit review process.

Case II:

The reasons why the loan project failed in case

II is analyzed as followed:

(1)The internal control organization is

immature. The failure to catch up with the loan

borrower is because relevant procedures and

documents related to loans were not supplemented in

time. As a result, the Bank of China did not recognize

who was ultimately responsible for the overdue loan,

which led to the dismissal of the case due to a lack of

evidence.

(2)The tracking and warning mechanism is

incomplete. The Bank of China failed to notice the

change in borrowers' financial condition and credit

condition and therefore failed to alert the significant

risk of overdue payments. The Bank only noticed the

alert until the Borrower could not repay the loan on

time. At this time, it had become impossible to trace

the borrower.

(3)Serious problems associated with credit

approval mechanism. The credit approval system in

China relied heavily on the relevant investigation

report that demonstrates potential risks in the pre-

credit loan phase. Thus, the quality of credit approval

was heavily dependent on the validity of the pre-loan

investigation report. If the validity and reliability of

the pre-loan investigation are absent, then the

borrower's credit rating is influenced and lead to non-

performing loans in the end.

3.2.2 Results and Discussions

Based on the analysis above, we believe that it is

crucial to address the following issues in the mid-loan

phase:

(1) Emphasize the construction of a credit risk

control environment

We need to improve the overall professional

quality of the banking staff. On the one hand, it is

urgent to improve Banking staff's professional skills

and quality of loyalty. On the other hand, we need to

enhance staff's risk awareness. We also need to

establish a rational assessment and accountability

mechanism for credit-loan business. The risks are not

detected in time because of the lack of supervision

and monitoring, as seen from the above two cases.

Therefore, building an effective and rational credit

appraisal and assessment system improves personnel

quality and gives them a greater incentive to identify

potential risks. In addition, an effective

accountability mechanism is essential to trace

responsible personnel when related issues arise. In

this way, the banking industry staff would have a

more responsible behavior to fulfill their duties and

avoid abusing authority, playing favoritism, and

committing irregularities.

(2) Always pay attention to affiliated enterprises'

credibility condition

Banks are supposed to choose their client

company cautiously when carrying out credit loan

business. After the routine investigation in the pre-

loan phase, banks should scrutinize the enterprise's

operating capacity and credit condition because they

are in constant change. Therefore, it is recommended

for Banks to provide credit loans for client companies

with outstanding main business, above-average

production indicators and dynamic cash flow.

(3) Perform strict monitor and re-valuation on

collaterals periodically

Banks needs to obtain information on whether the

values of collaterals have changed dramatically,

whether collaterals are double-pledged, or whether

the company sells them off.

(4) Apply multiple guarantee methods to

diversify credit risks

For enterprises with tight cash flows, Banks could

carry out a guaranteed mortgage on the enterprise's

intangible assets such as patents, technology, etc.

Thus, it promotes the development of some small and

Risk Management in the Credit Loan Project

387

medium-sized enterprises with tight cash flows to

obtain credit loans. One issue worth noting is that the

Banks must ensure the intangible assets carry values

and there is no potential dispute when dealing with

patents.

3.3 Post-credit Loan Risk Management

Post-loan risk management is an important link in the

credit risk management of commercial banks and a

key guarantee to ensure the recovery of loan principal

and interest. Based on the methods and data described

in section 2.3, we focus on providing analysis on the

status quo of Chinese Banks, obtaining results and

conclusions, and providing improvement measures.

3.3.1 Results

We conclude that the major problems associated with

Banks' post-loan management including (Zhang

2014):

(1)Lack of clear post-loan management concepts.

The majority of Chinese banks recognize losses after

the loan losses took place. Therefore, the major issue

in the bank industry is that banks focus on loan

expansion but neglect the subsequent necessary

management of loans.

(2)The post-loan management system still needs

to be improved. The Credit management department

performs the post-loan administrative function,

which means that the loan sales and post-loan

inspection are all performed by the account manager.

The lack of post-loan investigation and management

from independent supervisory authorities makes it

hard to yield the post-loan management well.

(3)The lack of effective performance appraisal

and reward and punishment mechanism. Banks in

China recognize profits when loans are issued and

losses when loan losses take place. Correspondingly,

Banks in China have strong rewards for loan

origination but rather a small reward for post-loan

management.

(4)Lack of talents for post-loan management. As

the scale of credit services expands, the expectation

for staff's professional competence and working

experience is extremely high and demanding. Not

only it requires knowledge of the law, finance, and

accounting, but also it demands broad experience in

identifying, analyzing, and handling risk signals.

3.3.2 Discussion.

From the information above, we could learn from

banks in the western world to improve deficiencies

existing in our China Banks' systems.

The measure we adopt to improve post-loan

management includes

(Zhao 2013):

(1)First, reinforce the important position of post-

loan management in all aspects. China's commercial

banking industry must strengthen the professional

skills training of loan officers at the basic level. Third,

enhance the bank employees' overall quality and risk

awareness.

(2)Promote the establishment of the post-loan

management system. For example, the establishment

of a risk warning system is vital. Also, Banks should

make full use of People' Bank of China's credit

information system and the China Banking

Regulatory Commission (CBRC) 's customer risk

monitoring system and the like.

(3)Establish reward and punishment mechanisms.

Establishing an effective reward system provides

great incentives for post-loan management staff.

(4)Establish a team of credit officers with great

professional skills and qualities. Hiring staff with

great qualities is crucial for protecting against credit

risk and for the security of the Bank's revenue.

4 CONCLUSION

In conclusion, China's current credit risk

management is not perfect, and there is plenty of

room for improvement and development. As the

globalization process continues, China's commercial

banks have also been in line with international

standards. However, competing with international

banks brings a complex environment and greater

uncertainties. Thus, Commercial banks in China has

a challenging mission to improve their credit loan

business and minimize risk by providing better risk

management. This article analyzes varieties of issues

associated with the Bank's credit loan business from

the perspective of project management. Regarding

the credit loan business as one project, we analyze the

project in three different stages: pre-loan, mid-loan,

and post-loan. These three stages constitute the whole

credit-loan project, and we alter, optimize, and

control each stage of the project and minimize its risk

within one stage to its least possible. This way, we

could achieve to manage the risks of the project as a

whole. At the same time, a sophisticated risk

management system not only help banks achieve

sustainable development, but also improves their

impact on the industry. Thus, we should emphasize

on the effort of risk managing and actively obtain

deeper understanding of credit loan risk management.

It is crucial to enact a credit risk management system

that is in conformity with national conditions.

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

388

REFERENCES

B.F Zhao, Research on credit risk control of small and

medium-sized enterprises in Nong'an branch of Bank

of China, Master thesis, Jilin University, 2012.

B.X, Shen, Thirty Years of Chinese Commercial Banks:

Business innovation and development, Peking

University Press, Beijing, 2013.

Basic system of credit management, Baidu Wenku.

F. Christian, Determinants of loan securitization in

European banking, Journal of Banking &

Finance,2015(1):12-27

F.Y Zhang, Research on credit risk of Commercial banks

in China, Master thesis, Capital University of

Economics and Business, Beijing,2005.

Information on https://www.bis.org/publ/bcbsc125.pdf

Information on

https://blog.csdn.net/hajk2017/article/details/8132566

1

Information on https://www.mckinsey.com/business-

functions/risk-and-resilience/our-insights/banking-

models-after-covid-19-taking-model-risk-

management-to-the-next-level

Information on www.cbrc.gov.cn

Information on www.pbc.gov.cn

J.Q Zou, Research on the internal control of China's

commercial bank, Economic Research Guide,

201226:115-117.

L Wang, Research on project loan Risk Management of

Commercial Banks in China, Master thesis, Xi 'an

Shiyou University, 2010.

N Wang, Research on risk management process

optimization of credit project in a branch of Bank of

China, Jilin University, 2017.

P Zhao, T.M Bai, The main problems and countermeasures

of post-loan management in basic-level banks,

Agricultural Development Bank of China Xinzhou

Branch,2013.

W. Chen, Research on pre-loan risk Management of branch

of China Construction Bank, Master thesis, ShanXi

Normal University, 2019.

W. Olaf, Environmental Credit Risk Management in Banks

and Financial Service Institutions, Business Strategy

and the Environment, 2011(4):248-263

X.D Zhou, Z.P Lv, Challenges of credit risk management

in commercial banks, China Finance, 201312:50-52.

X.P Zhang, Research on post-loan Management of China's

Commercial Banks -- A case study of ICBC, Master

thesis, Shanxi University of Finance and

Economics,2014.

Y.M Dai, Investigation and reflection on the bursting of

Wuxi Steel Trade credit bubble, The banker,

07(2013)129-130.

Z Cai, Research on internal control of state-owned

commercial banks, China Economist, 20117(3):208-

209.

Z. Yang, Research on post-loan risk Management of

Chinese Commercial Banks, Master thesis, Xiamen

University, 2014.

Risk Management in the Credit Loan Project

389