Managing Production Risks of Gas Industry Infrastructure

Organizations under Resource Constraints

Yulia Andreevna Mitina

1

1

St. Petersburg State University of Economics, Sadovaya 21, St Petersburg, Russia

Keywords: Gas industry production infrastructure, risk management system, risk identification, risk management cycle.

Abstract: The economic problem characteristic of the production infrastructure of the gas industry is the need to improve

the efficiency of the system of centralized allocation of financial resources for the operation, restoration and

replacement of production fixed assets (OS), the operation of which is associated with high production risks,

in the context of a shortage of financial resources associated with increased costs due to wear - on the one

hand, and the dependence of the holding's income on the geopolitical situation, regulated tariffs and other

factors, on the other. The creation of the necessary tools for solving this problem will increase the efficiency

of the functioning of both gas companies with state participation and the entire economic system of the country.

The article identifies the main features of the gas industry infrastructure organizations, formulates the features

of the formation of the gas industry infrastructure system, and suggests an approach to the formation of this

system in the gas industry infrastructure organizations.

1 INTRODUCTION

In the Russian Federation, production infrastructure

is represented mainly by natural monopolies of the

federal (for example, trunk electric networks (PJSC

FSK UES), gas transmission system (PJSC Gazprom)

and the regional level (for example, State Unitary

Enterprise Vodokanal of St. Petersburg, JSC

Mosvodokanal). Natural monopolies of federal level

are a component of the fuel and energy complex

(FEC) including also objects of the oil, coal, slate and

peat industry and heat supply. At the same time, the

gas industry or gas supply system is an activity to

provide gas to consumers, including activities to form

a fund for explored gas fields, production,

transportation, storage and supply of gas.

The vast majority of the gas industry is

concentrated in Gazprom (Gazprom Group), a

vertically integrated holding company representing a

global energy company, whose main areas of activity

are exploration, production, transportation, storage,

processing and sale of gas and gas condensate, sale of

gas as motor fuel, as well as the production and sale

of heat and electricity. As of the end of 2019, PJSC

Gazprom controlled 71% of gas reserves and

produced 69% of all Russian gas production. The next

Gazprom PJSC in terms of gas production and sale in

the domestic market are independent companies -

PJSC NOVATEK, PJSC NK Rosneft (a company

with state participation) and PJSC LUKOIL.

Gazprom has the world's largest gas transmission

system, the bulk of which is part of the Unified Gas

Supply System (ESG) of Russia. The ESG is a unique

technological complex that includes facilities for the

production, processing, transportation, storage and

distribution of gas in the European part of Russia and

Western Siberia, providing a continuous cycle of gas

supply from the well to the final consumer.

The production infrastructure of the gas industry

in PJSC Gazprom is represented by: 1) a gas

transportation system; 2) a gas distribution system of

organizations of various organizational and legal

forms, inextricably connected with the production,

processing and land storage of gas and gas

condensate. The gas transmission system is

concentrated mainly on the balance sheet of PJSC

Gazprom and transferred to its 100% subsidiaries

(Gazprom Transgaz St. Petersburg LLC, Gazprom

Transgaz Ugorsk LLC, etc., a total of 17 operating

organizations). The gas distribution system is

operated by a subholding - Gazprom Mezhregiongaz

Group, which includes the parent company Gazprom

Mezhregiongaz LLC, and 53 regional gas companies

selling gas, as well as 167 gas distribution

organizations supplying gas to consumers.

Mitina, Y.

Managing Production Risks of Gas Industry Infrastructure Organizations under Resource Constraints.

DOI: 10.5220/0010696900003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 211-214

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

211

The author, as a result of the analysis and

synthesis of existing definitions of the concepts of

"utilities" "gas industry," the features of the domestic

gas supply system, formulated the following

definition: "gas industry production infrastructure is a

property complex that provides the main production

processes of the gas industry through the transfer of

gas through networks and product pipelines as part of

a single technological process." For the purposes of

the study, a definition of "infrastructure organization"

has been formulated. "Infrastructure organization - a

gas industry production infrastructure enterprise

operating a property complex designed to transport

gas through gas pipelines and/or distribution

networks."

Given the complexity and multidimensional

nature of the concept introduced, reflecting the

development processes of the exploited property

complex in conditions of instability of socio-

economic processes, the problem of increasing the

efficiency of the oil and gas industry, which is

currently the basis for the formation of the profitable

part of the Russian budget, is quite large in setting and

requires a solution both strategically and

operationally tactically.

2 STUDY METHODOLOGY AND

CONTENT

Traditionally, the main focus is on exploration,

production and directly transportation of

hydrocarbons (gas and oil). At the same time, in our

opinion, not enough attention is paid to the problems

of production infrastructure. Currently, under the

influence of scientific and technological progress and

depletion of relatively easily accessible fields, the

technological structure of the industry is becoming

more complicated, investments in the production

infrastructure of the industry are significantly

increasing, and the task of operational management of

the production infrastructure is becoming more

complicated. Risk management of production

infrastructure is an important problem of practical

management, the importance of which is growing in

such capital-intensive industries and technological

intensive industries as the gas industry, which is even

more complicated due to the fact that the latter is an

industry that requires increased safety due to the

possible negative impact on the environment and

public health.

Risk management of production infrastructure is

a management procedure that allows to increase

stability and ensure efficiency of gas industry

enterprises in conditions of objective increase of risk

exposure. At the same time, there is a gap in the

methodological provision of risk management of the

production infrastructure in the gas industry of

Russia, in the context of the above trends.

The classification of production risks as

significant for infrastructure organizations is due to

the fact that these organizations are capital-intensive,

and their main production processes focus on the

operation of production OS in order to ensure

uninterrupted gas or electricity supply, unlike other

organizations of the gas industry, for example, selling

gas for export or to domestic consumers for whom

market, political or government regulatory risks are

recognized as the main. As a result, infrastructure

organizations have a high share of operating system

maintenance and recovery costs.

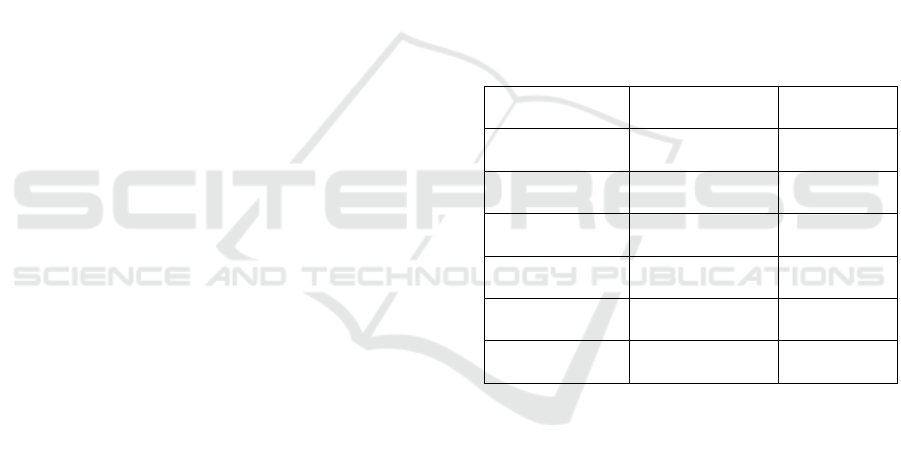

Table 1: Distribution of the length of gas main pipelines of

Gazprom Group gas transmission companies in Russia by

service life as of 31.12.2019

Life Length, thousand

km

Share, %

Up to 10 years

(inclusive)

17,3 10

From 11 to 20

y

ears

(

inclusive

)

16,2 9,5

From 21 to 30

years (inclusive)

40,9 23,8

From 31 to 40

years (inclusive)

55,2 32

From 41 to 50

y

ears

(

inclusive

)

24,8 14,4

More then 50

y

ears

17,7 10,3

Source: compiled on the basis of: Official website of PJSC

Gazprom - URL: www.gazprom.ru (circulation date:

10.02.2020).

Table 1 shows that at the end of 2019, almost 57%

of the main gas pipelines operated by PJSC Gazprom

in Russia are more than 31 years old. According to

Rosstat data, the average depreciation rate of fixed

assets of the production infrastructure is 56%. All this

leads to an increase in production risks, since the

impact of failures and accidents at production

facilities can not be underestimated. The number of

failures of PJSC Gazprom's gas transmission system

facilities in the last decade ranges from 2 to 5 cases

per 1000 km [Source: PJSC Gazprom's official

website - URL: www.gazprom.ru (circulation date:

10.02.2020)].

The listed internal and external factors, which

entail a shortage of financial resources in enterprises,

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

212

imply the introduction of risk management tools in

the system of management of industrial assets of

infrastructure organizations in order to take into

account the risk factor when making decisions

regarding limits of costs for maintenance and

restoration of fixed assets.

Thus, the peculiarity of forming the risk

management system of the production infrastructure

of the gas industry is to develop and integrate the

production risk management model into the fixed

asset management system while centrally limiting the

cost of servicing and restoring fixed assets by

prioritizing the entire demand for costs.

In the course of the study, the author developed

the main stages of the formation of the production risk

management system (PRMS), which is a subsystem

of the higher level system into which it is integrated.

The starting point of the said system formation is

determined depending on whether a high-level risk

management system exists in the organization at the

time of the decision to create it, since the PRMS is a

subsystem and is formed by developing the already

existing risk management system, focused mainly on

financial, market and other risks.

At the first stage, after the decision on the

implementation of the PRMS, it is determined

responsible for developing and maintaining a risk

management system structural division. This unit

shall identify the production risks, as well as their

detailed description and classification. Identified

production risks are analyzed and ranked. At the same

time, since at the initial stage of formation.

As a rule, the PRMS does not have the necessary

consolidated statistical information on failures,

accidents, etc., the level of risks is determined using

qualitative methods through expert assessments.

At the second stage (generation of PRMS),

existing ones are developed or specified:

- regulatory documents of the organization on the

procedure of industrial risk management, including a

detailed description of the stages and their dates,

- responsible departments/employees, as well as

all incoming and regulatory documents containing

methodological approaches to the management of

production risks, including a description of the main

types of production risks, methods of their assessment

and means of control.

After the implementation of organizational

measures to create a structural subdivision,

identification and initial assessment of production

risks, as well as the development/addition of

regulatory and methodological documents for the

successful implementation of PRMS, it is necessary

to test the system by implementing at least one cycle

of industrial risk management (selection of control

tools, information and communication, monitoring)

and integrating this system into the processes of

approval of management decisions.

Integration of PRMS and fixed assets

management system involves the use of risk

information in the current activities of structural

divisions implementing the task of managing the

fixed assets, i.e. the use of risk reporting (risk register,

risk matrix, etc.) when making decisions on allocation

of financial resources for maintenance and recovery

of the fixed assets, taking into account the risk factor.

At the stage of implementation of PRMS in the

organizations of the gas industry infrastructure,

qualitative and combined methods of risk assessment

are most applicable both in terms of probability and

consequences, and in terms of calculating the level of

risk and comparative analysis due to the lack of expert

competencies, the lack of special software products,

as well as the lack of a database, aggregated and

systematized in the required analytical sections.

Based on the results of one or more management

cycles and the organization of statistical data

collection, quantitative methods based on

retrospective data are recommended to assess the

probability and consequences of production risk in

order to reduce the influence of subjective factors on

the calculation result.

Most domestic industrial enterprises are at the

stage of forming the system, without using the

obtained formalized information on risks when

making management decisions within the framework

of functional production units. These findings,

according to the author, confirm the significance of

the integration of PRMS into the existing

management systems of infrastructure organizations.

The efficiency of implementing the production risk

management model consists in improving the quality

of decisions made in the face of a shortage of financial

resources, and thus is organizational in nature, as it is

a tool to support informed decision-making when

allocating cost limits for repair and replacement

work.

3 CONCLUSIONS

Modern organizations of the production

infrastructure of the gas industry are characterized by

a high level of moral and physical depreciation of

fixed assets, as well as a lack of financial resources

with a centralized allocation of limits for the

maintenance and restoration of these funds.

Accordingly, there is a need to improve approaches to

Managing Production Risks of Gas Industry Infrastructure Organizations under Resource Constraints

213

managing the production risks of the infrastructure in

order to prevent supply interruptions to end users of

the gas industry as a result of the realization of risks

associated with the fixed assets.

As a result of the study, the main features of the

organizations of the gas industry infrastructure were

identified, the features of the formation of PRMS

were formulated and an approach to the formation of

this system in the organizations of the gas industry

infrastructure was proposed.

Based on the analysis of the methods of

identification, assessment and management of

production risks, a corresponding classification was

developed taking into account the peculiarities of the

functioning of infrastructure organizations and a

model for managing production risks in organizations

was developed gas industry infrastructure, including

an algorithm for centralized allocation of financing

for fixed assets repairs and restoration by prioritizing

the entire demand for fixed assets costs based on the

index of the fixed assets facility production risk.

REFERENCES

Mitina Yu. A., 2015. Analysis of the experience of Russian

enterprises in the formation of a risk management

system in infrastructure companies. In collective

scientific monograph "Modern Entrepreneurship in an

Innovative Economy: Theory and Practice ". PERO

PUBLISHING HOUSE. MOSCOW.

Bezdejnih V. M., 2020. Why is it important to create a state

risk management system and formulate a risk

management policy. In the collection: Poly transport

systems. Materials of the XI International Scientific and

Technical Conference. NOVOSIBIRSK.

Mitina Yu. A., 2015. Risk Management System in Foreign

and Russian Business Management Practices. In the

collection: Materials of the III International Scientific

Congress "Entrepreneurship and Business in

Conditions of Economic Instability" (June 24-25,

2015). FINANCIAL UNIVERSITY UNDER THE

GOVERNMENT OF THE RUSSIAN FEDERATION,

DEPARTMENT OF ORGANIZATION

ECONOMICS. PUBLISHING HOUSE "SCIENTIFIC

CONSULTANT." MOSCOW.

Avdiysky V. I., Deuteronomy V. M., Liechtenstein V. E.,

Ross G. V., Solodovnikova K. I., 2015. Financial and

economic security of economic agents. In Bulletin of

the Financial University. MOSCOW.

Chaldaeva L. A., Masyukova, 2016. Financial and

economic resources of modern entrepreneurship:

foreign experience and Russian practice. In

monograph. CHU VO "MGTA," MOSCOW.

Kostina Yu. A., 2010. Features of the formation of a risk

management system in infrastructure companies. In

Finance and credit. MOSCOW.

Avdiysky V. I., Deuteronomy V. M., 2018. On the

Formation of Principles for the Organization of a

Federal Integrative Risk Management System

(FIRMS). In the collection: The Concept of a Federal

Risk Management System in the Field of Economic

Security. Collection of materials of the All-Russian

symposium "Problems of strategic management."

MOSCOW.

Bezdejnih V. M., Dadalko V. A., 2009. Economic security,

financial stability and stability as the quality of

efficiency of the economic entity. In Economic

sciences. MOSCOW.

Bezdejnih V. M., Sinyavsky N. G., 2018. On high-level

socio-economic systems as objects for ensuring

economic security. In Economics and management:

problems, solutions. MOSCOW.

Bezdenezhnykh V., Bezdenezhnykh A., Karanina E., 2020.

Synergy of interaction of control and supervisory

structures in ensuring the stability of the socio-

economic system: principles and organization. In the

collection: E3S Web of Conferences. "International

Scientific and Practical Conference "Environmental

Risks and Safety in Mechanical Engineering".

MOSCOW.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

214