Digital Currency: Prerequisites, Benefits and Risks

Nadezhda Konstantinovna

Savelyeva

1 a

and Tatyana Alekseevna

Timkina

1b

1

Vyatka State University, Kirov, Russia

Keywords: Digital currency, central bank, money, digitalization.

Abstract: The article deals with a new vector of developing monetary circulation based on the issuance of digital

currency by the Central Bank. Taking into account the digital changes in business, transactions, commodity

and money exchange, the financial system is undergoing changes, there is a need to digitize cash to increase

efficiency - the speed of operations and minimize the costs of cross-border transfers. The global trend at

CBDC has both benefits and risks for the economy. Based on the analysis of development trends, the authors

have defined the advantages and disadvantages of introducing digital currency into the use by all households.

1 INTRODUCTION

The globalization processes are rapidly penetrating

into the life of modern society, rebuilding the usual

business processes, and dictating new trends in doing

business. Developing information technologies

contribute to the formation of links between industry

entities, unification, new market segments and the

elimination of uncompetitive participants. Platforms

based on Internet technologies have become a

common vector for the work of companies from

completely different fields of activity. Intelligent

technologies enable to develop electronic banking

services, which are in high demand. The most

promising technologies are smart banking, Internet of

Things (IoT), ubiquitous computing (UC), artificial

intelligence (AI) and blockchain technology

(distributed ledger) (Savelyeva N.K., Timkina T.A.,

2021). Let us consider the functioning of commercial

banks through the use of new technologies in their

work. The banking sector is undergoing significant

changes. The development of remote services,

triggered by the Covid19 pandemic, is being shaped

by the Internet. It is stated that since 2020

digitalization has determined the quality of life in

developing countries to the same extent as economic

growth. Digitalization ensures the fight against

inflation (49.79%) (Savelyeva N.K., Sozinova A.A.,

Popkova, 2020). The growth of mobile Internet users

is growing, and therefore the potential number of

a

https://orcid.org/0000-0002-9497-6172

b

https://orcid.org/0000-0003-4587-6033

clients for a commercial bank is increasing. The

expansion of the client base confirms the relevance of

using remote technologies in the banking sector.

The new term "the bank ecosystem" is considered

by modern authors as a set of participants interacting

with the organization and directly or indirectly

participating in the “value chain” (universities, agents

selling goods and services, communities), and

customers (Bykanova NI, et al., 2020). In this context,

it can be determined that the ecosystem is

interconnected, independent organizations, united by

common goals to meet the needs of the client. In this

case, we are talking about expanding the list of

powers and boundaries. The main feature of new

technologies is the ability to form related links

between completely different areas within the

framework of one strategy. The activity on the part of

the restructuring activities of commercial banks, the

trend towards it-technologies made it possible not

only to restructure the development strategy of

commercial banks, but to draw the attention of the

Bank of Russia and the Government of the Russian

Federation to the regulation of the banking sector,

taking into account new development prospects. But

at the same time, the financial sphere of the state is

also undergoing large-scale changes, as in October

2020 the Central Bank of the Russian Federation

provided a report of public consultations on the topic

“Digital Ruble” (Bank of Russia, 2020).

Savelyeva, N. and Timkina, T.

Digital Currency: Prerequisites, Benefits and Risks.

DOI: 10.5220/0010693400003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 99-103

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

99

Money is of great importance in the life of society.

The development of electronic money is due to the

possibility of exchanging money through mobile

applications, Internet banking, mobile operators.

According to official statistics, the use of the Internet

in the context of payment for goods and services has

increased by 16% compared to 2020. Any

commodity-money transaction via the Internet is

accompanied by remote payment, that is commercial

banks act as a tool. Electronic money has already

entered the life of modern society, the stage of their

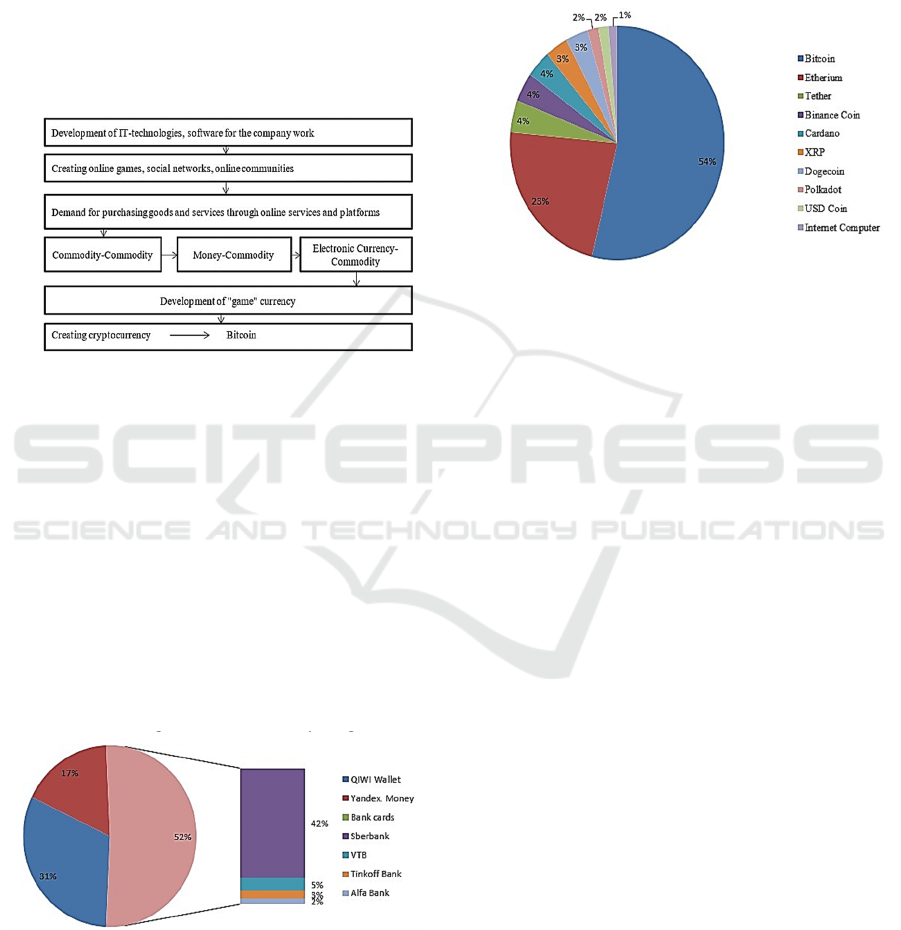

formation is shown in Fig. 1.

Figure 1: Development stages of electronic money.

The stages of developing electronic money have a

beginning, because the starting point can be called the

appearance of exchange currency in computer games.

Initially this process involved bartering goods for

goods. Then money became conventional units of

exchange, a fee for certain options, privileges, later

the possibility of exchanging game money for cash.

In 2020, according to RBC, the volume of the gaming

streaming market in the Russian Federation and the

CIS countries exceeded 20 billion rubles. According

to analysts, this direction is increasing and the

computer games industry will grow on average by

20% per year. The transfer of cash into game currency

is carried out through electronic money (Fig. 2).

Figure 2: Transferring funds into game currency.

The basis of transfer is electronic services.

According to the data of the diagram, they are based

on money transfers from mobile banking. These

operations can be called as the start of electronic

money used between citizens, the opportunity to

make money on buying and selling, on-time sale or

purchase. Gaming money, like cryptocurrency today,

has trends to increase or decrease. These principles

absolutely accurately characterize the basic principles

of cryptocurrency. By 05/25/2021 Bitcoin has taken

the leading place in the rating (Fig. 3)

Figure 3: Share of leading cryptocurrencies by market

capitalization, $.

According to Fig. 3, we can absolutely say that the

cryptocurrency is firmly entrenched in the market, the

leader is Bitcoin. Turnover on May 24, 2021 was $

68,394,666,153, with a market cap of $

716,460,385,872. The popularity of digital currency

is increasing, the growth in demand gives rise to

market expansion.

2 MATERIALS AND METHODS

The duality of the introduction of digital currency for

mass use can be traced in many reports of Western

banks and institutions. The analysis of the IMF claims

“... the launch of CBDC is a multidimensional event

that goes beyond the usual framework of project

management in the field of information technology of

the central bank. ... The new currency could lead to

major disruptions affecting monetary policy

transmission, financial stability, financial sector

intermediation, exchange rate channel and payment

system operation ...” (Kiff et al., 2020). Scientific

work on digital currency forms the concept “... CBDC

is a new form of money issued by the central bank in

digital form and intended to be used as legal tender

...” (Tommaso Mancini et al., 2018). In this case, it is

possible to single out the cause of activity in relation

to digital currency, namely, the convenience of a

digital means of payment to satisfy consumer

preferences, this fact is confirmed by the European

Central Bank (Fabio Panetta, 2021). Currently,

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

100

disputes between representatives of Western states

regarding the introduction of digital money under the

authority of the state are increasing.

Domestic scientists and government representati

ves form basic principles for forming CBDC. In 2020

a report on the role of the digital ruble, its features and

capabilities was published on the Bank of Russia

website, which confirmed the concern of the

authorities and the duality of meanings for the

country's economy. E.L. Sidorenko sees the digital

currency of central banks as a new means of

transporting money, a kind of alternative to non-cash

payments. At the same time, commercial banks retain

all the advantages of non-cash funds: both a transfer

mechanism through the registers of a commercial

bank, and the ability to track payments (Sidorenko E.

L., 2021). Dobrinskaya D.E., Martynenko T.S.consi

der digitalization processes as a phenomenon of soci

al inequality, since Russia has a problem of digital

accessibility and the inability of some segments of the

population to consume technology (Dobrinskaya

D.E., Martynenko T.S., 2019).

Having studied reports of central banks of foreign

states, the opinions of scientists and national

documents, we can conclude that the research topic is

relevant, since today there is no clear understanding

of conversion consequences of the national currency

for all states.

3 RESULTS AND DISCUSSION

Digital currency is a continuation of the era of plastic

cards, electronic money, cryptocurrency and bitcoins.

With the growing demand for electronic money, the

supply is rising. In this case we are talking about

private commercial institutions. Digital currencies

can be centrally managed, when one firm controls the

processes, for example, Facebook created the Libra

digital currency. The principles of decentralized

governance have cryptocurrencies based on

distributed ledgers, transaction records. In this case,

the more people who want to create a digital currency,

regardless of the form of organization, the more

difficult it becomes to exercise control by the state, to

assess their reliability and liquidity for the Central

Bank, because at the moment there is no single

methodology for assessing data. Thus, the question

arises about the centralized electronic currency

(hereinafter CBDC), which is controlled and issued,

like tangible money, by the main bank of the country

(Fig. 4).

Figure 4: Types of centralized digital currency.

In general, the digital currency of the Central

Bank can be defined as an electronic obligation of the

central bank, expressed in the national currency and

acting as a medium of exchange and storage of value.

At the same time, CBDC should be considered as a

new form of central bank money, different from

traditional central bank money and presented either in

the form of cash or in the form of money in reserve

and bank accounts with the central bank (Kochergin

D., Yangirova AI, 2019) ... Central Bank digital

currency is an electronic form of central bank money

that could be used more widely by households and

businesses to make payments and store valuables

(Bank of England, 2020). The concept of digital

currency is considered by the Institute of Banking

Policy, so the reporting document states that "...

CBDC is a digital payment instrument denominated

in the national unit of account, which is a direct

obligation of the central bank ..." (Bank policy

institute, 2020).

In order to determine the nature of changes with

the introduction of CBDC, let us turn to the main

properties of money, namely, in this case, technology.

If we talk about digital currency, then its functioning

is supposed to be based on tokens, and not on

accounts as when dealing with cash. In this case, the

key difference between tokens and accounts is their

verification: the person receiving the token verifies

the authenticity of the token, while the intermediary

verifies the identity of the account holder (Green

(2008) and Kahn and Roberts (2009)). However, the

definition of tokens varies considerably across

academic fields, and other reports differentiate

between value or account-based CBDC forms (e.g.

Sveriges Riksbank (2018) and Norges Bank (2018))

(Barontini Ch., Holden H., 2019). The uncertainty of

the scale and level of penetration of a possible

monetary instrument gives rise to speculations about

possible benefits and risks for the economy.

If we take into account the general availability of

the population to digital currency, based on the speed

of transfer, the absolute advantage of the innovation

is the elimination of additional transfer

intermediaries, both within the territorial boundaries

of the country and in cross-border transactions. But if

the risk lies in the increased load on the Central Bank

of the country, it is responsible for the execution of

Digital Currency: Prerequisites, Benefits and Risks

101

the transaction, thereby increasing the load, and,

consequently, the need to expand the structure of the

bank itself.

Based on the fact that CBDC is issued and

controlled by the country's main bank, it is possible to

track the legality of suspicious transactions of

individuals, concealment of income, targeted use of

budget money for government purchases of goods

and services, and the tax burden of enterprises and

organizations. To implement such measures, we need

large databases, ensuring cybersecurity and

protection against data leakage, which in turn requires

large investments.

Digital money minimizes the risk of

counterfeiting, as is impossible with cash. But at the

same time there is a risk of theft of funds at the

slightest system failure.

The funds of the population are kept in the Central

Bank, that is, in this case, we are talking about

minimizing the risk of bankruptcy, loss of a license,

default, non-return of money to a minimum in

comparison with commercial banks. At the same

time, more flexible prices for deposits of commercial

banks can significantly reduce the desire to keep

money in a "safe place" in order to increase the

amount of the deposit.

Of course, under the condition of CBDC, the

central bank is not an observer with the function of a

control body, but is a market participant. The

emergence of a new player can increase the level of

competition in the banking market and lead to more

favorable conditions for the buyer. The risk in this

case is obvious, because with the price competition

for the client, profit and lending activity decrease, and

most importantly, the withdrawal of deposits for

transfer to CBDC can lead to the liquidation of the

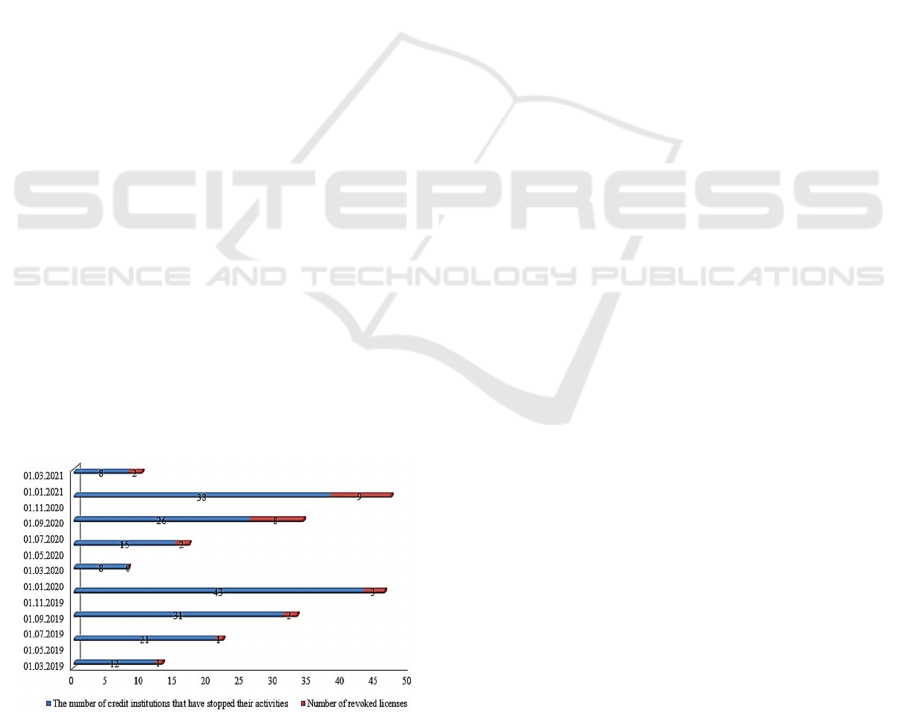

bank, so there are he following data and the

termination of activities for 2021.

Figure 5: Number of credit institutions that have stopped

independent activities.

In this case, we are talking about the loss of

competitiveness, which in turn results in an outflow

of customers, with the subsequent loss of profit and

reliability of the bank. The introduction of digital

currency implies functioning on the basis of software

products on the Internet. Taking into account the fact

that in Russia there is an obvious problem of ensuring

accessibility for residents of remote regions, there is

a risk that not all citizens will be able to use services.

Any new system requires a long time to test or

eliminate all inaccuracies. This process is

accompanied by a long time to process transactions,

which can create additional difficulties and determine

the unattractiveness of this type of service for the

client.

The CBDC system will reduce the risks of DvP

and PvP transactions, namely, in the first case,

simultaneous delivery and payment, and in the second

case, a quick transfer of one currency to another. It

will avoid additional client actions for currency

exchange to reduce costs.

Thus, the introduction of digital currency is

accompanied by equal risks - the duality of criteria.

Of course, CBDC is capable of solving a number of

global problems, reducing corruption, hiding income,

preventing illegal transactions, etc.

4 CONCLUSIONS

The processes of globalization are currently a vector

of change, the rapid trend for remote services is due

to the consequences of the Covid19 pandemic. Shock

events carried out by the Government and business to

maintain their existing positions, rapidly and on a

large scale allowed the entire economy to move to a

new digital level. Such terms as digitalization and

internetization, "remote" economy characterize

remote services. There is the growing demand for

electronic platforms for purchasing and selling goods,

services, credit products, in a word, to meet all kinds

of needs of the population, regardless of territorial

boundaries. Digital technologies, expansion of areas

of activity, commercial organizations attract

additional products, expanding the range of services

provided. An example of this merger is the bank's

ecosystem, a clear example of a remote software-

based product that allows to increase the usual list,

attracting new customers, expanding markets,

minimizing costs due to scale, etc.

Banks in this case act as an intermediary in

transactions, but taking into account various

participants, difficulties in cross-border transfers,

there is a need for a single form of exchange with ease

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

102

of transfer. For these reasons bitcoin,

cryptocurrencies and other forms of electronic money

arise. Demand is growing, the number of companies

creating their own cryptocurrencies is increasing, the

question arises from the point of view of government

control.

The creation of digital currency by central banks

is an unconditional response to the growth of

commercial cryptocurrency, the ability to control the

processes of exchange and consumption. But the

move has enormous implications for the economy,

both in terms of scale and risks. The question is open

today, because not one state can accurately determine

the consequences of this phenomenon. The

theoretical substantiation of existing risks provides

the basis for the formation of operating principles,

operating conditions, powers, but from the point of

view of practice, it is absolutely unknown to predict

how the digital currency will behave after being put

into use by all households. CBDC is a logical

continuation of globalization trends, it has a number

of indisputable advantages, will allow modernizing

monetary policy, expanding the central bank's

jurisdiction, and reducing corruption. Theses goals

are duplicated in all plans for the country's economic

development.

REFERENCES

Bailey, A., “Reinventing the Wheel (With More

Automation),”, Brookings Virtual Event.

Bank of England, 2020. Central Bank Digital

Currency, https://www.bankofengland.co.uk.

Bank of Russia, 2020, https://cbr.ru/.

Bank policy institute, 2020. See Bank of Canada, European

Central Bank, Bank of Japan, Sveriges Riksbank, Swiss

National Bank, Bank of England, Federal Reserve

Board, Bank for International Settlements, “Central

Bank Digital Currencies: Foundational Principles and

Core Features, Report No. 1” Bank for International

Settlements at 3 (hereafter “BIS 2020 Report”).

Barontini, Ch., Holden, H., 2019. Proceeding with caution

–a survey on central bank digital currency. In Bank for

International Settlements.101.

Bykanova, N. I., Solovey, J. A., Gordya, D.V., Konshina,

L. A., 2020. Formation of banks ecosystems in

conditions of digitalization of banking space. In Public

аnd Business Finance. 47(1). pp. 91 – 100.

Dobrinskaya, D. E., Martynenko, T. S., 2019. Defining the

Digital Divide in Russia: Key Features and Trends. In

Monitoring of Public Opinion: Economic and Social

Changes. 5. pp. 100 – 119.

Kiff, et al., (2020). The Governor of the Bank of England

has noted, “CBDC, whilst offering much potential, also

raises profound questions about the shape of the

financial system and the implications for monetary and

financial stability and the role of the central bank.”

Kochergin, D., Yangirova, A. I., 2020. Central bank

Digital Currencies: Key Characteristics and Directions

of Influence on Monetary and Credit and Payment

Systems. In Finance Theory and Practice. 23(4). pp.

80-98.

Mancini, T., et al., 2018. Casting Light on Central Bank

Digital Currency. In IMF Staff Discussion Note. 8. pp.

1–38.

Panetta, F., 2021. Evolution or revolution? The impact of a

digital euro on the financial system.

European Central Bank, https://www.ecb.europa.eu.

Savelyeva, N.K., Sozinova, А.А., Popkova, E.G., 2021. A

New Quality of Economic Growth in «Smart»

Economy: Advantages for Developing Countries. In

LNNS. 155. pp. 426-433.

Savelyeva, N. K., Timkina, T. A. «Smart Technologies» as

a Mechanism for Regulating Bank Competition in

Cross-Border Markets. ISC 2020. In Lecture Notes in

Networks and Systems. 155.

Sidorenko, E. L., 2021. Digital Ruble: Digital Currency

Model Of Central Banks. Global Challenges and

Prospects of the Modern Economic Development.

Digital Currency: Prerequisites, Benefits and Risks

103