Individual Housing Construction as an Element of the Diversification

Strategy of Companies of the Investment and Construction Complex

Olga Kovalevskaya

a

, Valentina Razumey

b

and Oleg Kolmogorov

c

Saint-Petersburg State University of Economics (SPbSUE); Sadovaya st., 21, 191023 Saint-Petersburg, Russia

Keywords: Strategy, diversification, investment and construction complex, organization, strategic economic zones,

resources, strategic niches of the construction market, individual housing construction.

Abstract: The prospects of using diversification strategies in the investment and construction complex have been

identified. The concept of strategy as a unified polycentric system has been clarified. The restrictions on the

use of diversification strategies for the structural units of the investment and construction complex have been

formulated. Based on the business analysis development trends of the investment organizations and

construction complex, a promising direction of the diversification strategy, such as individual housing

construction, has been identified.

1 INTRODUCTION

This work is aimed to study the strategic

opportunities for the structural units development of

the investment and construction complex through the

use of diversification strategies. Risks and

uncertainties in the construction business are

increasing in the absence of stability in economic

development, increased concentration of production

in the investment and construction complex, resource

constraints. In this regard the sustainable and

competitive construction companies development can

be achieved through the development and

implementation of business diversification strategies.

In most sources diversification means diversity in

business development. Moreover, this diversity can

be both a variety of activities, i.e. a variety of

products, and a variety in the choice of markets in

which the company operates or is going to develop.

A.M. Aronov and A.N. Petrov draw attention to the

fact that "from an economic point of view,

diversification is expressed in the development of the

distribution of capital between various investment

objects, which may or may not be related to each

other" in the work "Diversification of Production:

Theory and Strategy of Development" (2000).

a

https://orcid.org/0000-0003-1346-3031

b

https://orcid.org/0000-0002-7275-8836

c

https://orcid.org/0000-0001-9051-6227

Business diversification usually focuses on reducing

risks in the distribution of capital between various

types of activities, manufacturing different products,

and the expansion of the market presence."

We can consider the construction sector as one of

the promising areas of diversification in the context

of an unstable economic environment. The modern

investment and construction complex and its

individual elements (structural units) have a high

potential for the formation of strategic areas by

diversified construction companies and industrial

enterprises.

2 MATERIALS AND METHODS

Currently, the strategy is an integrated enterprise

development model which defines its main principles,

goals, and objectives, priorities, and directions for the

medium and long term as well as effective

mechanisms for improving competitiveness and

reducing operational risks.

The research method uses qualitative and

quantitative factors analysis and trends in the

investment development and construction complex

and its elements. The generally accepted terminology

Kovalevskaya, O., Razumey, V. and Kolmogorov, O.

Individual Housing Construction as an Element of the Diversification Strategy of Companies of the Investment and Construction Complex.

DOI: 10.5220/0010698900003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 291-296

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

291

allows us to consider the investment and construction

complex as a socio-economic system with the

corresponding interrelated elements; to clarify

generalizing concepts and definitions related to the

theoretical aspects of the interpretation of strategy

and development diversification; identify the features

of diversification processes in the area under

consideration. Statistical information from official

sources allows us to identify trends and directions in

development (for example, the volume of individual

housing construction in the Russian Federation).

The first scientific approaches to enterprise

management were formed at the beginning of the

twentieth century as a part of the management school

(F. Taylor, G. Gant, H. Emerson) and were further

developed in a number of scientific works of the

classical school of management (A. Fayol, M. Weber,

C. Bernard), where scientists identified planning as

the main function of enterprise management but it

was short-term in nature and postulated the stability

of the external business environment and the internal

potential of the enterprise.

The second half of the twentieth century is

characterized by a steady increase in the dynamics of

the business environment and constantly increasing

competition, which makes changes in the conceptual

provisions of enterprise management, where planning

becomes targeted and long-term, and a set of strategic

development alternatives is drawn up in accordance

with the projected dynamics of the external

environment.

A model based on the world-famous SWOT

analysis procedure is considered to be one of the first

strategy formation models. In the context of this

strategy concept the enterprise development is based

on the interaction of the potential organization

capabilities within the identified threats to the

external environment and the advantages of its

internal resource potential, which can contribute to its

further development.

I. Ansoff proposed a fundamentally different

model of strategy formation based on the formalized

goals concepts and presenting strategic planning

within an extremely formalized process.

The model "product/market" presented by him

and called the "vector of growth", in turn, contains

four basic strategies to ensure the integrity of strategic

planning: financial, administrative strategies as well

as strategies for diversifying and expanding the

market. A significant difference of the concept

proposed by him is considered to be the presence of

feedback which ensures the degree of interaction

between the formation procedure and the continuity

of the implementation process.

From the point of view of M. Porter, each industry

includes a limited number of strategies with certain

competitive advantages within which an enterprise

can carry out economic activities. That is why the

author lays special emphasis on competitive analysis,

which final result is the choice of one of the typical

strategies of competition. The general competitive

strategies outlined by the author are still considered

to be particularly successful tools in terms of practical

application in the modern enterprises activities.

From the middle of the last decade of the

twentieth century to the present the leading role in

strategic planning has been played by the "resource

concept", which is based on the theory of key

competencies developed by G. Khamel and K. K.

Prahalad, and expressed in the art of effectively

identifying and combining the internal resources of an

enterprise.

In 1998 Russian strategic planning theorists made

their contribution to the strategic planning theory by

using logical schemes to reflect the formation of a

strategy in the strategic management contour form.

The strategic management contour and the

previously studied models significantly differ in

criterial principles of construction:

A. the sequence of the chain of actions: analysis -

goal setting - choice - specific actions;

B. building an enterprise strategy based on

hierarchy, i.e. a plurality of strategies within

one enterprise in accordance with structural

divisions, whose strategies are adjusted among

themselves on the one hand, and "absorbed" by

a single strategy of the enterprise as a whole on

the other hand;

C. a strategy is a continuous process that does not

end with the formation stage and makes sense

only if it is implemented.

Therefore, it is possible to assume that the

principle of the hierarchy of strategy formation allows

us to speak about the polycentricity of the very

essence of the strategy.

From the authors' point of view, many strategy

formation models confirm the polycentric nature of

its essence, since 75% of the total number of existing

models are diversification strategies which are based

on "the penetration of the capital of this corporation

in industries that are not directly related to the main

sphere of its activity".

In a general sense the term "polycentricity" is

expressed as the unity of a form in the diversity of its

elements, and in a literal sense indicates that a certain

spatial unit has several centers but it does not specify

what types of centers are meant and how these centers

are connected with each other.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

292

The concept of "spatial unit" allows us to give a

new impetus to the development of economic science

which studies the spatial characteristics of economic

relations and determines the most important thing -

the nature and efficiency of individual economic

processes.

Within this work the authors propose to clarify the

conceptual framework of the very essence of the

strategy, since it has quite a lot of definitions.

It should be noted that this paper considers

diversification as a strategy which means a certain

direction of the organization's development to

achieve goals in the long term. In this regard the

authors have developed a definition of the strategy

which reveals in more detail the essence of the

concept, its goals, and functions from the point of

view of polycentric development:

The strategy is a unified polycentric system that

organizes a dynamically changing spatial

environment of the enterprise's operation which has

several "centers of gravity" built on optimal

combinations of competencies and creates value for

achieving long-term competitive advantage.

In this regard the diversification strategy for

companies in the investment and construction

complex is presented as a substantive variety of

projects being implemented, the territorial business

expansion, as well as the expansion that ensures the

effective implementation of projects through the

provision of engineering, design, and other services.

The work of M.V. Fadeev "Features of

Diversification in Investment and Construction

Companies" (2007) notes the advantages of the

diversification strategy in the investment and

construction complex (ICC). According to the author

they include the following:

“reducing risks by placing assets and resources

in various spheres of economic activity, which

very often are independent of each other. Due

to the absence of a high correlation between

these areas there is an effect of "smoothing"

risks. If the market situation deteriorates in one

area, such deterioration has no effect on the

other area;

cash flows optimization. Due to the fact that the

dynamics of the company's activities in

different markets are different, this allows us to

redistribute cash flows between strategic

business units operating in different markets;

increase of innovation activity. Technological,

managerial, or marketing solutions identified

when entering one market can be used in other

markets as well. The use of several

technological solutions increases the stability

of the production and technological base;

strengthening of competitive positions. In

many cases diversification allows the company

to strengthen its position in the market. For

example, in the case of horizontal

diversification it becomes possible to get more

favorable conditions from suppliers and more

rigidly dictate your price conditions to buyers;

cost reduction. When diversification is

accompanied by an increase in overall

production, the prerequisites for capitalizing on

economies of scale often arise. Diversification

also often leads to the exploitation of diversity

savings;

additional revenue from the synergy effect.

Diversification can create an additional

synergistic effect from combining the activities

of various enterprises."

Based on an extensive global review of

sustainable assessment systems in various industries

and organizations the authors (Lua, Zhang, 2016)

consider the positive impact of transition strategies of

investment and construction enterprises on the

sustainability and competitiveness of their

development.

Having studied and summarized the international

and industry potential for real estate portfolio

diversification, Candelona, Fuerstb, and Hasse (2021)

confirm the high importance of the diversification

tool for investors and offer a statistical test for

comparing the potential for diversification at the

country and sector level.

Research (Garrido-Prada, Delgado-Rodriguez,

Romero-Jordán, 2018) confirms the importance of the

interaction between a product and geographic

diversification to determine the overall product of

diversification for the company's performance. The

authors have developed comprehensive models

confirming the effectiveness and value of a

diversification strategy in an economic downturn.

Based on the study of the role of new products on

the capacity building and macroeconomic

development of countries and sectors the authors

(Dosia, Mathewabc, Pugliesede, 2020) in the study

"Products of the Company Matters: Processes of

Diversification, Coherence, and Efficiency of Indian

Manufacturing Companies" consider the individual

characteristics of different products, trying to

determine the synergy of the product line in relation

to the overall product basket of the company. The

analysis confirms that the future performance of

companies depends crucially on the interaction

between the products they produce.

Individual Housing Construction as an Element of the Diversification Strategy of Companies of the Investment and Construction Complex

293

Economic Policy Uncertainty (EPU) is positively

associated with corporate diversification in China.

The diversification of companies with a large number

of equity analysts and equity reports increases during

a period of high EPU. Diversification actively

reduces the risks associated with economic policy,

increasing the efficiency of the company. (Hoanga,

Nguyenb, Zhangc, 2020)

Based on an in-depth analysis of the historical

evolution of research over the period 1970-2017, the

authors (Guerras-Martin, Ronda-Pupa, Zuniga-

Vicente, Zuniga-Vicente, 2020), show the need to

develop a comprehensive theory of corporate

diversification.

At the same time diversification strategies may

also have limitations when used in the investment and

construction sector. These restrictions are associated

with the features inherent in the system of the

investment and construction complex. According to

the authors we should pay attention to the following:

locality of construction markets which may

have their own specific features and trends

inherent in this territory;

construction projects with a high investment

value and uniqueness in space-planning and

technological solutions, as a rule, are erected by

specialized construction companies;

industrial units of the ICC have a limited

market for the sale of products and its territorial

expansion will lead to an increase in transport

costs etc.

3 RESULTS AND DISCUSSION

However, in the modern conditions of world

economic development, the existing conceptual

approaches do not provide a universal response to the

challenges of the present time. In the context of

declining global economic growth - the spread of the

coronavirus pandemic (COVID-19) in Russia and the

world, the Russian Federation's withdrawal from the

OPEC+ deal, lower oil prices, and the devaluation of

the national currency the investment and construction

complex of the Russian Federation has to solve

difficult tasks. The current business environment is

characterized by the suspension of construction of

individual facilities, interruptions in the materials

supply and equipment, the emergence of financial

problems, a decrease in the number of employees,

and, as a consequence, a sharp significant weakening

of final demand and a high risk of bankruptcy.

One of the acute problems facing the participants

of the investment and construction market is the lack

or insufficiency of investment financing for the

implementation of construction projects which forces

construction companies to look for new directions for

the development of their areas of activity.

From our point of view participants in the

investment and construction complex of the Russian

Federation can solve the problem of reducing

entrepreneurial activity and strengthen their

competitive position in the construction market with

the help of a diversification strategy by creating a

portfolio of individual housing construction in their

assets.

For a long period of time one of the fundamental

issues of the social policy of the Russian Federation

is the need to provide citizens with decent housing

that meets modern requirements and standards on a

par with Western European indicators. However, the

level of provision of housing for the population of the

Russian Federation in recent years has significantly

lagged behind the level of a similar indicator in

economically developed countries. Usually, this is

due to the constant increase in housing prices and the

low rate of development of individual housing

construction (hereinafter "IHC").

According to the Federal State Statistics Service

250-270 thousand private sector objects with a total

area of 30-36 million square meters are sold annually

in the Russian Federation, which is about 43% of the

total volume of housing commissioned at the expense

of citizens' own funds.

At the same time about 40% of the total volume

of housing commissioned within individual housing

construction is concentrated in 10 regions:

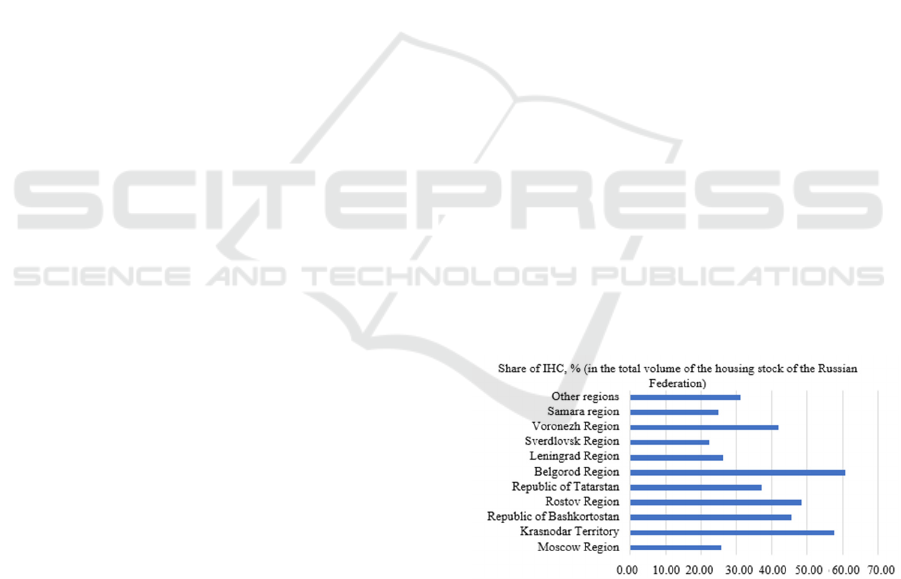

Figure 1: The share of IHC by regions of the Russian

Federation, %

It is worth noting that a significant increase in the

volume of housing commissioning in the regions of

the Russian Federation has been achieved in recent

years precisely due to the development of residential

housing. Consequently, individual housing

construction can become an element of the

diversification strategy of construction organizations

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

294

in the current economic conditions of market

development.

According to the official data of the ERZRF.RU

portal, the volume of commissioned housing in the

Russian Federation amounted to 80.6 million square

meters in 2020, which is 1.8% less than a year earlier.

However, the share of IHS in the total volume of

housing commissioning increased by 2.1%, since at

the end of 2019 this indicator was 45.9% (+13.6

points by 2018), and at the end of 2020, it reached

48% (+2.1% by 2019), which is 38.7 million square

meters of the total area of residential housing or 289.2

thousand private sector objects.

According to the official data of the All-Russian

Center for the Study of Public Opinion and the

estimates of a sociological study conducted for

DOM.RF JSC, the total demand of the population of

the Russian Federation for individual housing

construction within the five-year perspective is about

450 million square meters (or 3 million houses). This

demand can be met in 19 years at best considering

current construction volumes. At the same time about

300 thousand families would like to implement

individual housing projects annually with the

involvement of financing funds within mortgage

lending mechanisms. Accordingly, the IHC market in

the Russian Federation subject to state support can

become one of the main incentives for the

development of the investment and construction

complex.

However, there are a number of key problems that

hinder the development of this segment:

the implementation of IHC projects in most

cases is made by the citizens themselves

without the participation of construction

organizations;

the lack of provision of land plots with

engineering and transport infrastructure or

provision by the owners of the plots

themselves, which leads to an increased risk of

non-compliance with construction standards,

as well as to an increase in the costs of the

population;

the lack of development and accessibility of

mortgage lending instruments in the IHC

market which is 1% of the total volume of loans

secured by housing in apartment buildings due

to the low liquidity of individual houses and

land plots (due to the lack of construction

standards and infrastructure provision);

- increased risks of assessing the pledged object

due to the lack of methods for correctly

assessing the cost of completion of

construction and the absence of hidden defects;

- high costs of controlling the intended use of

funds during construction;

- high risks of non-compliance with construction

deadlines.

Consequently, the main constraint on the IHC

market is the lack of existing mechanisms and tools

for specialized preferential mortgage lending, while

transactions for the purchase and sale of real estate in

apartment buildings as of 2020 are carried out by

more than 50% using credit mortgage programs.

4 CONCLUSIONS

Summarizing the provisions outlined in this article

the authors came to the following conclusions:

strategy is a unified polycentric system that

organizes a dynamically changing spatial

environment of the enterprise's life, which has

several "centers of gravity" built on optimal

combinations of competencies and creates

value for achieving long-term competitive

advantage;

in conditions of instability of the external

environment, diversification strategies in the

activities of the structural units of the

investment and construction complex

suggesting a variety of business development

have rather high prospects for application;

when developing diversification strategies it is

necessary to allocate strategic management

zones, which are built on the basis of available

resources and the presence of strategic niches

in the construction market;

as the advantages of using diversification

strategies, first of all, attention should be paid

to reducing risks in the activities of companies,

optimizing cash flows, reducing costs per unit

of production, and others;

the use of diversification strategies in the

investment and construction complex has

limitations related to the specifics of

construction products which must be taken into

account in a diversified strategy;

considering the development trends in the

investment and construction complex, the most

promising direction of diversification is

individual housing construction, which is

confirmed by statistical data.

Individual Housing Construction as an Element of the Diversification Strategy of Companies of the Investment and Construction Complex

295

REFERENCES

Aronov, A. M., Petrov, A. N., 2000. Diversification of

production: theory and development strategy. SPB.:

LENIZDAT.

Fadeev, M. V. Features of Diversification in investment and

construction companies.

Lua, Y., Zhang, X., 2016. Corporate sustainability for

architecture engineering and construction (AEC)

organizations: Framework, transition and implication

strategies. ELSEVIER LTD. In Ecological Indicators.

Candelona, B., Fuerstb F., Hasse J., 2021. Diversification

potential in real estate portfolios. ELSEVIER LTD. In

International Economics.

Garrido-Prada, P., Delgado-Rodriguez, М., Romero-

Jordán, D., 2018. Effect of product and geographic

diversification on company performance: Evidence

during an economic crisis. ELSEVIER LTD. In

European Management Journal.

Dosia, G., Mathewabc, N., Pugliesede, E., 2020. What a

firm produces matters: Processes of diversification,

coherence and performances of Indian manufacturing

firms. ELSEVIER B. V. RESEARCH POLICY.

Hoanga, К., Nguyenb, C., Zhangc, H., 2020. How does

economic policy uncertainty affect corporate

diversification? ELSEVIER INC. In International

Review of Economics & Finance.

Guerras-Martín, L., Ronda-Pupo, G., Zúñiga-Vicente, J.,

Zúñiga-Vicente, J., 2020. Half a century of research on

corporate diversification: A new comprehensive

framework. ELSEVIER INC. In Journal of Business

Research.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

296