Development of a Methodology for Assessing the Performance of

Financial Mechanisms to Support SMEs

Maxim Alekseevich Kostyukhin

1

, Tatiana Sergeevna Sobol

1

, Nadezhda Vladislavovna Sergeeva

2

and

Irina Vladimirovna Razinkina

3

1

Moscow Witte University, Moscow, Russian Federation

2

Moscow Polytechnic University, Moscow, Russian Federation

3

Financial University under the Government of the Russian Federation, Moscow, Russian Federation

Keywords: Small and medium business, financial support mechanisms.

Abstract: The purpose of the study was to develop a methodology for assessing the performance of financial

mechanisms to support small and medium-sized businesses based on the analysis of statistical data. The

authors proposed the use of a composite index, which allows to assess the effect of the implemented

mechanisms in three aspects: the quality of the entrepreneurial environment development, budget efficiency

and the impact on the labor market. Each aspect was assessed based on a set of macroeconomic indicators

that form the corresponding evaluation index. The final assessment was carried out using a composite index,

which includes an integral index of the quality of development of small and medium-sized businesses, an

integral index of the efficiency of the use of state budget resources, an integral index of social efficiency of

small and medium-sized businesses. The results of the study allow us to draw conclusions about the

connection between individual measures of financial support and their impact on the quality of the business

environment

.

1 INTRODUCTION

Support for SMEs is a priority of the state economic

policy (Franquesa, Vera, Kakembo, Abduh, Salleh,

Mendy, Mittal, Raman, 2021).

As of December 01, 2019, the number of SMEs,

information about which is contained in the Unified

Register, is 5.9 million units (-118.2 thousand or -2%

to the same date in 2018): 2.5 million legal entities (-

183.5 thousand or -6.8% relative to 2018) (hereinafter

also - "LE") and 3.4 million individual entrepreneurs

(+65.3 thousand or + 2.0% by 2018) (hereinafter also

- "IE") (42.5% and 57.5% of the total number of

SMEs, respectively).

The majority of SMEs is engaged in services and

trade (80.0%). At the same time, over the period

2016-2019, there is an increase in the service sector

with a simultaneous reduction in the trade sector. So,

if, according to the Unified Register, as of December

01, 2016, 40.6% of the total number of SMEs were

engaged in trade, and 39.9% - in the service sector,

then as of December 01, 2019, the share of SMEs

engaged in trade amounted to 37.6%, in the service

sector - to 42.4%.

The largest number of SMEs is concentrated in

Moscow and St. Petersburg, as well as in the

Moscow, Sverdlovsk regions and Krasnodar

Territory, the smallest - in the Chukotka, Nenets and

Jewish Autonomous Districts.

When evaluating the distribution of funds from

the federal budget and the budget of Moscow in

dynamics (Rudenko, 2021), we can note an increase

in concentration on a limited number of more priority

measures of financial support for SMEs in Moscow,

the total amount of funding for which is growing

every year.

Nevertheless, there are a number of issues despite

the growth of financing for small and medium-sized

businesses.

In particular, there is no clear understanding of

how much and in what areas funds are spent to

support SMEs (Bykova, Rudenko, 2019). State

structures are not able to track and summarize data on

the number and volume of financial support measures

in the Russian Federation (Rudenko, 2021).

Kostyukhin, M., Sobol, T., Sergeeva, N. and Razinkina, I.

Development of a Methodology for Assessing the Performance of Financial Mechanisms to Support SMEs.

DOI: 10.5220/0010703000003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 347-353

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

347

Table 1: Source data for determining the integral quality index of the development of SMEs in Moscow for the period 2016–

2019

No. Indicators Calculation method 2015 2016 2017 2018 2019

Source data

The number of enterprises and organizations, units 1009747 1010064 1039834 1045258 1094198

Number of SMEs, units 320160 324254 355350 385029 529221

SME turnover, RUB bln 4533.75 4460.28 4492.83 4618.38 2909.04

Average headcount of SME employees (excluding external part-time

workers), thousand people

226.7 229.6 229.1 226.6 292.8

Population, thousand people 12463 12468 12471 12470 12472

Calculation parameters

1

Number of SMEs per 100

thousand people of

population

Number of SMEs / population (in

thousand persons)

25.689 26.007 28.494 30.876 42.433

2

Share of SMEs in the total

number of enterprises

Number of SMEs / Number of

enterprises and organizations

0.317 0.321 0.342 0.368 0.484

3

The volume of SMEs

turnover per person

employed by SMEs

SME turnover / Average headcount of

people employed in SMEs

19.999 19.426 19.611 20.381 9.935

Indexes

i

11

Index of change in the

number of SMEs per 100

thousand people of the

population

The number of SMEs per 100 thousand

people of the population

t

/ The number

of SMEs per 100 thousand people of

the population

t-1

- 1.012 1.096 1.084 1.374

i

12

Index of change in the

share of SMEs in the total

number of enterprises

The share of SMEs in the total number

of enterprises

t

/ The share of SMEs in

the total number of enterprises

t-1

- 1.012 1.065 1.078 1.313

i

13

Index of change in the

volume of turnover per one

person employed in SME

The volume of turnover per one person

employed in SME

t

/ The volume of

turnover per one person employed in

SME

t

-1

- 0.984 1.007 1.028 0.630

I

QD

Integral index of quality of

development of SMEs

𝑖

∗𝑖

∗𝑖

- 1.003 1.055 1.063 1.044

2 MATERIALS AND METHODS

The study consists in analyzing key macroeconomic

indicators of a small and medium-sized business

entity, reflecting the quality of the business

environment, government spending on financing

various forms of support for small and medium-sized

entrepreneurs, as well as changes in the labor market

among those employed in small and medium-sized

businesses.

An integral assessment based on indices was

carried out to assess the effectiveness of the

implemented financial mechanisms of small and

medium-sized entrepreneurs

3 RESULTS AND DISCUSSION

One of the methods for assessing the performance of

SME support policy is an integral assessment based

on indices [2, 6]. Based on the available statistical

data, it is proposed to establish a composite index

based on three integral indices: an integral index of

the quality of SME development, an integral index of

the efficiency of using budget resources, and an

integral index of social efficiency of SMEs.

1. The initial data for calculating the Moscow

SME development quality index are shown in Table

1.

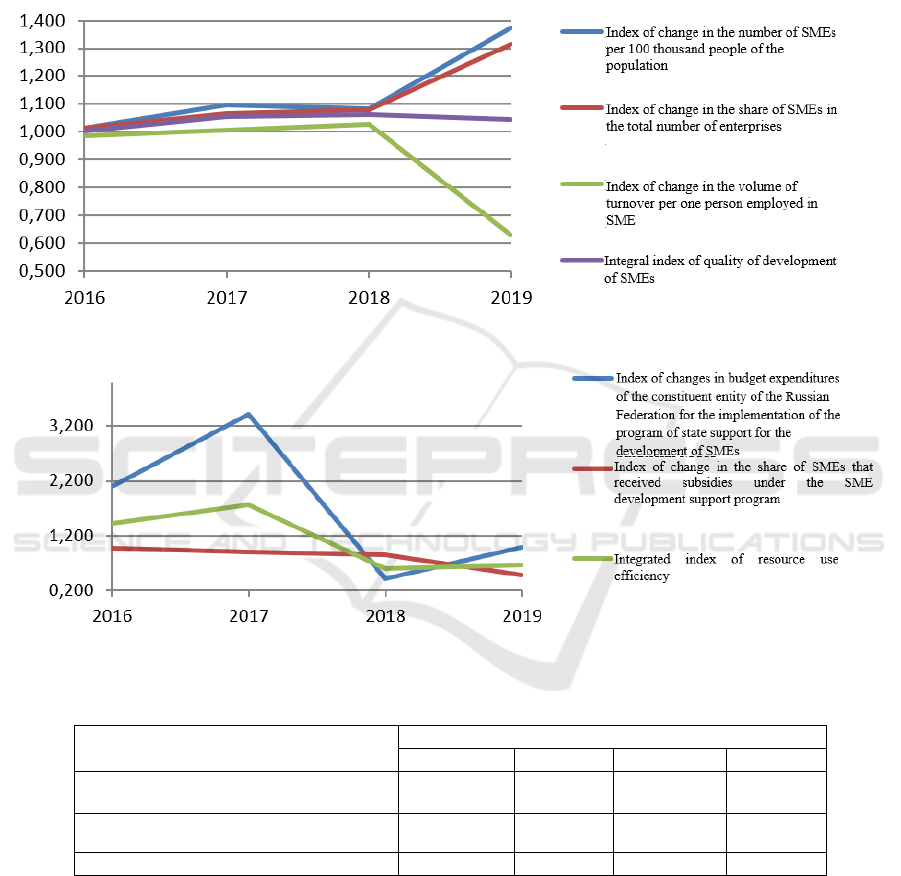

The results of calculating the integral quality

index of the development of SMEs in Moscow and its

components are presented in Figure 1.

The graphic interpretation of the analysis results

allows us to state the presence of positive changes in

the sphere of SMEs in Moscow from 2015 to 2019.

At the same time, however, despite the increase in the

indices of change in the number of SMEs per 100

thousand of the population and the change in the share

of SMEs in the total number of enterprises, the drop

in the index of change in the volume of turnover per

person employed by SMEs led to a decrease in the

integral index of the quality of SME development by

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

348

10% in 2019 compared to 2018. This indicates a

decline in the quality of SME development in

Moscow under the influence of macroeconomic

factors, which led to a significant reduction in the

turnover of SMEs in 2019 (– 37% compared to the

previous year), and the need to review the policy of

state support.

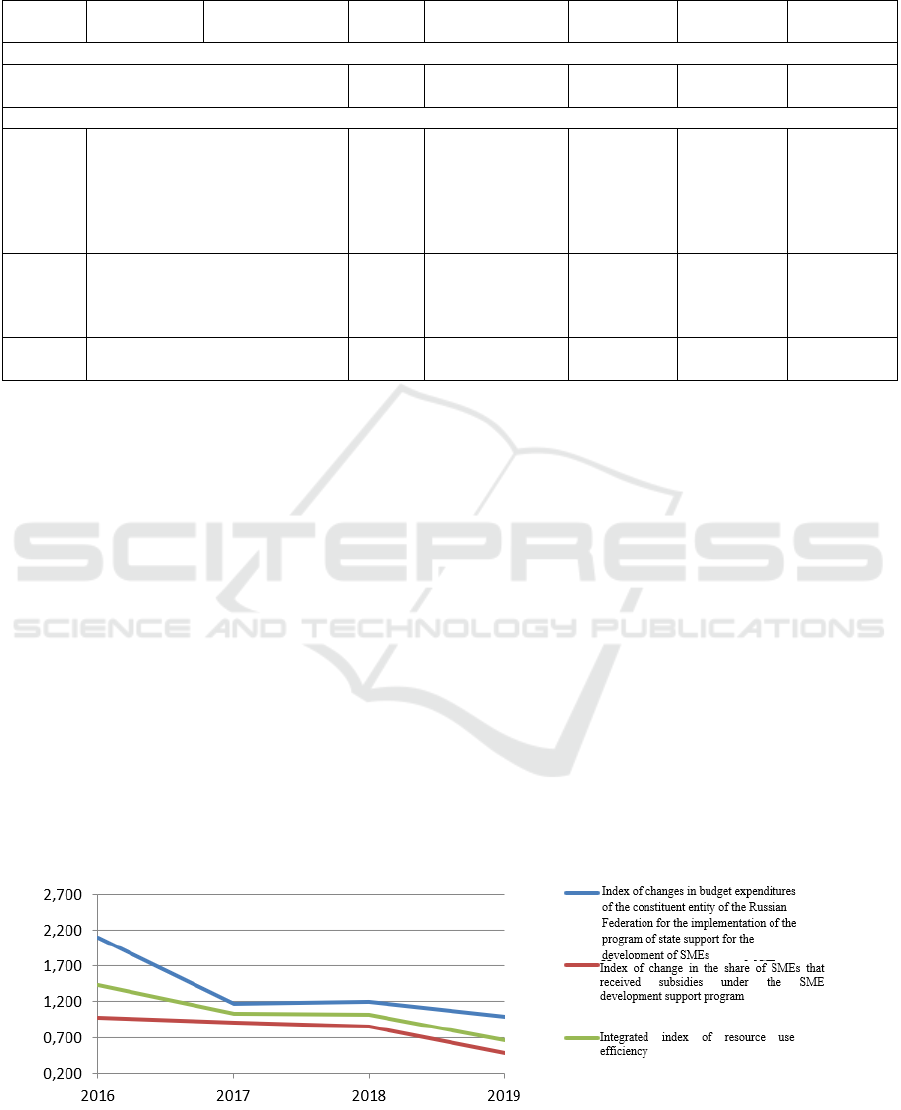

The source data for calculating the resource

efficiency index of the Moscow budget are presented

in Table 2

. The results of the calculation of the

integrated index of budget resource use efficiency in

Moscow and components thereof are shown in Figure

2.

Figure 1: Integral quality index of development of SMEs in Moscow for the period 2016–2019 and its components.

Figure 2: Integrated index of budget resource use efficiency in Moscow and components thereof for the period 2015–2019.

Table 3: Sources and volumes of SME development support programs in Moscow in 2016–2019, in thousand rubles

Funding sources

Funding volumes

2016 2017 2018 2019

Total budgetary allocations, including

1291680 4404040 1803200 1681760

regional budget funds

460000 926440 460000 443440

federal budget funds 831680 3477600 1343200 1238320

Development of a Methodology for Assessing the Performance of Financial Mechanisms to Support SMEs

349

Table 4. Source data for calculation of the integrated index of budget resource use efficiency in Moscow for the period 2016-

2019 (with the author's adjustments for the amount of funding for the SME development support programs in Moscow in

2017)

No. Indicators Calculation

metho

d

2015 2016 2017 2018 2019

Source data

Amount of financing of the state program for

the develo

p

ment of SMEs, thousand rubles

617320 1291680 2898000 1803200 1681760

Indexes

i

21

Index of changes in budget

expenditures of the constituent

entity of the Russian Federation

for the implementation of the

program of state support for the

develo

p

ment of SMEs

2.0924 1.1660 1.1973 0.9327

i

22

Index of change in the share of

SMEs that received subsidies

under the SME development

su

pp

ort

p

ro

g

ra

m

0.9776 0.9034 0.8577 0.4745

I

RUE

Integrated index of resource use

efficienc

y

1.4302 1.0263 1.0134 0.6652

The analysis findings show that there is no general

trend in the effective use of budget funds to support

the development of SMEs. A significant increase in

the index of changes in budget expenditures occured

in 2017 and, as a result, increase of the integral index,

followed by an even sharper decline in 2018 (the drop

in the integral index in 2018 compared to 2017 was

66%) and a slight improvement in the index value in

2019. This is due to significant changes in the amount

of funding for SME development support programs

Table 3 presents the distribution of funding

volumes depending on funding sources.

An analysis of the volume of budget funding and

the direction of program expenditures suggests that an

increase in funding from the regional budget in 2017

(by 457,240 thousand rubles compared to the

previous year) and from the federal budget (by

2,645,920 rubles (more than 3 times)) is associated

with funding within the SME support program of the

Moscow Fund for Assistance to Lending to Small

Entrepreneurship (457,240 thousand rubles were

allocated for its development in 2017 from the

regional budget and 2,645,920 thousand rubles - from

the federal budget). Thus, most of the expenses for

the support and development of SMEs in Moscow in

2017 are related to the funding of the Fund's work.

Since the allocation of such a large amount of

financial resources is a one-time event, it causes a

little distortion in the results of constructing the

integral index. Accordingly, it would be useful to to

compare the previously obtained data with the results

that can be obtained from the analysis without the

amount of funds for one-time funding of the Fund

(namely, 579,600 thousand rubles from the regional

budget and 2,318,400 thousand rubles from the

federal budget, i.e. 2,898,000 thousand rubles in

2013). The results of the calculation of the integral

index of resource efficiency are presented in Table 4

and Figure 3.

Figure 3. Source data for calculation of the integrated index of budget resource use efficiency in Moscow and components

thereof for the period 2016-2019 (with the author's adjustments for the amount of funding for the SME development support

programs in Moscow in 2017)

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

350

Table 5. Source data for determining the social efficiency index of the development of SMEs in Moscow for the period 2016–

2019.

No. Indicators Calculation metho

d

2015 2016 2017 2018 2019

Source data

Number of SMEs, units 320160 324254 355350 385029 529221

Average headcount of SME employees (excluding external

p

art-time workers), thousand people

2086 2112 2108 2085 2694

Average annual number of employed people, thousand

p

eo

p

le

15443 15391 15337 15281 15158

Average monthly wages of SME employees, thousand

rubles

36.6 39 42.3 47.4 46.2

Avera

g

e monthl

y

wa

g

es

p

er em

p

lo

y

ee, thousand rubles 60.06 67.5 76.95 83.04 88.92

Calculation

p

arameters

1 Share of people

employed in SMEs in

the total number of

em

p

lo

y

ees

The average number of

employees in SME /

Total average number of

em

p

lo

y

ees

0.1351 0.1372 0.1374 0.1364 0.1777

2 Social attractiveness of

SMEs

Average monthly salary

of SME employees /

Average monthly salary

in the econom

y

0.6095 0.5778 0.5497 0.5708 0.5195

Indexes

i

31

Index of change in the

share of people

employed in SMEs from

the total number of

employees

Share of people

employed in SMEs from

the total number of

employees

t

/ Share of

people employed in

SMEs from the total

number of em

p

lo

y

ees

t-1

1.0162 1.0013 0.9927 1.3027

I

32

Index of change in the

coefficient of social

attractiveness of SMEs

Social attractiveness of

SMEs

t

/ Social

attractiveness of SMEs

t-

1

0.9479 0.9514 1.0383 0.9102

I

SE

Integral index of social

efficiency of SMEs

𝑖

∗𝑖

0.9942 0.9649 0.9844 1.0960

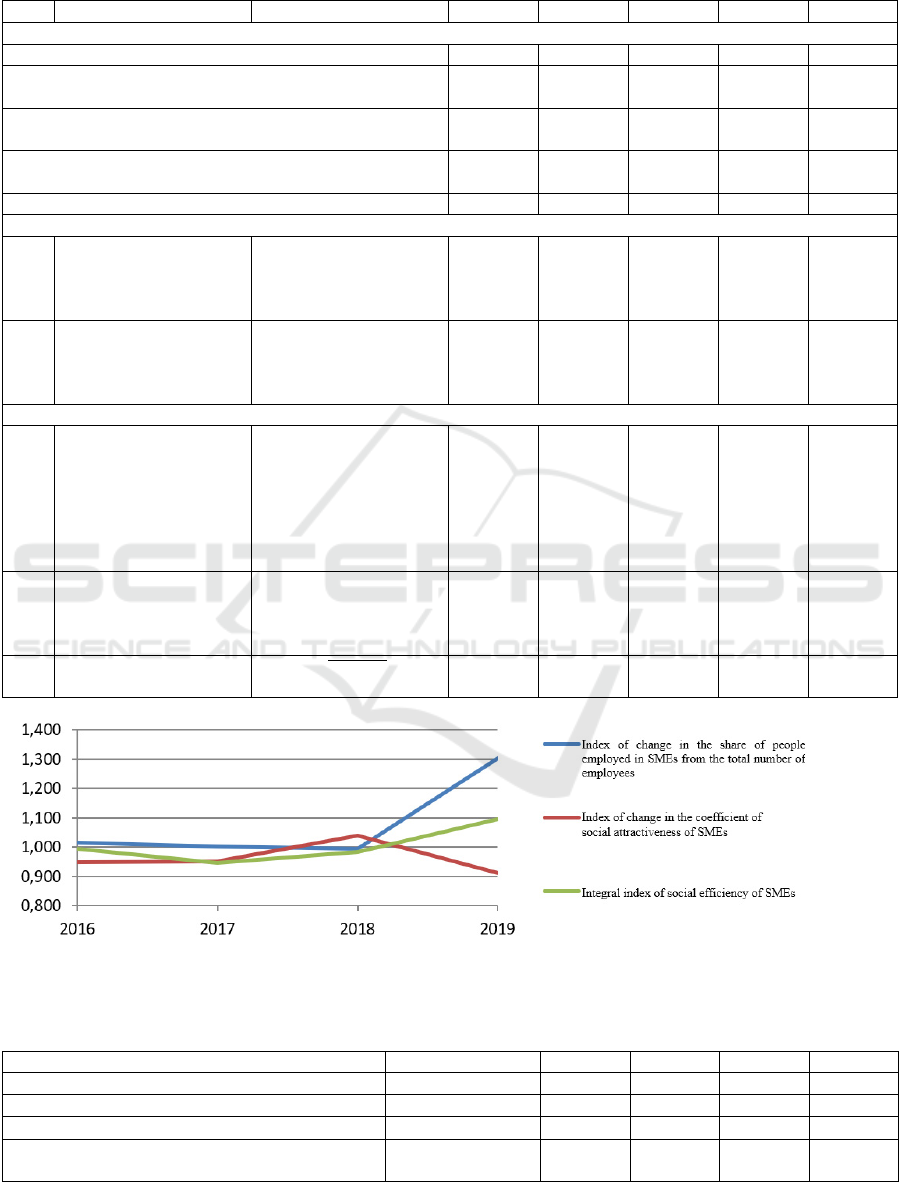

Figure 4: Integral quality index of development of SMEs in Moscow and components thereof for the period 2016–2019

Table 6. Results of calculations of integral and composite indices characterizing the quality of development, social efficiency,

and resource efficiency within the SME state support policy in Moscow for the period 2016-2019.

Indicato

r

Desi

g

nation 2016 2017 2018 2019

Integral index of quality of development of SMEs

𝐼

КР

1.003 1.055 1.063 1.044

Integrated index of resource use efficienc

y

𝐼

ЭИР

1.4302 1.0263 1.0134 0.6652

Integral index of social efficiency of SMEs

𝐼

СЭ

0.9942 0.9649 0.9844 1.0960

Composite index of the effectiveness of the SME

state support polic

y

𝐼

сводн

1.1256 1.0147 1.0198 0.9130

Development of a Methodology for Assessing the Performance of Financial Mechanisms to Support SMEs

351

Thus, without considering the funding of the

Moscow Fund for Assistance to Lending to Small

Entrepreneurship, but taking into account only the

activities of the authorities related to financial,

property, and information support of SMEs, we can

obviously note the negative dynamics of the change

in the integral index. This fact underlines the

expediency of spending budget funds not only on

traditional types of state support for SMEs, but also

on infrastructure facilities for supporting SMEs, the

funding of which contributes to improving the values

of the integral index of budget efficiency.

The initial data for calculating the social

efficiency index of the Moscow SMEs are presented

in Table 5, and the results are shown in Figure 20.

In general, we can consider the dynamics of

changes in the integral index of social efficiency of

SMEs in Moscow for the period 2016–2019 as

positive, which is primarily due to the stable growth

in the number of SMEs and average wages (until

2018). Separately, we should consider the results of

the construction of the integral index in 2019: a

significant increase in the number of employees of

SMEs (by 29.2% compared to 2018) was a key factor

in improving the integral index.

However, we should note that the index of

changes in the coefficient of social attractiveness fell

significantly, which is due to the manifestation of

inconsistency in the change in wages in small

enterprises and in the economy as a whole: while the

average monthly salary in the region increased (by

7% compared to 2018), in SMEs – decreased (by 2.5

%). This indicates a high sensitivity of SMEs to

economic shocks. The manifestation of this kind of

phenomena in combination with a relatively small

level of the integral rating (for all years (except for

2019) below 1) is the basis for strengthening and/or

revising the policy of state support for SMEs in

Moscow. Based on the constructed integral indices,

the composite index (Table 6) can be calculated using

the formula:

𝐼

сводн

𝐼

КР

∙𝐼

ЭИР

∙𝐼

СЭ

(1)

4 CONCLUSIONS

Based on the data obtained, we can conclude that

there is insufficient consistency in the changes in the

integral indices, which indirectly indicates that there

is quite a small connection between the use of

resources within the SME state support policy and the

quality of SME development and its social

attractiveness in Moscow in the period 2016-2019.

Due to the fact that currently, state bodies refuse

to directly subsidize the costs of SMEs in favor of

creating an institutional environment for expanding

the access of SMEs to financial resources, the author

analyzed the activities of the regions of the Russian

Federation to create and improve the work of

microfinance organizations that provide loans to

SMEs, and developed a system of proposals for the

development of the Moscow microfinance

organization established in 2019.

The areas of improvement of state support for

SMEs in terms of microfinancing of SMEs are

grouped as follows:

1) expansion of access for SMEs to the

microfinance system (in particular, expansion of

SMEs activities subject to microfinance and lending

purposes; reduction of the minimum threshold value

of the SMEs operation period (in order to involve

start-up entrepreneurs); formation of infrastructure

for access to microfinance, etc.);

2) expanding opportunities for SMEs, which

receive funding (increasing the term, volume of loans,

differentiation of loan products, the possibility of debt

restructuring, etc.).

The author justified the expediency of increasing

the maximum volume of microcredit to 3 million

rubles and made a forecast, according to which the

incorporation of the proposed recommendations in

the activities of the microfinance organization of

Moscow would improve the results of the

implementation of the SME state support policy in the

region.

REFERENCES

Bykova, O. N., Rudenko, L. G., 2019. Support system for

socially-oriented small and medium-sized businesses.

In Economics and Entrepreneurship.

Franquesa, J., Vera, D., 2021. Small business debt

financing: the effect of lender structural complexity. In

J. of small business and enterprise development.

Kakembo, S. H., Abduh, M., PMHAPHM, S., 2021.

Adopting Islamic microfinance as a mechanism of

financing small and medium enterprises in Uganda.

Mendy, J., 2021. Performance management problem of four

small and medium-sized enterprises (SMEs): towards a

performance resolution.

Mittal, V., Raman, T.V., 2021. Financing woes: estimating

the impact of MSME financing gap on financial

structure practices of firm owners. In South asian

journal of business studies.

Munyuki, T., CMP, J., 2021. The nexus between financial

literacy and entrepreneurial success among young

entrepreneurs from a low-income community in Cape

Town: a mixed-method analysis.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

352

Nicolas, T., 2021. Short-term financial constraints and

SMEs' investment decision: evidence from the working

capital channel.

Rudenko, L. G., 2021. Organizational and economic

mechanism for the implementation of state

management of infrastructural support for small

businesses. In Moscow Economic J.

Development of a Methodology for Assessing the Performance of Financial Mechanisms to Support SMEs

353