Towards a Smart Identification of Tax Default Risk with Machine

Learning

Vinicius Di Oliveira

1,2 a

, Ricardo Matos Chaim

1 b

, Li Weigang

1 c

,

Sergio Augusto Para Bittencourt Neto

1,2 d

and Geraldo Pereira Rocha Filho

1 e

1

University of Brasilia, Federal District, Brazil

2

Secretary of Economy, Brasilia, Federal District, Brazil

Keywords:

Machine Learning, Data Preparation, Tax Default, Risk Identification.

Abstract:

The failure to perceive non-payment of the tax due is the main risk of tax inspection. The complex tax

legislation and the volume of information available must be overcome for facing tax evasion. There is a gap in

studies investigating the analysis of tax default risk and Machine Learning algorithms. This study proposes the

use of ML algorithms ordinarily used on credit risk analysis as a risk analysis tool for tax default. The tax data

preparation issue was faced by discretizing qualitative and quantitative variables. This work presents a new

approach for the classification of companies regarding tax avoidance using Machine Learning. The developed

ANN model achieved an AUC = 0.9568 in the classification task. The study gathers more than 300 thousand

companies in the city of Brasilia - Brazil, analyzing their socioeconomic and financial characteristics.

1 INTRODUCTION

The objective of tax inspection is to detect the lack

of payments due to evasion or errors. Thus the main

risk of tax inspection is the failure to perceive non-

payment of the tax due. The large amount of infor-

mation available and the complexity of tax legislation

makes it necessary to use state-of-the-art technology

and scientific techniques to manage the risk of tax

evasion.

Several studies address algorithms based on statis-

tical techniques and machine learning algorithms in

credit risk analysis in the literature (Pochiraju and Se-

shadri, 2019; Golbayani et al., 2020; Bahrami et al.,

2020). However, there is a gap in studies related to

the analysis of tax default risk. Likewise, there is a

lack of studies on predicting taxpayers’ behavior. On

the one hand, the available taxpayer’s information is

abundant.

With this perspective, this study is proposed to in-

vestigate the use of predictive models based on ma-

chine learning to identify companies with the risk of

a

https://orcid.org/0000-0002-1295-5221

b

https://orcid.org/0000-0003-0206-7076

c

https://orcid.org/0000-0003-1826-1850

d

https://orcid.org/0000-0002-6903-938X

e

https://orcid.org/0000-0001-6795-2768

tax evasion.

For this assignment, a parallel was made between

credit risk and risk of tax default. The hypothesis

tested is whether the credit risk analysis performed

by Machine Learning models can be applied as a risk

analysis tool for tax default.

To do such a task, a methodology of data prepa-

ration was proposed to treat the companies features.

Among these characteristics there are those of an eco-

nomic nature and those of a financial nature. All

of them were transformed and grouped according to

their aspects and relevance. This methodology has

been called Full Discretization where the continuous

variables are discretized according to quartiles of its

distribution curve.

The observed population was more than 300 thou-

sand companies in the Fiscal Register of Brasilia, the

capital of Brazil. For all analyzes and modeling, the

entire population was considered.

The paper is organized as follows. Section 2

reports works related to the application of machine

learning techniques in the context of credit risk anal-

ysis and tax evasion avoidance. Section 3 presents

the data preparation process. Section 4 introduces

the models applied and the analysis of the results ob-

tained. Section 5 contains conclusions and further

ideas for future works.

422

Di Oliveira, V., Chaim, R., Weigang, L., Neto, S. and Filho, G.

Towards a Smart Identification of Tax Default Risk with Machine Learning.

DOI: 10.5220/0010712200003058

In Proceedings of the 17th International Conference on Web Information Systems and Technologies (WEBIST 2021), pages 422-429

ISBN: 978-989-758-536-4; ISSN: 2184-3252

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 RELATED WORK

Data mining has emerged as a very active field ap-

plied to virtually every field of science. There are a

wide variety of data mining tools available and sev-

eral different techniques in every area of evolving

research (Bramer, 2016; Aggarwal, 2015; Fayyad,

1996). A classic application of data mining is the clas-

sification for credit approval, where the models can

be constructed with fuzzy support vector machines,

or applied decision trees, neural networks, and logis-

tic regression applied to the risk analysis of receiv-

ables accounts (Pochiraju and Seshadri, 2019; Gol-

bayani et al., 2020; Jabeur et al., 2021). In particu-

lar, it is worth noting their use in credit risk analy-

sis, widely used by retail and financial establishments

(Wu, 2015). From this application emerges the hy-

pothesis of using credit scoring models to assess the

risk of tax default addressed in this study.

Credit scoring is concerned with the development

of empirical models to support decision-making in the

retail credit business (Thomas and Edelman, 2017).

Credit risk classification is a base model for estimat-

ing the likelihood of a borrower demonstrating some

unwanted behavior in the future. For example, in

scoring applications, lenders apply predictive mod-

els, called scorecards, to estimate the likelihood of de-

fault. Corporate risk models use balance sheet data, fi-

nancial indices, or macroeconomic indicators (Bromi-

ley, 2015), while retail models use data from request

forms, customer demographics, and transactional cus-

tomer historical data (Lessmann, 2015).

The use of electronic invoices to assess the risk

of payment default has grown in recent years. The

invoice issuing characteristics can be used to predict

the buyer’s behavior regarding the payment of those

transactions (Cha et al., 2020; Bahrami et al., 2020).

As used in default risk assessment, the classifica-

tion of invoice issuance using machine learning tech-

niques (Yu et al., 2018) has been studied and devel-

oped in recent works regarding avoidance of tax eva-

sion (Mathews et al., 2020; Bardelli et al., 2020; An

et al., 2020) and fraud detection (Kim et al., 2020; He

et al., 2020).

In this study, a much larger set of features will be

taken into account in the classification of companies

regarding their fiscal behavior.

The problem associated with credit risk classi-

fication is the categorization of potential borrowers

into good or bad payers. The models are designed

to help banks decide whether or not to grant a loan

to a new borrower using the data of their charac-

teristics. Despite the evolution of technology, lin-

ear regression is still the industry standard reference

model used to construct credit risk classification mod-

els (Gouv

ˆ

ea M., 2013), although other techniques

are overcoming (Teles et al., 2020), the studies sur-

veyed have demonstrated that artificial intelligence

techniques, such as neural networks, support vector

machine - SVM, decisions trees - DT, random forests

- RF e na

¨

ıve Bayes - NB, may be substituted for statis-

tical approaches in the construction of credit scoring

models (Maher A., 2016). That is, in recent years, ar-

tificial intelligence has shown its advantages in credit

scores compared to linear models of probability, dis-

criminant analysis and other statistical techniques.

A Multi-layer Perceptron - MLP is an artificial

neural network used for classification, pattern recog-

nition, and prediction consisting of an input layer, hid-

den layers, and output layer. The number of changes

in the hidden layer depends on the complexity of the

data. The MLP uses a supervised learning technique

in which the desired output is known by the network

(Pandey and Cho, 2018). In the field of credit scor-

ing, neural networks can be distinguished from other

statistical techniques. Using neural networks, if the

results are unacceptable, the estimated values of the

parameters will be altered by the networks until they

become acceptable or until they reach the ideal value

of each parameter (Abdou, 2011).

3 THE DATA ISSUE

A big challenge in data modeling is how the data will

be prepared and transformed. To carry out this study,

many features were considered, so looking at this task

brought the proposal of the full discretization method-

ology, which will be discussed in this section.

3.1 Business Understanding:

Prospecting Tax Default

Prospecting evidence is presented to seek clues to

some irregularity that generates less payment of the

tax due. This is distinct from the identification of ir-

regularities, which points exactly to the failure, fraud,

or omission of the taxpayer that generated tax evasion.

An example of identifying irregularities in the non-

delivery of declarations, the deliberate non-payment

of tax already launched, the non-accounting of tax

documents, or the mere non-issuance of invoices.

On the other hand, the prospect of evidence seeks

the discovery of unusual or peculiar irregularities that

have not yet been foreseen and documented. The

most used form in the tax administration of the city

of Brasilia / Brazil is the attempt to infer the income

Towards a Smart Identification of Tax Default Risk with Machine Learning

423

of certain taxpayers, then estimate the number of col-

lections expected for those individuals and compares

with the total effectively collected, where there is sig-

nificant divergence is separated for more accurate in-

spection to identify a possible irregularity that justi-

fies some fiscal action.

But what about cases of revenue omissions that

make an excellent inference impossible? Or in the

cases of innovative accounting maneuvers with the

purpose of tax evasion? Traditional methods would

not be effective. Therefore, the use of predictive mod-

els of risk default appears as an alternative, or even

complement, to the methods now used to identify tax

evasion cases not recognized in the routines currently

adopted.

3.2 Preparing and Understanding the

Data

To feed the models, the information of the taxpayer’s

object of study is arranged to demonstrate their char-

acteristics and economic-fiscal characteristics. In

comparison with the credit risk models used by fi-

nancial service providers, the individual characteris-

tics of a borrowing entity would be those related to

its people, such as age, sex, or profession, and its

economic-fiscal characteristics would be its income,

its expenses, or its behavioral history as a borrower.

At the same time, for a taxpayer entity, the individ-

ual characteristics would be those related to its legal

personalities, such as economic activity, type of com-

pany, or fiscal regime. The economic-fiscal character-

istics would be its billing outcomes, its tax collection,

or its fiscal history.

Data were extracted from 305,685 companies en-

rolled in the Tax Registry of Brasilia, the capital of

Brazil, among these, 79,548 companies have debts

registered for some non-payment referring to the

years 2012 to 2017. The same company may have

different debts registered, referring to more than one

year. The following is a description of each variable

and the report of how the data were discretized for the

composition of the model’s database as described by

Silva (Silva, 2016).

3.2.1 Discrete Variables

The individual characteristics of the “taxpayer” enti-

ties in this study were extracted from the Tax Registry

of the city of Brasilia. They are intrinsic qualities to

the legal personality of the company and its legal con-

stitution, registered at the moment in which the com-

pany is created, updated to each contract amendment

throughout the existence of the company. The exclu-

sive attributes, such as the registry identification num-

ber, address, and the partners’ names, were excluded

to maintain fiscal confidentiality, which will not prej-

udice the study.

All the discrete variables were treated in the same

way, the intention of this treatment is to separate, for

each variable, the most significant instances of the

others. For this, the 80/20 rule was applied so that the

instances responsible for 80% of the occurrences were

individualized, the others were grouped into a single

identification. The process followed these steps:

1. Identification of the observed instances and re-

spective frequencies (number of occurrences);

2. Sorting the instances by the frequency in descend-

ing order;

3. Each instance will be assigned its relative and ac-

cumulated frequency;

4. Assign an identification for each instance, sequen-

tially in the order of the previous item, until the

accumulated frequency is 80% of the total;

5. Group the other instances in the same identified

group, for example: Others.

The discrete variables are presented below.

TC. Taxpayer Type. The specification of the com-

pany’s corporate form as well as its legal nature, e.g.,

limited company, limited business partnership, corpo-

ration, joint stock company, cooperative, private asso-

ciation, etc.: TC1 = entrepreneur (individual), TC2 =

private limited company and TC3 = “Others”.

TA. Activity Time. The operation time of the com-

pany since its registration in the fiscal register of the

Federal District: TA1 = from 0 to 4 years, TA2 = 5 to

9 years and TA3 = 10 years or more.

AEICMS. ICMS Economic Activity. The indi-

cation of the economic activity performed by the

company related to the ICMS (tax similar to Euro-

pean VAT, but applied to transactions with goods):

AICMS1 = Commerce, AICMS2 = Housing and

Food, AICMS3 = Industry and AICMS4 = “Others”.

AEISS. ISS Economic Activity. The indication of

the economic activity performed by the company re-

lated to the ISS (tax similar to European VAT, but ap-

plied to services): AISS1 = Service Activities, AISS2

= Construction, AISS3 = Administrative Activities,

AISS4 = Professional Activities, AISS5 = Commerce,

AISS6 = Industry, AISS7 = Transportation, AISS8

= Autonomous, AISS9 = Education and AISS10 =

“Others”.

WEBIST 2021 - 17th International Conference on Web Information Systems and Technologies

424

CALC. Calculation Form of ICMS And/or ISS.

The description of the manner in which the tax

will be applied on the company’s economic activ-

ity, e.g., normal regime, simple national system, in-

dividual micro-entrepreneur - SIMEI, rural producer,

uni-professional, autonomous society, etc.: CALC1

= micro-entrepreneur, CALC2 = simple national sys-

tem, CALC3 = normal regime and CALC4 = “Oth-

ers”.

SOCI. Number of Company’s Partners. The

number of partners registered in the company’s so-

cial contract and indicated in the Fiscal Register of the

Federal District: SOCI1 = Only one member, SOCI2

= Two partners and SOCI3 = Three or more partners.

SOPJ. Has Legal Entity as a Partner. The indi-

cation that at least one of the company’s partners is

a legal entity: SOPJ1 = no legal entity and SOPJ2 =

With legal entity.

3.2.2 Continuous Variables

The socio-economic characteristics of the “taxpayer”

entities in this study were extracted from their tax dec-

larations, their financial records of collections, and

their fiscal history. This whole information was made

available for the present work in the State Department

of Finance of the city of Brasilia. The tax declarations

indicate qualities related to the company’s incomes,

consequently linked to its revenues, for this, the Elec-

tronic Tax Books - LFE

1

delivered were observed.

Its financial records of tax collections were observed

as part of the company’s costs. The tax behavior was

verified through the history of fiscal actions suffered

by the taxpayer, resulting in tax collection with fines.

In the base model, the sums of the total values ver-

ified individually by the companies regarding the de-

clared values and the values of collection, already for

the fiscal history, were observed whether the company

was sued or not. In this case, “sued” means that the

company has suffered some tax action in the past, and

it has resulted in some type of charge of tax due and

not collected with fines. Thus, the following charac-

teristics were used: Total value of exits over the total

value of entries declared in the Electronic Tax Book,

the total amount of tax collected, and finally, whether

it was sued or not.

RLFE. Total Value of Exits over the Total Value of

Entries Declared in the Electronic Tax Book. The

sum of the values of the exits (sales and / or services

1

From the Portuguese Livro Fiscal Eletronico

rendered) divided by the sum of the entries (purchases

and / or services taken) declared in the Electronic Tax

Book delivered in the system of the State Department

of Finance of the Federal District. In the extracted

database, 305,685 records, both null and absent val-

ues were verified in 261,382 records, thus the statis-

tics of this distribution considered only the observed

values.

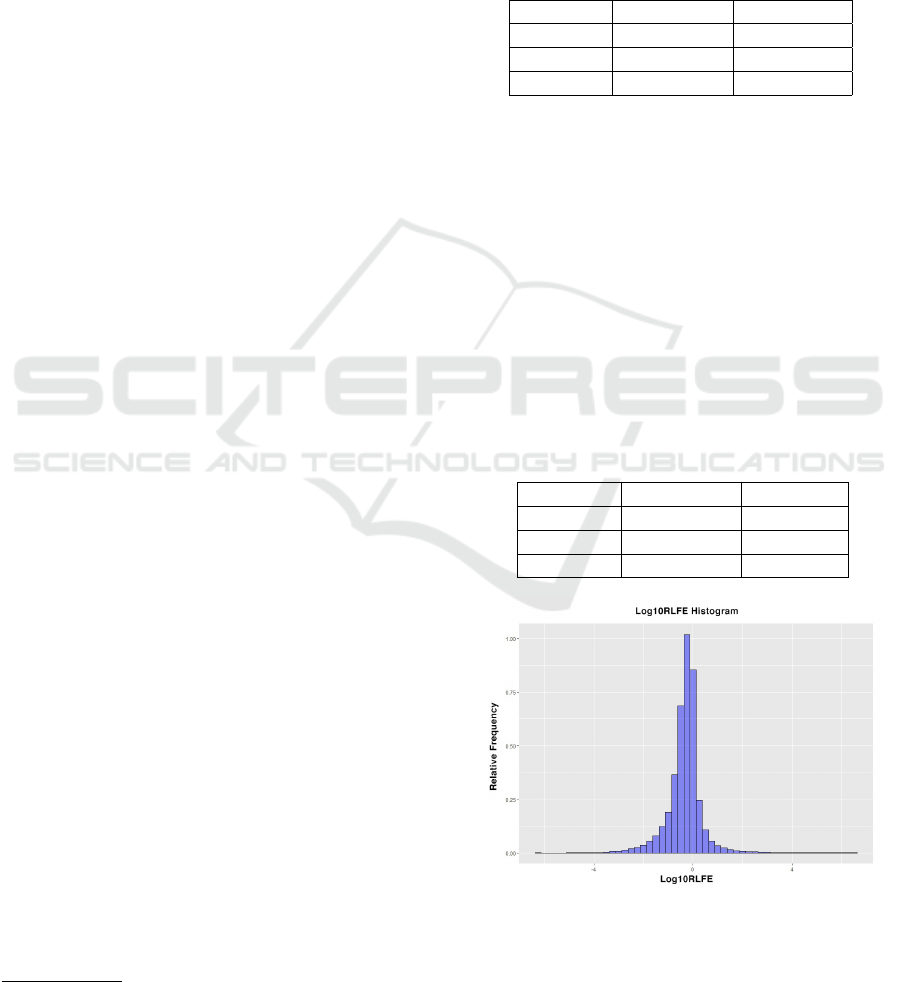

Table 1: Statistics of RLFE fraction values series.

Minimum 1st Quartile Median

0.0 0.1 0.4

Mean 3rd Quartile Maximum

225.4 0.8 2,802,499.9

It is noted by the series statistics, Table 1, that the

distribution is concentrated in values smaller than 1

(3rd quartile = 0.8), the rest being distributed spar-

ingly up to the maximum value of “2,802,499.9”.

where the average is“225”. It can be said that the se-

ries is a geometric distribution similar to the Gamma

Distribution, the values are concentrated in a region

of the frequency distribution with great dispersion at

the highest values. Thus, for the treatment of this se-

ries, the decimal logarithm of the values observed in

order to approximate the series frequency distribution

to the normal distribution (Oliveira, 2018), as can be

seen in Table 2 and Fig. 1 below.

Table 2: Statistics of Log10 of the RLFE fraction values

series.

Minimum 1st Quartile Median

-6.27 -0.59 -0.27

Mean 3rd Quartile Maximum

-0.35 -0.05 6.45

Figure 1: Histogram of Log10 of the RLFE fraction values

series.

Thus, the following configuration was proposed

for the RLFE variable.

Towards a Smart Identification of Tax Default Risk with Machine Learning

425

Where:

Null or absent values: RLFE0

Log10(RLFE) < (−0.59); 1st Q.: RLFE1

(−0.59) ≤ Log10(RLFE) < (−0.27); 2nd Q.:

RLFE2

(−0.27) ≤ Log10(RLFE) < (−0.05); 3rd Q.:

RLFE3

Log10(RLFE) ≥ (−0.05); 4th Q.: RLFE4

REC. Total Amount of Tax Collected. The sum of

values collected to the Federal District’s treasury re-

lated to ICMS and ISS taxes. Like the series of values

of the RLFE fraction, the values of the total collec-

tions, REC

2

, resemble a Gamma Distribution, values

concentrated in a region of the frequency distribution

with great dispersion in the highest values, as seen in

Table 3.

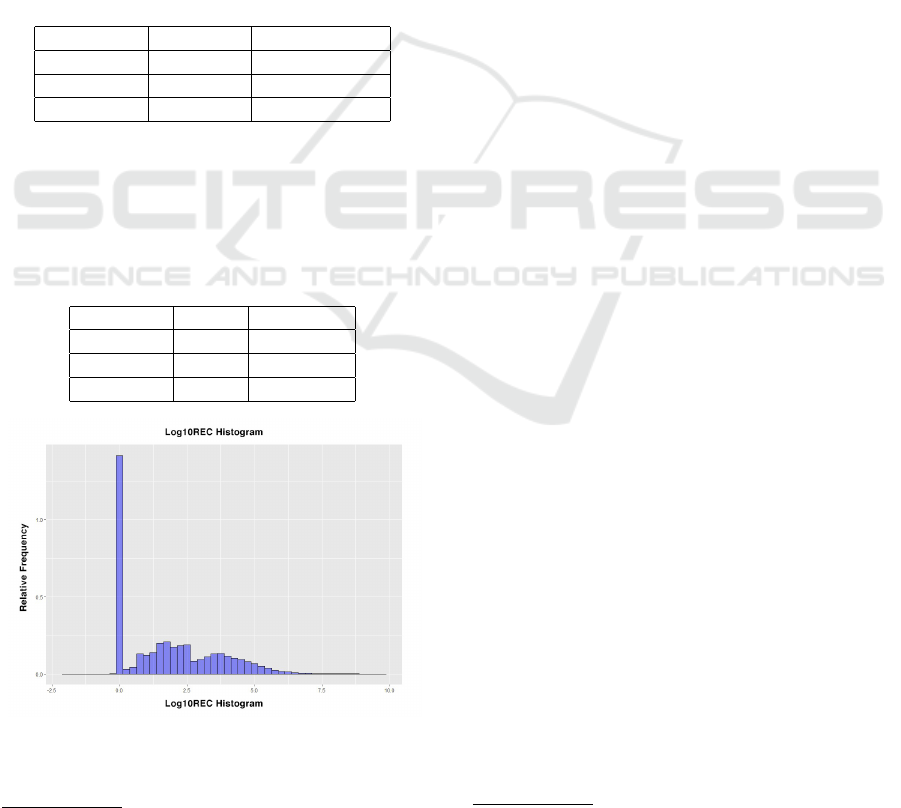

Table 3: Statistics of the REC values series.

Minimum 1st Q. Median

0.0 0.0 35.01

Mean 3rd Q. Maximum

156,324.57 1,2610.09 5,645,030,723

In this way the same previous strategy was

adopted, the conversion of the values to the decimal

logarithm. Table 4 presents the new series statistics

and in Fig. 2 we observe the frequency histogram of

the Log10 series of REC.

Table 4: Statistics of the REC values series.

Minimum 1st Q. Median

-2 0.0 1.54

Mean 3rd Q. Maximum

1.77 3.1 9.75

Figure 2: Histogram of Log10 of the REC values series.

2

From the portuguese Recolhimentos

The following configuration was proposed for the

REC variable. Where:

Log10(REC) ≤ 0; 1st Q.: REC1

0 < Log10(REC) ≤ (1.54); 2nd Q.: REC2

(1.54) < Log10(REC) ≤ (3.1); 3rd Q.: REC3

Log10(REC) > (3.1); 4th Q.: REC4

AUTO. If It Was Sued or Not. Indication if the

company has already suffered any tax action whose

result has proven some irregularity and consequently

charged taxes and penalties. A total of 1,597 compa-

nies was sued in some way during the observed pe-

riod. Thus, the following configuration was proposed

for this variable:

Company not sued in the period: AUTON

Company sued in the period: AUTOS

The models propose to predict the future default

situation or not of certain taxpayers. To represent such

a prediction, it will be adopted as variable explained

the registration of Active Debt of the Federal District.

This register shows the list of companies in default

regarding their obligations to the Tax Administration

of the Federal District (city of Brasilia) as well as the

characteristics of the debit registered, e.g., value, ref-

erence year or nature of debt.

DA (Variable Y). Inclusion in Active Debt. The

variable to be predicted in the models, or explained

variable, will be the company’s occurrence in the Fed-

eral District’s Active Debt register

3

. In the total of

305,686 records observed, there were 79,548 compa-

nies registered in active debt at some point in the ob-

served period. Thus, for the variable explained, the

standard configuration for classification algorithms

was adopted, i.e., the value “1” for positive occur-

rences and “0” for the negatives.

It was enrolled in Active Debt: “1”

It was not been enrolled in Active Debt: “0”

Regarding the temporal aspect, the data show the

information of the active companies in the DF veri-

fied in October 2018, as well as the ratio of compa-

nies registered in Active Debt to this date, but only

those debts referring to 2017 were considered. the

economic-financial data were observed the records of

the years 2012 to 2017. A partial view of the treated

data can be seen in Table 5.

4 MODELING

The database was randomly divided into three parts:

(1) Training - 70% of records; (2) Validation - 20% of

3

From the portuguese Divida Ativa

WEBIST 2021 - 17th International Conference on Web Information Systems and Technologies

426

Table 5: Data visualization after discretization treatment.

Reg. TC TA AEICMS ... DA

1 TC2 TA3 AICMS1 ... 1

2 TC1 TA1 AICMS4 ... 0

3 TC2 TA3 AICMS4 ... 1

... ... ... ... ... ...

305,586 TC1 TA1 AICMS2 ... 0

records; and (3) Test - 10% of the records (Oliveira,

2018). The algorithms used in the R Studio platform

for data modeling were: For the LOGIT regression,

“H2O Generalized Linear Models” (GLM) and for

the Artificial Neural Network, “H2O Deep Learning”

(DL). The GLM and DL models were developed as

shown in the following items.

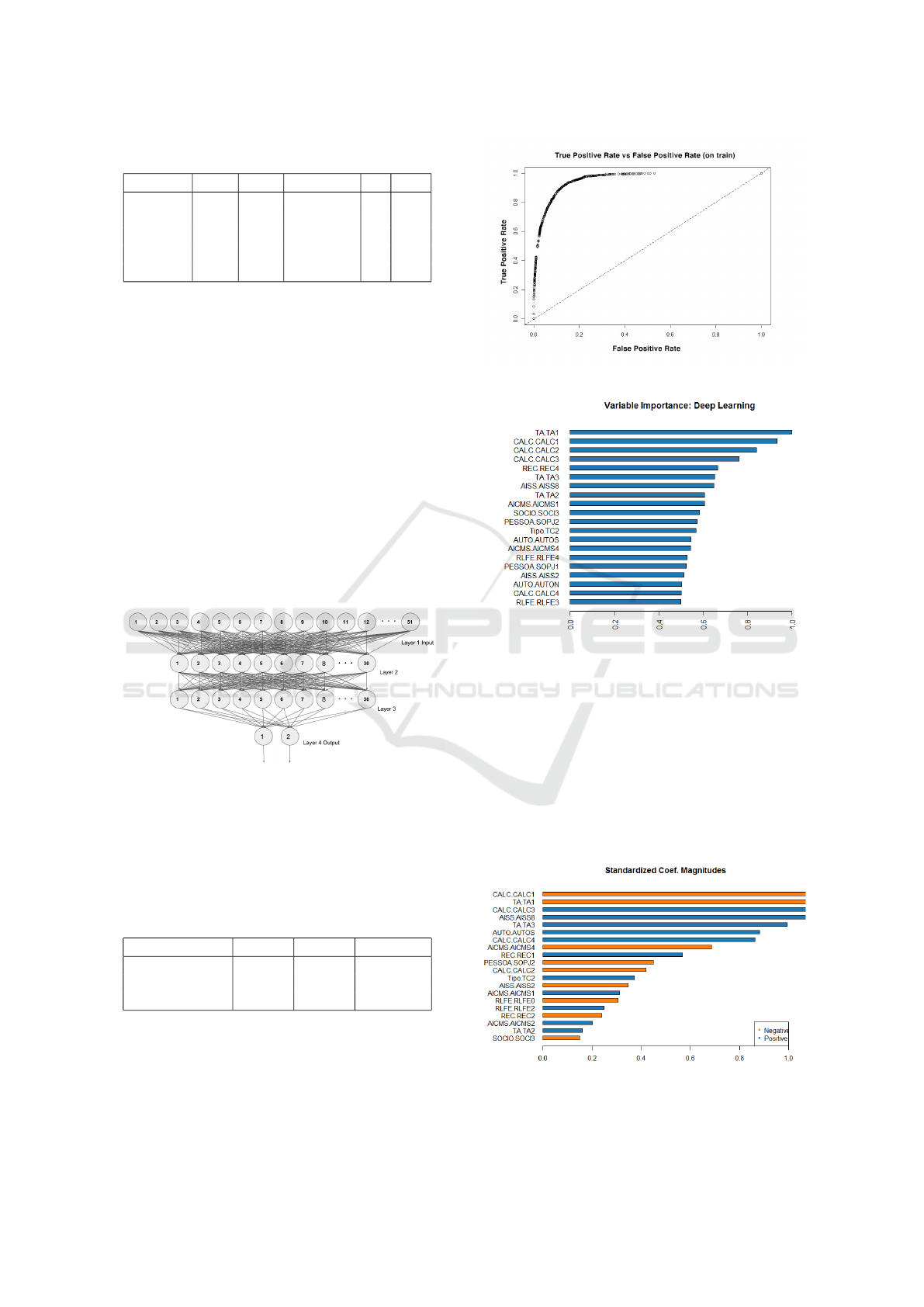

4.1 Artificial Neural Network: DL

In the configuration of the neural network, several

forms of network design were tested, ranging from

one to three internal layers as well as the number of

neurons per layer (10, 20, 30, 60 and 100 neurons).

Finally, we arrived at the optimal arrangement of two

internal layers with thirty neurons each, in 20 epochs,

as shown in Fig. 3.

Figure 3: Graphical representation of the optimal ANN

adopted in the model.

The neural network model obtained a R2 = 0.6203

and the area under the ROC curve was AUC = 0.9568,

as can be seen in Fig. 4. The model Confusion Matrix

is presented in Table 6.

Table 6: Confusion Matrix of ANN adopted.

Real X Predict 0 1 Error

0 41,128 3,907 0.086755

1 2,540 13,182 0.161557

Totals 43,668 17,089 0.106111

The 20 most significant variables of the DL model

are indicated in Fig. 5. In association with the magni-

tude of the GLM model coefficients (presented in the

next section), this information can be used to identify

the risk factors indicated by the modeling.

Figure 4: DL model ROC curve.

Figure 5: DL variables importance (20 major).

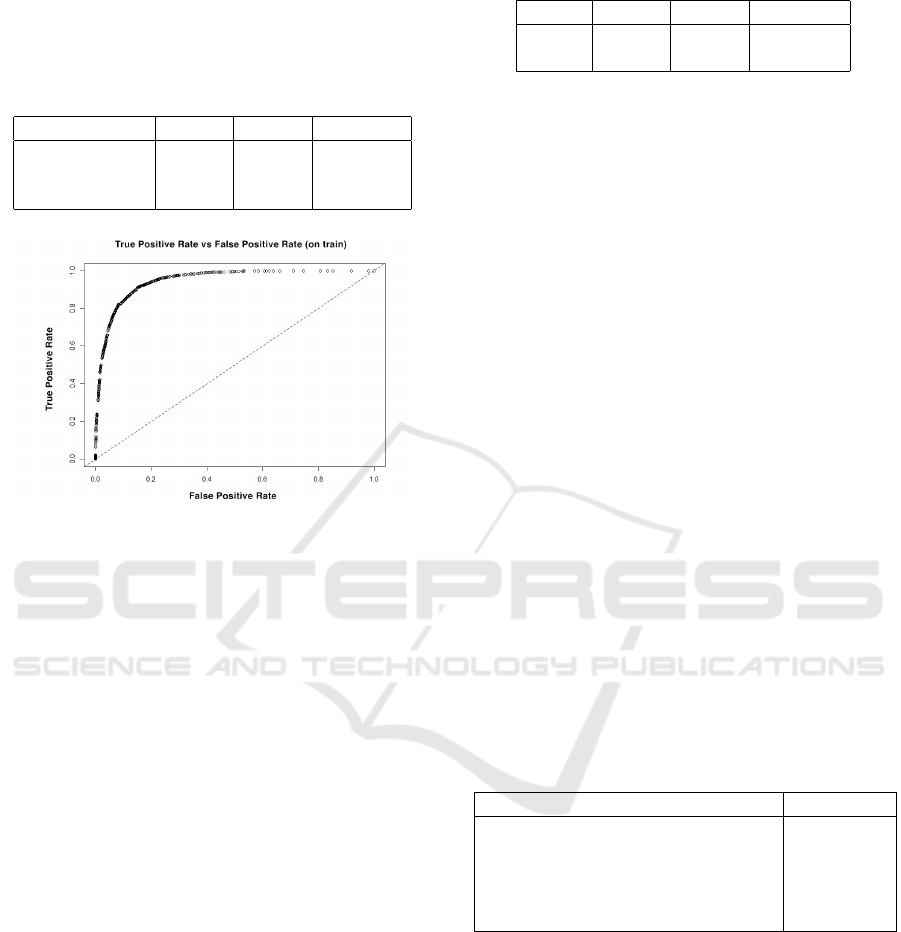

4.2 Logit Regression: GLM

The GLM model developed belongs to the binomial

family with 41 predictive coefficients, corresponding

to each of the binary variables, of which 32 were ac-

tive, that is, 9 did not have significance in the model

(Caffo, 2015; Hosmer Jr., 2004). Fig. 6 shows the 20

coefficients of greatest significance. This information

will be useful in identifying the risk factors of tax de-

fault.

Figure 6: GLM model Magnitude coefficients (20 major).

Towards a Smart Identification of Tax Default Risk with Machine Learning

427

The regression model obtained a R2 = 0.5902 and

the area under the ROC curve was AUC = 0.9484, as

can be seen in Fig. 7. The model Confusion Matrix is

presented in Table 7.

Table 7: GLM model Confusion Matrix.

Real X Predict 0 1 Error

0 41,288 3,747 0.083202

1 2,783 12,939 0.177013

Totals 44,071 16,686 0.107477

Figure 7: GLM ROC Curve.

4.3 Model Evaluation

The simplicity of the discretization methodology of

the variables based on the Pareto rule (80/20) was em-

phasized in the study, although the hard-working, this

method provides a uniform data treatment for all vari-

ables.

The qualitative variables discretization, regarding

the companies social and economic characteristics,

followed a clear and defined sequence of steps in

their treatment in order to prioritize the most recurrent

characteristics and to group the least recurrent ones.

On the other hand, the quantitative variables dis-

cretization, referring to the declared values and values

collected by the companies, was done by dividing the

data into quartiles according to their frequency distri-

bution. The mathematical artifice using the decimal

logarithm of the values proved to be effective as can

be observed in the significance of these variables in

both models.

The methodology presented above of preparing

discrete variables and continuous variables can be

called Full Discretization.

The studied models had a very similar perfor-

mance, as shown in Table 8. Both obtained a good

performance in the task of prediction with highlight

to neural network superiority (DL).

Table 8: Comparison between GLM and DL models.

Model R2 AUC Error rate

GLM 0.5902 0.9484 0.107477

DL 0.6203 0.9568 0.106111

4.4 Discussion

The predictive models used in this study highlighted

some variables in relation to others, as can be seen

trough the importance of the variables verified in the

models (Fig. 5 and Fig. 6). About the magnitude

measurement of the variables, the regression (GLM)

shows the positive or negative sign of each variable

coefficient. The neural network (DL), as its own char-

acteristic, shows only which are the most significant

variables for the model, it does not allows to observe

if this influence is positive or negative. Thus the in-

terpretation of the variables influence should be done

looking at the two models together, so is possible to

identify which variable could represent a tax default

risk (Gouv

ˆ

ea M., 2013). That said, it can be stated

that the variables with the highest positive values are

those that offer the highest tax default risk.

The Tax Administration of Brasilia had access to

our model. A data set of 270 thousands active com-

panies had been classified and 7,573 companies were

identified as “possible defaulters” (Y = 1). After a

closer look bay the tax audit team, strong signs of ir-

regularities were found in 1,004 of those companies.

The result is shown in Table 9, which confirms the rel-

evance of the classification made by Machine Learn-

ing.

Table 9: Indications of tax irregularity in companies indi-

cated by the DL model.

Tax irregularities detected Companies

I - Misappropriation of credit 377

II - Non-accounting of debts 146

III - Revenue omission 677

IV - At least two of the above items 58

V - The three evidences I, II and III 1

5 CONCLUSIONS

This work successfully demonstrated that machine

learning algorithms traditionally applied in credit risk

assessment can be used for tax risk evaluation. The

present study had the perspective to confirm Machine

Learning techniques in the search of tax defaults evi-

dence. Likewise, the Full Discretization methodology

was verified as a clear and objective path to prepare

data for modeling. In the near future, this process may

WEBIST 2021 - 17th International Conference on Web Information Systems and Technologies

428

be part of an artificial intelligence system for tax fraud

detection.

For future studies new variables should be in-

cluded, such as the issuance of invoices, billing with

sales on credit cards, or changes in the number of em-

ployees. Or yet, ANN assembles models associated

with other Machine Learning algorithms.

REFERENCES

Abdou, H., P. J. (2011). Credit scoring, statistical tech-

niques and evaluation criteria: a review of the liter-

ature. Intelligent Systems in Accounting, Finance &

Management, 18(2/3):59–88.

Aggarwal, C. C. (2015). Data mining: the textbook.

Springer.

An, J., Zheng, Q., Wei, R., Dong, B., and Li, X. (2020).

Neud-tri: Network embedding based on upstream and

downstream for transaction risk identification. In Pro-

ceedings - 2020 IEEE 44th Annual Computers, Soft-

ware, and Applications Conference, COMPSAC 2020,

pages 277–286.

Bahrami, M., Bozkaya, B., and Balcisoy, S. (2020). Using

behavioral analytics to predict customer invoice pay-

ment. Big Data, 8(1):25–37.

Bardelli, C., Rondinelli, A., Vecchio, R., and Figini, S.

(2020). Automatic electronic invoice classification us-

ing machine learning models. Machine Learning and

Knowledge Extraction, 2(4):617–629.

Bramer, M. (2016). Principles of Data Mining, volume 1.

Springer, London.

Bromiley, P., M. M. N. A. R. E. (2015). Enterprise risk man-

agement: Review, critique, and research directions.

Long Range Planning, 48(4):265–276.

Caffo, B. (2015). Regression Models for Data Science in R,

volume 1. Leanpub.

Cha, S. ., Wang, H., Tan, Z., Joung, Y. ., Tseng, Y. ., and

Yeh, K. . (2020). On privacy aware carriers for value-

possessed e-invoices considering intelligence mining.

IEEE Transactions on Emerging Topics in Computa-

tional Intelligence, 4(5):641–652.

Fayyad, U., P. G. S. P. (1996). From data mining to knowl-

edge discovery in databases. AI Magazine, 17(3):18.

Golbayani, P., Florescu, I., and Chatterjee, R. (2020). A

comparative study of forecasting corporate credit rat-

ings using neural networks, support vector machines,

and decision trees. The North American Journal of

Economics and Finance, 54:101251.

Gouv

ˆ

ea M., Gonc¸alves E., M. D. (2013). An

´

alise de risco

de cr

´

edito com aplicac¸

˜

ao de regress

˜

ao log

´

ıstica e re-

des neurais. Revista Contabilidade Vista & Revista,

24(4):96–123.

He, Y., Wang, C., Li, N., and Zeng, Z. (2020). Attention and

memory-augmented networks for dual-view sequen-

tial learning. In Proceedings of the ACM SIGKDD In-

ternational Conference on Knowledge Discovery and

Data Mining, pages 125–134.

Hosmer Jr., D., L. S. (2004). Applied logistic regression,

volume 1. John Wiley & Sons.

Jabeur, S. B., Serret, V., et al. (2021). Bankruptcy prediction

using fuzzy convolutional neural networks. In World

Finance Conference.

Kim, S., Tsai, Y. ., Singh, K., Choi, Y., Ibok, E., Li, C. ., and

Cha, M. (2020). Date: Dual attentive tree-aware em-

bedding for customs fraud detection. In Proceedings

of the ACM SIGKDD International Conference on

Knowledge Discovery and Data Mining, pages 2880–

2890.

Lessmann, S., B. B. S. H. e. a. (2015). Benchmarking state-

of-the-art classification algorithms for credit scoring:

An update of research. European Journal of Opera-

tional Research, 247(1):124–136.

Maher A., M. F. (2016). Classifiers consensus system ap-

proach for credit scoring. Knowledge-Based Systems,

104(1):89–105.

Mathews, J., Mehta, P., Suryamukhi, and Babu, S. (2020).

Link prediction techniques to handle tax evasion.

In ACM International Conference Proceeding Series,

pages 307–315.

Oliveira, P., G. S. (2018). Ci

ˆ

encia de Dados com R –

Introduc¸

˜

ao. Ed. IBPAD, Bras

´

ılia, 1 edition.

Pandey, T., J. A. D. S. and Cho, S. (2018). A novel commit-

tee machine and reviews of neural network and sta-

tistical models for currency exchange rate prediction:

An experimental analysis. Journal of King Saud Uni-

versity – Computer and Information Sciences.

Pochiraju, B. and Seshadri, S. (2019). Essentials of Busi-

ness Analytics: An Introduction to the Methodology

and Its Applications, volume 264. Springer.

Silva, L. A., P. S. M. B. C. (2016). Introduc¸

˜

ao a Minerac¸

˜

ao

de Dados: com aplicac¸

˜

oes em R. Ed. Elsevier, Rio de

Janeiro, 1 edition.

Teles, G., Rodrigues, J. J., Rab

ˆ

e, R. A., and Kozlov, S. A.

(2020). Artificial neural network and bayesian net-

work models for credit risk prediction. Journal of Ar-

tificial Intelligence and Systems, 2:118–132.

Thomas, L., C. J. and Edelman, D. (2017). Credit scoring

and its applications, volume 2. Siam.

Wu, D., O. D. L. D. A. (2015). Decision making in enter-

prise risk management: A review and introduction to

special issue. Omega, 57(Part A):1–4.

Yu, J., Qiao, Y., Sun, K., Zhang, H., and Yang, J. (2018).

Poster: Classification of transaction behavior in tax

invoices using compositional cnn-rnn model. In Ubi-

Comp/ISWC 2018 - Adjunct Proceedings of the 2018

ACM International Joint Conference on Pervasive and

Ubiquitous Computing and Proceedings of the 2018

ACM International Symposium on Wearable Comput-

ers, pages 315–318.

Towards a Smart Identification of Tax Default Risk with Machine Learning

429