Research on the Influence of Industry Index on Individual Stock

Price in Neural Network Prediction Model

Yajiao Wang

1a

, Bo Zheng

2b

, Xiangqi Meng

3c

and Jizhe Cui

1d

1

College of Economics and Management, Yanbian University,Hun chun, Jilin, China

2

Institute of Finance, Jilin University of Finance and Economics,Changchun, Jilin, China

3

International Economics and Trade, Shanghai Lixin College of Accounting and Finance, Shanghai, Shanghai, China

Keywords: Neural Network, Stock Forecast, Industry Index, Kweichow Moutai.

Abstract: With the development of the economy and society, it is increasingly clear that stock price changes are running

ahead of economic changes, and there is no shortage of predictions. Based on the neural network prediction

model to screen and clean the actual stock price data and establish a model to predict the impact of industry

indicators on the single stock price, this paper predicts the stock price and its stock price trend of Kweichow

Moutai through BP neural network and explores whether the rise and fall index of the industry index added

to the wine, beverage and refined tea manufacturing industry has a positive effect on the model prediction.

When the price of a single stock is added to the daily rise and fall index of the industry to which the stock

belongs, it can greatly improve the predicted value of the model and effectively analyze the influence of the

valuation fluctuation of the single stock. This is shown by the operation of the prediction model compared

with the experimental data.

1 INTRODUCTION

The change of the price in the stock market not only

changes with the change of the market law, but also

indicates the change of the overall situation of the

market. The conclusion that the fluctuation of the

stock market price is ahead of the market fluctuation

is shown by the empirical research results (Chen

2012). Stock prices have begun to rise before the

macroeconomic situation has come out of the trough,

and this phenomenon is generally due to the

unanimous judgment of investors on the economic

cycle (Liu 2012). The stock market is generally

called the operation of the virtual economy. The real

economy is the corresponding real economic market,

and the relationship between the two is like a shadow.

Therefore, the prediction of the stock market is

particularly important.

a

https://orcid.org/0000-0003-2468-2766

b

https://orcid.org/0000-0002-9457-2266

c

https://orcid.org/0000-0003-1369-3187

d

https://orcid.org/0000-0002-5095-3091

There are numerous topics about stock analysis

and forecasting in recent years. For example, how do

people make expectations and judgments about stock

price fluctuations, what direction the economic cycle

will change and how to be closer to the stock market,

and so on. From the early development of the method

of technical analysis, such as the Dow theory, the

average line theory, and the analysis of the K line, bar

charts, points graph analysis method, etc. and then to

the result of the development of the network of

financial technology arises at the historic moment of

the theory and the analysis of many technical

indicators. These analysis methods are essentially the

initial epitome of stock simulation and prediction. In

essence, these analysis methods are the initial

epitome of stock simulation and prediction.

However, in a strict sense, the above methods can

only be used as a basis based on theoretical analysis,

and cannot directly predict the development trend of

the securities market. In addition, people also try to

Wang, Y., Zheng, B., Meng, X. and Cui, J.

Research on the Influence of Industry Index on Individual Stock Price in Neural Network Prediction Model.

DOI: 10.5220/0011344000003437

In Proceedings of the 1st International Conference on Public Management and Big Data Analysis (PMBDA 2021), pages 327-334

ISBN: 978-989-758-589-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

327

use computational methods such as regression

analysis to predict the securities market (Zhao 2006).

However, the huge amount of information waiting to

be processed is the most basic problem existing in the

use of traditional forecasting technology. The stock

price trend is affected by political, macroeconomic,

social epidemic and other factors, and its content is

complicated, so it is more difficult to get a more

accurate forecast (Yang 2010, Wang 2006).

Therefore, it is necessary for valuable valuation

prediction information to be obtained with the help

of other models.

In order to effectively predict the impact of

industry indicators on single-branch valuation, this

paper introduces the BP neural network, which is

based on the traditional prediction model. In order to

predict the overall trend of its stock price in the

future, this paper attempts to model the stock price of

Kweichow Moutai. Try to explore whether it has a

positive effect on the model prediction, so on this

basis, the industry index of wine, beverage and

refined tea manufacturing is added.

2 OVERVIEW OF THE

CULTURAL BACKGROUND

The second (enlarged) meeting of the sixth Council

of China Wine Association was held in Beijing on

April 28, 2021. According to data from the National

Bureau of Statistics, 1,887 enterprises above

designated size in the national wine industry have

completed a total wine output of 5,407,400 kiloliters,

which is a year-on-year decrease of 2.21% in 2020.

The sales revenue of the completed products was

835.331 billion yuan, an increase of 1.36% over the

same period last year; the total profit realized was

179.2 billion yuan, an increase of 11.71% over the

same period last year. Among them, the output of the

liquor industry was 8 million kiloliters, which did not

increase by 8.0% compared with the 13th five-year

Plan, with an average annual increase of 1.6%; sales

revenue reached 950 billion yuan, an increase of

62.8% over the same period last year, with an average

annual increase of 10.2%; and realized profits of 270

billion yuan, an increase of 70.3% over the same

period last year, with an average annual increase of

11.2%. The completed profit was more than 2700

billion yuan, an increase of 70.3% over the same

period last year, with an average annual increase of

11.2%.

As one of the most popular sectors in the stock

market, investors in the liquor industry have

remained enthusiastic about several leading stocks in

recent years. Because of the nonlinearity, complexity,

and uncertainty of the test data, the course cannot use

the traditional ordinary least square method and time

series model to predict the stock trend. Therefore,

this paper will build a model based on BP neural

network, and take Kweichow Moutai as an example

to further predict the development trend of its stock

price.

3 BP NEURAL NETWORK

3.1 Theory and Application of Neural

Network

Artificial neural network (Artificial Neural

Networks, ANN) is an adaptive nonlinear dynamic

system, which is connected by many neurons with

adjustable connection weights. It has the

characteristics of large-scale parallel processing,

distributed information storage, good self-organizing

and self-learning ability, and so on. The processing

of massive data is becoming more and more efficient

through machine learning. Machine learning

methods can obtain some data features which are

easy to be ignored by traditional methods by mining

a large amount of data.

Based on the above neural network

characteristics, which can be applied to the

prediction research of stock systems. Among the

many factors that affect the accuracy of predicting

stock price trends, the choice of input variables is one

of the key factors, such as the essential characteristics

of price changes are not well reflected by the input

variables. it will inevitably lead to the deviation of

the forecast results (Lu 2019).

3.2 Neural Network Model and Its

Implementation

BP (Back Propagation) neural network is a kind of

multilayer forward neural network. In the training of

the network, the training algorithm of adjusting

weights and thresholds follows the propagation mode

of error reverse, so it is a mature and perfect part of

the neural network (Hong 2016). In general, BP

neural network is a kind of neural network with three

or more layers, which includes the input layer, hidden

layer, and output layer, with the full connection

between upper and lower layers, but no connection

between neurons in the same layer. The neural

network can extend the traditional linear method to

include some variables with nonlinear relationships.

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

328

Every neuron in between layers is connected. To put

it simply, every neuron connected in the lower layer

and every neuron in the upper layer should be

realized. However, there is no right to connect

between neurons in the same layer (Huang 2016,

Huang 2016). The structure diagram of the BP neural

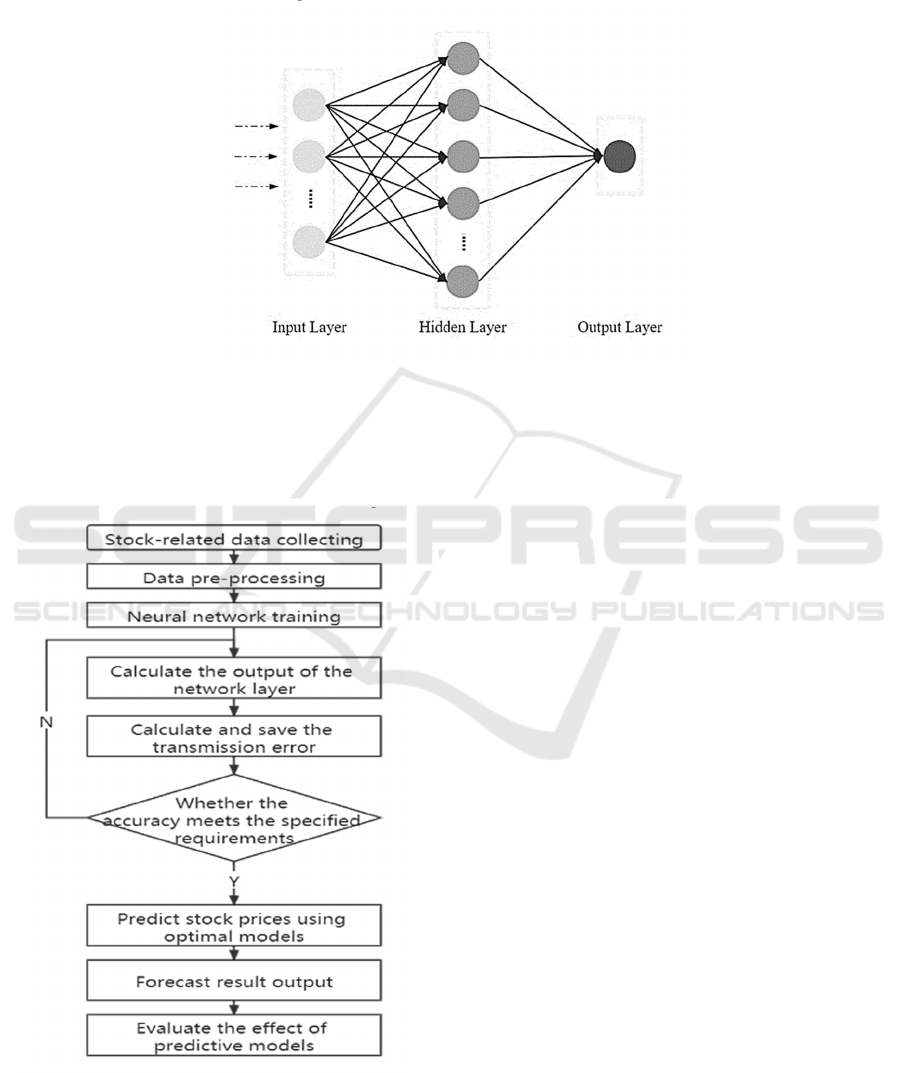

network is shown in figure 1.

Figure 1: Structure diagram of neural network.

The flow chart of this experiment is based on the

goal of this experiment and refers to the algorithm

structure of BP neural network, as shown in figure 2.

Figure 2: Flow chart of stock forecasting model based on

neural network

4 ESTABLISHMENT AND

SOLUTION OF MODEL

4.1 Selection of Research Objects and

Samples

The prediction of the stock price and price trend of

Kweichow Moutai is realized by BP neural network.

It also explores whether the daily rise or fall index of

the industry indicators including the wine, beverage,

and refined tea manufacturing industry has a positive

effect on the model prediction. Based on the

establishment of the conventional model, this paper

tries to explore the relevant indicators of the wine,

beverage, and refined tea manufacturing industry in

the process of prediction. By comparing the model

effects of the control group (not included in the

indicators of wine, beverage, and refined tea

manufacturing) and the experimental group

(included in the indicators of wine, beverage, and

refined tea manufacturing), to explore whether the

relevant industry data can effectively promote stock

prediction. This paper selects the relevant data of the

stock of Kweichow Moutai and the production

industry data of wine and beverage (daily ups and

downs) from August 1, 2011 to August 1, 2021.

Among them, there are 2432 valid data. The data

indicators include a total of 13 indicators related to

the stock of Kweichow Moutai and the wine,

beverage, and refined tea manufacturing.

Research on the Influence of Industry Index on Individual Stock Price in Neural Network Prediction Model

329

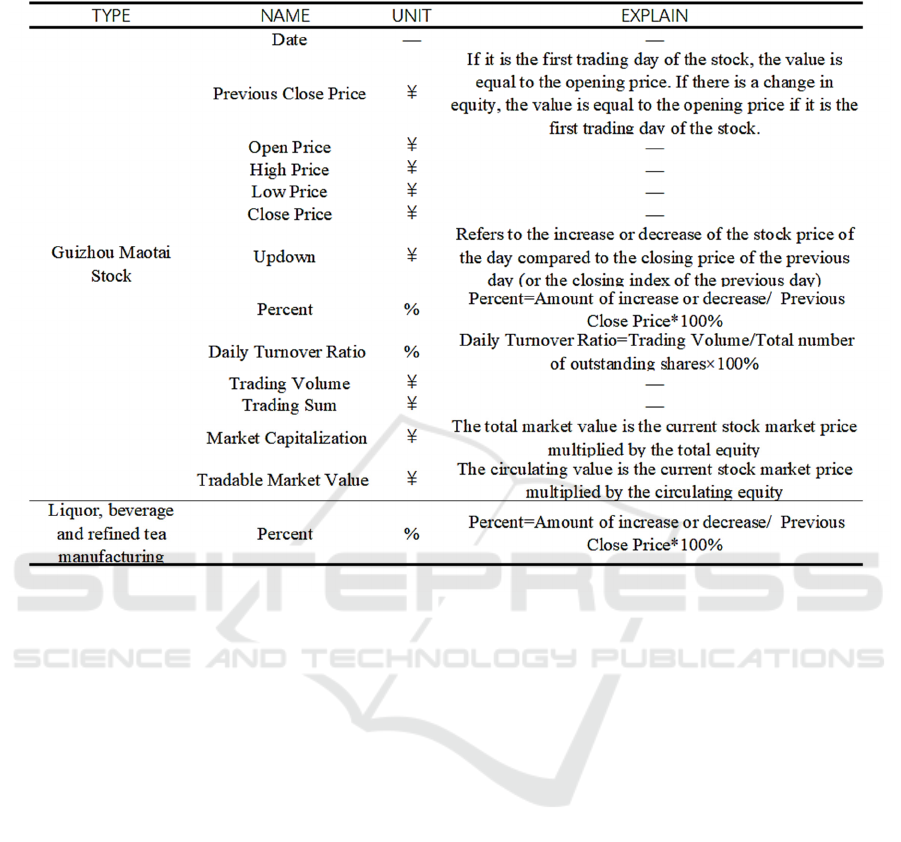

T

able 1: Data of the Research Sample.

Data source: CHOICE Database of East-money

4.2 Establishment of the Model

Input the 12 existing data of the previous day as

independent variables, and then use the closing price

of the stock the next day as the dependent variable to

output the predicted value, so that the good nonlinear

processing capabilities of the BP neural network can

be fully utilized. The specific process is as follows:

4.2.1 Data Preprocessing

Firstly, preprocess the data and optimize the data to

be preprocessed and the data of impact factors. Get

rid of the dimensional differences in the data. Divide

the processed data into the training set and detection

set. For data, the normalization of input values is

extremely important. The value processing of the

signal is normalized here into the interval [0, 1] (Chu

2019).

4.2.2 Parameter Setting of the Model

Based on MATLAB, the parameters set by this model

and the conditions for stopping the cycle are as

follows:

net.trainParam.show=20; %The display interval is set

to 20

net.trainParam.lr=0.1; %The rate of learning is set to

0.05

net.trainParam.mc=0.6; %The additional momentum

factor is set to 0.6

net.trainParam.epochs=1000; %The number of trainings is

set to 1000.

net.trainParam.goal=0.01; %The minimum error of the

training target is set to 0.01

4.2.3 Training of Models

The test of the fitting degree should correspond to the

feature dimension at each time in the model. This

article predicts the closing price of the stock on the

next day in the form of 13 indicators from the

previous day and uses the loss function to make the

output constantly approach the real data. In this

paper, the mean square error is used to measure the

performance of the model, which is used to predict

the overall deviation and whether the predicted trend

is consistent with the actual trend, which is defined

as follows:

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

330

MSE

y,y

′

y

y

′

n

In the above formula, y

is the true value of the

ith data in the above formula, and y

is the predicted

value given by the neural network, and n is the

number of samples.

4.2.4 Output and Evaluation of Prediction

Results

Because the test set and training set of the model are

randomly generated, the results of any run of the

model may be different, but all meet the above setting

of the model parameters. Based on the data of the

control group and the experimental group, the

training results of any neural network model training

were analyzed:

The time range of the test set from August 1, 2011

to August 1, 2021 is the abscissa of the forecast

curve, and the closing price for the day is ordinate.

The red star shape is the real data, and the round blue

one is the prediction data, as shown in figure 3.

According to the chart, we can see that the overall

forecast trend is basically consistent with the real

stock closing price, so the prediction effect is better.

Figure 3: The predicted curve.

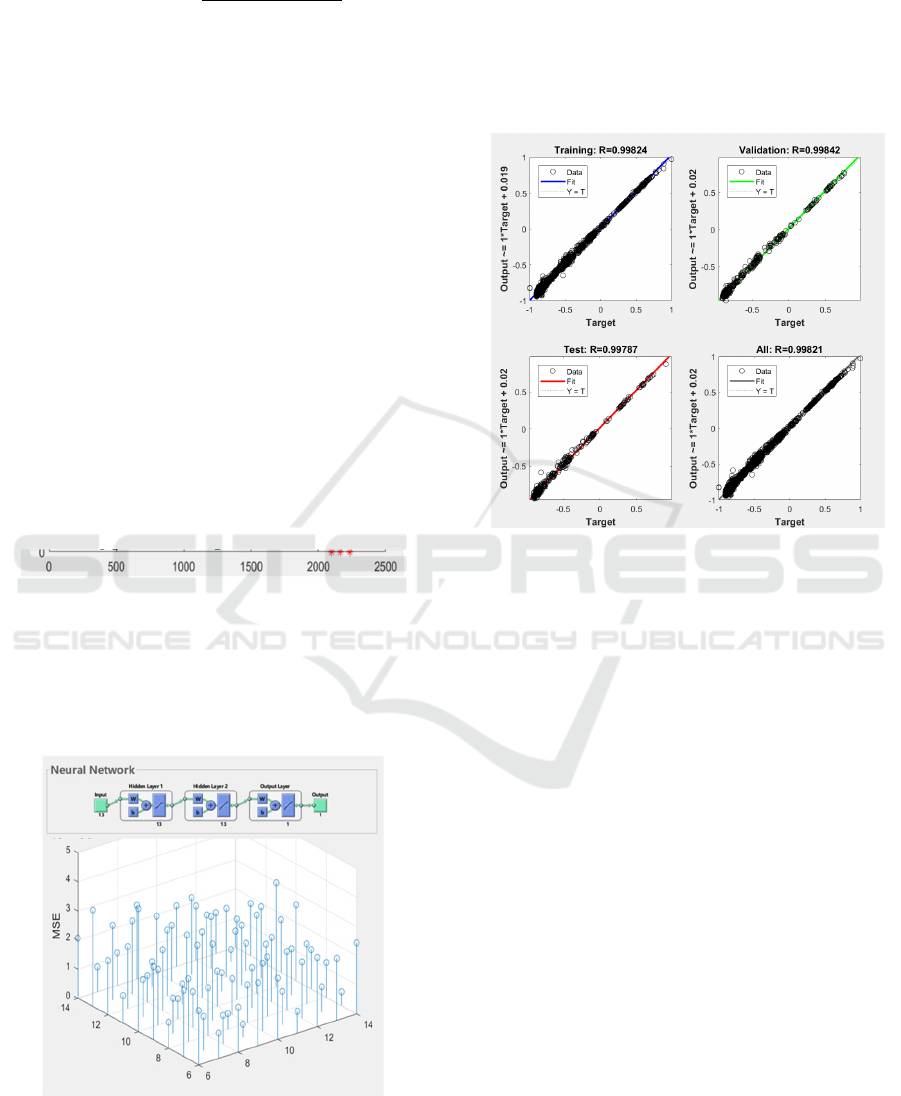

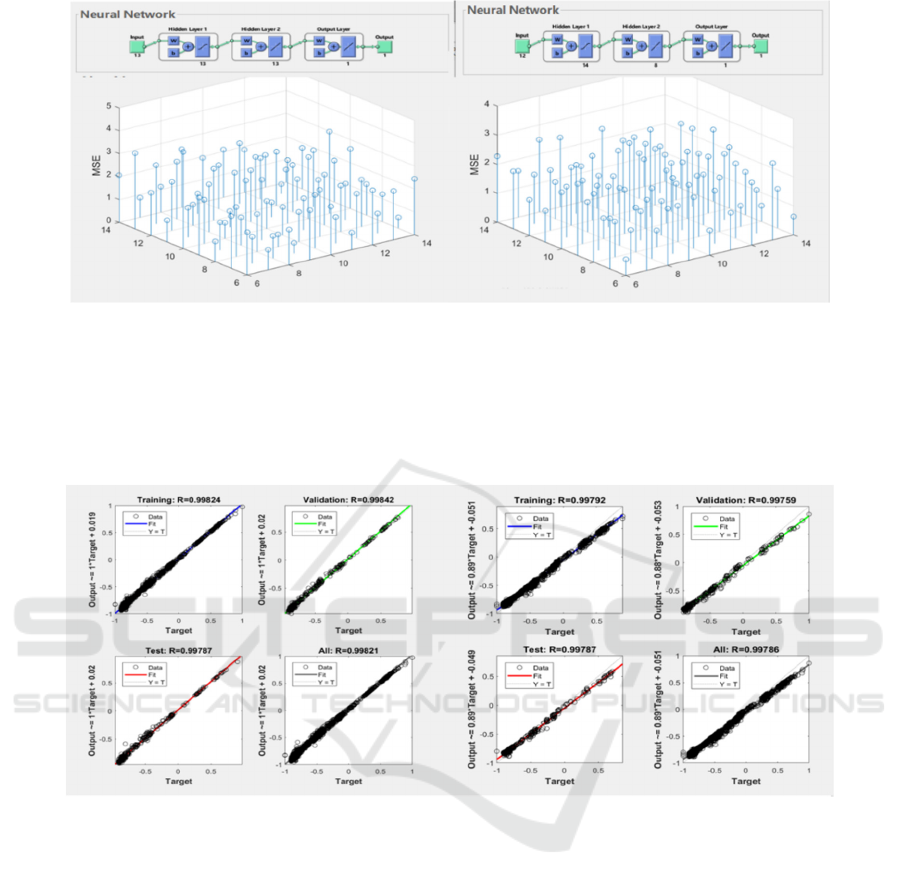

It can be concluded from the prediction process

graph that under the constraint of the minimum MSE,

the number of input layers in this training is 13, and

the number of hidden layers is 13 as the optimal

prediction model.

Figure 4: Process diagram of prediction.

The predictive regression map is a regression line

that is drawn to measure the fitting degree of the

corresponding data of the neural network to fit the

data. It can be seen that the target fitting curve Fit of

linear output on the regression map runs through the

lower left corner and the upper right corner, which

shows that the model has a good fitting effect to a

certain extent.

Figure 5: Diagram for predicting regression.

Combining the above models, the following

results are obtained: it is possible to accurately

predict the stock price with non-linearity and

randomness with the help of the stock price

prediction model of BP neural network. The

prediction data with a certain accuracy can be used

to make the model more ideal, make the error of the

predicted value reach the minimum, and effectively

achieve a better prediction effect.

4.3 Analysis of the Influence of

Industry Indexes on Individual

Stock Price

The ultimate purpose of the experiment is to predict

the stock price of Kweichow Moutai by BP neural

network, and to predict the trend of stock price and

explore whether the daily rise and fall index of wine,

beverage and refined tea manufacturing industry has

a positive effect on model prediction. Based on the

above model, this paper will explore whether the

addition of industry-related indicators will affect the

accuracy of the prediction results of the prediction

model of neural network. In this experiment, the

results of each run of the model may be different

because of the addition of random numbers in the

Research on the Influence of Industry Index on Individual Stock Price in Neural Network Prediction Model

331

process of test set selection. Therefore, this paper

carried out ten training runs for both the experimental

group and the control group. Through the record of

MSE, the average value of MSE in the experimental

group and the control group in the ten experiments

was calculated. As shown in the table below.

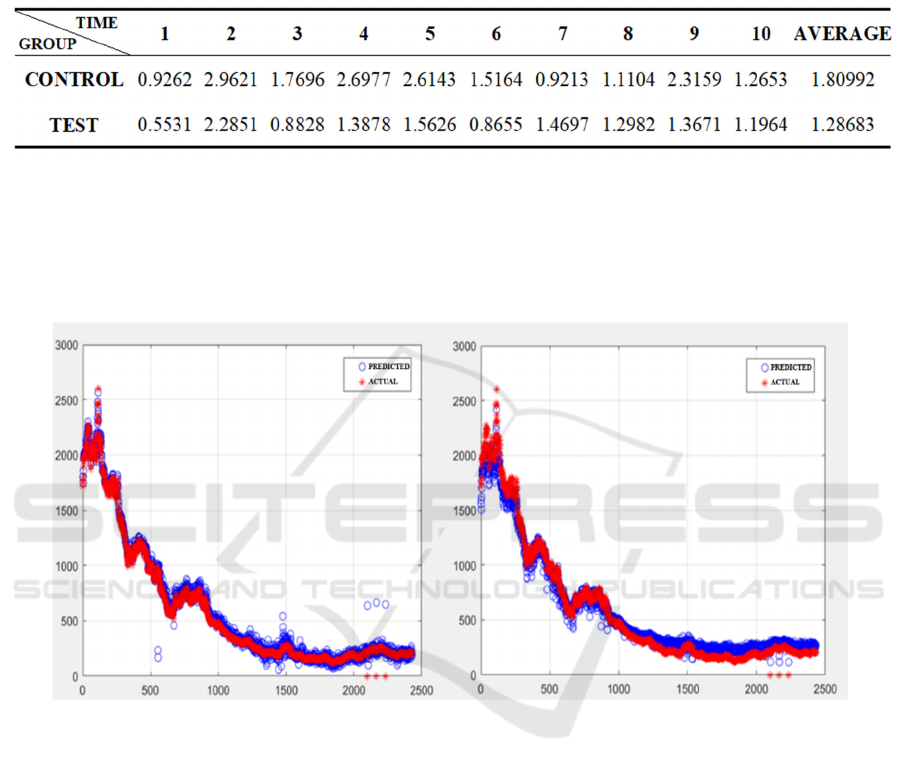

Table 2: MSE Summary Table of Experimental Group and Control Group.

By comparing this value, it can be found that the

MSE value of the experimental group is smaller than

that of the control group, which to a certain extent

means that the overall fitting degree is better and the

error is smaller, and a helpful way to predict stock

prices is to add indicators of wine, beverage, and

refined tea manufacturing. At the same time, the

relevant data taken in this paper were taken when the

control group and the experimental group had the

smallest MSE, respectively. As shown in the

following figure (control group on the left and

experimental group on the right):

Figure 6:

A Comparison of the Prediction Curves Between the Experimental Group and the Control Group.

By comparing the forecast graphs, the predicted

value of the left picture is basically the same as the

real value trend, but the error fluctuation situation is

relatively inferior to the overall level of the right

picture. Relatively speaking, the fitting situation of

the right figure is better and the predictive ability is

stronger.

According to the table (MSE) after the prediction

process chart, the number of input layers in the

control group is 14, the number of hidden layers is

0.9213, the number of hidden layers in the

experimental group is 13, the number of hidden

layers is 13, the MSE of hidden layers is 0.5531.

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

332

Figure 7. A Comparative Diagram of the Prediction Process Between the Experimental Group and the Control Group.

By comparing the predictive regression map, we

can see that the fitting degree of the control group

and the experimental group is better, and their target

fitting curves run through the lower-left corner and

the upper right corner. The R-value of the

experimental group is closer to 1 than that of the

control group, which indicates that the daily increase

index of the wine, beverage, and refined tea

manufacturing industry can make the model have a

better prediction effect from a certain Angle.

Figure 8: Comparativ

e Diagram of Predictive Regression Between the Experimental Group and the Control Group.

The advance goal of the experiment is proved to

a certain extent by the experiment and the above

analysis, that is, adding the relevant increase index of

the wine industry to the stock forecast can effectively

enhance the accuracy of the BP neural network for

stock prediction.

5 ANALYSIS OF

EXPERIMENTAL RESULTS

In this paper, the prediction model of the stock price

of the BP neural network is used to test and optimize

the artificial neural network model, and the problem

of feature extraction of related data is solved to a

certain extent. It also solves to some extent the

defects in the forecasting methods of some previous

stock trends in Reference 7 by reflecting the

influence of industry data on stock prices in

Reference 11.

In the research on the prediction of the stock

system, most of them measure the effectiveness of an

algorithm by whether it can accurately reflect the

changing trend of data in a period in the future. The

experimental results of using neural network to

predict stock price in this paper show that it is

effective. But at the same time, it is also found that

there are many problems to be solved in the use of

neural network for prediction. For example, the

training value of each time is different due to the

dynamic change of the neural network, and the

relationship between the input and output of the

predicted system cannot be expressed and analyzed,

Research on the Influence of Industry Index on Individual Stock Price in Neural Network Prediction Model

333

so the output of the system is difficult to explain. At

the same time, because the stock market is a complex

economic system, the result of using neural network

to deal with it may have errors due to the selection of

parameters or the training time is too short.

In order to eliminate the experimental error

caused by these problems, this article combines two

points to solve this problem, namely adding industry

indicators to the proposed forecasting model, and

reusing the BP neural network's forecasting model of

the stock price for forecasting. The experimental

results show that the MSE value of the brewing

industry index is generally smaller than the previous

MSE value, which shows that the prediction effect of

the BP neural network's forecasting model of the

stock price is better after adding the brewing industry

index. It also makes the prediction accuracy of this

model improved due to the addition of industry

indicators. In the prediction of this experiment, the

experimental data are based on the historical data of

Kweichow Moutai, a leader in the liquor industry. By

analogy, we can predict the future stock trend of other

brand data in the liquor industry. The model can be

extended to other industries and predict the future

stock prices of other brands. The effectiveness of the

scheme proposed in this paper has been proved in this

experiment, which makes the system optimized and

achieves higher stability. This provides a scientific

basis for the optimization of the model.

6 CONCLUSION

The BP neural network's forecasting model of stock

price can be obtained by analyzing the experimental

results of this paper by using the network structure

and initial conditions. It is effective to forecast the

stock price by using the selected historical data of

Kweichow Moutai and the brewing industry index in

Reference 6. At the same time, the forecasting model

in this paper can only be used as an auxiliary tool for

investment decision-making, and manual

intervention is still needed in actual investment

decision-making. Moreover, in the rapidly changing

environment of the securities market, the investment

model needs to be changed at any time according to

market changes and investment strategies, and the

same investment model cannot be used for a long

time. The model structure and algorithm should be

adjusted to a prediction system that is more suitable

for the law of market operation in Reference 6.

Through the analysis of this paper, we can do

more research on the BP neural network's forecasting

model of the stock price from the aspects of

increasing output variables and increasing or

changing input variables, to gradually improve the

prediction accuracy of this model and provide more

accurate prediction data for industry institutions and

the government.

REFERENCES

Chunhua Liu. (2012). Study on the influencing factors of

gold stock price [D]. Shandong University.

Feng Chen. (2012). Analysis of the influence of Stock

Index Futures on the volatility of China's A-share

Market [D]. Fudan University.

Fuyong Yang. (2010). Application of Neural Network

Model in Stock Investment [J]. Computing Technology

and Automation, 2010 Ji 29 (3): 108-112.

Hongyun Huang. (2016). Application of an improved

IPSO-BP Neural Network in Stock Index Forecast--

taking Shanghai Composite Index as an example [J].

Journal of Yanbian University: Science and

Technology, 42 (4): 6.

Hongyun Huang, Libin Wu, Shizheng Li. (2016).

Application of BP Neural Network in Stock Index

Forecast [J]. Journal of Tonghua Normal University,

37(10):32-34.

Jiancheng Long, Xiaoping Li. (2005). Study of the stock

market tendency based on the neural network [J].

Journal of Xidian University, 2005(03):460-463.

Wenhua Chu. (2019). Application of BP artificial Neural

Network in Stock Forecast [J]. Journal of Harbin

University of Commerce: Science and Technology, 35

(2): 4.

Xiyan Lu, Qingmei Liang. (2019). Prediction and Analysis

of Stock trend based on Neural Network [J]. Modern

Commerce, (9): 2.

Yun Hong, Libin Wu, Shipeng Li. (2016). Application of

BP Neural Network in Stock Index Forecast [J].

Journal of Tonghua Normal University, 37 (10): 32-34.

Ying Wang. (2006). Application and Research of BP

Neural Network in Stock Market Forecast [D].

University of Electronic Science and Technology of

China.

Yan Zhao. (2006). Analysis and Research of Stock Forecast

based on Neural Network [D]. Chang’an University.

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

334