How Do Russian Banks Evaluate the Retail Credit Risks?

Henry Penikas

1a

and Darya Savenko

2

1

Bank of Russia, Laboratory of Mathematical Modeling of Complex Systems of the P.N. Lebedev Physical Institute,

Moscow, Russian Federation

2

Moscow Institute of Electronics and Mathematics (MIEM), Moscow, Russian Federation

Keywords: IRB, lending, risk-taking, risk-appetite, SIFI.

Abstract: We use novel data for the lending rate offers by the Russian banks since November 2020 to April 2021. The

data source is the aggregator website banki.ru. It had initially retail loan offers from 19 banks. We control for

the cost of funding and the bank’s risk-appetite in terms of the Return on Equity (ROE). As the result, we are

able to decompose the lending rate into transaction- and bank-specific components. As with the research on

the international banks for the variability in the risk-weights we find that the banks running IRB approach

tend to evaluate retail credit risk higher and set higher interest rates. Banks with the foreign ownership,

inversely, tend to price in lower risk all else being equal and set lower lending rates. The narrow segment of

banks with the available planned ROE data allow us to say that the state-owned banks evaluate the retail credit

risk and set the rates higher, though the magnitude is lower than for the IRB impact. For the narrow segment

also we do not find statistically significant differences in the risk assessment for the listed banks, though we

see that they impose higher lending rates all else being equal.

1 INTRODUCTION

This is not surprising that banks may offer different

lending rates when the very same borrower applies.

One may easily guess that the bank funding mix or its

risk-appetite matter. For instance, expensive deposits

require a bank to impose higher lending rates.

Wishing to obtain higher return on equity (ROE) a

bank may also claim higher lending rates. We do not

discuss here the perverse consequences when higher

lending rates attract less creditworthy borrowers and

thus may result in lower return or even in a bank

failure.

However, if we were able to extract the above

components from the lending rate, we could see how

a bank prices the risk associated with a loan. A

baseline hypothesis would naturally be that banks

price the very same risk similarly. That should

particularly be true when the banks use own default

data and models, and not solely rely upon the

prudential estimates. The former approach is known

as the internal-ratings based (IRB) one. Many studies

discuss its specifics (Gordy, 2000), (Gordy, 2003)

including such shortcomings like procyclicality

a

https://orcid.org/0000-0003-2274-189X

(Gordy & Howells, 2006), infinite granularity

assumption (Gordy & Lütkebohmert, 2013), and its

implications to bank risk-taking (Repullo, 2004).

Regulators and researchers also departed from this

assumption when studying IRB-banks. However,

both stakeholders came to disappointing findings that

the banks are materially not in concordance in their

risk assessments (BCBS, 2013c), (BCBS, 2016),

(Behn, et al., 2016). Nevertheless, a recent study

counterargues that the differences in the risk-

assessments are more due to the fundamentals (EBA,

2021).

All the studies above considered European

countries, except Russia. That is why we wish to

verify what the situation in Russia is, i.e., do banks

evaluate the very same borrowers and transactions

similarly or not. Such a verification means that bank-

specific factors (other than funding costs or risk-

appetite) should not impact neither the risk

assessment, nor the ultimate lending rate.

To undertake such a verification, we lay down our

methodology and describe available data in section 2.

We present our findings in section 3. Section 4

concludes.

354

Penikas, H. and Savenko, D.

How Do Russian Banks Evaluate the Retail Credit Risks?.

DOI: 10.5220/0010704800003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 354-363

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 MATERIALS AND METHODS

We follow the straightforward approach presented by

(Horny, et al., 2018) when studying the EU sovereign

bond yields. As (Diebolt, 2015) recommends, we try

to fit the best full sample model without breaking the

subsample into the training and testing ones. This

limitation also originates from the scarce data we

possess at our disposal. Let us cover in more detail

our methodology and data below.

2.1 Methodology

We wish to decompose the lending rate

ijt

Rate

at

time t for bank i and loan type j into time dummies

t

T

, bank-specific drivers

it

X

(including funding costs

and risk-appetite) and risk component

jt

Y

. Latter one

comprises de facto of the transaction-specific factors.

We denote the respective vectors of estimates as

t

Ω

,

i

Β

,

j

Φ

. To account for heteroskedasticity we use

robust estimates for the model residuals

ijt

in (1).

ijt t t it i jt j ijt

Rate T X Y

ΩΒΦ

(1)

To derive the risk component directly, we first

compute the break-even lending rate

MIN

it

R

. It

captures the funding mix by accounting for the capital

adequacy ratio

it

CAR

as the equity portion proxy.

CAR is the ratio of the bank’s capital over its risks.

Simplistically, the risk amount equals to the risk-

weight multiplied by the asset (or exposure) amount.

The equity funding cost or the bank risk-appetite is

the return over equity

it

ROE

. We will consider the

actual and planned values where available. The non-

equity cost of funding is the deposit rate

D

it

r

in local

currency as the loans are offered in our dataset only

in RUB.

1

MIN D

it it it it it

R r CAR ROE CAR

(2

)

We assume that the risk component is the

differential of the actual lending rate and the break-

even one. We call it as the probability of default (PD)

because it generally combines the factors leading to

default on a particular loan.

M

IN

ijt it

Rate R

ijt

PD

(3

)

Having obtained PD estimate, we may run

regression over it in (4) where

it

X

does not comport

ROE, CAR and deposit rate like

it

X

had. This is

equivalent by estimating model (1) with restrictions

over particular coefficients.

t t it i jt j ijt

TXY

ijt

PD Ω Β Φ

(4

)

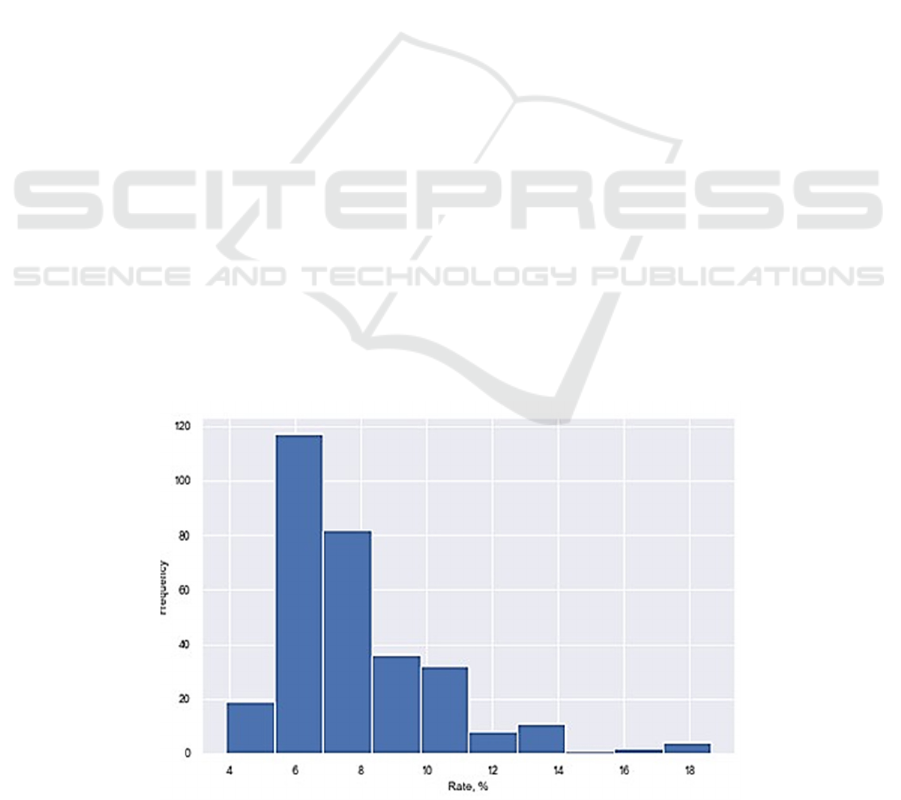

Figure 1: Lending Rate Frequency Distribution.

How Do Russian Banks Evaluate the Retail Credit Risks?

355

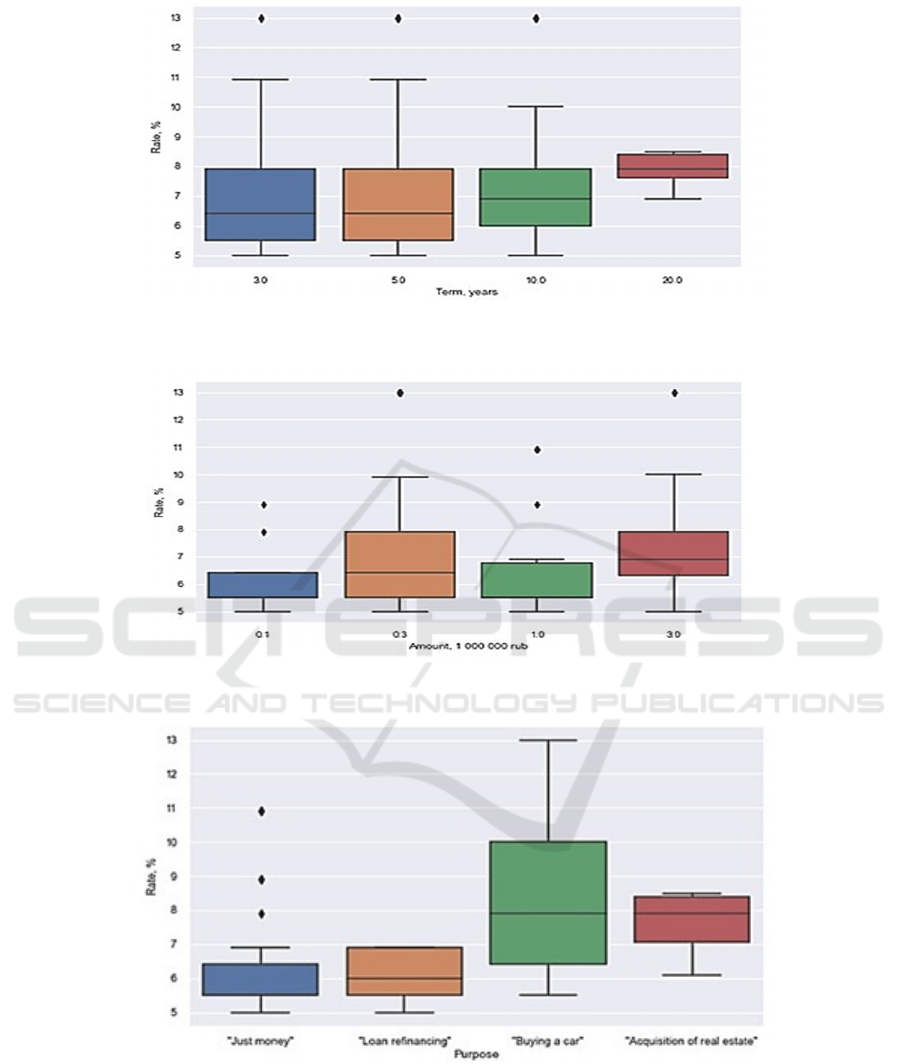

Figure 2: Lending Rate Distribution By Maturity (Term).

Figure 3: Lending Rate Distribution By Volume (Amount).

Figure 4: Lending Rate Distribution By Loan Purpose.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

356

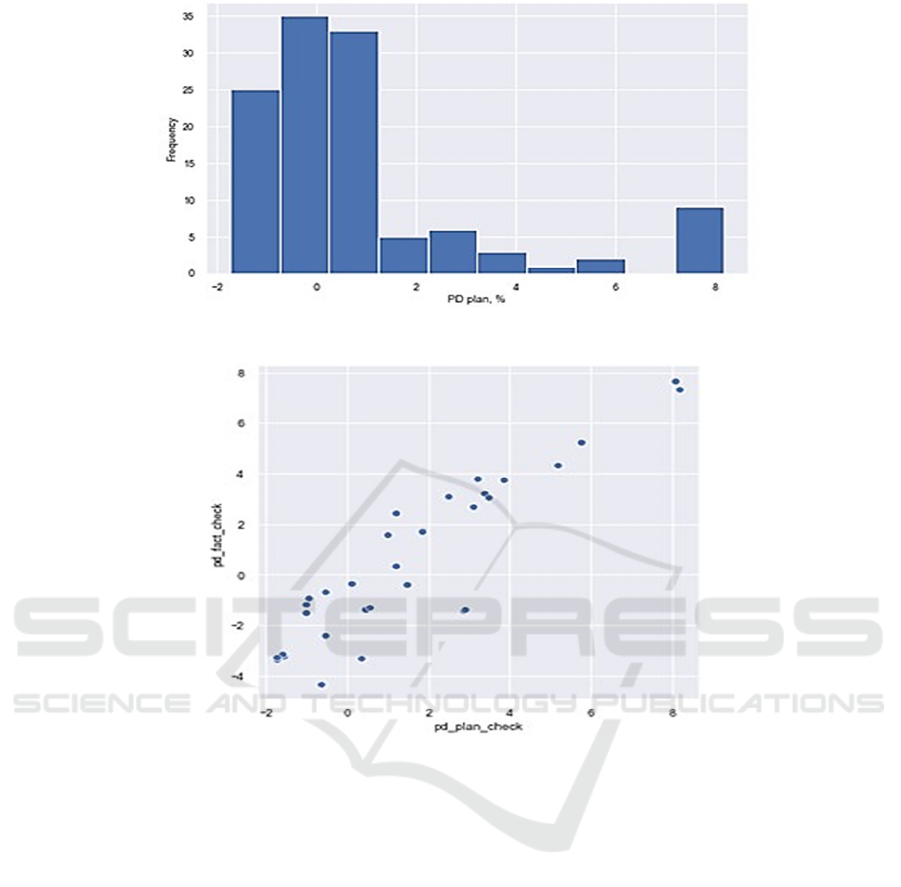

Figure 5: Planned PD Frequency Distribution.

Figure 6: Planned and Actual PD Co-Dependence.

In the principal part of the manuscript we present

the regression estimates for the significant variables

only (

Table 1

), where as Appendix has the output for

the entire list of variables even if the respective

coefficient was insignificant (Table 5).

2.2 Data

We wished to utilise a country-wide dataset of loans,

applications and the respective risk assessments

equivalent to that of (Jimenez, et al., 2014). However,

those are not publicly available.

That is why we utilise a unique publicly available

dataset from the Russian aggregator website banki.ru.

It has no archive. That is why we were lucky to have

made downloads in November 2020, March and April

2021. The website allows a person to enter one’s

quasi-personal data and obtain a set of lending offers

from several banks. We tried entering difference

income, age etc. parameters, but always obtained the

same minimum lending rates. That is why we proceed

with the study of these minimum offered rates for a

single profile inputted to the website.

Importantly, no one – even ourselves included –

knows the borrower risk. Thus, we do not claim to

have perfect risk prediction, but we do compare risk

assessments by different banks. We do not know

which bank has a risk prediction closer to a true one,

but what we wish to find out is to what extent and why

estimates of different banks are misaligned.

Since April 2021 the number of loan offering

banks rose to a hundred. As we started in November

with 19 banks only, we proceed with these 19 banks.

The lending rate varies from 4% to 18% (Fig. 1).

Larger rates are observed for car loans and mortgages

(two right boxes at Fig 4), than for consumer loans or

loan refinancing purposes (two left boxes there).

The mean rates rise when the loan maturity (term)

goes up. However, the dispersion of the observed rates

– on the contrary – shrinks when the maturity rises.

How Do Russian Banks Evaluate the Retail Credit Risks?

357

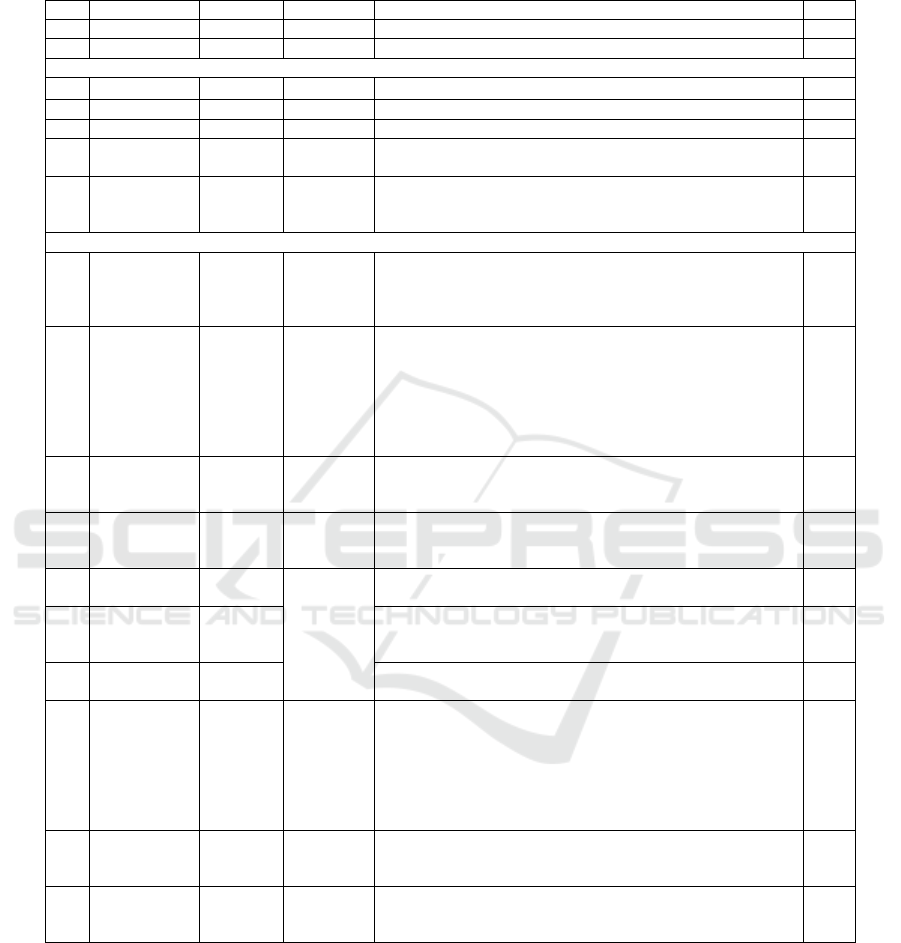

Table 1: Regression Output.

Determinan

t

PD_plan PD_fact PD_fact Rate_plan Rate_fact Rate_fact

Intercept -0.395 -0.948*** 7.199*** 10.124*** 6.416*** 7.419***

dt_march -1.191*** -2.262*** -1.214***

dt_nov

1.307*** -1.229** 0.779***

Loan Features

term 0.124*** 0.093** 0.128***

dg_CarLoan 2.565*** 2.743*** 2.340*** 1.930***

dg_CashLoan

-1.808*** 1.326***

dg_Refinance

-2.407*** 1.049**

Bank Features

CAR

-1.045*** 0.117***

R_

d

-0.690***

roe_fact

0.091***

roe_plan

-0.784***

t_foreign

-6.804*** -2.700*** -1.382***

t_governmen

t

0.893*** 1.423*** -3.910*** 2.451*** -0.623**

t_private -1.288*** -2.371*** -3.192*** 9.252*** 3.965***

t_irb 1.304*** 2.580*** 4.643*** 5.077***

t_listed

-5.403*** 12.824*** 5.421*** -0.728***

t_sifi

2.414*** -1.828** 3.446***

Observations 119 119 312 119 119 312

R2 0.361 0.516 0.235 0.427 0.443 0.287

Adjusted R2 0.333 0.495 0.220 0.391 0.408 0.264

F Statistic 8.818*** 35.079*** 41.025*** 403.069*** 401.519*** 19.378***

Note: *p<0.1; **p<0.05; ***p<0.01

We would also expect higher rates for larger loan

volumes. However, there is no clear pattern here.

We also switch to the PD data according to

formulas (2) and (3). PD proxy lies in the range of -

2% to +8% when we consider the planned ROE data.

Same time we do not observe material differences in

PD rankings when using planned or actual ROE

values. Using planned ones, allows us to benefit from

less observations with the negative PD estimates.

Such values are de facto feasible as, for instance, a

bank in our dataset offers lending rates for RUB 100k

at 7.9% and for RUB 1m at 6.9% when the break-

even level is 7.45%. Thus, the PD is -0.55% in the

latter case, while it is +0.45% in the former one.

More granular description of the independent

variables used in regression (1) is available in Table

2, its descriptive statistics come in

Table 4. Table 3

explains how we assigned bank-specific indicators to

particular banks.

3 RESULTS AND DISCUSSION

As a result, we test six model specifications. Three

models where the PD is a dependent variable (see PD

in the column header for specification (4)), and the

three ones where the offered lending rate is a

dependent one (see Rate in the column header for

specification (1)). The first two sub-columns within

each dependent variable type relate to the reduced set

of five banks (119 observations). For those banks we

run a regression with the planned ROE data in the first

column and with the actual one in the second column.

The third column relates to the enhanced data sample

of 19 banks (312 observations). For those we use only

the actual ROE values for comparability in-between

different banks. Results for the significant

coefficients are available in

Table 1. If interested, the

coefficients for all not-excluded variables are given in

Annex.

We are more confident to interpret the

determinants and their signs in case we do not see

controversies in between various specifications.

Thus, we observe that lending rates in March 2021

were lower, than in April by around 1-2 pp. (see

dt_march). We may remember that the Central Bank

raised the key rate from 4.5% to 5.0% p.a. on

April 23, 2021. However, this should not be priced in

the PD estimates as the PD is already cleaned from

the funding component. Unless the banks decided not

to increase the deposit rates after the policy rate hike,

but did it only for the lending rates.

Each RUB 1m adds around 0.1% to the risk (PD)

estimate, as well as to the lending rate (see term).

As for the loan types, the association measure for

the consumer and refinancing loans is mixed when

looking at the lending rate and it is insignificant when

looking at PD (see dg_CashLoan, dg_Refinance).

Thus, we may more confidently conclude that the car

loans are riskier than the mortgage ones by a level of

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

358

2-3 pp. As a result, the lending rate is also higher by

that magnitude (see dg_CarLoan). We may recall

here that the mortgage loans might be subsidized by

the government. That might be the reason for the

lower risk assessment in mortgages.

Interpreting actual ROE has a drawback of reverse

causality (endogeneity) that we did not control for.

The rates might be higher when the ROE target is

high. Same time high rates may imply high actual

ROE. To avoid such a discussion, we will look at the

planned ROE. Importantly, we find a statistically

significant negative sign for the lending rates. This

means the higher the target ROE is, the lower lending

rates the bank offers all else being equal. This is

exactly the illustration of the bank risk-taking

channel. The bank sets rates lower wishing to attract

more clients and expecting to thus earn more profit.

However, underpricing may result in extra losses and

most probably harm the profit targets.

As for the bank-specific features, we have several

quite robust findings. Foreign banks tend to

underprice risk by up to -7 pp. and offer lower loan

rates by 1-2 pp. That might be in part due to the use

of the parent company risk models. When latter are

calibrated in the developed economy, they might

yield over-optimistic risk estimates in the emerging

economy than they really are.

State-owned banks – at least in the reduced sample

– demonstrate higher risk evaluation and setting

higher rates than other banks by around 1-2 pp. This

may come from their more prudent or more

conservative credit policy when bank’s safety is a

higher priority than its earnings. However, the status

of a systemically important bank does not seem to

statistically significantly impact neither risk

assessment, nor the loan ultimate pricing.

Banks that applied for the IRB permission

systematically demonstrate higher risk-assessment by

1-2 pp. and set rates by 4-5 pp. higher. Such a

difference may come from banks using own default

statistics and thus being able to more correctly assess

the retail credit risk.

Private and listed banks demonstrate interesting,

though in part controversial trends. From one side,

they are likely to underprice the retail credit risk from

-1 to -5 pp. From another side, they tend to set lending

rates – on the opposite – higher by 4-12 pp.

To sum up, we find that Russian banks tend to

materially differently evaluate retail credit risk as

well as differently price retail loans. This echoes the

findings of the international prudential authority

(BCBS, 2013c), (BCBS, 2016) and the academic

researchers (Behn, et al., 2016). Some of the

differences may originate from the differences in

constraints applied to banks. For instance, IRB-banks

compute risk and risk-weights themselves to derive

the capital adequacy, whereas other banks are forced

to utilize predefined fixed risk-weights. Positive

coefficients for the IRB status imply that the

prudential predefined risk-weights might be more

optimistic as they under-assess the retail credit risk.

A sort of implication for a bank might be not to file

IRB application for a retail book as long as possible

to benefit from the lower prudential risk-weights and

CAR constraints.

4 CONCLUSIONS

Bank risk-taking is an important research stream

within the Central Bank. People wish to investigate

how risk-taking changes in response to changes in the

monetary policy (Repullo, 2004), (Jimenez, et al.,

2014).

The natural demonstration of the bank risk-taking

behaviour is how it assesses risks and how it sets the

lending rates afterwards. Earlier studies demonstrated

that banks tend to materially differ in risk-assessment

for the very same borrower (actual or hypothetical

ones) (BCBS, 2013c), (Behn, et al., 2016).

In this paper we wished to screen Russian banks

to verify whether they are different to their European

counterparts from the above studies. Generally, we

find out that Russian banks are not much different as

they also produce different risk estimates and offer

different lending rates after controlling for the

funding costs and the bank risk-appetite proxied by

actual and planned ROE values.

Our research is unique in several aspects. First, it

uses unique, though not extensive dataset on the loan

offered rated for the same person since late 2020.

Second, we are the first to identify the differences in

the risk perception by the Russian banks. Third, we

found that most probably Russian banks decided to

faster uplift the lending rates and their risk assessment

after the key rate increase in April 2021, rather than

to proportionately increase the deposit rates. Fourth,

we uniquely study the specifics in the IRB-banks

behaviour in Russia. To the best of our knowledge, no

one considered IRB as a separate differentiating

factor of Russian banks. The fair excuse is that most

researchers before focused on data prior to 2018 when

the first Russian banks launched IRB for CAR

computation. Fifth, we seem to have found not only

the determinants of the differences in risk-

perceptions, but have concrete policy implications.

We see that foreign banks and private banks tend to

underassess the retail risk compared to the state and

How Do Russian Banks Evaluate the Retail Credit Risks?

359

IRB-banks. This may come from the usage of the

parent datasets and models by foreign banks. On the

contrary, IRB-banks have Russian up-to-date default

data to be able to more adequately assess local risks.

This implies that the local standardized (fixed) risk-

weights might be too outdated and be too optimistic

in retail credit risk assessment compared to the IRB

risk-weights.

ACKNOWLEDGEMENTS

Opinions expressed in the paper are solely those of

the authors and may not reflect the official position of

the affiliated institutions.

REFERENCES

Gordy, M. B., Anatomy of credit risk models. In J. of

Banking and Finance. 24. pp. 119-149.

Behn, M., Haselmann, R., Vig, V., 2016. The Limits of

Model-based Regulation. European Central Bank

Working paper series.

Diebolt, F. X., 2015. Comparing Predictive Accuracy,

Twenty Years Later: A Personal Perspective on the

Use and Abuse of Diebolt-Mariano Tests. In J. of

Business & Economic Statistics. 33(1). pp. 1-9.

EBA releases its annual assessment of the consistency of

internal model outcomes for 2020, 2021. EBA.

Gordy, M. B., 2003. A risk-factor model foundation for

ratings-based bank capital rules. In J. of Financial

Intermediation. 12. pp. 199-232.

Gordy, M. B., Howells, B., 2006. Procyclicality in Basel

II: Can We Treat the Disease Without Killing the

Patient? In J. of Financial Intermediation. 15. pp. 395–

417.

Gordy, M. B., Lütkebohmert, E., 2013. Granularity

adjustment for regulatory capital assessment. In Int. J.

of Central Banking. 9(3). pp. 33-70.

Horny, G., Manganelli, S., Mojon, B., 2018. Measuring

Financial Fragmentation in the Euro Area Corporate

Bond Market. In J. of Risk and Financial

Management. 74(11). pp. 1-19.

Jimenez, G., Ongena, S., Peydro, J.-L., Saurina, J., 2014.

Hazardous times for monetary policy: what do twenty

three million bank loans say about the effects of the

monetary policy on credit risk-taking? In

Econometrica. 82(2). pp. 463-505.

Regulatory consistency assessment programme (RCAP) -

Analysis of risk-weighted assets for credit risk in the

banking book, 2013. BCBS.

Regulatory Consistency Assessment Programme (RCAP).

Assessment of Basel III risk-based capital regulations

– Argentine, 2016. BCBS.

Repullo, R., 2004. Capital requirements, market power,

and risk-taking in banking. In J. of financial

Intermediation. 13(2). pp. 156-182.

Vernikov, A., 2015. Russian bank data: Breaking down the

sample of banks by ownership. SSRN.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

360

APPENDIX

Table 2: The Variables Description.

No. Variable Units. Source

D

escription Note

1 dt_march Dummy Banki.ru Indicator for March 2021 data; 1

2 dt_nov Dummy Indicator for November 2020 data 1

L

oan Features

3 amount RUB mln Banki.ru The loan amount that a client may choose

4 term Years Banki.ru The contract loan maturity when requested

5 dg_CarLoan Dummy Banki.ru Indicator for the loan to purchase a car, i.e., collateralized loan; 2

6 dg_CashLoan Dummy Banki.ru Indicator for the consumer loan (in Russian - 'Just Cash' or

'Prosto Den'gi'), i.e., UNcollateralized loan;

2

7 dg_Refinance Dummy Banki.ru Indicator for the loan to refinance an existing one; we cannot

definitely say whether it is collateralized or not (depends upon

the original loan type to be refinanced)

2

B

ank Features

8 CAR pp. Banki.ru The actual total capital adequacy ratio (N1.0); we use it as a

proxy for the share of equity in the total funding mix of a bank;

respectively, (1-CAR) is the proportion of the non-equity

funding

9 R_d pp. Banki.ru the cost of the non-equity funding. It is the deposit rate in local

currency (RUB) for the closest maturity to that of the loan. We

extract the rate from the same website, but from another

webpage devoted to deposits (we thank Denis Shibitov for help

in deposit data collection). We collapse our data by maturity

for all deposit offers. Thus, we take an average RUB deposit

rate for a bank on the eve of our loan data collection date

10 roe_fact pp. Banki.ru Actual return on equity (roe) on the eve (the preceding month)

to the loan data collection; we take it as one of the two costs of

equity funding. It is available for all banks

3

11 roe_plan pp. Authors Planned return on equity. We take it as a second proxy for the

equity funding component of a bank. We were able to publicly

find values for the five banks only

3

12 t_foreign Dummy Authors +

(Vernikov,

2015)

The indicator (FOR) that a bank has a foreign ownership stake;

generally speaking, it is a foreign bank subsidiary in Russia

2

13 t_government Dummy The indicator (GOV) that a bank has a state ownership

component; in common citizen's perception it is a government

(state-owned) ban

k

2

14 t_private Dummy The indicator that a bank is a local private bank, i.e., it has

neither foreign ownership, nor the state one

2

15 t_irb Dummy Authors The indicator that a bank has filed application for the use of the

Basel II own default statistics and own models; also known as

Internal-Ratings-Based Approach (IRB), regulated by local

legislation No. 483-P and 3752-U. At the moment of the

research preparation three Russian banks filed an application

for the IRB to the Central Bank, two of them (Sberbank and

Raiffeisen) fully run it since 2018 and 2019, respectively

4

16 t_listed Dummy Authors The indicator that a bank or its Russian subsidiary under

consideration is or was listed on the stock exchange in Russia

or abroad

17 t_sifi Dummy Authors The indicator that a bank belongs to the list of the domestic

systemically important banks (D-SIBs), or in other word is a

systemically important financial institution (SIFI)

Notes:

1) the respective regression coefficient signals for differences against recent (April 2021) data.

2) the respective regression coefficient is benchmarked against the mortgage loans.

3) we also call it the bank's risk-appetite.

4) see https://bosfera.ru

How Do Russian Banks Evaluate the Retail Credit Risks?

361

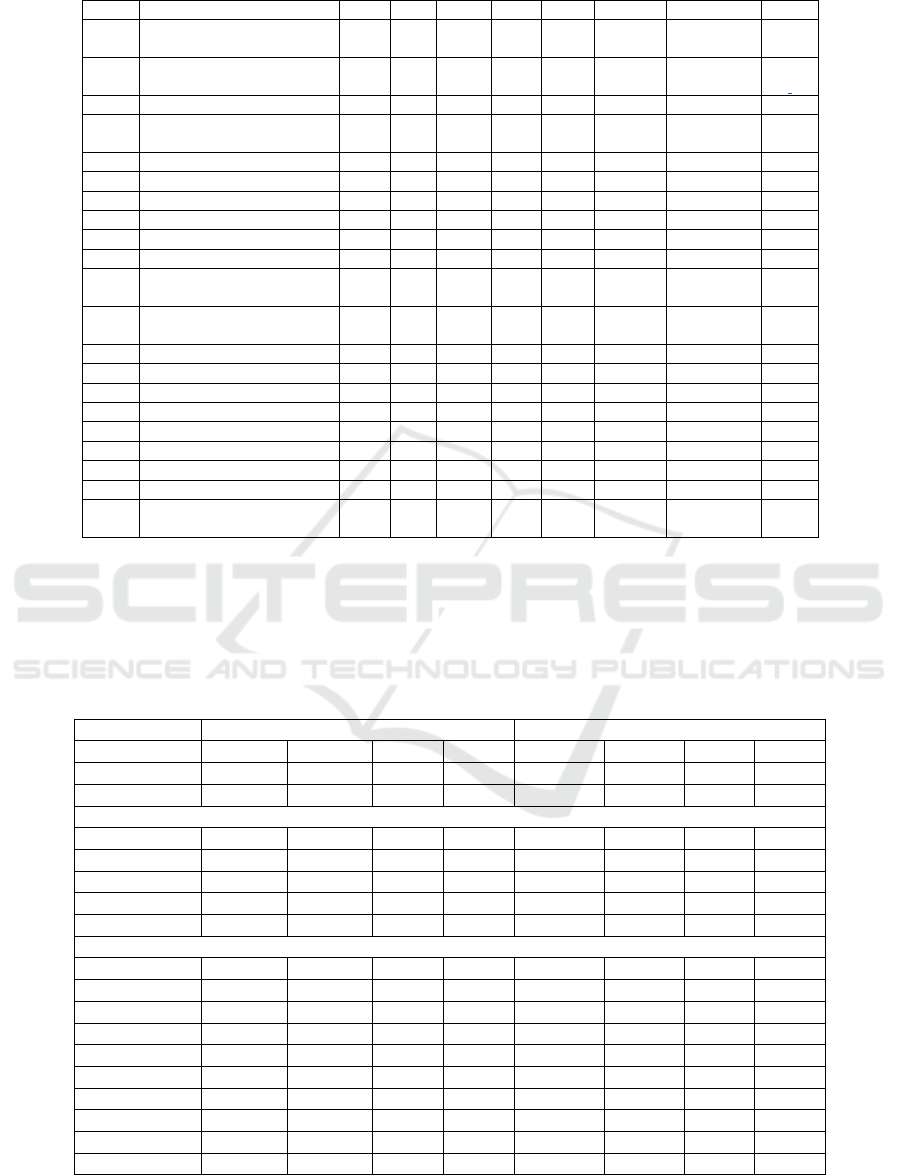

Table 3: Bank Features.

Regn Name Gov For Priv. IRB SIFI Listed* ROE_plan notes

316

Home Credit (OOO

"KHKF Bank") 1

354

Gazprombank (Bank GPB

(АO)) 11

429 PАO KB "UBRiR" 1

650

Postbank (PАO "Pochta

Bank") 1

902 PАO "Norvik Bank" 1

912 PАO "MInBank" 1

963 PАO "Sovkombank" 1

1000 Bank VTB (PАO) 1 1 VTB 15% 1

1326 АO "АL'FА-BАNK" 1 1 1 1 15% 2

1481 PАO Sberbank 1 1 1 SBER 20% 3

1810

"Аziatsko-Tikhookeanskij

Bank" (PАO) 1

1978

PАO "MOSKOVSKIJ

KREDITNYJ BАNK" 1 1 CBOM

2209 PАO Bank "FK Otkrytie" 1 1 OPEN 18% 4

2673 АO "Tin'koff Bank" 1 TCS LI 30% 5

2707 KB "LOKO-Bank" (АO) 1

2776 OOO "АTB" Ban

k

1

3073 PАO "RGS Bank" 1

3138 АO "Bank BZHF" 1

3251 PАO "Promsvyaz'bank" 11

3292 АO "Rajffajzenbank" 111

3354

KB "Renessans Kredit"

(OOO) 1

Notes: * where applicable, a ticker is given; if a unity is not marked for a dummy, a zero value is used.

1) https://www.vtb.ru

2)https://alfabank.ru

3) Statement by VTB IB analyst team for the Sberbank valuation, made on April 12, 2021.

4) https://cdn.open.ru

5)https://acdn.tinkoff.ru

Table 4: Descriptive Statistics for The Considered Independent Variables.

119 obs (5 banks) 312 obs (19 banks)

Variable Mean St.Dev. Min Max Mean St.Dev. Min Max

dt

_

march 0.34 0.48 0 1 0.21 0.41 0 1

dt_nov 0.18 0.38 0 1 0.32 0.47 0 1

Loan Features

amount 1.38 1.27 0.1 3 1.32 1.22 0.1 3

ter

m

6.20 3.98 3 20 6.11 3.74 3 20

d

g_

CarLoan 0.31 0.46 0 1 0.28 0.45 0 1

d

g_

CashLoan 0.25 0.44 0 1 0.41 0.49 0 1

dg_Refinance 0.32 0.47 0 1 0.22 0.42 0 1

Bank Features

CAR 12.78 1.09 11.20 15.42 14.25 5.95 3.70 54.11

R

_d

4.19 0.75 1.56 5.52 4.31 0.79 1.56 5.52

roe

_

fact 27.37 15.31 4.12 58.53 13.81 20.75 -53.29 64.95

roe_plan 19.77 6.50 15.00 30.00

t_foreign 0.21 0.41 0.00 1.00 0.18 0.39 0.00 1.00

t_gove

r

nment 0.51 0.50 0.00 1.00 0.37 0.48 0.00 1.00

t

_p

rivate 0.49 0.50 0.00 1.00 0.53 0.50 0.00 1.00

t

_

irb 0.25 0.44 0.00 1.00 0.16 0.37 0.00 1.00

t

_

liste

d

0.25 0.41 0.00 1.00 0.32 0.47 0.00 1.00

t_sifi 0.72 0.45 0.00 1.00 0.40 0.49 0.00 1.00

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

362

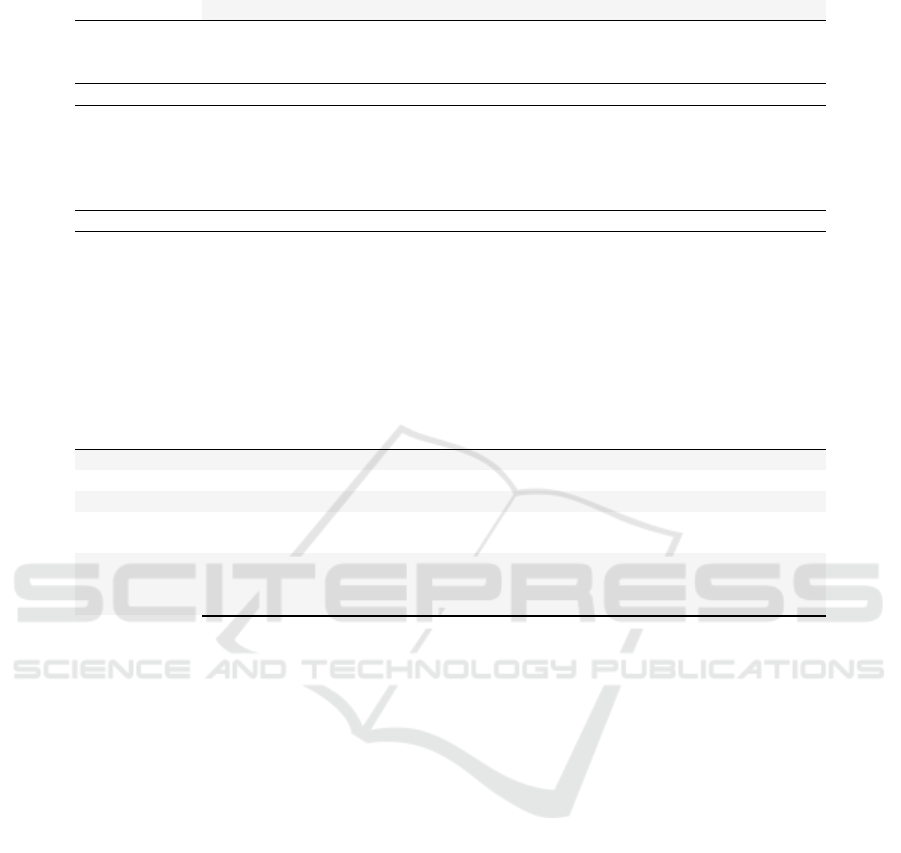

Table 5: Regression output with all variables included.

Determinant PD

_p

lan PD

_

fact PD

_

fact Rate

_p

lan Rate

_

fact Rate

_

fact

Intercept -0.010 -1.003** 4.327*** 10.068*** 6.175*** 7.650***

dt

_

march -1.303*** -2.393*** -1.355** -0.421 -0.978** -0.520

dt_nov -0.887* 0.003 0.890* -1.495** -0.223 0.595*

Loan Features

amount -0.013 -0.068 0.195 -0.030 -0.054 0.075

ter

m

0.079 0.097 0.076 0.007 0.020 0.129***

dg_CarLoan 1.668* 2.957*** 2.561*** 0.921 1.668** 2.116***

d

g_

CashLoan -1.253 -0.168 2.289*** -1.193 -0.554 1.439**

dg_Refinance -0.869 0.509 2.324*** -1.649** -0.863 1.189*

Bank Features

CAR 0.528 -0.743 0.105***

R_

d

-0.000 -0.440 -0.765***

roe

_

fact 0.074*** -0.006

roe_plan -1.111*

t

_

forei

g

n -0.709 -0.759 -6.495*** -4.113 1.066 -0.726

t_government 0.946*** 1.203*** -3.688*** -0.392 2.247*** -0.474

t_private -0.955* -2.206*** -2.942*** 10.460*** 3.928*** 0.238

t

_

irb 2.154 2.764** 0.062 4.810 3.003 -0.712

t_liste

d

0.699 -0.245 -5.343*** 14.181*** 5.109*** -0.620

t

_

sifi 0.237 0.444 2.643*** -4.505 3.313*** 0.117

Observations 119 119 312 119 119 312

R2 0.389 0.523 0.253 0.446 0.465 0.296

Adjusted R2 0.332 0.479 0.221 0.377 0.399 0.258

Residual Std.

Erro

r

2.098

(df=108)

2.243

(df=108)

4.168

(df=298)

1.682

(df=105)

1.652

(df=105)

2.189

(df=295)

F Statistic 4.765*** 18.982*** 20.699*** 252.347*** 263.071*** 15.820***

df

(df=10;

108

)

(df=10;

108

)

(df=13;

298

)

(df=13;

105

)

(df=13;

105

)

(df=16;

295

)

Note: *p<0.1; **p<0.05; ***p<0.01

How Do Russian Banks Evaluate the Retail Credit Risks?

363