The State of the Residential Real Estate Market of the Russian

Federation: Problems and Prospects of Development

Galina Pivovarova, Tatiana Tretyachenko and Svetlana Sogomonyan

Department of Commerce and Logistics, Rostov State University of Economics (RINH), Rostov-on-Don, Russia

Keywords: Escrow accounts, primary market, mortgage lending, sales volumes, project financing.

Abstract: Indicators that characterize the current state and dynamics of the development of the residential real estate

market are not considered by a number of subjects of the Russian Federation when developing regional

development programs as factors that not only determine the level of business activity and social stability of

the territory, but also carry systemic risks for the stability of the regional system. The article analyzes the state

and development of the residential real estate market of the Russian Federation in the pre-pandemic period,

when the transition to project financing using escrow accounts was carried out, and the conditions of the crisis

of 2020. The article reveals the possibilities of using the results of the analysis of the indicators of the

residential real estate market, based on the established relationship between the indicators of project financing,

price, mortgage rates and sales volumes of primary market objects, to regulate the level of social stability and

business activity in the region, to minimize the risks caused by the uncertainty of the external environmen.

1 INTRODUCTION

Be advised that papers in a technically unsuitable

form will be returned for retyping. After returned the

manuscript must be appropriately modified. Based on

the opinion of Atif Mian, professor of Economics,

public policy and Finance at Princeton University,

and a number of other foreign and domestic scientists

(Mian, Sufi, 2009., Barrell, Davis, Karim, Liadze,

2010., Kotlyarov, 2015), the residential real estate

market should be considered as a complex and very

significant element of the economic system. The

degree of development of the residential real estate

market is an indicator of the level of business activity

in the country and its regions, the social attractiveness

of a particular territory, as well as the trends emerging

in the development of the economy, which is

especially relevant for Russia, since"it is the real

estate market that creates the material basis for the

functioning of the labor, capital, goods and services

markets" (Tretyachenko, Pivovarova, 2020). Objects

of the residential real estate market are immediately

erected where only the birth of social or economic

activity becomes barely noticeable. The importance

of the residential real estate market, which acts as an

effective indicator of the state of the economic system

of the region, an additional assessment of the level of

development of the subject of the Federation and its

stability, requires a study of the state and dynamics of

its development not only on a permanent basis, but

also from the standpoint of the system paradigm. The

COVID-19 pandemic has had a negative impact on

the implementation of infrastructure projects in many

consumer-oriented industries. For the residential real

estate sector, 2020 was not only difficult, but also far

from unambiguous. Unlike other industry markets,

the Russian residential real estate market was

influenced not only by restrictive measures caused by

the new coronavirus infection, but also by new

requirements for organizing financial relations with

buyers of construction-in-progress objects. These

circumstances determine the necessity and relevance

of this study.

The article reveals the opportunities that are laid

down in the norms of Federal Law No. 214, which

determine the transition of the construction industry

to project financing using escrow accounts; their

impact on the indicators of the residential real estate

market in the pre-pandemic period and in the context

of the crisis associated with the spread of the new

coronavirus infection COVID-19, taking into account

the state support measures provided in this regard. It

contains proposals for the introduction of regulatory

instruments based on the indicators of the

development of the residential real estate market in

144

Pivovarova, G., Tretyachenko, T. and Sogomonyan, S.

The State of the Residential Real Estate Market of the Russian Federation: Problems and Prospects of Development.

DOI: 10.5220/0010695200003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 144-148

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

the activities of the subjects of the Russian

Federation.

2 MATERIALS AND METHODS

Issues of the real estate market have become the

subject of attention of many Russian scientists, a

systematic approach to its development was

considered in the works of A. N. Asaul, V. A.

Goremykin, V. V. Grigoriev, A. I. Ostrin, A.V.

Rudnev, V. I. Buzyrev, (Asaul, 2017, Buzyrev, 2016,

Goremykin, 2018, Grigoriev, 2001). N. Ya.

Kovalenko (Kovalenko, 2018.), A. M. Platonova

(Platonov, 2004.) .

In his work "Analysis of the real estate market for

professionals", the chief analyst of the Russian Guild

of Realtors, G. M. Sternik, defines the real estate

market as "a sector of the national economy that

combines the elements of "subjects", "objects",

"processes" and "functions" of their management"

into a complex socio-economic system " (Sternik,

2009).

In the textbook "Analysis and evaluation of

income-generating real estate", the authors D.

Friedman and N. Ordway define the real estate market

as "an interconnected system of market mechanisms

that ensure the creation, transfer, operation and

financing of real estate objects" (Friedman, Ordway ,

1997).

The opinion of scientists about the real estate

market only confirms the authors ' idea of the need to

apply a systematic approach to the analysis of the

residential real estate market, considering the state

and level of its development in relation to internal and

external factors that have both direct and indirect

influence on it. This approach will allow us to more

accurately assess the opportunities that are inherent in

the real estate market indicators for analyzing and

forecasting the economic development of the subject

and minimizing the risks associated with social

stability and business activity in the region.

3 RESULTS AND DISCUSSION

For the mutual benefit and protection of Authors and

Publishers, it is necessary that Authors provide

formal written Consent to Publish and Transfer of

Copyright before publication of the Book. In this

study, the authors focus on two factors that have a

significant impact on the state of the residential real

estate market and sales volumes in its primary

segment: the introduced project financing is the first

factor, and the level of mortgage rates is the second

factor, distinguishing them from the system of

indicators as significant in the conditions of 2020.

The misuse of equity holders 'funds in the

construction of residential real estate has led to the

appearance of"defrauded equity holders". The

intensity of the issue of "deceived shareholders",

which is of a social nature, reached a peak by 2019,

and the mechanism for protecting participants in

shared-equity construction was fixed by amendments

to the law on participation in shared-equity

construction of apartment buildings and other real

estate objects in July of the same year. According to

the new interpretation of the 214-FZ, the developer

can conduct its activities using the bank's credit funds,

and access to the money of shareholders accumulated

in escrow accounts will appear after the developer

fulfills its obligations to the shareholders, i.e. puts the

object into operation. The introduction of project

financing and escrow accounts caused a lot of

discussion in the professional community, the central

issues of which were the possible increase in the costs

of developers under the new rules and the associated

decline in sales. According to the parties, the use of

credit funds should definitely lead to an increase in

the cost of construction projects and an increase in the

offer price, which, in turn, will affect the volume of

sales and cause changes in the state of the residential

real estate market, up to its stagnation. The experts '

conclusions were partially confirmed in the behavior

of the residential real estate market: the observed

changes in prices for residential real estate on the

primary market during 2020 differed from the price

dynamics during 2019. At the end of 2019, the price

growth of 1 m2 in the primary housing market was

5.52%, and in 2020-already 10.48%. However, the

market has not stagnated, but continues to develop

dynamically.

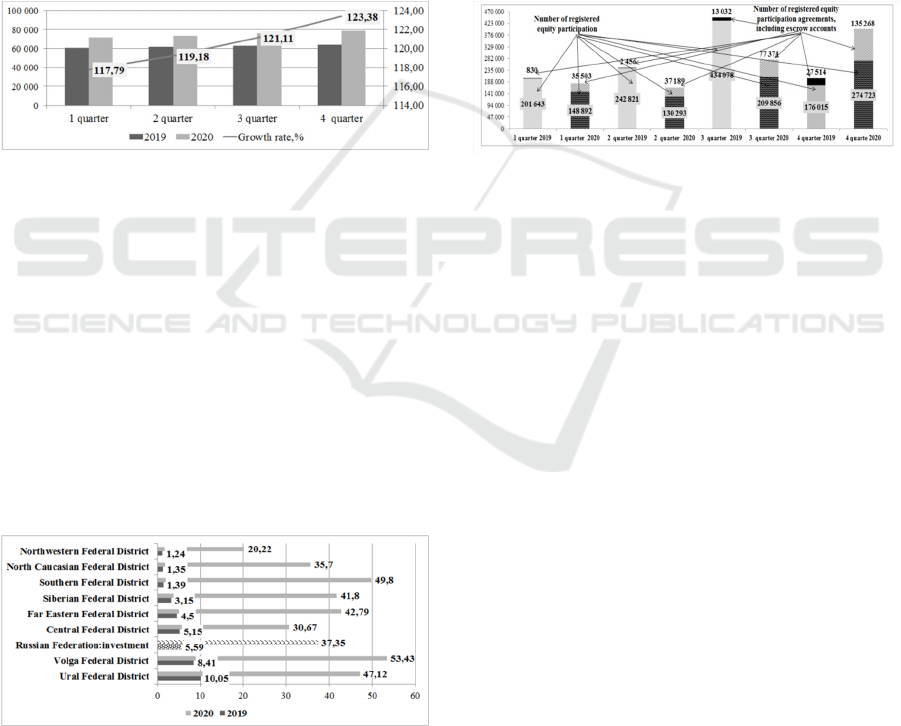

Figure 1: Dynamics of changes in the price of 1 sq. m. in

the Russian Federation as a whole for new buildings in the

quarterly section for 2019-2021 (Fedstat, 2021).

The dynamics of changes in the offer price in the

domestic residential real estate market for 2019-2021

is shown in Figure1.

The State of the Residential Real Estate Market of the Russian Federation: Problems and Prospects of Development

145

Analysis of quarterly changes in the median price

of 1 m2 in the domestic primary housing market

showed that in the first quarter of 2020, the price

increased by 17.78%, in the second quarter of 2020,

the price growth was 19.18%, in the third quarter –

21.1%, in the fourth quarter – 23.32% compared to

the same periods in 2019. It is worth noting that in

2019, the price growth in the second quarter relative

to the indicators of the Second Quarter was 1.5%, in

the third quarter relative to the second quarter –

2.06%, in the fourth quarter relative to the third

quarter – 1.85%; and in the first quarter of 2020, the

price growth was 11.62% relative to the fourth quarter

of 2019. Price growth in the second quarter of 2020

relative to the second Quarter – 2.7%, in the third

quarter-3.7%, in the fourth quarter-3.7% (Fig. 2).

Figure 2: Dynamics of changes in the price of 1 sq. m. in

the Russian Federation as a whole for new buildings in the

quarterly section for2019-2020. (Fedstat, 2021).

It becomes legitimate to ask how the price

increase will affect sales volumes, given that the

demand in the real estate market is elastic, and

potential customers are very sensitive to price

changes. According to Rosreestr, the share of

registered equity participation agreements

(hereinafter referred to as DDS) in the Russian

Federation with the involvement of escrow accounts

in 2018 was 0.04 %, in 2019 – 5.59%, in 2020-

37.35%. The percentage of registered DDS using

escrow accounts, broken down by federal district, is

shown in Figure 3.

Figure 3: Share of equity participation agreements using

escrow accounts in the total volume of registered equity

participation agreements by federal districts for 2019-2020,

% (Federal Service of State Registration, Cadastre and

Cartography, 2021)

As follows from the data shown in Figure 3, from

July 2019 to December 2020, the share of using

escrow accounts in the Russian Federation was

37.55%; the maximum value was recorded in the

Volga Federal District – 53.43%, the minimum value

– in the North-Western Federal District – 20.22%.

Ensuring the protection of the interests of

shareholders is, of course, an important issue, but the

issue of housing affordability for the citizens of the

country who need it is no less important. To

understand the results of the transition to escrow

accounts in terms of its impact on the degree of

housing affordability, it is necessary to analyze the

sales of primary market properties. Figure 4 shows

information on the number of registered DDS in the

Russian Federation for 2019-2020.

Figure 4: The number of registered contracts for

participation in shared-equity construction in the Russian

Federation as a whole for 2019-2020 (Fedstat, 2021)

Comparing quarterly 2020 and 2019, we can draw

the following conclusions.

In the first quarter of 2020, when the share of

escrow accounts was 23.84%, and the price increase

was 17.78%, the drop in sales was 26.17% compared

to the first quarter of 2019, when the share of escrow

accounts was 0.41%.

In the second quarter of 2020, when the share of

escrow accounts was 28.54%, and the price increase

was 19.18%, the drop in sales was 46.35% compared

to the second quarter of 2019, when the share of

escrow accounts was 1.01%.

A completely opposite picture can be observed in

the third and fourth quarters of 2020. The growth of

escrow accounts in the third quarter of 2020 was

460.17% from 8.01 % to 36.66%, price growth-

21.1%, and sales volume - 29.01% compared to the

same period of 2019;the growth of the share of

escrow accounts in the fourth quarter of 2020 was

314.97% from 15.63% to 49.23%, price growth –

23.32%, and sales volume growth was 56.07%

compared to the same period of 2019.

What is the reason for this situation, when in the

first and second quarters of 2020 there is a sharp drop

in sales, and in the third and fourth quarters of 2020

we see their active growth? Is sales activity related to

an increase in the share of escrow accounts and a

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

146

decrease in risks in the primary market, or is it the

influence of other factors?

At the end of the first quarter of 2020, a pandemic

of a new coronavirus infection was declared. The

global coronavirus outbreak has triggered a global

crisis. Sanitary force majeure caused by COVID-19

caused not only a recession in the global economy,

but also in national economic systems (Glazyev,

2020). Restrictive measures have also affected the

residential real estate market.

The lockdown introduced in April-May 2020

paralyzed development activities, restrictive

measures were introduced in 44 regions, and

construction activities were completely stopped in

Moscow and the Moscow Region. As a result, sales

volumes began to fall in the first quarter of 2020; the

trend continued in the second quarter. The drop in

sales, triggered by the increase in the supply price due

to the introduction of project financing, was

exacerbated by the restrictive measures associated

with the pandemic; and the result of these two factors

was a record drop in sales in 2020 – 46.35%. The

current situation posed a real threat of bankruptcy of

many construction companies and the appearance of

"deceived shareholders"on the market.

The point of view expressed by the chief analyst

of the RGR, Gennady Sternik, regarding the measures

taken by the authorities during the crisis of 2014 is

also relevant for the crisis of 2020: "from the point of

view of the model of economic development that the

authorities are trying to implement, the reaction is

competent. It is based on the fact that it is necessary

to stimulate not demand, but supply – production and

construction. After all, only the real sector can lead to

the creation of new jobs, income growth and,

ultimately, demand" ((Sternik, 2015). The opinion of

the scientist, who has been analyzing and forecasting

the situation in the residential real estate market for

many years, was supported by Russian President

Vladimir Putin, when speaking at a meeting on the

construction industry, he noted: "We will definitely

support the construction complex. Moreover, at the

stage of economic recovery, it is construction that

should become one of the engines of growth, which

will pull other sectors along with it" (Putin, 2020) ,

One of the measures of state support for the

industry was the implementation of the Program of

subsidizing mortgage rates at 6.5% per annum of

preferential mortgages. The preferential program was

launched in May 2020 and in October of the same

year was extended until the end of the first half of

2021 (Decree of the Government of the Russian

Federation No. 1732 of October 24, 2020), allowing

citizens to purchase residential real estate on the

primary market.

The implementation of the program of subsidizing

mortgage rates against the background of the

weighted monetary policy of the Bank of Russia, the

programs led to a decrease in mortgage market rates,

during 2020, the average mortgage rate decreased by

1.64% (from 9.05% at the beginning of the year to

7.36% on 01.01.2021), in the primary housing

market, the decrease in the average housing rate for

this period was 2.46%. During this period, there was

an increase in the weighted average term of mortgage

lending from 215 to 222 months, which, along with a

decrease in interest rates, led to an increase in the

availability of mortgage lending. In 2020, the growth

in the number of mortgage loans issued for the

purchase of housing in new buildings compared to

2019 amounted to 142.4 %, the increase in the amount

of loans issued for this period amounted to 62.0%. In

2020, more than 484 thousand rubles were issued.

loans in the amount of about 1.5 trillion rubles.

The share of transactions under the Mortgage Rate

Subsidy Program, according to the Financial Institute

for Housing Development DOM.RF, increased from

51% in 2019 to 66%in 2020. During this period,

348,900 loan agreements for the purchase of housing

in new buildings were issued under the preferential

mortgage program with a supply of no more than

6.5%, which is 45.8% of the total number of

registered DDU (Review of housing markets, housing

construction and mortgages in 2020). It is precisely

the measures of state support for the construction

industry introduced in time in the form of preferential

mortgages that explain the recovery in sales volumes

in the primary residential real estate market in the

third and fourth quarters of 2020.

The anti-crisis measures proposed by the Russian

government in the form of a preferential mortgage at

6.5% for the purchase of housing in new buildings

reoriented demand from secondary housing to the

segment of new buildings, since the weighted average

mortgage rate for the secondary housing market was

8.33% in January 2020, and 8.04% in December, with

a mortgage rate in the subsidized segment of 8.0%

and 5.8%, respectively. The existing preferential

mortgage on the secondary housing market is

available to a limited number of families – families

with children and children with disabilities, which,

together with the observed dynamics of real estate

prices for months, when prices for primary housing

are lower than for secondary housing (especially in

Moscow), exacerbates the existing problems and

pushes the buyer's demand in the segment of new

buildings.

The State of the Residential Real Estate Market of the Russian Federation: Problems and Prospects of Development

147

The package of anti-crisis measures announced by

the Government of the Russian Federation in mid-

March 2020 to support the housing construction

sector contained special approaches to the application

of financial sanctions under the legislation on shared-

equity construction for the failure of developers to

meet their obligations during housing construction in

2020. In addition, a temporary moratorium was

introduced on the recovery of funds for enforcement

proceedings related to improper performance of

obligations by the developer, and a temporary ban on

the inclusion of apartment buildings in the register of

problematic objects was established. The list of

strategic organizations included 54 construction

organizations that meet such criteria as the volume of

construction of residential and non – residential

buildings of at least 400.0 thousand square meters and

revenue for 2019-at least 10 billion rubles. The total

volume of objects under construction at the

organizations included in the list amounted to 53.5

million square meters.

Along with the factors that positively affected the

recovery of the residential real estate market, there

were also negative ones, which, first of all, include

the reduction of wages and the loss of jobs. "Real cash

income (income minus mandatory payments – taxes

and fees, interest on loans, etc., adjusted for inflation)

in 2020 fell by 3.5% after an increase of 1.0% in

2019." (Fedstat, 2021).

4 CONCLUSIONS

The current situation in the residential real estate

market makes us seriously think about the question

that the solution of the social issue with "deceived

shareholders" through project financing, which leads

to an increase in prices, reduces the availability of

housing and regional development. Therefore, for the

implementation of the national project "Housing and

Urban Environment", according to which it is

necessary to ensure the availability of housing for

middle-income families using mortgages with a rate

of less than 8%, as well as to ensure the construction

volume of 120 million square meters. in a year" [20],it

is necessary to develop and implement a set of state

support measures aimed at both developers and target

customers. A striking example was the mortgage at

6.5% per annum, which became the driver of the

industry and allowed us to achieve sales volumes

almost as in 2019.

REFERENCES

Mian, A., Sufi, A., 2009. Household Leverage and the

Recession of 2007 to 2009. In Paper presented at the

10th Jacques Polak Annual Research Conference.

Washington, DC.

Barrell, R., Davis, E., Karim, D., Liadze, I. , 2010. Bank

Regulation, Property Prices and Early Warning

Systems for Banking Crises in OECD Countries. In

Journal of Banking and Finance.

Kotlyarov , M. A. , 2015. Real Estate market in the system

of ensuring financial stability by the Central Bank of the

Russian Federation. In Financial Analytics: problems

and solutions.

Tretyachenko, T. V., Pivovarova, G. B., 2020. Elasticity of

demand at the present stage of development of the

residential real estate market of the Russian Federation.

In Bulletin of the Rostov State University of Economics

(RINH).

Asaul, A. N., 2017. Real Estate Economics: A textbook for

universities. 3rd ed. Third-generation standard. St.

Petersburg: Piter.

Buzyrev, V. V., 2016. Modern methods of housing

construction management. Infra-M.

Goremykin, V. A., 2018. Real Estate Economics: Moscow:

Yurayt.

Grigoriev, V. V., 2001. Management of municipal real

estate. M.: Delo.

Kovalenko, N. Ya. , 2018. Real Estate Economics. M.:

KolooS.

Platonov, A.M., 2004. Development of mechanisms for

ensuring housing affordability. Series "Economics and

Management".

Sternik, G. M., 2009. Analysis of the real estate market for

professionals. ZAO "Publishing House "Ekonomika".

Friedman, D. P., Ordway, N. , 1997. Analysis and

evaluation of income-generating real estate. M.: Delo

Ltd.

Glazyev, S. Yu. , 2020. On the deep causes of growing

chaos and measures to overcome the economic crisis

PULSE AFTERSHOCK. https://aftershock.news/

Sternik, G. M., 2015. The crisis in the real estate market

will be delayed until 2019. Information System

ROSNED.RU. http://www.rosned.ru/

Putin:V., 2020. The construction complex will become the

engine of growth in the recovery of the economy

Russian News Agency TASS. https://tass.ru/

Review of housing markets, housing construction and

mortgages in 2020 Financial Institute for Development

in the housing sector "DOM. RF". https://дом.рф/

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

148