Strengthening Financial Stability based on the Factor Forecast of

Profitability of the Enterprise

Natalia Aleksandrovna Voronina

1a

, Elena Gennadyevna Zhulina

1b

,

Natalia Yuryevna Sadchenko

2c

and Elena Aleksandrovna Yurmanova

1d

1

Yuri Gagarin State technical university of Saratov, Saratov, Russia

2

Volga region cooperative Institute of Russian University of cooperation, Engels, Russia

Keywords: financial stability, assessment, factors, forecast, profitability of activities, equity, correlation and regression

analysis, methodology.

Abstract: The article presents the materials of theoretical and empirical studies of the influence of factors on such a

significant indicator of the activities of enterprises and organizations as profitability. In the theoretical part of

the work, the types of factor analysis are considered; the importance and necessity of using correlation and

regression analysis in the study of the influence of factors on the profitability of the organization's activities

are justified; the conditions and tasks of using this type of analysis are described. In the practical part of the

work, the described methodology for analyzing the influence of factors on the profitability indicator was

tested on the example of BioVitrum M LLC, which sells medical laboratory and diagnostic equipment. The

assessment of the degree of influence of factors on the change in the profitability of the analyzed enterprise

was carried out on the basis of data for 2014-2019. For the purposes of evaluation, the method of stochastic

modeling, such as correlation and regression analysis, was used. On the basis of the constructed regression

model, the forecast level of profitability of the activities of LLC "BioVitrum M" was determined, which was

formed under the influence of the growth of equity capital, and contributes to the strengthening of the financial

stability of the enterprise.

1 INTRODUCTION

In modern economic conditions, the efficiency of any

enterprise is evaluated using various indicators. In

turn, the value of the company's performance

indicators is formed under the influence of various

factors, the totality of which can be divided into

objective and subjective, external and internal factors.

The final result of the activity, which acts as a

generalizing indicator of the effectiveness of the

functioning of any organization, is the indicator of

profitability.

The study of various groups of factors and the

assessment of their impact on the change in the

performance indicators and sustainability of the

organization, the identification of existing reserves is

possible through competent management. In this

a

https://orcid.org/0000-0003-1415-8290

b

https://orcid.org/0000-0002-7464-3100

c

https://orcid.org/0000-0002-9297-8385

d

https://orcid.org/0000-0002-4361-1755

regard, the importance and necessity of using

correlation and regression analysis in the study of the

influence of factors on the profitability of an

organization is justified; the conditions and tasks of

using this analysis, and the stages of its practical

implementation are described (Tarasova, 2019;

Shokumova, 2019; Shchepkina, 2019). In the

practical part of the work, on the basis of this

methodology, the key factor of influence on the

profitability indicator of LLC "BioVitrum M" and its

financial stability is determined.

2 MATERIALS AND METHODS

Factor analysis is used to analyze profitability and the

factors that influence it (Savitskaya, 2014). This

Voronina, N., Zhulina, E., Sadchenko, N. and Yurmanova, E.

Strengthening Financial Stability based on the Factor Forecast of Profitability of the Enterprise.

DOI: 10.5220/0010698000003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 253-258

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

253

methodological toolkit allows us to identify the

degree of influence of each factor on the overall

change in the final result (Kogdenko, 2016).

The type of factor analysis – deterministic or

stochastic (Galchina, 2009) - is determined by the

nature of the relationship under study. Using this

methodological approach involves performing the

following actions: determining the factors that affect

the performance indicator, grouping these factors and

systematizing them, modeling the relationship

between the factors and the performance indicator,

assessing the degree of influence of each factor on the

result, as well as identifying the reserves for growth

of the performance result and formulating a

management decision on this basis (Ponomarenko,

2014; Voronina, 2018; Zhulina, 2020).

A specific mathematical equation obtained during

the analysis and evaluation allows us to measure the

role of a single factor in the formation of the final

estimated indicator (Voronina, 2015). At the same

time, stochastic (regression) modeling serves as a

supplement to deterministic factor analysis and is

used in cases where the factors cannot be combined

in one model, or the complexity of the factors cannot

be estimated by a single quantitative indicator. Using

correlation and regression analysis, the degree of

tightness of the relationship between the sets of

indicators is established and an analytical expression

of the stochastic dependence between the studied

features is formed (Voronina, 2015; Voronina, 2020).

The practical use of correlation and regression

analysis involves the construction of models of this

type using ready-made software packages, such as

Statistica, MathCad, MatLab, applications in Excel,

etc. (Kundakchyan, 2014).

3 RESULTS AND DISCUSSION

Testing of the described method was carried out on

the materials of LLC "BioVitrum M", which sells

medical laboratory and diagnostic equipment. To

assess the degree of influence of factors on the change

in the profitability of the activities of LLC

"BioVitrum M" for 2014-2019, such a method of

stochastic modeling as correlation and regression

analysis was used.

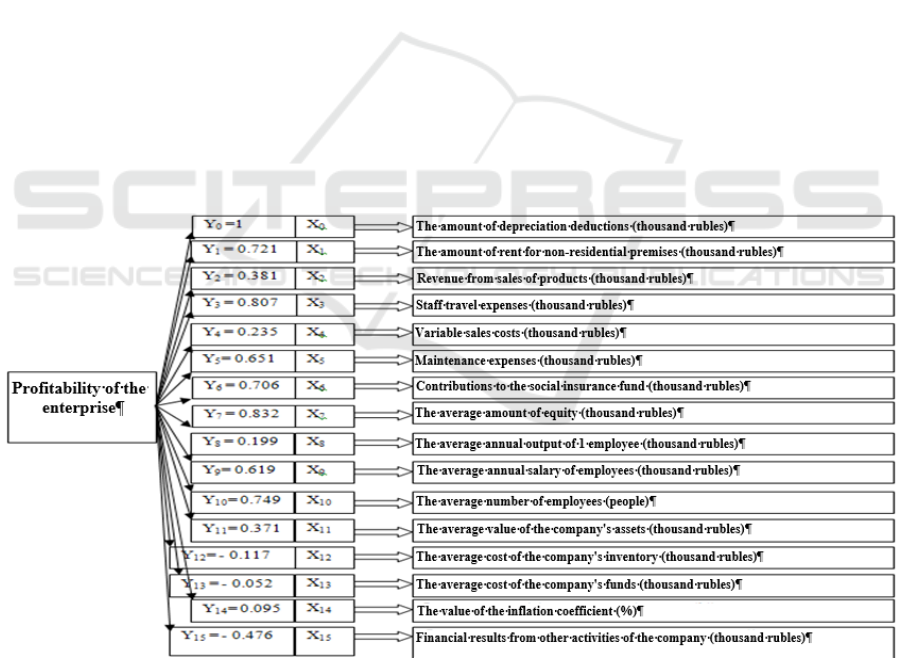

For the purpose of the assessment, a list of factors

that affect the effective indicator of the profitability

of the organization (Y) was determined, and the

coefficients of the pair correlation between the factors

were calculated (Fig. 1).

Figure 1: Values of paired correlation coefficients between factors affecting the level of profitability of the enterprise

Based on the determination of the "weight" of the

indicators and their ranking by the degree of

decreasing relationship (Table 1), only factors X

7

and

X

10

were taken into account to exclude

multicollinearity (the other factors were excluded

from the model construction).

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

254

Table 1: Calculation of the specific weight of influence factors.

Indicator

Correlation coefficient

Sum of coefficients

"Weight" of the

indicator

K

i

|K

i

|

Х

7

0.832 0.832

7.781

10.69

Х

3

0.807 0.807 10.38

Х

1

0.765 0.765 9.83

Х

10

0.749 0.749 9.63

Х

0

0.721 0.721 9.27

Х

6

0.706 0.706 9.07

Х

5

0.651 0.651 8.37

Х

9

0.619 0.619 7.96

Х

15

-0.476 0.476 6.12

Х

2

0.381 0.381 4.90

Х

11

0.371 0.371 4.78

Х

4

0.235 0.235 3.02

Х

8

0.199 0.199 2.56

Х

12

-0.117 0.117 1.51

Х

14

0.095 0.095 1.23

Х

13

-0.052 0.052 0.67

The empirical formula (mathematical model) for

the dependent variable "Profitability of the

enterprise" due to the factors X

7

and X

10

was formed

using the Excel software package. For these purposes,

the functions LINEAR (linear approximation) and

LGRFPRIBL (exponential approximation) were

used. The results of the calculations are presented in

Tables 2, 3.

Table 2: Results of calculation of linear regression indicators.

Constant 1 Constant 0

m

n

= 0.0222 m

n-1

= 8E - 05 b = 0,517

m

n

= 0.04 m

n-1

= 6E - 05 b = 0

S

en

= 0.0477 S

en-1

= 6E - 05 S

eb

= 1.32

S

en

= 0.01 S

en-1

= 4E -05

# No data

available

R

2

= 0.713 S

ey

= 0.438

# No data

available

R2 = 0.971 S

ey

= 0.3887

# No data

available

F = 3.7274 Df = 3

# No data

available

F = 67.19 Df = 4

# No data

available

Ssreg = 1.4288 Ssresid = 0.575

# No data

available

Ssreg = 20.3 Ssresid = 0.6044

# No data

available

Table 3: Results of calculation of exponential regression indicators (constant 1).

Constant 1 Constant 0

m

n

= 1.0125 m

n-1

= 1 b = 0.8175 m

n

= 1.005 m

n-1

= 1 b = 1

S

en

= 0.023 S

en-1

= 3E - 05 S

eb

= 0.6345 S

en

= 0.005 S

en-1

= 0

# No data

available

R2 = 0.7874 S

ey

= 0.2105

# No data

available R2 = 0.939 S

ey

= 0.19

# No data

available

F = 5.5539 Df = 3

# No data

available F = 30.83 Df = 4

# No data

available

Ssreg = 0.4922 Ssresid = 0.1329

# No data

available Ssreg = 2.118 Ssresid = 0.14

# No data

available

The choice of the model that allows the most

accurate description of how close the equation

approximates the actual data was carried out on the

basis of the determinism coefficient (R

2

).

For the linear type of dependence (equation of the

form y(x) = b

0

+ b

1

ꞏ x), the value of R2 was 0.713.

For the linear form of dependence (equation of the

form y(x) = b ꞏ x) the value of R2 was 0.971.

Strengthening Financial Stability based on the Factor Forecast of Profitability of the Enterprise

255

For the exponential type of dependence (equation

of the form y(x) = b

0

ꞏ b

х

1

) , the value of R2 was

0.787.

For the exponential type of dependence (equation

of the form y(x) = b

х

) , the value of R2 was 0.939.

The highest value of the determination coefficient

was obtained for a model of the form y(x) = b

1

ꞏ x

1

+

b

2

ꞏ x

2

. In this regard, the quality of the model was

evaluated according to the Student and Fisher criteria.

The evaluation was carried out by comparing the

calculated values with the data in the tables.

The calculated value of the Fischer F-test for our

model was obtained at the level of 50,389.

The critical value of this statistic corresponds to F

Table

(0.05; 2; 3) = 9.552 (table 4).

Since F

is calculated

> F

table

, the regression equation

can be considered adequate, that is, the constructed

model of the dependence of the profitability of the

enterprise on such factors as the average size of equity

and the average number of employees explains 97.1%

of the total variance of the Y attribute:

Y = 0.00006 ꞏ X

7

+ 0.04 ꞏ X

10

Y 0,00006*X

0,04*X

. (1)

Table 4: estimated performance of the model according to the Fisher F-criterion and the Student's coefficient (t-criterion).

F

Estimated

F

table

Regression equation Factor t t Significance

50.389 9.552 is adequately Х

7

3.001 2.776 significant

Х

10

2.262 2.776 insignificant

The evaluation of the model quality according to

the Student's criterion (Kuznetsova, 2019), taking

into account the level of significance (α = 0.05) and

the number of degrees of freedom (n - 2), showed the

significance of the factor X10 as not significant (t

is

observed

< t

of the criterion

) (Table 4). Therefore, the

"average headcount" factor was also excluded from

the model.

Thus, the model of the influence of factors on the

level of profitability of activities has received the

form of the equation of paired (one-factor) regression.

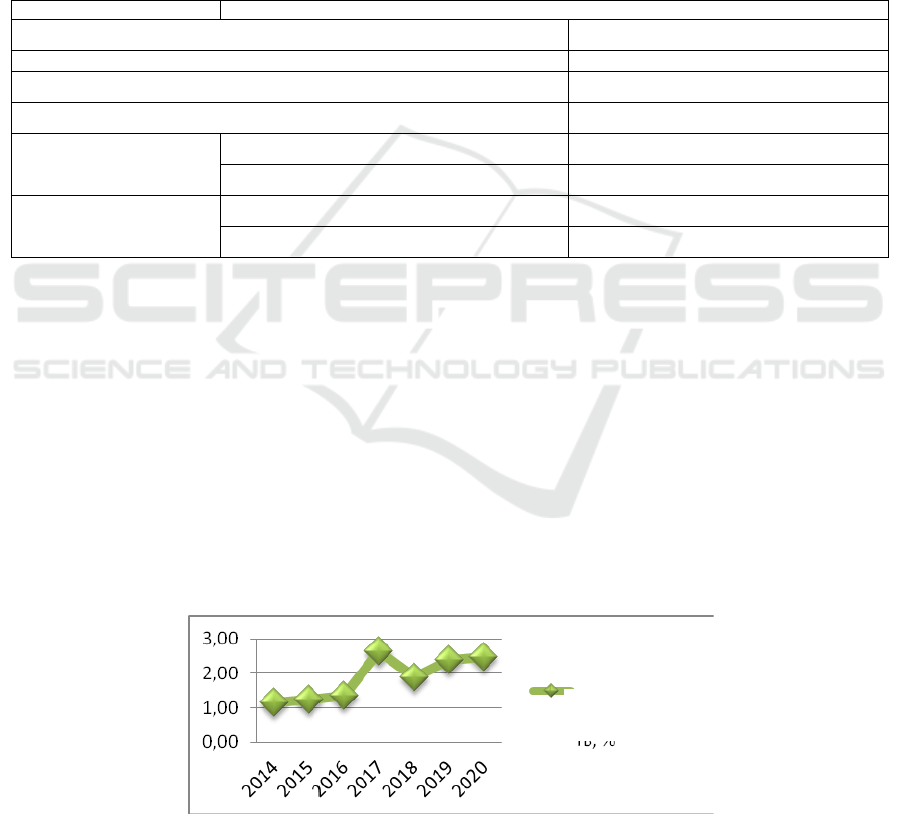

The initial data for modeling the relationship

between the level of profitability of the activities of

LLC "BioVitrum M" and the value of the average size

of the company's equity are presented in Table 5 and

in the form of a scatter plot, which shows the presence

of such a relationship (Fig. 1).

Table 5: Initial data for constructing the regression model.

Period

Profitability of activity of LLC

"BioVitrum M", %

The average equity capital

,

RUB ths

2014 1.16 578

2015 1.23 1,881

2016 1.35 3,811

2017 2.64 9,092

2018 1.87 12,155

2019 2.40 13,050

The average value of the indicato

r

1.78 6,761

Figure 1: The dependence of the profitability (y) of the activities of LLC "BioVitrum M" on the average size of equity.

Linear(Y)

Theaveragevalueofequity,thousandrubles.

Profitabilityof

operations,%

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

256

Using the MS Excel software package "Data

Analysis", the regression equation was constructed on

the basis of the obtained source data:

Y = 1.113234423 + 0.000097877 ꞏ X

7.

Y 0,00006*X

0,04*X

. (2)

The results of the correlation analysis conducted

by MS Excel allowed us to obtain the following

results (Table 6).

The multiple correlation coefficient (r =

0.83211833) characterizes a strong relationship

between the dependent and independent variables of

the constructed model.

The coefficient of determination (R

2

=

0.69242092) shows that the variation in the values of

the profitability indicator of the enterprise by 69.2%

depends on the size of the equity capital. The

influence of unaccounted factors on the profitability

of the enterprise in the resulting model is 30.8%.

The value of the standard error (in our calculation

"0.392527571") means that the deviation of the actual

value of the profitability indicator from the projected

values is no more than 0.39 percentage points.

Table 6: Results of the correlation analysis conducted by MS Excel.

Indicator Regression statistics

Multiple R 0.83211833

R-square 0.69242092

Normalized R-square 0.61552615

Standard error 0.39252757

Coefficients: Y-intersection 1.11323442

Х

7

9.7877Е – 0,5

t-statistics: Y-intersection 4.083701

Х

7

3.000798

The free term of the equation (b

0

= 1.11323442)

shows that the value of the profitability indicator in

the absence of the X7 factor will be at the level of

1.113234423%.

The regression coefficient (b

1

= 0.000097877)

shows that with an increase in the amount of equity

by 1 thousand rubles, the expected increase in the

profitability of activities will be 0.000097877

percentage points.

Checking the obtained model by the F-criterion

showed that the regression equation is considered

adequate.

Checking the significance of the model at the five

percent significance level (t

b0

= 4.0837, t

b1

= 3.0008)

showed a linear relationship between the indicators.

Further, on the basis of the constructed regression

model, the forecast of the values of the profitability

indicator of the analyzed enterprise was determined,

subject to an increase in the amount of equity by

7.36% (similar to the growth rate of the indicator in

2019). The results of the calculations are shown in

Fig. 2.

The analysis of forecast calculations shows that

with an increase in the amount of equity by 7.36%,

the forecast value of the level of profitability of the

enterprise will be 2.49% (with 2.40% in 2019).

Figure 2: Forecast of the values of the profitability indicator of LLC "BioVitrum M"

Profitability,%

Strengthening Financial Stability based on the Factor Forecast of Profitability of the Enterprise

257

4 CONCLUSIONS

To assess the degree of influence on the performance

indicator – the profitability of the activities of LLC

"BioVitrum M" of individual factors, a sample was

conducted and 15 characteristics of the activities that,

according to experts, have a significant impact were

identified. The results of the correlation and

regression analysis showed that of all the factors

listed, only one (the amount of equity) is in a

significant linear relationship with the resulting

indicator and actually affects the change in the level

of profitability of the enterprise. Thus, it was proved

that the growth of the amount of equity capital leads

to an increase in the efficiency of activities,

acceleration of the mobilization of own sources and

strengthening of the financial stability of the

enterprise.

REFERENCES

Vasilyeva, E.K., Lyalin, V.S., 2017. Statistics: textbook.

Moscow.: UNITY-DANA.

Voronina, N.A. 2015. Methodology for the study of the

impact of factors on the financial results of the

organization. Scientific review: theory and practice.

Voronina, N.A., Kuznetsova, I.V., 2018. Theory and

practice of studying the influence of factors on the

financial performance of enterprises. Saratov: Limited

Liability Company "Institute for Research and

Development of Professional Competencies".

Voronina, N.A., Kuznetsova, I.V., Zhulina, E.G., 2020.

Model of the evaluation of population living standards

dependence on the sphere of services development.

Quality - Access to Success.

Zhulina, E.G., 2020. Management of the company's

profitability reserves. IV International scientific and

practical Conference "Scientific dialogues in the era of

innovative transformations of society". Saratov:

Limited Liability Company "Institute for Research and

Development of Professional Competencies".

Kogdenko, V.G., 2016. Economic analysis. Moscow.

UNITY-DANA.

Kundakchyan, R.M., Zulfakarova, L.F., 2014. Current

issues of optimal capital structure based on forecasting

financial performance of the company. In LIFE

SCIENCE JOURNAL.

Ponomarenko, M. A., 2014. Classification of factors

affecting the financial condition of the enterprise

International Scientific Conference. "Innovative

Economy". Kazan: Buk .

Savitskaya, G.V., 2014. Methodology of complex analysis

of economic activity. Moscow. INFRA-M.

Shchepkina, N., 2019. Assessment of the economic

efficiency of the innovative development of industrial

enterprises. E3S WEB OF CONFERENCES

International Scientific Conference «Construction and

Architecture: Theory and Practice for the Innovation

Development», CATPID.

Tarasova, A.Yu., Burykin, A.D. Methodological

approaches to the analysis of the financial results of the

enterprise. In Economics and Management: problems,

solutions.

Shokumova, R.E., 2019. Analysis of factors affecting the

financial performance of the enterprise. In Economy

and entrepreneurship.

Kuznetsova, O.A., Mazurmovich, O.N., 2019.

Econometrics. Samara: Samara University Publishing

House.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

258