Mechanism of Regulation and Assessment of Degree of Debt Load of

the Population of the Russian Federation

Konstantin Anatolyevich Malyshenko

1a

, Vadim Anatolyevich Malyshenko

1b

, Diana

Alexandrovna Mardar

1c

, and Marina Viktorovna Anashkina

1d

1

V.I. Vernadsky Crimean Federal University, Simferopol, Russia

Keywords: Crediting, debt load of economy, debt load, indicator of debt load of the population, banking system, income

of the population, collection sector.

Abstract: This article reveals the problem of debt load of the population of the Russian Federation. The main purpose

of the study is to determine the degree of debt load of the population on the basis of publicly available data,

with the subsequent development of a final indicator that may be used in the analysis, control and regulation

of the banking system of the Russian Federation. Methods of graphical analysis and modeling were used in

the work. The authors have developed a coefficient of debt load of the population. On the basis of the

presented coefficient and publicly available data, an assessment of the degree of debt load of the population

was carried out. As a result of this author’s assessment, the necessity of introducing a control system for the

RF loan capital market was substantiated. The authors identified the main stages of the implementation of this

system, as well as the procedure for the banking sector, taking into account its functioning. The dynamics of

the volume of funds provided by credit institutions, consumer and corporate lending in the Russian Federation

is considered. The main methods of regulation of the banking sector at the present stage have been studied,

the necessity of using the indicator and the system for monitoring the degree of debt load of the population

has been substantiated, the procedure for its implementation and the mechanism of functioning have been

presented. Based on the results of the analysis, it was concluded that in the Russian Federation there is a

significant level of debt load of the population.

1 INTRODUCTION

One of the main mechanisms for increasing the share

of profit in the banking sector of the Russian

Federation today is an aggressive credit policy. Over

the past three years, the volume of loans issued has

shown significant growth dynamics, which is

perceived as a positive fact that has a beneficial effect

on the country’s economy.

However, the process of active expansion of the

loan capital market is characterized by ambiguity,

since under certain conditions it may have a negative

impact on the country’s economy. The main ones are

a decrease in consumer activity as a result of an

increase in the debt burden and a decrease in the

volume of disposable income of citizens, an increase

a

https://orcid.org/0000-0002-3453-2836

b

https://orcid.org/0000-0002-7589-9132

c

https://orcid.org/0000-0002-3448-9268

d

https://orcid.org/0000-0003-1495-0632

in the volume of repeated lending aimed at repaying

existing debts. These consequences are reflected in

various spheres of the socio-economic life of society,

and act as prerequisites for the aggravation of social

problems, the development of mistrust in the

country’s financial system, in particular, in the

banking system. This, in turn, leads to the withdrawal

of funds from bank accounts by the population, an

increase in the cash money supply in circulation.

By itself, the concept of debt load represents the

share of loans in the total volume of real incomes of

citizens. A high level of debt load, as a rule, leads to

the inability of individual citizens to pay off their

existing debt, which becomes an impetus for the

development of the collection sector. As a result of

the lack of the required regulatory framework, the

Malyshenko, K., Malyshenko, V., Mardar, D. and Anashkina, M.

Mechanism of Regulation and Assessment of Degree of Debt Load of the Population of the Russian Federation.

DOI: 10.5220/0010681600003169

In Proceedings of the International Scientific-Practical Conference "Ensuring the Stability and Security of Socio-Economic Systems: Overcoming the Threats of the Crisis Space" (SES 2021),

pages 17-24

ISBN: 978-989-758-546-3

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

17

actions of collectors over the past years have been of

a strict preventive, often illegal nature, which

contributed to the accelerated growth of distrust of the

banking system on the part of the population and the

growth of social tension. Obviously, in such

conditions, full development of various sectors of the

economy is impossible.

The study of the issue of debt load, credit policy

and mechanisms for managing the volume of loans

issued, as well as their impact on the economy, have

recently been studied by such foreign authors as Leao

(2003), Waters (2018), He et al. (2019), Grandi

(2019), Chevallier Joueidi (2019), Nguyen,

Papyrakis Van Bergeijk (2019), Shi et al. (2019),

Arestis Jia (2019). The closest to this paper is the

study by Thus, Mue, de Almedia Philo and Thomas

(Debtor level collection operations using Bayesian

dynamic programming) (So et al., 2019), which raises

the question of the need to collect and systematize

data on debtors.

The study of the issue of debt load of the

population in the Russian Federation was carried out

by such scientists, as Shafirov L.A.(2014), Malanov

V.I., Yakovleva I.A. Burlov D.Yu. (2017) reveals

the problem of the deterioration of the socio-

economic region as a result of the high level of debt

burden in his paper "The standard of living as a factor

of the population’s debt load”. This problem is also

noted in V.B. Bulatova, I.A. Yakovleva and D.Yu.

Burlov’s work. (). The reasons of increase in

level of debt load and growth of arrears of the

population are rather in detail considered in the paper

of Ibragimova P.A. (Ibragimova, 2018). The author

notes that the problem of debt load of the population

is aggravated with long fall of the real located income

of citizens therefore so-called "vicious circle" is

formed.

Moreover, works of such authors as Karanin E.V.,

Timin A.N. are devoted to studying the matter

(Karanina E.V. Timin, 2017).

The methods of assessment of level of debt load

are considered in the paper of Chupryn A.P. and

Evdokimov S.S. (2018).

It is worth noting that domestic scientists have not

studied the issue of the need to develop a coefficient

to assess the level of debt load of the population and

to build a unified system of borrowers as the main

component of the banking sector infrastructure,

which makes it possible to track and adjust the level

of debt load of the population. The mechanism for the

functioning of the system and its implementation in

the infrastructure of the banking sector has not been

worked out, despite the existence of objective reasons

for this need.

2 MATERIALS AND METHODS

The study of the degree of indebtedness of the

population at the moment is possible on the basis of

publicly available data, and is a study of the dynamics

of individual indicators, conducting surveys of

citizens. It should be noted that in this case, obtaining

an objective final result is impossible. The data

obtained are incomparable, which does not allow

studying the dynamics of the indicator, since different

authors use different indicators in the assessment.

To assess the degree of debt load of the population

of the Russian Federation, we will conduct an

analysis based on data from the Central Bank of the

Russian Federation. Table 1 shows the amount of

funds provided by credit institutions in Russia for the

period 2016-2018 The dynamics of the volume of

funds provided by credit institutions in Russia for the

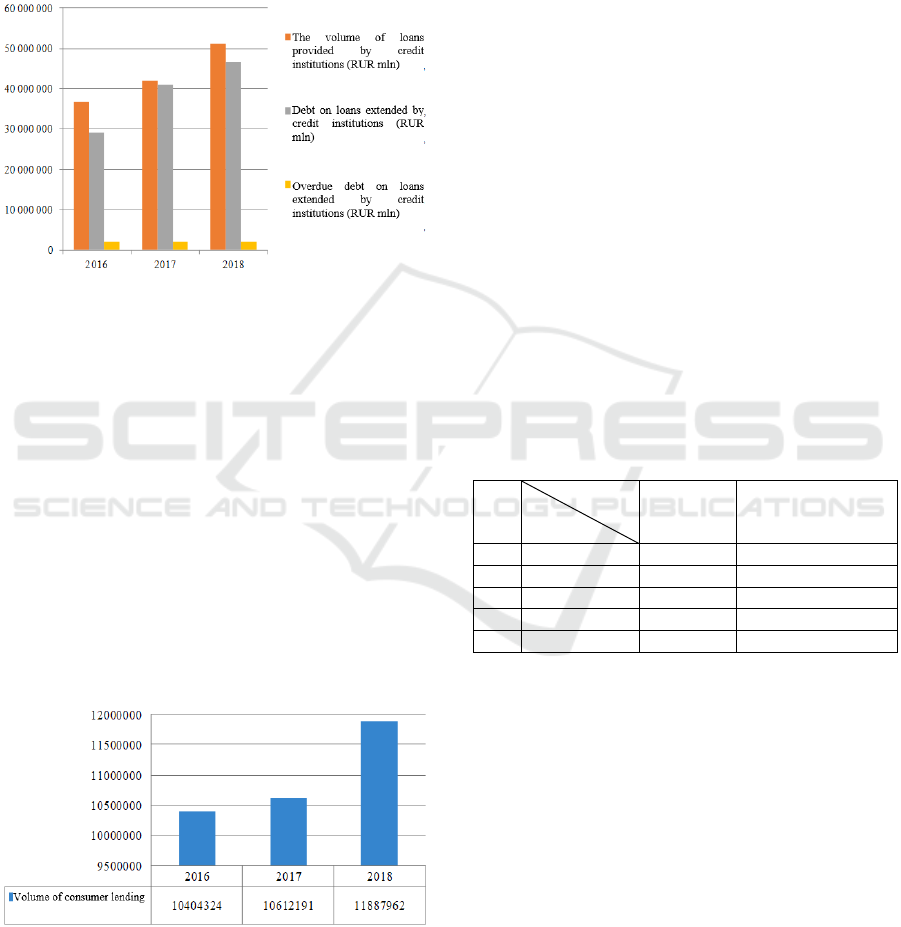

period 2016-2018 is shown in Fig. 1.

The presented histogram (Fig. 1) shows that the

volume of loans provided by credit institutions

increases in 2018, compared to 2016, by 14,400,371

RUB mln (+39.2%). Loan debt also tends to increase,

in 2018 by 17,592,814 RUB mln or 61%, compared

to 2016

As may be seen from the data in Table 1, the share

of debt on loans in the total volume tends to increase,

which is undoubtedly a negative characteristic - if in

2017 this indicator was 70%, then by the end of 2018

it reached 91%.

Table 1: Amount of funds provided by credit institutions of

the Russian Federation in 2016-2018

Line 2016 2017 2018

The volume of loans

provided by credit

institutions (RUB mln)

36 704

165

41 892

527

51 104

536

Debt on loans extended

by credit institutions

(RUB mln)

28 975

839

41 089

304

46 568

653

Overdue debt on loans

extended by credit

institutions (RUB mln)

1 947

563

1

990 463

2 149

829

Share of debt on loans in

the total volume of loans

issued (%)

78.9 69.8 91.1

Share of overdue debt in

total debt (%)

6.9 4.8 4.6

Consumer lending occupies a significant share of

the credit market - 23% in 2018, which has been

growing rapidly in the Russian Federation in recent

years. This is primarily due to the emergence of new

loan products and the addition of existing ones.

However, the retail lending market continues to

experience a number of problems associated with low

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

18

solvency and financial instability of many borrowers,

gaps in the legal and regulatory framework for the

activities of credit institutions, regional differences in

socio-economic and political situations, etc.

From the data presented in the histogram (Fig. 2),

it may be concluded that the volume of consumer

lending in the Russian Federation has grown over the

past three years.

Figure 1: Dynamics of the amount of funds provided by

credit institutions of the Russian Federation in 2016-2018

If in 2016 the volume of loans issued amounted to

10,404,324 RUB mln, then already in 2018 this

volume increased by 1,483,638 RUB mln. and

amounted to 11,887,962 RUB mln.

Corporate lending, unlike retail lending, was

characterized by a smaller increase in 2018, but its

dynamics is considered sufficient. The volume of

corporate loans in 2018 increased by 10.5%. In 2017,

the growth was 0.2%, and in 2016, lending decreased

by 9.5%. In general, lending to legal entities in 2018

offset the decline in the previous two years. The

resumption of lending to legal entities may be

explained by an increase in consumer activity, the

need for corporate clients to finance fixed and

circulating assets.

Figure 2: The volume of consumer lending in the Russian

Federation in 2016-2018 (RUB mln)

Thus, the debt burden of Russian citizens is quite

significant, the amount of debt obligations in the

Russian Federation amounted to about 55 RUB trln,

of which about 15 RUB trln is the debt to banks.

It also cannot be denied that the mood of the

borrowers themselves has a negative impact on the

state of the country’s credit sector. Studies show that

the reason for this attitude lies in the low level of

financial literacy of Russians, although herewith

unscrupulous market participants who mislead

gullible citizens may also cause such a negative

reaction.

In 2017-19, the Central Bank adopted a number of

measures to regulate the activities of credit

institutions. The main purpose of the amendments

was to enhance the banking sector by excluding

organizations with low financial stability, as a result

of which their number decreased significantly (Table

2).

As may be seen from Table 2, the number of non-

bank credit institutions (NCIs) did not change during

the study period. The high share of debt in the total

volume of issued loans, as well as the significant debt

load of the population of the Russian Federation,

served as an impetus for bringing the collection sector

to a new level of state regulation, the attitude towards

which among the population of the country in the last

decade may be characterized as negative.

Table 2: Structure of credit institutions of the Russian

Federation in 2014-2018.

No.

Quantity

Year

Banks

Non-bank

commercial

institutions

1. 2014 783 51

2. 2015 681 52

3. 2016 575 48

4. 2017 499 43

5. 2018 440 44

As a result of the growth of overdue debt on loans,

over the past 3 years, banks have three times more

often sold debts to companies specializing in their

repayment, which led to the growth of this sector and

its active development. The current situation has led

to the need to create an appropriate regulatory

framework, its detailed study, in other words - to the

legalization of the actions of collection agencies.

Collection agencies are represented by

commercial organizations involved in the collection

of overdue debts from legal entities and individuals.

They act as intermediaries between creditors and

debtors. After the adoption in 2018 of Federal Law

No. 230, the rights of collectors are limited:

companies are officially allowed to take actions

regarding the collection of debts from Russian

citizens, while the methods used should not contradict

Mechanism of Regulation and Assessment of Degree of Debt Load of the Population of the Russian Federation

19

the current legislation. The law forbids damage of

property, threats etc. As a result of the Central Bank’s

adoption of additional legislative and regulatory acts,

the collection sector received a solid foundation for

further development.

The Central Bank exercises control and

supervision over the banking sector through a variety

of methods. Modern policy is aimed at a qualitative

transformation of the banking sector by tightening

requirements for credit institutions, however, in

parallel, there is an increase in the population’s debt

load. Control over this problem is exercised by the

Central Bank only indirectly, and no corresponding

attention is paid to it. Thus, the expansion of the

collection sector and its legalization cannot be an

effective method of combating the debt burden of the

population. In addition, the excessive intervention of

collection agencies at this stage may serve to

aggravate the current situation and multiply the level

of debt load. The reduction in the number of credit

institutions also cannot produce the desired effect.

Lack of attention to the regulation of the number of

NCIs significantly affects the degree of debt load.

This is facilitated by the following reasons: the

minimum requirements of non-bank credit

institutions to the client for issuing loans; issuing

loans to customers in a short time; the lack of a check

of the client’s solvency when deciding on the

issuance of a loan.

With all the visible advantages, NCIs set higher,

in comparison with bank, interest rates, and the

procedure for concluding an agreement is not

transparent enough, as a result of which controversial

situations arise. Clients counting on a certain amount

of debt as a result fall into a "trap" and are forced to

apply to another credit institution for a new loan in

order to fulfill the terms of the previous agreement.

As a result, credit institutions issue loans not to

expand the borrower’s consumer opportunities, but to

pay off his already existing debts. This practice leads

to a decrease in real disposable income, and,

ultimately, to a decrease in demand for certain groups

of goods, works of services. This situation may be

illustrated in the graph (Fig. 3).

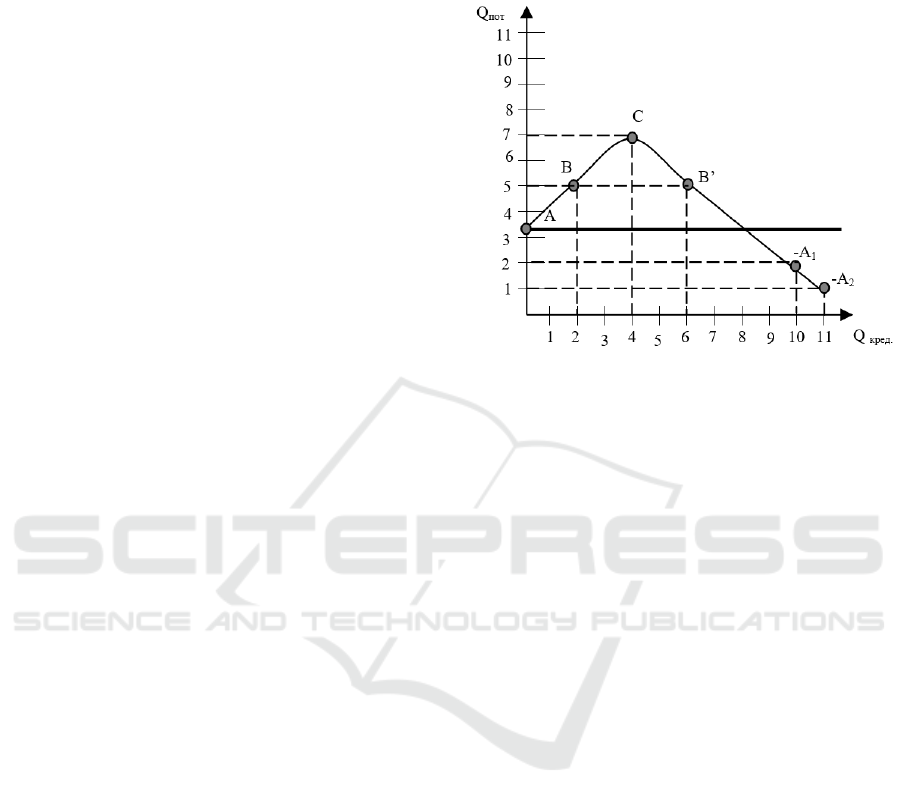

In the figure, point A denotes the consumer’s

disposable income. When applying for a loan, the

amount of available funds temporarily increases,

temporarily overcoming the line of marginal income

(MI) and moving to point B, and with an increase in

the loan - to point C. However, if the borrower draws

up an additional loan agreement, then the amount of

his disposable income will decrease, since the amount

of payments for the loan will increase and move

below the level of the marginal income (points –A1

and –A2). Thus, the higher the total amount of

borrowed funds, the lower the amount of the

consumer’s disposable income.

Figure 3: The relationship between the volume of loans

received and the volume of consumption

This situation leads to a forced reduction by

borrowers in the consumption of goods of certain

groups, and in some cases, their exclusion at the time

of repayment of funds under loan agreements.

Thus, a situation has developed in the Russian

Federation that requires attention from the regulator.

When implementing the regulatory policy, the

Central Bank does not consider such an indicator as

the debt load of the population, despite the fact that it

exists objectively. In the terminology of the regulator,

there is such a concept as "debt burden", which,

however, also has not received development and

widespread use, and the calculation of which is

carried out in most cases formally. The concept of

debt burden is not identical to the concept of debt

load. The first indicator is microeconomic, and allows

to assess the burden on an individual consumer /

economic entity, while debt load refers to

macroeconomic indicators. On its basis, it is possible

to estimate the volume of loans re-issued to repay

previous debts, i.e. assess the degree of debt burden

on the economy as a whole. At the moment, there is

no single indicator, and the debt load is estimated on

the basis of such data as the total volume of loans

issued, the total volume of debt, their ratio, etc., as

presented at the beginning of this work. Its

implementation would greatly simplify the procedure

for monitoring the functioning of credit markets, and

would allow for their objective assessment and

effective correction depending on the nature of the

dynamics.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

20

3 RESULTS AND DISCUSSION

There is no separate indicator for assessing the degree

of debt load of the population of the Russian

Federation. As mentioned earlier, the analysis is

carried out on the basis of publicly available data, as

presented above, or on the basis of expert judgment.

However, a homogeneous final indicator is

preferable, since it allows one to more clearly assess

not only the percentage of the population using

borrowed capital, but also the dynamics of the volume

of debt load. For these purposes, we present the

following formula, on the basis of which it is possible

to make this assessment:

DL

p

= Q

loans

/ (I

p.

× RDI

p

) (1)

where: DL

p

- the coefficient of the population’s

debt load, units;

I

p

- income of the population by years, RUB;

RDI

p

- real disposable income of the population

by years,%;

Q

loans.

- the volume of loans issued by years, RUB.

We will summarize the required data in a table

and make a calculation (tab. 3).

Thus, the percentage of debt load of the

population of the Russian Federation has been

calculated. As may be seen from the table, in 2016 it

is 72%, in 2017 and 2018. - 76 and 89%, respectively.

By 2018, there has been an increase in the percentage

of debt load. Thus, it may be seen that 100% of

citizens’ incomes account for 89% of loans in 2018.

Analyzing the presented indicator, it is worth noting

that a value equal to 1 may be considered critical,

which will mean that by 1 RUR of income of citizens

will account for 1 RUR of debt. As follows from the

calculated data, in 2018 the indicator of the debt load

of the population of the Russian Federation is quite

close to the critical value and, in addition, shows a

trend towards an increase during the study period.

Table 3: Calculation of the indicator of debt load of the

population of the Russian Federation for 2016-2018

Year

Indicator

2016 2017 2018

The volume of loans

provided by credit

institutions, RUB bln

36704.2 41892.5 51104.4

Cash income of the

population, RUB bln

53991.0 55272.1 57457.0

Table 3: Continued.

Real disposable cash

income,%

94.0 98.9 99.9

Debt ratio of the

p

opulation

0.72 0.76 0.89

In order to check the objectivity of the obtained

coefficient values, we will analyze the dynamics of

the main indicators of debt load, presenting their

dynamics in the form of a diagram. The most

informative in order to analyze the degree of debt load

of the population is the consideration of the values of

indicators by month. For these purposes, it is required

to adapt the previously derived coefficient pursuant to

the publicly available statistical indicators required

for its calculation. Thus, the calculation of monthly

values of the debt load ratio will be made pursuant to

the following formula:

DL

p

=

Q

ly

/

ANW

p

(2)

where: ANW

p.

- change in the average

nominal accrued wages of the population by

months,% .;

Q

ly

- change in the volume of loans issued by

months,%.

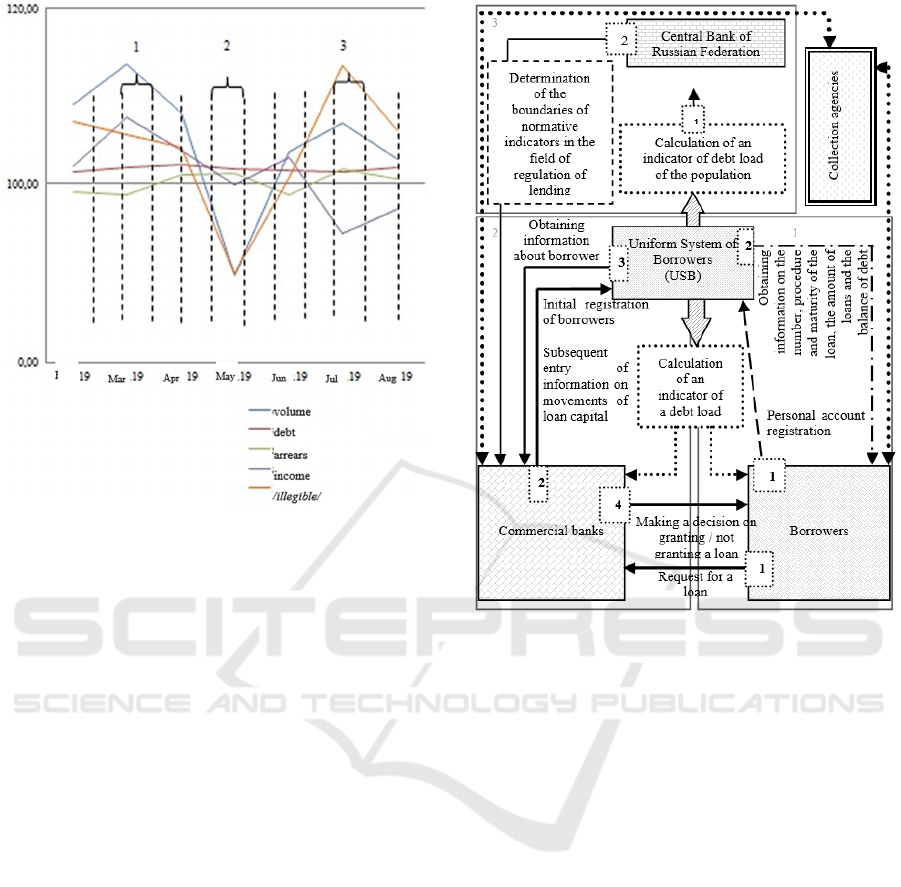

Let’s analyze the main indicators of debt load,

namely, the volume of lending, debt and arrears,

income of citizens, in the form of a diagram (Fig. 4)

in order to determine the value of the critical debt

load.

Critical debt load should be understood as the

outstripping of lending volumes and real incomes by

the rate of overdue debt. As may be seen, several

areas correspond to this concept on the chart. Regions

1, 2 and 3 are characterized by an increase in the rate

of overdue debt and a simultaneous decrease in

lending volumes and the level of income of citizens.

Mechanism of Regulation and Assessment of Degree of Debt Load of the Population of the Russian Federation

21

Figure 4: Dynamics of the amount of funds provided by

credit institutions of the Russian Federation in 2016-2018.

The most critical is the value of indicators in the

period July-August 2019 (area 3), where the level of

overdue debt exceeds the level of total debt.

Herewith, there is a significant decrease in the level

of income with a simultaneous increase in lending

volumes. The values of the debt load ratio

superimposed on this graph make it possible to assess

its sensitivity. As may be seen, the value of the

indicator is the smallest in the second area,

characterized by a significant reduction in lending

volumes with a slight change in income values, and is

critical in area 3. Thus, we may say that this indicator

is a fairly effective indicator of debt load.

One of the reasons for the population’s debt load

and a fairly high percentage of overdue debt is the

inability to track the status of the borrower, namely,

the presence and amount of loan agreements already

concluded with other credit organizations, the total

amount of debt, the regularity of loan repayment, etc.

This problem is obvious, but the mechanism for its

solution has not yet been developed.

Figure 5: The procedure for the functioning of the banking

system of the Russian Federation in the implementation of

the Uniform System of Borrowers (USB).

One of the most optimum ways is the introduction

of a unified system of borrowers, based on the data of

the subjects of the banking system, which will allow

for effective management. This process may be

represented in the form of the following diagram

(Figure 5). As may be seen, the introduction of this

element may be useful to all participants in the

banking system, including directly borrowers. The

formation of the system should be carried out directly

by credit institutions during the execution of credit

agreements, as well as on the basis of already existing

documents. The system should contain information

about the volume, quantity, timing, regularity and

timeliness of repayment of loans by the borrower, etc.

For borrowers, as a result of using the system,

information will be available on the volume and

number of loans taken, the timing and sequence of

their repayment (repayment calendar), the part of the

outstanding loan, the procedure for calculating and

repaying interest, the personal indicator of the debt

burden, as well as the credit limit (opportunities for a

given volume income and already received loans,

Feb

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

22

obtaining an additional amount of loans) (area "1" in

Fig. 5).

When connected to the system, credit institutions,

in turn, will be able to assess the reliability of the

borrower, calculate the optimum amount of the issued

loan, which will avoid the risk of non-repayment of

funds in the future, thus allowing banks to exercise

effective financial management (area “2” in Fig. 5).

On the basis of the data entered into the system, the

indicator of the population’s debt load, which is

required for the control of the credit industry by the

regulator (area “3” in Fig. 5), may be calculated.

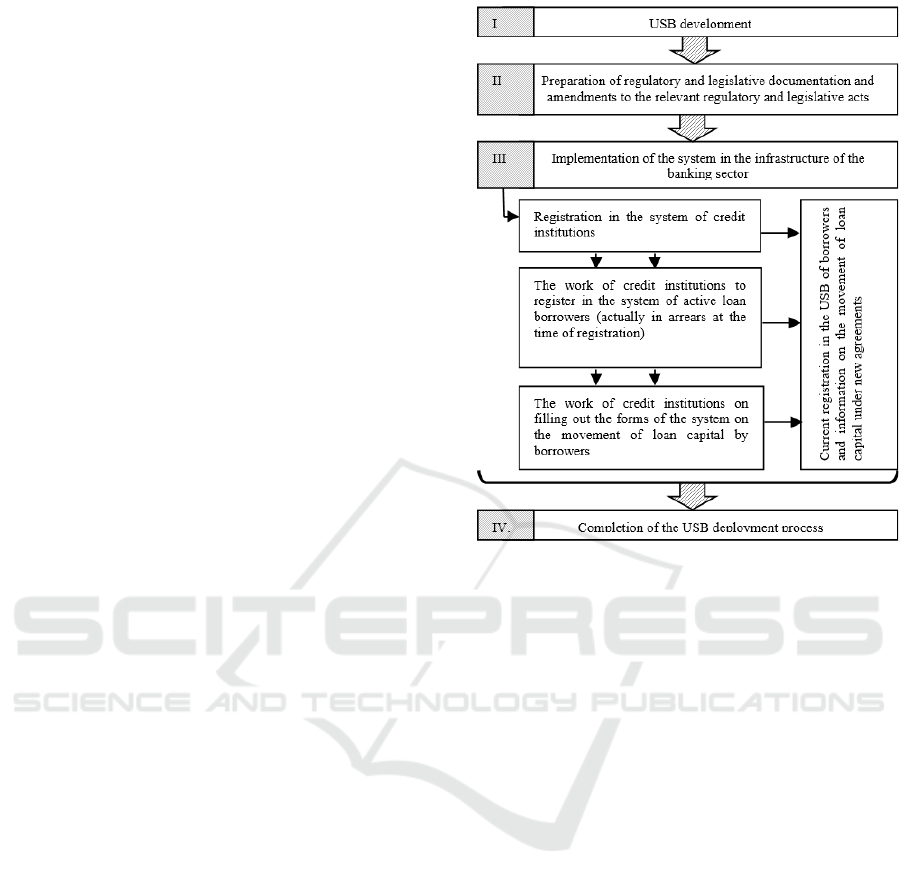

Stages of introduction of a system are presented

on the figure (fig. 6).

4 CONCLUSIONS

Thus, on the basis of public data and the indicator

developed by authors in this article assessment of

degree of debt load of the population of the Russian

Federation for 2016-2018 is made. Based on the

results of the analysis, it may be said that in the

Russian Federation there is a significant level of debt

load DL

p.

= 0.89 in 2018), which justifies the need to

develop and implement a unified system of

borrowers. As a result of its implementation, the

regulator represented by the Central Bank will be able

to effectively regulate the banking system. This

indicator may be used as the basis for the regulatory

documents of the Central Bank and applied in the

implementation of monetary policy.

The regulation of the credit sector of the Russian

Federation, in particular, the loan capital market, has

significant drawbacks. The introduction of the

indicator and system presented in this work may open

up new opportunities for the development of the

country’s banking system.

Figure 6: Stages of introduction of a uniform system of

borrowers

First of all, their task should be to exercise control

over the volume of loans issued, in order to prevent a

situation of debt load on the country’s population,

which entails extremely negative consequences for

the economy as a whole, up to default.

REFERENCES

Leao, E.R., 2003. A dynamic general equilibrium model

with technological innovations in the banking sector. In

Journal of economics. 79-2. pp. 145-185.

Waters, H.A., 2018. The financialization of help:

moneylenders as economic translators in the debt-based

economy. In Central Asian Survey. 37(3). pp. 403-418.

He, L., Liu, R., Zhong, Z., Wang, D., Xia, Y., 2019. Can

green financial development promote renewable energy

investment efficiency? In A consideration of bank

credit. Renewable Energy. 143. pp. 974-984.

Grandi, P., 2019. Sovereign stress and heterogeneous

monetary transmission to bank lending in the euro area.

In European Economic Review. 119. pp. 251-273.

Chevallier, C.O., El Joueidi, S., 2019. Capital regulation

and banking bubbles. In Journal of Mathematical

Economics. 84. pp. 117-129.

Nguyen, T.M.L., Papyrakis, E., Van Bergeijk, P.A.G.,

2019. Assessing the price and output effects of

Mechanism of Regulation and Assessment of Degree of Debt Load of the Population of the Russian Federation

23

monetary policy in Vietnam: evidence from a VAR

analysis. In Applied Economics. 51(44). pp. 4800-4819.

Shi, B., Zhao, X., Wu, B., Dong, Y., 2019. Credit rating and

microfinance lending decisions based on loss given

default (LGD). In Finance Research Letters. 30. pp.

124-129.

Arestis, P., Jia, M.M., 2019. Credit risk and macroeconomic

stress tests in China. In Journal of Banking Regulation.

20(3). pp. 211-225.

So, M.C., Mues, C., de Almeida Filho, A.T., Thomas, L.C.,

2019. Debtor level collection operations using Bayesian

dynamic programming. In Journal of the Operational

Research Society. 70(8). pp. 1332-1348.

Shafirov L.A., 2014. Consumer lending as impediment and

financial source for the sustainable development of the

depressed mono-towns (research proposal). In Journal

of Economic Regulation. 5(1). pp. 116-127.

Malanov V.I., Yakovleva I.A., Burlov D.Yu., 2017.

Standard of living as factor of debt load of the

population. In VSGUTU bulletin. 1(64). pp. 110-116.

Bulatova V.B., Yakovleva I.A., Burlov D.Yu., 2017. Debt

load of socially vulnerable population groups: problems

and ways of their decision. In VSGUTU bulletin. 2(65).

pp. 77-85.

Ibragimova P.A., 2018. Problem of debt load of the

population of Russia. In Bulletin of the Dagestan State

University. 33. 1. pp. 34-49.

Karanina E.V., Timin A.N., 2017. Credit load of the

population as factor of assessment of economic security

of the federal districts of Russia. In Economy and

management: problems, decisions. 3. 8. pp. 56-64.

Chupryna A.P., Evdokimova S.S., 2018. Improvement of

approach to assessment of debt load of the population

of the Russian Federation. In Current trends of

development of social and economic systems. Materials

of the international academic and research conference.

Volgograd. pp. 258-260.

SES 2021 - INTERNATIONAL SCIENTIFIC-PRACTICAL CONFERENCE "ENSURING THE STABILITY AND SECURITY OF

SOCIO - ECONOMIC SYSTEMS: OVERCOMING THE THREATS OF THE CRISIS SPACE"

24