Risk of CAPM Model Apply in Chinese Concept Stocks based on

Python

Hechen Wang

Management and Marketing, Durham University, Durham, DH1 1NY, U.K.

Keywords: Capm, Chinese Concept, Stock, Finance, Investment.

Abstract: Sharpe developed the Capital Asset Pricing Model, which was completed by Lintner and Mossing based on

portfolio theory and capital market theory. The Chinses Concept stocks have a particular situation in the US

stock market because of enterprises’ backgrounds. The paper will apply CAPM model in two Chinese Concept

Stocks NIO and LKNCY by using python to analyse data. The risks are analysed by unsystematic and

systematic risks and the special situation of Chinese Concept Stock will be also discussed as factors. The data

analysis through python will be more accurate and less lab or cost. The purpose of this research is to provide

more objective investment suggestions to Chinese concept stocks investors.

1 INTRODUCTION

Sharpe (1964) developed the Capital Asset Pricing

Model, which was completed by Lintner (1965) and

Mossin (1966) based on portfolio theory and capital

market theory, with a focus on the relationship

between the expected return of assets and risk assets

in the securities market, as well as the formation of

equilibrium price. The Capital Asset Pricing Model is

the foundation of modern financial market pricing

theory, and it is applied in the fields of investment and

corporate finance. The Capital Asset Pricing Model

The theoretical and practical value of the CAPM

model has been proved under ideal circumstances.

CAPM model classifies risk into two types:

systematic risk and unsystematic risk. Furthermore,

since the US stock market permits enterprises

globally to IPO and the Chinese stock market has

restricted regulations.

As a result, many Chinese companies are listed on

the US stock market, such as NIO and Alibaba. On

the other hand, Chinese concept stocks are a group of

Chinese stocks listed outside of China and include

companies that are registered in mainland China and

listed abroad, as well as enterprises that are registered

in mainland China but have their primary business

and relations in mainland China. Those stocks are

heavily influenced by the expected trend of overseas

investors on mainland China's economy, and they are

limited by foreign investors' lack of understanding of

China.

Thus, this article will apply the close prices

between 2019-2020 in python and analyze the risk of

the CAPM model in Chinese concept stocks by

calculating expected returns and actual returns for

two Chinese concept stocks: NIO and LKNCY. More

importantly, the research will provide a more

productive analysis for Chinese concept stock

investors.

2 LITERATURE OVERVIEW

CAPM theory has been widely adopted in the modern

finance theory, and numerous researchers have

studied it. Under ideal circumstances and

assumptions that the investors are rational and

diversified invest strictly in a portfolio from

somewhere along the efficient frontier according to

the rules of the Markowitz model (Markowitz, 1967),

as well as the capital markets, are fully efficient

markets with no frictions hindering investment,

CPAM model confirms the linear relationship

between risk and returns under the CAPM model

showing that greater exposure to risk provides higher

returns.

In addition, Black (1972) claimed that the line

connecting the anticipated return on an efficient

portfolio to its beta is made up of two straight line

208

Wang, H.

Risk of CAPM Model Apply in Chinese Concept Stocks based on Python.

DOI: 10.5220/0011161700003437

In Proceedings of the 1st International Conference on Public Management and Big Data Analysis (PMBDA 2021), pages 208-213

ISBN: 978-989-758-589-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

segments, with the lower-risk section having a

steeper slope than the higher-risk one. However,

Dempsey (2012) argued that the facts of the

experiments don't support the CAPM model.

Contrary, Gençay et al. (2005) suggested that the

CAPM's predictions are more meaningful in the

medium to long term range. Thus, in the portfolio

selection issue, CAPM may be significant decision-

making challenge for most companies.

3 METHODOLOGY

First of all, expected returns and real returns will be

calculated. The study CAPM model is a line equation

that determines the capital return on assets. The

equation of the CAPM model is:

E(Ri) = Rf + β(Rm – Rf). (1)

E(Ri): capital asset expected return

β: sensitivity E(Rm): expected return of the

market

Rf: risk-free rate of interest

The beta coefficient is the sensitivity of individual

stock returns relative to the overall market, and it is

determined by the connection between market swings

and the price variations of individual stocks or

groups, implying that the model use market risk to

explain the risk of individual stocks:

β = COV(i, m)/ σ² (2)

When β= 1, the price of the security correlated to

the market.

When β< 1, the price of the security less violate

than the market.

When β> 1, the price of the security fluctuates

more than the market.

The study uses NIO Inc. (NYSE: NIO) and

Luckin Coffee Inc (OTCMKTS: LKNCY) as sample

data to analyze and uses python to compute Expected

returns and plot regression lines between individual

security and the market portfolio. Secondly, since a

risk-free asset should have zero deviation, so the U.S

government ten years treasury bill is utilized as a risk-

free asset.

Therefore, the Rf is calculated as 0. Thirdly, S&P

500 is applied as a market portfolio because it is the

market-capitalization-weighted index of the top 500

companies in the U.S. stock market.

In addition, in order that the two stocks used as

examples can be compared relatively fairly, the

variables is reduced so that 'Close' data from June 1,

2019 to June 1, 2020 and data from June 1, 2020 to

June 1, 2021 are chosen since Luckin Coffee Inc. has

been listed on May 24, 2019.

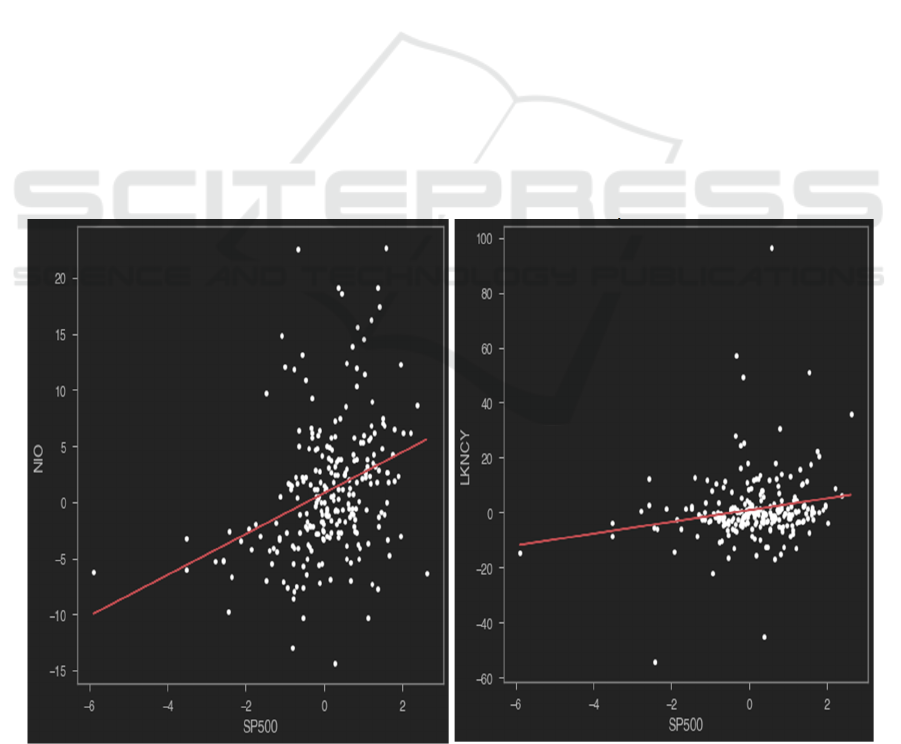

Figure 1: CAPM model applied in NIO (Left) and LKNCY(Right) in 2019-2020.

Risk of CAPM Model Apply in Chinese Concept Stocks based on Python

209

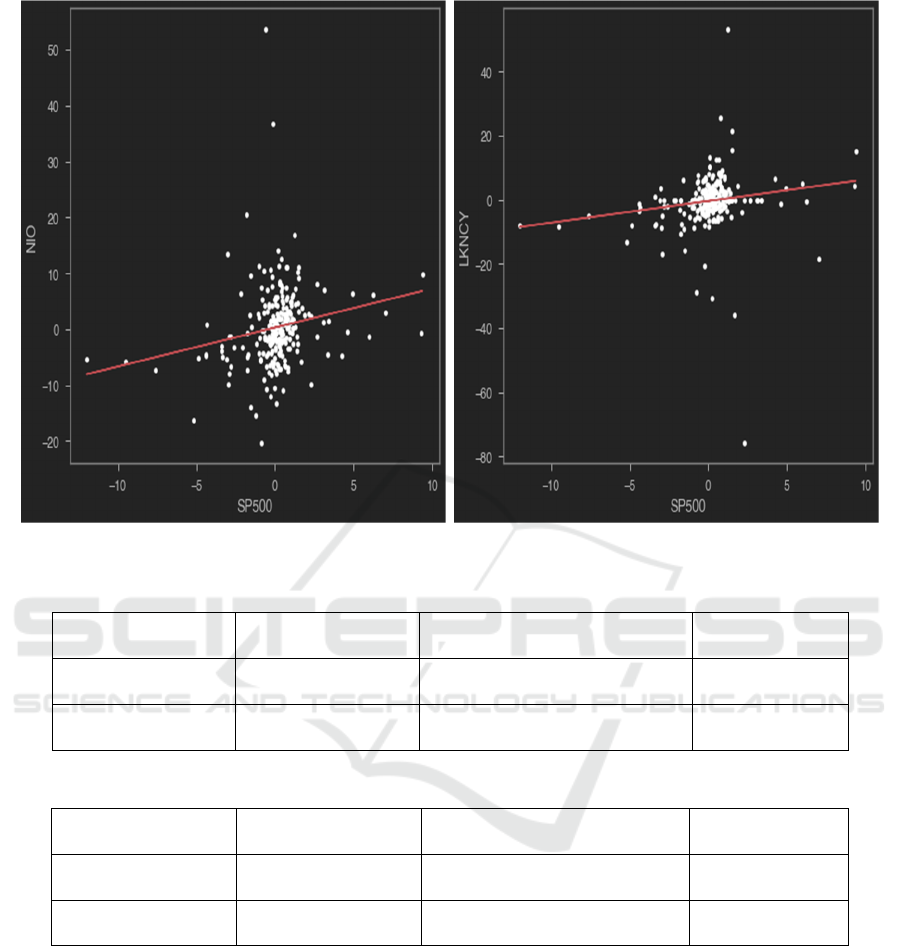

Figure 2: CAPM model applied in NIO (Left) and LKNCY(Right) in 2020-2021.

Table 1: Beta coefficient, expected return and real return of NIO and LKNCY in 2019-2020.

2019-2020 Beta expected return real return (ROR)

NIO 0.697 11.01% 34%

LKNCY 0.674 10.65% -90%

Table 2: Beta coefficient, expected return and real return of NIO and LKNCY in 2020-2021

2020-2021 Beta expected return real return (ROR)

NIO 1.824 60.92% 807%

LKNCY 2.140 71.49% 260%

According to Figure 1 and Table 1, the Beta value

of two stocks from 2019-2020 are both less than 1,

which means the price of the security less violate than

the market.

However, from Figure 2 and Table 2, the Beta

value of the two stocks are greater than 1, which

means they are more sensitive than the market.

Additionally, LKNCY is more sensitive than NIO.

The expected return of NIO for two ranges are

11.01% and 60.92% and the expect return of LKNCY

for two ranges are 10.65% and 71.49% respectively.

Besides, comparing the four sets of expected return

and real return data, the results indicate that all of

them have the varied extent of differences. The

results will be discussed in the discussion section.

4 EFFECTS OF RISK ON

COMPANY VALUE

As the model mentioned above, total risk =

systematic risk + unsystematic risk. Firstly, risks will

be categorized as market and unsystematic risks.

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

210

Market risk refers to market risks that cannot be

eliminated through diversification, such as interest

rates, recession, and war. For example, in mid-March

2020, the U.S. stock market triggered a trading curb

mechanism four times separately.

As a result, the Dow Jones Industrial Average

reduced about 35%, which was the worst level in 100

years. The trading curb mechanism has been

triggered five times in the history of the U.S. stock

market and four times in 2020 alone, so this market

has performed very poorly in all such cases. Delta Air

Lines has dropped over 40% on March 19. Therefore,

when the systematic risk is relatively difficult to

avoid, when the systematic risk is high, choosing

individual stocks with a beta coefficient less than one

will be relatively less risky.

On the other hand, unsystematic risk, also known

as unique risk, is the risk associated with a particular

stock that can be eliminated by rebalancing the stock

portfolio. Take Luckin Coffee Inc as an example,

2020 April, the company admitted to a fraudulent

financial statement. There were indeed several cases

of material misstatement of financial statements

before that, however, Luckin Coffee Inc. had a

tendency to ignore the material misstatements and

Chinese companies listed in the U.S. were reportedly

not required to comply with SEC audit and disclosure

procedures because the Chinese government made

some patronizing moves (Kukreja, 2021).

Thus, Luckin Coffee Inc. has been delisted from

The Nasdaq Stock Market in 2021 June. Hence, this

demonstrates that non-systematic risk is less market

correlated, so it can be hedged by selecting several

individual stocks in different sectors in a portfolio.

5 DISCUSSIONS

The discussion part will be separated in three parts:

First, the expected return differs from the real

return in the following aspects; Second, the

assumptions with CPAM model; Third, special

situation of Chinese Concept stock.

5.1 Results from Expected and Real

Return

The results from data of 2019-2020 indicate that

when the beta coefficient is less than one, stocks are

less sensitive compare to market volatility. Therefore,

the expected return and real return of NIO in 2019-

2020 the difference is not particularly unexpected.

Moreover, LKNCY's underperformance is due to the

company's financial fraud scandal. Furthermore,

according to the results from 2020-2021 group, the

beta coefficients of both stocks are greater than one,

indicating that both stocks are significantly sensitive

to market volatility.

Also, because the U.S. stock market has

performed well since the four crashes in 2020, so both

stocks have exceeded expectations by a remarkable

amount especially for the NIO.

However, what can't be ignored is that NIO has

risen more than eight times also because the entire EV

sector stocks are hot stocks in 2020-2021. Therefore,

in the process of applying CAPM model, in order to

reduce the difference between expected and real

returns, it is also necessary to consider individual

stocks, such as the performance of its sector in the

market.

5.2 The Assumptions with CPAM

Model

Firstly, the effectiveness of CAPM models is based

on a number of rigorous assumptions. In the real

world, these assumptions are not so easily satisfied.

In principle, there is no dynamic short-selling profit

behavior since the CAPM is a single period model. In

fact, because the CAPM assumes that all investors

have the same information and risk preferences, they

all assign the same equilibrium price to assets, and

because investors can expect a negative return if they

deviate from the equilibrium price (due to the

possibility of short selling), any rational investor will

take action to avoid this behaviour.

Secondly, the model assumes that all investors are

rational, but in 2020 there are many irrational

investors in the market. In the particular case of

covid-19, with the U.S. government giving bailouts

to people and more young people losing their jobs due

to the epidemic, these young risk-takers enter the

stock market with their money like entering a casino.

They would ignore the stock's fundamentals and

enjoy more the sense of achievement of getting rich

overnight. A suitable case is Gamestop (NYSE:

GME), a company that financial performance was

almost bankrupt, the stock has been skyrocketed

because of these young irrational investors.

Thirdly, an asset's market exposure or beta,

completely explains the return on an asset in the

CAPM calculation, the market portfolio may not

explain all of ROA in the CAPM formula. In reality,

ROA may be influenced by more than just market

conditions. Their contribution to ROA will be

disregarded if we examine all other variables in the

firm's diversified risk. As a consequence, if the

Risk of CAPM Model Apply in Chinese Concept Stocks based on Python

211

ignored variables have a substantial impact on the

ROA at certain points in time, the CAPM model's

findings will be skewed.

Fourthly, under various market circumstances,

market capitalization weighting may provide

different outcomes. For example, if a significant

quantity of money flows into high-cap companies

causes the index to increase under present market

circumstances, market capitalization weighting will

be useful in positioning positions. Otherwise, if the

majority of money flows into small and mid-cap

companies, the cap-weighted strategy may miss the

rise or even lose money as a result of a downturn in

high-cap stocks.

5.3 Special Situation of Chinese

Concept Stock

The unique characteristics of Chinese stocks also

increase the risk. First, most U.S.-listed Chinese

companies have accurate and credible financial

statements, but earnings fraud is also a possible risk.

In addition to Luckin Coffee's fraudulent financial

data, 2021 Guangzhou EHang Intelligent Technology

Co. Ltd (NASDAQ: EH) was also found to have

falsified sales data after Wolfpack's investigation.

The second point is that since most Chinese

companies are based in China, there may be a lag in

information about the company's operations.

Moreover, investors who do not have an

understanding of the Chinese culture may find it

challenging to understand the company's operations,

such as the reasons for Bilibili's (NASDAQ: BILI)

large number of young users, in addition to the public

information about the company. Therefore, this

information inequality increases unsystematic risk.

6 SUGGESTIONS

The CAPM methodology's disadvantage is that the

analytical model is overly subjective, and the data is

dependent mainly on analysts' projections for future

growth.

As a result, a sensitivity analysis will be an

essential component of the CAPM model study. In

addition, in the application of the CAPM model to

Chinese stocks, apart from using historical data to

calculate expected returns, more consideration should

be given to non-systematic risk factors such as the

truthfulness of financial statements.

So, investors may want to hedge risk by choosing

multiple different types of stocks or by buying

Chinese concept stocks that have been established for

a long time and have a large user base in China.

7 CONCLUSIONS

In conclusion, the study uses data from two Chinese

Concept stocks compare with S&P 500 by applying

the CAPM model formula and contrasts expect the

return and real return to analyse the risk of the CAPM

model in two types. Despite the CAPM model's

numerous flaws in fitting actual data, the CAPM

model's correct derivation procedure and essence as

an equilibrium model define its place in the area of

financial economics. In applying this model to

Chinese Concept stocks, more consideration needs to

be given to the non-systematic risks associated with

unique attributes. The limitation of this study is the

inadequacy of the sample data and the fact that the

politics of China and the U.S. are not considered at

risk. More researches need to be done in the future.

ACKNOWLEDGMENT

I would like to thank Associate Prof. Colleen

Honigsberg for her insightful academic support.

Finally, I would like to provide profound gratitude

to my parents for providing me with unfailing

support.

REFERENCES

Black, F. (1972). Capital Market Equilibrium with

Restricted Borrowing. The Journal of Business, 45(3),

444–454. https://doi.org/10.1086/295472

Dempsey, M. (2012). The Capital Asset Pricing Model

(CAPM): The History of a Failed Revolutionary Idea in

Finance? Abacus, 49(S1), 7–23.

https://doi.org/10.1111/j.1467-6281.2012.00379.x

Gençay, R., Selçuk, F., & Whitcher, B. (2005). Multiscale

systematic risk. Journal of International Money and

Finance, 24(1), 55–70.

https://doi.org/10.1016/j.jimonfin.2004.10.003

Lintner, J. (1965). The Valuation of Risk Assets and the

Selection of Risky Investments in Stock Portfolios and

Capital Budgets. The Review of Economics and

Statistics, 47(1), 13–47.

https://doi.org/10.2307/1924119

Markowitz, H. (1967). Portfolio selection: efficient

diversification of investments. New York: J. Wiley.

Mossin, J. (1966). Equilibrium in a Capital Asset Market.

Econometrica, 34(4), 768–783.

https://doi.org/10.2307/1910098

PMBDA 2021 - International Conference on Public Management and Big Data Analysis

212

Sharpe, W. F. (1964). CAPITAL ASSET PRICES: A

THEORY OF MARKET EQUILIBRIUM UNDER

CONDITIONS OF RISK*. The Journal of Finance,

19(3), 425–442. https://doi.org/10.1111/j.1540-

6261.1964.tb02865.x

Risk of CAPM Model Apply in Chinese Concept Stocks based on Python

213