The Use of Analytical Tools in the Justification and Adjustment of the

Company's Strategic Guidelines

Olga Alexandrovna Polishchuk and Nadezhda Alekseevna Gracheva

Department of Economics, Management and Audit, Southwestern State University, Kursk, Russia

Keywords: Analysis, analytical tools, strategy, strategic guidelines, strategic management.

Abstract: The article shows the need to improve the strategic management of companies based on the development of

analytical tools for the development and implementation of the strategy. The authors clarified the concept of

strategy and strategic guidelines. The results of the study of corporate transparency of Russian companies on

the disclosure of information about strategic management in various aspects are summarized. The problems

in terms of analytical support of strategic management are identified and the need for its further development

is shown. The article presents the author's conceptual model of analytical support for strategic management

of production companies. It involves the formation of a set of analytical tools for strategic management,

focusing managers' attention on ensuring business continuity, minimizing risks, improving the efficiency of

the company as a whole and individual business processes, which will result in an increase in the value of the

business.

1 INTRODUCTION

In the context of a rapidly changing external

environment, fierce competition and the introduction

of sanctions, the determining factors for the success

of companies are to increase the efficiency of their

business and its development through the

achievement of their strategic goals. Therefore, many

Russian enterprises in the manufacturing sector of the

economy are forced to deal closely with issues of

strategic management. Quite a lot of foreign

publications (Ansoff, 1979; Drucker, 1969; Ferguson,

1993; Mintzberg, 1994; Porter, 1998; Thompson,

Strickland, 2007) and domestic authors (Vikhansky,

2002; Petrov, 2010; Khorin, 2006; Klochkov, 2010;

etc.) are devoted to the problems of developing,

implementing the strategy and evaluating its

effectiveness. These publications contain separate

analytical tools used in the process of developing

company strategies. At the same time, a

comprehensive approach is required to form

analytical tools that ensure the development and

implementation of the strategy, which will improve

the quality of the developed strategies and ensure

their implementation.

2 MATERIALS AND METHODS

General scientific methods were used in writing the

article: analysis, synthesis, complex and systematic

approaches, modeling. The article presents the results

of research on information transparency of Russian

companies on such an aspect of information

disclosure as strategic management (data from the

Russian Regional Network for Integrated Reporting).

3 RESULTS AND DISCUSSION

Since there is no unambiguous position on the

concept of "strategy", we propose the following

definition of it, which was formulated, on the one

hand, by generalizing existing approaches, on the

other hand, based on the tasks solved by companies

in the process of strategic management. So, from our

point of view, the strategy for the development of a

production organization is a plan of action for the

future, supported by solutions to adapt companies to

the opportunities for obtaining competitive

advantages and to the threats of weakening their

competitive positions, in order to improve the

efficiency of activities based on risk management,

continuity, assets and business processes.

286

Polishchuk, O. and Gracheva, N.

The Use of Analytical Tools in the Justification and Adjustment of the Company’s Strategic Guidelines.

DOI: 10.5220/0010698800003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 286-290

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

In practice, there are strategies with clearly

defined goals in quantitative terms, developed by the

management of companies, and strategies without

well-thought-out and clearly formulated goals, which

rather give an idea of the company's intentions. For

Russian companies, the second option is more typical,

especially for regional production organizations that

belong mainly to medium-sized businesses. Some

large companies do not disclose their strategic goals,

which means that it is difficult to form an idea of them

in this regard.

Since strategies are often cumbersome, vague and

insufficiently justified, it is difficult to evaluate them

and, consequently, to implement them. Therefore, it

is necessary to identify the key points of the strategy,

which will ensure the consistency of the interests of

owners and managers who implement the same

strategy, but at the same time have different interests.

In this regard, there is a need to develop the concept

of a "key strategic reference point", which will

become a "beacon" in strategic development for each

specific company. In our opinion, a key strategic

benchmark is a key indicator, the achievement of

which allows the organization to effectively develop

and implement a multi-vector policy.

The strategy in the process of its implementation

is forced to undergo adjustments under the influence

of various factors. Leaving the strategic guidelines

the same or not radically changing them, it is

advisable to adjust the intermediate parameters of the

strategy, the action plan. Significant adjustments to

the strategy are allowed only in crisis situations and

in case of drastic changes in business conditions. The

study of the strategic guidelines of Russian

corporations is usually carried out within the

framework of studying the system of goals put

forward by them and building corporate strategies

(Polishchuk, 2019).

An integral part of the Russian Regional Network

for Integrated Reporting (RRN) transparency studies

of Russian companies is the study of the disclosure of

strategic management information by major

companies.

Thus, the report for 2013 presented the results of

a survey of public reports of 100 companies from 24

industries. At the same time, 100% of the companies

disclosed information about the strategy and its

implementation. The best information is about the

industry/market situation. However, some aspects are

not sufficiently described: only 34% of companies

describe their strategic goals in quantitative terms;

38% of companies describe the resources needed to

implement the strategy. The contribution of the

reporting year to the achievement of strategic goals is

disclosed by 82% of companies, while in the reports

of 70% of companies this contribution is covered in

both quantitative and qualitative descriptions. Among

the leading industries in the disclosure of information

about strategic management are the chemical,

petrochemical and ferrous industries [Russian

Regional Network for Integrated Reporting].

The RRN report on corporate transparency of the

largest Russian companies for 2015 presented the

following results. For such an aspect of transparency

as strategic management, data on 182 companies that

disclose information in excess of the requirements of

Russian legislation are presented. Of these, 174

companies (96%) disclose information on the basis of

which it is possible to judge their further

development. The most disclosed information is the

company's position in the industry/market. 138

companies (76%) have a strategy description, only 78

companies (43%) describe their strategic goals in

quantitative terms; 51 companies (28%) disclose the

resources needed to implement the strategy – this is

the least disclosed aspect of strategic management.

The contribution of the reporting year to the

implementation of the strategy was described by 78

companies (43%) [Russian Regional Network for

Integrated Reporting].

In 2016, 184 companies were surveyed, of which

103 (56%) disclosed information about the strategy

and its implementation. RRN reports on company

transparency for subsequent years are not publicly

available. There is an acute problem of access to this

kind of information, since the transparency of a

number of Russian companies still remains poorly

illuminated in the media and the Internet space. The

imposition of sanctions against Russian companies

has also affected their willingness and ability to

disclose information about their strategic goals, as

well as the resources used to achieve them.

Unfortunately, many Russian manufacturing

companies do not have an effective and clearly

formulated long-term development strategy or their

strategic goals are not quantified. The reasons for this

situation are:

1. Lack of close attention to the development

strategy on the part of the company's owners.

2. Lack of highly qualified specialists in strategy

development.

3. Insufficient alignment of the achievement of

the company's strategic goals with the system

of remuneration of top managers.

The Use of Analytical Tools in the Justification and Adjustment of the Company’s Strategic Guidelines

287

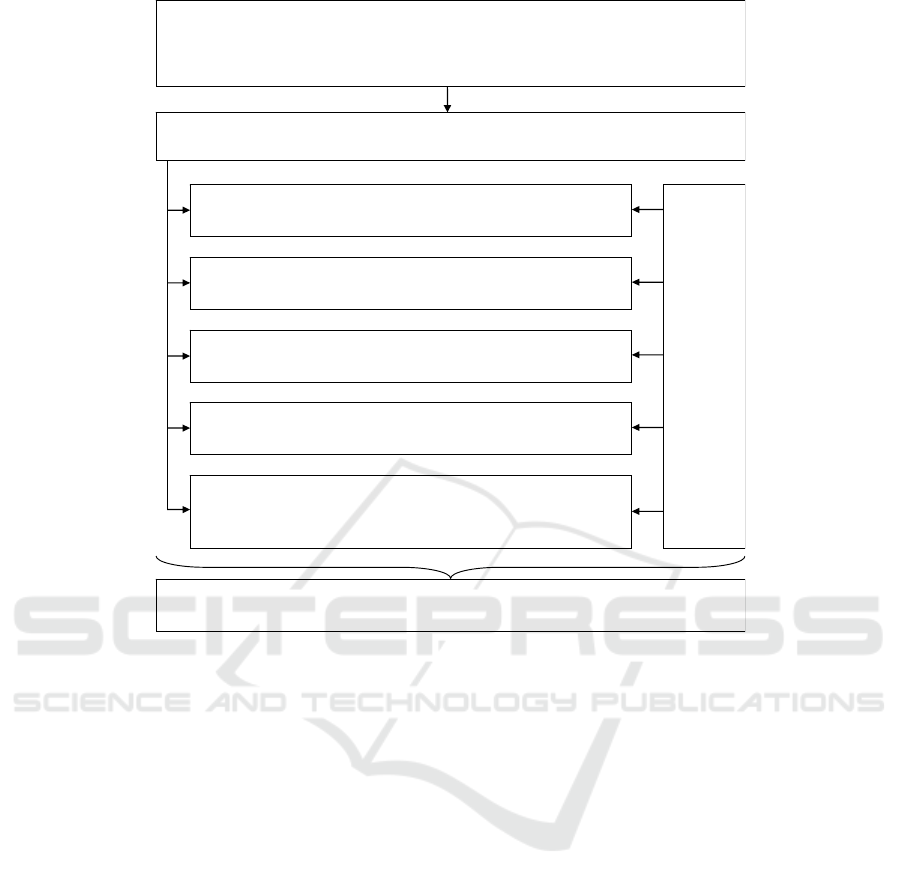

Figure 1: Model of analytical support for strategic management of production companies.

4. Poor alignment of the company's strategy with

the development strategies of the regions and

individual sectors of the economy.

5. Introduction of sanctions against Russian

companies.

At present, companies' strategic guidelines need

to be further aligned with regional development

strategies, and in some cases with the country's

development strategy as a whole, since these

strategies are not sufficiently developed in all regions

and are not fully provided with resources, including

financial ones, which makes it difficult to develop and

implement them. Nevertheless, there are serious

theoretical developments concerning various aspects

of regional development that are of practical interest

both for regional managers and for those companies

that consider it necessary and profitable to take into

account the vector of regional development in their

goal-setting [Belyaeva, Kozieva, 2019; Bessonova,

2018; Vertakova, 2016]. The alignment of the

companies' strategies with the strategic plans for the

development of the territories will increase their

efficiency, increase the investment attractiveness of

the companies, and increase their value.

Improving the process of developing and

implementing the strategy makes it necessary to

create a model of analytical support for strategic

management of companies, which should be based on

the modernization and development of a set of

analytical tools used to justify, adjust and implement

the development strategy of production

organizations.

The proposed model (Fig. 1) and its

implementation will improve the efficiency of the

company as a whole and individual business

processes, ensure the continuity of the company's

functioning, take into account and minimize risks,

and accelerate the achievement of goals. Many

manufacturing companies need to improve the

effectiveness of their development strategy. This

should also be aimed at improving the analytical

support of the strategic management process.

Let's look at the individual analytical tools of this

model.

In our view, the starting point for the

implementation of the strategic priorities of the

production company should be ensuring the

continuity of its activities. This is necessary to reduce

Modernization of analytical tools for development and

implementation of the development strategy a production

organization

A model for improving the efficiency of strategic management of production

companies based on analytical tools for developing and implementing their

development strategies

Analytical support system for strategic management of production organizations in order to increase

their efficiency

Assessment of the business continuity of a production organization

The end result of the implementation of the model: development of measures to achieve

strategic targets, including to increase the value of the business

Assessment of internal risks of the production organization to

minimize the degree of their impact

Analysis of the effectiveness of the activities and individual business

processes of the production organization

SWOTanalysis

PESTanalysis

Building a scheme for integrating financial and

non-financial indicators that forms the process of creating added

business value

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

288

the risks of business interruption and the negative

consequences of such failures, and restore the

business to an acceptable level. Therefore, the

assessment of the continuity of the company's

activities should be interlinked with the corporate

strategy and the strategies of the business units. It is

also important to rely on an understanding of the

specifics of business processes in various

organizations, taking into account their industry

affiliation. It is advisable to integrate the continuity

assessment into the organization's risk management

system (diagnostics of bankruptcy risk). Equally

important is which business unit will conduct the

continuity assessment. Most often, the assessment of

the continuity of the company's activities is difficult

due to the lack of a unified methodological approach

to its conduct and a quantitative assessment of the

factors that threaten it.

The development and justification of a business

development strategy must necessarily be

accompanied by the identification and assessment of

the level of risks. Performing the risk analysis for the

purposes of strategic management, it is proposed to

divide them into three groups: risks of strategic

management zones and the external business

environment; internal risks; risks of a separate project

(product) [Petrov, 2010]. In our opinion, the

company's internal risks deserve close attention,

which can be diagnosed in a timely manner and then

managed.

Currently, in the context of a decline in production

in certain sectors of the economy and the introduction

of sanctions, many companies are experiencing the

need to identify points of potential tension, the

presence of which can lead to a violation of the

balance within the organization and conflicts, and as

a result, to the inability to achieve their strategic

goals. One of the methods for diagnosing internal

risks is the standard model of the internal riskiness

calculator of an organization, modified by us

[Polishchuk, 2019], which can be used to identify,

track, control and minimize points of tension in

companies through corrective management actions.

Its use is aimed at achieving strategic goals.

The classic analytical tools used in strategic

management are SWOT analysis, PEST analysis,

GAP analysis, which should be used to more clearly

take into account the industry specifics of the

organization and its position in the commodity

markets.

The analysis of the achievement of strategic goals

should include an assessment of the performance of

companies: whether their achievement is

accompanied by an increase in key performance

indicators, whether the remuneration of top managers

is linked to the implementation of the set strategic

goals and objectives. For the company, it is necessary

to create key performance indicators, the system of

which can be represented by performance indicators

grouped by its types of activities, by functional zones,

by areas of asset use, and other characteristics. The

effectiveness of the company's activities and its

progress towards the set goals is seriously affected by

the effectiveness of individual business processes of

the organization, which strongly affects the coherence

of the actions of the company's divisions in the

process of implementing the strategy.

When evaluating the implementation of

companies' strategic plans, it is necessary to analyze

the achievement of corporate performance targets.

The target indicators can be the size and rate of profit

growth, sales growth, an increase in the share of

products in the market, indicators of return on assets

and equity, and capitalization growth. "In achieving

long-term goals, EVA, EBITDA and performance

indicators calculated on their basis are indispensable.

The company's goals may be to increase the value

added of equity capital (SVA), market value added

(MVA)." [Gracheva, 2016].

To link strategic goals with business processes

and personnel actions at each level of the company's

management, it is advisable to use such a tool as the

balanced system of organizational performance

indicators (BSC). It combines financial and non-

financial performance indicators, as well as the

achievement of strategic indicators and development

plans of the company. To determine the company's

prospects, goals and indicators, as well as the links

between them, it is necessary to develop a strategic

map. A strategic map with a description of non-

financial quantitative goals (for example, increasing

the company's market share, reducing the length of

the production cycle of manufacturing products,

increasing the satisfaction of both customers and

staff) allows you to imagine the process of creating

added value. Non-financial indicators should account

for about 80% of the indicators. The optimal ratio of

indicators is as follows: customers - 22%, internal

business processes - 34%, training and development -

22%, finance - 22%. The strategic map identifies

causal relationships that indicate how intangible

assets (for example, the availability of highly

qualified personnel, customer bases, brands) are

transformed into tangible results (attracting new

customers, providing increased revenue from the sale

of new products and services, increasing profits and

increasing the value of the company). Thus, the BSC

allows the company to describe its strategy in an

The Use of Analytical Tools in the Justification and Adjustment of the Company’s Strategic Guidelines

289

accessible way in the form of a map and translate

strategic goals into a clear plan of operational

activities of departments and key employees for

subsequent evaluation of results using key

performance indicators (KPI). Ultimately, the KPI

system used in the company should be aimed at

ensuring the growth of the business value through the

management of the factors that affect it.

The main goal of the implementation of the KPI

system is to ensure the growth of the overall

efficiency of the company, due to the fact that each of

the employees will understand the relationship

between their specific responsibilities and the

strategic goals of the company. Managing a company

using a system of key performance indicators allows

you to look at the current situation in the company

through the prism of a strategic perspective.

4 CONCLUSIONS

Further research is required on strategic management,

in particular, on analytical support for the

development and implementation of company

strategies. The model developed by the authors

provides for the formation of a set of analytical tools

for strategic management, which will improve the

efficiency of the company as a whole and individual

business processes, ensure the continuity of the

company's functioning, take into account and

minimize risks, and accelerate the achievement of

strategic goals.

REFERENCES

Ansoff, H. I., 1979. Strategic Management, The MacMillan

Press.

Drucker, P., 1969. The age of discontinuity, Heinemann.

Ferguson, Marylin., 1993. The New Paradigm: Emerging

Strategic for Leadership and Organizational Change.

New Consciousness Reader.

Mintzberg, H., 1994. The rise and the fall of strategic

planning. N.Y. The Free Press.

Porter, M. E., 1998. Competitive Strategy: Techniques for

Analyzing Industries and Competitors. N.Y.: The Free

Press.

Thompson, Jr., Arthur A., Strickland III, A. J., 2007.

Strategic Management: Concepts and Situations for

Analysis, 12

th

. M.: Publishing house "Williams". p. 928.

Fleischer, K., and Bensussan, B., 2005. Strategic and

competitive analysis. Methods and means of

competitive analysis in business. M.: BINOM.

Knowledge Lab. p. 541.

Vihansky, O. S., 2002. Strategic Management, M.:

Gardariki. p. 296.

Petrov A. N., 2010. Strategic Management, St. Petersburg:

Peter, p. 496.

Horin, A. N., 2006. Strategic analysis. Moscow: Eksmo. p.

288.

Klochkov, A. K., 2010. KPI and personnel motivation, M.:

Eksmo. p. 160.

Polishchuk, O. A., Gracheva, N. A., 2019. Analytical

support for the strategic management of a production

organization. Kursk, CJSC "University book".

Gracheva, O. A., Ponomareva, T. V., 2011. Formalization

and reengineering of business processes of an industrial

enterprise in order to increase the efficiency of its

activities. In Economics, Statistics, and Computer

Science. Bulletin of the UMO. 3. pp. 34-41.

Gracheva, N. A., Polishchuk, O. A., 2012. Methodological

approaches to assessing and managing the value of

companies from the perspective of risk management

and business process optimization. In Bulletin of the

Samara State University of Economics. 9(95). pp. 18-

25.

Gracheva, N., 2016. Analysis in corporate governance. In

Economic magazine-XXI. 157. 3-4-1. pp. 85-87.

Belyaeva, T., Kozieva, I., 2019. Diagnostics of strategic

spatial development scenarios of the national economy.

In Economic magazine-XXI. 11-12. pp. 122-129.

Vertakova, Yu. V., Klevtsov, S. M., Klevtsova, M. G.,

2016. Sustainability of territory development:

morphology of economic space. In Proceedings of

Southwest State University. Series: Economy.

Sociology. Management. 18(1). pp. 89-96.

Bessonova, E., Alekseeva, V., Milgunova I., 2018.

Development of the assessing method of investment

attractiveness for the regional socio-economic system.

In Proceedings of the 32nd International Business

Information Management Association Conference,

IBIMA 2018 - Vision 2020: Sustainable Economic

Development and Application of Innovation

Management from Regional expansion to Global

Growth. pp. 5864-5876.

Russian Regional Network for Integrated Reporting, 2013.

http://transparency2013.downstream.ru.

Russian Regional Network for Integrated Reporting, 2015.

http://transparency2015.downstream.ru.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

290