Peculiarities of German World Economic Development Policy

Mikhail Savelyev

1a

, Andrey Savchenko

1b

,Valery Ivanov

2c

and Yury Polyakov

2d

1

Association for Methodological Support of Business Activity and Social Development "Mitra", Pushkinskaya 241, Izhevsk,

Russia

2

Udmurt State University, Universitetskaya, 1, Izhevsk, Russia

Keywords: Economic development policy, Germany, German world, culture, institutions.

Abstract: The growth rates and sustainability of the economic development of German-speaking countries in the years

1850-2020 have been investigated. The comparison is made for 18 economic cycles, which are grouped into

4 historical periods: imperial, republican-fascist, division and unity. The proposed method for economic

development policies to be studied makes it possible to quantify the proximity of economic development

strategies based on the changes in economic growth and risk. The features of progressive, regressive,

conservative and aggressive policies of economic development are described. The formula for evaluating the

index of similarity of economic development policy is proposed. In accordance with this indicator, a

comparison of the economic policy of Germany with more than 30 European countries showed that the

similarity of policies depends on the influence of the cultures and institutions of the compared countries on

the strategy of their economic development. In the current historical period, 3 cultural and geographical groups

of countries have been identified with a policy of economic development that coincides with Germany, with

an independent and opposite policy. The results of the research show the area of the German world as a sub-

civilizational community.

1 INTRODUCTION

The work examines the development of the

economies of the German world countries. The

hypothesis about the dependence of the economic

development policy of the studied countries is tested:

if the cultural and institutional proximity of these

countries, the similarity of their economic

development strategies affects the coincidence of

their economic development trends.

Such studies include the work (Baltserovich L. &

Zhontsy, 2012) where the trajectories of economic

growth of Australia and New Zealand are compared

on the basis of the similarity of their cultures. In the

work (Helantera A. & Ollus), based on a comparative

analysis of Finland and Russia, it is shown that the

differences in the economic and technological

development of these countries are determined by the

activities of the government.

a

https://orcid.org/0000-0002-4145-4098

b

https://orcid.org/0000-0003-4452-5071

c

https://orcid.org/0000-0002-8470-0869

d

https://orcid.org/0000-0001-9328-218X

Some works are devoted to the German economy

(Ridley, 1968; Evans, 1986; Tsedilin, 2005; Uebele.

& Sarferaz, 2009; Streb & Waidlein, 2013; Olczyk,

2019; Boldyrev et al., 2020; Savelyev et al., 2020a).

However a comparative study of cultural and

institutional phenomena has not been identified.

Especially little is paid to research on the GDR

economic performance. The history of the post-war

economic recovery in eastern Germany is described

by Kulbakin (Kulbakin, 1979). Yablokov B.V.

explores peculiarities of practical implementation in

1963-1973 of the “new economic system” of the

GDR, which actually imitated market-based

mechanism within the centralized planned economy

(Yablokov, 2018). Having studied the GDR economy

from 1961 to 1976, P. Ludz, came to the conclusion

that the leadership of the GDR did not manage to

adapt the East German economy to a new type of

industrial society, which combines advantages in the

382

Savelyev, M., Savchenko, A., Ivanov, V. and Polyakov, Y.

Peculiarities of German World Economic Development Policy.

DOI: 10.5220/0010707200003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 382-387

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All r ights reserved

social sphere with the efficiency of a market economy

(Ludz, 1977).

2 MATERIALS AND METHODS

This study is focused on the economic development

of the countries of the German world which

comprises German-speaking countries and countries

are exposed to the German institutions and culture.

The study does not include the American countries of

German migration, in which the influence of the

culture and institutions of their former metropolises is

more significant, and the former German colonies,

which practically did not inherit the institutions of the

German Empire and gained independence from other

countries, and data for the colonial period of their

relations with Germany have not been found.

The features of the policy of economic

development and their results in the historical

retrospective of 1850-2020 are under study.

A feature of the research methodology is the use

for assessing economic development, besides the

usual indicators of economic growth (growth rates of

real GDP), also indicators of stability (risks) of this

development - the standard deviations (here and after

SD) of the growth rates of real GDP. The risk

assessment period is defined as the economic cycle

from the first year of the start (or acceleration) of

economic growth to the last year of the recession (or

slowdown) in Germany. This approach allows us to

assess the quality of economic decisions and their

implementation within the specific culture of the

German world.

For the purposes of analysis, economic cycles are

combined into four historical periods:

imperial period - 7 cycles - until 1919;

period of the Weimar Republic and the Third

Reich - 3 cycles - until 1946;

the period of division into two states (FRG and

GDR) - 5 cycles - until 1990;

the period of united Germany - 3 cycles - until

2020.

Within this approach, the policy of economic

development is considered to be as progressive when

the subsequent period, in comparison with the

previous one, has a higher rate of growth of

macroeconomic indicators and a lower rate of risk

(SD). On the contrary, decreasing in growth and

increasing in risks are associated with the regressive

policy of economic development. A mutual decline in

growth rates and risks is the indicator of the

conservative policy of economic development, and in

the case of growth, it is aggressive.

The index of coincidence of the development

policies of Germany with the countries of the German

world is calculated by the formula (1).

IC M O N 100

⁄

%,

(1)

where:

IC is an index of coincidence of development

policies, for convenience on the percentage,

N is the total number of studied periods (economic

cycles),

M is the number of coincidences of development

policies,

O is the number of opposite development policies.

This approach is theoretically substantiated in

earlier studies by the authors, which shows the

correlation between culture and institutional models,

which is confirmed by econometric studies of

economic development (Savelyev, 2015; Savelyev,

2020; Savelyev et al., 2020a, 2020b; Savelyev et al.,

2021a, 2021b, 2021c, 2021d). Data sources were

works (Maddison, 2008; Bolt, van Zanden, 2014;

World Bank, 2019; TED, 2020).

Information base for the analysis of data on the

Russian Empire – Nominal GDP historical series

(Dincecco, 2013). This source contains data on

nominal GDP. For correct comparison for the period

1900-1913 according to (Maddison, 2008), the

average annual inflation index was evaluated and the

values of nominal GDP reduced by this index were

obtained. This indicator can be considered the closest

analogue of real GDP. Actual inflation by years may

differ significantly, but for the purposes of this work,

longer periods than a year are studied, and deviations

of real GDP from the calculated one due to the

deviation of the actual annual inflation index from the

average annual level are leveled, which allows us to

calculate growth data reduced by the average annual

inflation nominal GDP comparable to real growth.

3 RESULTS AND DISCUSSION

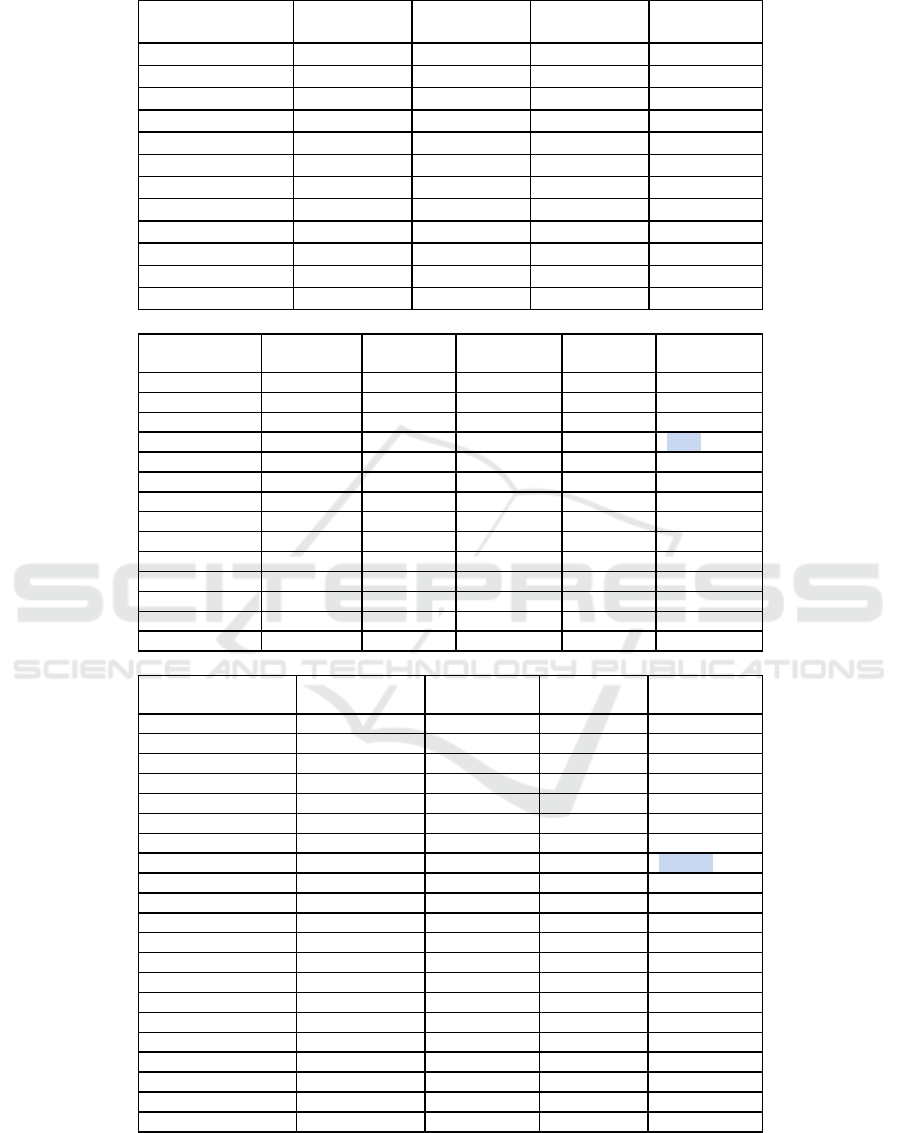

The evaluation of the development policy during the

periods of certain economic cycles in the studied

countries is presented in Table 1. Analysis of the

evaluation of the coincidences of policies and

opposite policies in these periods is made in Table 2.

Peculiarities of German World Economic Development Policy

383

Table 1. Economic development policy of the countries of the German world

Country \

C

y

cle 1862-1871 1872-1880 1881-1891 1892-1901

German

y

Pro

g

. Re

g

ress. Pro

g

.A

g

ress.

Austria

─

─

A

g

ress. Conser.

Switzerlan

d

Conse

r

. Conser. Pro

g

.Pro

g

.

Great Britain A

g

ress. Conser. A

g

ress. A

g

ress.

Bel

g

iu

m

Conser. A

g

ress. Conser. Conser.

Netherlands Pro

g

. A

g

ress. Conser. A

g

ress.

France Re

g

ress. A

g

ress. Conser. A

g

ress.

Ital

y

─

Pro

g

.Re

g

ress. A

g

ress.

Denmar

k

Pro

g

. Conser. Pro

g

.Pro

g

.

Sweden Agress. Conser. Prog. Prog.

Finlan

d

ia Conser. Conser. Agress. Agress.

Russian empire -

─

─

Prog.

Country \

Cycle 1902-1908 1909-1915 1916-1919 1920-1923 1924-1932

Germany Prog.

R

egress. Regress. Agress. Prog.

Austria Agres. Regress. Cons. Prog. Regress.

Switzerland Regress. Cons. Regress. Prog. Cons.

Grea

t

Britain Cons. Prog. Regress. Agres. Prog.

Belgium Agres. Regress. Regress. Prog. Cons.

Netherlands Prog. Agres. Agres. Prog. Regress.

France Cons. Regress. Regress. Prog. Regress.

Italy Prog. Agres. Regress. Prog. Prog.

Denmark Regress. Regress. Regress. Prog. Cons.

Sweden Agres. Prog. Regress. Agres. Cons.

Finlandia Cons. Regress. Regress. Prog. Regress.

Russian empire Regress. Prog.

─

─

─

Czechoslovakia

─

─

─

─

Regress.

Yugoslavia

─

─

─

─

Regress.

Country \

Cycle 1933-1946 1947-1958 1959-1967 1968-1975

Germany Regress. Prog. Conser. Conser.

Austria Regress. Prog. Conser. Agress.

Switzerland Agress. Prog. Prog. Regress.

Luxembourg.

─

─

Prog. Agress.

Grea

t

Britain Agress. Conser. Prog. Regress.

Belgium Regress. Prog. Prog. Regress.

Niederl. Regress. Prog. Conser. Conser.

France Regress. Prog. Conser. Regress.

Italy Regress. Prog. Conser. Regress.

Denmark Regress. Prog. Prog. Conser.

Sweden Agress. Conser. Prog. Regress.

Finlan Agress. Prog. Prog. Agress.

Turkey Regress. Prog. Conser. Prog.

Czechoslovakia Regress. Prog. Conser. Conser.

Yugoslavia Prog. Agress. Prog. Agress.

USSR Agress. Prog. Regress. Conser.

Polan

d

─

Conser. Regress. Agress.

Hungary

─

Prog. Conser. Regress.

Romania

─

Agress. Conser. Regress.

Bulgaria

─

Prog. Prog. Regress.

R S F SR

─

─

Prog. Conser.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

384

Table 1. Economic development policy of the countries of the German world (cont.).

Country \

Cycle

1976-

1982

1983-

1990

1991-

2003

2004-

2009

2010-

2020

Germany Conser. Conser. Conser. Regress. Prog.

Austria Regress. Agress. Conser. Regress. Regress.

Switzerland Conser. Prog. Conser. Agress. Conser.

Luxembourg Conser. Agress. Conser. Regress. Prog.

Grea

t

Britain Conser. Prog. Regress. Regress. Regress.

Belgium Conser. Prog. Conser. Regress. Regress.

Netherlands Conser. Prog. Regress. Regress. Conser.

France Conser. Regress. Regress. Regress. Regress.

Italy Conser. Conser. Regress. Regress. Regress.

Denmark Conser. Prog. Conser. Regress. Prog.

Sweden Regress. Prog. Regress. Regress. Regress.

Finlan

d

Conser. Prog. Regress. Regress. Conser.

Turkey Regress. Regress. Regress. Agress. Prog.

Czechoslovakia Regress. Regress. Agress. Prog.

─

Yugoslavia Conser. Regress. Regress. Prog.

─

the USSR Conser. Regress. Regress. Prog.

─

Polan

d

Regress. Agress. Prog. Prog. Regress.

Hungary Regress. Regress. Agress. Conser. Prog.

Romania Conser. Regress. Agress. Prog. Conser.

Bulgaria Regress. Regress. Agress. Prog. Conser.

Czech

Republic Regress. Prog. Regress. Prog. Conser.

Slovakia Agress. Conser. Agress. Prog. Conser.

Croatia Conser. Regress. Agress. Prog. Conser.

Slovenia Conser. Regress. Agress. Agress. Conser.

Russia Conser. Regress. Regress. Prog. Conser.

Kazakhstan Conser. Prog. Regress. Prog. Conser.

Lithuania Prog. Regress. Regress. Prog. Conser.

Latvia Prog. Prog. Regress. Agress. Conser.

Estonia Prog. Agress. Regress. Agress. Prog.

Kyrgyzstan Prog. Prog. Regress. Prog. Regress.

Serbia Conser. Regress. Regress. Prog. Conser.

Ukraine Prog. Prog. Regress. Prog. Regress.

Belarus Prog. Prog. Regress. Prog. Regress.

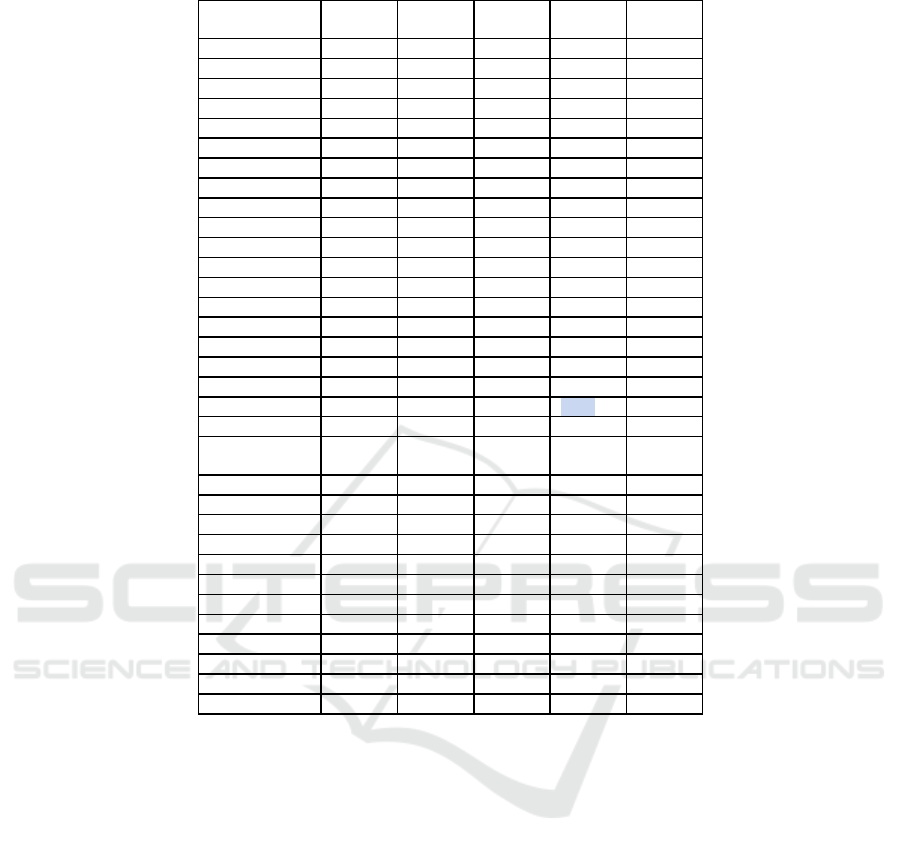

Analysis of the data in Table 2 confirms that the

policy matching index does not show the closeness of

the cultures of the German world. The policy

matching index of the German-speaking is not higher

than other Western European countries. This

indicator fails to reflect the institutional closeness of

the countries: for the CMEA countries and the EU

during the period of their simultaneous existence, this

indicator is approximately equal.

Most likely, this indicator characterizes the

closeness of development strategies in general and

innovation activity in particular, which, in turn, are

dependent on culture and institutions: in the period of

fragmentation, the similarity of policies is higher with

the EU countries than with the CMEA countries.

institutions in most of Germany coincided with those

of the EU. And the most consistently high rates of

similarity of policies are shown by countries

culturally close to Germany: Denmark, Luxembourg,

the Netherlands, Belgium.

Another phenomenon identified with the policy

similarity indicator for the last analyzed historical

period after the unification of Germany is an impact

on a group of countries by the German institution and

culture. These are mainly Protestant, German-

speaking, which have a similar economic structure

with Germany, an almost indistinguishable

institutional model, integrated geographically,

technologically and infrastructurally.

It is obvious that Italy, France, Great Britain and

Sweden have development strategies independent of

Germany and zero index values. They are culturally

and institutionally more distant from the German

World. The countries of Eastern Europe are currently

developing in relation to Germany, mainly with

negative indicators of the index, because they in a

relationship of semi-colonial dependence on

Germany as suppliers of resources and sales markets.

In fact, these three groups of European countries

outline the contours of Europe's future if the EU

continues to disintegrate.

Peculiarities of German World Economic Development Policy

385

Table 2. Index of coincidence of economic development policies of Germany with the countries of the German world

Country

Historical period Total for the

entire study

period

1862-1919 1920-1946 1947-1990 1991-2020

Austria 0 0 0 33,3 6,25

Switzerland 14,3 0 40 33,3 22,2

Luxembourg - - -25 100 28,6

Belgium 14,3 33,3 40 33,3 27,8

Netherlands 42,9 0 80 33,3 27,8

France 28,6 0 60 0 33,3

Italy 16,7 66,7 80 0 41,2

Grea

t

Britain 14,3 66,7 20 0 22,2

Denmark 42,9 33,3 60 100 55,6

Sweden 14,3 33,3 0 0 11,1

Finlandia 42,9 -33,3 20 33,3 22,2

Turkey - 100 40 0 33,3

Russian Empire , USSR, RF -66,7 0 60 -33,3 0

Kazakhstan - - 50 -33,3 0

Lithuania - - 0 -33,3 -20

Latvia - - 0 0 0

Estonia - - -50 33,3 0

Kyrgyzstan - - 0 -66,7 -40

Ukraine - - 0 -66,7 -40

Belarus - - 0 -66,7 -40

Czechoslovakia - 0 60 -100 11,1

Czech Republic - - 0 -33,3 -20

Slovakia - - 0 -66,7 -40

Yugoslavia - -100 0 -50 -33,3

Croatia - - 50 -66,7 -20

Slovenia - - 50 -66,7 -20

Serbia - - 50 -33,3 0

Polan

d

- - -60 -66,7 -62,5

Hungary - - 40 0 25

Romania - - 40 -66,7 0

Bulgaria - - 20 -66,7 -12,5

4 CONCLUSIONS

The index of coincidence of economic development

policies characterizes the proximity of economic

development strategies, which, in turn, depends on

culture and institutions. To differentiate the influence

of culture and institutions, a more sophisticated

research methodology is required.

The predictive application of the methodology

lies in the ability to identify groups of countries with

similar economic development policies, institutional

and cultural proximity for the formation of future

economic unions.

The result of the study is also the identification of

the boundaries of the German world, as a sub-

civilizational community

ACKNOWLEDGEMENTS

The reported study was funded by RFBR, project

number 20-010-00869.

REFERENCES

Baltserovich, L., Zhontsy, A., 2012. Mysteries of economic

growth: forces and crises, MYSL Publ. Moscow.

Between East and West, Political Analysis (1961-1976),

1977. Munich.

Boldyrev, R. Y., Boldyreva, S. Y., Vakhabova, A. A.,

Tychina, O. L., 2020. Science and Technic

Revolution’s Impact on the Economic Development of

Germany in 16th – 19th Centuries. ISC 2019. In Lecture

Notes in Networks and Systems. 129.

Bolt, J., van Zanden, J. L., 2014. The Maddison Project:

Collaborative research on historical national accounts.

In Economic History Review. 67(3). pp. 627-651

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

386

Dincecco, M., Mauricio, P., 2013. “Nominal GDP Series,

1870-2000”. Global Prices and Incomes Database,

http://gpih.ucdavis.edu.

Evans, R., 1986. The German Empire 1871-1918. In

German History. 3. pp. 89-92.

Helantera, A., Ollus, S. E., Why Russia is not Finland? A

comparative analysis of the competitiveness,

https://iq.hse.ru.

Kulbakin, V. D., 1979. History of German Democratic

Republic (1949—1979), Nauka Publ. Moscow.

Maddison A., Historical Statistics, http://www.ggdc.net.

Olczyk, G., (2019). Elements of economic culture as

informal institutions in the economic development of

Germany. In Economics and Law. 18. p. 233.

Ridley, F., 1968. The Economic Causes of the German

Empire. In Business History. 10. pp. 121-125.

Savelyev, M., 2015. Multicultural institutionalism: General

economic theory of civilizations. The political economy

of traditionalism. In Network Society. 488.

Savelyev, M., 2020. Methods for researching the

sustainability of economic development of territories.

In Problems of regional economy. 3(4). pp. 54-62.

Savelyev, M., Gruzdeva, T., Savchenko, A., Koretsky, V.,

Pushina, N., 2021b. Assessment of the Competitiveness

and economic development policies of the countries of

the Former French Empire. In SHS Web Conf. 101

02005.

Savelyev, M., Ivanov, V., Polyakov, Yu., 2020a. The effect

of institutional differences on the economic

development of German-speaking countries. In E3S

Web of Conf. 222 05009.

Savelyev, M., Kutyashova, E., Savchenko, A., Koretsky,

V., Polyakov, Yu., 2021a. Diversity of economic

development in Portuguese-speaking countries. In SHS

Web Conf. 101 02004.

Savelyev, M., Pushina, N., Bryndin, A., 2021d. Search for

Effective Governments in Post-Soviet Russia While

Excluding the Factor of World Oil Prices from the

Results of the Country's Economic Development. In

IOP Conf. Ser.: Earth Environ Sci.666062092.

Savelyev, M., Pushina, N., Savchenkо, A., 2020b.

Assessment of the sustainability of economic

development under the governments of Russia. In E3S

Web Conf. 208 03052.

Savelyev, M., Sokolova, N., Polyakov, Yu., 2021c. Newly

Industrialized Countries: Is There an Alternative to the

Golden Billion? In IOP Conf. Ser.: Earth Environ Sci.

666062093.

Streb, J., Waidlein, N., 2013. Knowledge and Space in

Economic History: Innovations in the German Empire,

1877–1918. 5.

The conference board, https://conference-board.org.

Tsedilin, L. 2005. The EU Enlargement and the Prospects

of Eastern Germany Lands. In Economic issues. 4. pp.

23-42.

Uebele, M., Sarferaz, S., 2009. Tracking down the business

cycle: A dynamic factor model for Germany 1820-

1913. In Explorations in Economic History. 46. pp.

368-387.

World Bank, "World Development Indicators",

https://databank.worldbank.org.

Yablokov, B.V., 2018. Foreign economic policy of GDR in

the "New economic system" (1963- 1973).

Peculiarities of German World Economic Development Policy

387