Analysis and Risk Assessment of the Investment Project of the

Organization

Angelina Alexandrovna Klimakova

Financial University under the Government of the Russian Federation, Leningradsky ave, 49, Moscow, Russian Federation

Keywords: Investment project, risk assessment methods, scenario method, analysis of sensitivity, PJSC «NLMK»

Abstract: The article substantiates the need for a full-fledged assessment of the effectiveness of the investment project,

consisting not only of the analysis of standard indicators of project efficiency (NPV, DPP, IRR), but also the

analysis of the risks of projects. In addition, the analysis and risk assessment of the investment project of the

organization, the ways to improve the effectiveness of risk assessment methods of the investment project are

proposed. The purpose of this work is to analyze and assess the risks of the investment project of the

organization. To conduct the study the following methods were used: classification, analysis, comparison,

modeling and forecasting. The work performed showed that the use of only one method for risk assessment

is considered ineffective, since only different combinations of methods for analyzing the risks of an

investment project can give a complete picture of the weaknesses and strengths of the project, as well as assess

its effectiveness in case of changes in any external conditions.

1 INTRODUCTION

As we know, making investment decisions is

inseparably connected with uncertainty and risks.

This means that in evaluation of any investment

project we must evaluate not only its efficiency with

standard indicators NPV (net present value), IRR

(internal rate of return) and DPP (discounted payback

period), but also pay attention to risk evaluation tools

of this project.

The importance and relevance of this topic is that

full-fledged assessment of investment project

efficiency is possible only in case of analysis of not

only standard indicators (NPV, DPP, IRR), but also

the analysis of project risks. This applies to all

companies, regardless of the area in which they

operate.

This work is devoted to the analysis and risk

assessment of the investment project of the

organization, the study of indicators that characterize

the effectiveness of the investment project.

Conclusions made in the work, which reflect the

recommendations on the choice of methods for

assessing the risks of investment project in the

company, can find practical application in the

analysis of investment projects in various

organizations.

The object of the study is an investment project of

Novolipetsk Steel Company (NLMK).

The subject of the research is methods of

investment risk assessment.

The purpose of this work is to analyse and assess

the risks of an organization's investment project.

Achievement of the specified goal determined the

statement and solution of the following tasks:

1. definition of the concept of investment

project;

2. description of classification of risks of an

investment project and methods of their estimation;

3. analysis of investment project by the example

of Novolipetsk Steel Company (NLMK);

4. characteristics of risk assessment methods for

NLMK's investment project;

5. evaluation of the effectiveness of risk

assessment methods of the investment project at

NLMK.

The following methods were used for the study:

classification, analysis, comparison, modeling and

forecasting.

The analysis of works on the problem under study

showed that at present the main methods of risk

assessment of organizations are formed. But, at the

same time, only a small part of enterprises is engaged

in the analysis and risk management of the investment

project. As a rule, companies assess the effectiveness

Klimakova, A.

Analysis and Risk Assessment of the Investment Project of the Organization.

DOI: 10.5220/0010697200003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 223-227

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

223

of the project in traditional ways, using a discounted

approach, and do not consider the risks that may be

inherent in it.

Theoretical and methodological basis and

information base of the study are the works of

domestic and foreign researchers. As an information

base the materials of the Novolipetsk Steel Company,

available in the public domain, are used.

The issues of studying the risks of an investment

project and the choice of methods for risk analysis are

presented in the works of foreign and domestic

scientists. The basics of the concept of probability and

risk were developed in their works by such scientists

as F. Knight, K. Gauss and D. Neumann. In the future,

the study of various types of risks and methods of

their assessment was carried out by many specialists,

including L. Haight, F. Hayek, J. Conan, M. Golder,

L.V. Dontsova, N.A. Nikiforova and O.P. Zaitseva.

2 MATERIALS AND METHODS

2.1 The Concept of an Investment

Project

According to the Federal Law dated February 25,

1999 N 39-FL "On investment activities in the

Russian Federation, carried out in the form of capital

investments" an investment project is a substantiation

of economic feasibility, volume and terms of capital

investments, including necessary project

documentation, elaborated in accordance with the RF

legislation, as well as description of practical steps to

make investments.

Each investment project has its own life cycle,

which consists of 5 stages: initiation, planning,

implementation, monitoring (control), closing of the

project.

At the same time, at each stage of the investment

project it has different risks, which should be

identified in advance and find effective methods of

managing them, because the consideration of any

investment project and its implementation is

impossible without taking into account the changes

occurring in the economy (Naidenova, 2020).

At the moment, many investment projects,

especially in the sphere of small and medium

business, as indicators of their future effectiveness

assess only the classic indicators of profitability, the

amount of future cash flows and payback period of

the project, without paying attention to its risks. But

it is the realization of any of the risks may lead to a

project becoming unprofitable. That is why when

assessing an investment project, it is necessary to pay

special attention to its possible risks (Stefan, 2018).

2.2 Classification of Investment Risks

A unified classification of investment project risks

has not been worked out yet. Risks of an investment

project can be classified according to various

parameters, for example, according to the stages of

the life cycle of the project, according to the criterion

of acceptable risk limit and the possibility of

insurance, based on the sphere and form of

manifestation, as well as the source of occurrence

(Shevchenko, Razvadovskaya, Kaplyuk, Rudneva,

2020).

2.3 Methods of Risk Assessment of an

Investment Project

In order to manage the risks of an investment project,

it is necessary to assess them. The updated

international standard on risk assessment methods

IEC 31010:2019, which is a supplement to the ISO

31000:2018 standard, presents and describes 41 risk

assessment methods, which are grouped into 10

groups related to elements of the risk management

process (Suyasa, 2019). Qualitative and quantitative

methods are used to assess the risks of an investment

project.

Qualitative analysis is a method of prioritizing the

risks of the project for further analysis or action by

assessing their probability and impact on the project,

in case of implementation.

The purpose of qualitative analysis is to determine

the severity of risk by predicting the probability and

impact of risk. Typically, this procedure is performed

for all identified risks within a project, and for all

types of projects. Risks are usually presented in a risk

assessment matrix, which is then used to report the

existing most significant risks to the relevant

stakeholders.

While qualitative risk analysis should generally

be performed for all risks, quantitative risk analysis

has a more limited application depending on the type

of project, the risks of the project, and the availability

of data to use for quantitative analysis. This is why

quantitative analysis is usually done only for the most

significant risks identified by the qualitative method.

The most popular quantitative methods are sensitivity

analysis, scenario method and modeling (Gileva,

2017).

It is worth noting that, as a rule, when making a

decision to implement an investment project,

investors use a combination of different methods to

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

224

more thoroughly assess the various indicators and

risks of the project. For example, to determine the

effectiveness of an investment project, as a rule, a

number of indicators is used, which can be divided

into statistical and dynamic. Statistical indicators

include the following: return on investment (ROI),

payback period (PP), investment efficiency ratio

(ARR). In turn, dynamic methods of assessment

include such indicators as: net present value (NPV),

internal rate of return (IRR), discounted investment

payback period (DPP) and modified internal rate of

return (MIRR) (Suslov, 2021).

Next, let's consider the analysis and risk

assessment of the investment project on the example

of Novolipetsk Steel Company (NLMK).

3 RESULTS AND DISCUSSION

3.1 Analysis of an Investment Project

at Novolipetsk Steel Company

(NLMK)

Novolipetsk Steel Company is the leading production

site of the international NLMK Group. NLMK uses

qualitative and quantitative methods to assess risks.

In particular, the company uses in its practice the

method of expert evaluations, as well as the method

of scenarios, the application of which is possible in

the absence of statistical data for risk assessment.

Next, let us consider an example of an investment

project for NLMK and assess its risks.

The purpose of the project is to build a plant for

the production of steel structures and hot-dip

galvanized metal with polymer coating (Sukharev,

2018).

The construction of the plant is planned to be

carried out in the vicinity of the Lipetsk site of NLMK

Group. To implement the project requires borrowed

funds in the amount of 5 500 thousand dollars U.S.

(bank loan for 7 years at 11%), working capital of

2,000 thousand dollars U.S., equipment costs of 3,300

thousand dollars U.S., labor costs of 870 thousand

dollars U.S. and other costs of 2,300 thousand dollars

U.S. It is assumed that the price of 1 ton of produced

goods will be 850 dollars U.S. and the cost of 1 ton

will be equal to 380 dollars U.S. (Eriksson, 2021).

The production line is designed for a volume of up to

4000 tons per year. The final cumulative cash flow is

positive (6,378 thousand dollars U.S.), which

indicates that this investment project is financially

sound. That is, all project costs, including repayment

of the loan and payment of interest on it, are fully

financed by the cash flows from the project

implementation.

According to the calculations, the discounted

payback period of DPP project is just over 4 years,

the internal rate of return IRR is 23.67%, and the NPV

of the project is 2,463 thousand dollars U.S. This

indicates the effectiveness of the project.

When implementing the project, the following

risks may arise:

the risk of delay in the preparation of project

documentation and displacement of the start date of

the project;

the risk of an accident in production;

the risk of reduction of prices for the products

manufactured;

the risk of increase of the cost of the products;

the risk of increase of the interest rate on the

credit and change of credit conditions;

the risk of breakage of equipment and temporary

suspension of production;

the risk of underproduction of the planned

volume of production;

the risk of change in tax legislation;

the risk of underfunding of the project due to

losses caused by fraud and corruption;

the risk of leakage of commercially sensitive

information (production technology).

3.2 Characteristics of NLMK

Investment Project Risk

Assessment Methods

Let us analyse the risks of lower prices for the output

products, increased production costs and

underproduction of the planned volume of products

with the help of the scenario method used in the

company.

Consider 3 scenarios: pessimistic, optimistic and

realistic (most likely).

Each of these scenarios is characterized by a small

deviation of the considered indicators of volume,

price and cost. In the case of the pessimistic scenario,

the price and sales volume decrease by 5%, and the

cost increases by 5%. In the case of the optimistic

scenario, the indicators are reversed - price and sales

volume increase by 5%, while cost of sales decreases

by 5%. In the case of the realistic scenario, all

indicators remain basic.

The method of scenarios has shown that the

occurrence of the pessimistic scenario is not critical

for the investment project, because in this case, the

NPV of the project remains positive and the project is

financially solvent. This means that in the case of this

Analysis and Risk Assessment of the Investment Project of the Organization

225

scenario, to carry out this investment project is still

appropriate. In this case, the internal rate of return

(IRR) is 18.54%, and the payback period of the

project is almost 4 years.

The realistic scenario also allows the project to

pay off, moreover, its internal rate of return becomes

23.67%, which is more than 2 times higher than the

discount rate and indicates a large safety margin and,

consequently, a low risk of the project. The payback

period of the project is just over 4 years.

In case of the optimistic scenario when

implementing the investment project, NPV will also

be positive, the internal rate of return will be 28.73%,

and the discounted payback period will be 3.5 years.

Given the probabilities of occurrence of different

scenarios, the expected NPV will be 2,531 thousand

dollars U.S. This is a good indicator for the project.

Despite the fact that Novolipetsk Steel also uses

the method of expert evaluations for risk analysis, the

company does not have a wide range of risk

assessment methods, which is quite a serious

disadvantage for it.

Thus, the scenario method used at NLMK for risk

assessment allows us to assess the feasibility of the

investment project in case any of the scenarios occurs.

However, it does not make it possible to determine

which of the factors has the greatest impact on the

change in NPV, so it is not very effective.

3.3 Evaluating the Effectiveness of Risk

Assessment Methods for an

Investment Project at NLMK

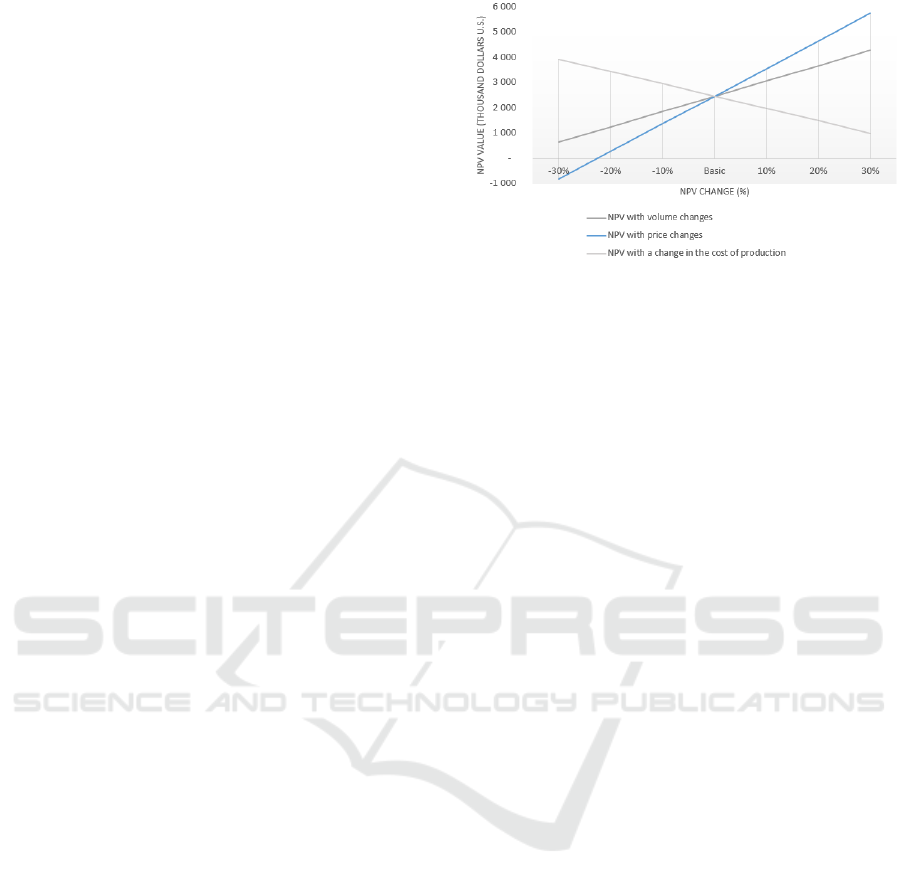

For quality increase of investment project risk

analysis, you can use sensitivity analysis. For

example, conducting a sensitivity analysis on the

project under consideration showed that the

considered risks are not critical for the project,

because even in the case of reducing the volume or

cost indicators by 30% NPV of the project remains

positive, which indicates its financial solvency even

in difficult times. However, a 30% reduction in price

leads to a negative NPV and negatively affects the

implementation of the investment project (see Figure

1).

Figure 1: Sensitivity analysis of NLMK's investment

project.

This pattern was revealed by conducting a

sensitivity analysis. Having only the method of

scenarios for risk assessment did not make it possible

to understand to what extent certain indicators can

deviate, while leaving the project financially sound.

4 CONCLUSIONS

Thus, we can conclude that indeed only different

combinations of risk analysis methods of an

investment project can give a complete picture of the

weaknesses and strengths of the project, as well as

assess its effectiveness in case of changes in any

external conditions (Golov, 2020).

On this basis, it is worth noting that Novolipetsk

Steel, being one of the largest metallurgical

companies, should pay special attention not only to

the management system of the organization as a

whole, but also to risk assessment in individual

investment projects. Since it is successful

implementation of investment projects that will

contribute to improving the company's efficiency and

increasing its competitive advantages. In case of an

inaccurate assessment of an investment project,

NLMK faces the risk of incurring losses under the

project and its non-payback, as well as losing part of

its competitive advantages due to the slowdown of its

own development as compared to competitors.

REFERENCES

Eriksson, M., 2021. World iron ore market review 2019-

2020. In Notes of the mining institute. 1.

Gileva, T. A., 2017. Monitoring of Investment Project

Implementation: Concept and Tools. In Upravlenets –

The Manager. 3(67).

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

226

Golov, R. S., Smirnov, V. G., Teplyshev, V. Y., Papelnyuk,

O.V., 2020. Modern methods of risk management at

industrial enterprises. In Technology of textile indust

ry. 1(385).

Naidenova, Y. N., 2020. The impact of economic policy

uncertainty on the investment of Russian companies. In

Economic issues. 2.

Shevchenko, I. K., Razvadovskaya, Y.V., Kaplyuk, E.V.,

Rudneva, K. S., 2020. Development of indicators for

assessing the dynamic capabilities of industrial

enterprises. In Terra Economicus. 18 (1).

Stefan, M. A., 2018. Estimation of efficiency and risks of

investment projects: an integral approach. In Business

Informatics. 4(46).

Sukharev, O. S., 2018. Factors of economic growth: an

empirical analysis of industrialization and investment

in technological renewal. In Economic issues. 6.

Suslov, V. I., 2021. Pricing aspects of the evaluation of

investment projects. In Regional Economy. 17(1).

Suyasa, G. W. A., Legowo, N., 2019. The implementation

of system enterprise risk management using framework

ISO 31000. In J. of Theoretical and Applied

Information Technology. 97(10).

Analysis and Risk Assessment of the Investment Project of the Organization

227